Investment Strategy Brief

2024 and Q4 Market Review

January 5, 2025

Executive Summary

- Equity markets climbed throughout 2024 while bond markets experienced notable volatility.

- Major asset classes have seen positive returns in 2024, though Q4 performance was mixed.

- A small set of companies led capitalization and growth to drive performance in 2024 in the U.S. but not international markets.

- Investors should maintain neutral positioning while actively looking to rebalance and diversify portfolios.

Equity markets climbed throughout 2024 while bond markets experienced notable volatility

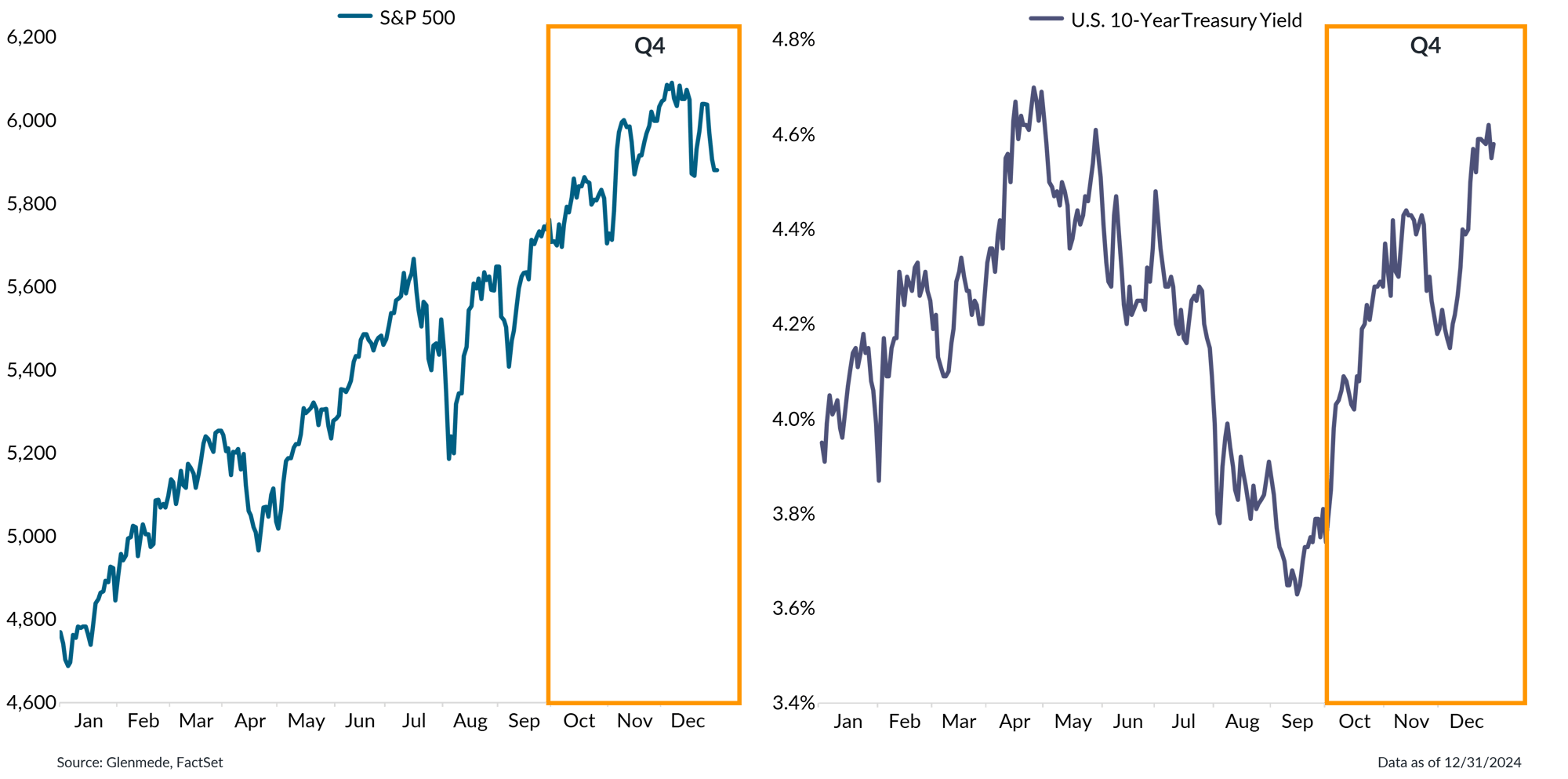

Shown in the left panel is the S&P 500 which is a market capitalization weighted index of U.S. large cap stocks. Shown in the right panel is the yield on 10-year U.S. Treasury bonds. Past performance may not be indicative of future results. One cannot invest directly in an index.

- Although equity markets reached new all-time highs in November fueled by a post-election rally, profit taking at the end of the year reversed some earlier gains.

- Bond yields remained volatile throughout 2024, trending higher in Q4 due to shifting expectations for government fiscal policies, inflation and broader economic growth expectations.

Major asset classes have seen positive returns in 2024, through Q4 performance was mixed

Shown are 2024 and Q4 2024 total returns for various asset classes represented by the following indices: U.S. Large Cap (S&P 500), U.S. Small Cap (Russell 2000), Int’l Developed (MSCI EAFE), Int’l Emerging (MSCI EM), Real Estate (FTSE EPRA/NAREIT Developed), Core Bonds (Bloomberg U.S. Aggregate), Municipal Bonds (Bloomberg Municipal), High Yield (Corp) (Bloomberg U.S. High Yield Ba to B), High Yield (Muni) (Bloomberg Municipal High Yield), Cash (FTSE 3-Month Treasury Bills). Past performance may not be indicative of future results. One cannot invest directly in an index.

- U.S. equities posted strong year-to-date performance, fueled by steady economic growth and robust gains in key sectors.

- The final quarter of 2024 experienced weaker markets, with many asset classes struggling to sustain momentum and deliver consistent gains.

Capitalization and growth drove U.S. equity performance in 2024 but not international markets

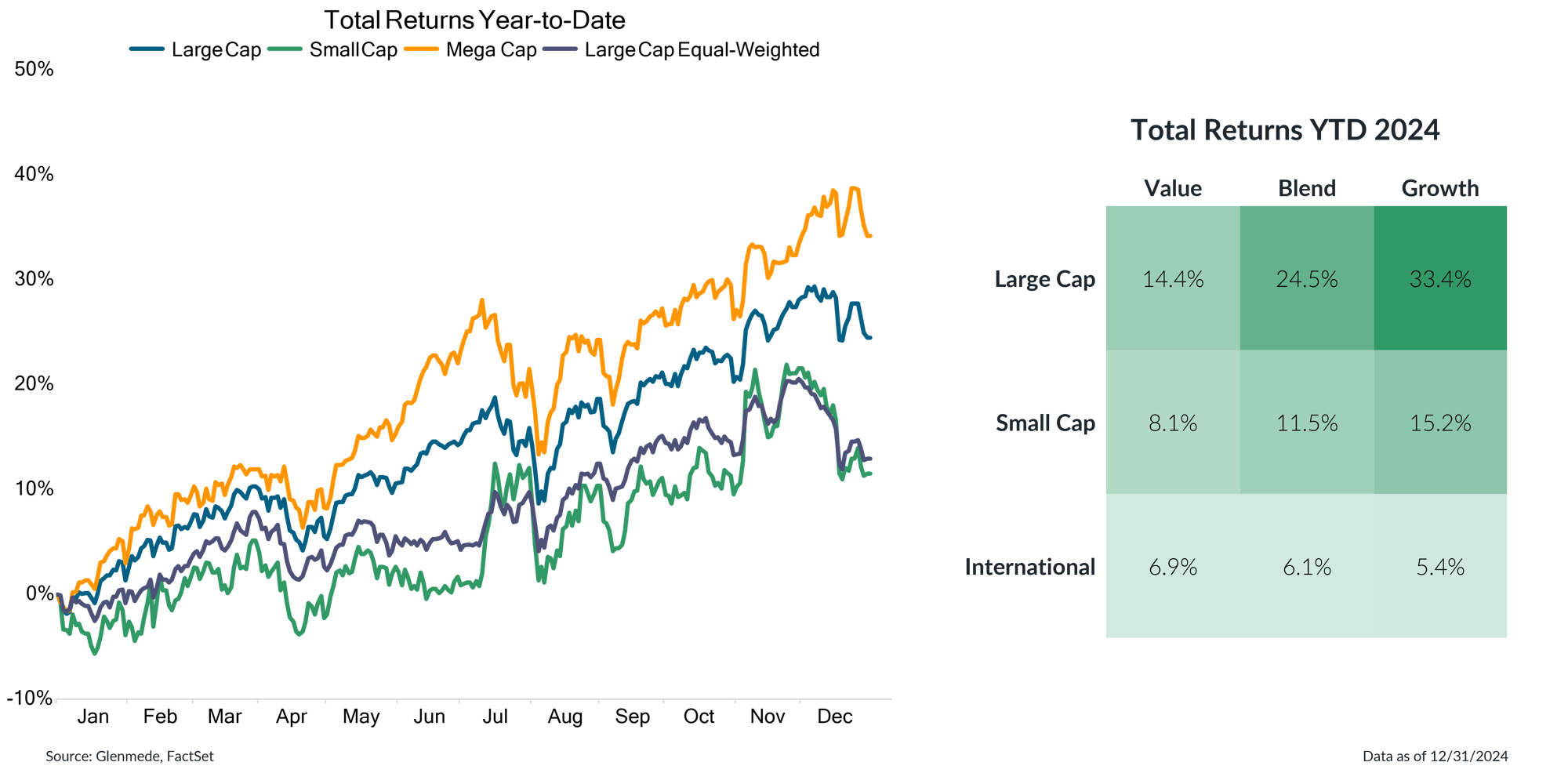

Shown in the left panel are year-to-date 2024 cumulative total returns for various asset classes, represented by the following indices: Large Cap (Russell 1000), Small Cap (Russell 2000), Mega Cap (Russell Top 50), Large Cap Equal-Weighted (S&P 500 Equal-Weighted). Shown in the right panel are year-to-date total returns for the value, growth and blend variants of the following indices: Large Cap (S&P 500), Small Cap (Russell 2000), International (MSCI All Country World ex-U.S.). Past performance may not be indicative of future results. One cannot invest directly in an index.

- Small caps began to catch up and even surpass the large-cap equal-weighted basket in Q4, though a gap in equity performance still persists.

- Growth stocks have been outperforming in both large-cap and small-cap categories, but this trend does not appear to hold for international stocks.

Large cap stocks have outperformed expectations, but a small set of companies have led the charge

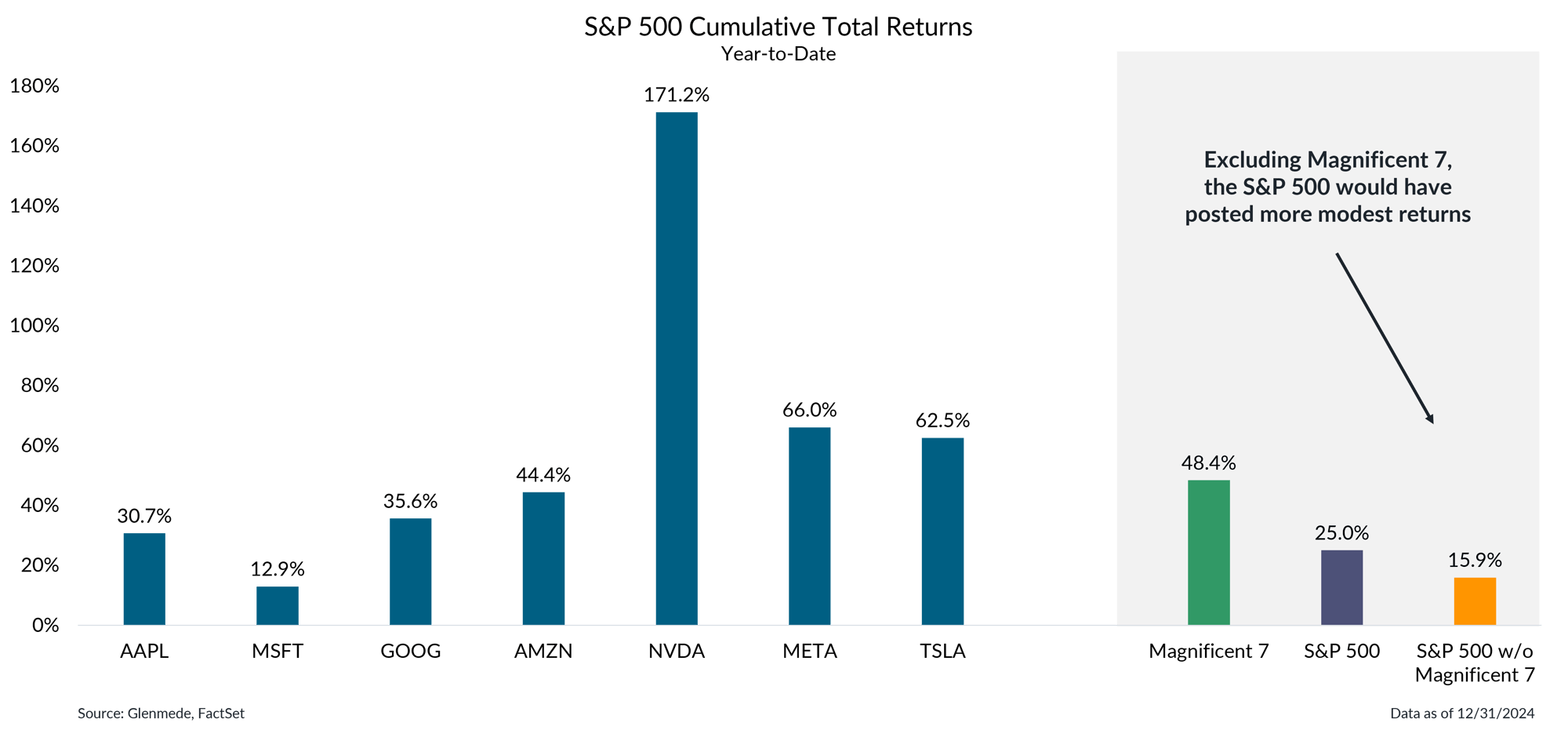

Data shown in blue are cumulative total returns for the Magnificent 7 year-to-date, including Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG & GOOGL), Amazon (AMZN), Nvidia (NVDA), META Platforms (META) and Tesla (TSLA). The green bar shows the aggregate performance of these 7 stocks. The purple bar shows the total return of the S&P 500 over this period. The yellow bar shows the total return for the S&P 500 during this period, excluding the Magnificent 7. The S&P 500 is a market capitalization weighted index of U.S. large cap stocks. This visual should not be interpreted as a recommendation to buy, hold or sell any specific securities. Past performance may not be indicative of future results. One cannot invest directly in an index.

- The Magnificent 7 have driven the outperformance of large-cap stocks, continuing to post double-digit growth despite broader market volatility.

- The combined performance of the Magnificent 7 accounted for combined returns of nearly 50%, almost double the S&P 500’s total return of 25%.

For our 2025 Market Outlook, please view this white paper.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.