Investment Strategy Brief

An Unusually Busy Mid-Summer Week

July 27, 2025

Executive Summary

- Investors should anticipate a moderate increase in volatility given key economic releases and trade deadlines heading into August.

- Amid a large number of company reports this week, earnings should continue to exhibit resilience.

- Economic growth is estimated to have rebounded in Q2, while the unemployment rate is likely to remain low.

- The Federal Reserve is expected to keep rates unchanged, but the debate over rate cuts is growing louder.

- The August 1 tariff deadline is fast approaching, with the scope of trade deals mostly unchanged.

Key economic releases and the trade deadlines should lead to a moderate increase in volatility

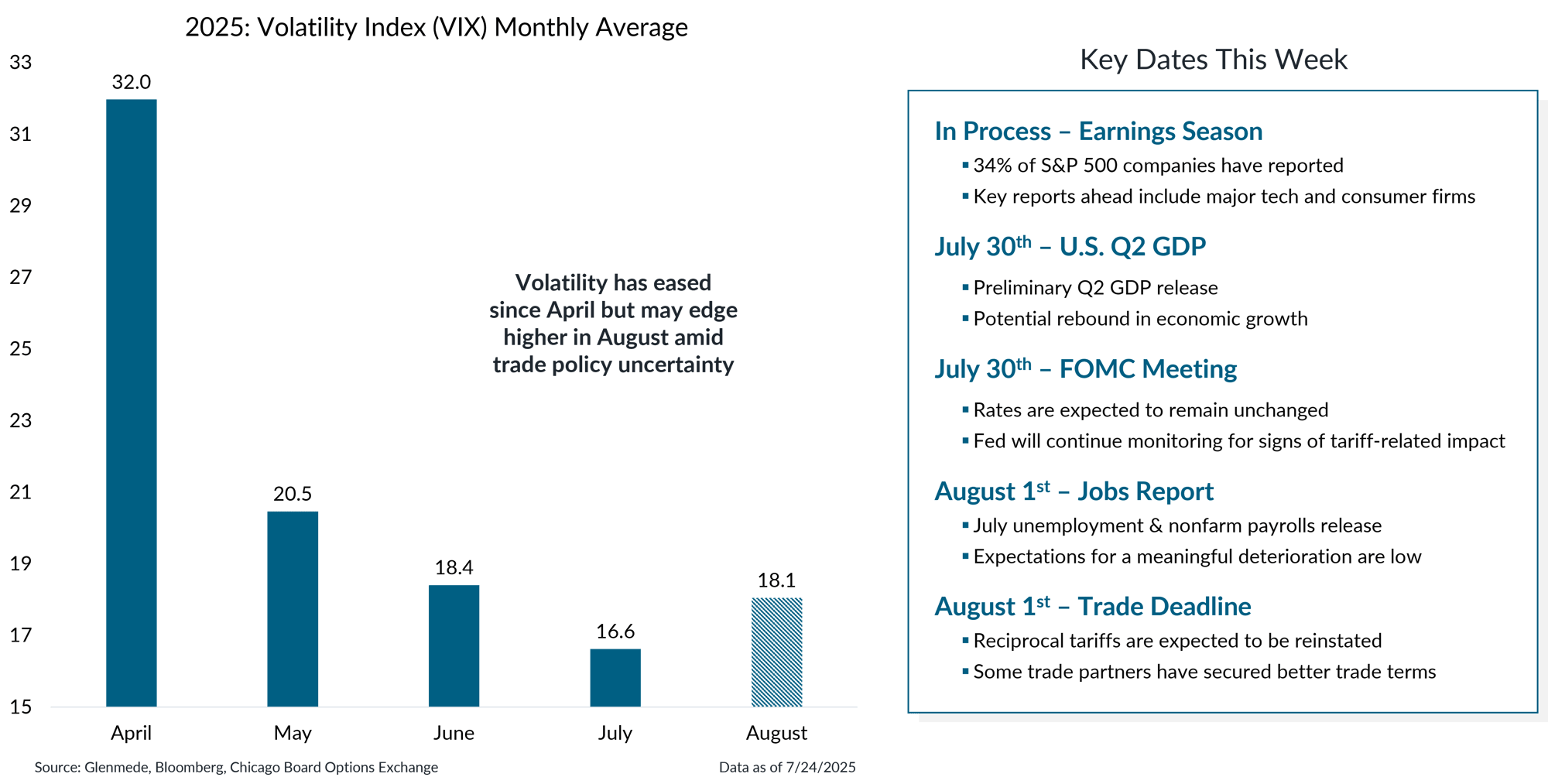

Shown in the left panel in solid blue is the average daily value of the Chicago Board Options Exchange Volatility Index (VIX) by month in 2025 and in hashed blue is the expected value of the VIX based on VIX futures expiring 8/25/2025. The VIX measures the implied volatility of the S&P 500 index based on options-pricing. Shown in the right panel are a handful of key dates over the next week. Past performance may not be indicative of future results.

- The final week of July is shaping up to be a busy one for markets, highlighted by key economic releases, a Federal Open Market Committee (FOMC) meeting, and a looming trade deadline.

- Volatility expectations have modestly increased heading into August, as investors brace for potential surprises across economic data and trade developments.

Amid a large number of company reports this week, earnings should continue to exhibit resilience

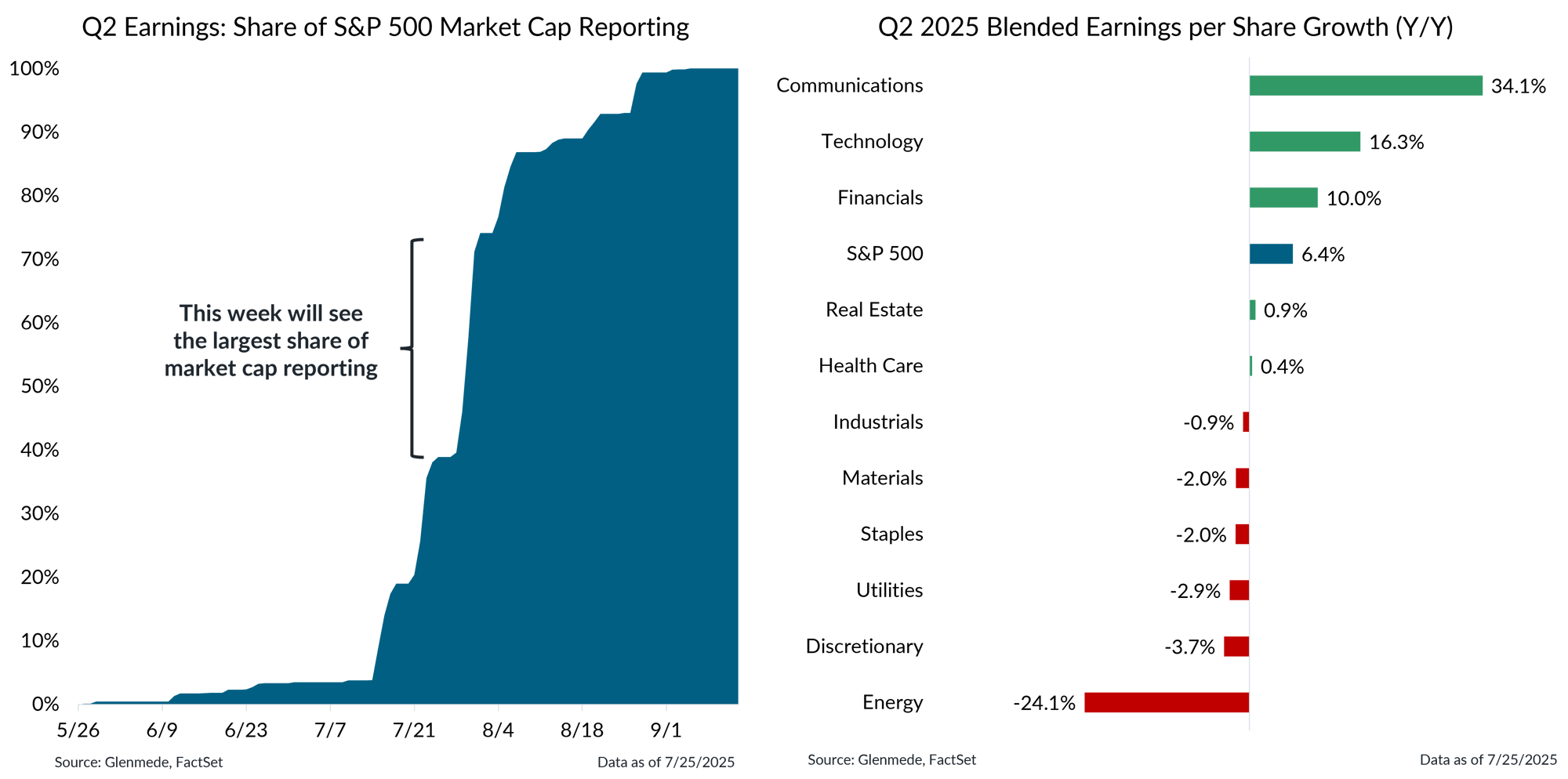

Shown in the left panel is a timeline of the cumulative share of the S&P 500’s market capitalization that will report Q2 2025 earnings results. Shown in the right panel is the blended growth in earnings per share for the S&P 500 and its 11 constituent sectors for Q2 2025 on a year-over-year, percent-change basis. Blended growth figures combine actual results with consensus expectations for companies that have yet to report. The S&P 500 is a market capitalization weighted index of large cap stocks in the U.S. Actual results may differ materially from expectations. One cannot invest directly in an index.

- Earnings season is well underway, with the largest share of S&P 500 companies reporting this week, bringing the total to nearly 70% of the index by market capitalization.

- Strong contributions from the communications and technology sectors are expected to help lift earnings growth for the S&P 500 to the mid-single digits for the quarter.

Economic growth is estimated to have rebounded in Q2, while the unemployment rate is likely to remain low

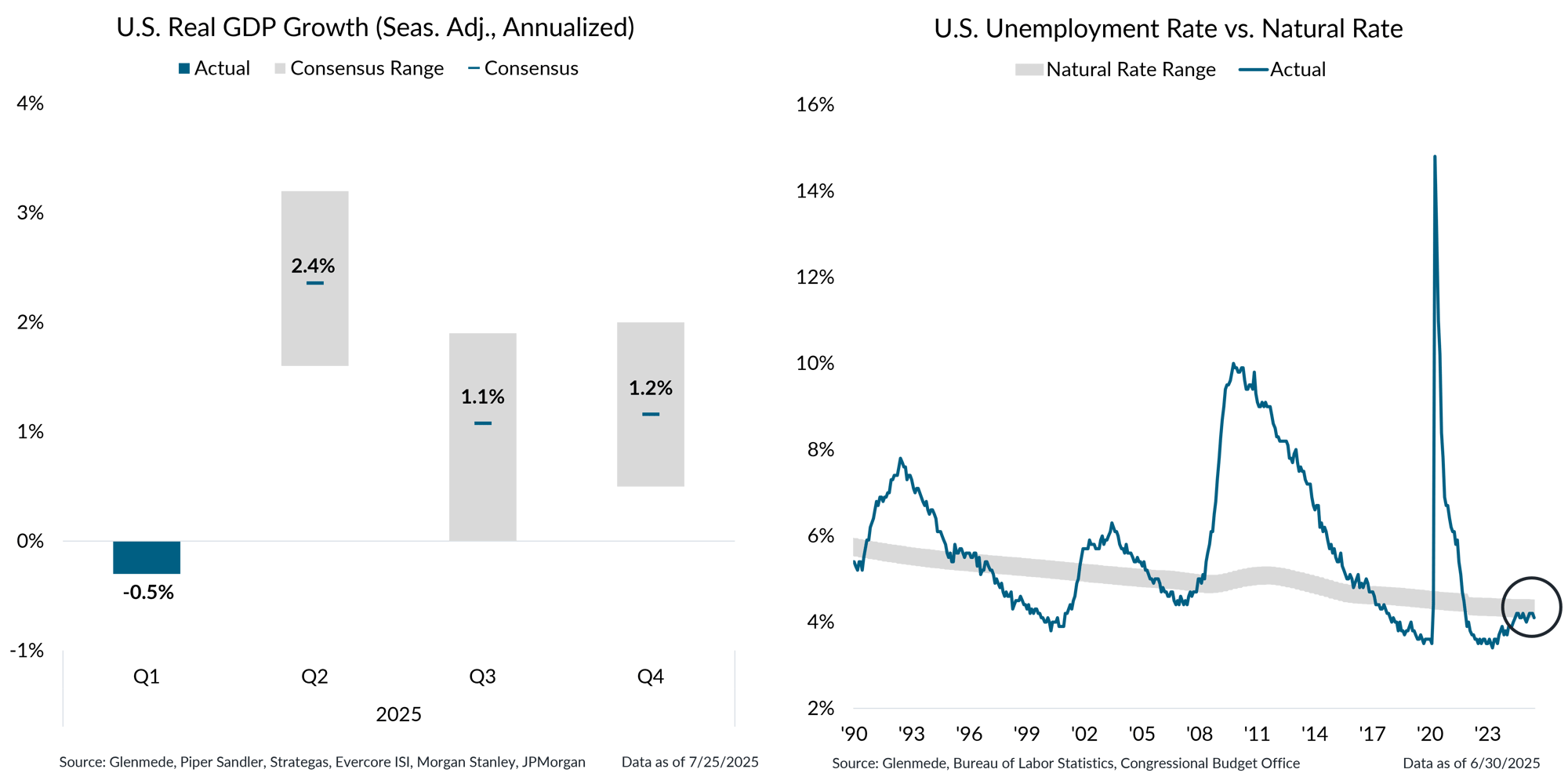

Shown in the left panel in gray is a range of estimates from economists for quarterly U.S. real gross domestic product (GDP) growth on a seasonally adjusted annualized basis. Solid blue figures are actual results. The blue dashes represent the average of estimates. Shown in the right panel is the U.S. unemployment rate for persons aged 16 years and over in blue and a range estimate of the natural rate of unemployment with a Glenmede-defined buffer in gray, which is the baseline level of joblessness that persists in a well-functioning economy due to frictional and structural factors.

- Economic growth is estimated to have rebounded from Q1, supported by easing trade tensions, stronger-than-expected corporate earnings, and robust consumer spending.

- The U.S. labor market is expected to remain resilient and relatively healthy despite the challenges posed by broader economic uncertainties.

The Fed is expected to keep rates unchanged, but the debate over rate cuts is growing louder

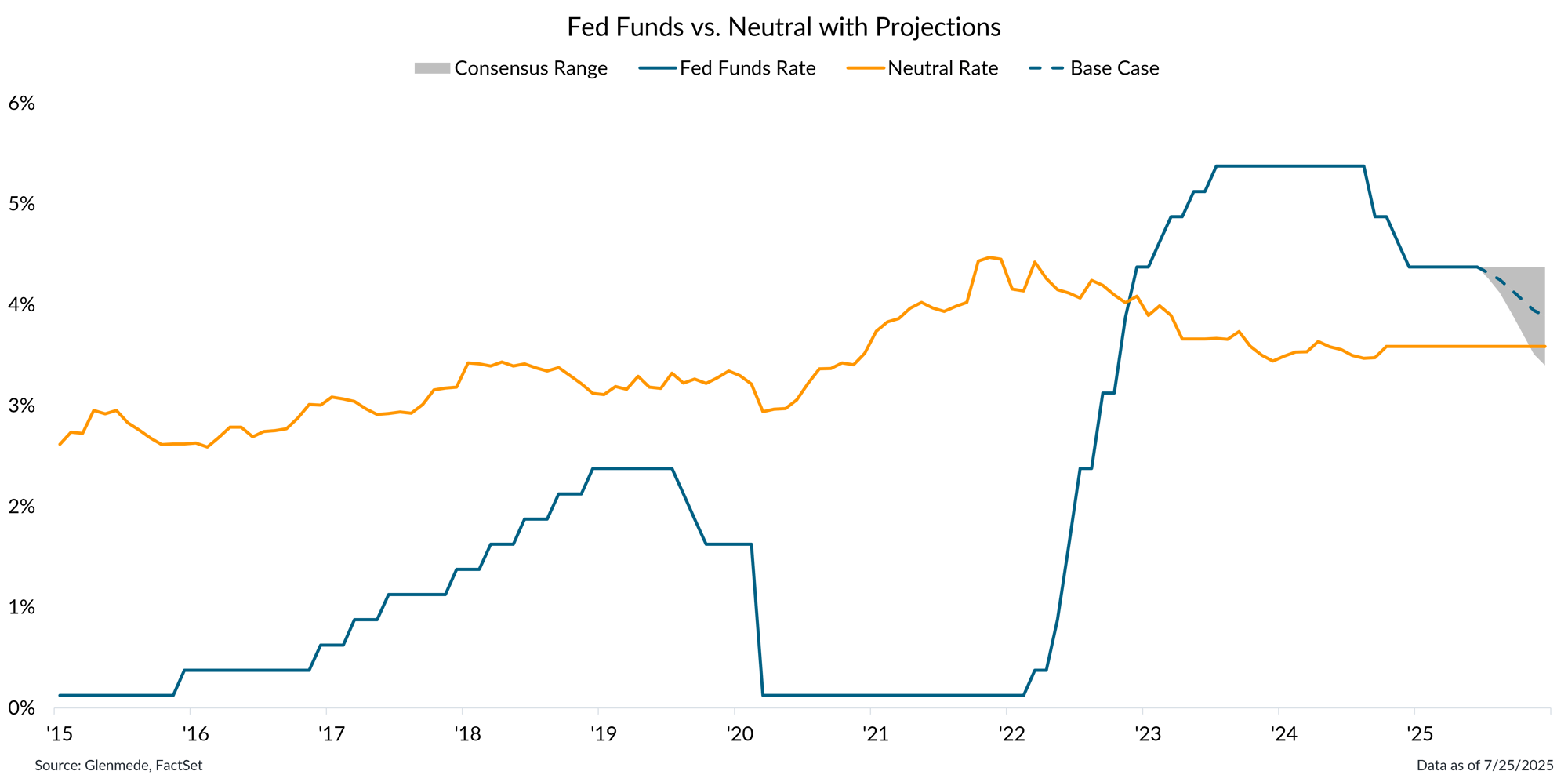

Data shown in orange are Glenmede’s estimates of the neutral federal funds rate over time (i.e., the level of rates that is neither economically stimulative nor restrictive) based on expectations for real interest rates via the Holston-Laubach-Williams model and Glenmede’s 10-year inflation expectations. Fed Funds Rate in blue is the target rate midpoint. The dashed blue line represents a base case projection based on current pricing in fed funds futures, and the gray region around that represents a range of plausible outcomes. Actual results may differ materially from projections.

- The Fed is expected to remain in “wait and see” mode as it looks for greater clarity on the impact of tariffs on inflation and the economy.

- The debate within the Fed is growing louder as opinions diverge over how long the Fed should keep interest rates higher than their longer-term neutral level.

The August 1 tariff deadline is fast approaching, with the scope of trade deals mostly unchanged

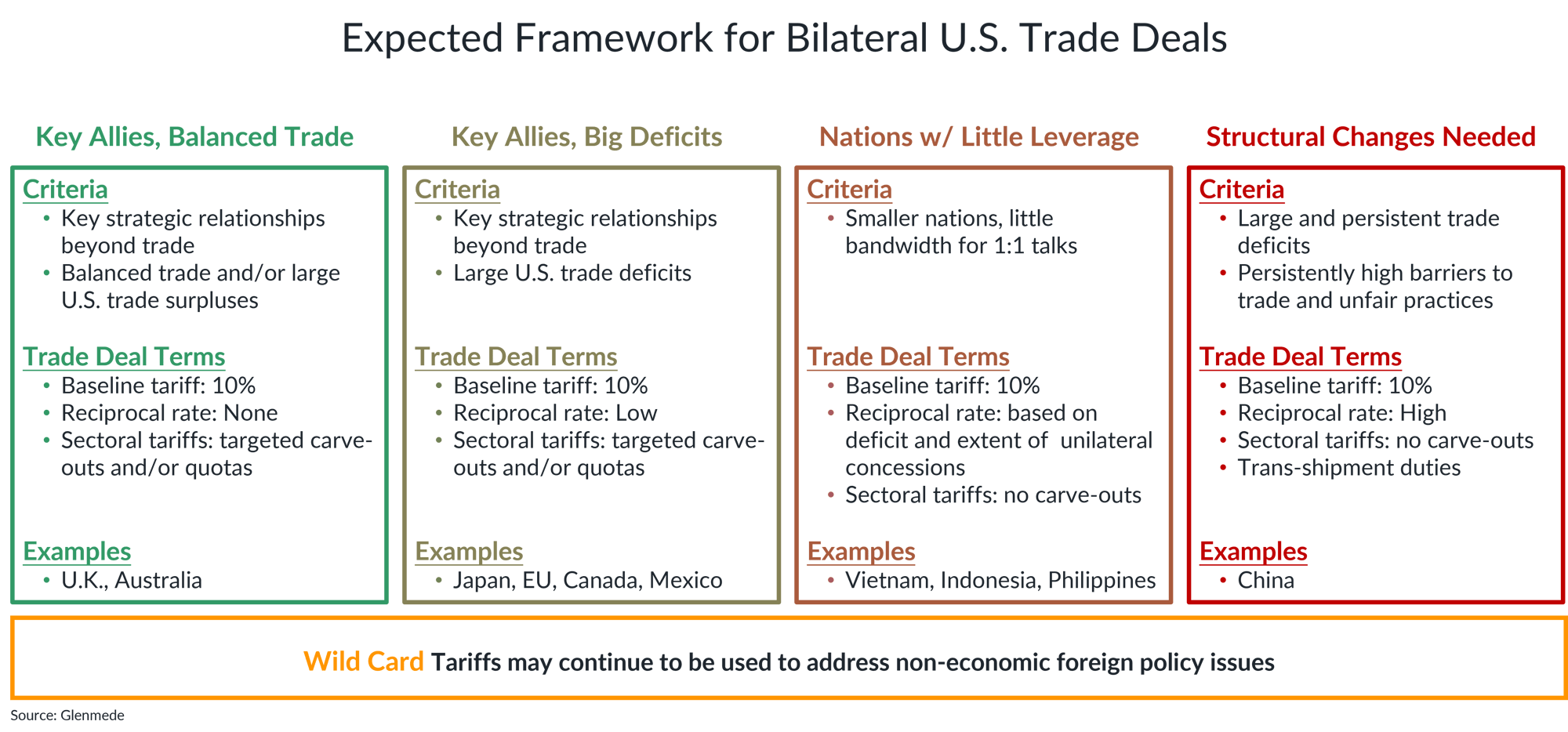

The information shown is purely for illustrative purposes and highlights Glenmede’s expectations for the emerging framework on trade deals with the U.S. Actual results may differ materially from expectations and are subject to change alongside adjustments to trade policies.

- With the August 1 deadline quickly approaching, trade partners such as Japan, Indonesia, and the EU have accelerated negotiations and secured some relief.

- A spectrum of potential outcomes for trade deals is taking shape, with key allies receiving favorable terms while others with less leverage face stricter terms of trade.

This material is provided solely for informational and/or educational purposes and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Any company, fund or security referenced herein is provided solely for illustrative purposes and should not be construed as a recommendation to buy, hold or sell it. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.