Investment Strategy Brief

Earnings Resilience in Q2

July 20, 2025

Executive Summary

- Q2 earnings season has kicked off, with communications and tech expected to drive S&P 500 gains, masking weakness in other sectors.

- Earnings expectations have remained notably resilient, with small cap earnings projected to rebound.

- The One Big Beautiful Bill Act’s (OBBBA) provisions are expected to lower the effective tax rate for corporations, serving as a tailwind for earnings.

- Companies are pursuing tariff workarounds to manage margin pressure from tariff costs.

- Corporate earnings have demonstrated resilience amid ongoing economic uncertainty and an unsettled trade policy landscape.

Q2 earnings season has kicked off, with communications and tech expected to drive S&P 500 gains

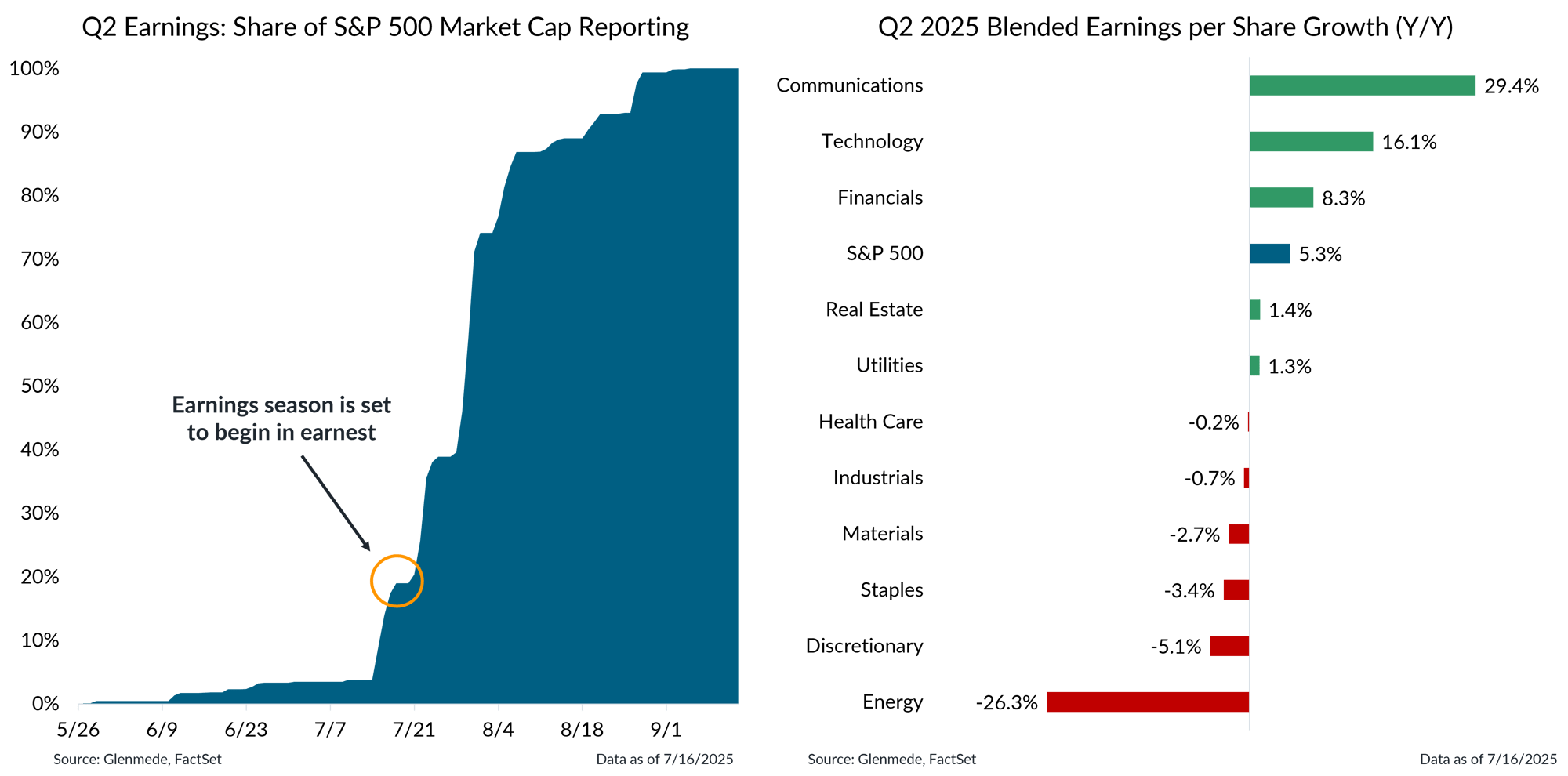

Shown in the left panel is a timeline of the cumulative share of the S&P 500’s market capitalization that will report Q2 2025 earnings results. Shown in the right panel is the blended growth in earnings per share for the S&P 500 and its eleven constituent sectors for Q2 2025 on a year-over-year, percent change basis. Blended growth figures combine actual results with consensus expectations for companies that have yet to report. The S&P 500 is a market capitalization weighted index of large cap stocks in the U.S. Actual results may differ materially from expectations. One cannot invest directly in an index.

- Earnings season is well underway with most companies scheduled to report over the next two weeks.

- Strong contributions from the communications and technology sectors are expected to help lift earnings growth for the S&P 500 to the mid-single-digits for the quarter.

Earnings expectations have remained notably resilient, with small cap earnings projected to rebound

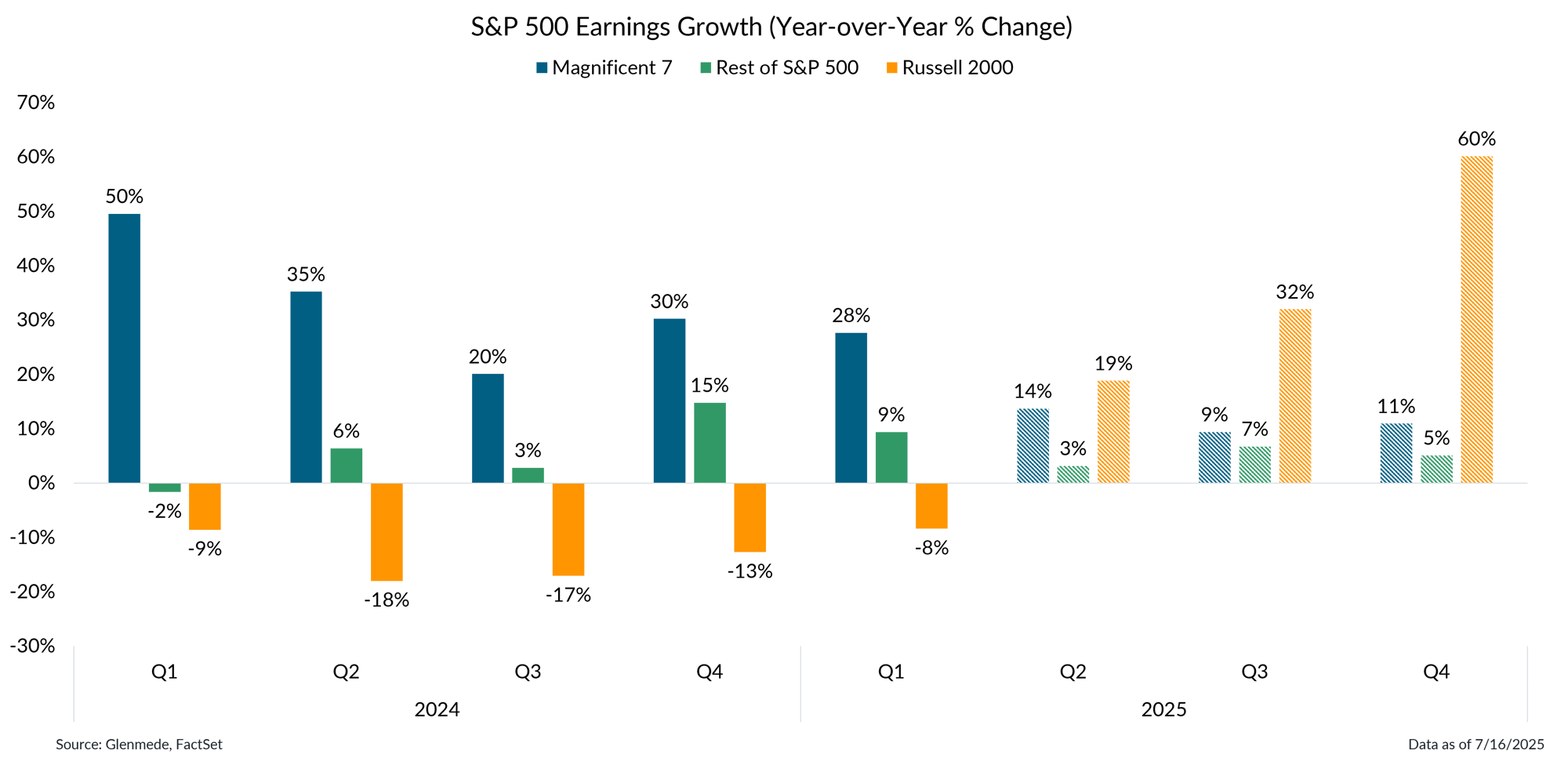

Data shown are quarterly earnings per share growth rates on a year-over-year percent change basis. Figures in blue represent the results for the Magnificent 7 (Apple, Microsoft, Amazon, Alphabet, Meta, Tesla), figures in green represent the rest of the stocks in the S&P 500 index and figures in orange represent the Russell 2000 index. Solid bars represent actual results, and hashed bars represent projections based on bottom-up equity analysts’ estimates. Past performance may not be indicative of future results. Actual results may differ materially from expectations. One cannot invest directly in an index. References to specific stocks should not construed as advice to buy, hold or sell individual securities.

- The Magnificent 7 are poised to deliver healthy earnings growth this quarter, albeit at a decelerating pace from the prior year.

- While recent earnings gains have been concentrated in large cap tech leaders, small caps earnings are positioned for a rebound and may finally begin to outpace their large cap counterparts.

The OBBBA’s provisions are expected to lower the effective tax rate for corporations

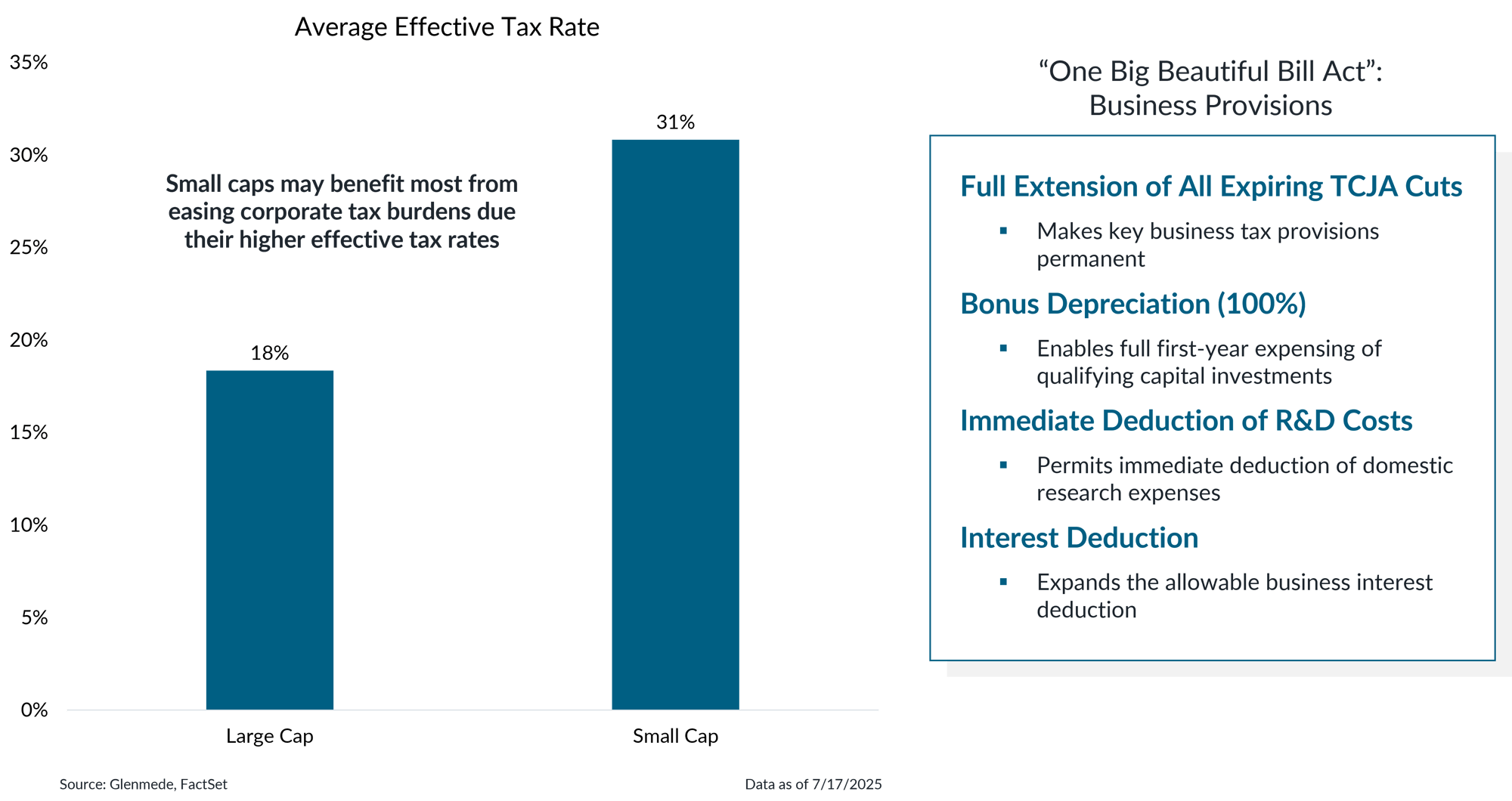

Shown in the left panel are the 6-year average effective tax rates for constituents in the S&P 500 and Russell 2000 indexes. Shown in the right panel is a non-exhaustive summary of the business provisions included in the “The One Big Beautiful Bill Act” (OBBBA). TCJA refers to The Tax Cuts and Jobs Act of 2017. Past performance may not be indicative of future results. One cannot invest directly in an index.

- The recently enacted “One Big Beautiful Bill Act” introduces a range of tax incentives for businesses that should provide a tailwind for equities.

- With higher effective tax rates on average, small cap companies stand to benefit disproportionately from enhanced deductions for interest and depreciation compared to large caps.

Companies are pursuing tariff workarounds to manage margin pressure from tariff costs

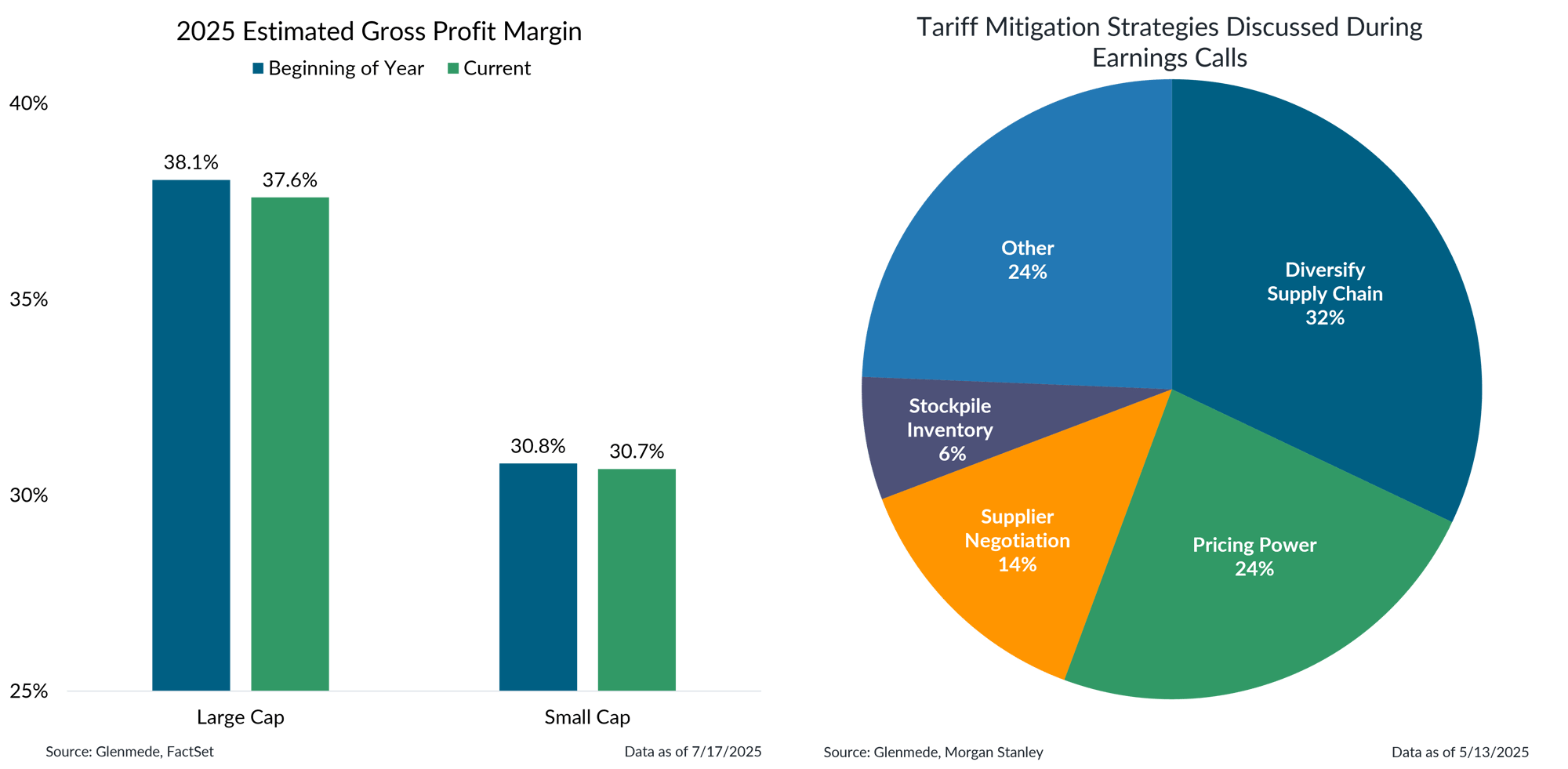

Shown in the left panel are gross profit margin projections for 2025 based on bottom-up equity analysts’ estimates for the S&P 500 and S&P 600 indexes. Shown in the right panel are the number of companies that mentioned various mitigation strategies during their Q1 2025 earnings calls. Actual results may differ materially from expectations. One cannot invest directly in an index.

- On the other side of fiscal policy, tariffs have emerged as a key focus, with investors closely monitoring their potential impact on corporate profit margins.

- Companies outlined mitigation strategies to offset tariff-related pressures earlier this year, and despite some likely cost absorption, margins are expected to remain relatively resilient in 2025.

This material is provided solely for informational and/or educational purposes and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Any company, fund or security referenced herein is provided solely for illustrative purposes and should not be construed as a recommendation to buy, hold or sell it. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.