Investment Strategy Brief

An Elephant in the Room: The U.S. National Debt

December 8, 2024

Executive Summary

- While the national debt has been low on the priority list this election cycle, its long-term impact on fiscal stability remains critical.

- High debt levels have proven problematic for other nations, but the U.S.’s reserve currency status likely provides more flexibility.

- Deficits and rising debt balances have led to credit rating reductions, but U.S. rates remain at a level consistent with strong credit.

- The U.S. still has time to establish a plan to gradually reduce deficits without hindering economic growth.

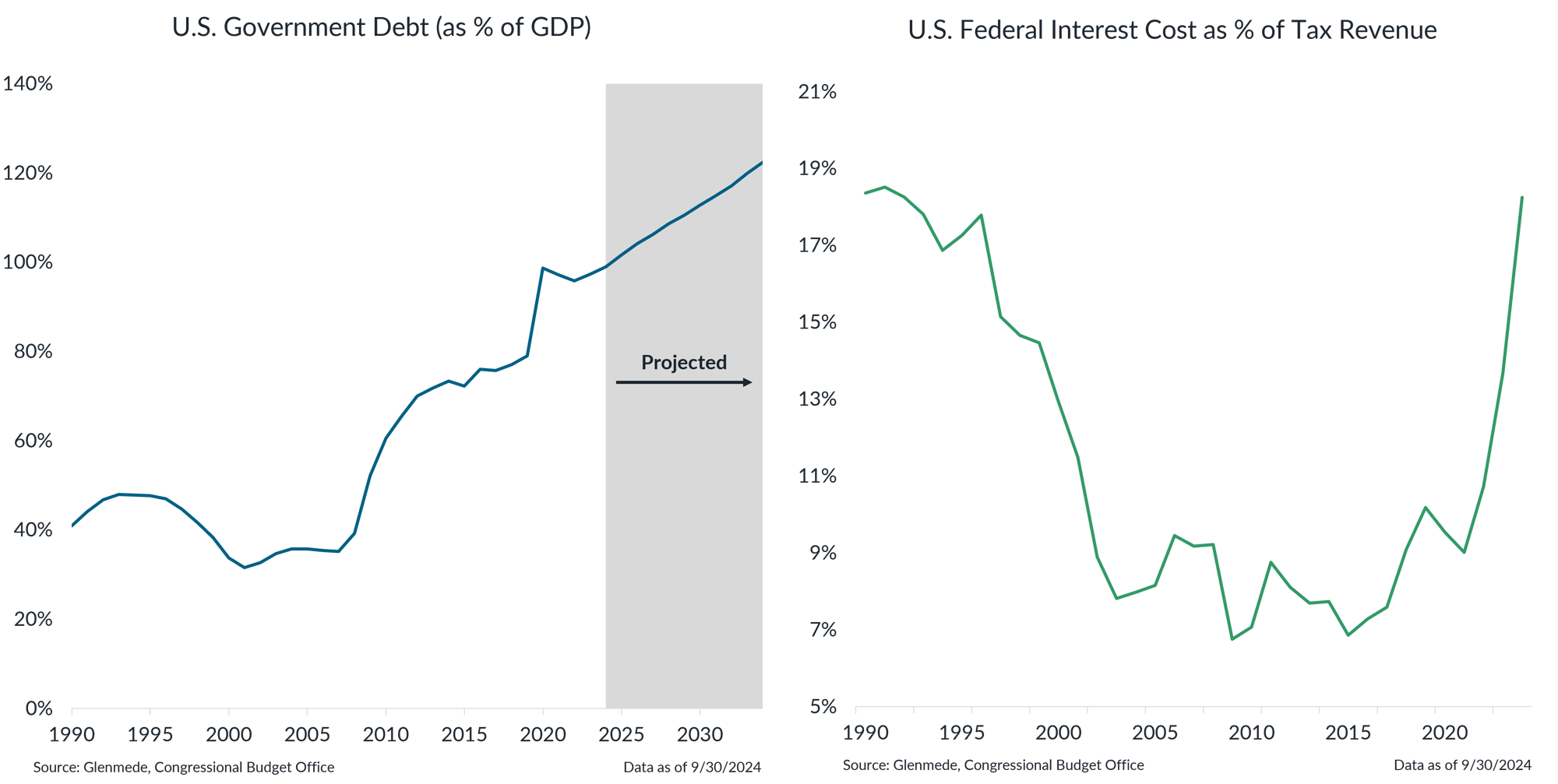

Current legislation is expected to lead to higher debt balances and interest costs

Shown in the left panel is U.S. government debt as a percent of gross domestic product (GDP), a measure of overall economic activity. U.S. government debt includes publicly held debt and excludes the portion of public debt that is held within the government by agencies or government trust funds such as those for Social Security for periods after 1980. The figure for 2024 reflects the latest estimate from the Congressional Budget Office. The gray region represents projections from the Congressional Budget Office. Data shown in the right panel are net interest costs (total interest paid minus interest received) as a percent of tax revenues collected each year. Actual results may differ materially from projections.

- Current projections show that legislation, spending patterns and economic growth are expected to contribute to ongoing deficits, further increasing U.S. debt relative to the size of the economy.

- As a result, the accumulated debt, coupled with rising interest rates has led to an increase in the total interest cost on the national debt.

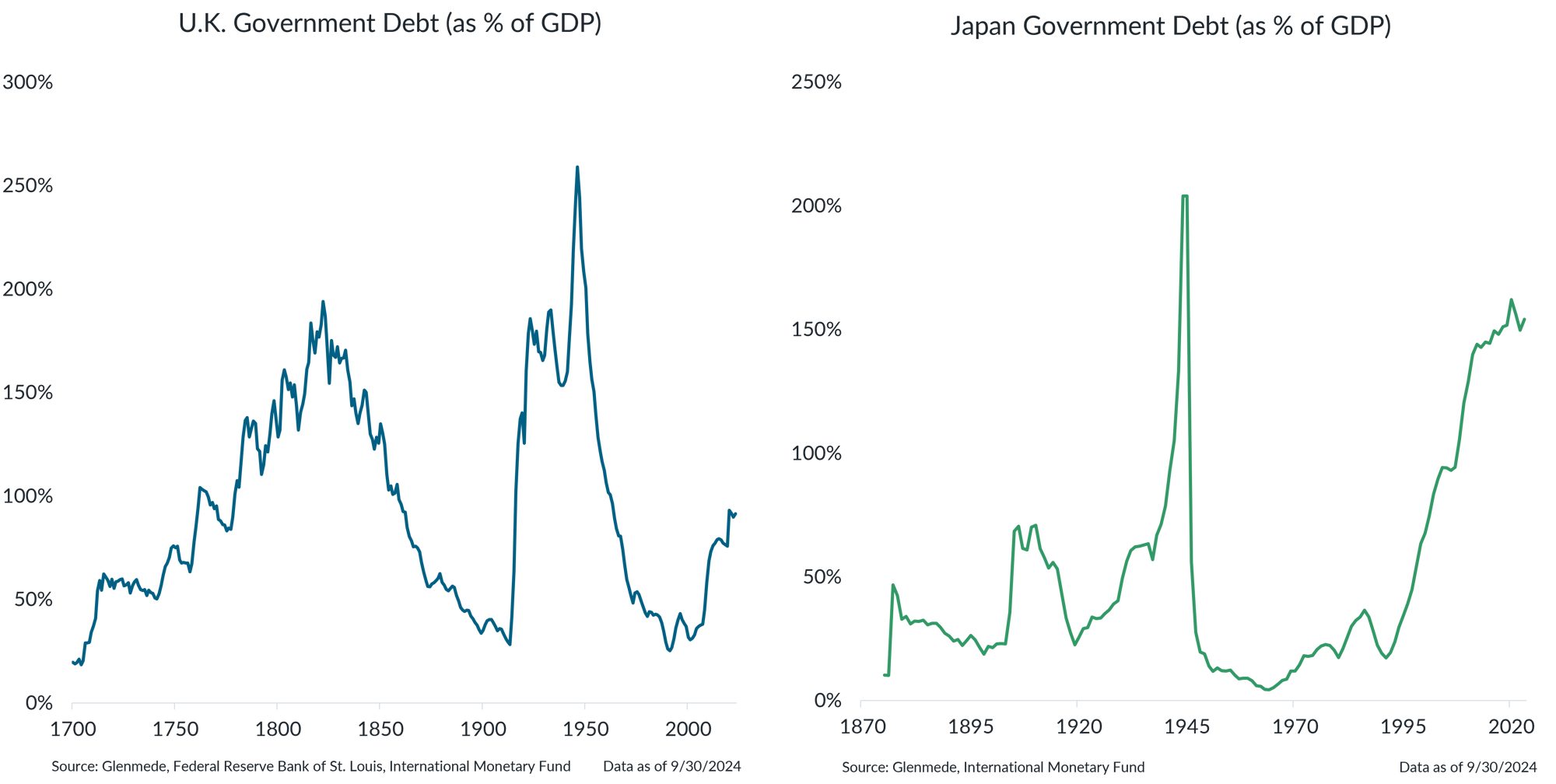

The U.S. likely has flexibility above 100% debt to GDP like other countries with reserve currencies

Shown in the left panel is government debt as a percent of GDP for the U.K. for periods after its formation in 1800 and for Great Britain prior to and including 1800. Data shown in the right panel represent Japan’s government debt as a percent of GDP, a measure of overall economic activity. Government debt includes publicly held debt and excludes the portion of public debt that is held within the government by other inter-governmental agencies or divisions for periods after 1980.

- While the U.K.’s dominant reserve currency gave it significant borrowing capacity in the early 1800s, during the second wave in the 1900s debt-financing strained the economy.

- Japan has also sustained high levels of debt, supported by its central bank which has been able to keep interest rates (and inflation) generally low, buying it decades of time to fix its ailing economy.

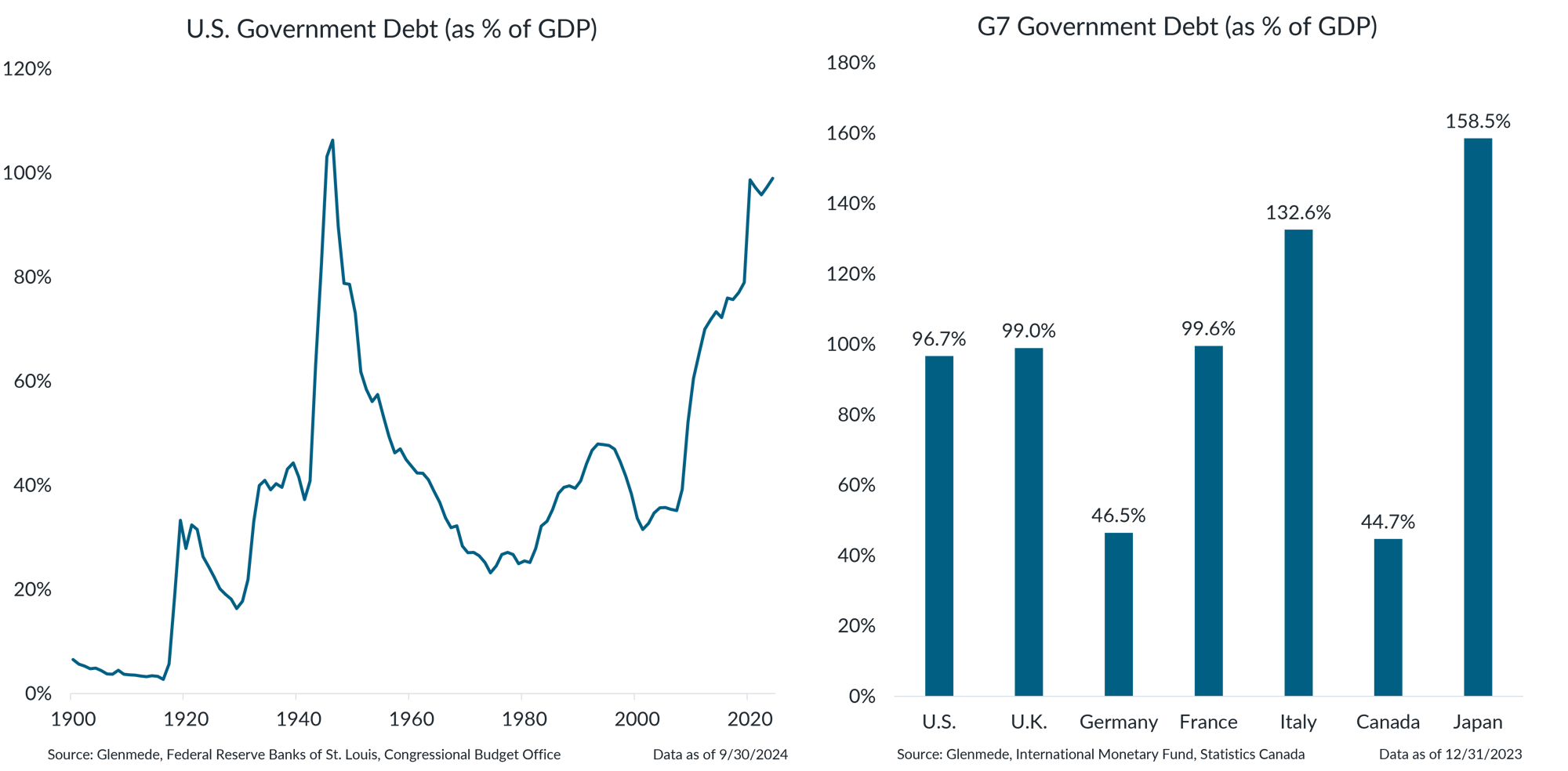

The U.S.'s debt has been this high before and does not appear that different from other developed nations

Shown in the left panel is U.S. government debt as a percent of U.S. gross domestic product (GDP), a measure of overall economic activity. U.S. government includes publicly held debt and excludes the portion of public debt that is held within the government by agencies or government trust funds such as those for Social Security for periods after 1980. The figure for 2024 reflects the latest estimate from the Congressional Budget Office. Shown in the right panel is net government debt as a percent of GDP for the G7 countries. Canada’s net debt excludes social security program funds.

- The U.S. has also experienced accumulations of debt before, most notably from post-WWII reconstruction efforts, but swiftly recovered as a result of strong economic growth.

- While the current magnitude of U.S. government debt is high by historical standards, many nations have either faced similar challenges or are encountering them now.

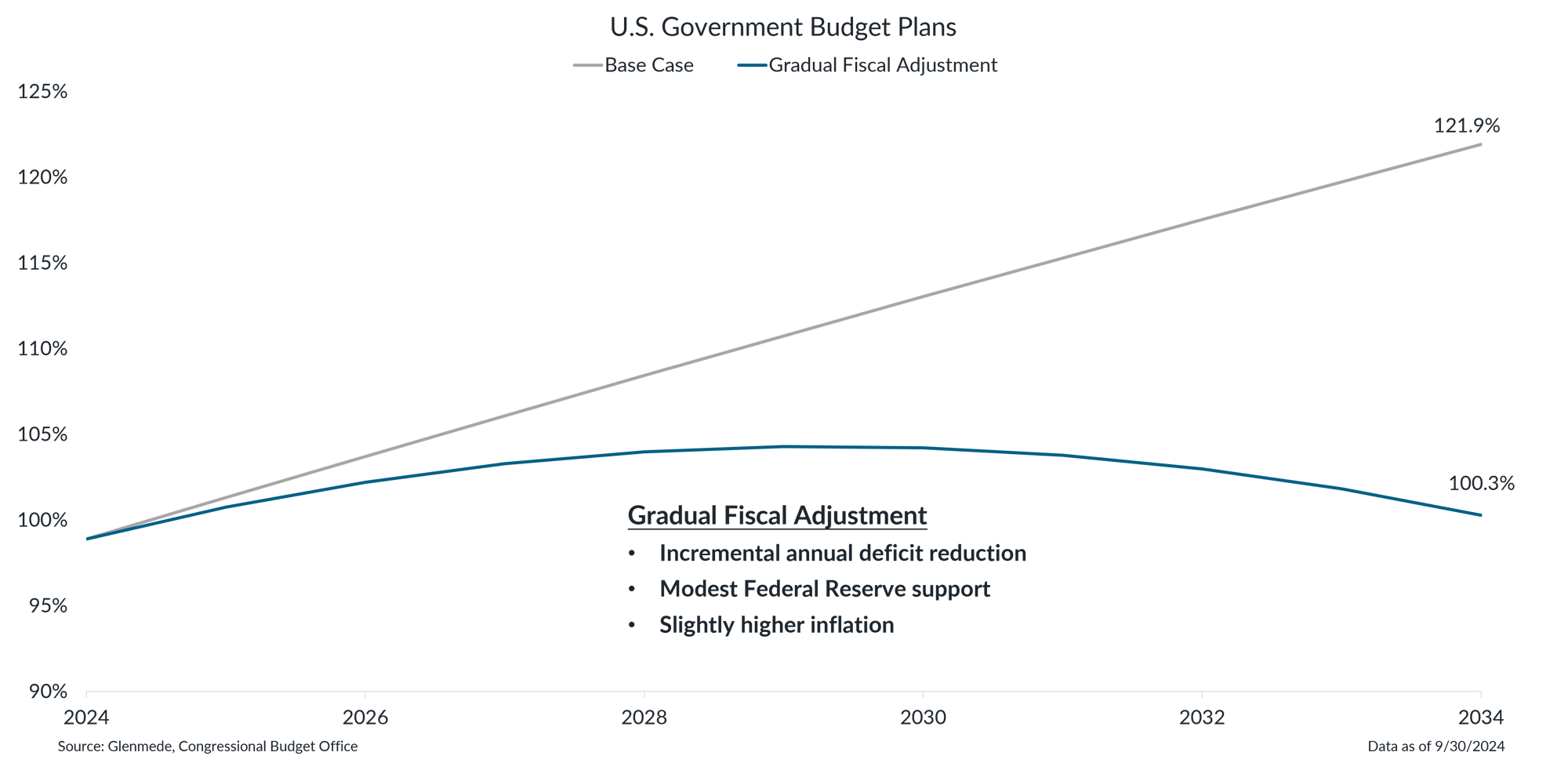

There still appears to be time to implement a gradual fiscal adjustment plan to change the trajectory

Shown are projections for U.S. government debt as a percent of U.S. gross domestic product (GDP), a measure of overall economic activity. U.S. government debt includes publicly held debt and excludes the portion of public debt that is held within the government by agencies or government trust funds such as those for Social Security. Base Case reflects a scenario in which current deficits continue for the next 10 years. Gradual Fiscal Adjustment reflects a scenario in which the Federal Reserve holds rates slightly (0.5%) lower and allows inflation to run slightly (0.5%) higher and the budget deficit is gradually reduced by 0.5% per year. Actual results may differ materially from projections.

- The recipe for the malady of excess debt and deficits may be a reduction in spending in some form, coupled with central bank support and modestly higher inflation targets.

- While there are a range of options, gradual fiscal adjustment appears to be the most plausible choice and the least likely to cause a shock to the political and financial system.

For our deeper analysis of the U.S. National Debt, please view this white paper.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.