Introduction

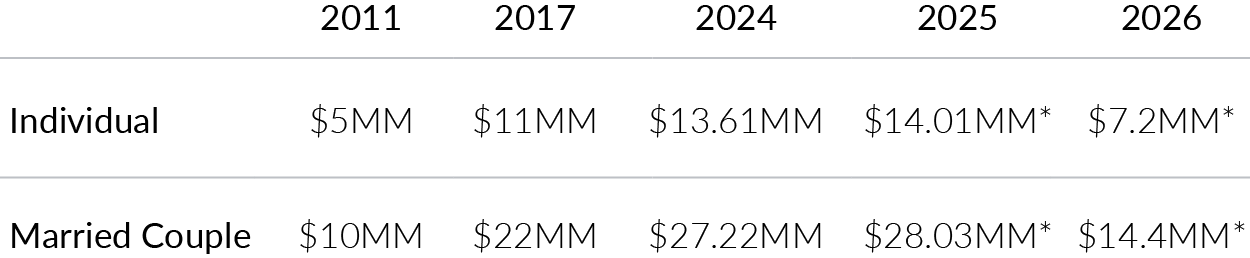

The temporary doubling of the estate, gift and generation-skipping transfer tax exemptions is scheduled to sunset on December 31, 2025. As a result, these exemptions will be reduced from approximately $14,010,000 to $7,200,000 per individual and from approximately $28,030,000 to $14,400,000 per married couple.

Individuals and couples who have not utilized exemptions over the reduced amounts by the end of 2025 would lose the ability to do so, unless Congress acts.

Estate Tax Exemption Amount

*Assuming a 3% inflation adjustment. 2026 exemptions assume no extension by Congress.

Utilizing The Elevated Bonus Exemption

There are many techniques that can be leveraged to utilize the bonus exemption before the tax sunset. Your individual circumstances, goals and personal preferences will help you determine the best option.

Below are four of the more commonly used gifting strategies:

- Outright Gifts of Cash or Marketable Securities

Gifting into a trust is often preferred due to family circumstances, the nature of the asset that’s being gifted or the magnitude of the gift; however, an outright gift of cash or marketable security is a simple and straightforward option.

- A Spousal Lifetime Access Trust (SLAT)

A SLAT allows one spouse to use their federal gift and estate tax exemption by gifting assets into an irrevocable trust for the benefit of the other spouse. A SLAT may also include additional beneficiaries. Upon the beneficiary spouse’s death, the trust often continues for the benefit of the other beneficiaries, usually children or more remote descendants (but the assets could be distributed outright). If the generation-skipping transfer tax exemption was applied to the SLAT, the trust can continue without imposition of the transfer tax until the trust finally terminates.

SLATs that are drafted as a grantor trust permit the assets to accumulate within the trust without being reduced by income taxes. Since the donor pays the trust’s income tax obligation from assets outside the trust, the donor’s taxable estate is further reduced. A SLAT provides financial security to the beneficiary spouse, but potential challenges, such as divorce or premature death of the beneficiary spouse, should be addressed when creating the trust.

- Partial Interest Gifts via an Entity

Some assets, like real estate, can be difficult or impractical to transfer in full. If parting with an asset completely would be financially imprudent or logistically complicated (due to debt structures or control concerns), consider gifting an interest in the asset through an entity structure such as a limited liability company (LLC). Once the asset is transferred to the LLC, the gifts are some of the LLC membership interests. This also might enable the donor to effectuate a partial gift of the asset while preserving some cash flow or control.

- Non-controlling business interests

For owners of closely held businesses who want to begin to transfer equity in the business to the next generation but are not yet ready to transfer operation and control, one technique that works well is a gift of a partial interest in an LLC or other entity. Often, the business is recapitalized to create a small percentage of voting interests (e.g., 1%) and the balance in non-voting shares (99%). The non-voting shares are then used to make the gifts, outright or in trust.

These are four of the many techniques available to utilize the elevated exemption amounts prior to the scheduled reduction. Your unique circumstances and values will guide your decision with respect to which technique to use and how much to give.

We're here to help

Glenmede Private Wealth is privileged to have the opporutnity to partner with you.

This material provides information of possible interest to Glenmede’s clients and friends, and does not provide investment, tax, legal or other advice. Any advice in this communication is not intended or written by us to be used, and cannot be used, for the purpose of (i)avoiding penalties that may be imposed by any governmental taxing authority or agency, or (ii) promoting, marketing or recommending to another party any matters addressed herein. Any opinions, recommendations, expectations and/or projections expressed herein may change after the date of publication. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Any potential outcome discussed, including but not limited to performance, legislation or tax consequence, ultimately may not occur due to various risks and uncertainties. Clients are encouraged to discuss any matter discussed herein with their tax advisor, attorney or Glenmede Relationship Manager.