Investment Strategy Brief

A Budding Global Easing Cycle

July 7, 2024

Executive Summary

- Several large central banks around the world have started to undertake easing cycles, including the European Central Bank and the Bank of Canada.

- Almost half of the world’s central banks have started cutting rates and synchronized global easing cycles have historically been a bullish signal for equities.

- The Fed is likely to begin cutting rates in 2024, though that is likely predicated on further progress reining in domestic inflation.

- If inflation moderates without collateral damage to the economic expansion, the resulting Fed easing cycle could be a tailwind for risk assets.

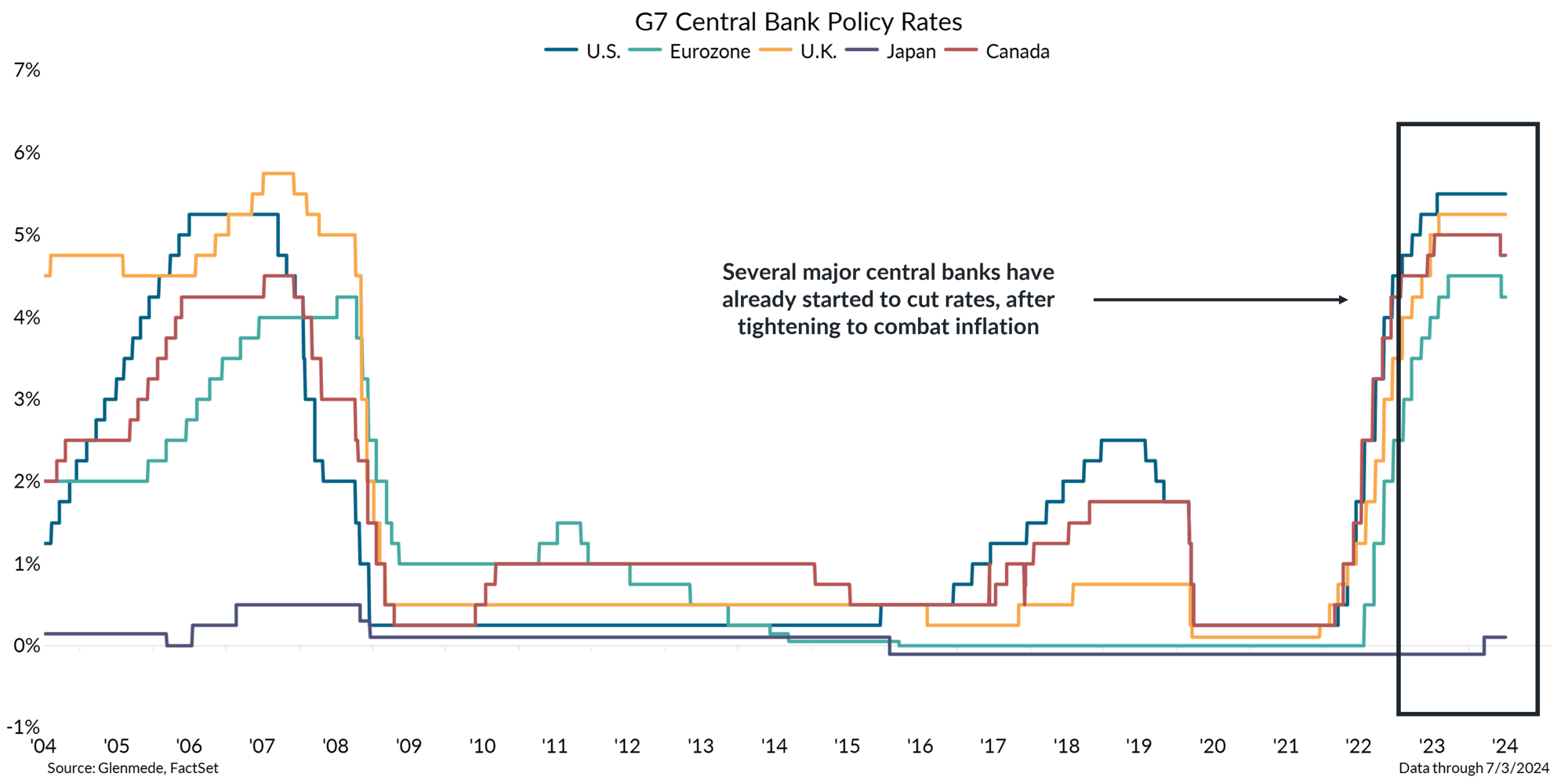

Some major central banks have started easing cycles

Data shown are central bank policy rates for G7 countries, represented by the following: U.S. (Fed Funds Target Rate), Eurozone (Main Refinancing Operations Bid Rate), U.K. (Bank Rate), Japan (Policy Rate), Canada (Target Rate).

- The European Central Bank and the Bank of Canada have recently cut rates as they’ve judged their own domestic inflation trends have improved sufficiently.

- The Bank of Japan has been a notable exception, as it maintained ultra-accommodative policy in hopes of generating inflation, and just started raising rates after proving successful.

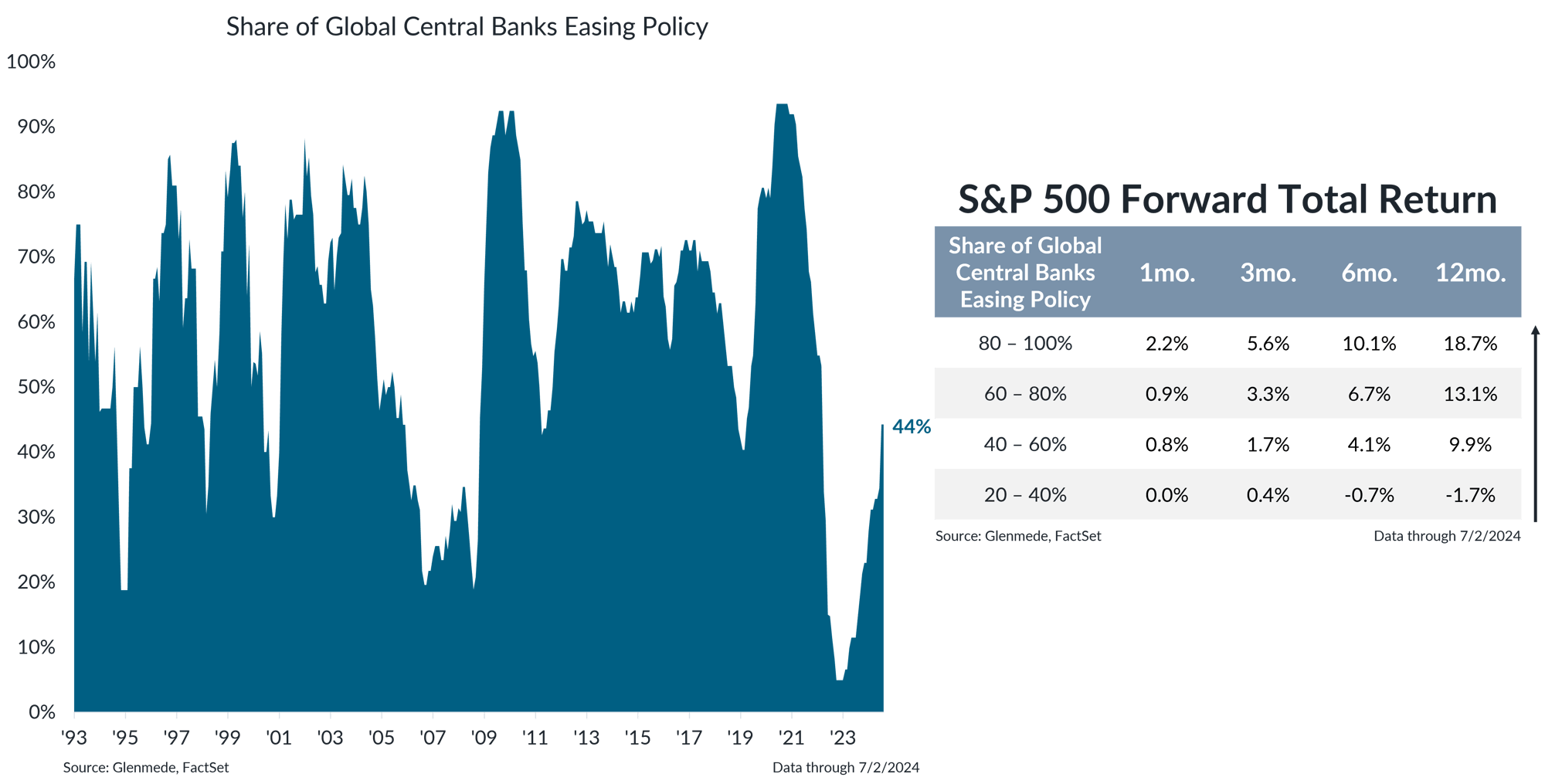

Almost half of the world's central banks have started cutting rates

Data shown in the left panel represent the share of global central banks for which the last change to its policy rate was a cut. Data shown in the right panel are forward-looking performance statistics for the S&P 500 index based on the share of global central banks easing policy. The 0 – 20% bucket is excluded due to small sample size. The S&P 500 is a market capitalization weighted index of large cap stocks in the U.S. Past performance may not be indicative of future results. One cannot invest directly in an index.

- The last policy rate shift was a cut for 44% of global central banks, as one of the tightest periods for world monetary policy is beginning to ease.

- Synchronized global easing cycles have historically been a bullish signal for equities in the short- to medium-term.

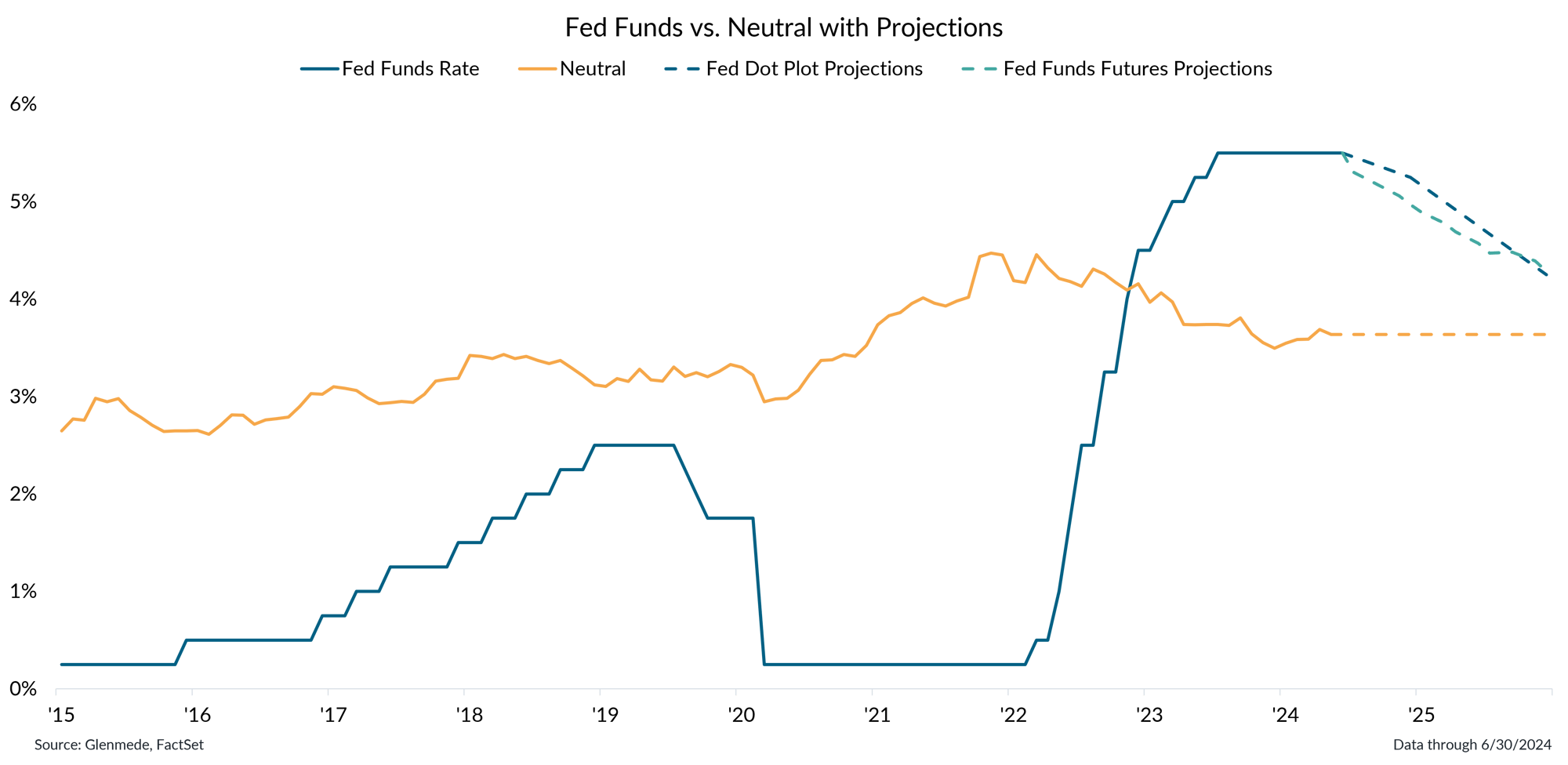

The Fed is likely to being cutting rates in '24, though that is likely predicated on further inflation progress

Data shown in yellow are Glenmede’s estimates of the neutral federal funds rate over time (i.e., the level of rates that is neither economically stimulative nor restrictive) based on expectations for real interest rates via the Holston-Laubach-Williams model and Glenmede’s 10yr inflation expectations. Fed Funds Rate in blue is the target rate upper bound. The dashed blue line represents projections based on the median response in the Federal Open Market Committee’s latest dot plot survey. The dashed green line represents projections based on fed funds futures. Actual results may differ materially from projections.

- The fed funds rate continues to sit on tight footing here in the U.S., though both the market and the Fed itself are expecting rate cuts later this year, to varying degrees.

- If inflation continues to moderate without an adverse impact on the broader economy, the Fed may be able to join their counterparts abroad, which could be a tailwind for risk assets.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.