Investment Strategy & Research

Appraising the Housing Market

June 3, 2024

Executive Summary

- Underinvestment in the U.S. housing market has led to a significant supply-demand imbalance, driving home prices higher.

- Higher home prices/mortgage rates have contributed to deteriorating affordability, forcing existing homeowners to stay put and potential buyers to the sidelines.

- Lower interest rates could bring down mortgage costs and incentivize new home building, normalizing affordability over time.

- Housing remains a seller’s market for now, which is likely to persist until interest rates and supply stabilize.

Underinvestment in housing has led to a supply-demand imbalance, driving home prices higher

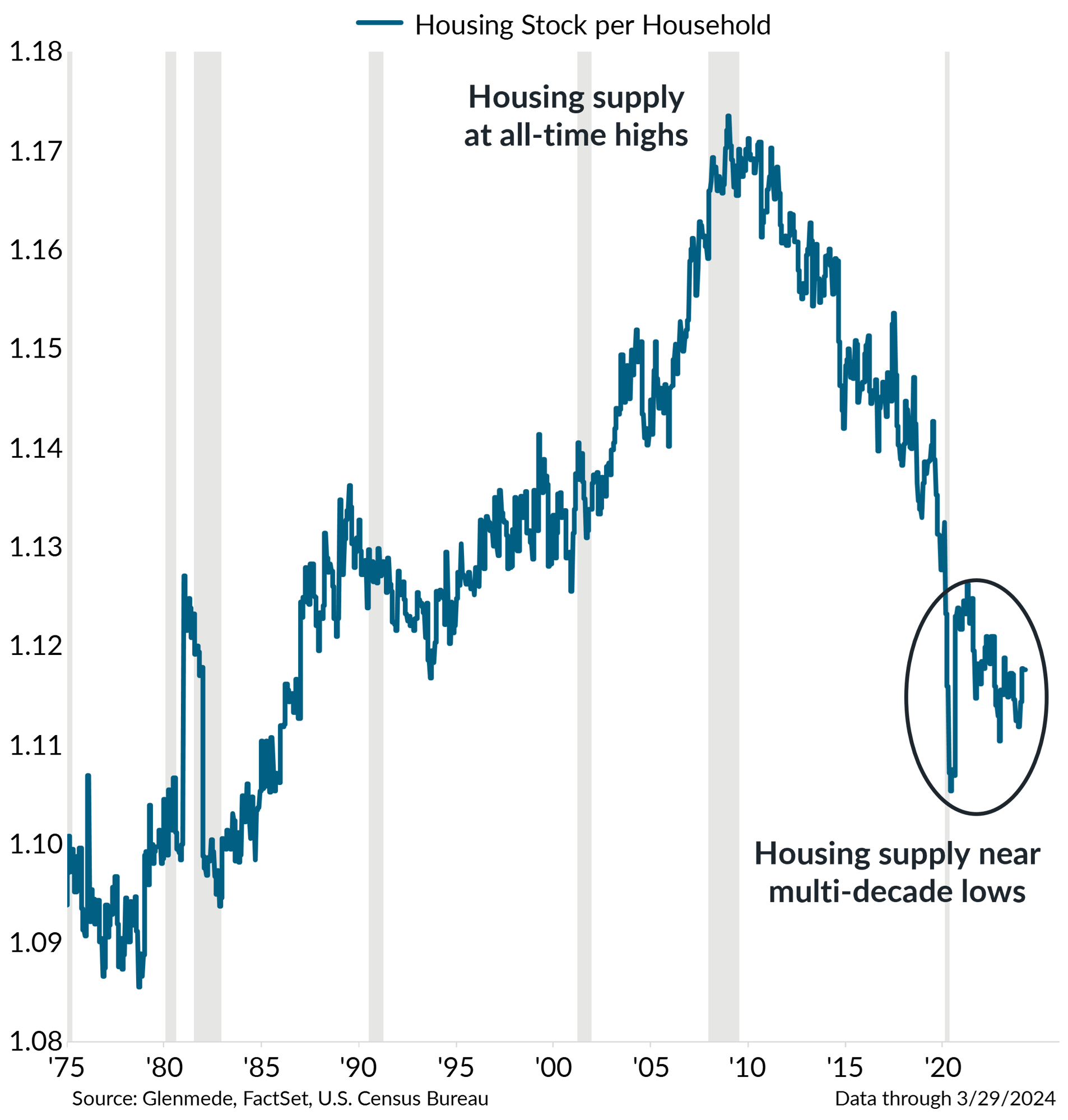

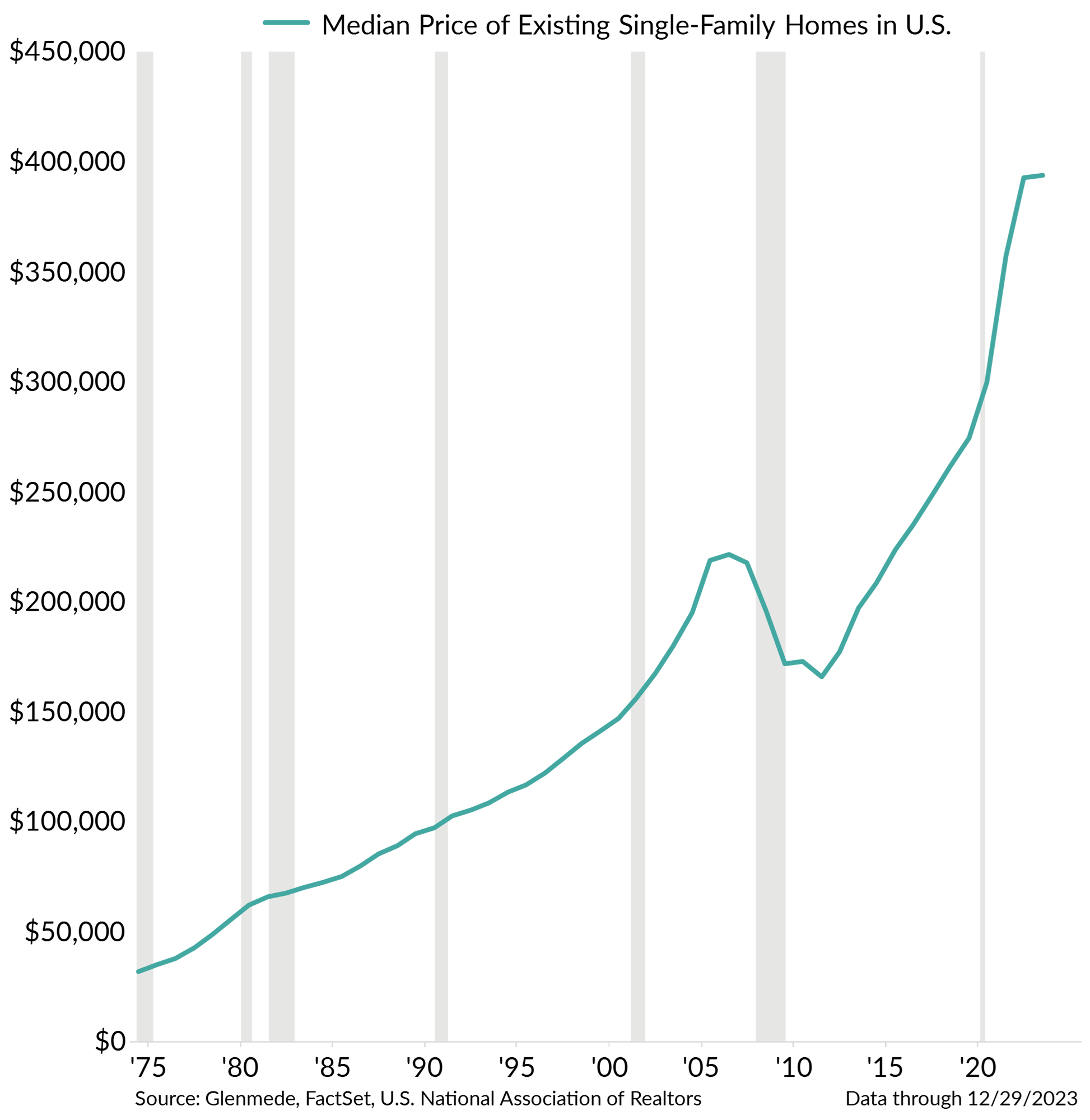

Shown on the left is the ratio between the number of households in the U.S. and the total supply of housing stock in the U.S., including units that are currently occupied or vacant. Shown on the right is the median selling price of existing single-family homes. Gray bars represent periods of recession in the U.S.

- There was a significant underinvestment in single-family housing since the Great Financial Crisis, which has led to a supply-demand imbalance.

- This has been a contributing factor to rising home prices, as the median price of a single-family home in the U.S. has risen considerably over the last ten years.

Home ownership costs are extended relative to household incomes for new buyers

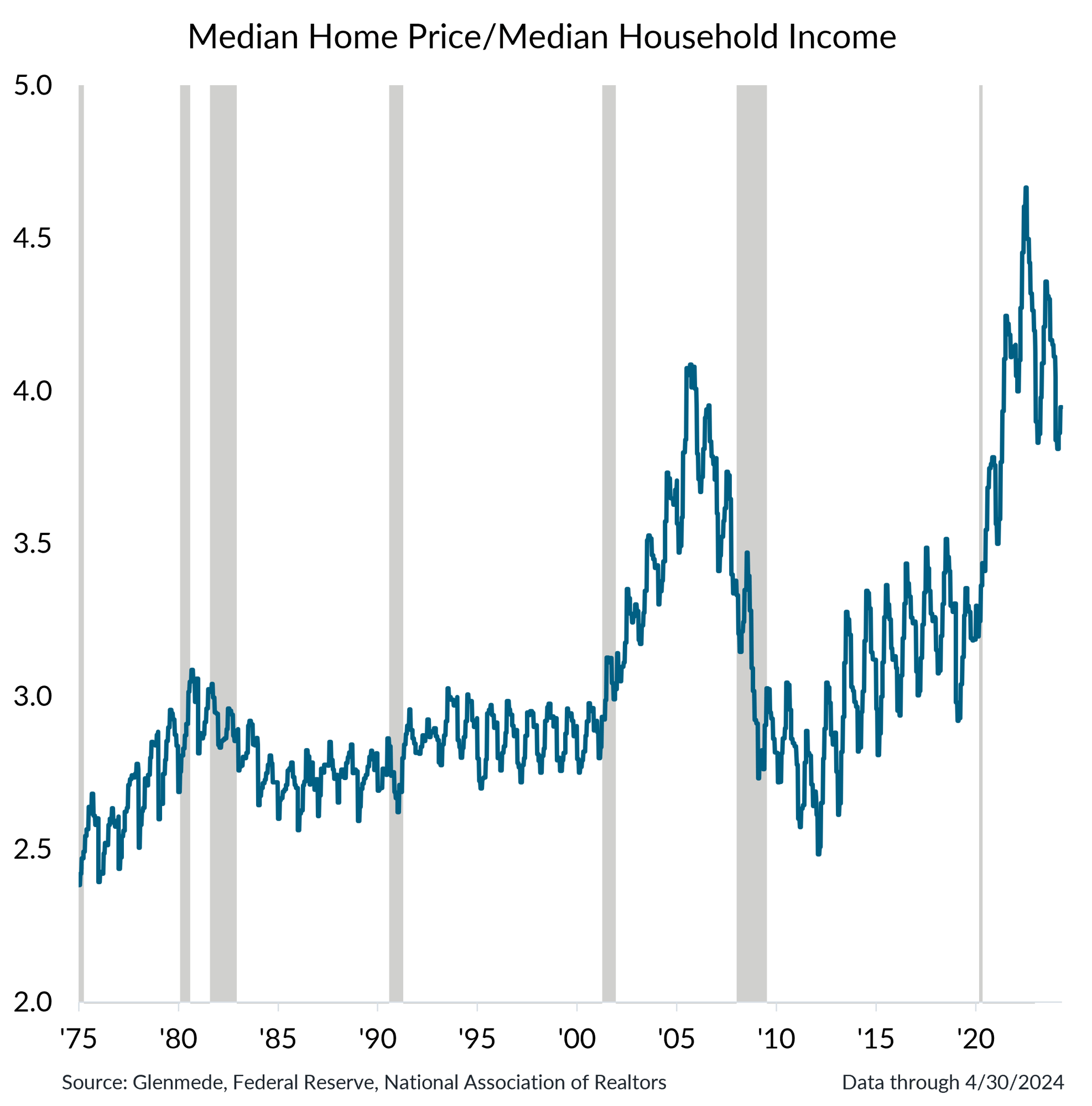

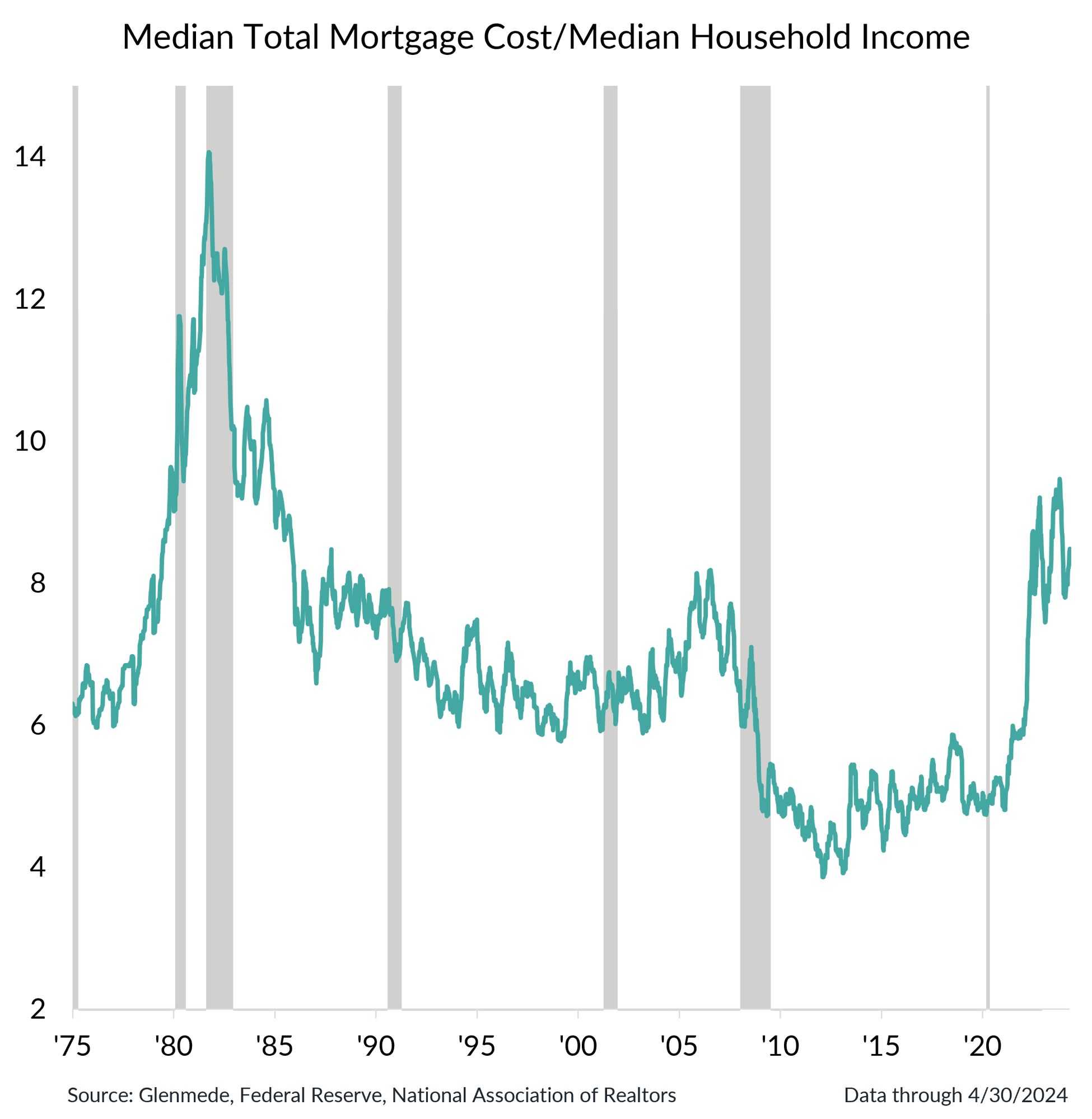

Data shown in the left panel is the ratio between the U.S. median home price and the median household income. Data shown in the right panel is the all-in cost for a buyer of the median priced home in the U.S., assuming a 30-year fixed mortgage rate with 20% down payment, divided by median household income. Gray bars represent recessionary periods in the U.S.

- While somewhat off their recent highs, the ratio of median home prices to household incomes remains elevated.

- Measures that account for the all-in costs of purchasing a home (i.e., cost of home and mortgage rate) also remain elevated near multi-decade highs.

Lower rates could bring down mortgage costs and incentivize new home building

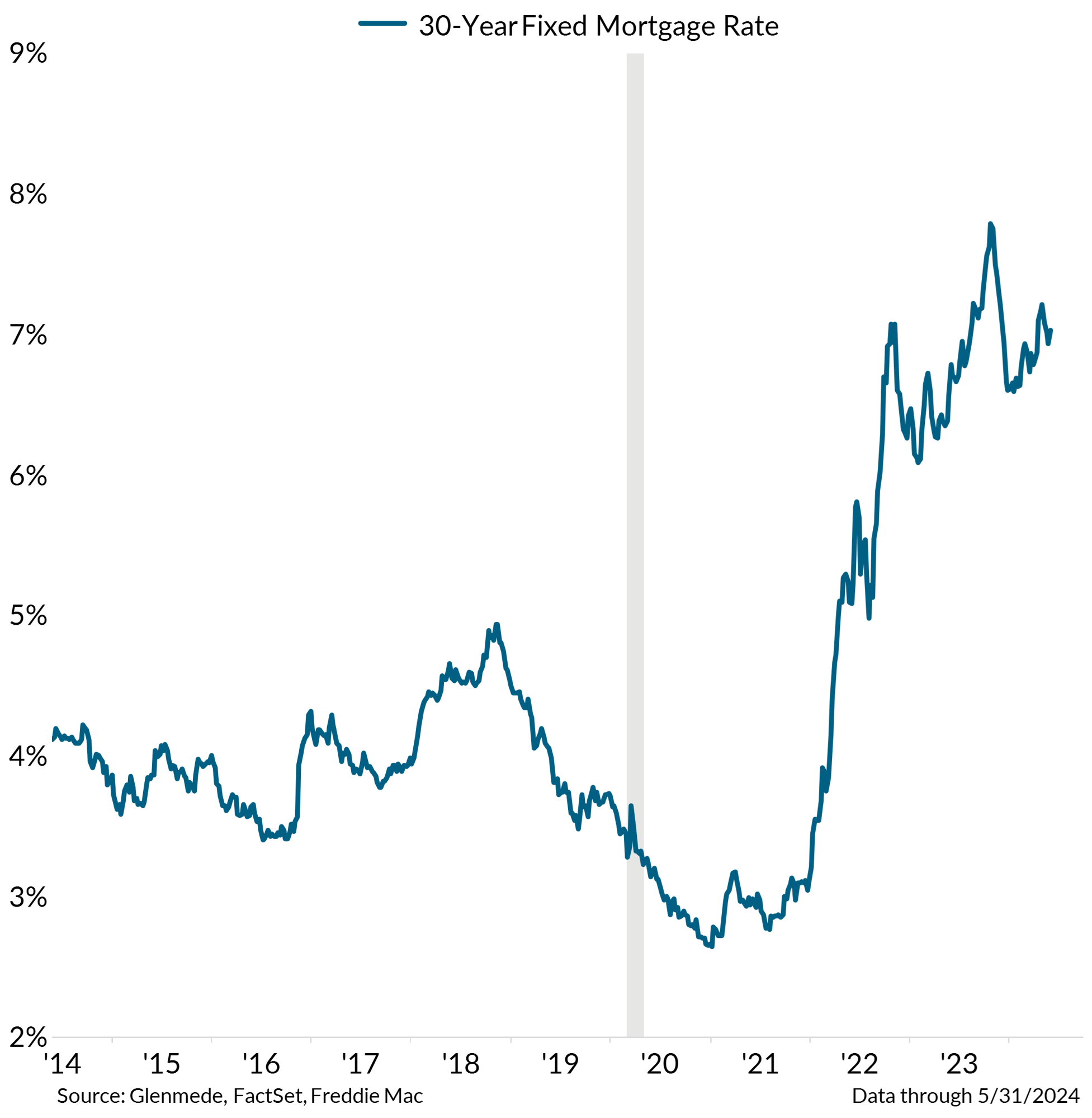

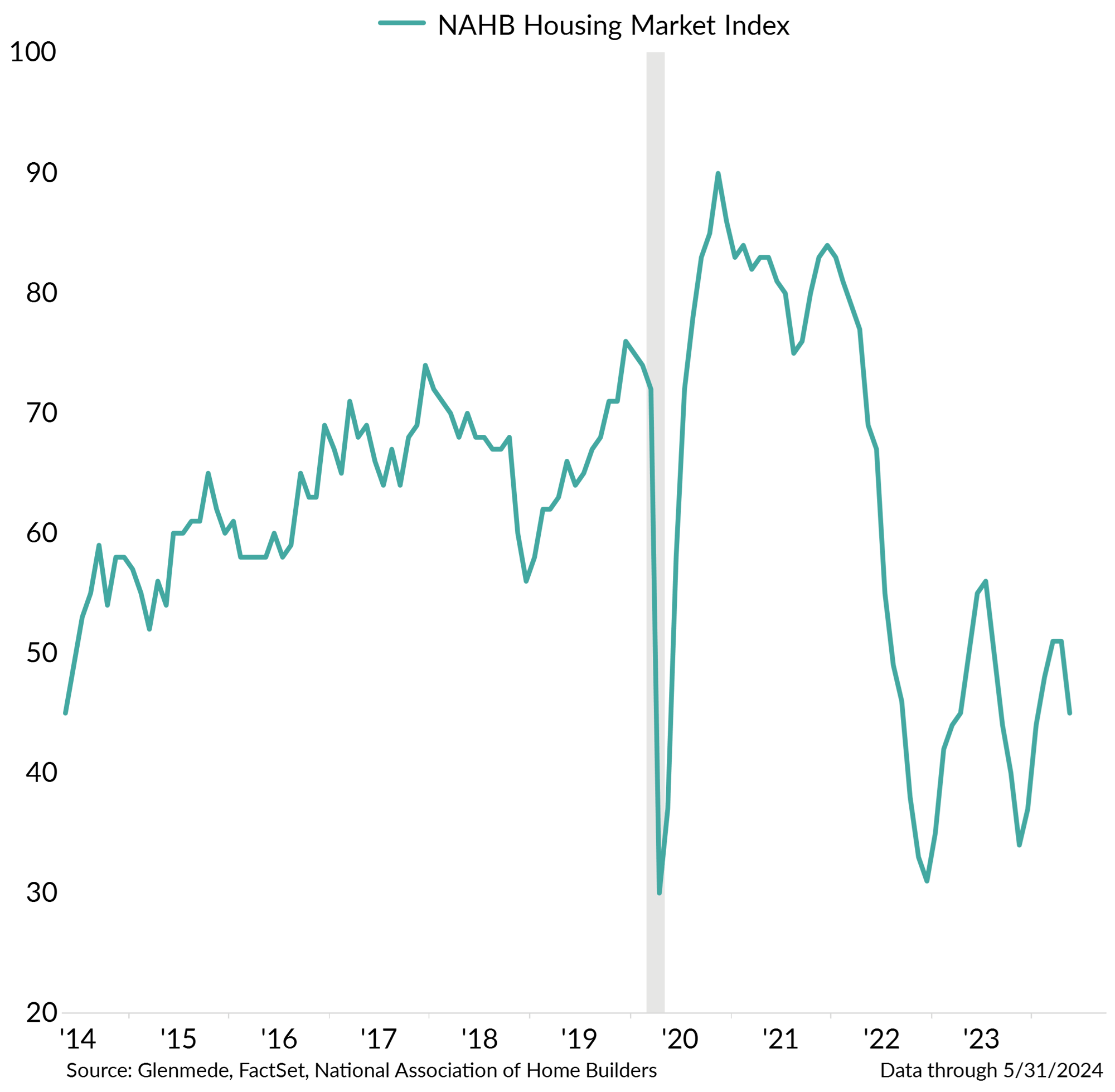

Shown on the left is the 30-year fixed mortgage rate for new loans in the U.S. Shown on the right is the National Association of Home Builders (NAHB) Housing Market Index on a seasonally-adjusted basis, which is designed to gauge homebuilder sentiment for single-family home construction in the U.S. Gray shaded regions represent periods of recession in the U.S.

- Mortgage rates remain high, but they could fall if monetary policy begins to ease, potentially improving affordability.

- Lower rates could also incentivize additional building activity – homebuilder sentiment has remained downbeat in part due to higher costs for financing new building projects.

For more in-depth information on this topic, please reach out to your Glenmede Relationship Manager.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.