Investment Strategy Brief

Due Diligence on Tariff Duties

November 17, 2024

Executive Summary

- Trade policy is likely to be a key pillar in a second Trump term, but some of his tariff proposals may face roadblocks in Congress.

- Tariffs can have nuanced effects on inflation in practice, as competitive markets often adjust to offset the impact.

- The potential impact on economic growth from threatened tariffs is of a larger magnitude than those imposed in Trump’s first term.

- Tariffs risk near-term impacts to economic growth and inflation, with longer-term implications for the structure of trade relationships.

Investors may begin to consider the impact of a return to a higher tariff regime

.png?width=2000&height=979&name=IS%20Brief%20Chart%201%202024-11-18%20(1).png)

Data shown in the left panel in blue are effective tariff rates on U.S. imports over time, which includes nominal tariffs on final goods as well as on imported inputs used in production. The dots in blue are projections for the effective tariff rate if Trump were to implement various proposed tariffs, including 60% tariffs on all Chinese imports and 10% tariffs on all other imports. Actual results may differ materially from projections.

- Trump has proposed several new tariffs, including 60% tariffs on all Chinese imports and baseline 10% tariffs on all imports, which would return effective tariff rates to early-20th century levels.

- Trump should have the authority to impose the China tariffs unilaterally, but the universal tariffs would likely require an act of Congress, making the latter less likely for actual implementation.

Tariffs can have nuanced effects on inflation in practice

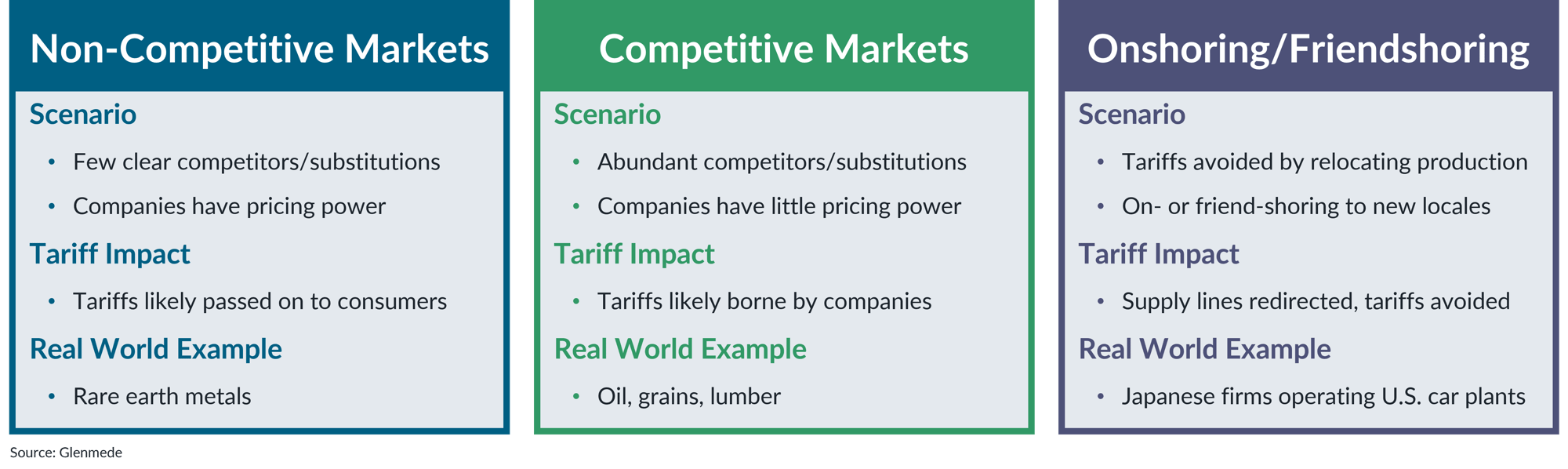

The information shown are general thought exercises on the impacts tariffs can have on inflation in practice. Actual results may differ materially from those described or may be subject to factors from multiple scenarios.

- The ultimate impact that tariffs have on inflation and economic growth largely depends on the structures for those markets and barriers to entry.

- Very few markets for goods fall neatly into these three scenarios. The majority are likely to have characteristics that are shades in between.

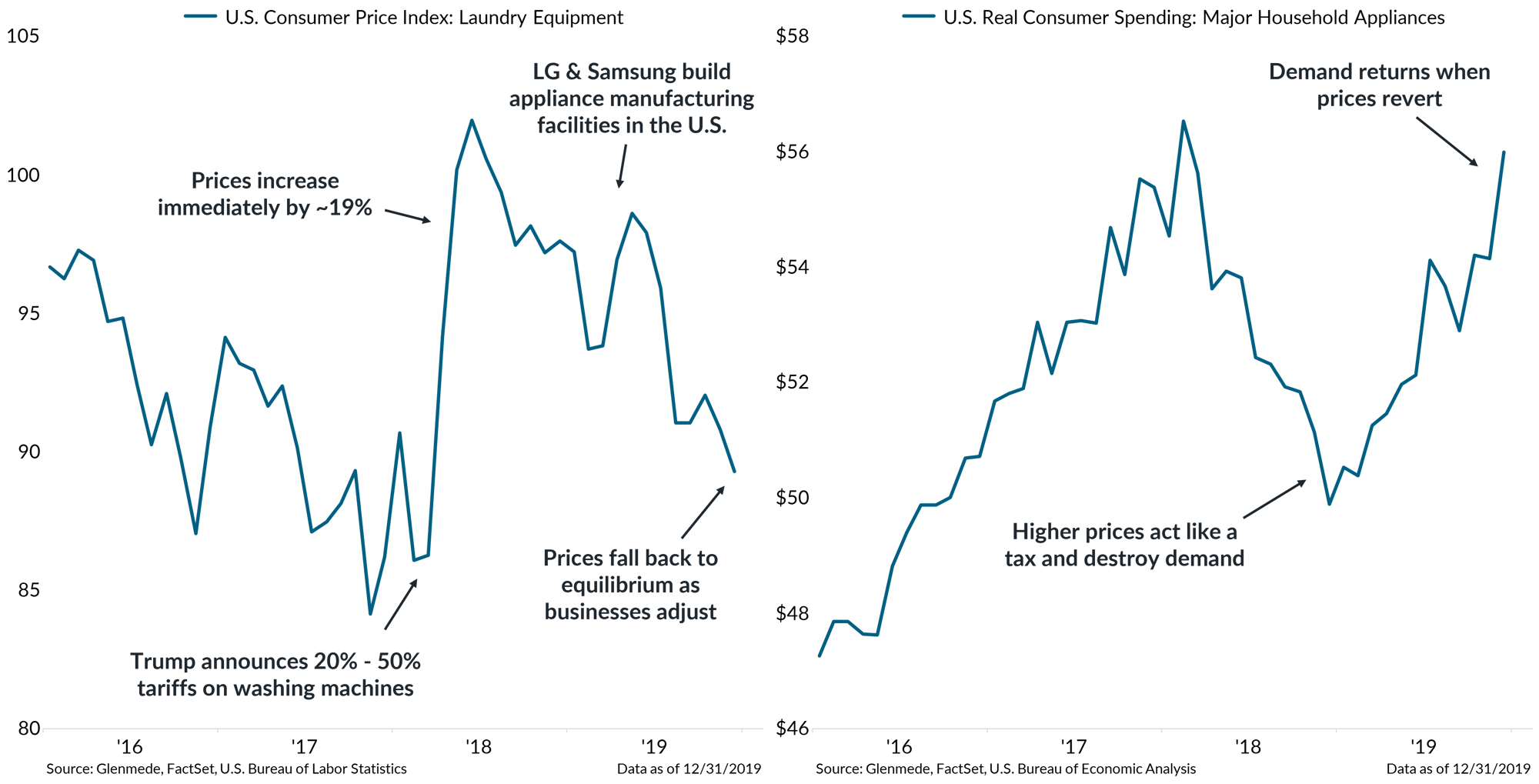

Washing machines offer a real-world example of how markets adjust to tariffs

Data shown in the left panel represent the laundry equipment subcomponent of the U.S. Consumer Price Index on a seasonally-adjusted basis. Data shown in the right panel represent consumer spending on major household appliances on an inflation-adjusted and seasonally-adjusted basis in billions of U.S. dollars as of 2017 prices.

- Trump’s washing machine tariffs in early 2018 are a good case study. In the near term, demand pulled back as consumers balked at higher prices, as the tariffs acted like a tax.

- Thereafter, several large manufacturers took steps to build out facilities in the U.S. to bypass tariffs, which brought the market back into better balance with falling prices and renewed demand.

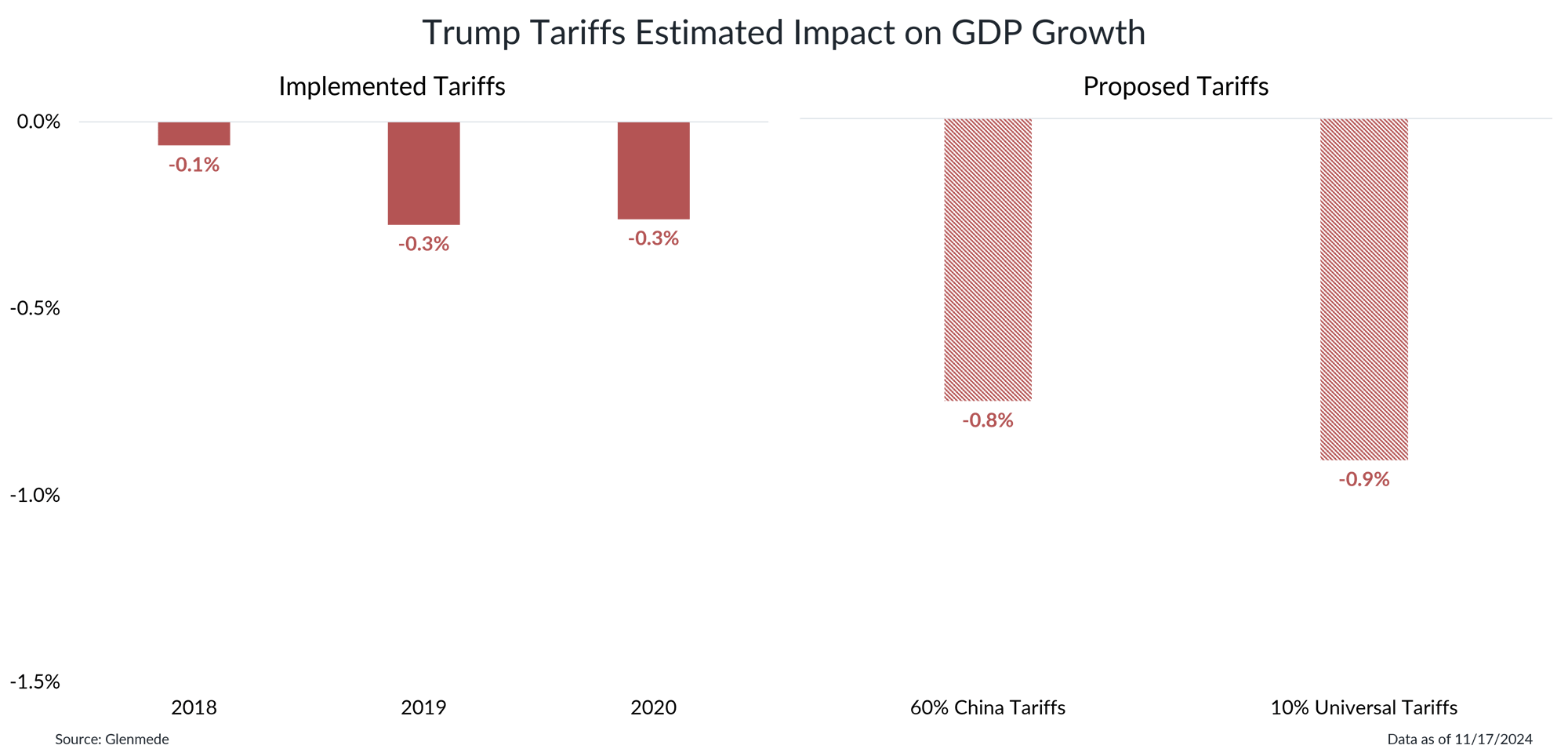

Tariffs threatened on the campaign trail are of a larger magnitude than those imposed in the first term

Estimates of the impact of tariffs on gross domestic product (GDP) growth assume full demand destruction via a tariff-induced price shock. The impact of proposed tariffs assumes the following: “60% China Tariffs” increase all tariff levels on Chinese goods imports; “10% Universal Tariffs” increase tariffs on all goods imports to 10%. All tariff proposals assume they are implemented in isolation, with no cross effects or impact from retaliatory tariffs. Actual results may differ materially from expectations or projections.

- Trump’s first-term tariffs were likely a 0.8% economic growth headwind spread out over multiple years given the spacing of those tariffs over time.

- The tariffs proposed for his second term are roughly twice the scale in combination. However, the president lacks unilateral authority on the universal tariffs and appetite for it in Congress may be scarce.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.