Investment Strategy Brief

Earnings Season

Sets Sail

July 14, 2024

Executive Summary

- Expectations for Q2 earnings season are for high single digit growth overall, with some sector dispersion.

- The Magnificent 7 continues to set the pace on earnings, but that dominance may give way to broader fundamental improvement.

- As 2024 progresses, large caps may pass the earnings growth baton to their smaller counterparts.

- Modest earnings growth should support modest returns for equities, justifying an allocation that does not stray far from longer-term investment policy.

Expectations are for high single digit growth overall, with some sector dispersion

Shown is the expected growth in earnings per share for the S&P 500 and its eleven constituent sectors for Q2 2024 on a year-over-year, percent change basis. Expected growth is based on a consensus of company analysts, compiled on a bottom-up basis. The S&P 500 is a market capitalization weighted index of large cap stocks in the U.S. Actual results may differ materially from expectations. One cannot invest directly in an index.

- After posting earnings growth of 6% in Q1, the S&P 500’s fundamental base is expected to accelerate in Q2.

- Most sectors are expected to see positive earnings growth driven by communications, health care and technology, though industrial and materials may be laggards.

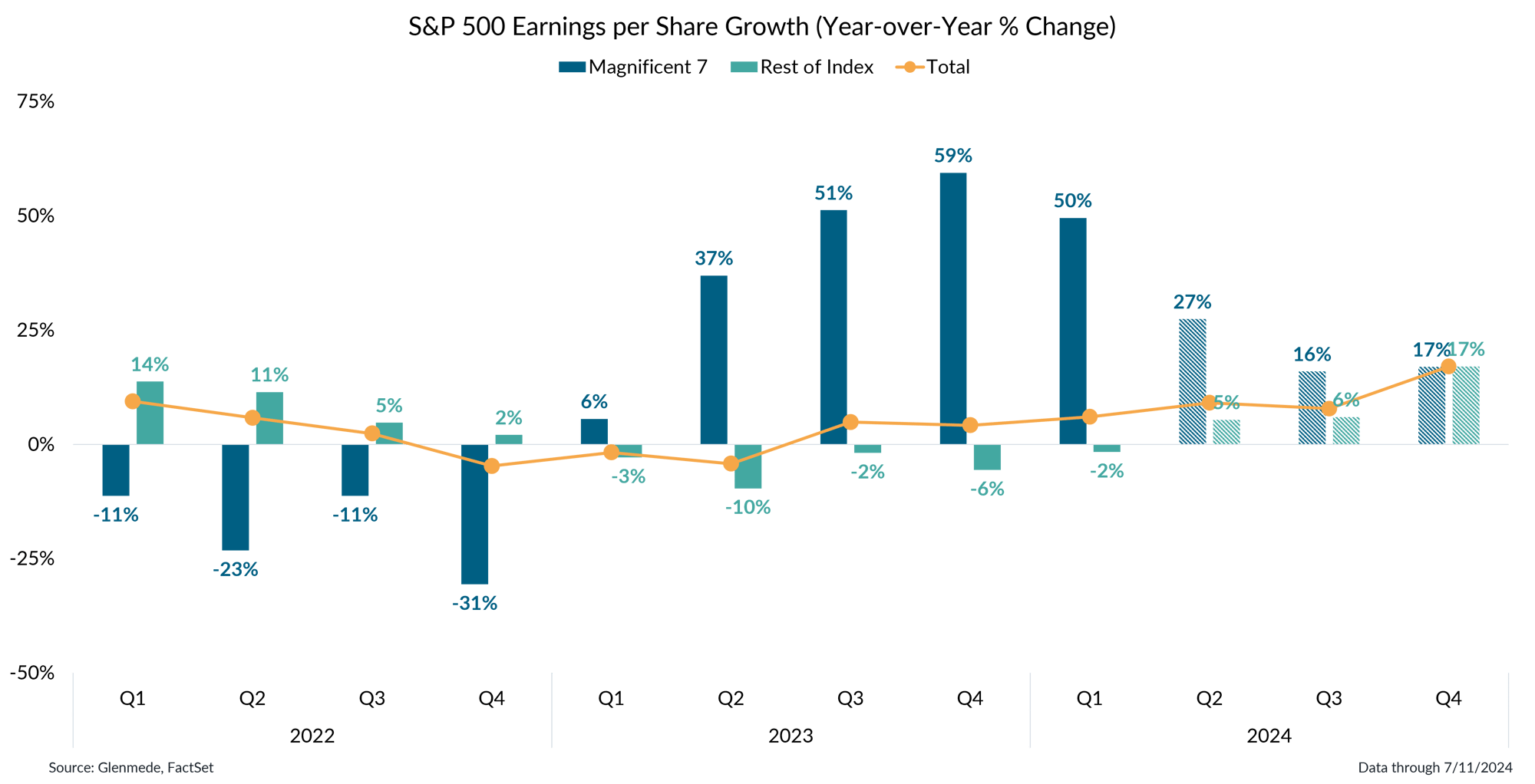

Another quarter of Magnificent 7 earnings dominance may give way to broader improvement

Data shown are quarterly earnings per share growth rates on a year-over-year percent change basis. Figures in blue represent the results for the Magnificent 7 (Apple, Microsoft, Amazon, Alphabet, Nvidia, Meta, Tesla) and figures in green represent the rest of the stocks in the S&P 500 index. Solid bars represent actual results and hashed bars represent projections based on bottom-up equity analyst estimates. Past performance may not be indicative of future results. One cannot invest directly in an index. References to specific stocks should not be construed as advice to buy, hold or sell individual securities.

- The Magnificent 7’s earnings growth did not miss a beat over the past year, surging ahead while the rest of the index faced an earnings recession.

- This quarter may be the start of a process that sees a broader set of companies participating, with Q4 expected to be the moment of parity between the two groups.

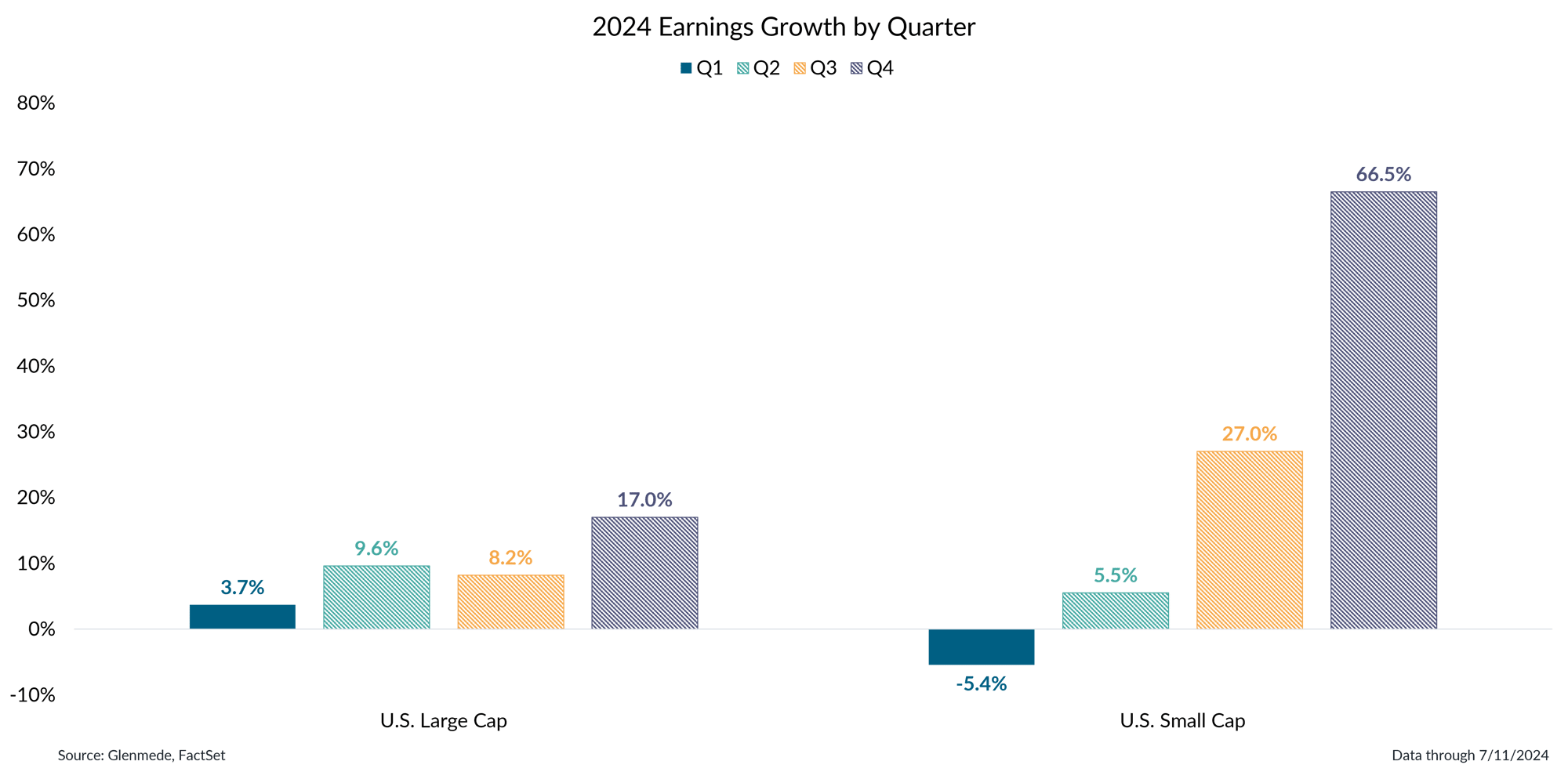

As 2024 progresses, large caps may pass the earnings growth baton to their smaller counterparts

Data shown are the year-over-year growth rates in earnings per share for multiple asset classes for each quarter in 2024. Q1 represents actual results and Q2 through Q4 are projections based on bottom-up equity analyst estimates. Each class is represented by the following: U.S. Large Cap (S&P 500), U.S. Small Cap (Russell 2000). Past performance may not be indicative of future results. One cannot invest directly in an index.

- Small caps have undergrown their earnings relative to large caps to start the year, but that may give way to significant divergence in small caps’ favor in the coming quarters.

- Overall modest earnings growth should support modest returns for equities, justifying an allocation that does not stray far from longer-term investment policy.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.