Investment Strategy Brief

Campaign Proposals vs. Political Reality

October 20, 2024

Executive Summary

- The race for the White House remains close, but the outcome of the presidential election typically matters less to markets than the winning party’s strength of control.

- Candidates have proposed many ideas on the campaign trail, but a lack of strong control in Congress should temper the outcome.

- The range of fiscal budget impacts is similar across likely scenarios, but the composition of tax and spending priorities may differ.

- The presidential election is likely to lead to near-term uncertainty, but the longer-term impact on the economy/markets may be more muted.

The 2024 Presidential Election remains contingent on a handful of key battleground states

%202024-10-21.png?width=2000&height=1918&name=IS%20Brief%20Chart%201%20(Left%20Panel)%202024-10-21.png)

%202024-10-21.png?width=1933&height=2000&name=IS%20Brief%20Chart%201%20(Right%20Panel)%202024-10-21.png)

Shown in the left panel are implied election probabilities based on data from online betting sites BetOnline, Betfair, Bovada, Bwin, Polymarket, PredictIt and Smarkets, aggregated by RealClearPolitics. References to any betting sites and the use of associated data in no way should be interpreted as an endorsement or recommendation of use by Glenmede. Shown in the right panel are averages of recent state polls as compiled by RealClearPolitics. Actual results may differ materially from implied probabilities or expectations. Probabilities and polling information shown are not the opinions of Glenmede and are shown for illustrative purposes only.

-

The implied probabilities from betting markets for the next occupant of the White House remain quite volatile, reflecting the uncertainty of the outcome.

-

Polling averages in key swing states remain well within the margin of error, suggesting the election remains close.

Longer-term, presidential elections typically matter less to markets than the winning party's strength of control

%202024-10-21.png?width=2000&height=1842&name=IS%20Brief%20Chart%202%20(Left%20Panel)%202024-10-21.png)

%202024-10-21%20(1).png?width=2000&height=1822&name=IS%20Brief%20Chart%202%20(Right%20Panel)%202024-10-21%20(1).png)

Data shown are average inflation-adjusted total returns for the S&P 500 for each two-year federal election cycle since 1872. Returns for the S&P 500 are backfilled with returns for the S&P composite based on data provided by Robert Shiller prior to 1970. Shown in the left panel are returns based on each party’s control of the White House, Senate and House of Representatives. Shown in the right panel are returns based on the composition of the White House, Senate and House of Representatives after each two-year election cycle. Divided refers to periods in which all three are controlled by different parties, Strong Sweep refers to periods in which one party controls all three and has a large enough majority in the Senate to end a filibuster via cloture and Weak Sweep refers to all other periods in which one party controls all three. The S&P 500 is a market capitalization weighted index of large cap stocks in the U.S. Past performance may not be indicative of future results. One cannot invest directly in an index.

- Markets have historically performed better with a Democratic White House and a Republican Congress, but the statistical relationship is rather weak.

- More significant is the market’s preference for a balance of power between the parties, which is likely connected to less regulatory change and a focus on compromise solutions.

- While there is some likelihood of a sweep outcome in either party’s direction, the likelihood of either party obtaining strong control of the legislature is quite small.

Campaign proposals cover a range of ideas, but lack of strong congressional control should temper the outcome

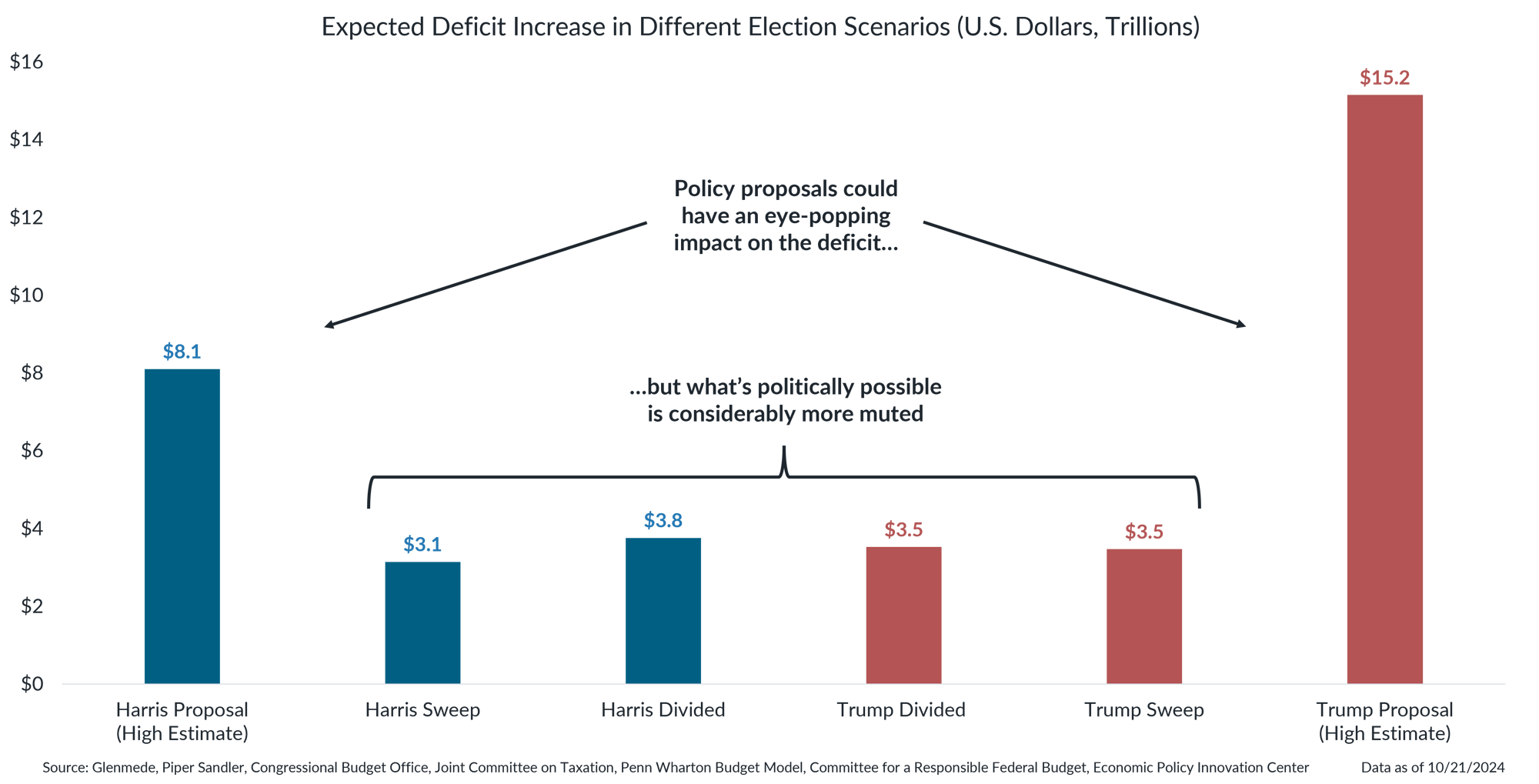

Data shown represent the projected incremental impact of various election scenarios on the federal government’s primary budget deficit (excluding the impact of interest costs on federal debt). Proposals refer to the Committee for a Responsible Federal Budget’s high-cost estimate for each candidate’s policy proposals. The Sweep and Divided scenarios refer to Piper Sandler’s estimates based on what is likely politically possible to achieve under various election scenarios. Actual results may differ materially from projections.

-

Both candidates have floated a host of policy proposals that would, if taken at face value, add up to rather significant expansions of the government deficits.

- However, given the low likelihood of a filibuster-proof majority in Congress, political realities will likely materially limit what is possible to implement in practice.

The range of budget implications is similar across likely scenarios, but the composition differs

.png?width=2000&height=973&name=IS%20Brief%20Chart%204%202024-10-21%20(1).png)

The table shown represents estimates for the change in the federal government’s primary budget deficit in various election scenarios. Sweep refers to one party controlling the White House, Senate and House of Representatives and Divided refers to mixed control of those three bodies. TCJA refers to the Tax Cuts & Jobs Act of 2017. SALT refers to the state and local tax deduction. ACA refers to the Affordable Care Act. SNAP refers to the Supplemental Nutrition Assistance Program. Corporate tax breaks include reinstate research & development deductibility, full expensing and adjustments to interest deduction limits. New entitlement programs includes affordable housing programs, universal pre-K, child care subsidies, changes to the Child Tax Credit program and long-term care funding. Actual results may differ materially from expectations. Other tariffs refers to targeted 10% tariffs on individual trade partners.

- A range of election outcomes remains possible, in which different policy proposals may be prioritized over others.

- While the impact on the federal deficit is mostly consistent across the various scenarios, the configuration of new spending priorities may differ.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.