Investment Strategy Brief

Fed Gets the Ball Rolling

September 22, 2024

Executive Summary

- The Fed has taken the first step in a new easing campaign, which should see rates return to the neighborhood of neutral in 2025 and support borrowing conditions/housing affordability.

- As yields fall, higher-than-normal cash balances may give way to a rotation toward more productive investments.

- Small caps may be one of the biggest beneficiaries of falling rates, as a larger share of their debt is floating rate.

- Fed policy normalization should relieve some pressure from this late-stage expansion and may provide opportunities in small caps.

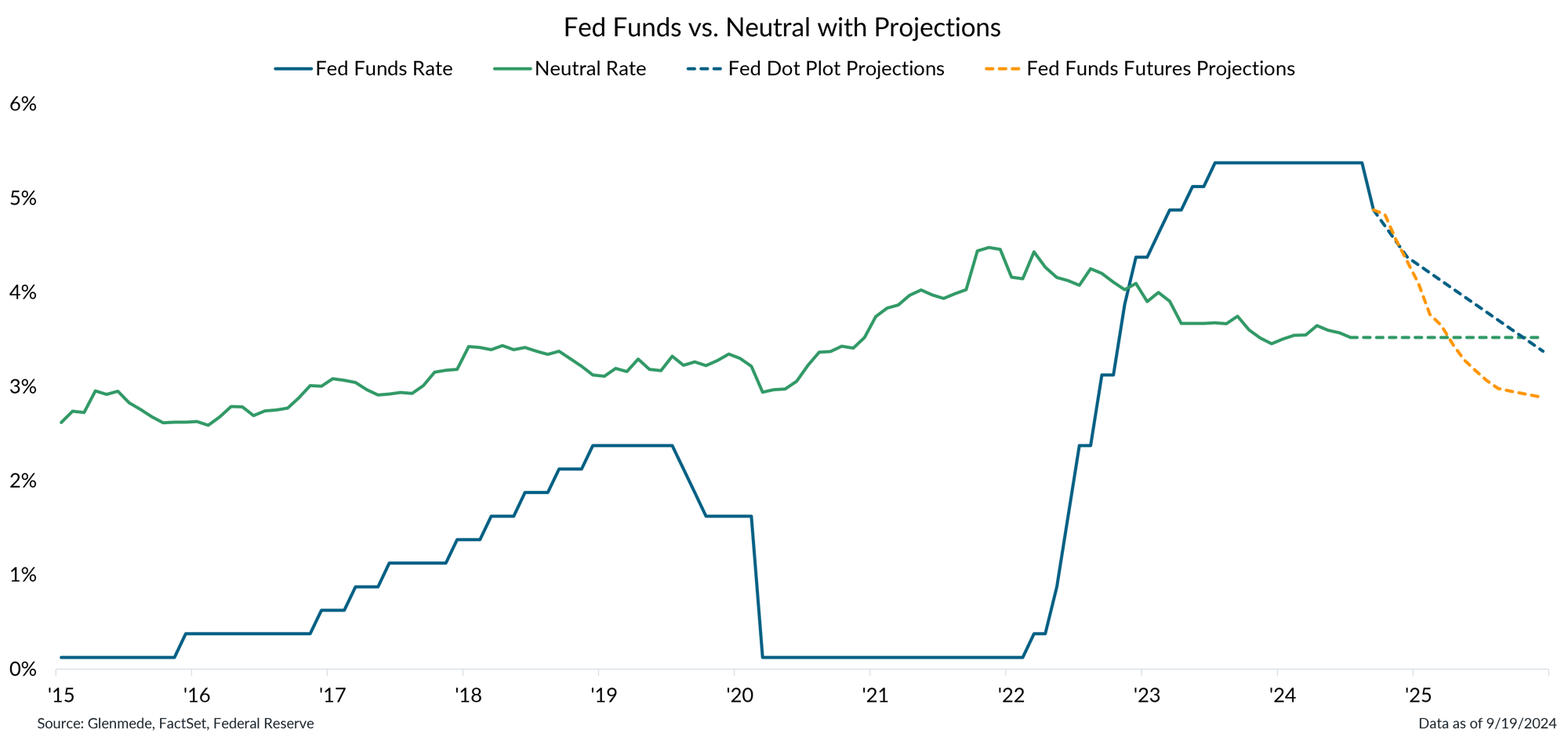

The Fed has taken the first step in a rate cut campaign, a journey that could see rates near neutral in 2025

Data shown in green are Glenmede’s estimates of the neutral federal funds rate over time (i.e., the level of rates that is neither economically stimulative nor restrictive) based on expectations for real interest rates via the Holston-Laubach-Williams model and Glenmede’s 10yr inflation expectations. Fed Funds Rate in blue is the target rate midpoint. The dashed blue line represents projections based on the median response in the Federal Open Market Committee’s latest dot plot survey. The dashed yellow line represents projections based on fed funds futures. Actual results may differ materially from projections.

- The Federal Reserve kicked off a new easing campaign with a half percent rate cut to fed funds last week.

- Alongside the rate decision, the updated dot plot showed the median respondent expecting rates to return to neutral by the end of 2025, consistent (though not as aggressive as) market expectations.

Lower rates may be a tailwind for borrowing conditions and housing affordability

%202024-09-23.png?width=2000&height=1988&name=IS%20Brief%20Chart%202%20(Left%20Panel)%202024-09-23.png)

%202024-09-23.png?width=2000&height=1981&name=IS%20Brief%20Chart%202%20(Right%20Panel)%202024-09-23.png)

Data shown in the left panel are the federal funds rate (upper bound) in blue (graphed along the left y-axis) and the actual interest rate paid by small businesses on short-term loans via the National Federation of Independent Business Small Business Economic Trends survey (graphed along the right y-axis). Data shown on the right are the prevailing rate for new 30-year mortgages in purple and the average rate on outstanding 30-year mortgages in yellow.

- Lower rates should take some pressure off the economy, including improved conditions for small business borrowing.

- Falling mortgage rates could help grease the wheels for a tepid housing market as the historic difference between prevailing mortgage rates and those already put in place normalizes.

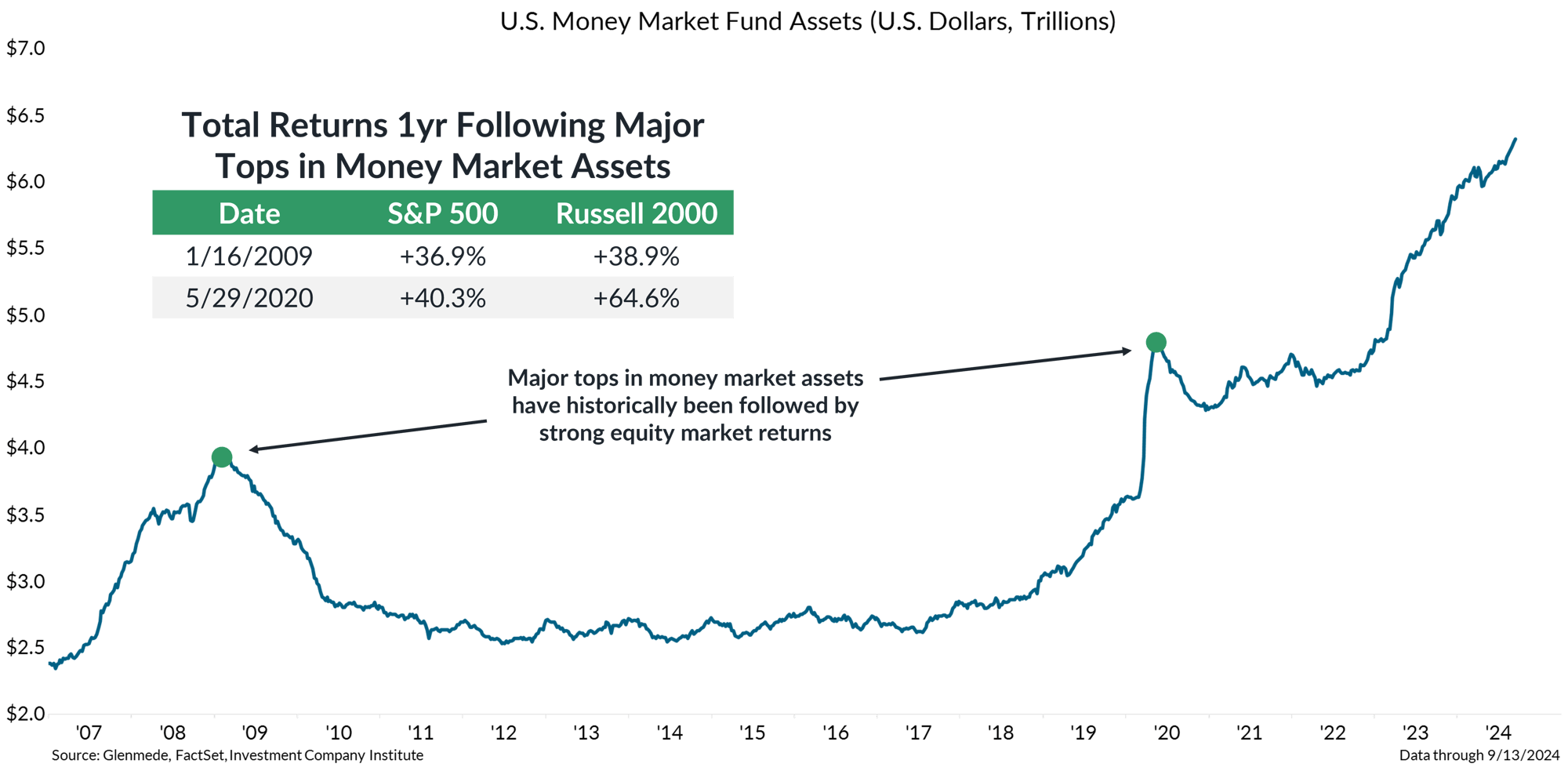

As yields fall, higher-than-normal cash balances may give way to a rotation toward more productive investments

Data shown in the chart are total money market fund assets through time in trillions of U.S. dollars. Data shown in the table are 1-year ex-post total returns for the S&P 500 and Russell 2000 following major tops in money market assets in the U.S., marked in the chart by green dots. Past performance may not be indicative of future results. One cannot invest directly in an index.

- Money market balances chased attractive cash yields in their march to all-time highs over the past year, but that capital may seek more productive use as interest rates fall.

- Historically, major tops in money market assets have been bullish for equities, as low rates have been a catalyst for a rotation to risk assets.

Falling rates may be supportive for small caps

%202024-09-23.png?width=2000&height=1913&name=IS%20Brief%20Chart%204%20(Left%20Panel)%202024-09-23.png)

%202024-09-23.png?width=2000&height=1961&name=IS%20Brief%20Chart%204%20(Right%20Panel)%202024-09-23.png)

Shown in the left panel are the latest interest expense figures as a percentage of total debt, which is a rough proxy for the interest rate on outstanding debt, for the S&P 500 and the Russell 2000 indexes. Shown in the right panel are the shares of outstanding debt that pay floating vs. fixed coupons for the constituents of the S&P 500 and Russell 2000 indexes. One cannot invest directly in an index.

- Small cap stocks may be notable beneficiaries of easier Fed policy, as they face higher interest cost burdens, and a larger share of their debt is more sensitive to changes in interest rates.

- This is one of several tailwinds in small caps’ favor, which also includes fair valuations relative to their larger counterparts and solid earnings expectations.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.