Investment Strategy Brief

Debt Ceiling Déjà Vu

January 12, 2025

Executive Summary

- The debt ceiling is set to be reached in the coming days, preventing the federal government from issuing new bonds.

- The government will turn to Treasury funds and extraordinary measures to temporarily manage its financial obligations.

- These measures are likely to last through the end of summer, while Congress negotiates a long-term solution.

- Extraordinary measures by the Treasury can last for quite some time and provide temporary support to the economy and markets.

The debt ceiling is set to be reached soon, preventing the federal government from issuing new bonds

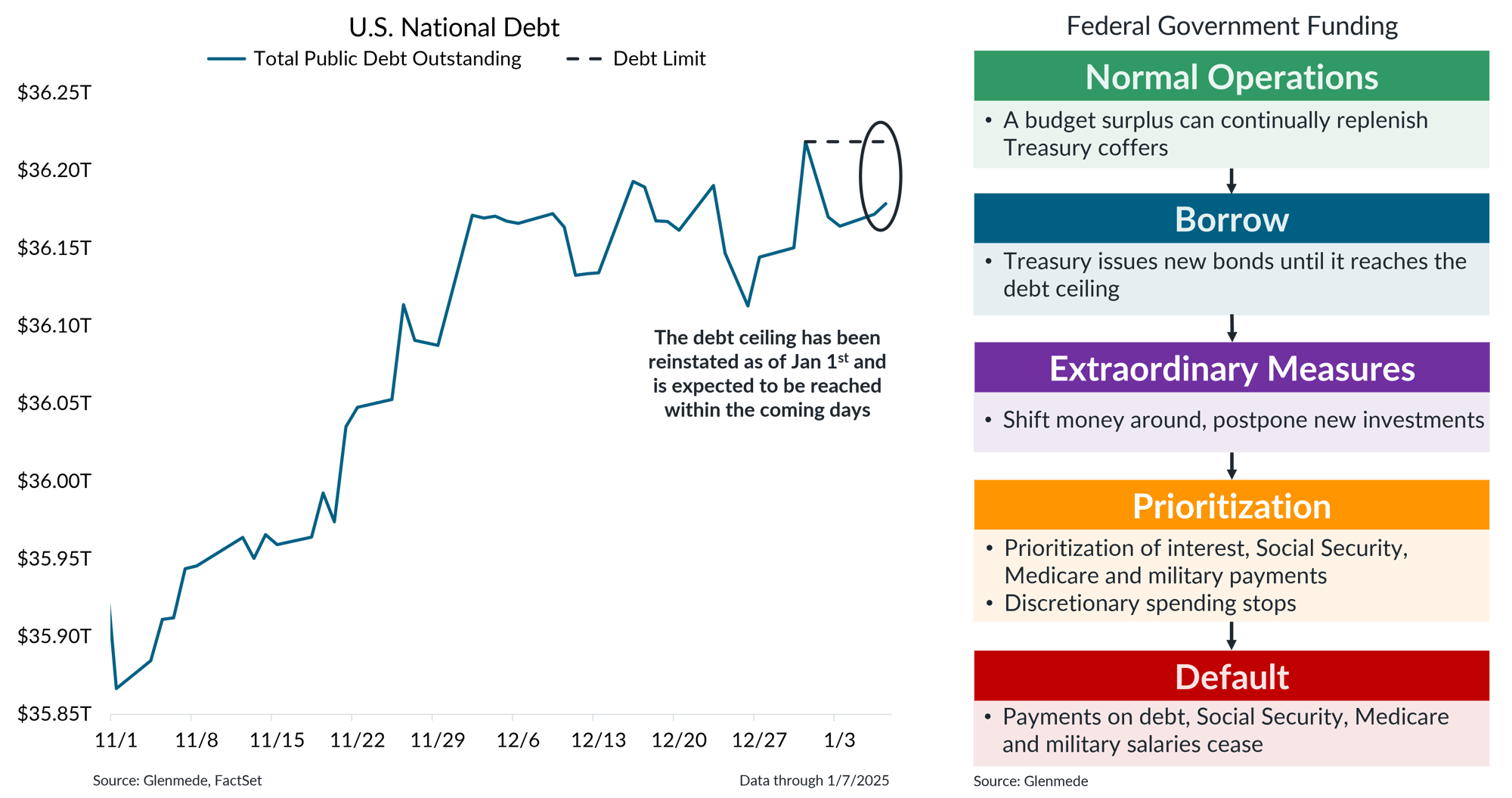

Data shown in the left panel in dashed black is the U.S. statutory federal debt ceiling limit level and in blue are the values of outstanding U.S. federal debt that is subject to the debt ceiling limit. All values are quoted in trillions of U.S. dollars. The flowchart shown in the right panel is a general representation of the steps the federal government can take to fund its operations and raise cash and is not meant to be an exhaustive list of all possibilities and tools at the disposal of the federal government. Actual steps taken and subsequent outcomes may differ materially from expectations.

- The debt limit, which had been suspended in 2023, was reinstated as of January 1st at the current level of public debt outstanding.

- While the debt limit was reinstated, the limit was not technically reached due to a scheduled redemption of certain securities that temporarily reduced the deficit.

- However, the limit is set to be reached within the next few days, prompting the start of extraordinary measures.

Historically, there has been enough excess cash in the treasury to fund the government in the short-term

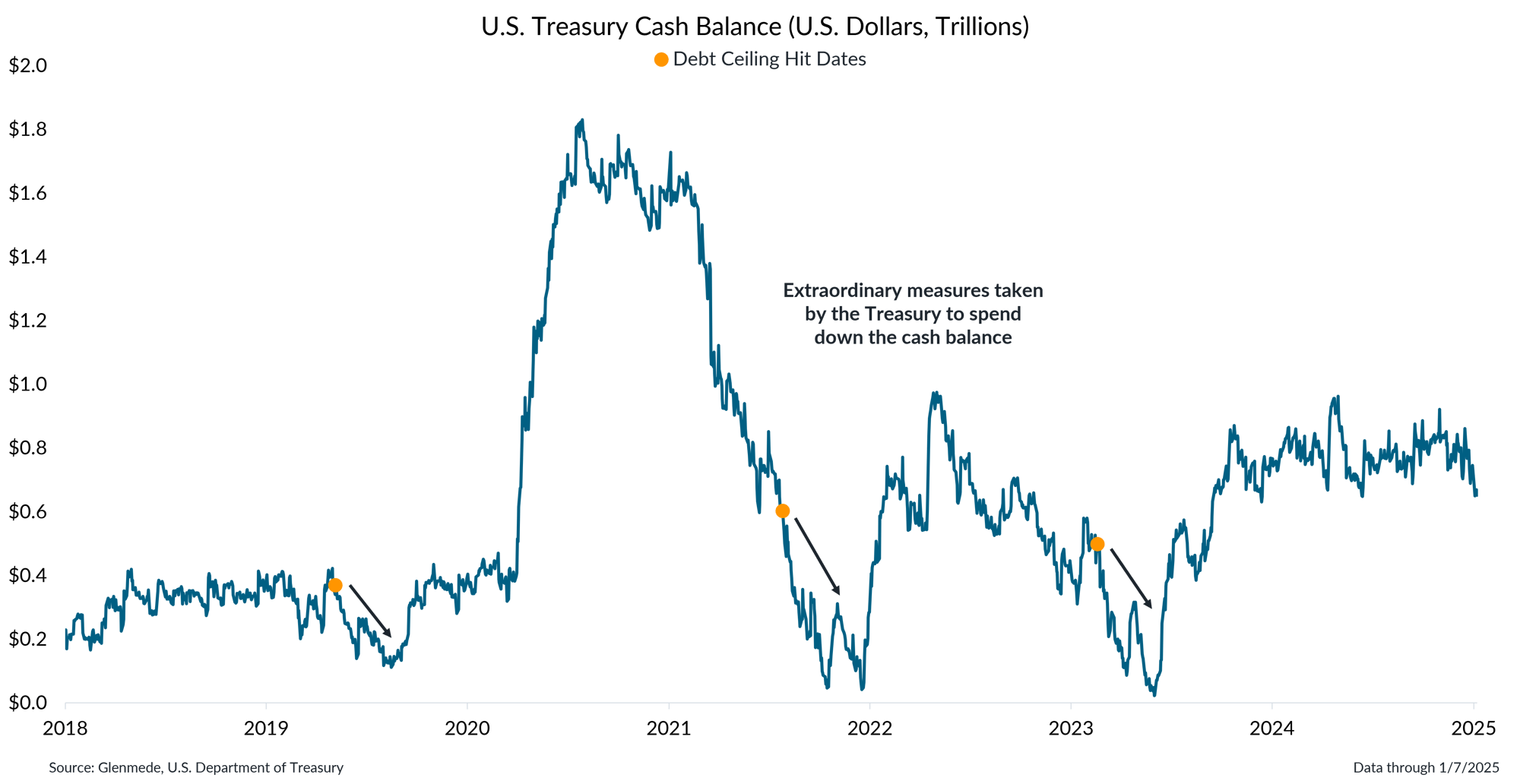

Shown in blue is the cash balance of the U.S. Treasury, measured in trillions of U.S. Dollars. The yellow dots represent the days when the debt ceiling has been hit in the past.

- Once the debt ceiling is reached, the Treasury will implement extraordinary measures by using the cash on hand to fulfill obligations and temporarily prevent default.

- Historically, excess cash in the Treasury has allowed the government to continue operations in the short-term giving lawmakers the opportunity to negotiate a solution.

The Treasury’s current projected cash balance is expected to buy time through the summer

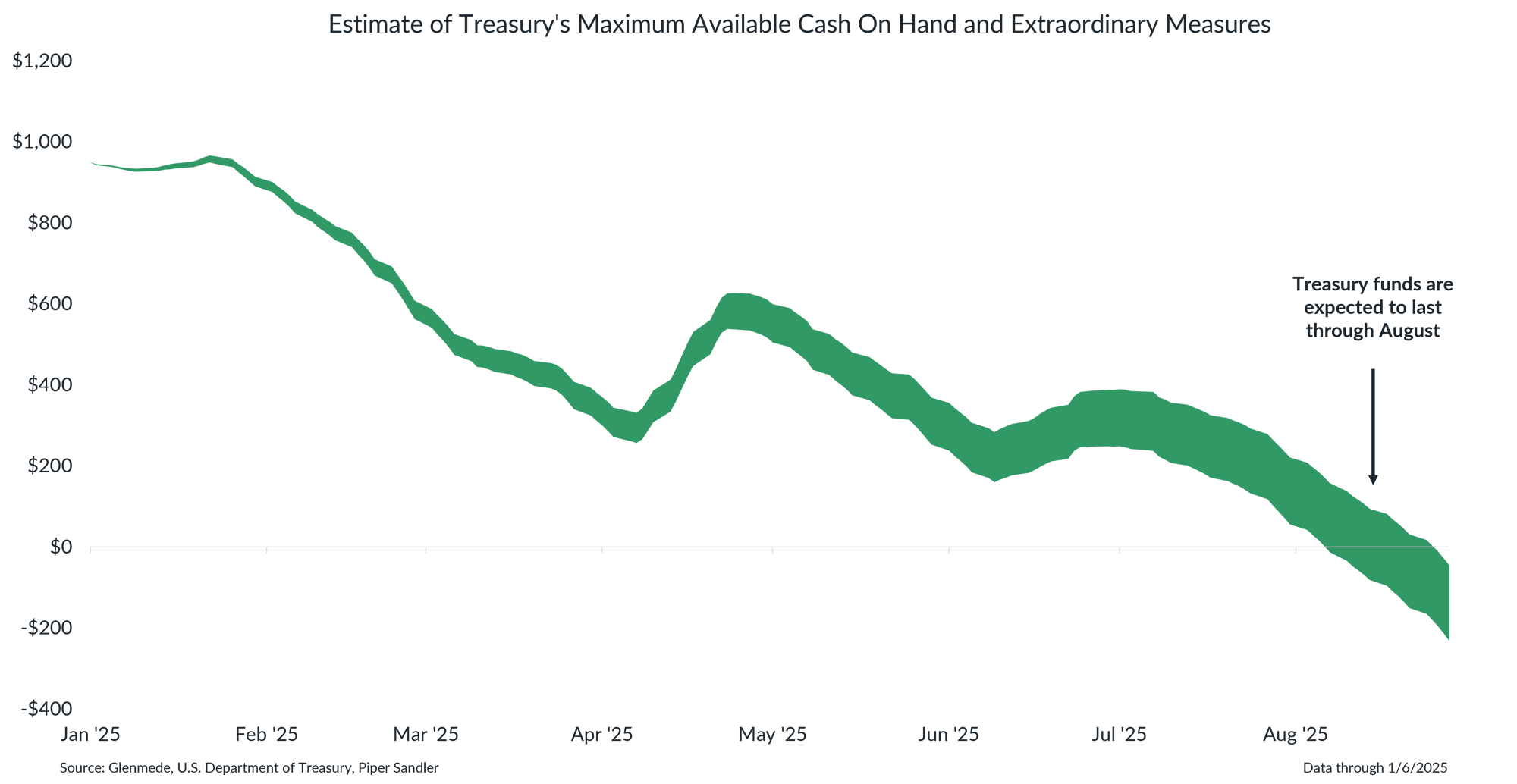

Data shown are range projections for the balance of cash, additional borrowing and the value of extraordinary measures available to the U.S. Treasury to meet its financial obligations through 2025. Actual results may differ materially from projections.

- The U.S. Treasury’s projected cash balance, combined with available borrowing room and extraordinary measures, is expected to last through August.

- The government still has some time to establish a more long-term solution for the national debt and the risk of default remains low.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.