Investment Strategy Brief

Carving Up 2026 Growth: Key Economic Drivers

November 23, 2025

Executive Summary

- A host of key drivers should, in combination, lead to an acceleration of the U.S. economy in 2026.

- Stimulative fiscal policy should more than offset the residual impact of tariffs.

- Employment growth has slowed amid a decline in immigration and a slowdown in hiring.

- The adoption of artificial intelligence (AI) is driving a second wave of improvement in labor productivity.

- Deregulation efforts remain a wild card that could produce an unexpected upside.

A host of key drivers should, in combination, lead to an acceleration of the U.S. economy in 2026

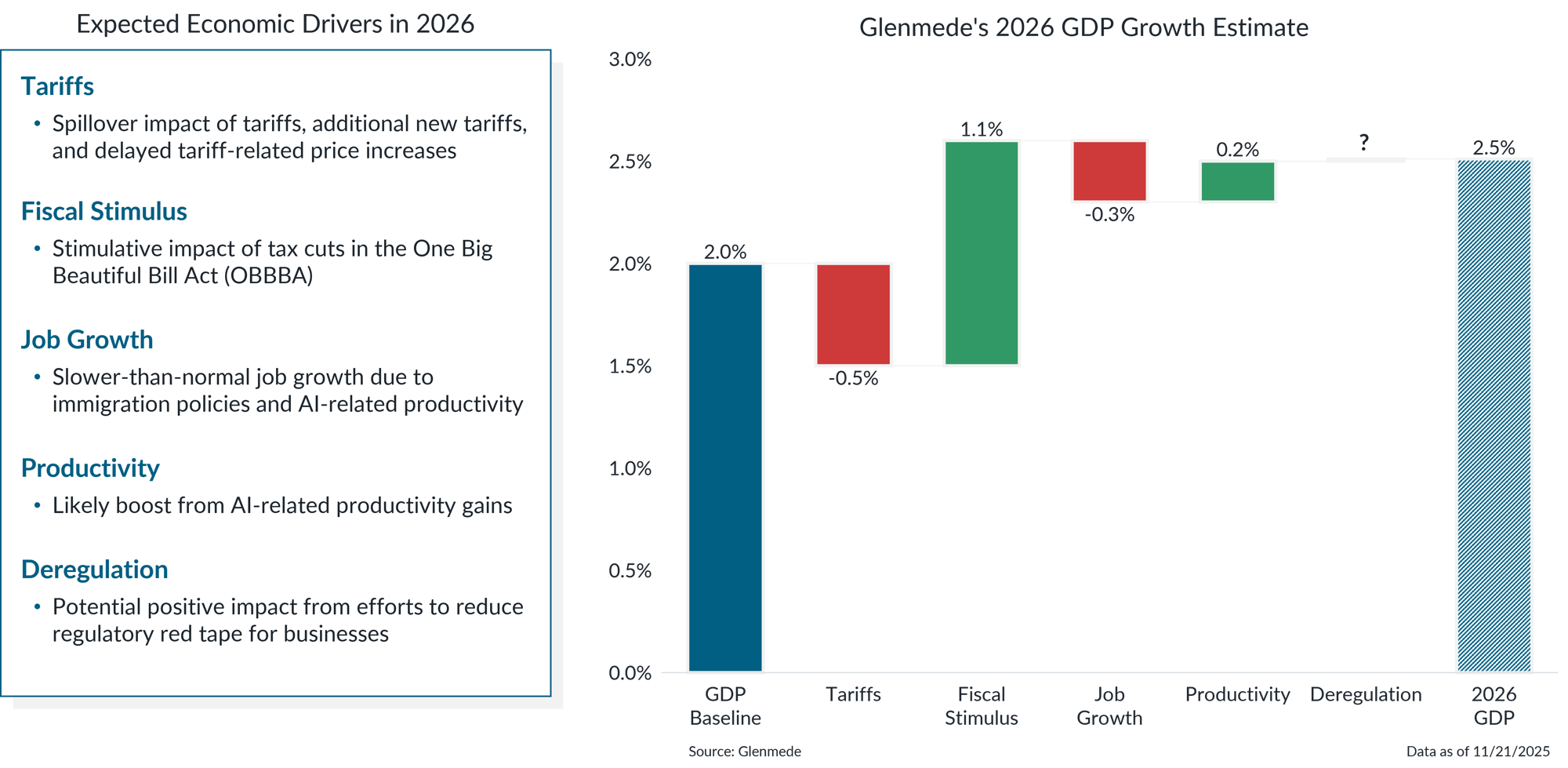

Shown on the left are expected economic drivers in 2026. Shown on the right are the drivers and their estimated impact on U.S. real GDP growth. GDP Baseline is an assumed long-term growth rate for the U.S. economy that is consistent with estimates used by both the Congressional Budget Office (CBO) and the Federal Reserve. Though created in good faith, there can be no guarantee that these indicators will be accurate. Actual results may differ materially from projections.

- Government policy will likely remain a key driver in 2026, with tariffs posing a headwind to growth but largely offset by fiscal stimulus from the OBBBA.

- Labor markets may continue to soften, while AI-related productivity gains and deregulation could offer tailwinds.

Tariff policy has largely found its shape, but its effects on economic growth should spill over into 2026

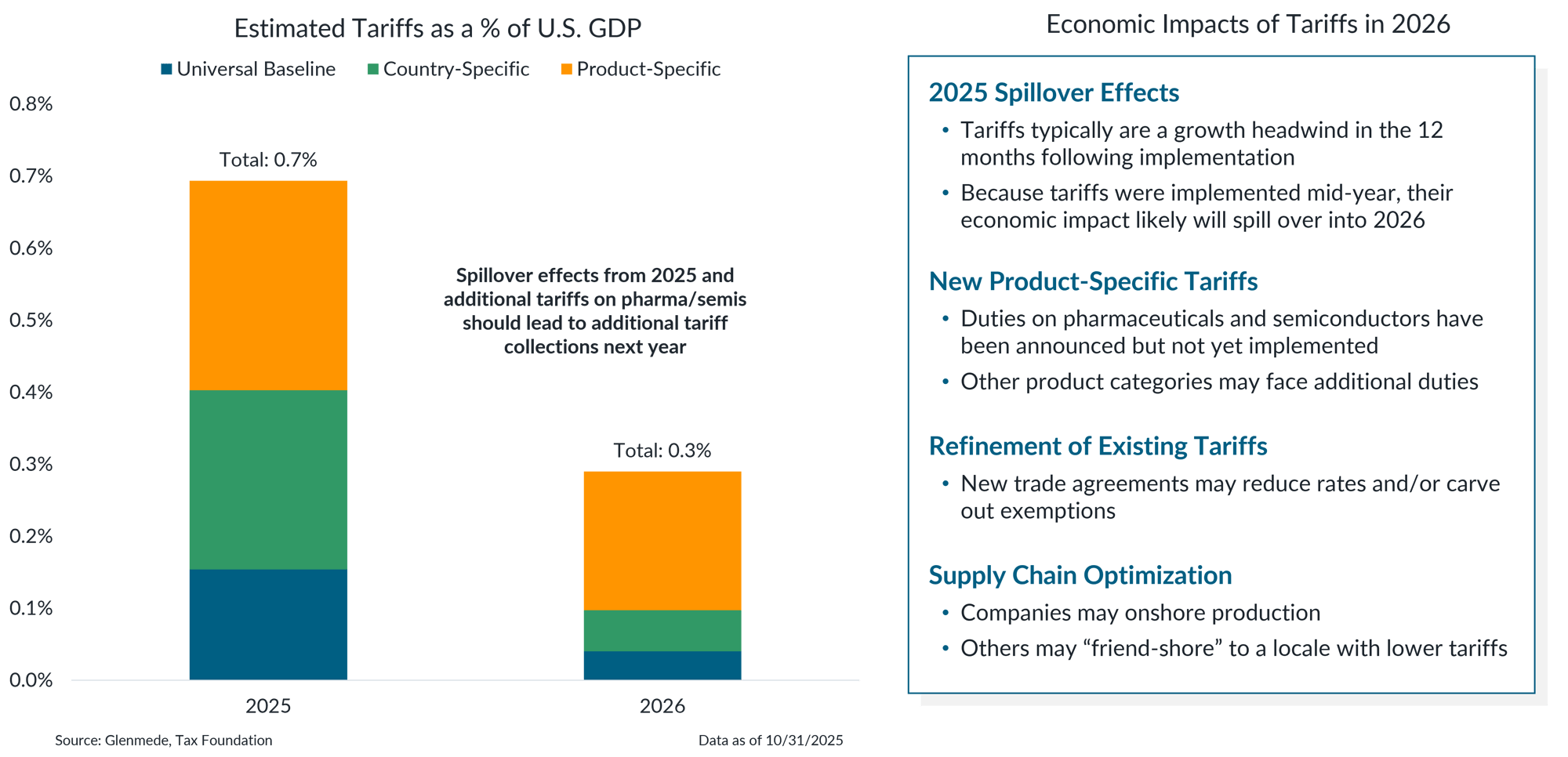

Shown on the left are the estimated tariffs as a percent of U.S. GDP for calendar years 2025 and 2026, broken into three components: universal baseline tariffs of 10%, country-specific tariffs of 10%+, and product specific tariffs. All figures shown are projections as a share of nominal U.S. GDP and are subject to change. Actual results may differ materially from projections.

- Tariff policy is mostly set for 2026, but the growth impact remains uneven as earlier actions and newly announced product-specific duties continue to filter through the economy.

- Corporate responses such as onshoring and supply-chain shifts may soften the impact, though these changes take time and can create short-term friction for growth.

Stimulative fiscal policy should more than offset the residual impact of tariffs in 2026

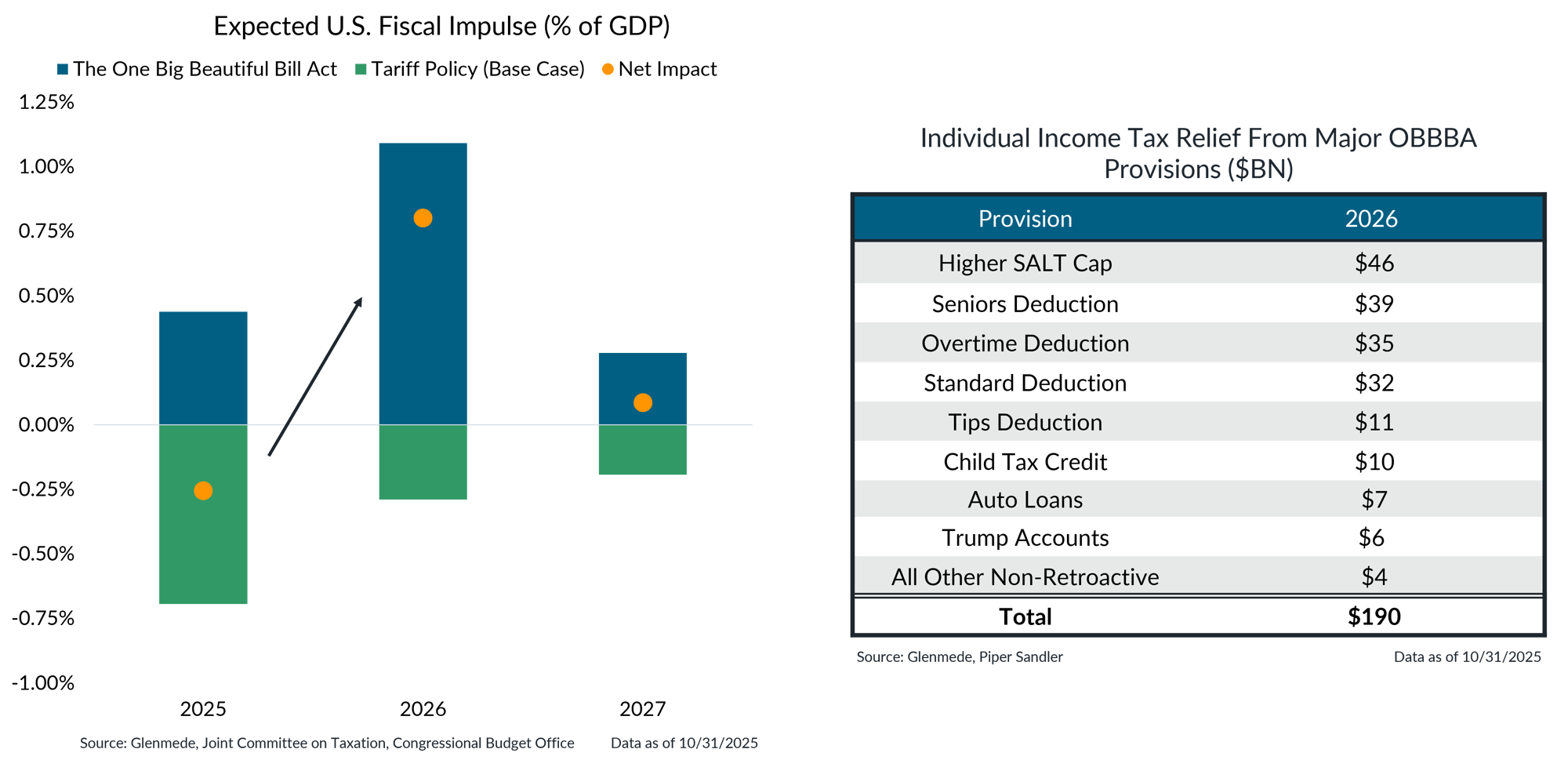

Shown on the left are the expected fiscal stimulus effects by year due to key policy changes associated with the OBBBA and Glenmede’s Base Case projection for revenues generated by new tariffs, which reflects tariff collections only. Orange dots represent the net impact between both dimensions of policy change. Data on the right highlights major OBBBA provisions for individuals for the full year. SALT cap is the legislated cap on the deduction of state and local income taxes from federal income taxes. Trump Accounts refers to the Money Account for Growth and Advancement (MAGA) program, which aims to set up savings accounts for children with contributions from the government to advance financial futures. Actual results may differ materially from projections and expectations.

- The OBBBA included a number of tax relief provisions that should support the consumer in the coming year.

- In addition, businesses are likely to benefit from provisions allowing accelerated depreciation of capital spending, providing both a tax break and an incentive for businesses to increase investments.

Employment growth has slowed amid a decline in immigration and a slowdown in hiring

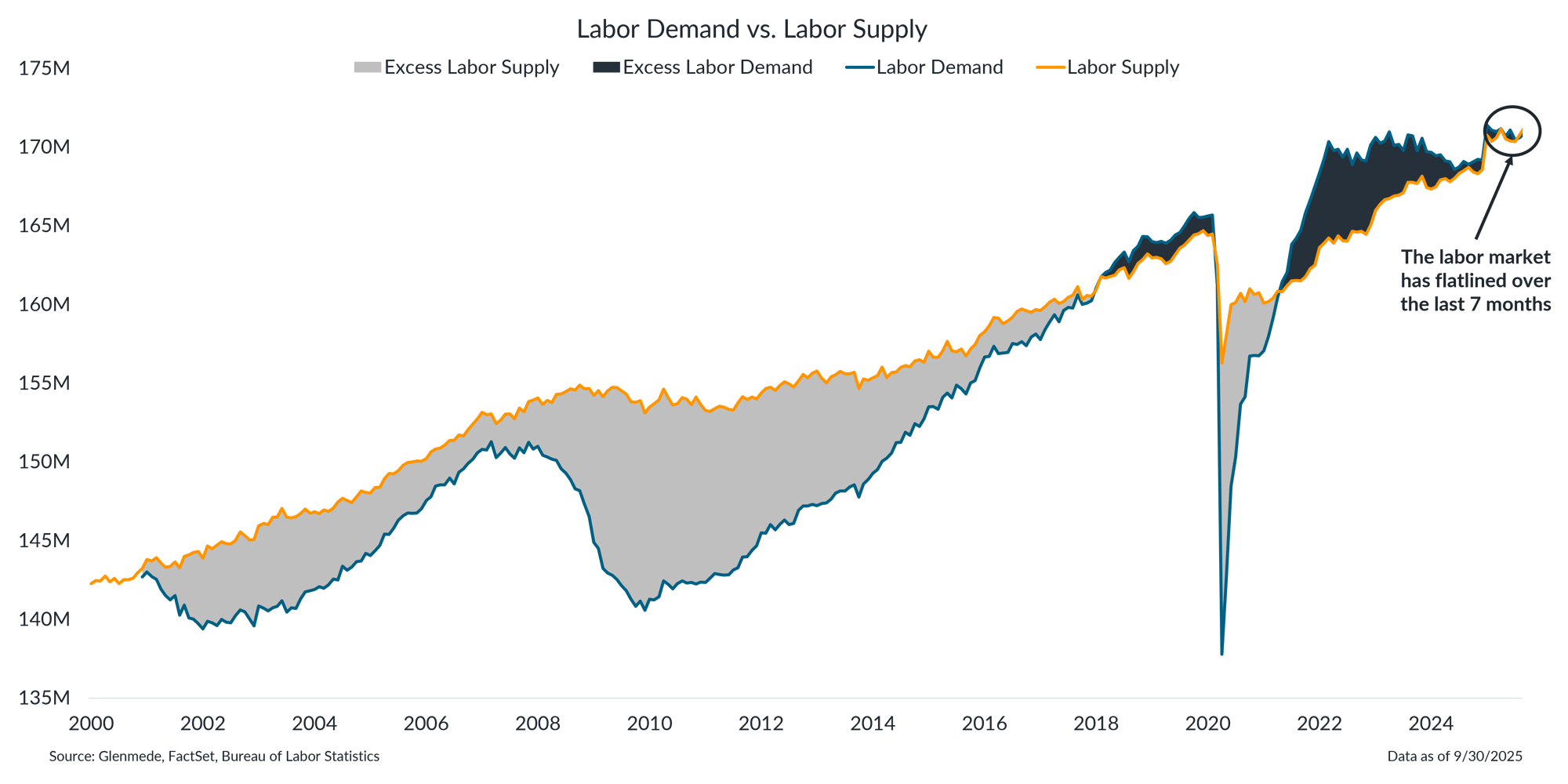

Shown in blue is labor demand defined as the number of employed individuals plus job openings. Shown in yellow is labor supply defined as the number of employed plus unemployed individuals. The light gray area illustrates periods when supply outstripped demand and the dark gray area illustrates those in which demand outstripped supply.

- The flattening in employment growth reflects a cooling in both immigration flows and hiring appetite, leaving labor supply and demand much closer to balance than earlier in the cycle.

- With the labor market no longer providing the same tailwind to overall growth, future gains will likely depend on more productivity improvements rather than continued workforce expansion.

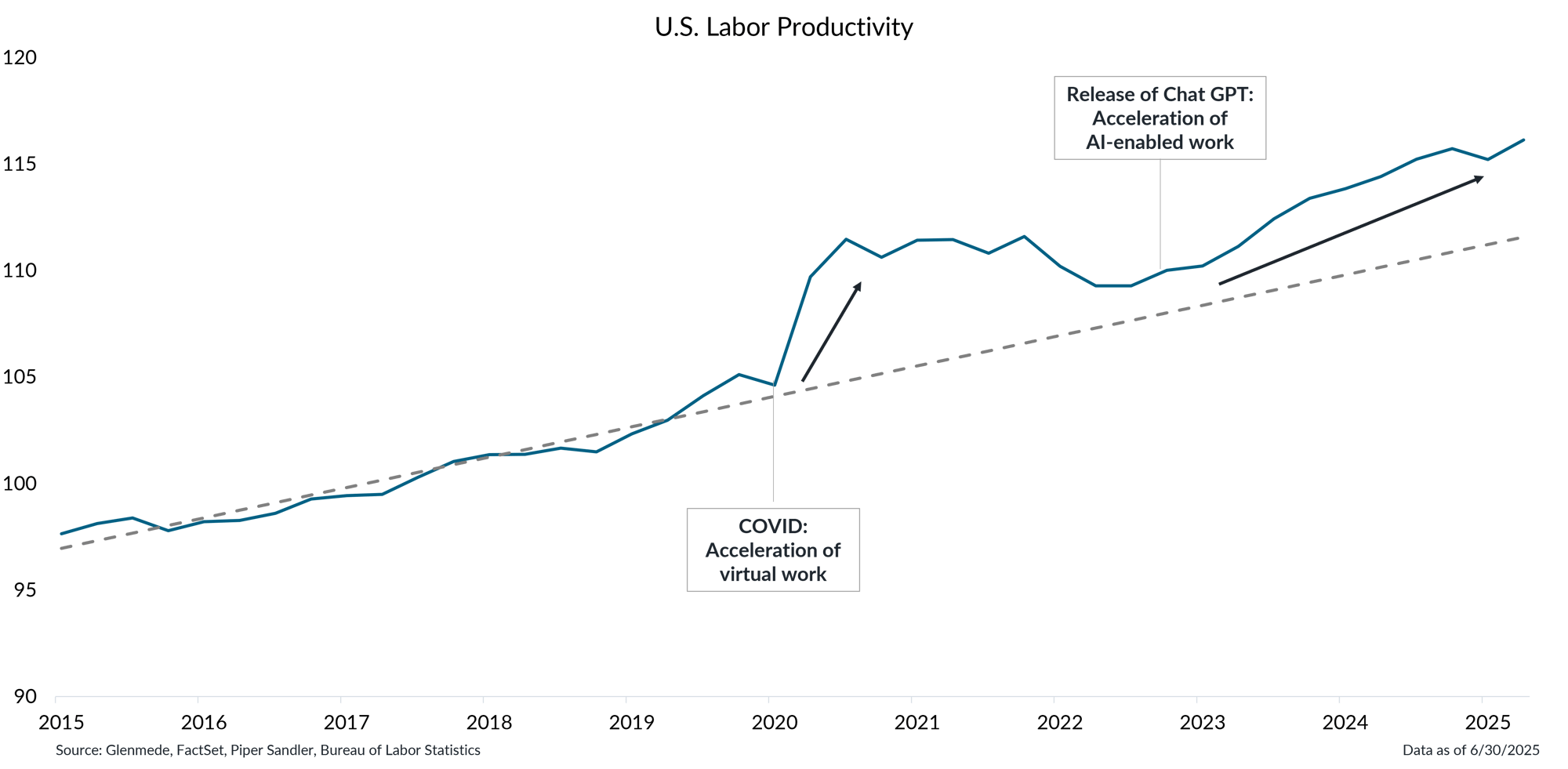

The adoption of AI is driving a second wave of improvement in labor productivity

Shown in blue is U.S. non-farm labor productivity, measured as output per hour for all U.S. persons employed by non-farm businesses. The gray dashed line shows labor productivity’s pre-COVID trendline based on 2015-2019 data.

- The post-pandemic surge in productivity appears to have transitioned into a more durable trend, supported by the broader rollout of AI tools across various industries.

- While still early, the pace of recent gains suggests that AI adoption is beginning to lift labor productivity above its pre-COVID levels, offering an important offset to slower labor-force growth.

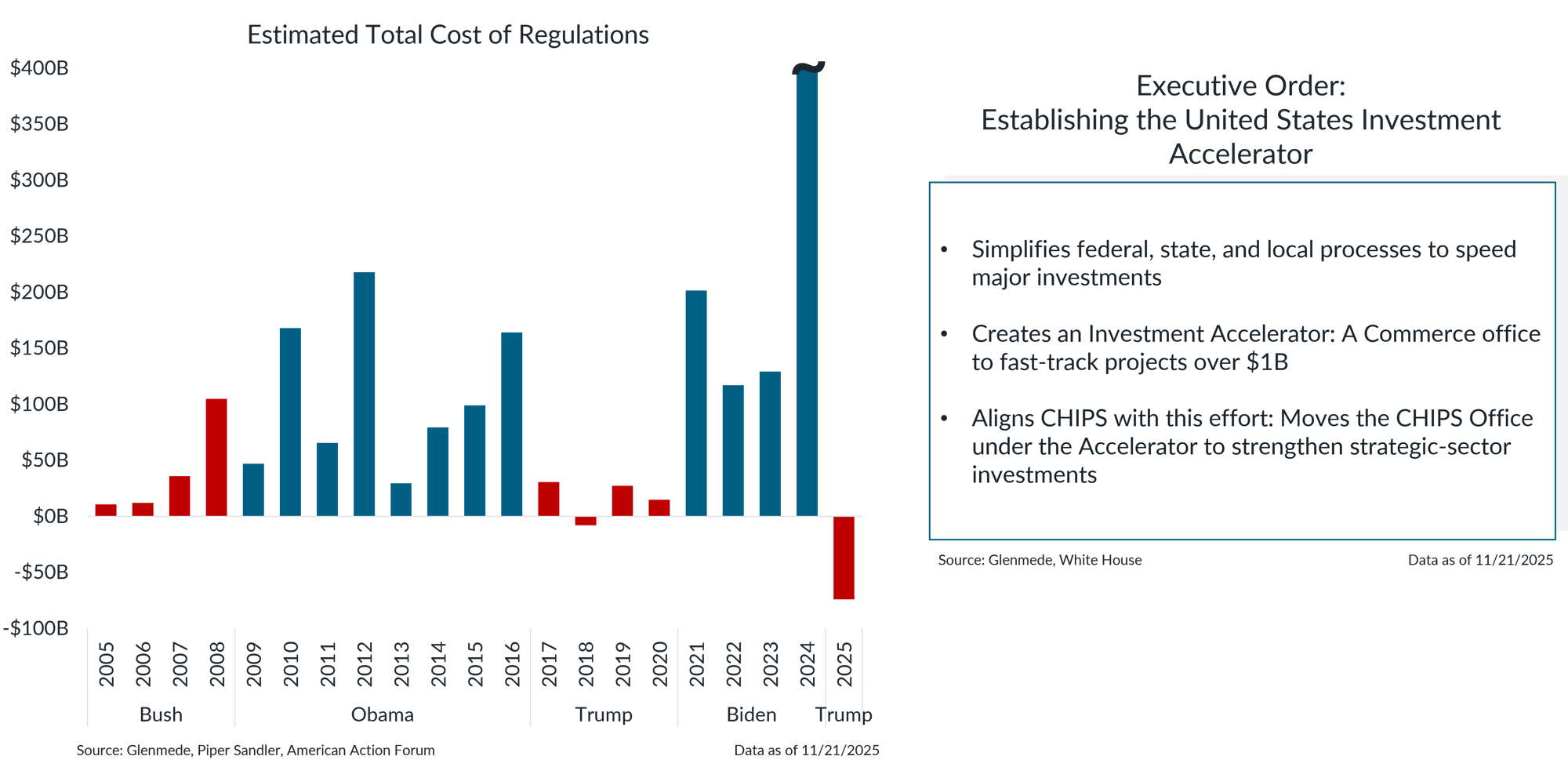

Deregulation efforts remain a wild card that could produce an unexpected upside

Data shown in the left panel represent the estimated cost of new regulations by year and grouped by presidential administration. The data point for 2024 is $1,402B, but the bar uses an axis break for visual purposes. American Action Forum is an independent, non‐profit organization and is not formally affiliated with or controlled by any political group but may not be a completely unbiased source as it was established to promote “center‐right” economic and fiscal policy. The use of its data should in no way be construed as an endorsement of the group’s political leaning, policy preferences or accuracy of estimates. Data in the right panel reflects White House–published information on the U.S. Investment Accelerator.

- The Trump administration’s deregulation efforts have led to a greater reduction in the estimated cost of new regulations than was achieved during his first term.

- Reduced regulations alongside efforts to streamline major business investments should, on the margin, incentivize business growth.

This material is provided solely for informational and/or educational purposes and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Any company, fund or security referenced herein is provided solely for illustrative purposes and should not be construed as a recommendation to buy, hold or sell it. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.