Investment Strategy Brief

Connecting the Dots on Fed Policy

June 22, 2025

Executive Summary

-

The Fed left rates unchanged last week, with future moves dependent on trade policy developments and their economic impact.

-

Risks surrounding the Fed’s dual mandate (employment and inflation) are roughly balanced for now.

-

Shifting trade policy and fiscal stimulus may keep inflation elevated, which may result in a slower Fed rate cut path.

-

The median official in the latest dot plot calls for two rate cuts in the second half of 2025, but a conservative camp expecting no rate cuts appears to be emerging.

-

While rate cuts are possible within the next year, investors should expect short-term rates to be more steady than changing.

The Fed’s next steps will largely hinge on how trade policy evolves and the economic impact that follows

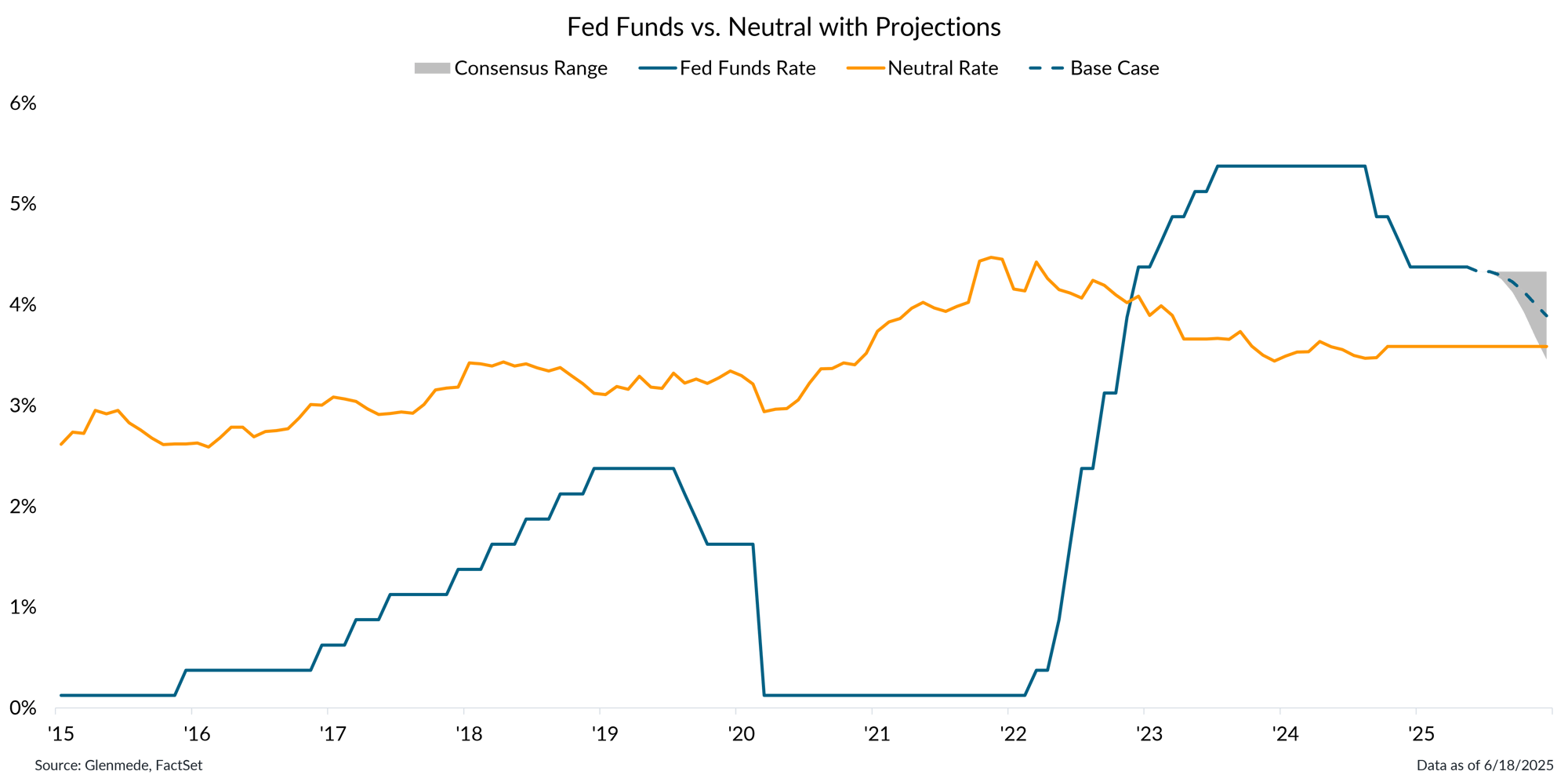

Data shown in orange are Glenmede’s estimates of the neutral federal funds rate over time (i.e., the level of rates that is neither economically stimulative nor restrictive) based on expectations for real interest rates via the Holston-Laubach-Williams model and Glenmede’s 10yr inflation expectations. Fed Funds Rate in blue is the target rate midpoint. The dashed blue line represents Glenmede’s base case projection and the gray region around that represents a range of plausible outcomes. Actual results may differ materially from projections.

- Although the FOMC left rates unchanged last week, the baseline expectations remain for 1 -2 cuts in the second half of the year, contingent on greater clarity around trade policy.

- If risks related to the Fed’s inflation mandate increase, the Fed is likely to proceed with caution, leaving rates largely unchanged.

- On the other hand, if concerns intensify over economic growth, it may adopt a more aggressive stance on rate cuts.

Risks surrounded the Fed’s dual mandate (employment and inflation) are roughly balanced for now

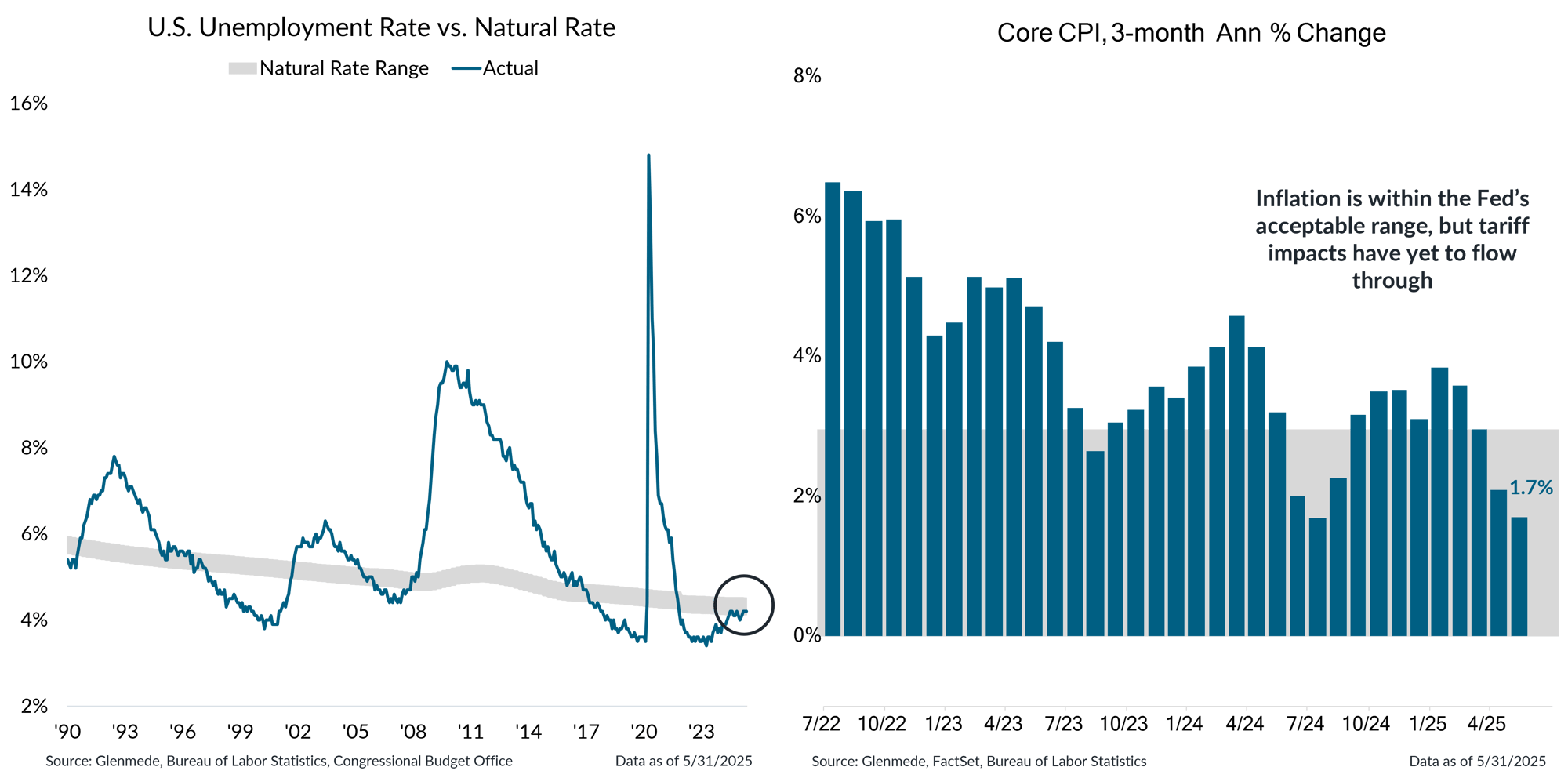

Shown in the left panel is the U.S. unemployment rate for persons aged 16 years and over in blue and a range estimate of the natural rate of unemployment with a Glenmede-defined buffer in gray, which is the baseline level of joblessness that persists in a well-functioning economy due to frictional and structural factors. Shown in the right panel is the 3-month annualized percent change in the U.S. Consumer Price Index (CPI) excluding food and energy. The gray region represents the Fed’s target range consistent with its price stability objective.

- The U.S. labor market remains resilient and relatively healthy despite the challenges posed by broader economic uncertainties.

- Recent inflation prints have come in softer than expected, though tariff related pressures may soon begin to materialize.

Tariffs may keep inflation elevated through year-end, though the precise path remains uncertain

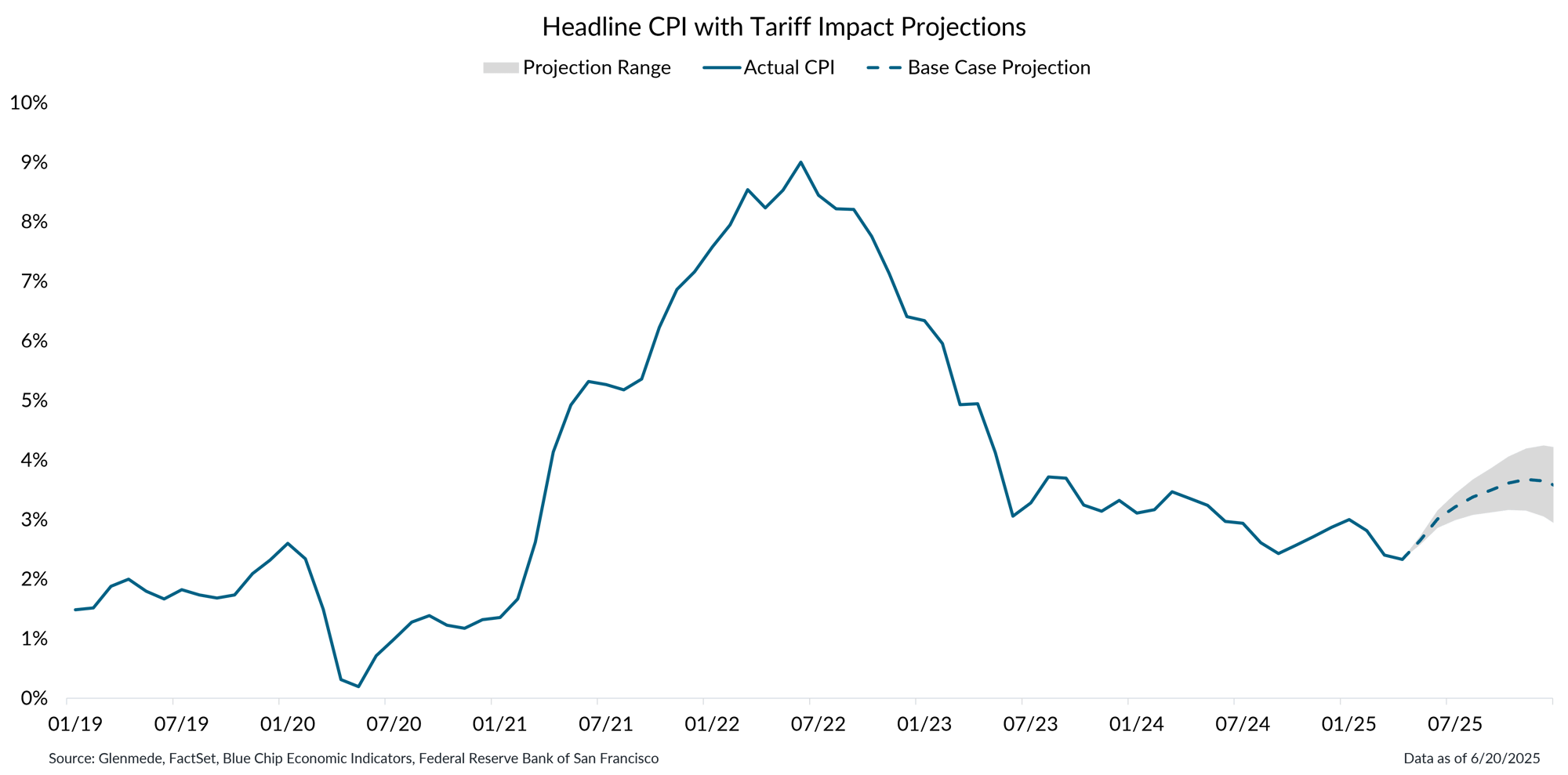

Data shown in blue is year-over-year percent change in the U.S. Consumer Price Index (CPI). The dashed blue line represents Glenmede’s base case projections and the gray region represents a range of plausible outcomes. Projections assume all price increases are passed on to consumers. Actual results may differ materially from expectations or projections.

-

Inflation could take several paths through year-end, as the impact of new tariffs on consumer prices remains uncertain and the Fed continues to assess the evolving outlook.

-

If the effective tariff rate settles around 5%, inflation is likely to hold near recent levels and eventually begin to decline.

-

With a 15% effective tariff rate, inflationary pressure would likely reaccelerate. A higher 25% tariff regime could result in more substantial price increases, especially if businesses pass higher import costs on to consumers.

The median respondent in the latest dot plot calls for only two rate cuts in ‘25

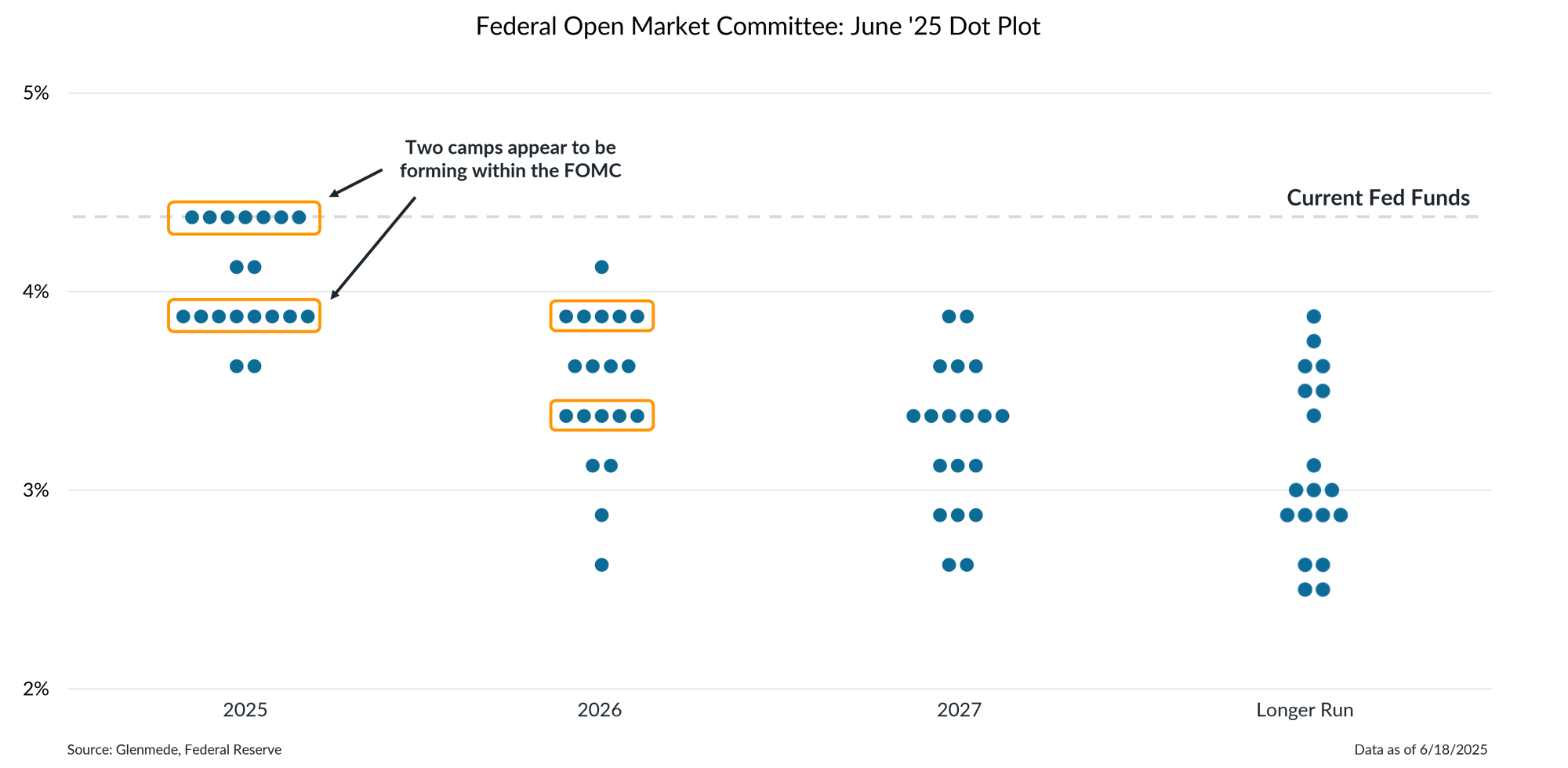

Data shown are the Federal Open Market Committee’s dot plot projections from June 2025. Each dot represents the response of one Fed official’s projections regarding where they expect the federal funds rate to sit at the end of each of the next three calendar years, as well as their estimate of the longer run level of federal funds. Actual results may differ materially from projections

-

The latest dot plot calls for two rate cuts this year. However, two camps seem to be forming on the FOMC, with about 40% expecting no changes to rates this year while another 40% expect two cuts.

-

While Fed officials have so far stressed a patient approach, investors might soon expect to hear more diversity of opinion regarding the path of rates.

-

Glenmede’s base case is 1-2 rate cuts starting in late summer/early fall, though uncertainty around those expectations is higher than normal.

This material is provided solely for informational and/or educational purposes and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Any company, fund or security referenced herein is provided solely for illustrative purposes and should not be construed as a recommendation to buy, hold or sell it. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.