Investment Strategy Brief

Inflation Steady, but Tariff Pressures Loom

June 8, 2025

Executive Summary

- Inflation has remained stable in recent months, but the upcoming report may reveal early signs of tariff-related impacts.

- Near-term inflation expectations have risen, while long-term expectations remain relatively anchored.

- Tariffs and the declining dollar may keep inflation elevated through year-end, though the precise path remains uncertain.

- Longer term, reduced globalization may remove a prominent headwind to inflation, making containment more difficult.

- While this week’s inflation report is likely to show only a small impact from tariffs, its near- and long-term impact warrants ongoing caution.

Inflation has held steady, but the upcoming report may reveal early signs of tariff-related impacts

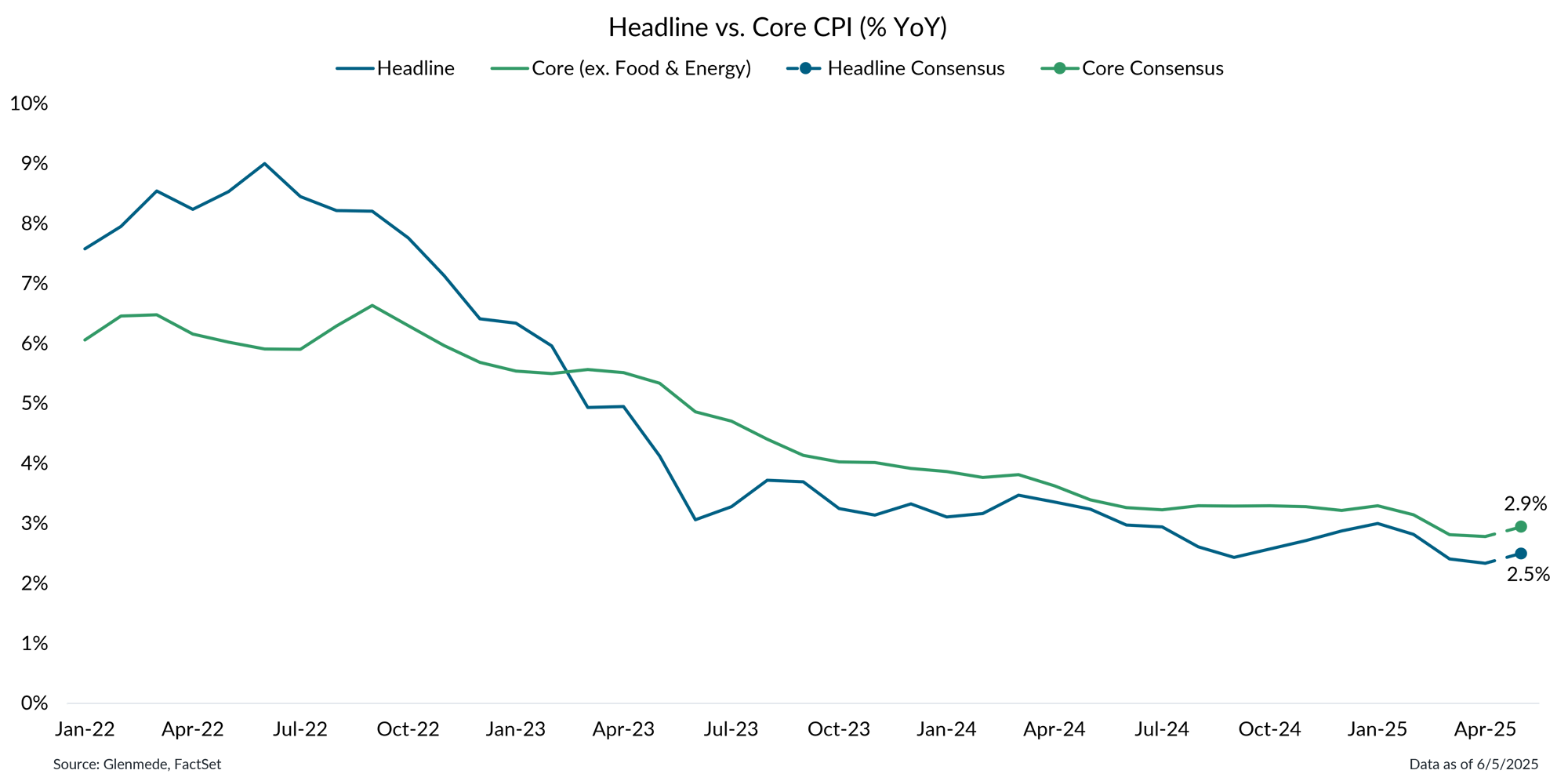

Data shown are the year-over-year percent changes in the headline U.S. Consumer Price Index (CPI) in blue, which includes all components, and the Core CPI, which excludes food and energy, in green. The CPI measures the percent change in the price of a basket of goods and services consumed by households in the U.S. Solid lines represent historical data, and dashed lines represent expectations based on a consensus of economists. Actual results differ materially from expectations.

- Inflation has come down significantly from its 2022 peak and remained relatively steady in recent months, but new tariffs could pose a renewed risk to price stability.

- Consensus estimates for the May CPI report point to a modest increase in both headline and core inflation, potentially signaling early signs of those pressures.

Near-term inflation expectations have risen, while long-term expectations remain relatively anchored

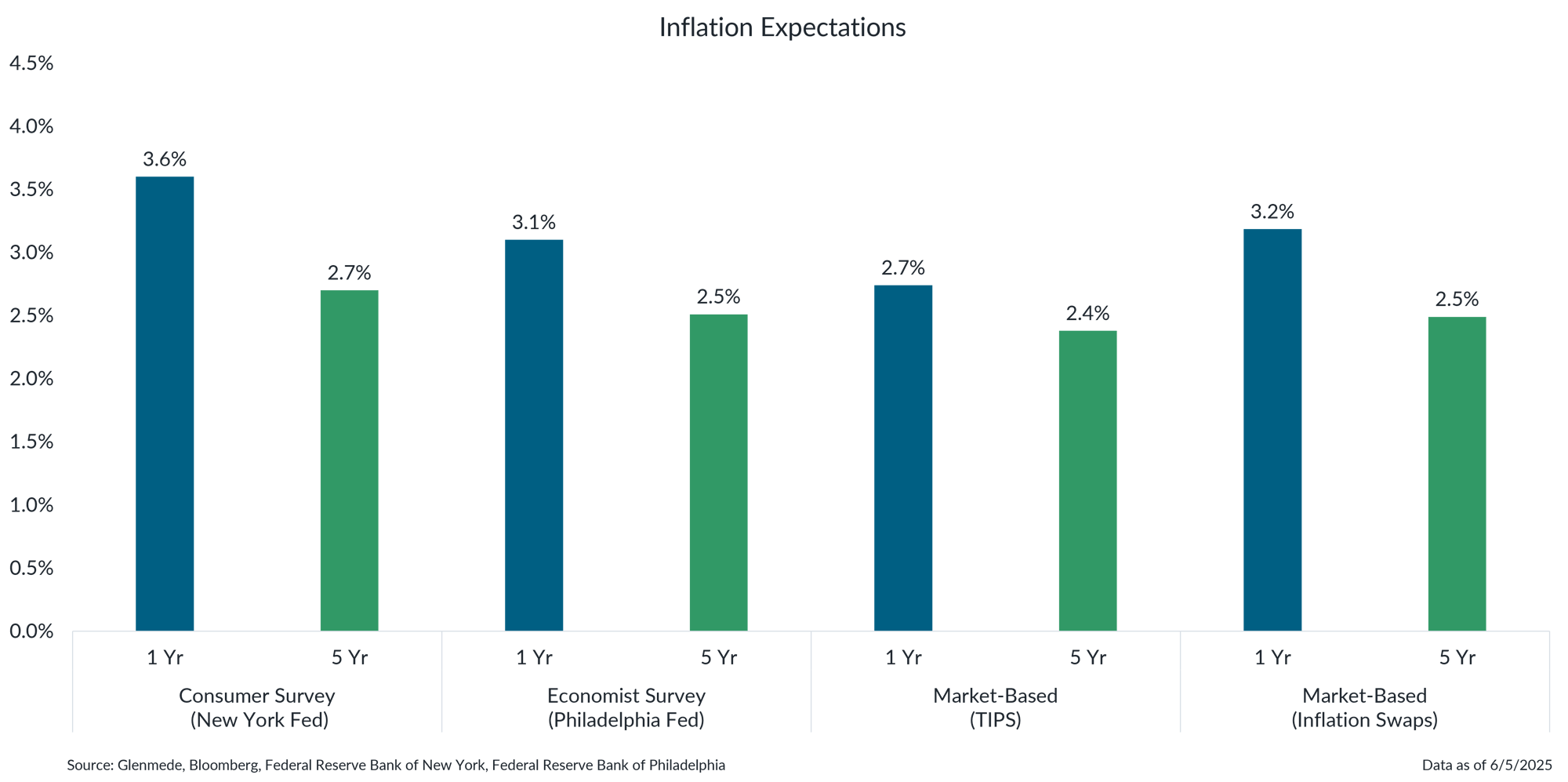

Shown are 1-year and 5-year inflation expectations based on various metrics such as the consumer survey conducted by the Federal Reserve Bank of New York, the Survey of Professional Forecasters conducted by the Federal Reserve Bank of Philadelphia, market-based expectations derived from pricing in Treasury Inflation-Protected Securities (TIPS), and inflation swaps, which are financial instruments that capture the market’s consensus view on future inflation. Actual results may differ materially from expectations or projections.

- Near-term inflation expectations have moved higher across consumer and economist surveys, as well as market-based measures, reflecting growing concerns about price pressures over the next year.

- In contrast, long-term expectations remain relatively well anchored, suggesting continued confidence that inflation will return to more stable levels over time after a near-term level shift in prices.

Tariffs may keep inflation elevated through year-end, though the precise path remains uncertain

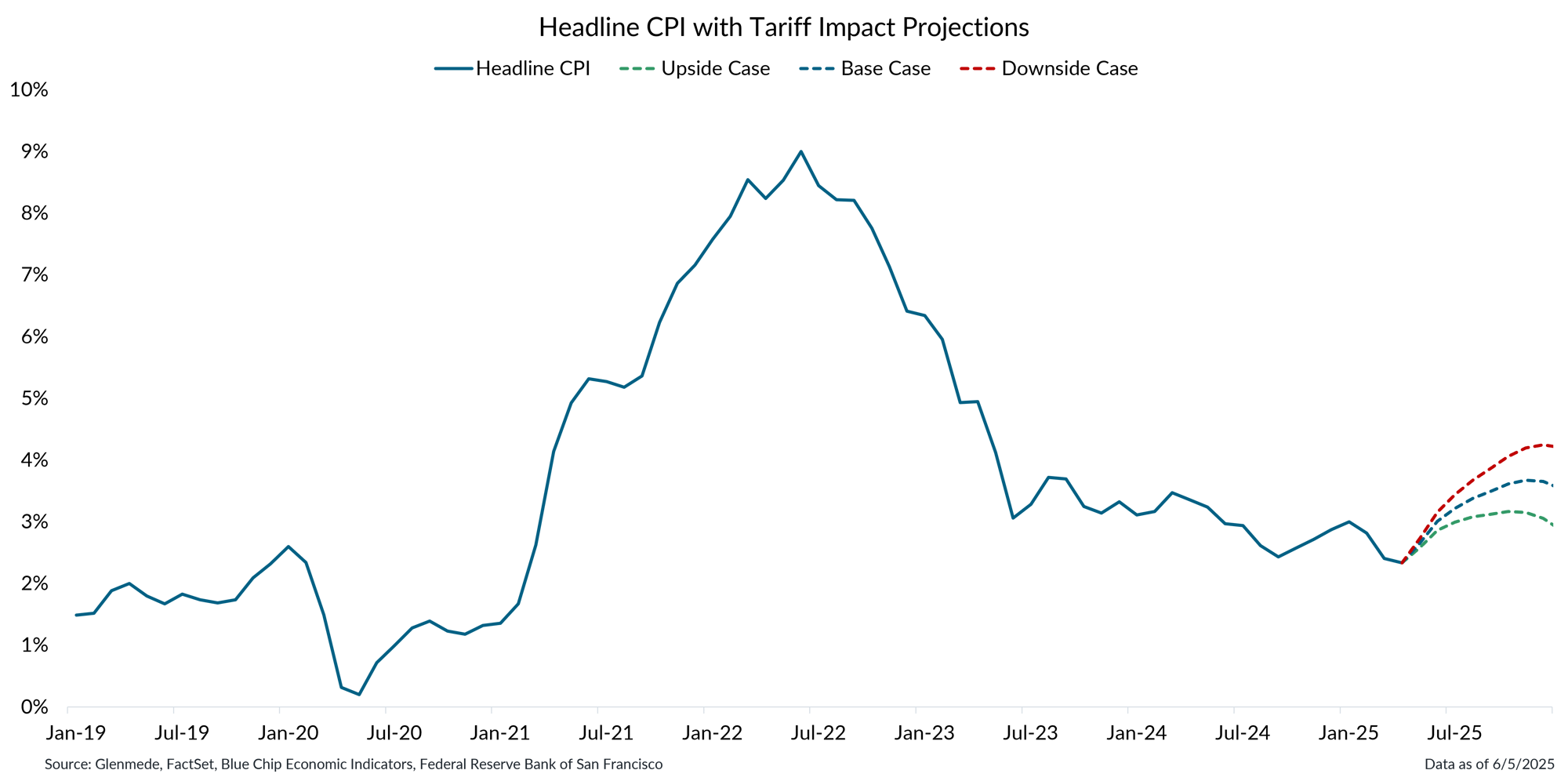

Data shown in blue are year-over-year percent change in the U.S. Consumer Price Index (CPI). The dashed lines represent Glenmede's projections. The upside case assumes a 5% effective tariff rate, the base case assumes a 15% effective tariff rate, and the downside case assumes a 25% effective tariff rate. Projections assume all price increases are passed on to consumers. Actual results may differ materially from expectations or projections.

- Inflation could take several paths through year-end, as the impact of new tariffs on consumer prices remains uncertain.

- If the effective tariff rate settles around 5% (upside case), inflation is likely to hold near recent levels and eventually begin to decline.

- With a 15% effective tariff rate (base case), the inflationary pressure would likely reaccelerate. A higher 25% tariff regime (downside case) could result in more substantial price increases, especially if businesses pass higher import costs on to consumers.

A stronger U.S. dollar has historically helped contain inflation, whereas a weaker dollar tends to push it higher

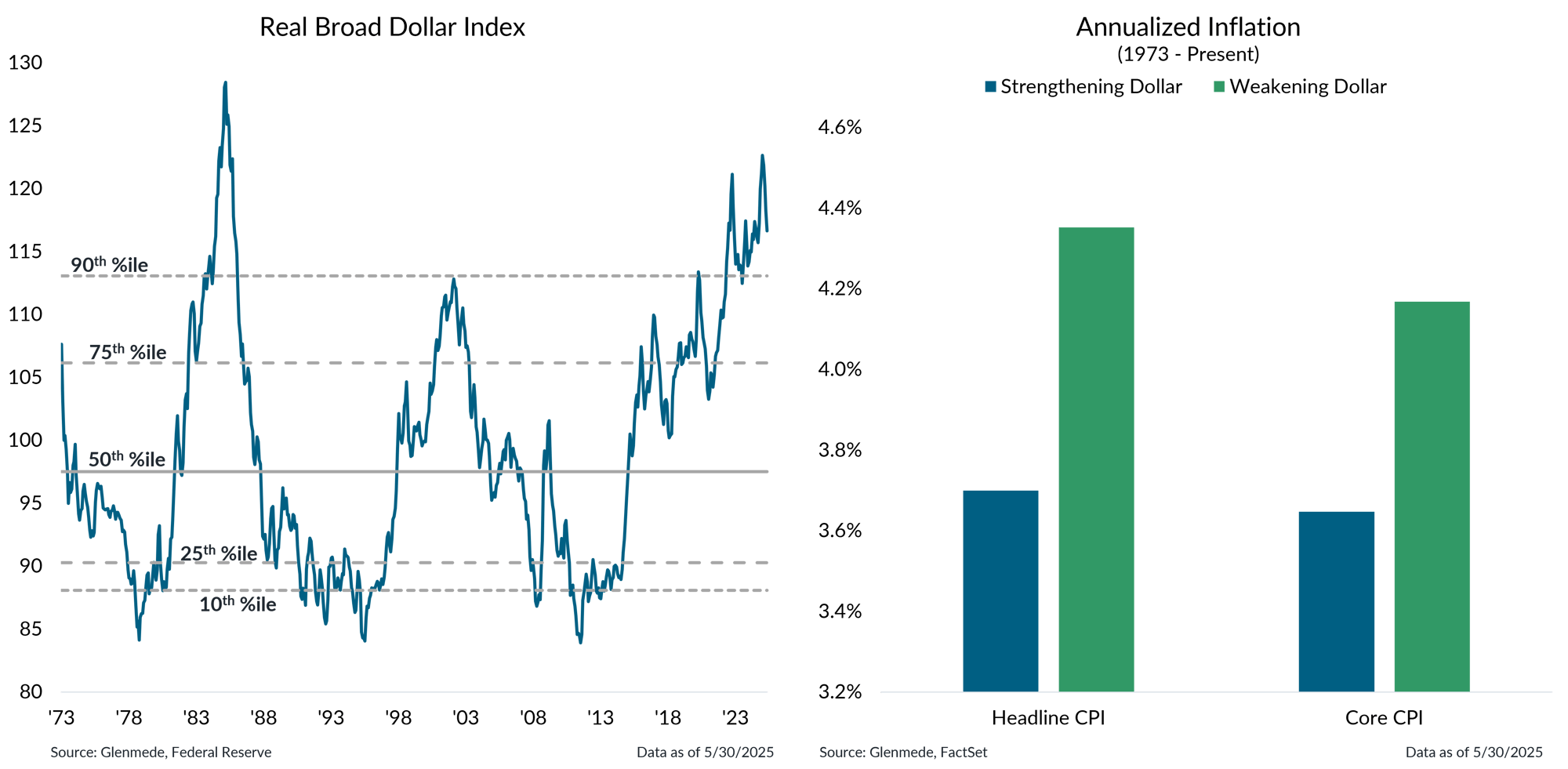

Data shown in the left panel are weighted averages of the foreign exchange value of the U.S. dollar against the currencies of a broad group of major U.S. trading partners, adjusted for inflation to account for purchasing power differentials. Shown in the right panel is the annualized rate of inflation of the Consumer Price Index (Headline CPI) and the Consumer Price Index excluding food and energy (Core CPI) during periods when the U.S. dollar was strengthening in blue and periods when the U.S. dollar was weakening in green. CPI measures the price of a basket of goods and services consumed by U.S. households.

- A stronger U.S. dollar typically helps contain inflation by making imported goods cheaper, effectively reducing input costs for businesses and prices for consumers.

- On the other hand, a weaker dollar tends to push inflation higher by increasing the cost of imports, which can feed through to broader price pressures in the economy.

- With the dollar currently weakening amid rising trade tensions and market uncertainty, this dynamic could add to inflation risks in the coming months.

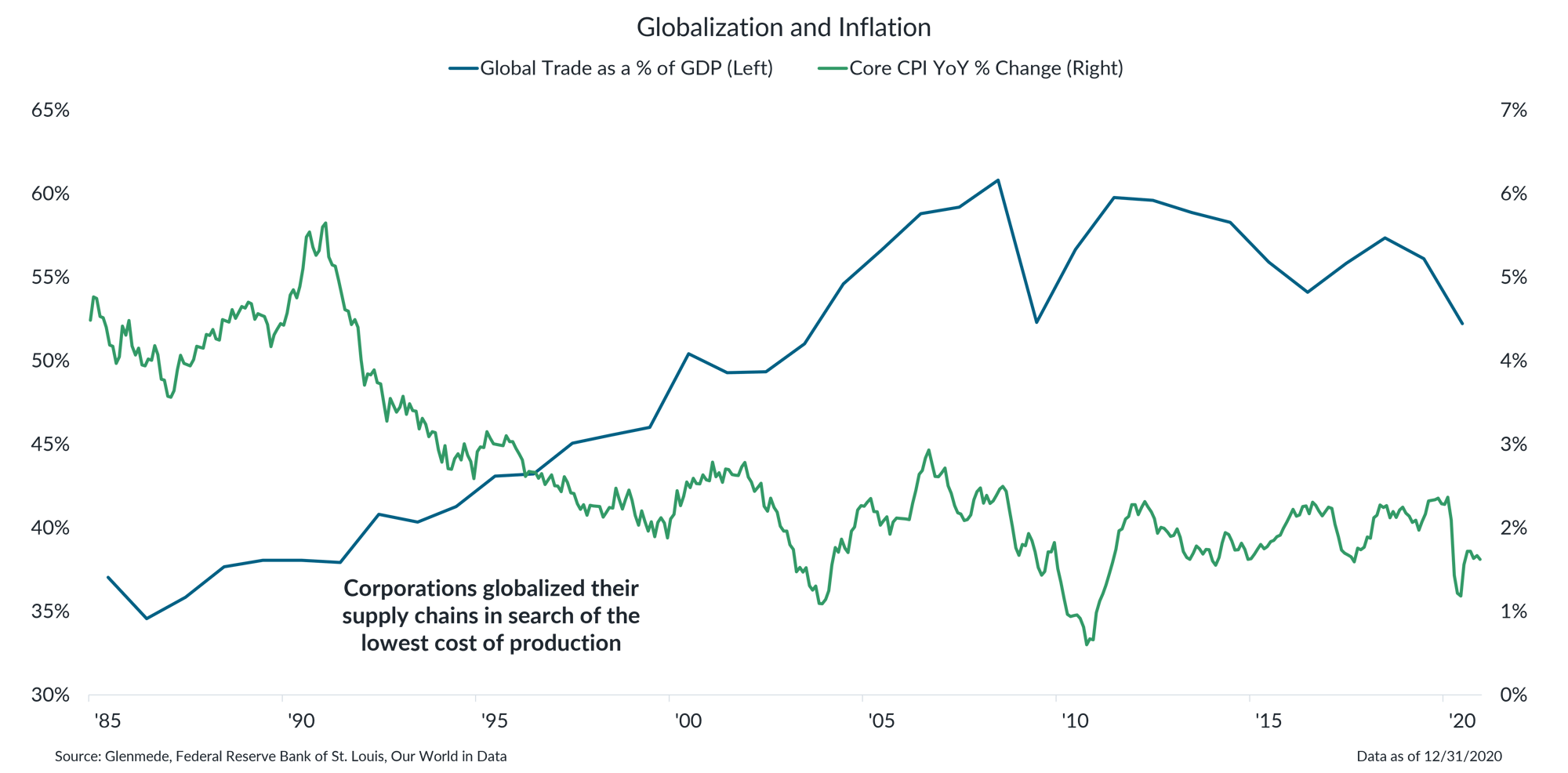

Globalization has been a headwind to inflation; its reversal would likely have the opposite impact

Data shown are the sum of imports and exports as a share of global gross domestic product (GDP) in blue (graphed along the left y-axis) and the year-over-year percent change in the Core Consumer Price Index (CPI), which excludes foods and energy, in green (graphed along the right y-axis). CPI measures the price of a basket of goods and services consumed by U.S. households.

- Globalization has acted as a significant headwind to inflation by promoting competition, lowering production costs, and enabling access to cheaper goods from around the world.

- A reversal of this trend, prompted by increased trade barriers, would likely reduce these cost advantages and exert upward pressure on inflation over the long term.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.