Investment Strategy Brief

Here Come the Rate Cuts

September 15, 2024

Executive Summary

- The Federal Reserve is preparing to cut rates as both parts of its dual mandate, inflation and employment, have normalized.

- September’s rate cut will likely be the start of a longer rate cut campaign to bring rates back to neutral at a normal pace relative to history.

- Rate cuts have historically been supportive of risk assets, with the weakest outcomes occurring during coincident recessions.

- This rate cut cycle should be supportive of risk assets like equities, justifying a neutral risk allocation amid this late-cycle economic expansion.

Risks surrounding the Fed's dual mandate (inflation and employment) now appear balanced

%202024-09-16.png?width=2000&height=1877&name=IS%20Brief%20Chart%201%20(Left%20Panel)%202024-09-16.png)

%202024-09-16.png?width=2000&height=1932&name=IS%20Brief%20Chart%201%20(Right%20Panel)%202024-09-16.png)

Shown in the left panel is the 3-month annualized percent change in the U.S. Consumer Price Index (CPI) excluding food and energy. CPI measures the price of a basket of goods & services consumed by U.S. households. The gray region represents the Fed’s target range consistent with its longer-term price stability objective. Shown in the right panel is the U.S. unemployment rate for persons aged 16 years and over on a seasonally-adjusted basis in blue and a range estimate of the natural rate of unemployment in gray, which is the baseline level of joblessness that persists in a well-functioning economy due to frictional and structural factors.

- Inflation has moderated to the Fed’s acceptable range, while the labor market has normalized to a point that is no longer tight nor over-supplied.

- The balance in the Fed’s dual mandate no longer justifies a tight monetary policy stance.

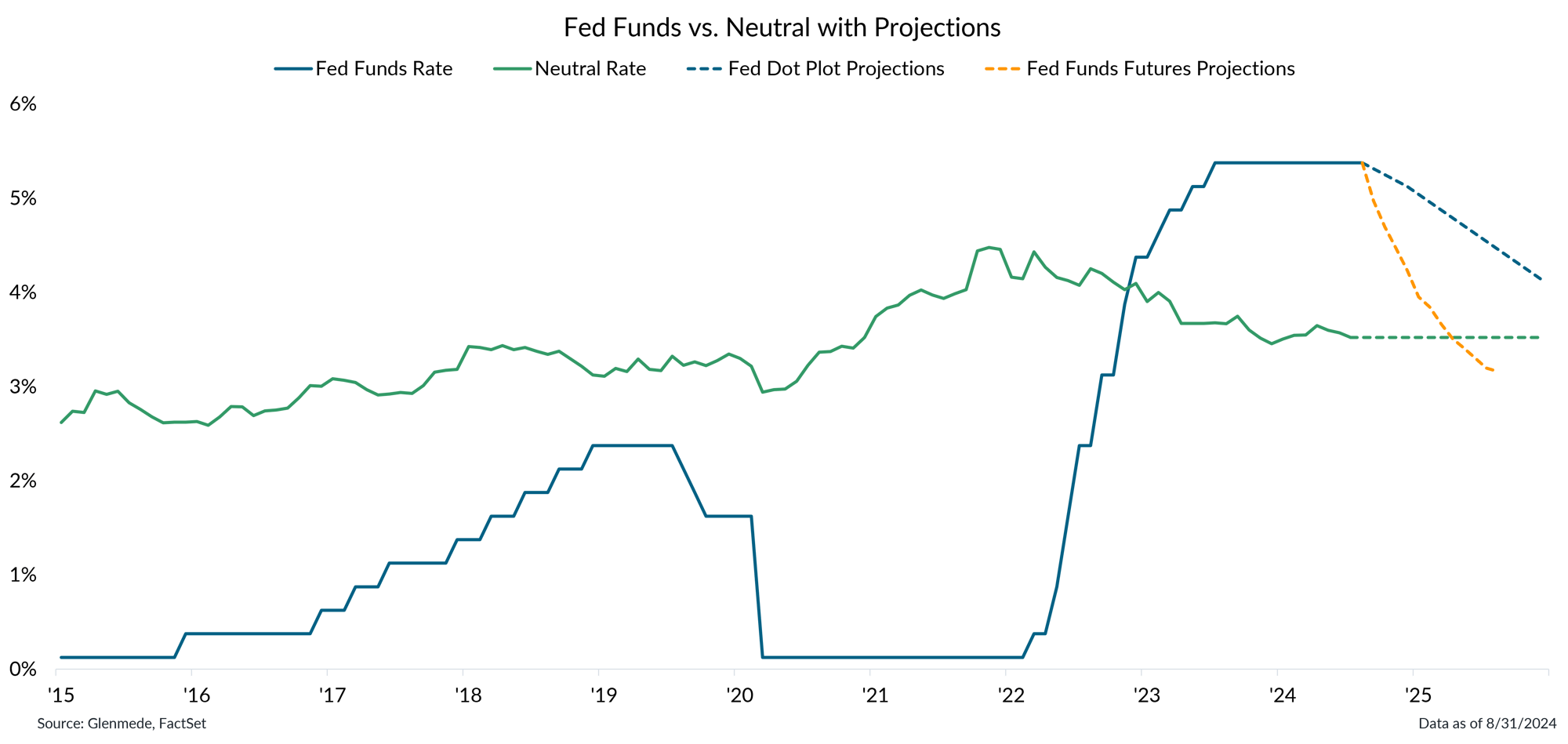

The Fed is expected to begin cutting rates in September, with intention to return to neutral

Data shown in green are Glenmede’s estimates of the neutral federal funds rate over time (i.e., the level of rates that is neither economically stimulative nor restrictive) based on expectations for real interest rates via the Holston-Laubach-Williams model and Glenmede’s 10yr inflation expectations. The latest value of the neutral federal funds rate is carried forward via the dashed green line for illustrative purposes. Fed Funds Rate in blue is the target rate midpoint. The dashed blue line represents projections based on the median response in the Federal Open Market Committee’s latest dot plot survey. The dashed yellow line represents projections based on fed funds futures. Actual results may differ materially from projections.

- Fed funds futures currently expect the Fed to bring rates back to neutral as early as April 2025, while the Federal Reserve’s previous survey from June 2024 points to a slower pace.

- The actual pace will likely be somewhere in between since inflation and employment have normalized more quickly than previously expected but the market’s expectations may be too aggressive.

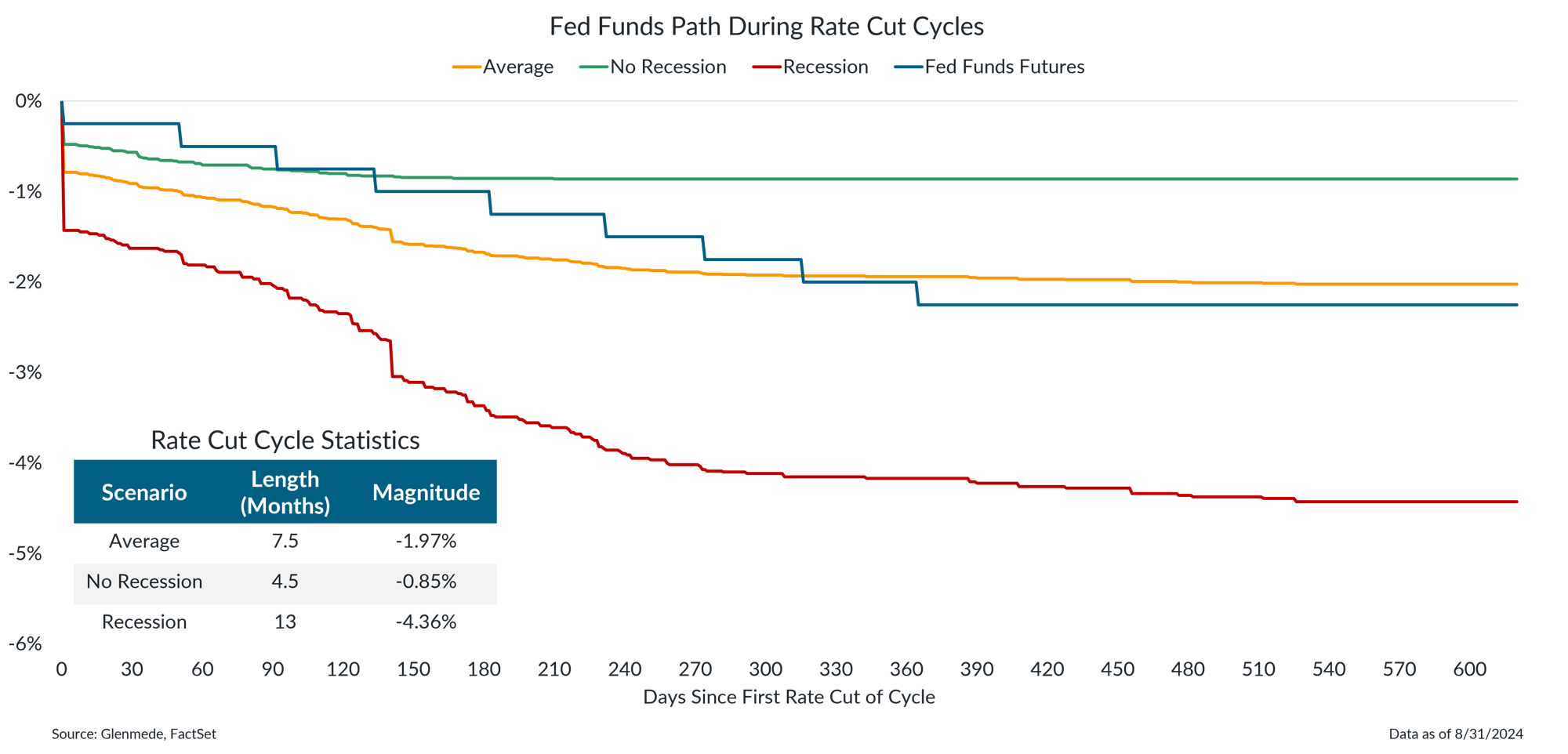

The expected rate cut path is not as aggressive as those historically associated with recessions

Data shown are the average paths of the federal funds rate based on the previous 43 Federal Reserve rate cut campaigns since 1954. Shown in yellow is the average path of those rate cut campaigns. Shown in red is the path of rate cut campaigns during which the economy was in recession at any time during the rate cut cycle. Shown in green is the average of the rate cut paths during rate cut cycles that were not associated with recessions. Shown in blue is the projected path of the fed funds rate based on fed funds futures. Data shown in the table are summary statistics for each rate cut cycle scenario, including the length of the cycle in months and the magnitude of change in the fed funds rate through the cycle. Past performance may not be indicative of future results.

- The market’s projection for the pace of rate cuts currently appears quite normal relative to previous rate cut cycles, particularly given that rates are beginning at a point quite high relative to neutral.

- Such a path is much slower than the average historical path associated with recessions and does not indicate a Federal Reserve that is hurried by recession worries.

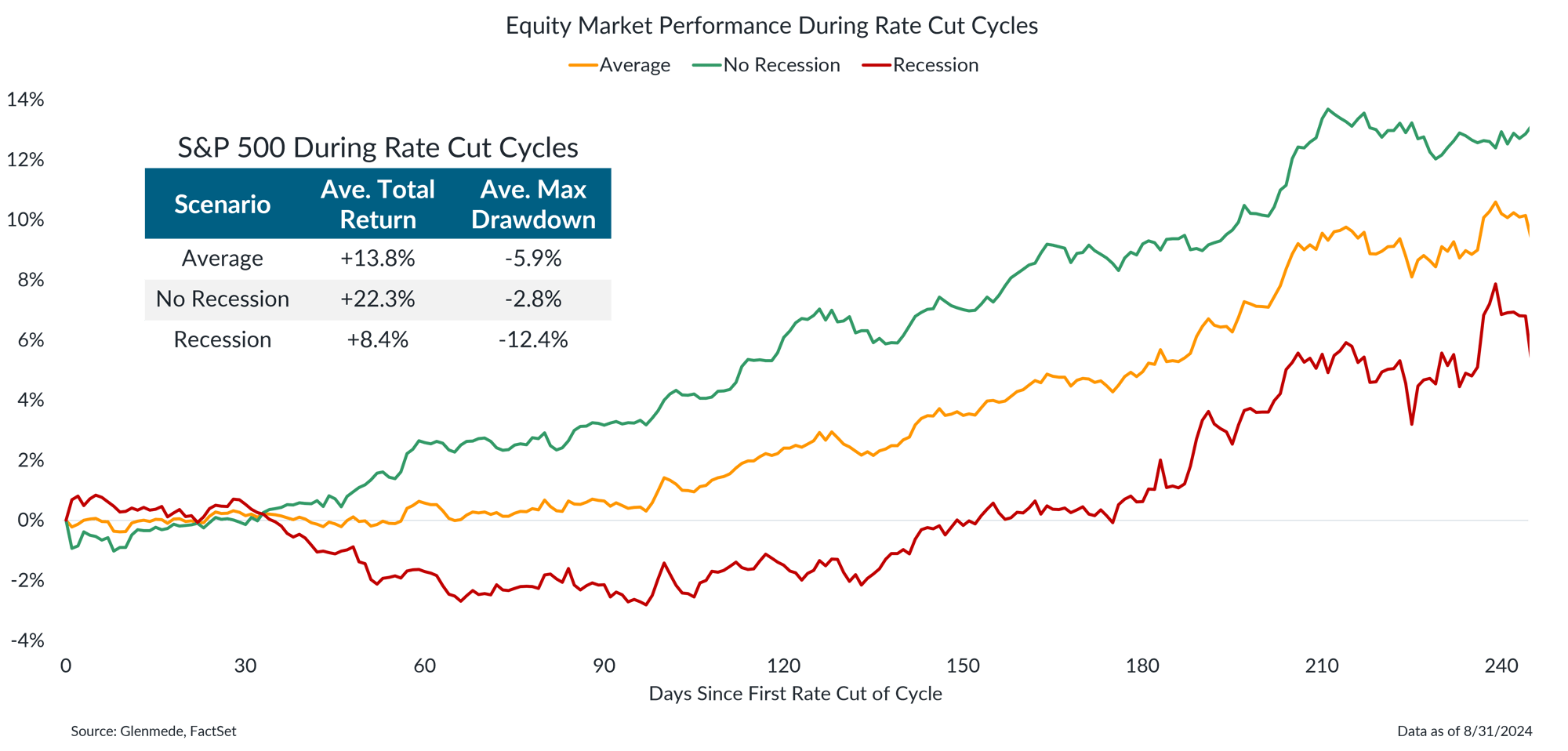

The market has historically responded favorably to rate cuts, with weaker outcomes during recessions

Data shown are the average paths of total returns for the S&P 500 based on the previous 43 Federal Reserve rate cut campaigns since 1954. Shown in yellow is the average path of returns during those rate cut campaigns. Shown in red is the average path of returns during rate cut campaigns in which the economy was in recession at any time during the rate cut cycle. Shown in green is the average path of returns during rate cut cycles that were not associated with recessions. Data shown in the table are summary statistics for each path based on average total returns and the maximum drawdown experienced within each rate cut cycle. Past performance may not be indicative of future results. One cannot invest directly in an index.

- Federal Reserve rate cut campaigns have been associated with positive market performance based on the average outcome during the past 43 rate cut campaigns.

- The outcome, however, has historically been much better during rate cut campaigns that were not associated with recessions than those that were.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.