Investment Strategy Brief

Market Implications of a Trump Administration

November 6, 2024

Executive Summary

- A consensus of media outlets has called the presidential election for former president Trump

- The outcome of the presidential election typically matters less to markets than the winning party’s strength of control

- The GOP flipped the Senate and are favorites to retain the House, but the lack of a filibuster-proof majority will be a constraint

- Markets should now begin to focus on the fate of expiring tax cuts and likely tariffs

- Investor uncertainty regarding the elections will now turn toward evaluating the likelihood of key policies such as taxes and tariffs

Enough votes have been counted that Trump has been declared the winner of the 2024 Election

The map shown represents the results of the 2024 Presidential Election, with each state colored either blue, red or gray based on whether a consensus of media outlets have declared the state’s electoral votes for Harris, Trump or neither, respectively. Maine and Nebraska split their electoral votes between the state popular vote winner and the popular vote winner in each congressional district.

- A consensus of media outlets have called the presidential election for former president Trump, as he secured enough electoral votes to pass the key 270 threshold.

- After Inauguration Day, he will join Grover Cleveland as only the second president in U.S. history to serve non-consecutive terms.

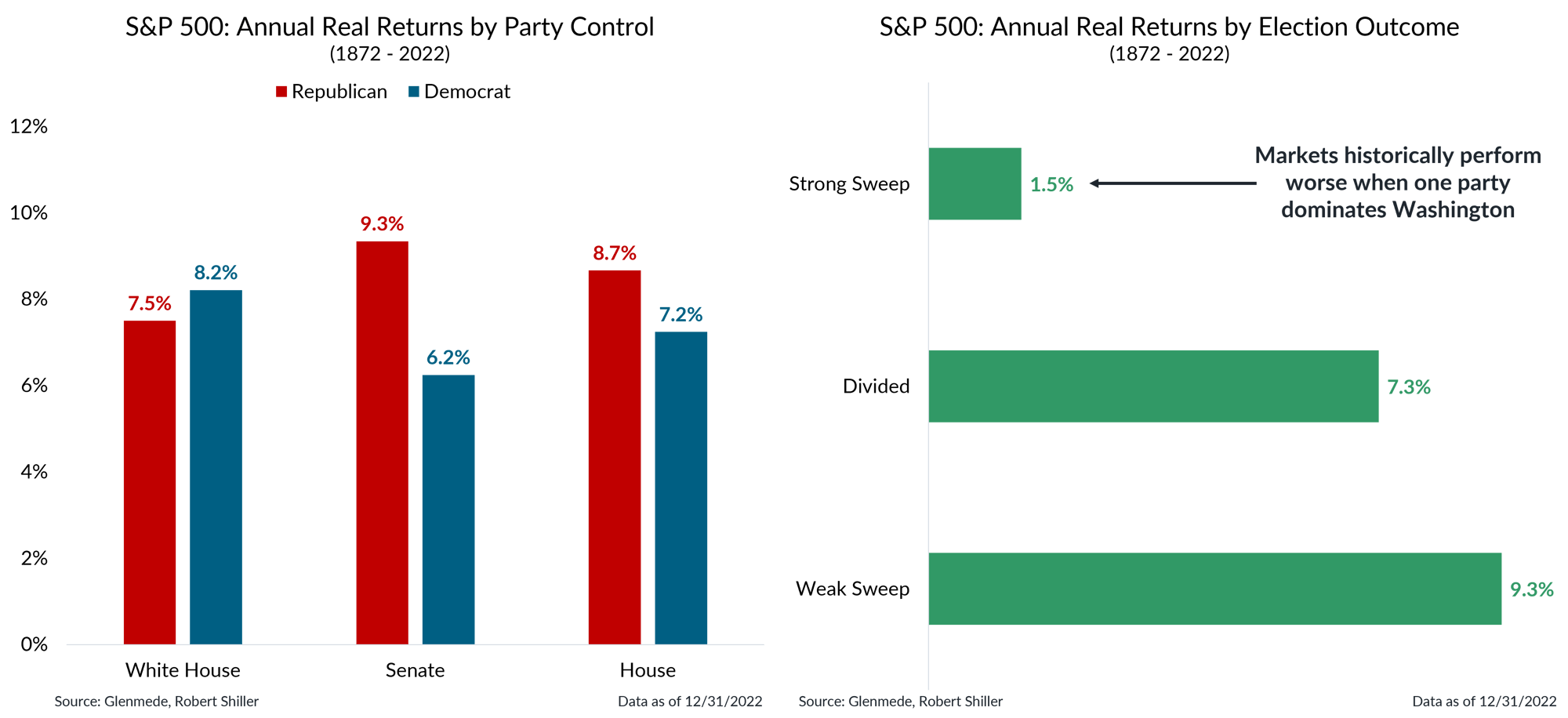

Longer-term, presidential elections typically matter less to markets than the winning party’s strength of control

Data shown are average inflation-adjusted total returns for the S&P 500 for each two-year federal election cycle since 1872. Returns for the S&P 500 are backfilled with returns for the S&P composite based on data provided by Robert Shiller prior to 1970. Shown in the left panel are returns based on each party’s control of the White House, Senate and House of Representatives. Shown in the right panel are returns based on the composition of the White House, Senate and House of Representatives after each two-year election cycle. Divided refers to periods in which all three are controlled by different parties, Strong Sweep refers to periods in which one party controls all three and has a large enough majority in the Senate to end a filibuster via cloture and Weak Sweep refers to all other periods in which one party controls all three. The S&P 500 is a market capitalization weighted index of large cap stocks in the U.S. Past performance may not be indicative of future results. One cannot invest directly in an index.

- Data since the Reconstruction era suggest that equity markets show very little convincing evidence of party favoritism in Washington.

- More significant is the market’s preference for a balance in power between the parties. Strong sweeps that includes a filibuster-proof majority in Congress have historically been associated with poor returns for equities.

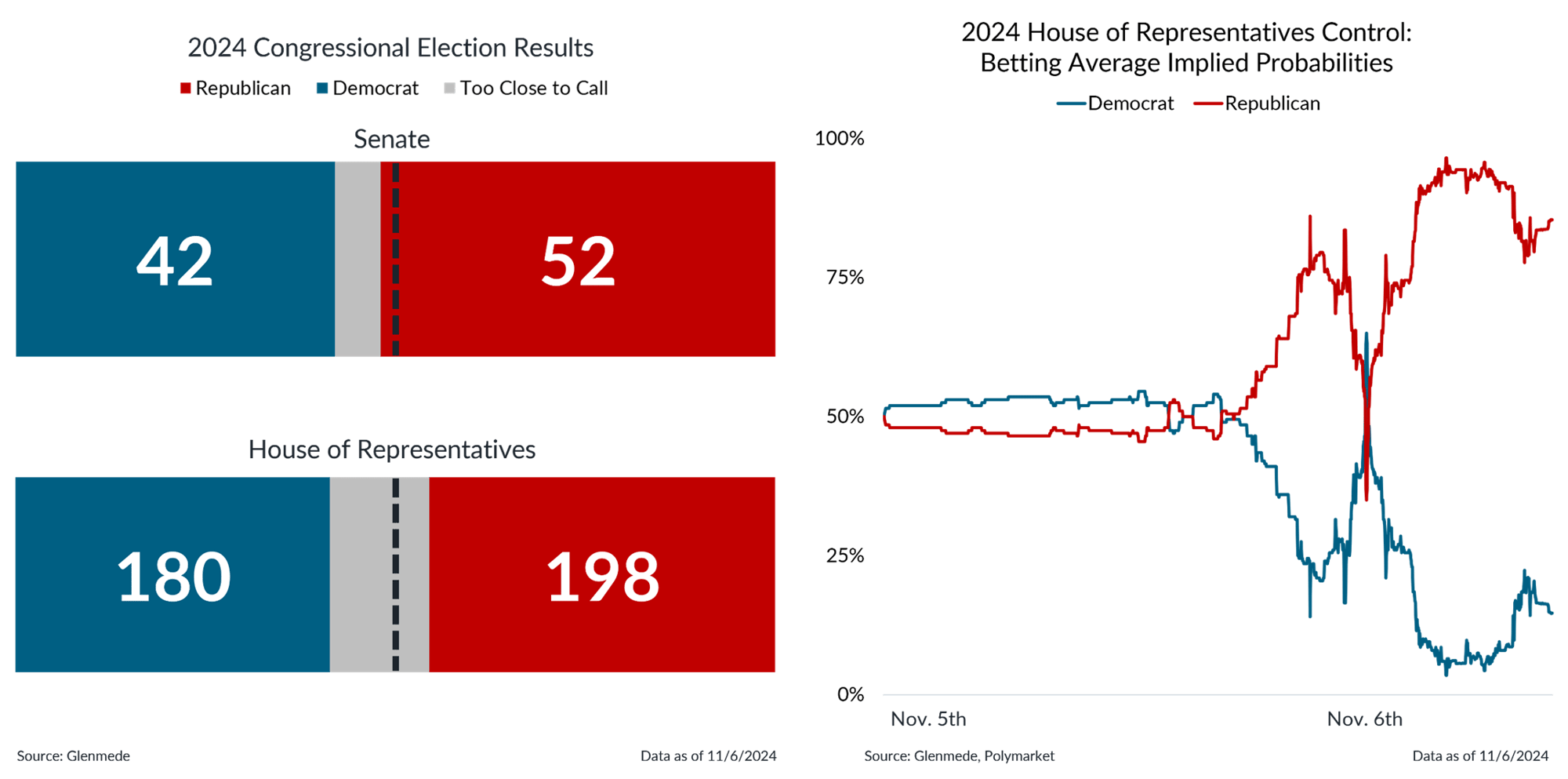

Republicans have flipped the Senate and are favorites to retain the House of Representatives

The chart shown on the left represents the results of the 2024 Election for the U.S. Senate and House of Representatives based on whether a consensus of media outlets have declared each seat for a Democrat (blue) or Republican (red). The chart shown on the right represents Polymarket’s betting market odds for the results of the 2024 Election for the House of Representatives. References to any betting sites and the use of associated data in no way should be interpreted as an endorsement or recommendation of use by Glenmede. Actual results may differ materially from implied probabilities or expectations. Probabilities and polling information shown are not the opinions of Glenmede and are shown for illustrative purposes only.

- Although not all the congressional results have been finalized, Republicans have flipped the Senate and are on track to maintain control of the House of Representatives according to the betting markets.

- While this means the next administration will have some latitude to enact its agenda, the lack of a filibuster-proof majority should temper more ambitious proposals.

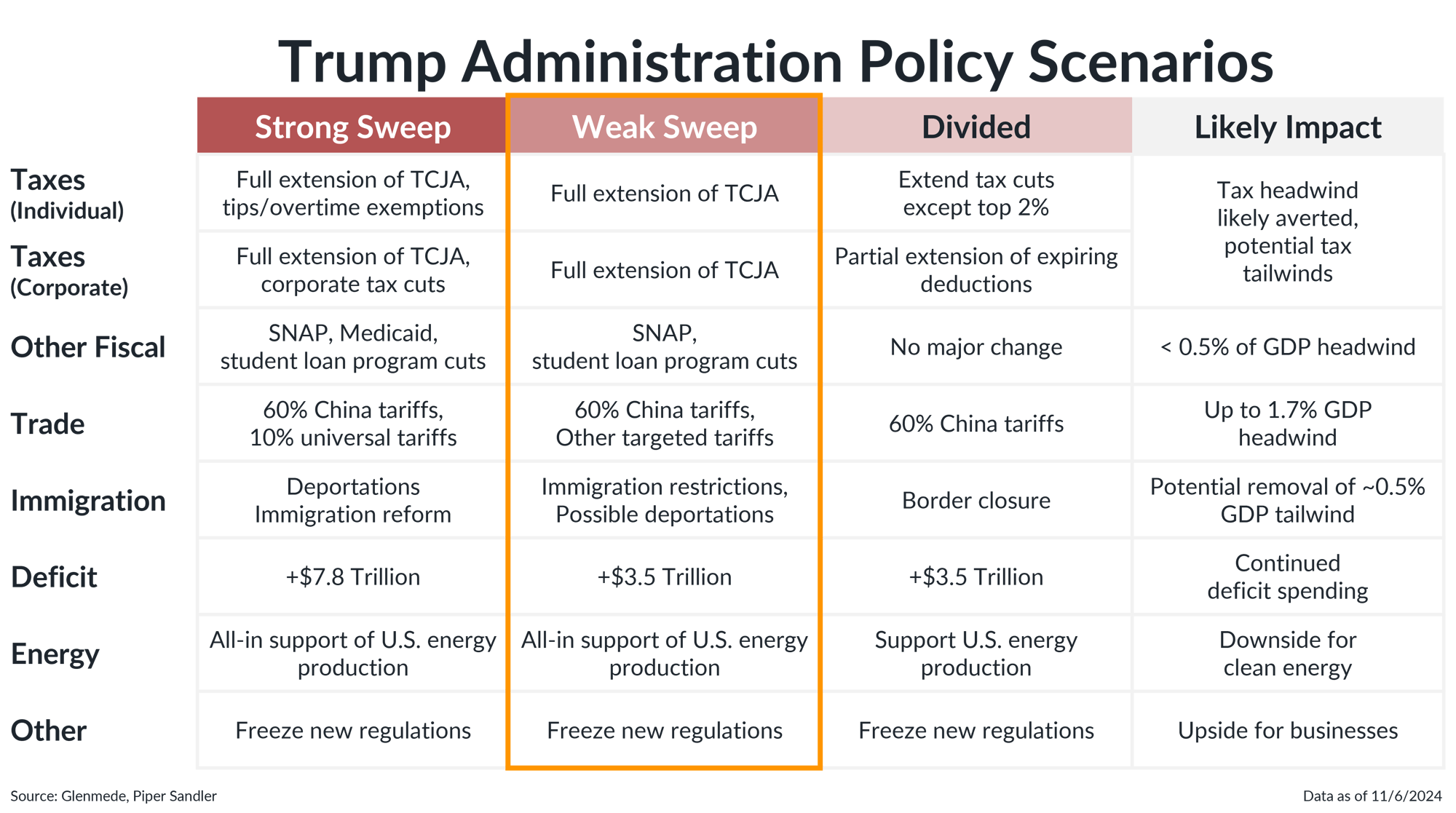

The most consequential result of the Republican sweep is likely a full extension of tax cuts and new tariffs

The information shown provides a general representation of the policy platforms for the major candidates for President in 2024 and is not meant to be exhaustive. TCJA refers to the Tax Cuts and Jobs Act of 2017. Impact Range reflects the potential Glenmede’s potential outcomes expected by Glenmede from Strong Republican Sweep to Divided government under a Trump presidency. Strong Republican Sweep refers to a scenario in which Republicans hold the White House, House of Representatives and a 60+ seat majority in the Senate. Actual policies may differ materially from those listed.

- The most immediate and consequential result of the Republican sweep is likely a full extension of tax cuts next year and the potential imposition of new tariffs.

- Other policies of note may limit immigration, support domestic energy production and freeze new regulations.

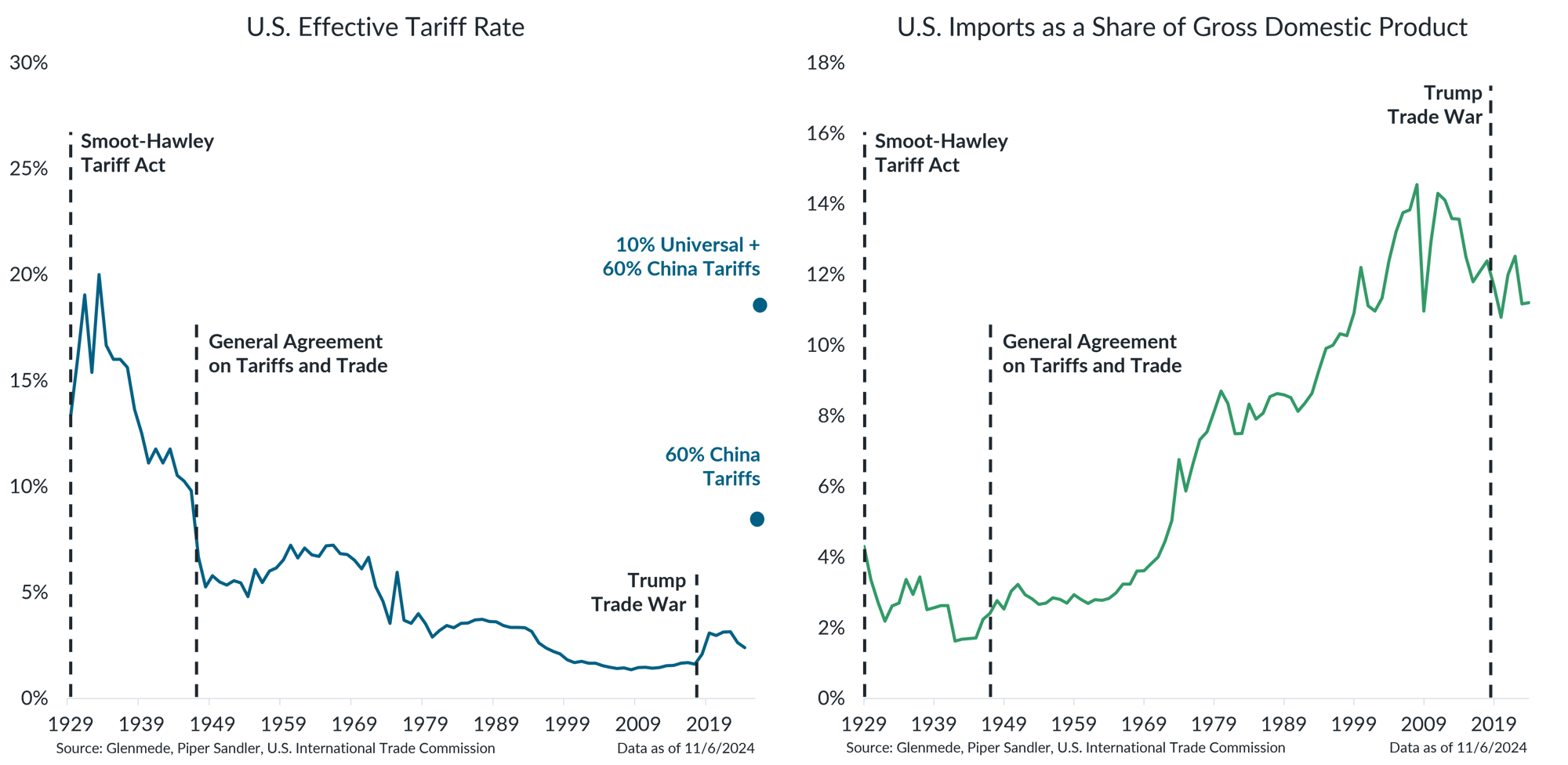

Investors may begin to consider the impact of a return to a higher tariff regime

Data shown in the left panel in blue are effective tariff rates on U.S. imports over time, which includes nominal tariffs on final goods as well as on imported inputs used in production. The dots in blue are projections for the effective tariff rate if Trump were to implement various proposed tariffs, including 60% tariffs on all Chinese imports and 10% tariffs on all other imports. Data shown in the right panel are U.S. imports as a share of gross domestic product. Actual results may differ materially from projections.

- Trump has proposed several new tariffs, including 60% tariffs on all Chinese imports and baseline 10% tariffs on all imports, which would return effective tariff rates to early-to-mid-20th century levels.

- The next administration should have the authority to impose the Chinese tariffs unilaterally, but the universal tariffs would likely require an act of Congress, making the latter less likely for actual implementation.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. These statements reflect Glenmede’s opinions or projections, which may change after the date of publication. Actual future developments may differ materially from the opinions and projections noted above. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.