Investment Strategy Brief

Cash on the Sidelines

August 11, 2024

Executive Summary

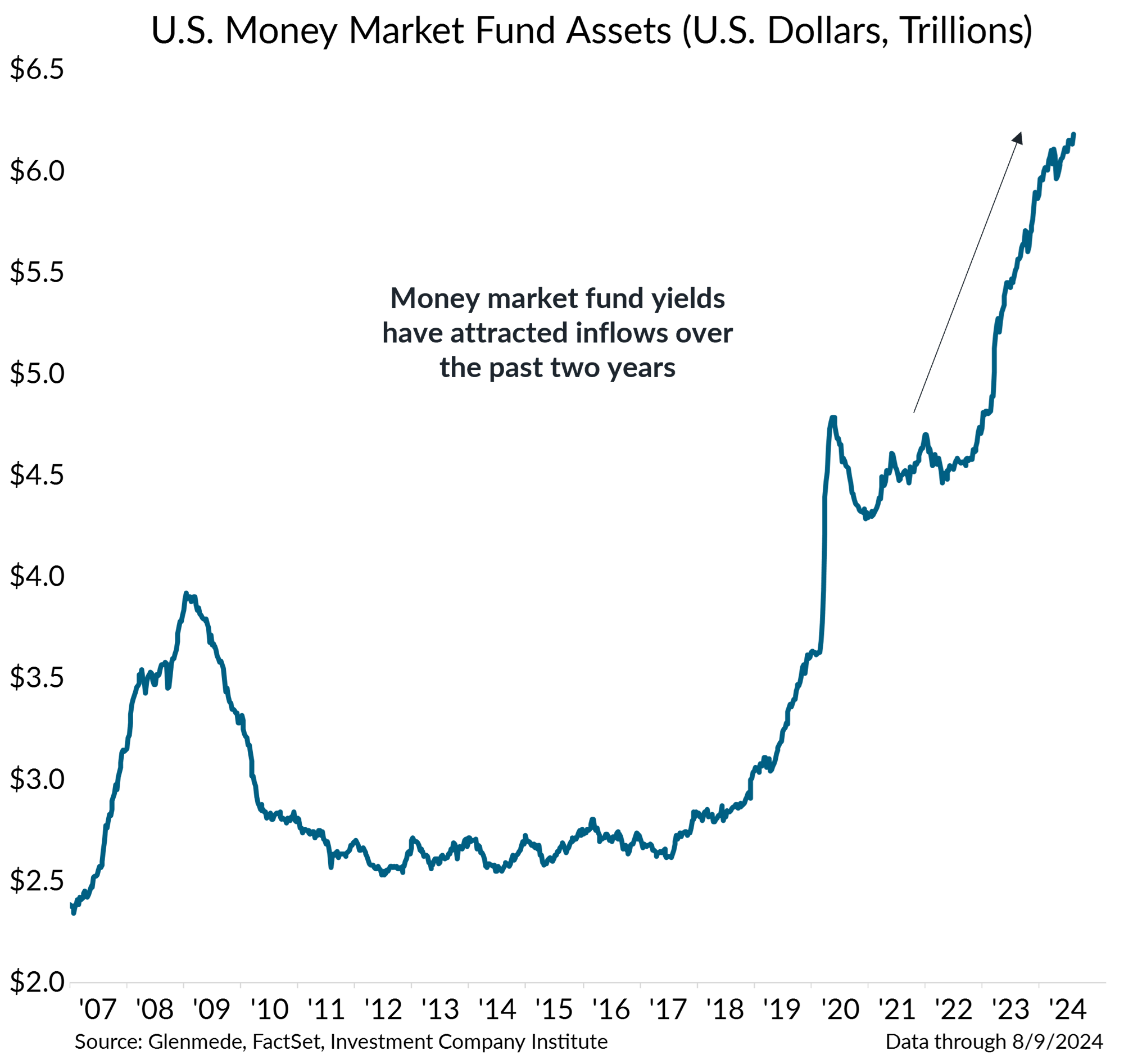

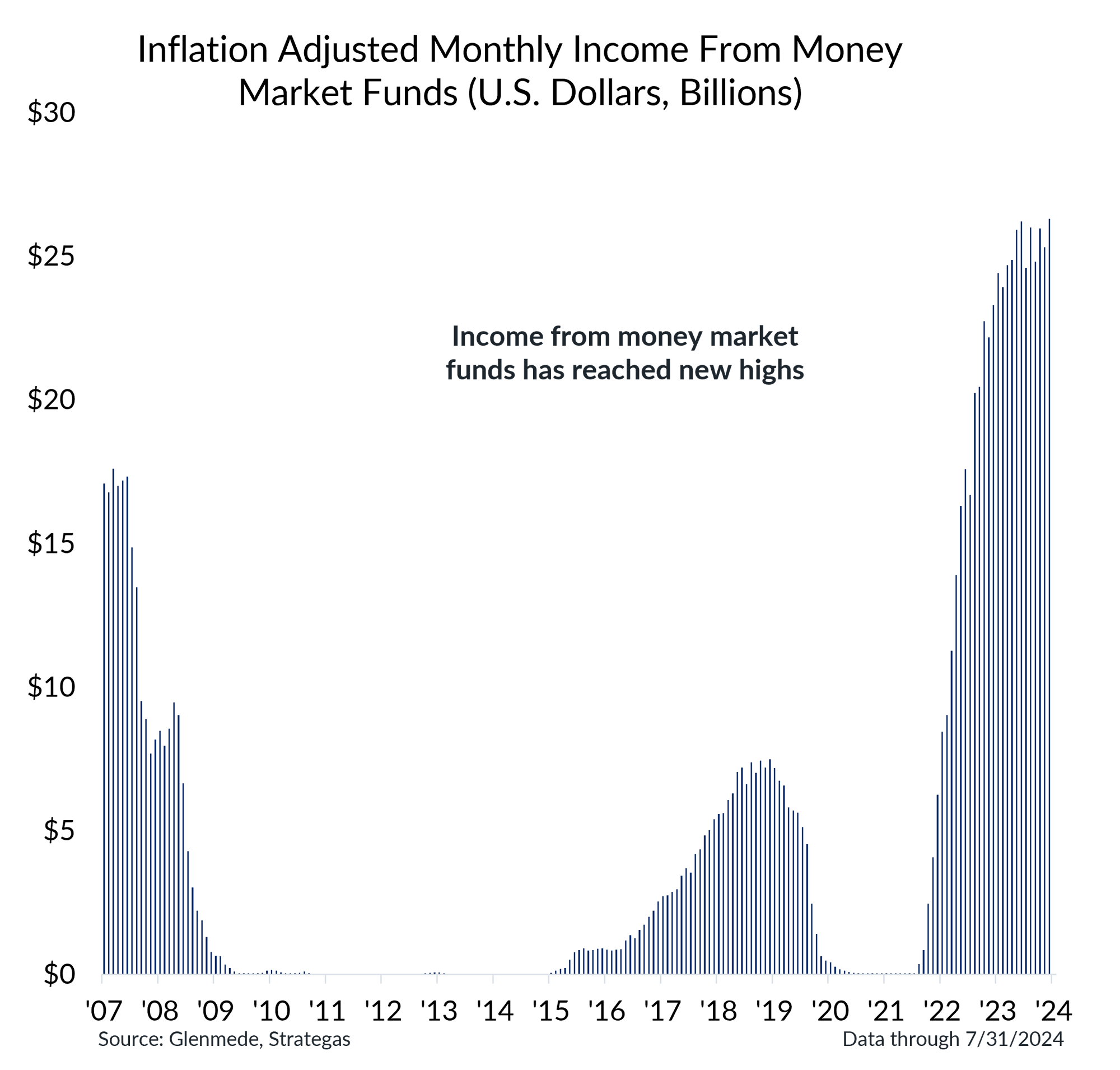

- The rise in yields in money market funds over the past two years, driven by the Fed's rate hikes, has attracted inflows and bolstered household interest income.

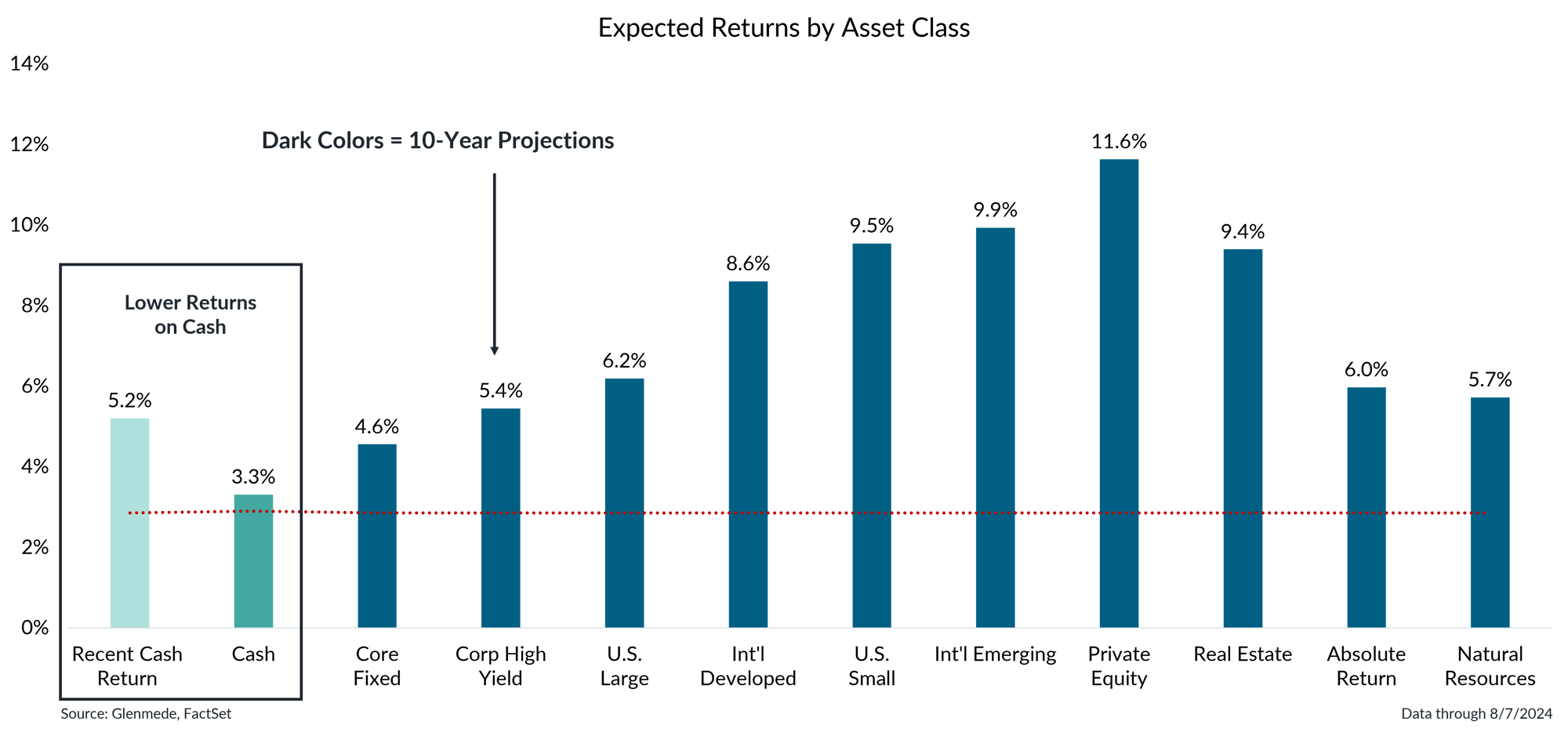

- Lower longer-term returns on cash should make prospective returns on other assets incrementally more attractive on a relative basis.

- These shifts in prospective returns should alter investor’s preference and are likely to prompt a shift from money market funds to other assets.

- Given the steep cost of staying out of the market, investors should increasingly shift unneeded cash toward other investment options as cash rates decline.

Rising yields in money market finds have attracted inflows and bolstered household interest income

Data shown in the left panel are total money market fund assets through time in trillions of U.S. dollars. Data shown in the right panel represent estimated inflation adjusted monthly income from money market funds in billions of U.S. dollars. Monthly money market fund income is derived by multiplying the yield on Vanguard’s Federal Money Market Fund by the total amount of U.S. money market fund assets. Past performance may not be indicative of future results.

-

The rise in yields in money market funds over the past two years, driven by the Fed's rate hikes, has attracted significant inflows into money market assets.

- Income from money market funds has reached new highs, providing households with sizable interest earnings.

Longer term, cash is projected to have more moderate returns expectations

Data shown are Glenmede's proprietary estimates for 10 year expected returns for several asset classes. Proxy indexes for each asset class are as follows: Cash (Bloomberg Treasury Bellwethers 3M), Core Fixed Income (Bloomberg U.S. Aggregate Index), Corp High Yield (Bloomberg U.S. Aggregate Credit Corporate High Yield BB Index), U.S. Large (MSCI USA Index), Int'l Developed (MSCI EAFE Index), U.S. Small (Russell 2000 Index), Int’l Emerging (MSCI EM Index), Real Estate (FDSAGG World / Real Estate Index), Absolute Return (HFRI Fund of Funds Composite), Natural Resources (Bloomberg Commodity Index). Expected returns for private equity are derived by applying a liquidity premium on top of expected returns for U.S. Small. Recent cash return is the 12-month expected return one year ago (8/7/2023). These figures are projections which, though arrived at in good faith, are not guaranteed. Actual returns may differ materially from projections. One cannot invest directly in an index.

-

The Federal Reserve is now expected to begin cutting rates in September, which should lead to lower future returns on cash.

-

Lower longer-term returns on cash should make prospective returns on other assets incrementally more attractive on a relative basis.

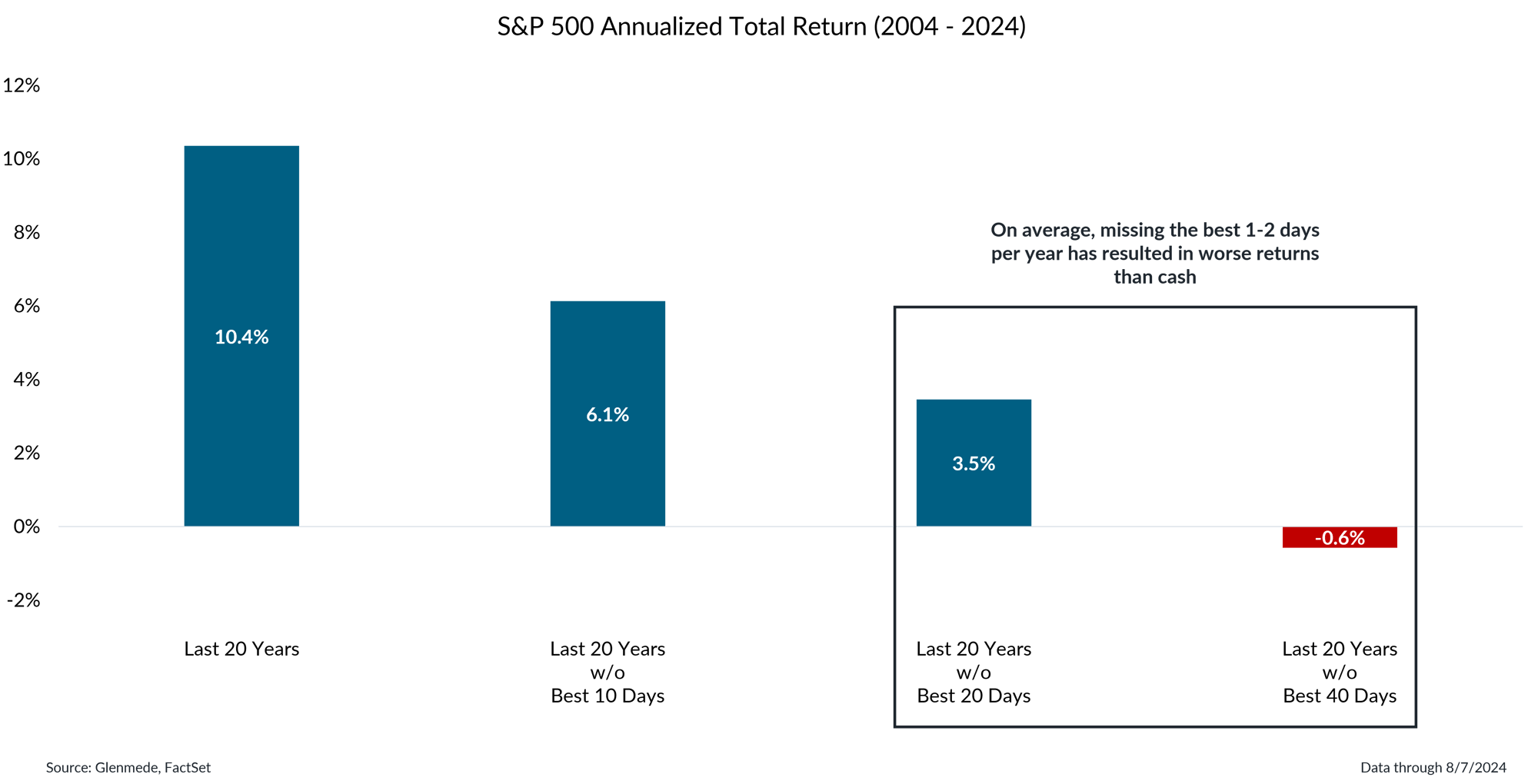

There is a price of staying out of the market

Data shown is the historical annualized total return for the S&P 500 which is a market capitalization weighted index of large cap stocks over the span of twenty years. The data points reflect the annualized return if an investor were to miss the best ten, twenty and forty days over the period specified. Past performance may not be indicative of future results. One cannot invest directly in an index.

- Lower prospective returns on cash increases the already steep cost of staying out of the market; on average, missing the best 1 – 2 days per year has resulted in worse returns than cash.

- Investors should increasingly shift unneeded cash toward other investment options as cash rates decline.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.