Investment Strategy Brief

Cracks in the Consumer,

or Just Concerns

March 2, 2025

Executive Summary

- Consumer surveys show sentiment has ticked lower, but these may be distorted by political opinion.

- Retail sales declined in January, likely reflecting external factors rather than consumer financial stress.

- The labor market remains healthy, and households continue to make meaningful real income gains.

- Recent concerns about the consumer appear premature, but inflation and credit issues are some risks to continue monitoring.

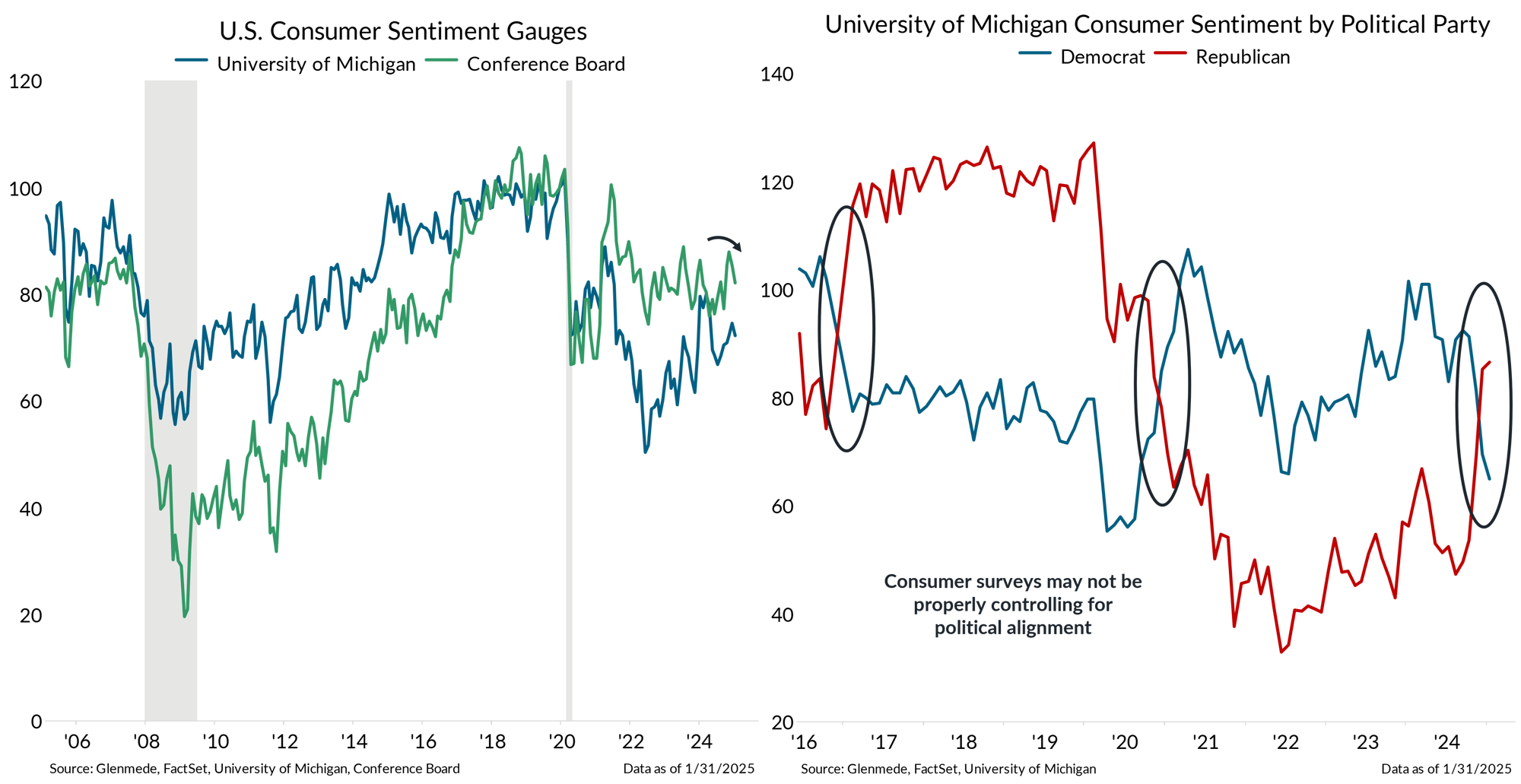

Consumer surveys show sentiment has ticked lower, but these may be distorted by political opinion

Shown in the left panel are the University of Michigan’s Consumer Sentiment Index in blue and the Conference Board’s Consumer Confidence Index in green, both indexed to 100 at the end of 2019. Shown in the right panel are the results of the University of Michigan’s Consumer Sentiment Index by the political party with which each respondent identifies.

- Consumer surveys show that sentiment ticked lower in January, reflecting a decline in consumer confidence, though it remains above the lows seen in previous periods.

- However, surveys may be distorted by political affiliations as sentiment shifts tend to occur along party lines, with each president’s party gaining confidence and the opposition feeling more pessimistic.

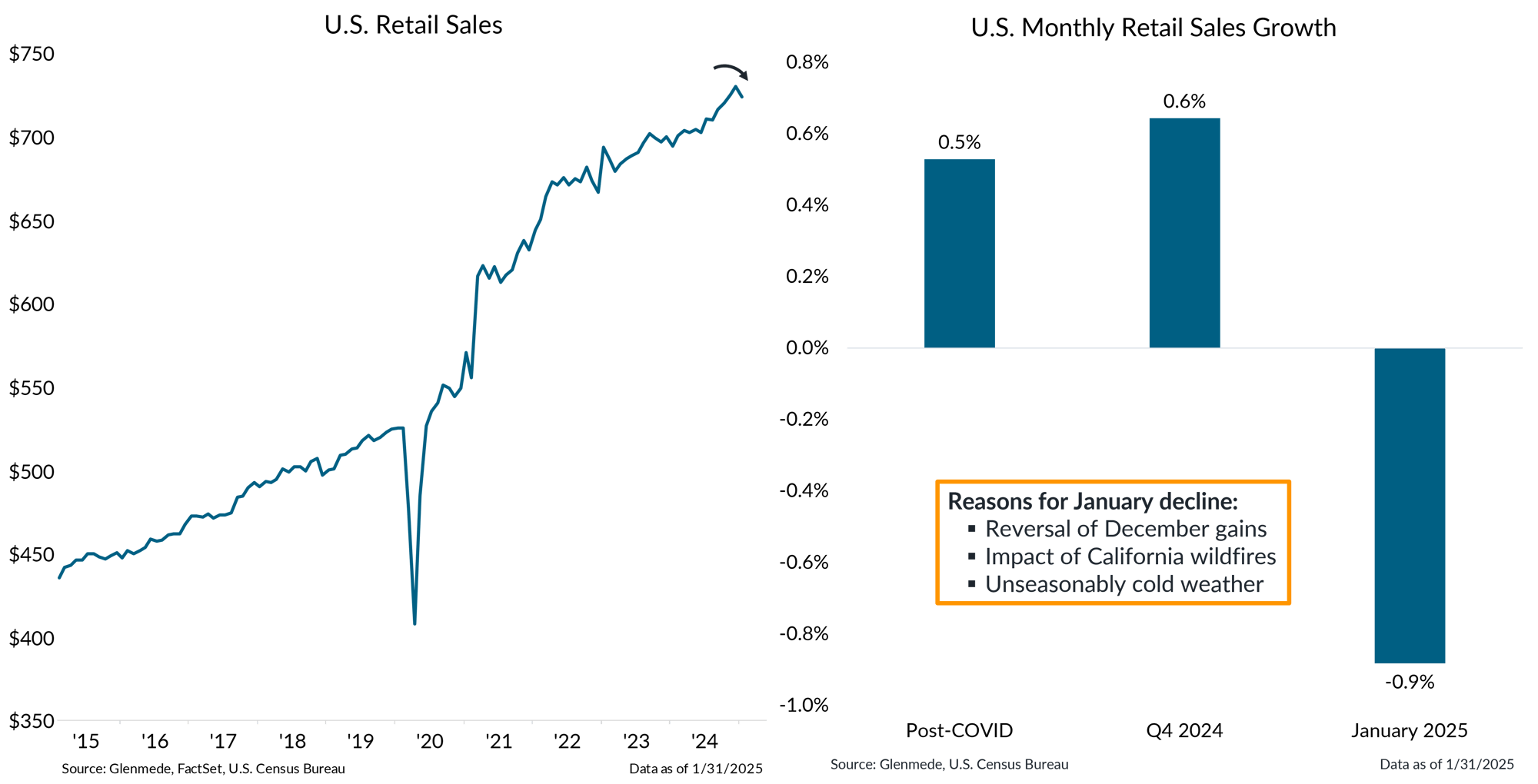

Retail sales declined in January, likely reflecting external factors rather than consumer financial stress

Shown in the left panel is monthly U.S. retail sales in billions of U.S. dollars on a seasonally-adjusted basis. Shown in the right panel is the average monthly growth rate in retail sales Post-COVID (since 12/31/2019), in Q4 2024 and January 2025.

- Retail sales declined in January following a strong fourth quarter which had seen a surge in consumer spending driven by holiday shopping.

- This downturn likely reflects external factors such as the impact from the California wildfires and the unseasonable cold weather, rather than being driven by consumer financial stress.

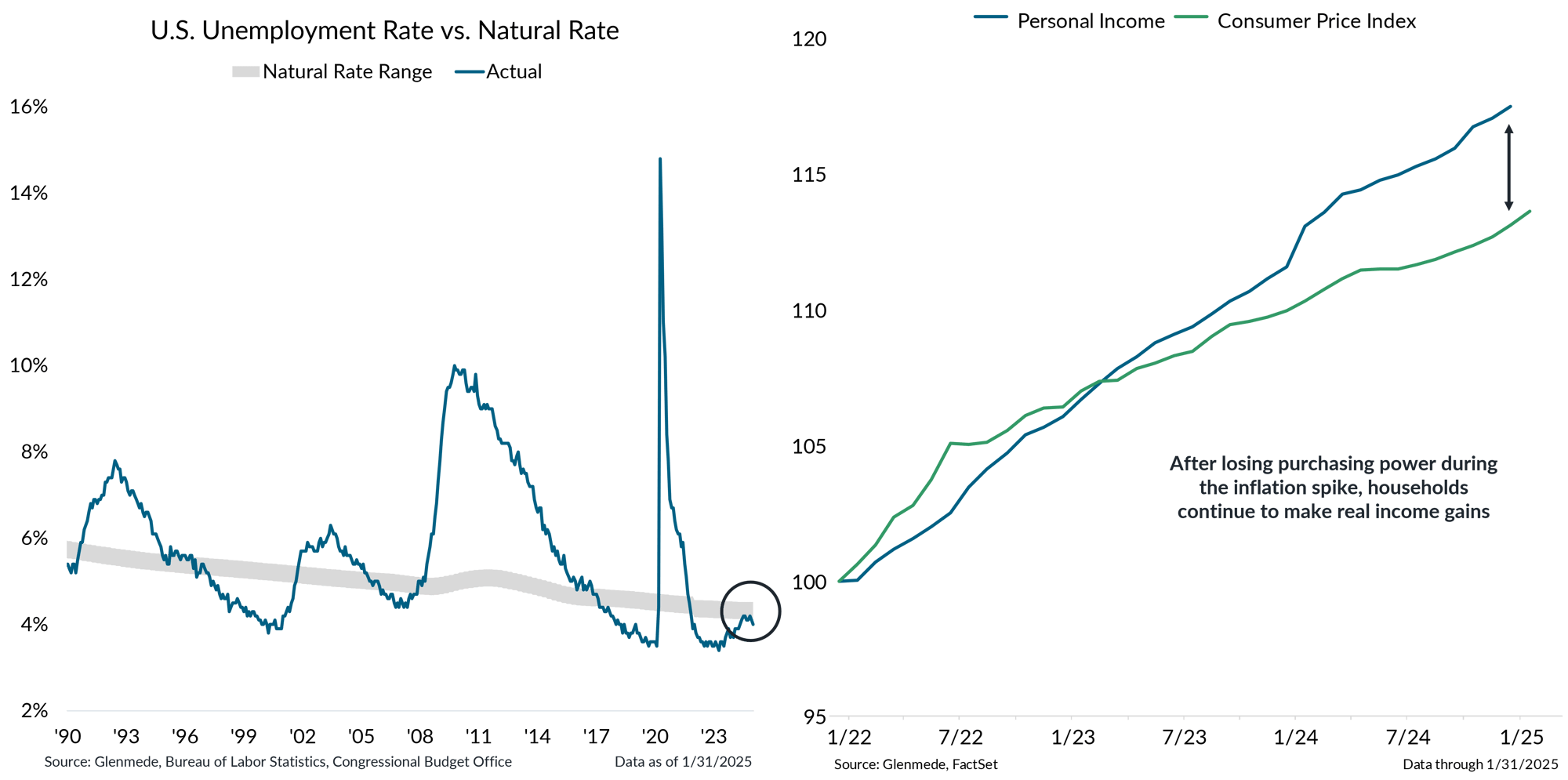

The labor market remains healthy, and households continue to make meaningful real income gains

Shown in the left panel is the U.S. unemployment rate for persons aged 16 years and over in blue and a range estimate of the natural rate of unemployment with a Glenmede-defined buffer in gray, which is the baseline level of joblessness that persists in a well-functioning economy due to frictional and structural factors. Shown in the right panel in blue is U.S. personal income, in green is the U.S. Consumer Price Index. Each series is seasonally-adjusted and indexed to 100 on 12/31/2021.

- Although consumer sentiment has softened, as seen in weaker surveys and retail sales, the labor market remains healthy with a low unemployment rate.

- Households are also seeing meaningful real income gains, driven by rising wages that have boosted consumers’ purchasing power since the inflation spike in 2022.

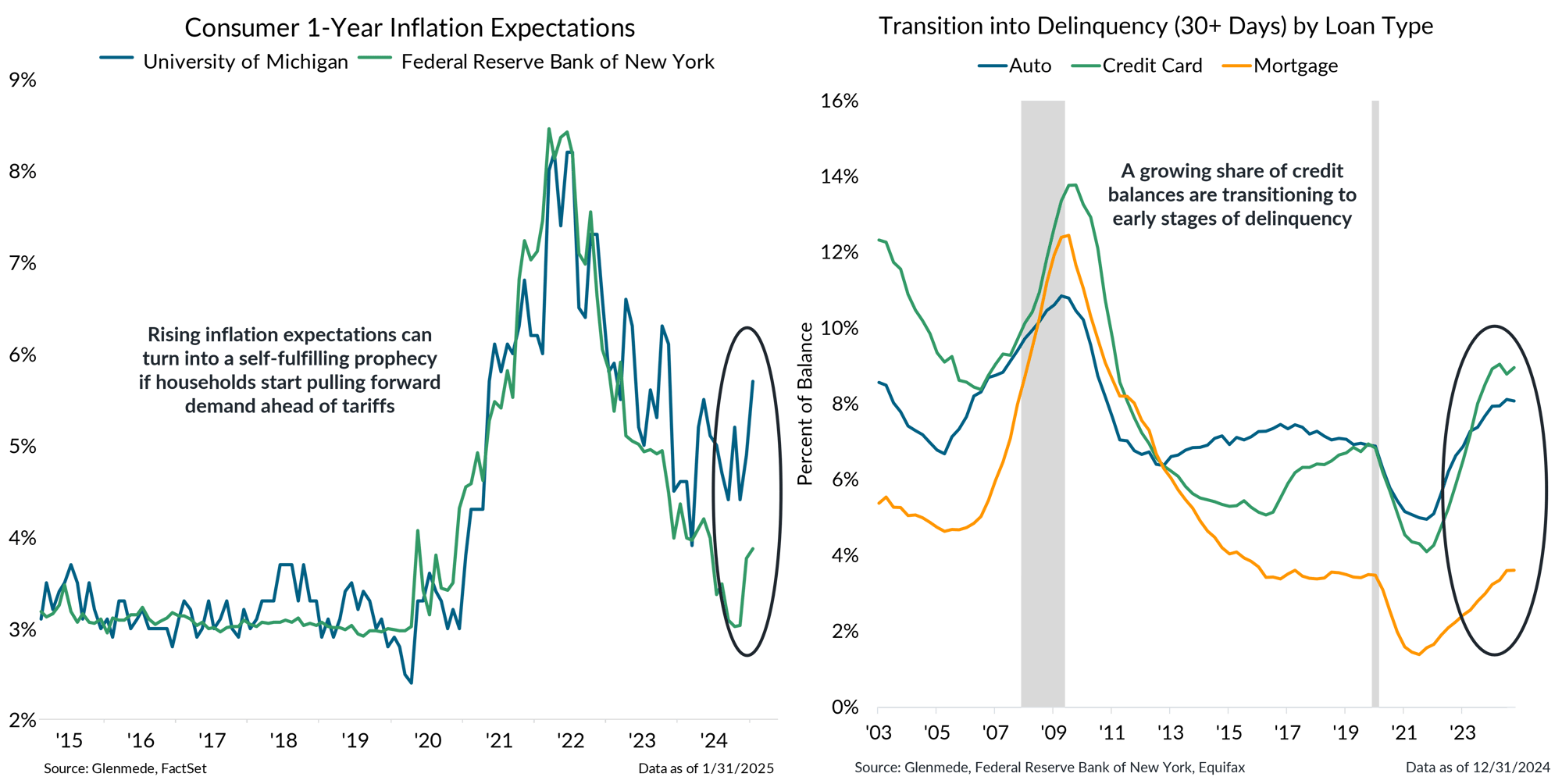

Among concerns that could be realized are inflation and rising delinquencies for those with too much debt

Shown in the left panel are 1-year inflation expectations based on consumer surveys conducted by the University of Michigan in blue and the Federal Reserve Bank of New York in green. Shown in the right panel are four-quarter rolling sums of the percent of outstanding balance for U.S. auto loans (in blue), credit card debt (in green) and mortgage debt (in yellow) that have transitioned into delinquency after 30 or more days of nonpayment. Gray bars represent recession periods in the U.S. Actual results may differ materially from expectations.

- Consumer inflation expectations have increased, partly driven by the uncertainty surrounding tariffs, which has raised concerns about higher prices.

- Rising delinquencies among individuals with high levels of debt pose some risk, but while signs of stress remain, they seem contained rather than systemic at this point.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.