Investment Strategy Brief

Beyond the Magnificent Few: Diversification Delivers

March 23, 2025

Executive Summary

- Amid the pullback in U.S. large cap equities this year, diversification has paid off in multiple ways.

- Extreme concentration in domestic equity markets provided a timely signal for diversification.

- Regional market leadership has historically gone through long, alternating cycles and is perhaps at a key juncture.

- Bonds have resumed their historical role of providing portfolio ballast during periods of volatility.

- A diversified portfolio construction process should continue to reduce risks and enhance potential returns.

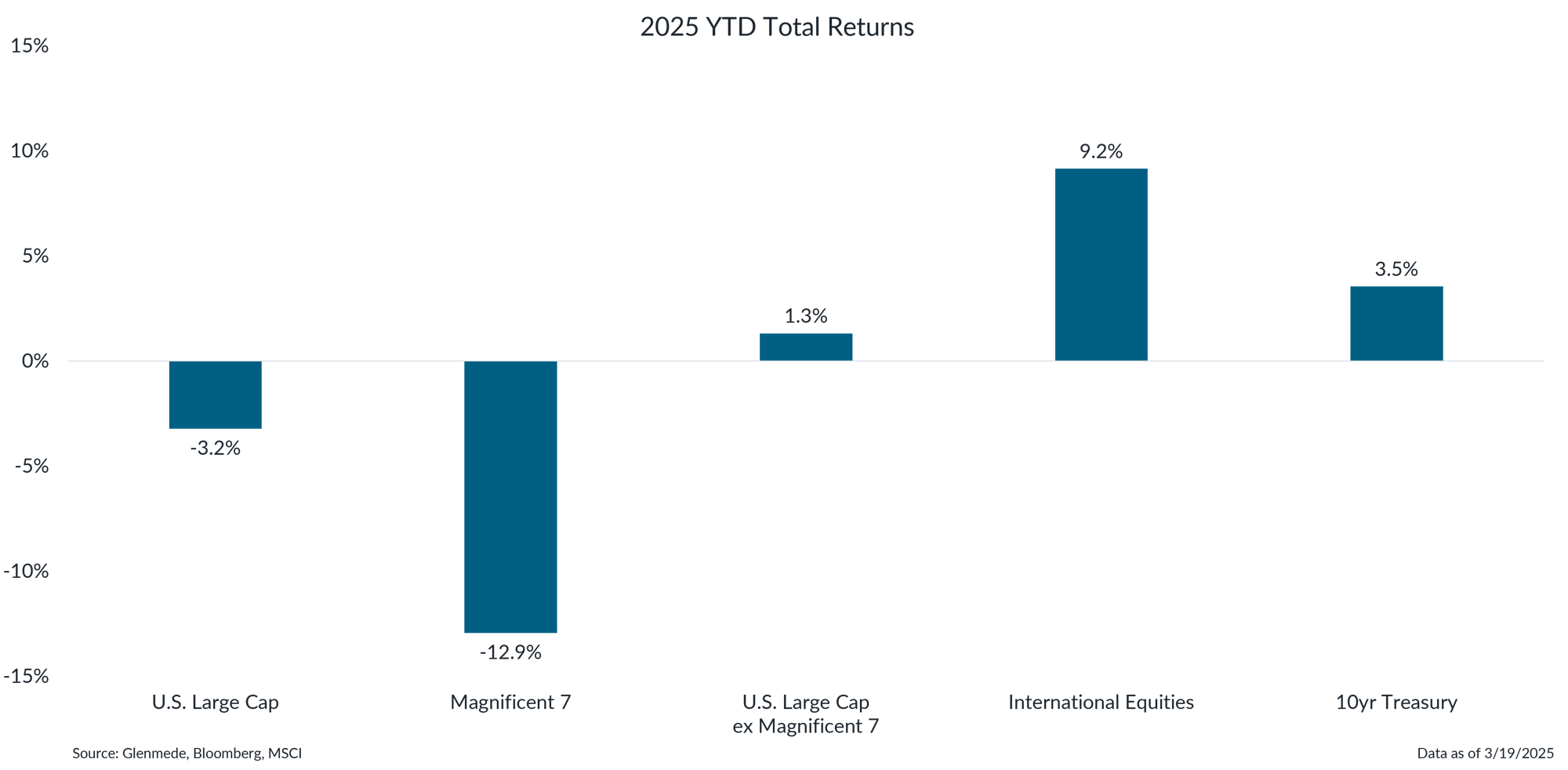

Amid the pullback in U.S. large cap equities this year, diversification has paid off in multiple ways

Data shown are 2025 year-to-date total returns for U.S. Large Cap (S&P 500), International Equities (MSCI All Country World ex-U.S.), Magnificent 7 (Apple, Alphabet, Amazon, Meta, Microsoft, Nvidia, Tesla), U.S. Large Cap ex Magnificent 7 (S&P 500 ex-Mag 7) and 10yr U.S. Treasuries (Bloomberg U.S. Treasury Bellwethers 10Y Index). References to individual securities should not be construed as a recommendation to buy, hold or sell. Past performance may not be indicative of future results. One cannot invest directly in an index.

- U.S. equities have experienced significant volatility this year, though the Magnificent 7 has been a key source of the associated downside.

- In comparison, investment approaches that have avoided the pitfalls of market concentration, diversified with foreign equities and allocated a portion of their portfolios to bonds have fared better than the headline market indexes.

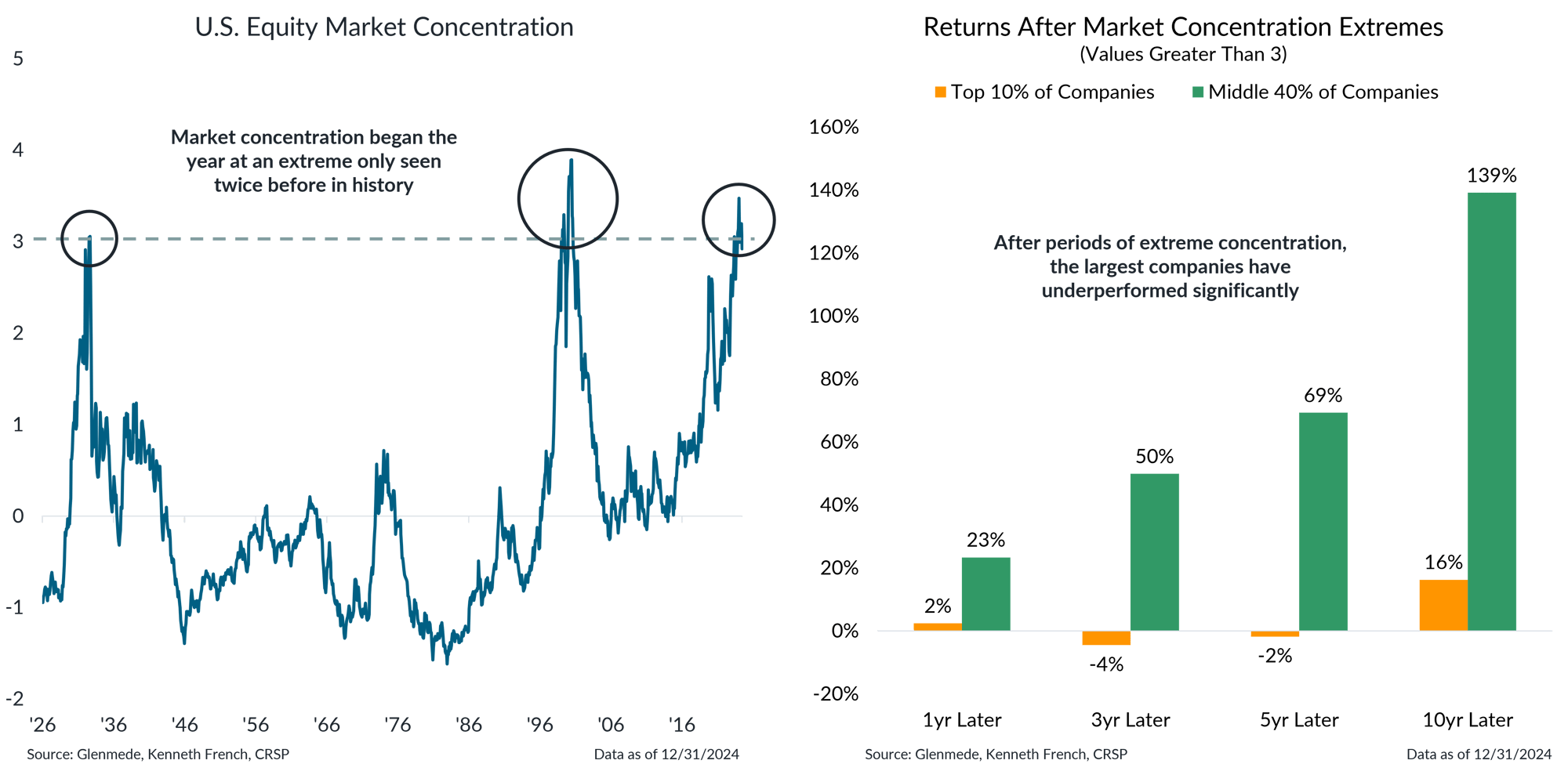

Extreme concentration in domestic equity markets provided a timely signal for diversification

Shown in the left panel is a measure of equity market concentration defined as the average firm size in the top decile of companies in the Center for Research in Security Prices (CRSP) database divided by the average firm size across the middle 40% of companies. The data graphed represent the number of standard deviations from the mean of this quotient. Data shown in the right panel are ex-post, cumulative value-weighted total returns for the following 1-, 3-, 5- and 10-year periods after the measure of equity market concentration eclipses 3 for the top decile of companies and the middle 40% of companies in the database. Past performance may not be indicative of future results.

- U.S. market concentration began the year at a historical extreme, seen only twice before; amid the Roaring ’20s and the Tech Bubble of the late ’90s.

- Such extremes in concentration have historically been followed by better returns from the field, as the largest companies have underperformed significantly.

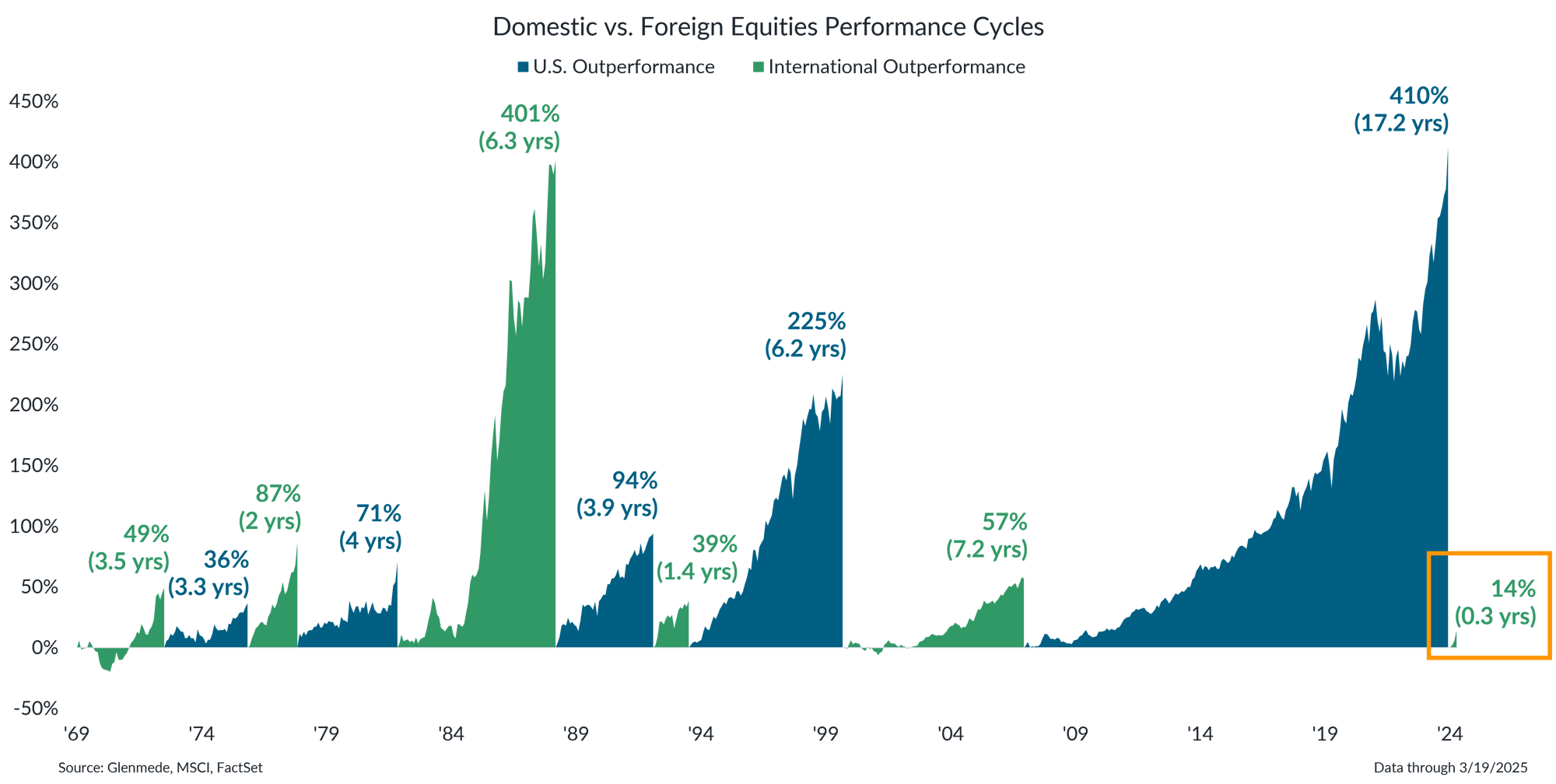

Regional market leadership has historically gone through long, alternating cycles and is perhaps at a key juncture

Data shown is the relative total return performance of U.S. Large Cap (MSCI USA) and International Developed (MSCI EAFE) equities from December 31, 1969. Regime changes are determined when cumulative outperformance peaks and is not reached again in a subsequent 12-month period. Past performance may not be indicative of future results. One cannot invest directly in an index.

- Regional market leadership has gone through long, alternating cycles, recently capped off by a long outperformance cycle for U.S. stocks.

- However, the script may be starting to flip, as domestic equities have struggled this year while international markets have performed well in comparison.

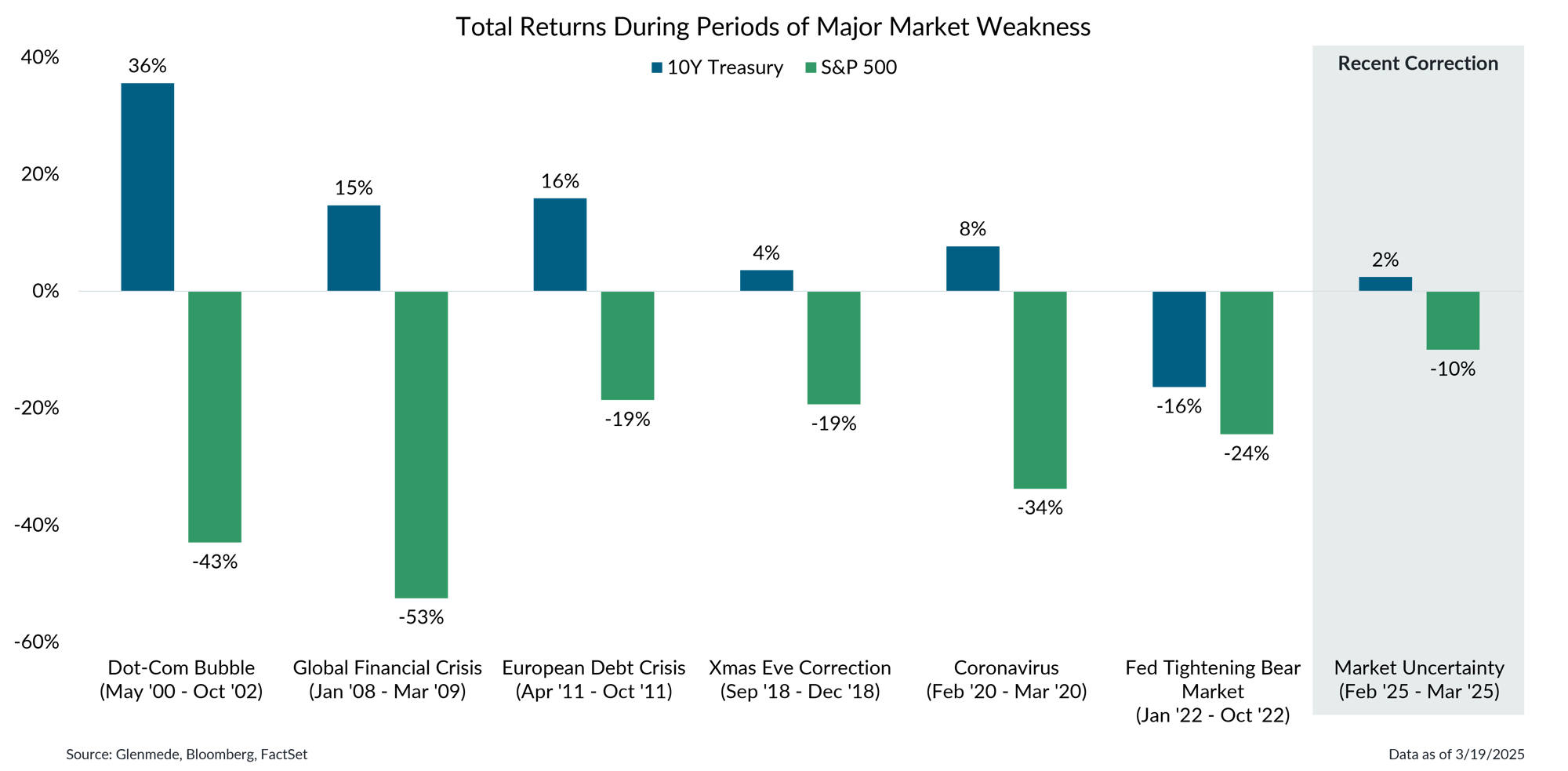

Bonds have resumed their historical role of providing portfolio ballast during periods of volatility

Data shown represent total returns for U.S. Large Cap (S&P 500) and 10-year U.S. Treasuries (Bloomberg U.S. Treasury Bellwethers 10Y Index) over the last several major periods of weakness in markets. Past performance may not be indicative of future results. One cannot invest directly in an index.

- Fixed income has performed well this year as yields have fallen, which generally fits the historical pattern regarding the interplay between stocks and bonds during periods of major market weakness.

- As markets continue to remain volatile, bonds have reclaimed their role as a stabilizing force within portfolios, offering a cushion against the volatile swings of equity markets.

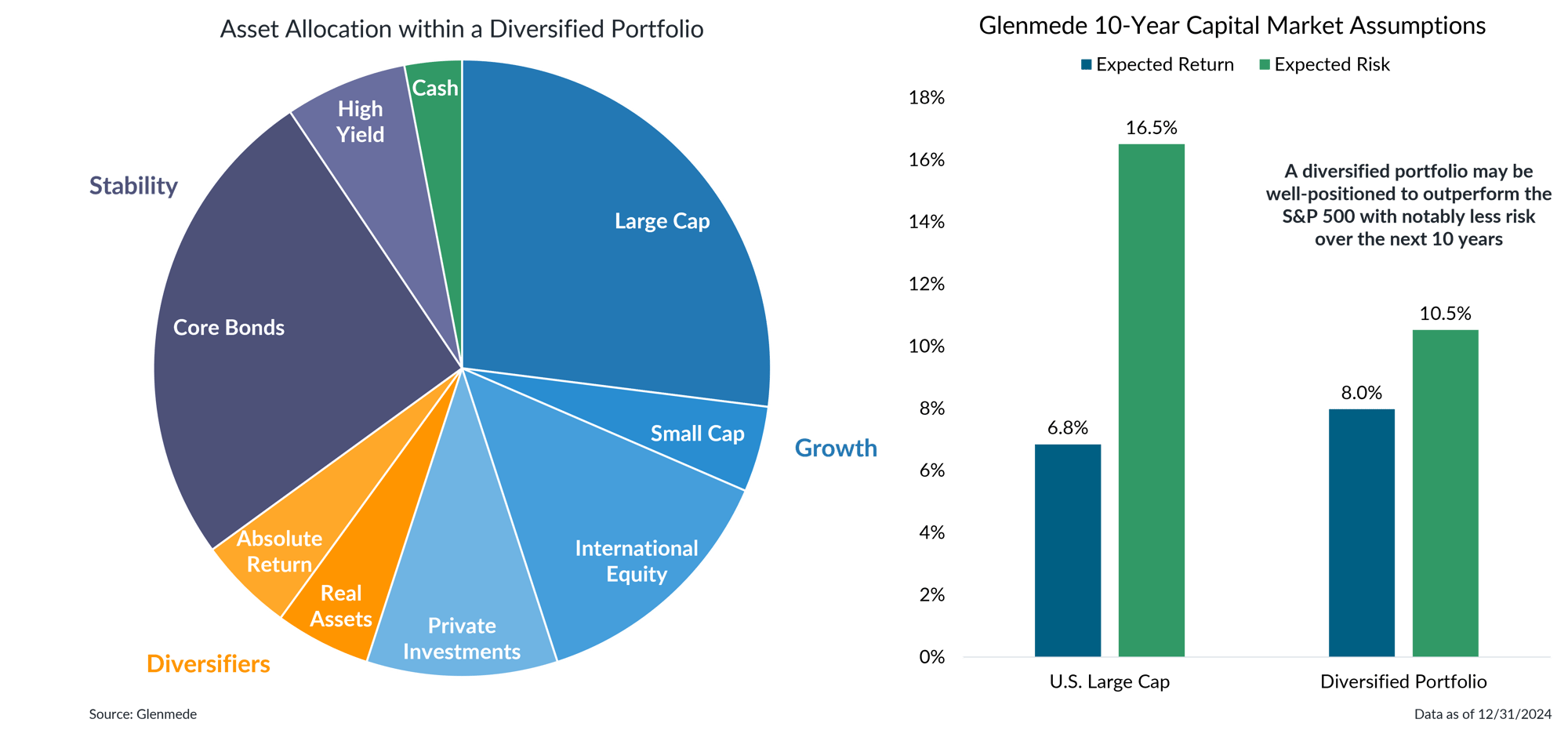

A diversified portfolio should continue to reduce risks and enhance potential returns

The chart in the left panel is provided solely for illustrative purposes to depict a hypothetical portfolio diversified across various asset classes and should not be construed as a recommendation to invest in any particular asset class or combination of asset classes. Investors should consult with their advisors to determine an appropriate asset allocation for their particular circumstances. Data shown in the right panel represent Glenmede’s proprietary capital market assumptions for the next 10 years. Diversified Portfolio is represented by Glenmede’s All Asset+ Growth with Income model portfolio. Expected risk is represented by the standard deviation of annual returns. Actual results may differ materially from expectations.

- A well-diversified portfolio that allocates capital across stocks, bonds and alternative investments has the potential to enhance returns while managing risk more effectively.

- Glenmede’s capital market assumptions project that a well-diversified portfolio may be well-positioned to outperform the S&P 500 with less risk over the next 10 years.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.