Investment Strategy Brief

Bitcoin: All That Glitters Is Not (Digital) Gold

December 1, 2024

Executive Summary

- Bitcoin has again reached new highs, driven in part by expectations for a more cryptocurrency-friendly incoming administration.

- Historically, bitcoin has exhibited unrivaled volatility, a poor attribute for a store of value.

- Bitcoin’s positive correlation with stocks undermines its potential as a diversifier particularly during periods of market weakness.

- Until bitcoin exhibits lower volatility and less correlation with stocks, it should be considered a speculative asset and not a store of value.

Bitcoin went mainstream around 2017 and has since experienced waves of interest

.png?width=2000&height=1031&name=2024-12-02%20slide%201%20(1).png)

ETF refers to exchange-traded funds. Past performance may not be indicative of future results.

- Since the election, bitcoin has again found its way to new highs, surpassing previous peaks established during the launch of the first bitcoin ETF and bitcoin halving.

- The latest wave of interest comes as president-elect Trump has taken a more friendly stance toward cryptocurrencies, pledging to dismantle restrictive regulation and establish policies that foster growth.

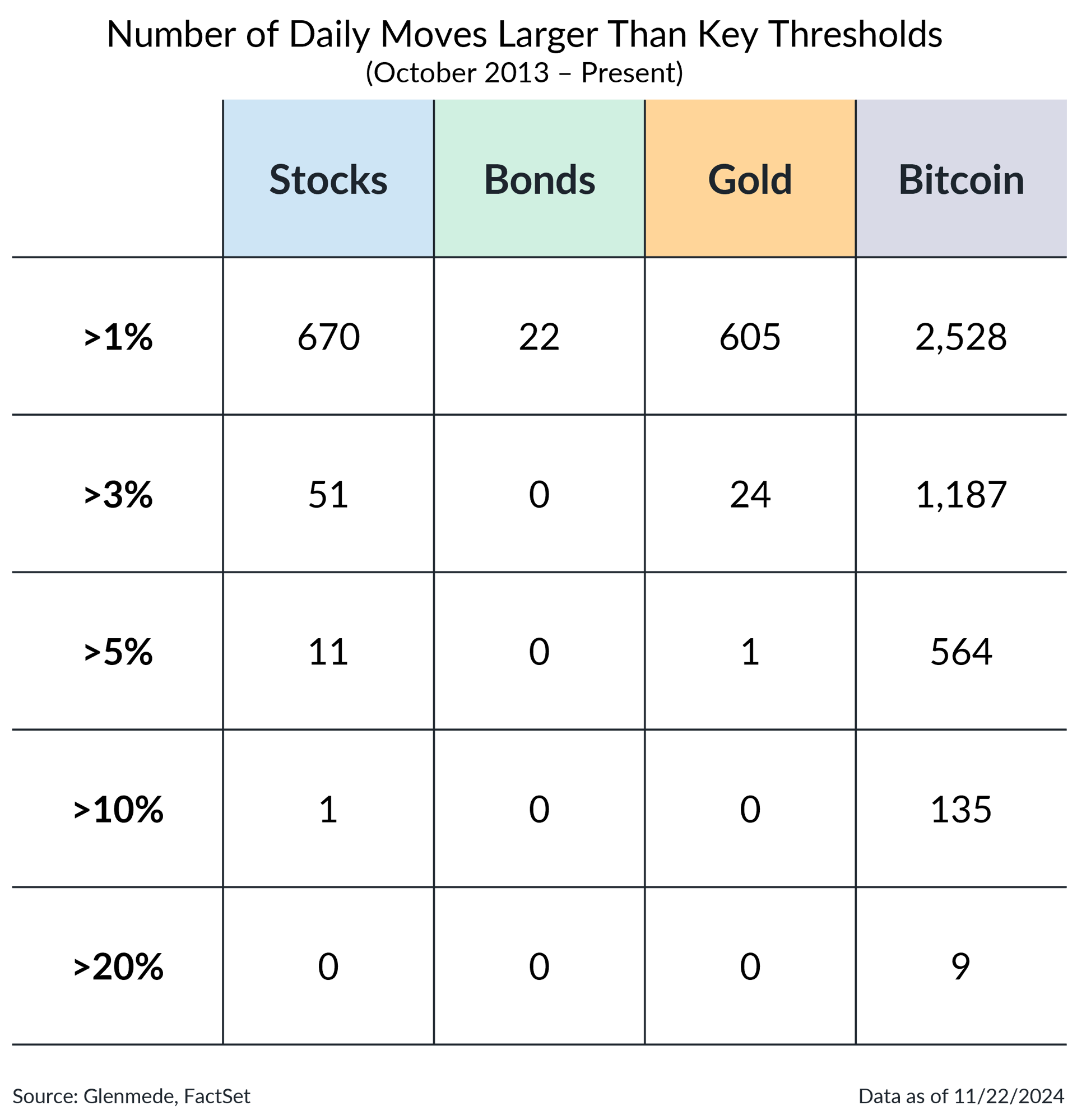

Bitcoin's volatility is persistently higher than that of other assets

The analysis in the left panel begins with data starting on October 1, 2013. Data shown in the right panel reflect the annualized standard deviation of daily returns over a rolling one-year period for stocks (as represented by the S&P 500 Index), bonds (as represented by the Bloomberg U.S. Aggregate Index), gold (as represented by the SPDR Gold Shares ETF) and bitcoin (as represented by daily transactions via CoinDesk). Past performance may not be indicative of future results. One cannot invest directly in an index.

- Since late-2013, bitcoin has seen daily moves of 10% or more 135 times. In comparison, U.S. core bonds and gold have had none, while stocks experienced just one such day.

- Bitcoin may be a poor store of value due to its extreme volatility, as the standard deviation of its returns sits magnitudes above that of stocks, bonds and gold.

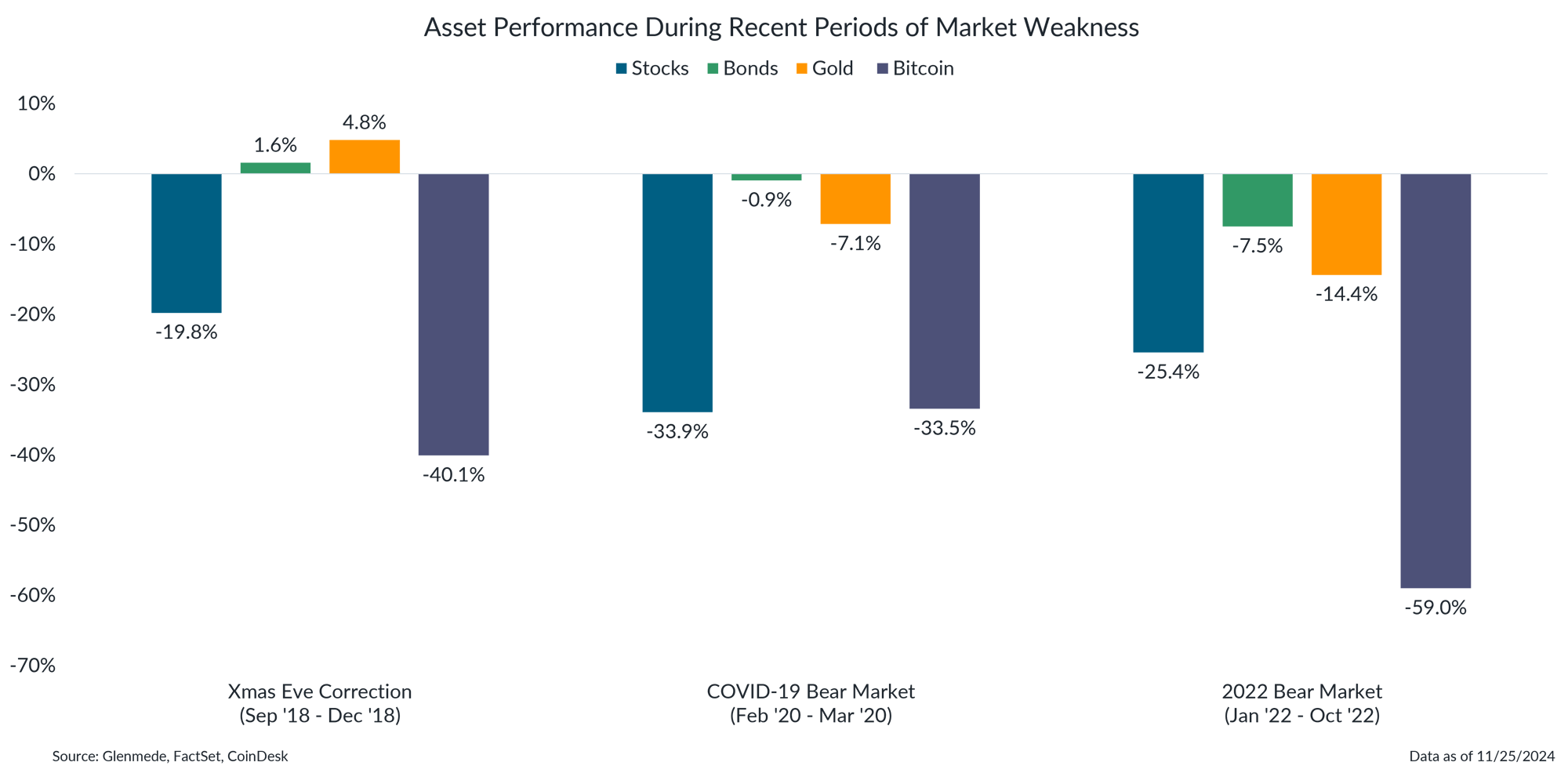

Bitcoin appears to offer little, if any, downside protection

Stocks are represented by the S&P 500 Index. Bonds are represented by the Bloomberg U.S. Aggregate Bond Index. Gold returns are derived via daily prices for gold bullion by the London Bullion Market Association. Bitcoin returns are derived via daily prices for bitcoin by CoinDesk. Past performance may not be indicative of future results. One cannot invest directly in an index..

- Just when it is needed most, bitcoin has shown little diversification benefit, as it was often down as much as (if not more than) equities during the last few bear markets.

- During the most recent bear market in 2022, stocks declined over 25%. During the same period, bitcoin declined nearly 60%.

Bitcoin will likely remain a speculative asset until volatility and stock correlation decrease

.png?width=2000&height=1037&name=2024-12-02%20slide%204%20(1).png)

Shown in the left panel is the percentage drawdown from all-time highs for the price of bitcoin. Past performance may not be indicative of future results.

- Bitcoin has a history of long and steep declines, with several drops of over 75% from its all-time highs, occurring on average once every four years.

- Until bitcoin can achieve lower volatility, reduced correlation with stocks, broader marketplace acceptance and/or stronger support from the government, it is unlikely to serve as a reliable store of value.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.