Investment Strategy Brief

Backing Off the

Tariff Brink

April 13, 2025

Executive Summary

- The reciprocal tariff pause has pulled trade policy back from the brink, but the economic impact may still be notable.

- The probability of recession this year has fallen closer to 40%, though the path from here continues to remain uncertain.

- The 90-day pause on reciprocal tariffs and high inventories may delay price impacts, but some categories could show effects first.

- Trade policy changes may now be structural in nature, justifying an ongoing evaluation of the longer-term impact on economies and corporate profits.

- Ongoing uncertainty may push risk premiums higher, highlighting the importance of a patient, opportunistic approach to rebalancing.

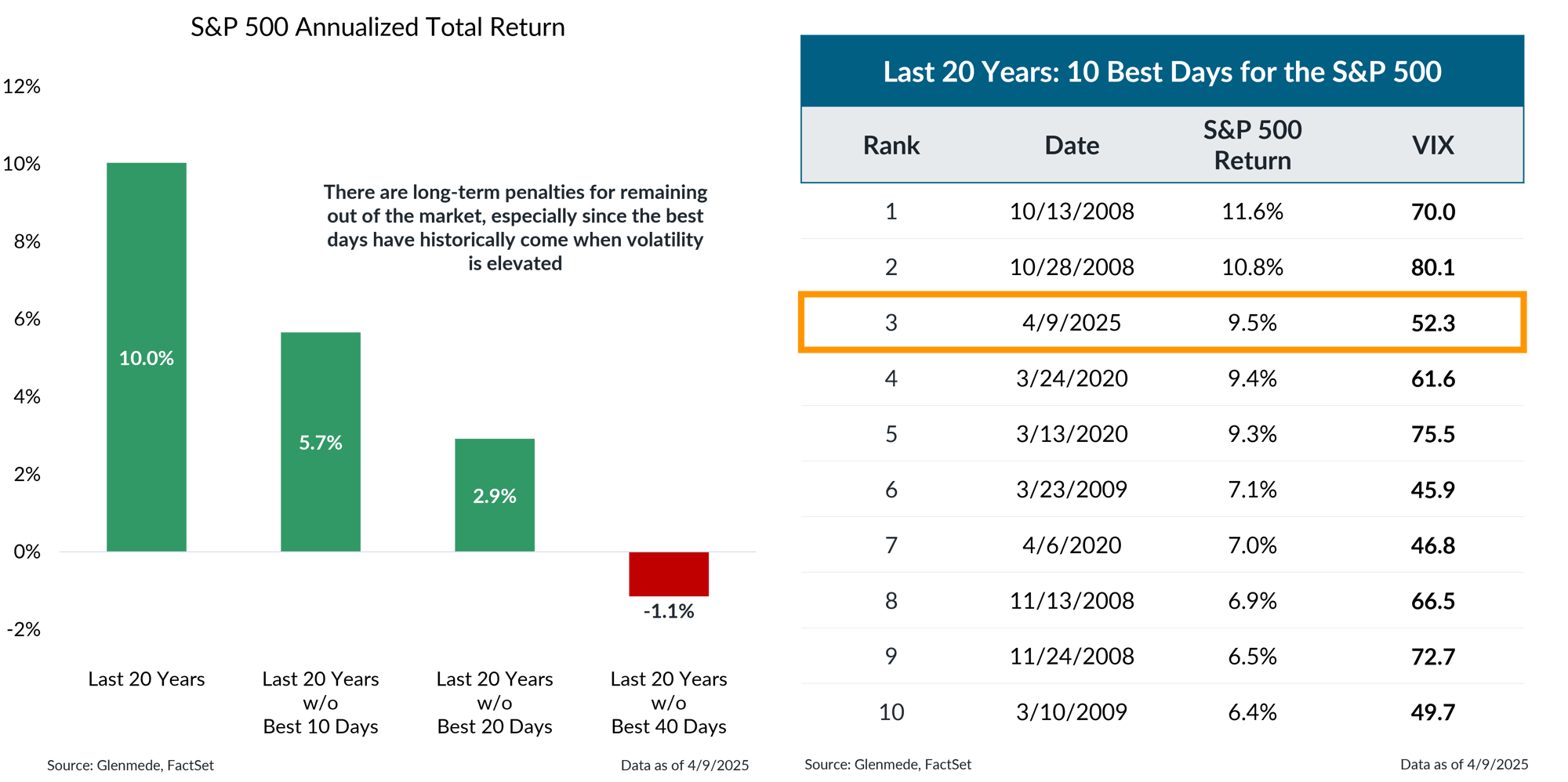

Last week was case-in-point that wholesale market timing can prove costly

The S&P 500 is a market capitalization weighted index of U.S. large-cap stocks. The Chicago Board Option Exchange’s Volatility Index (VIX) is a measure of the market’s expectation of volatility based on derivatives pricing on the S&P 500 Index. Past performance may not be indicative of future results. One cannot invest directly in an index.

- Last week served as a prime example of how costly market timing can be, as the S&P 500 posted one of its strongest single-day gains on Wednesday during a period of elevated volatility.

- Market timing is very difficult and can prove costly — missing just the ten best days in the market over the last 20 years would have almost halved the return experienced by investors.

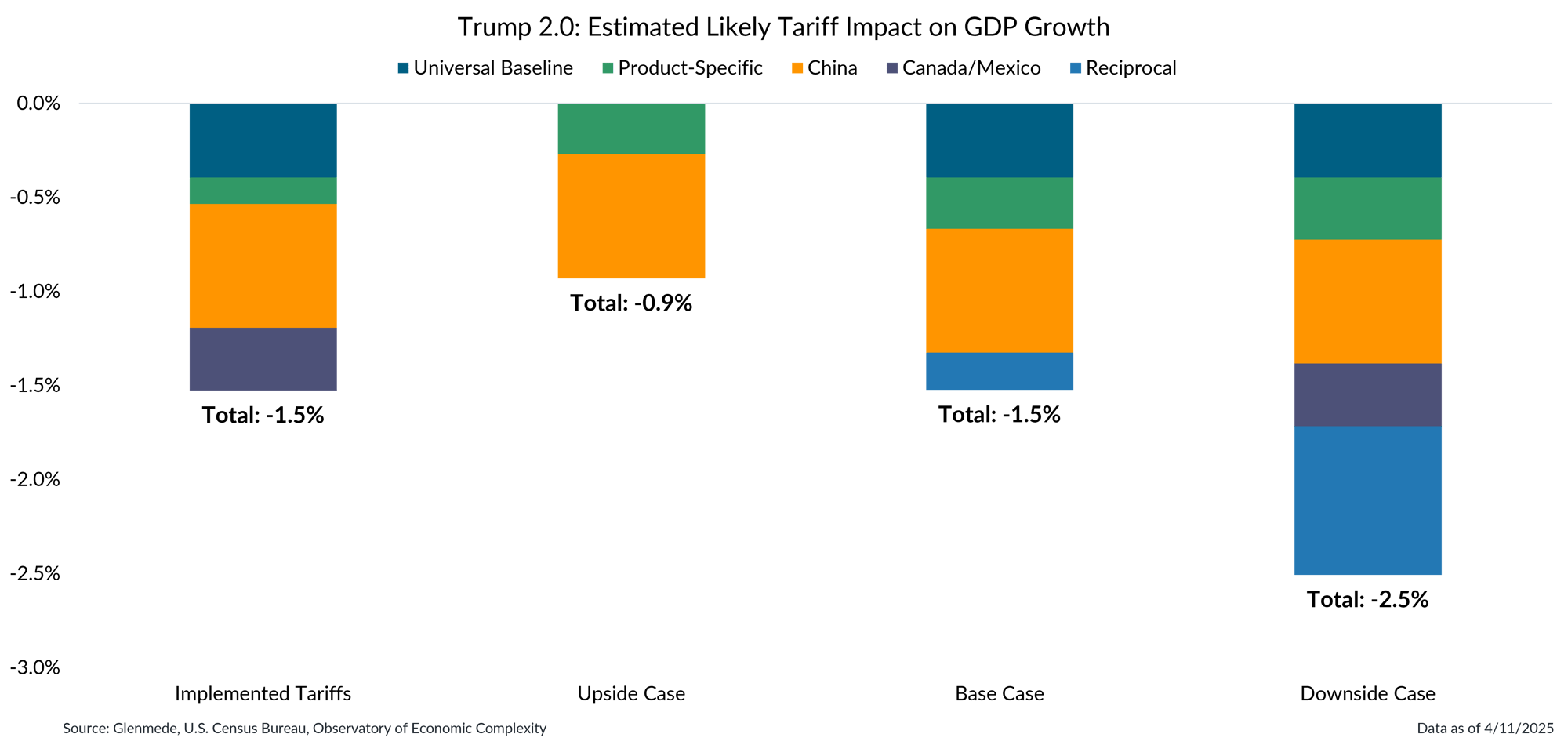

The reciprocal tariff pause pulled trade policy back from the brink, but the economic impact may still be notable

Implemented Tariffs includes 145% China tariffs, 25% Canada/Mexico tariffs with exemptions for goods compliant with the U.S.-Mexico-Canada Agreement, 25% steel/aluminum/auto tariffs and 10% universal baseline tariffs. Upside Case includes 145% China tariffs and 25% product-specific tariffs (steel, aluminum, autos, copper, lumber, pharmaceuticals, semiconductors). Base Case includes 145% China tariffs, 25% product-specific tariffs, 10% universal baseline tariffs and a quarter of the full announced program of reciprocal tariffs. Downside Case includes 145% China tariffs, 25% Canada/Mexico tariffs, 25% product-specific tariffs, 200% alcohol tariffs from the European Union, 10% universal baseline tariffs and the full announced program of reciprocal tariffs. All figures shown are projections as a share of nominal U.S. gross domestic product (GDP) and are subject to change. Actual results may differ materially from projections.

- With reciprocal tariffs now paused for 90 days, the economic impact of the implemented tariffs so far amounts to an estimated 1.5% headwind to GDP.

- There are a range of potential outcomes from here, including an upside case that focuses solely on China and product-specific duties, a downside case that goes full throttle on a range of tariffs and a base case that lands somewhere in between.

Tariff proposals are increasing the risk of recession, though the path taken from here remains uncertain

Shown in the left panel is Glenmede’s Recession Model, a tool developed by Glenmede to estimate the probability of a recession in the U.S. occurring within the next 12 months. The model is a balanced mix of (1) long-term excess indicators covering manufacturing, employment and debt balances and (2) near-term leading indicators covering monetary policy, credit markets, business sentiment and other economic trends. Shaded areas represent recession periods of the U.S. economy. Though created in good faith, there can be no guarantee that these indicators will be accurate. The model was established in 2015. The data shown for prior periods represents backtested results. The scenarios expressed in the right panel are hypothetical. TCJA refers to the Tax Cuts & Jobs Act of 2017. Actual results may differ materially from expectations.

- In the short term, trade policy headwinds are expected to weigh on economic activity, slowing GDP growth closer to the 0% line and raising the probability of recession this year to ~40%.

- Although significant uncertainty remains surrounding trade policy, multiple outcomes remain a possibility, including tariffs being challenged in court, trade partners choosing to negotiate/retaliate and/or Congress speeding up its timeline to intervene with offsetting tax cuts.

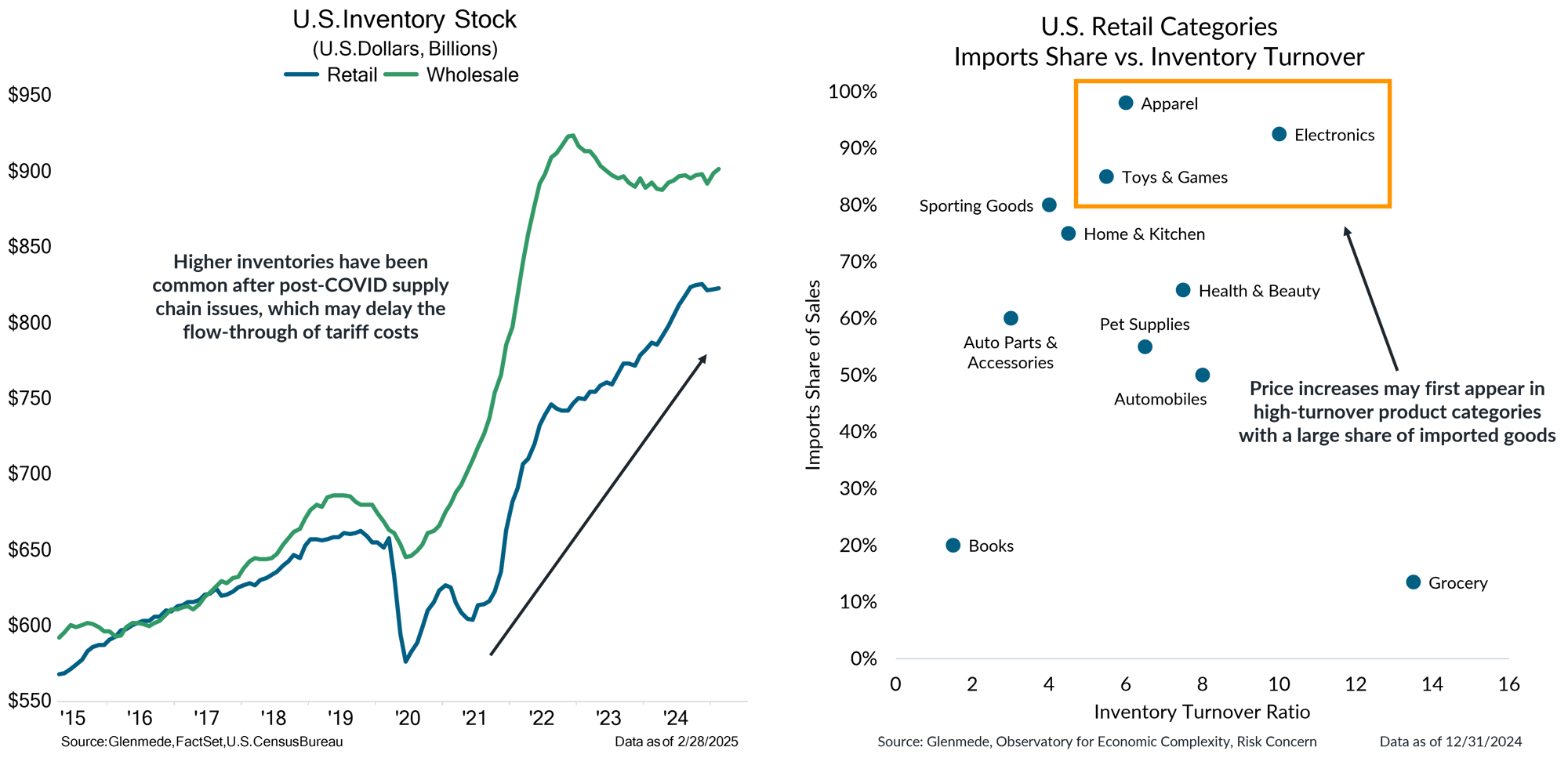

The 90-day pause and high inventories may delay price impacts, but some categories could show effects first

Data shown in the left panel are the value of total inventories for retailers (blue) and wholesalers (green) in the U.S., measured in billions of U.S. dollars. Each dot shown in the right panel represents a major category of retail in the U.S. and is graphed along the y-axis according to the share of sales that are imported into the U.S. and along the x-axis according to average inventory turnover ratios, which measures how quickly existing inventory is typically sold.

- It may take some time for tariffs to flow through to consumer prices, as inventory levels are elevated, and some firms may use the 90-day pause on reciprocal tariffs to accelerate imports and build on existing stockpiles.

- The types of products that may start to see the impacts of tariffs first can be found at the intersection of goods that are heavily imported and have high inventory turnover rates (e.g., apparel, electronics and toys).

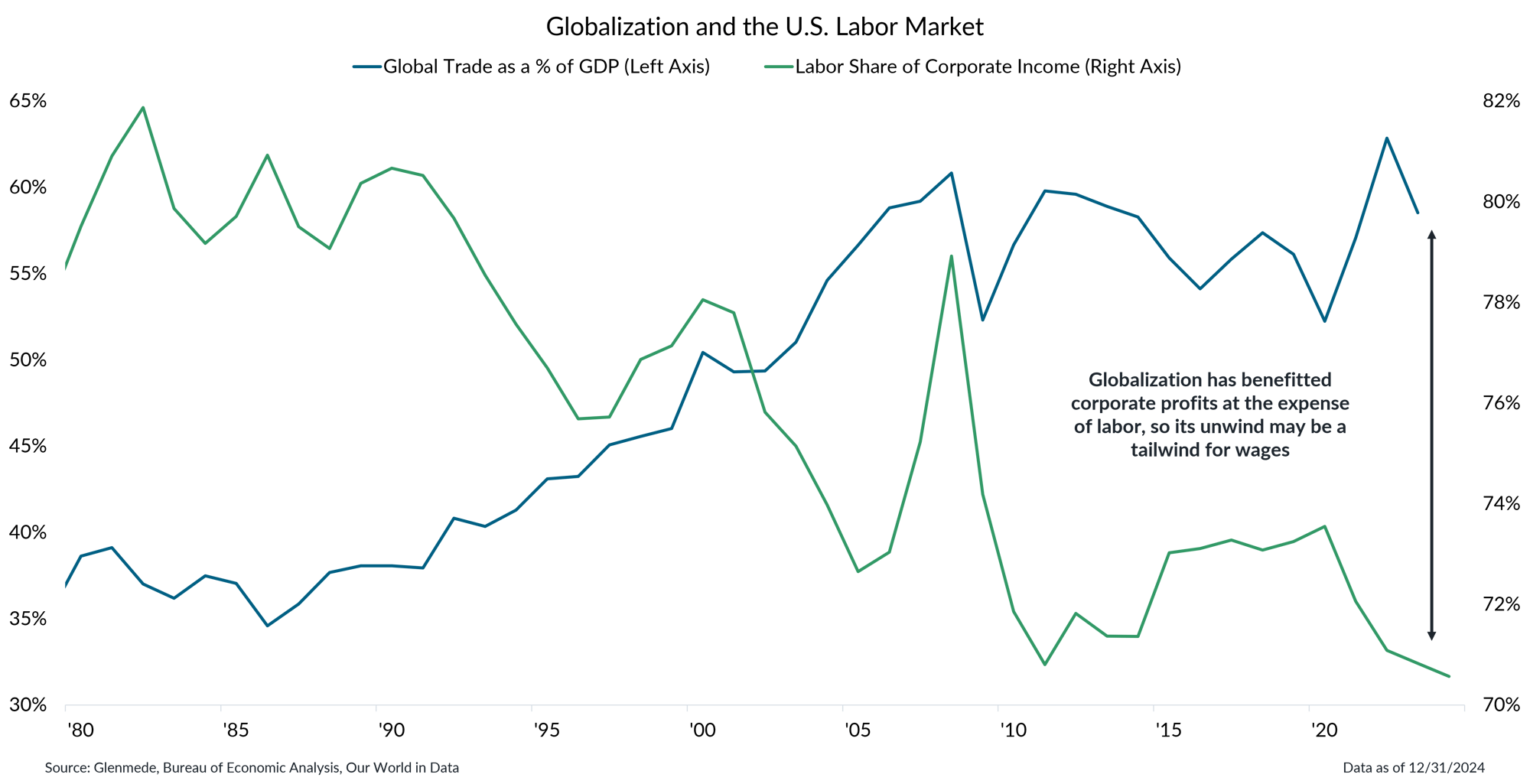

Longer-term, peak globalization may be the inflection point that benefits U.S. labor over businesses

Data shown is the sum of imports and exports as a share of global gross domestic product (GDP) in blue (graphed along the left y-axis) and compensation of employees as a share of national income less rental income of persons, net interest, net taxes on production/imports, surplus of government enterprises and miscellaneous payments in green (graphed along the right y-axis).

- Over the last few decades, the expansion of global trade has significantly boosted corporate profits, while labor has seen its share of corporate income steadily decline.

- Over the long-term, shifting trade policy and a potential retreat from globalization could be a catalyst that begins to unwind this trend, which may boost wage growth at the lower end of the income distribution.

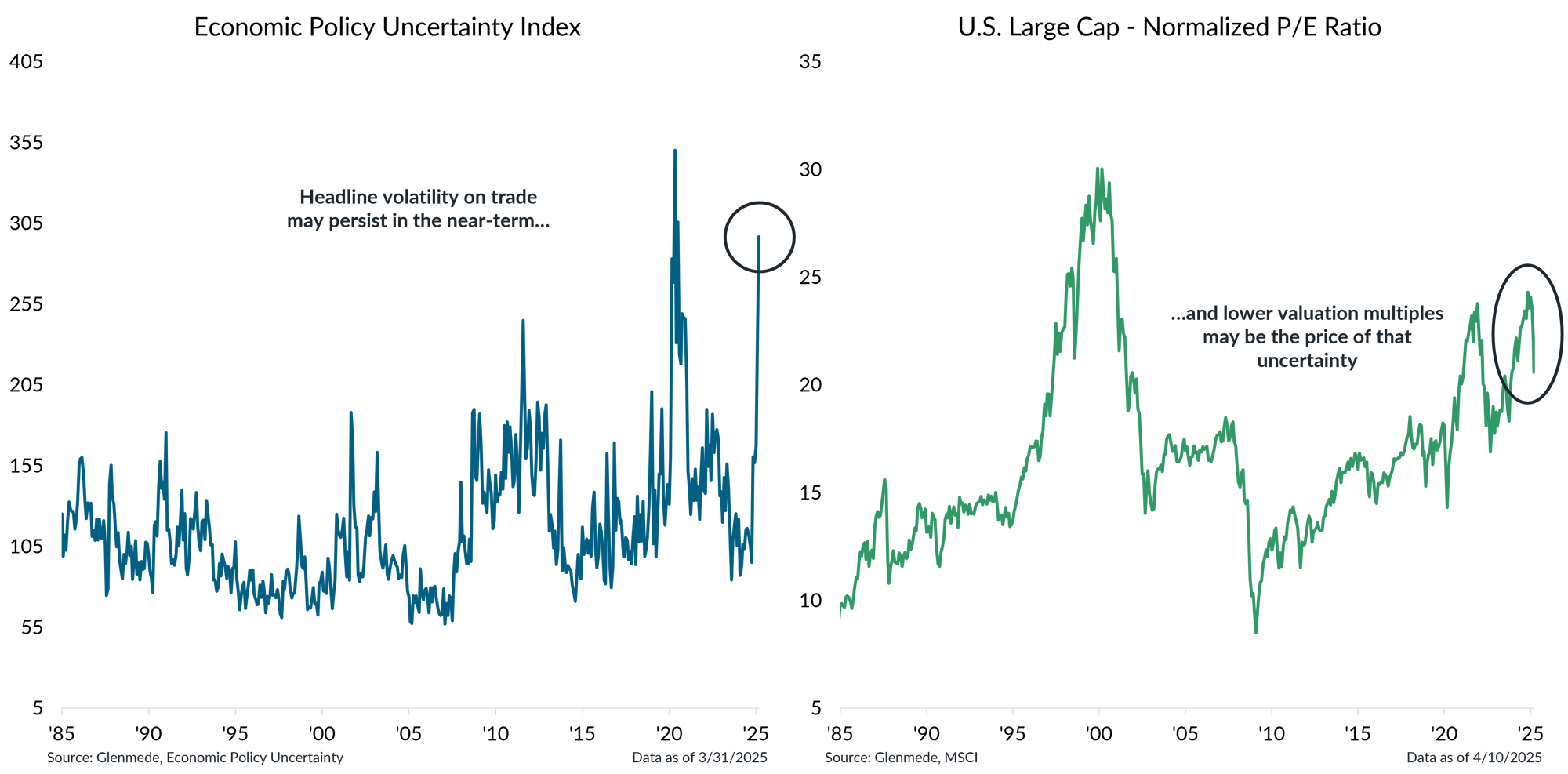

As long as economic uncertainty remains elevated, investors are likely to demand a larger risk premium

Data shown in the left panel is an index meant to represent uncertainty regarding economic volatility, which includes components such as the volume of news articles discussing economic policy uncertainty, the number of federal tax code provisions set to expire and disagreement among economic forecasters. Data shown in the right panel are normalized price-to-earnings (P/E) ratios over time for U.S. large cap stocks, as represented by the S&P 500. Past performance may not be indicative of future results. One cannot invest directly in an index.

- Economic uncertainty remains near all-time-highs due to shifting government policy, creating a challenging environment for business decision making and financial markets.

- As a result, ongoing uncertainty may push risk premiums higher in the near-term, highlighting the importance of a patient, opportunistic approach to rebalancing.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.