Investment Strategy Brief

Don’t Call It a (Small Cap) Comeback

September 28, 2025

Executive Summary

- After several challenging years, small cap stocks have broken out to new highs.

- Small cap earnings are also trending higher after remaining relatively stagnant in recent years.

- The renewed rate cut cycle and declining effective corporate tax rates are likely to disproportionately favor small cap stocks.

- Small cap valuations still sit near fair value, presenting an attractive opportunity for investors.

- Even though small caps are near all-time highs, there may be further upside due to earnings, valuation, and policy-driven tailwinds.

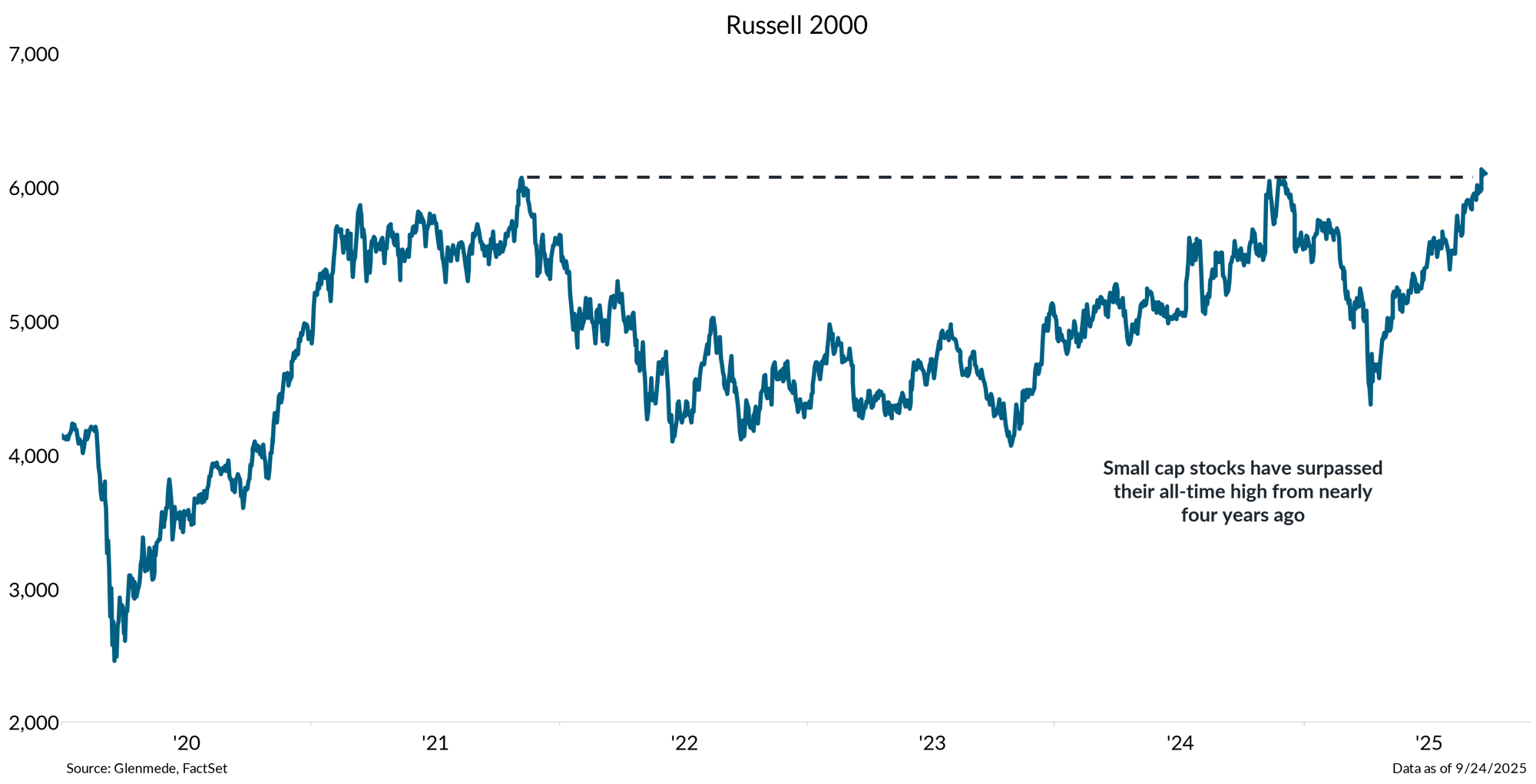

After several challenging years, small cap stock have broken out to new highs

Shown is the Russell 2000 Index, which is a market capitalization weighted index of the U.S. small cap stocks. Past performance may not be indicative of future results. One cannot invest directly in an index.

- For the first time since their November 2021 peak, small cap equities have broken out to new all-time-highs.

- Tailwinds from easing rate pressures, domestic economic resilience, and extended valuations in large caps are fueling renewed interest down the capitalization spectrum.

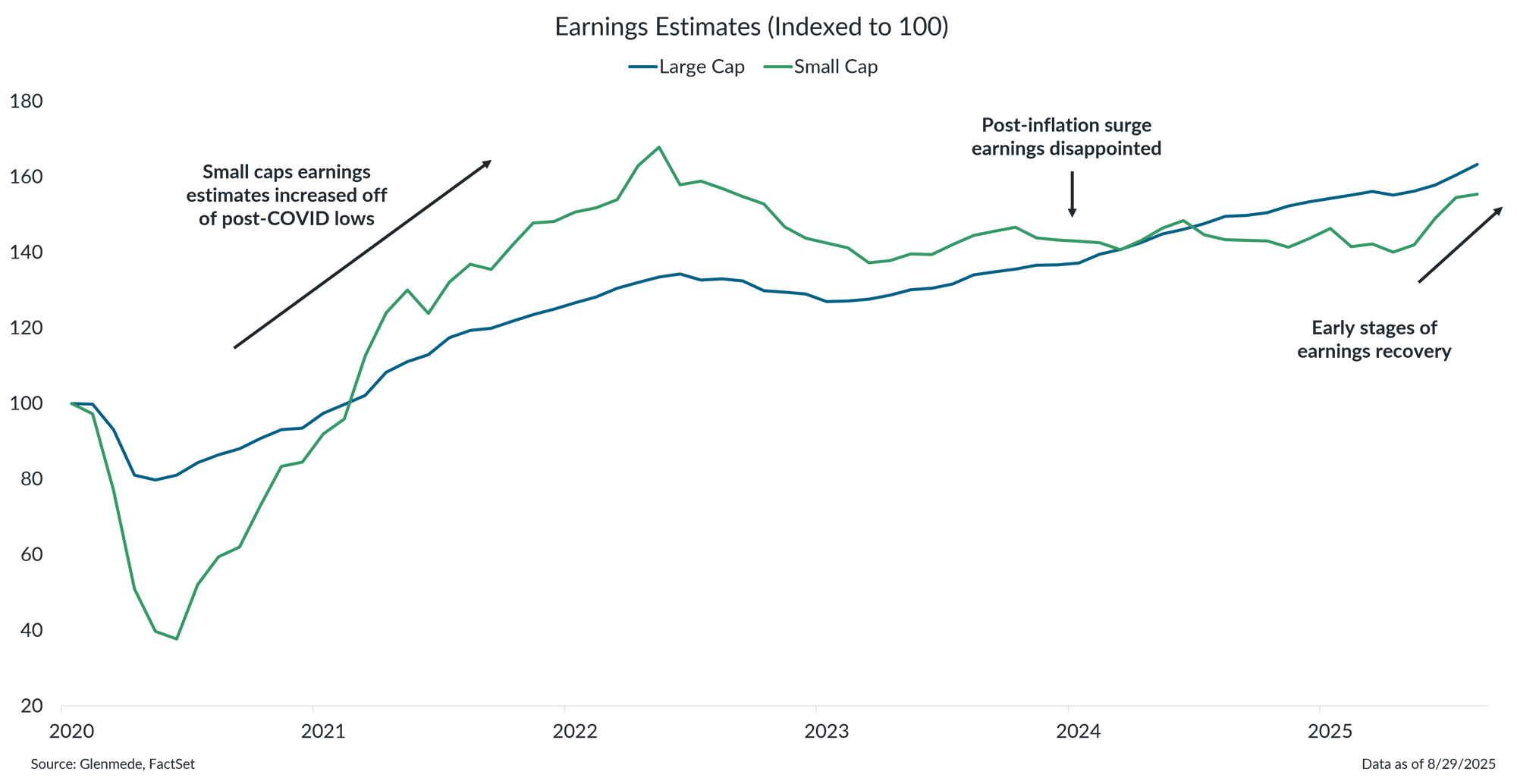

Small cap earnings are also trending higher after remaining relatively stagnant in recent years

Data shown are earnings estimates for the next twelve months based on bottom-up equity analysts’ projections for U.S. large cap (S&P 500 Index) and U.S. small cap (Russell 2000 Index). Earnings are indexed to 100 at the start of the period shown. Past performance may not be indicative of future results. One cannot invest directly in an index.

- After rebounding significantly from their post-COVID lows, small-cap earnings stagnated during the inflation surge, falling short of expectations.

- However, signs of recovery are emerging, suggesting earnings may finally be turning higher after years of muted growth.

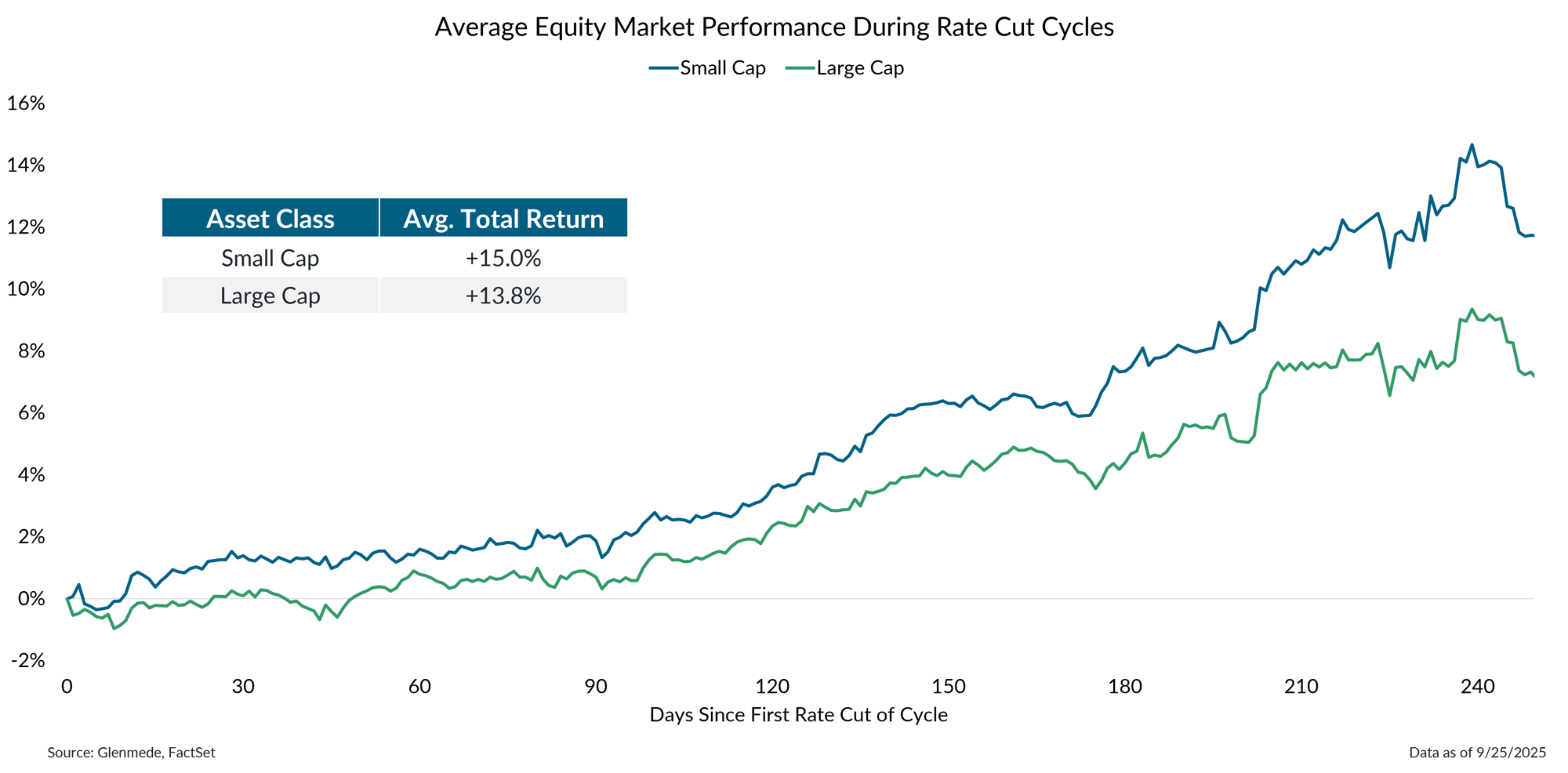

Rate cuts are likely to provide support for small caps’ relative performance

Data shown represent the average total return paths of the S&P 500 and Russell 2000 during the last 18 Federal Reserve rate cut campaigns since 1980. Shown in blue is the average return path for the Russell 2000 and shown in green is the average return path for the S&P 500. Data shown in the table are summary statistics for average total returns over the periods shown in the chart. Past performance may not be indicative of future results. One cannot invest directly in an index.

- Based on the average outcome during the past 18 rate cut campaigns, small caps have responded more favorably than their large cap counterparts.

- With more than half of small cap debt issued at floating rates, the falling interest expenses during easing cycles could provide a meaningful tailwind to earnings, supporting a more constructive outlook.

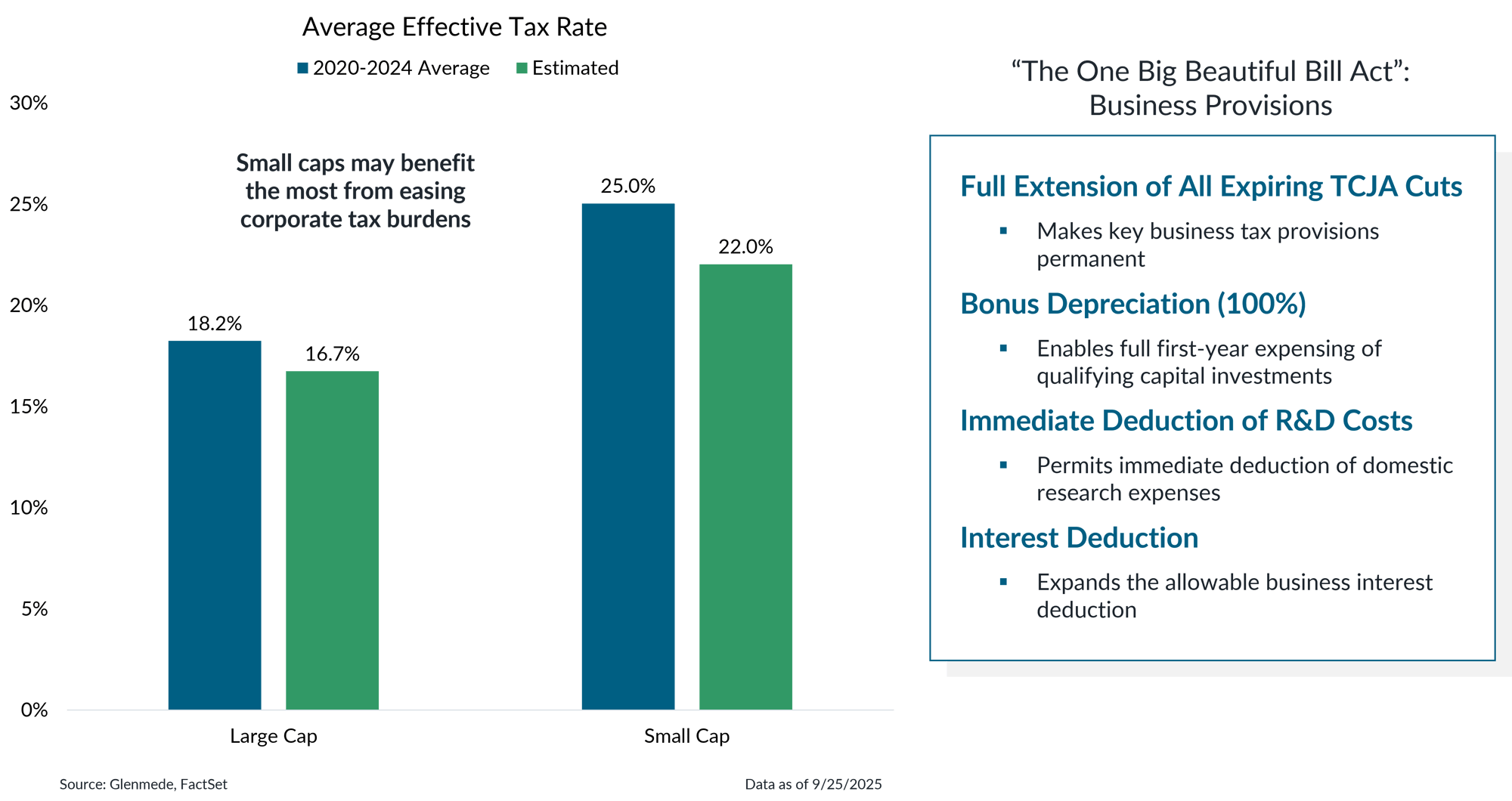

The OBBBA’s provisions are expected to lower the effective tax rate for corporations

Shown in the left panel are the 4-year average effective tax rates for large cap (S&P 500) and small cap (S&P 600). Shown in the right panel is a non-exhaustive summary of the business provisions included in the “The One Big Beautiful Bill Act” (OBBBA). TCJA refers to The Tax Cuts and Jobs Act of 2017. Past performance may not be indicative of future results. One cannot invest directly in an index.

- The OBBBA provisions are expected to lower the average effective tax rate, with small cap companies likely benefitting more than large caps.

- Provisions like bonus depreciation and R&D deductions could provide a strong growth tailwind for small caps by encouraging reinvestment and innovation.

Small cap valuations sit near fair value, presenting an attractive opportunity for investors

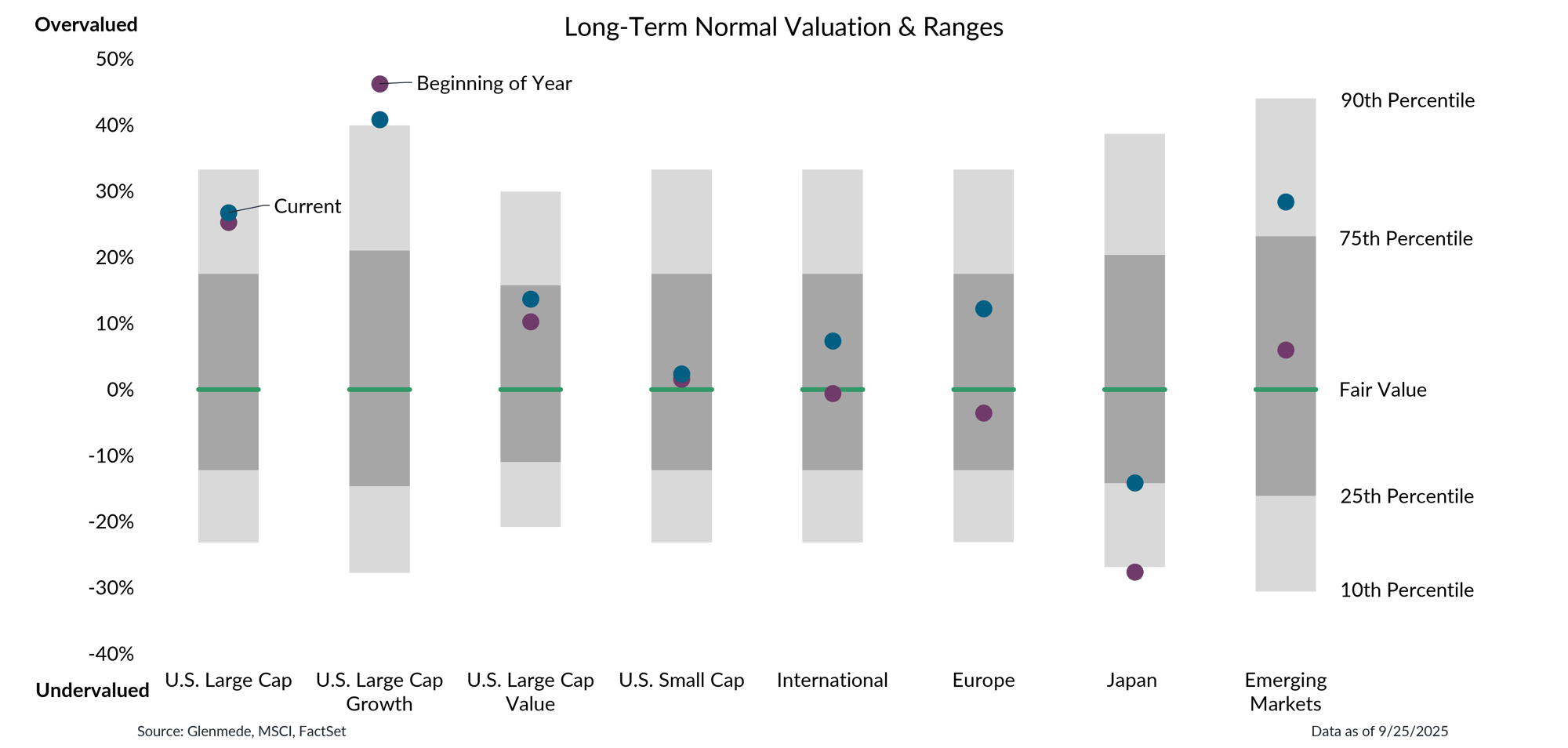

Data shown are Glenmede’s estimates of long-term fair value for U.S. Large Cap (MSCI USA), U.S. Large Cap Growth (MSCI USA Growth), U.S. Large Cap Value (MSCI USA Value), U.S. Small Cap(MSCI USA Small), International (MSCI All Country World ex-U.S.), Europe (MSCI Europe), Japan (MSCI Japan) and Emerging Markets (MSCI EM) based on normalized earnings, normalized cashflows, dividend yield, and book value for each index. Blue dots represent current valuation levels and purple dots represent valuation levels at the beginning of 2025. Glenmede’s estimates of fair value are arrived at in good faith, but longer-term targets for valuation may be uncertain. One cannot invest directly in an index.

- Small caps are currently priced closer to long-term fair value, offering a more favorable risk-reward profile than their large cap counterparts.

- In contrast, large caps are trading near the 75th percentile range, making small caps look relatively inexpensive.

This material is provided solely for informational and/or educational purposes and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Any company, fund or security referenced herein is provided solely for illustrative purposes and should not be construed as a recommendation to buy, hold or sell it. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.