Investment Strategy Brief

Assessing the Hype Around Artificial Intelligence

September 1, 2024

Executive Summary

- Market interest and investment in AI has skyrocketed, with infrastructure companies (i.e., those enabling AI) reaping the immediate benefits.

- Innovation cycles often become over-hyped, with stock prices anticipating higher earnings that can take years to materialize.

- The required earnings growth to justify current valuations of AI related companies appears lofty, but is not yet at extremes seen during the internet bubble.

- Investors should exercise caution around hot technology trends, as the price one pays for those investments is a key determinant of future returns.

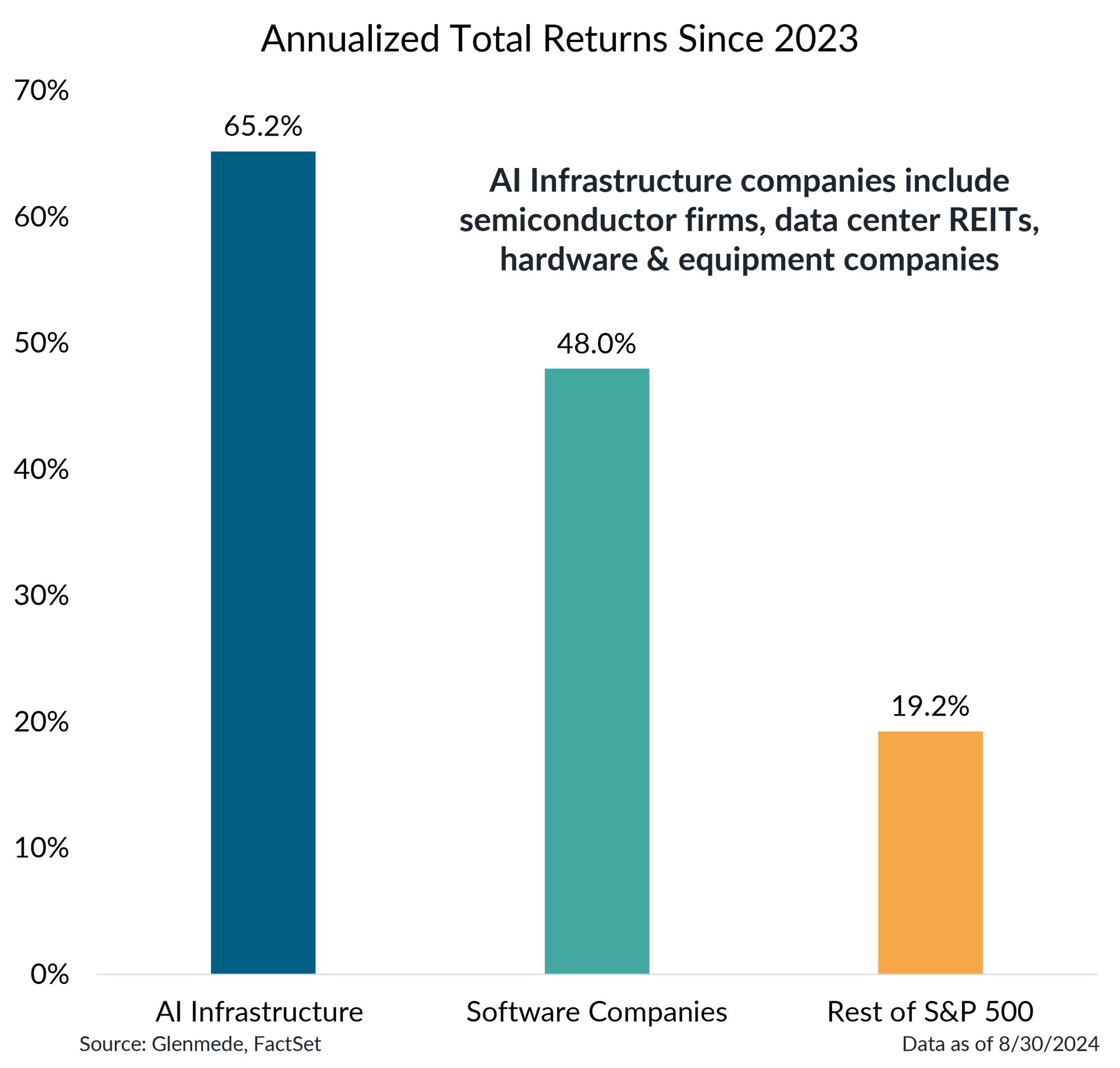

Artificial intelligence infrastructure companies have been benefiting the most from tech-related investment

![2024-09-02_Slide_1_Left[1] 2024-09-02_Slide_1_Left[1]](https://info.glenmede.com/hs-fs/hubfs/2024-09-02_Slide_1_Left%5B1%5D.png?width=2000&height=1864&name=2024-09-02_Slide_1_Left%5B1%5D.png)

Shown in the left panel is U.S. manufacturing construction put in place for computer, electronic or electrical manufacturing in billions of U.S. dollars on a seasonally-adjusted basis. Shown in the right panel are annualized total returns since 12/31/2022 for various cohorts of the S&P 500 index split by AI infrastructure, Software and Rest of S&P 500. AI Infrastructure is represented by semiconductor firms, data center real estate investment trusts and hardware & equipment companies, Software is represented by software companies and Rest of S&P 500 is represented by the remaining companies not included in the prior cohorts. The S&P 500 is a market capitalization weighted indices of U.S. large cap stocks. Past performance may not be indicative of future results. One cannot invest directly in an index.

- The advent of generative AI has sparked a massive surge in tech-related investment, particularly in companies that provide the infrastructure necessary for AI development.

- These AI infrastructure companies—encompassing semiconductor firms, data center REITs and hardware & equipment providers—have been the immediate beneficiaries of this wave.

Innovation cycles often become over-hyped, anticipating higher earnings that can take years to materialize

![2024-09-02_Slide_2[1] 2024-09-02_Slide_2[1]](https://info.glenmede.com/hs-fs/hubfs/2024-09-02_Slide_2%5B1%5D.png?width=2000&height=1015&name=2024-09-02_Slide_2%5B1%5D.png)

Data shown are the earnings and market capitalization of the S&P 500 Index’s information technology sector. S&P 500 Information Technology Earnings is an estimate of market value based on net income capitalized at a rate of 20 times earnings. The S&P 500 and its sector-specific sub-indices are market capitalization weighted indices of U.S. large cap stocks. Past performance may not be indicative of future results. One cannot invest directly in an index.

- Innovation cycles often become over-hyped, with stock prices anticipating higher earnings that can take years to materialize.

- Earnings during the tech bubble fell short and even declined after the bubble popped, leading to a decade-long gap before catching up to lofty market expectations.

AI valuations build in high expectations for earnings, similar to but not quite as high as a prior boom

![2024-09-02_Slide_3_Left[1] 2024-09-02_Slide_3_Left[1]](https://info.glenmede.com/hs-fs/hubfs/2024-09-02_Slide_3_Left%5B1%5D.png?width=1987&height=2000&name=2024-09-02_Slide_3_Left%5B1%5D.png)

![2024-09-02_Slide_3_Right[1] 2024-09-02_Slide_3_Right[1]](https://info.glenmede.com/hs-fs/hubfs/2024-09-02_Slide_3_Right%5B1%5D.png?width=2000&height=1946&name=2024-09-02_Slide_3_Right%5B1%5D.png)

Data shown in the left panel are the earnings and market capitalization of the S&P 500 Index’s Information Technology sector. S&P 500 Information Technology Earnings is an estimate of market value based on net income capitalized at a rate of 20 times earnings. Data shown in the right panel are the earning and market capitalization of AI Infrastructure companies, which are represented by semiconductor firms, data center real estate investment trusts and hardware & equipment companies in the S&P 500 Index. The S&P 500 and its sector-specific sub-indices are market capitalization weighted indices of U.S. large cap stocks. Price-to-Earnings (P/E) ratio is calculated as market value over net income. Required EPS Growth represents the growth in EPS (earnings per share) needed over the next 5 years to generate a return of 9% annualized from the starting P/E ratio and assuming a P/E ratio of 20x at the end of the 5-year period. One cannot invest directly in an index.

- The required earnings growth to justify current valuations of AI related companies appears lofty, but is not yet at extremes seen during the internet bubble.

- Investors should exercise caution around hot technology trends, as the price one pays for those investments is a key determinant of future returns.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.