Investment Strategy Brief

2024 Election: What to Watch

July 28, 2024

Executive Summary

- Given the nascent nature of the Harris candidacy, there are few concrete proposals on the table to gauge her perspective on economic issues.

- A Harris candidacy might look similar to Biden’s on economic issues, with modest differences on the margin.

- The next President will likely be constrained by the marginal vote in the Senate given the improbability of either party gaining a filibuster-proof majority.

- Markets may exhibit some volatility due to election uncertainty, but future legislative constraints are likely to remain longer-term mitigants.

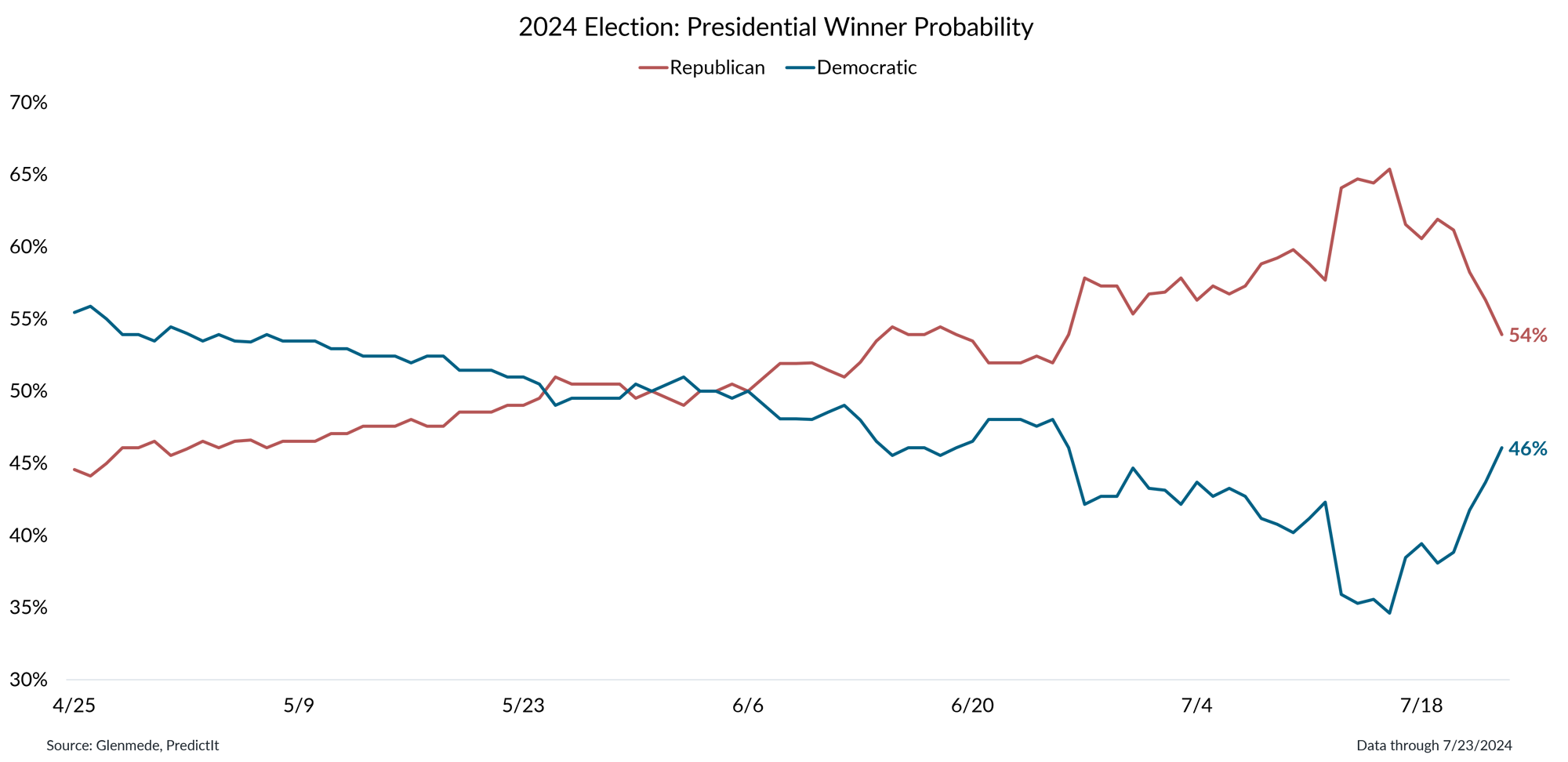

The race for the White House has narrowed over the last week

Figures shown may not add up to 100% due to rounding. PredictIt purports to be an experimental research and educational facility of Victoria University of Wellington, New Zealand, and not an investment market or gambling facility. Its website supports the operation of a "predictions market," a facility for buying and trading futures contracts linked to political or financial events or circumstances. References to PredictIt and use of its data herein in no way should be interpreted as an endorsement or recommendation of PredictIt by Glenmede. Actual results may differ materially from implied probabilities or expectations. Probabilities or likelihoods shown are not the opinions of Glenmede and are shown for illustrative purposes only.

- Following Biden’s decision to suspend his campaign for re-election, Harris has emerged as the favorite to secure the Democratic nomination.

- Harris’s ascension to presumptive nominee of the Democratic Party has coincided with a narrowing of White House election odds.

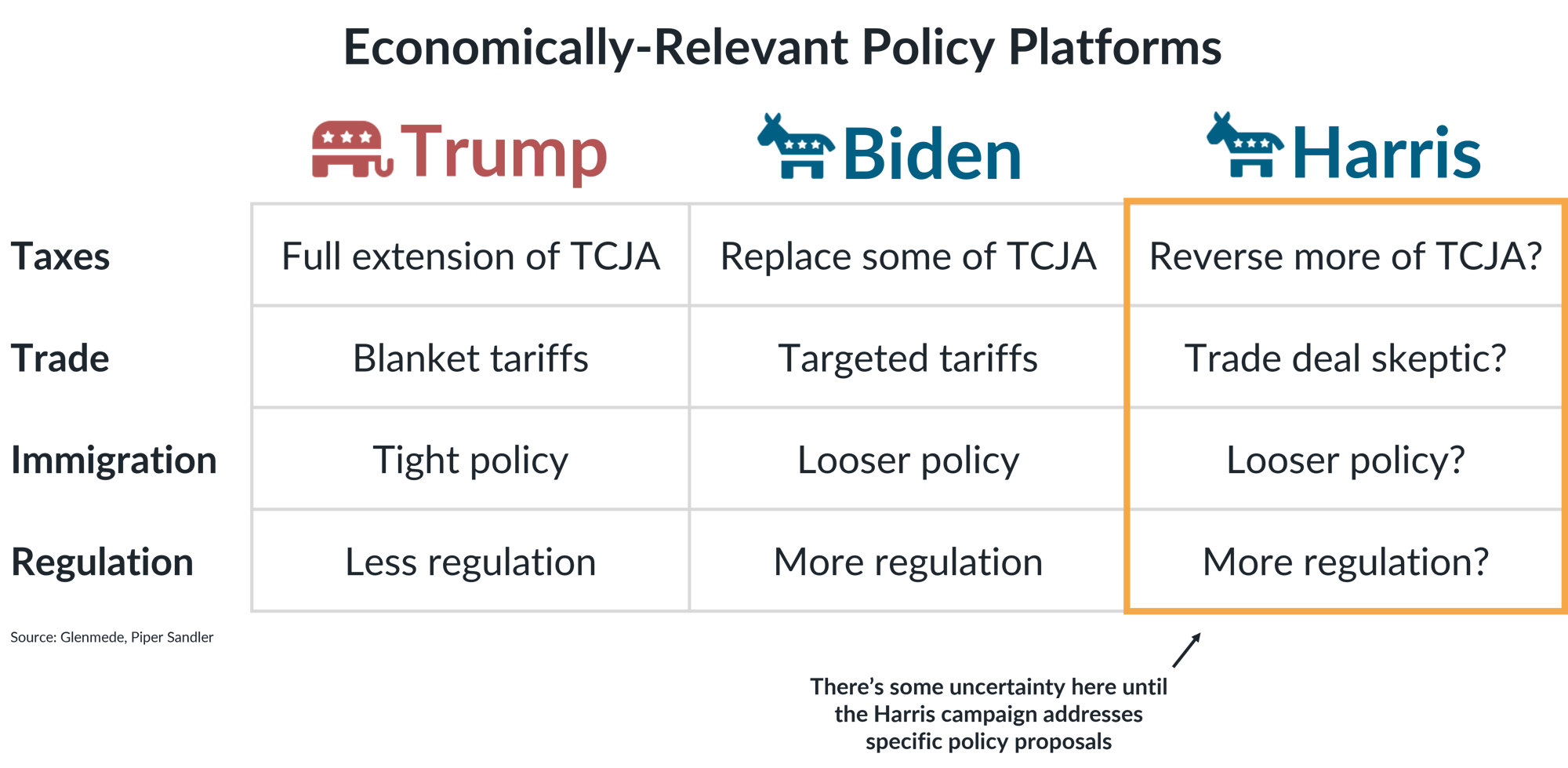

A Harris candidacy may look similar to Biden’s on economic issues, with modest differences

The lists shown are a general representation of the policy platforms for the major candidates for President in 2024 and are not meant to be exhaustive. TCJA refers to the Tax Cuts and Jobs Act of 2017. Actual policies may differ materially from those listed.

- While concrete proposals from Harris are scarce, her voting record from her time in the Senate and her run in the 2020 primaries may be a guide on policy.

- Her policy platform may look quite similar to Biden’s, but there may be differences in details. For example, Harris has called for increasing the corporate tax rate to 35% vs. 28% in Biden’s budget proposal (current law is 21%).

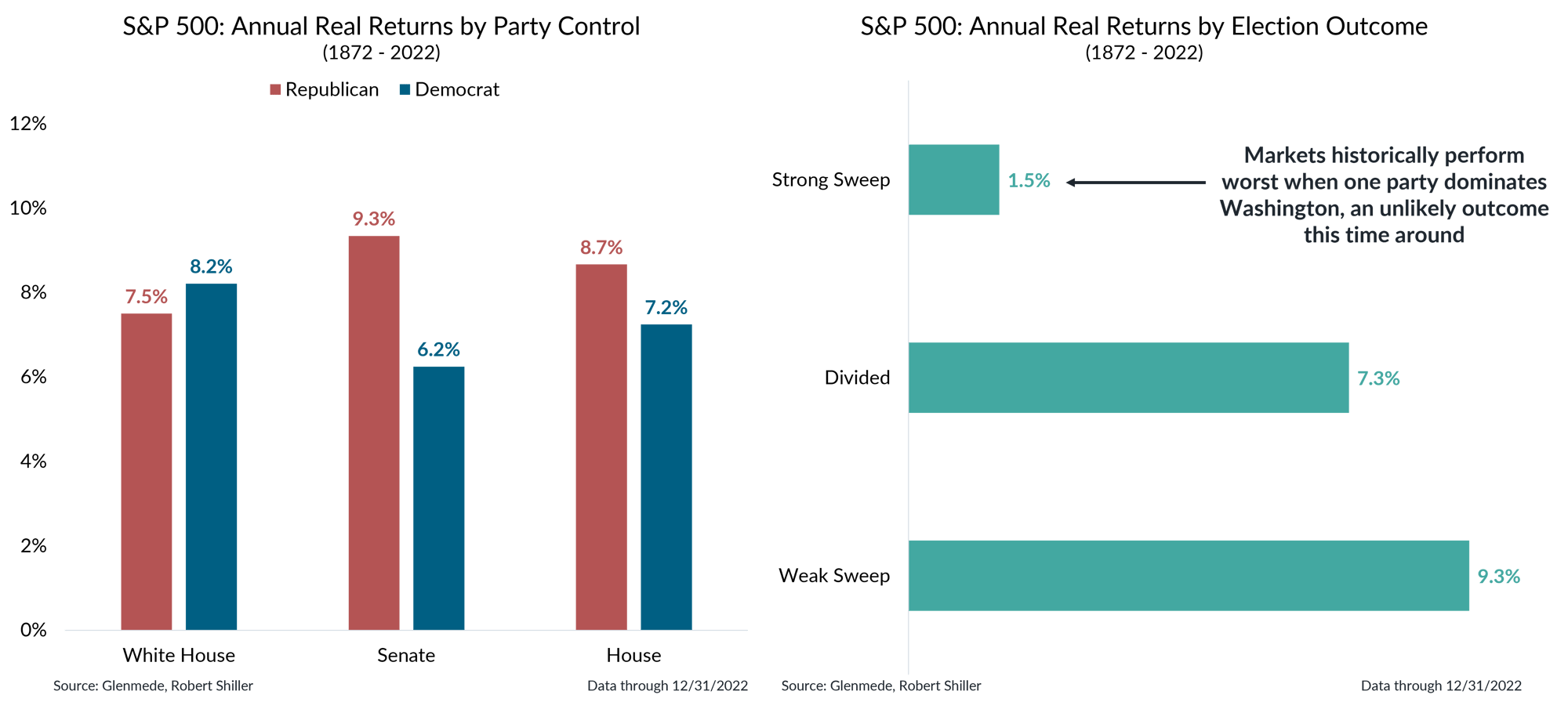

Party composition has historically mattered less than the strength of control for market returns

Data shown are inflation-adjusted total returns for the S&P 500 for each two-year federal election cycle since 1872. Returns for the S&P 500 are backfilled with returns for the S&P composite based on data provided by Robert Shiller prior to 1970. Shown in the left panel are returns based on each party’s control of the White House, Senate and House of Representatives. Shown in the right panel are returns based on the composition of the White House, Senate and House of Representatives after each two-year election cycle. Divided refers to periods in which all three are controlled by different parties. Strong Sweep refers to periods in which one party controls all three and has a large enough majority in the Senate to end a filibuster via cloture. Weak Sweep refers to all other periods in which one party controls all three. The S&P 500 is a market capitalization weighted index of large cap stocks in the U.S. Past performance may not be indicative of future results. One cannot invest directly in an index.

- Historically, the party that occupies key levers of power in Washington appears to have mattered little. What matters more is the strength of party control, as markets underperform when one party dominates.

- Given the map of Senate seats up for grabs this cycle, a strong Congressional majority is unlikely for either party, meaning the eventual occupant of the White House will likely be constrained by the marginal vote in the Senate.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.