Investment Strategy Brief

Inside the Fed, Where It Happened

November 2, 2025

Executive Summary

- The Fed cut rates last week and is expected to move rates toward a more neutral posture by mid-year 2026.

- Tariffs may push inflation up 0.5-1.0%, but the Fed considers this to be a one-time price level adjustment.

- In the absence of national data, aggregated state jobless claims point to a tenuous balance in the labor market.

- The Fed is ending quantitative tightening (QT), intending to maintain liquidity at current levels.

- Small caps have been sensitive to the Fed's balance sheet runoff and may benefit from its end.

The Fed cut rates last week and is expected to move rates toward a more neutral posture by mid-year 2026

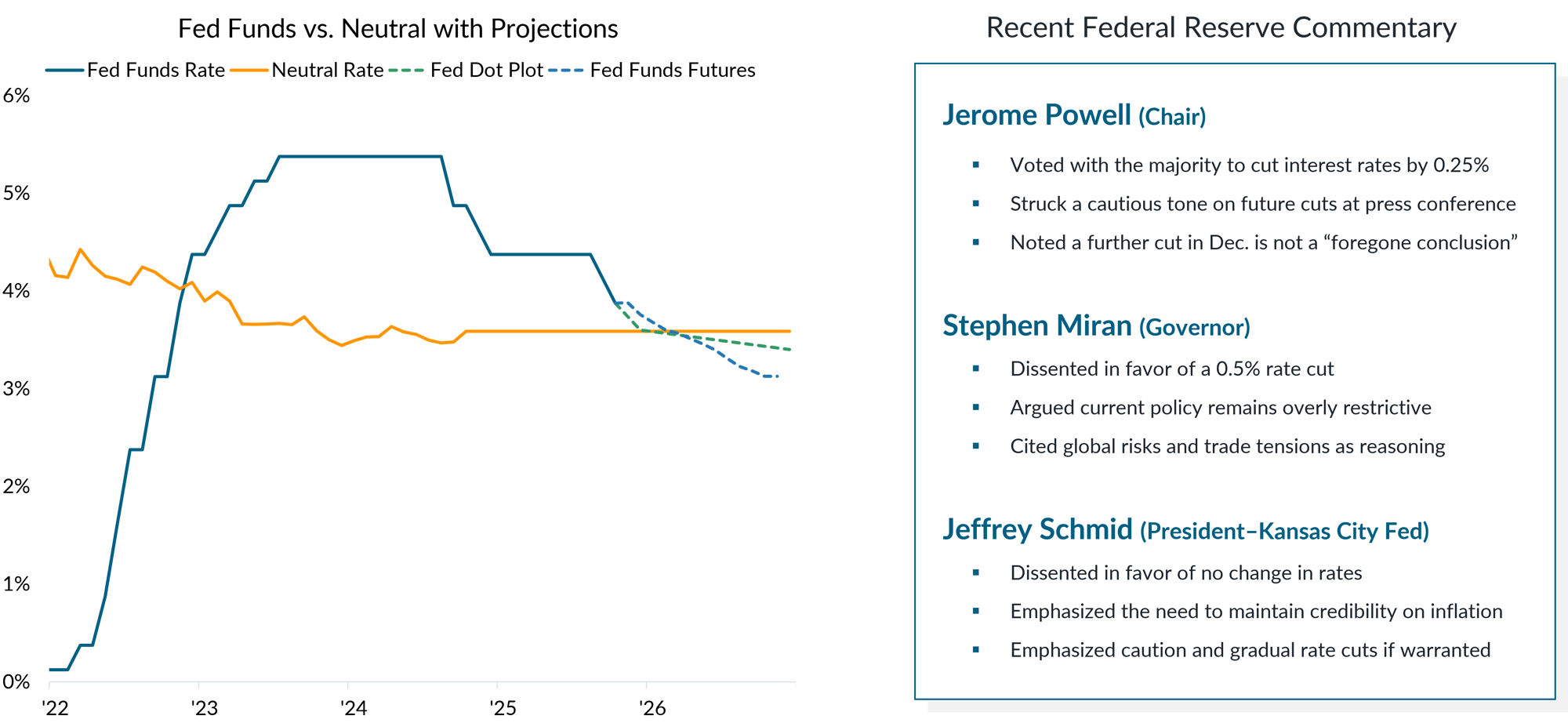

Data shown in orange are Glenmede’s estimates of the neutral federal funds rate over time (i.e., the level of rates that is neither economically stimulative nor restrictive) based on expectations for real interest rates via the Holston-Laubach-Williams model and Glenmede’s inflation expectations. Fed Funds Rate in blue is the target rate midpoint. The dashed blue line represents expectations for the forward path of rates based on fed funds futures pricing. The dashed green line represents expectations for the forward path of rates based on the median respondent in the Federal Open Market Committee’s dot plot projections. Actual results may differ materially from projections. Shown in the right panel are key highlights from recent speeches by Jerome Powell (Chair of the Federal Reserve), Stephen Miran (Federal Reserve Governor) and Jeffrey Schmid (President, Federal Reserve Bank of Kansas City).

- The Fed cut its policy rate by a quarter point last week in a continuation of its ongoing easing campaign. The decision was not a unanimous one, with dissenting opinions in both directions.

-

During the press conference, Chair Powell appeared to push back on the market's aggressive pricing of another rate cut in December, highlighting ongoing uncertainty for both inflation and the labor market.

Tariffs may push inflation up 0.5–1.0%, but the Fed considers this to be a one-time price level adjustment

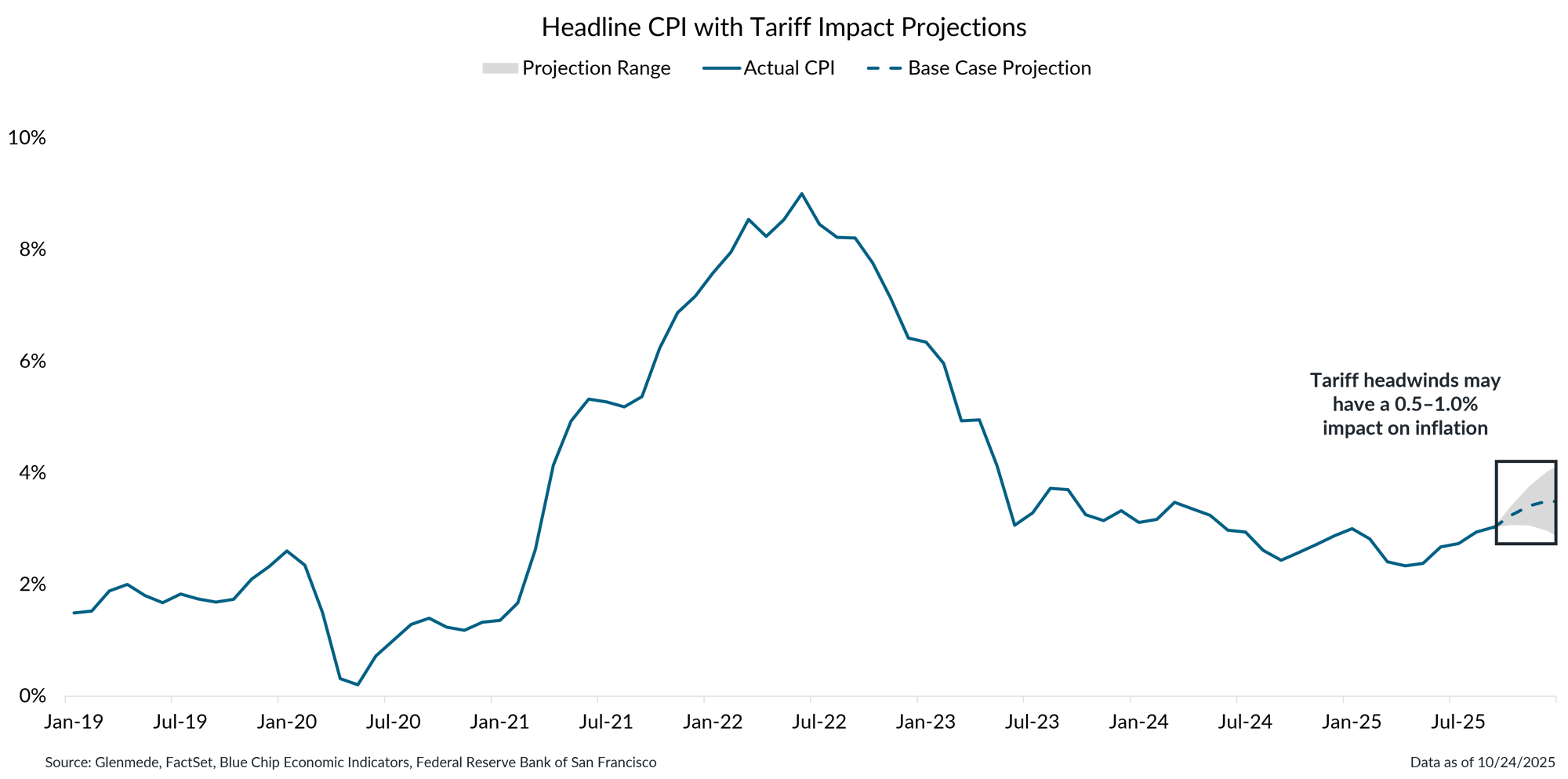

Data shown in blue is the year-over-year percent change in the U.S. Consumer Price Index (CPI). The dashed blue line represents Glenmede’s base case projections and the gray region represents a range of plausible outcomes. Projections assume all price increases are passed on to consumers. Actual results may differ materially from expectations or projections.

- So far, consumers have experienced one-third of the impact of tariffs in the form of price increases; businesses are expected to pass along more of the costs in the coming months.

- Still, the Fed will likely view the impact of tariffs as a one-time price level shift that may not be repeated in the future.

In the absence of national data, aggregated state jobless claims point to a tenuous balance in the labor market

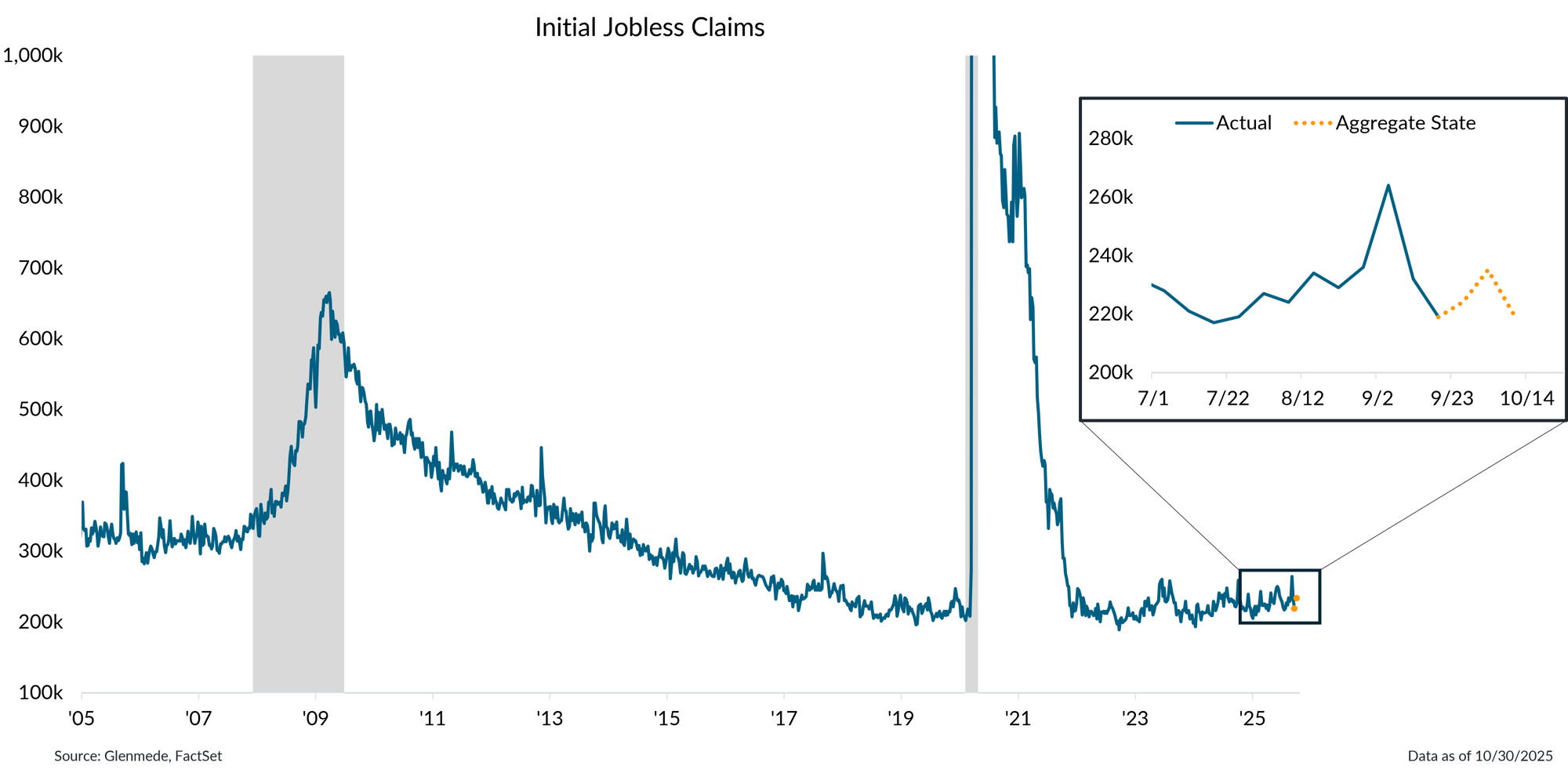

Data shown in blue represent actual initial claims for unemployment insurance in the U.S., while the orange dashed line reflects projections based on aggregated state-level data. All data are shown on a seasonally-adjusted basis. The inset illustrates the estimated path of national initial jobless claims. Gray shaded areas represent periods of recession in the U.S. Actual results may differ materially from projections.

- Just before the government shutdown data blackout, initial jobless claims at the national level were experiencing some volatility, leading to concerns about cracks emerging in the labor market.

- Amid the dearth of official data, jobless claims aggregated up from the state level provide a reasonable proxy for national labor market conditions, pointing to a tenuous balance.

The Fed is ending quantitative tightening (QT), intending to maintain liquidity at current levels

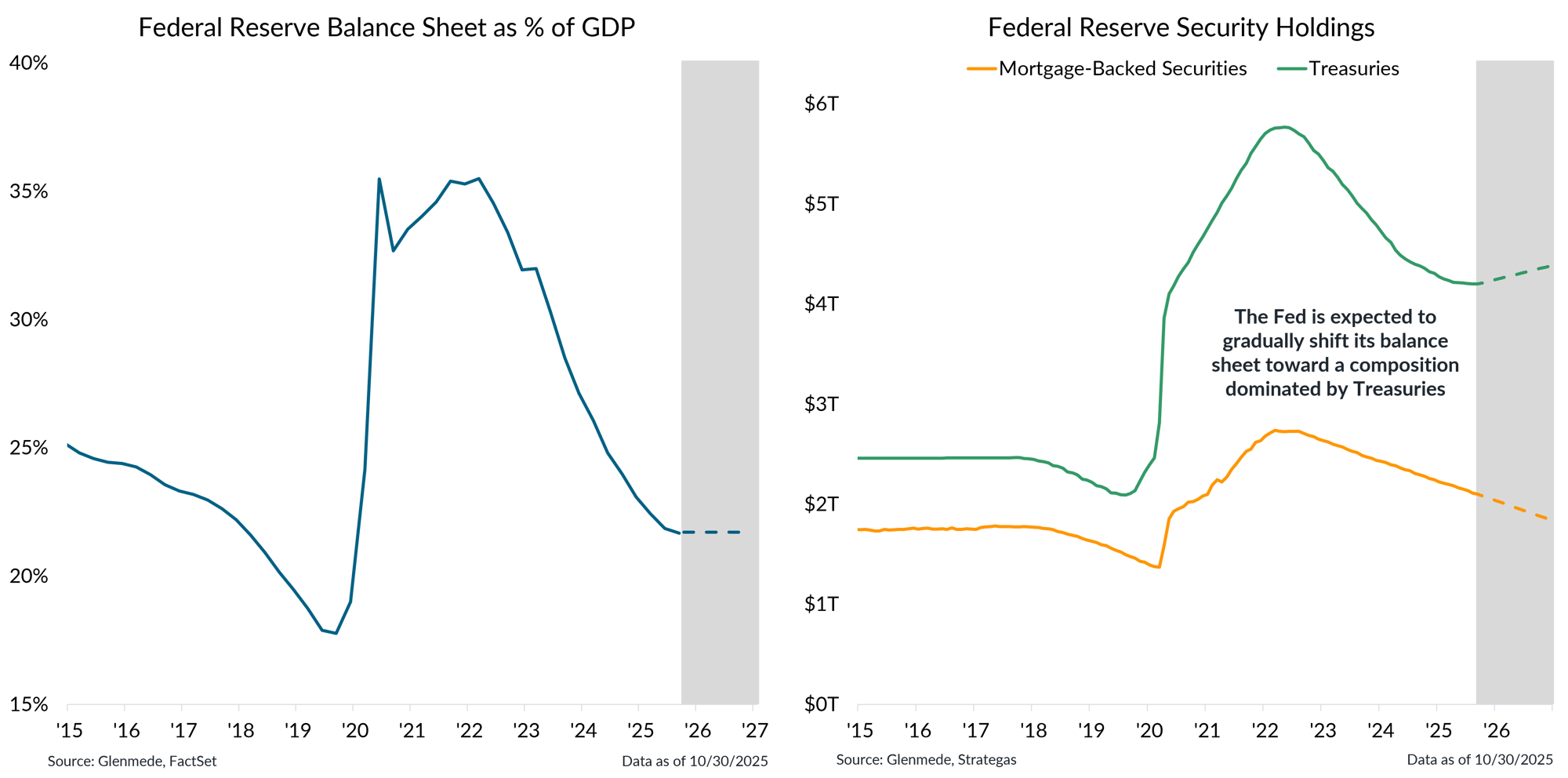

Shown in the left panel is the Federal Reserve’s balance sheet as a percentage of U.S. gross domestic product (GDP). Shown in the right panel are the Federal Reserve’s holdings of U.S. Treasuries and mortgage-backed securities (MBS). Actual figures are shown in solid lines, while projections are shown in dashed lines within the gray areas. Actual results may differ materially from projections.

- The Fed announced it will be bringing its balance sheet runoff to a close at the end of November, stabilizing the size of its balance sheet relative to GDP and helping to maintain ample reserves in the financial system.

- However, the composition of the balance sheet may continue to see a mix shift that winds down mortgage-backed securities holdings over time in favor of Treasuries.

Small caps have been sensitive to the Fed’s balance sheet runoff and may benefit from its end

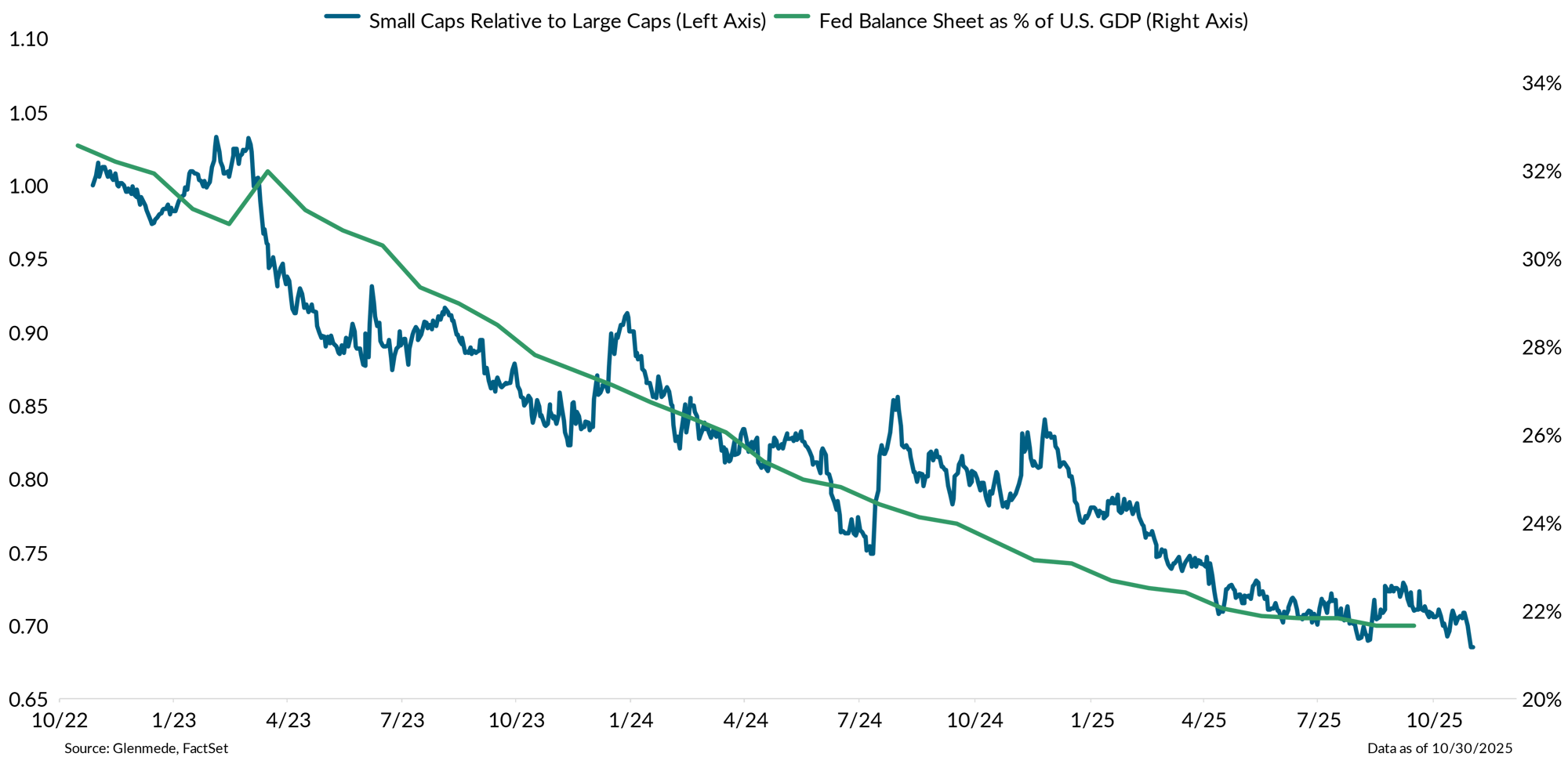

Data shown represent the ratio of the S&P 600 Index to the S&P 500 Index, with both series indexed to a common starting point to illustrate relative performance between small- and large-cap equities over time. The green line represents the Federal Reserve’s balance sheet as a percentage of U.S. GDP. Past performance may not be indicative of future results. One cannot invest directly in an index.

- Small cap valuations have been pressured by tighter financial conditions and reduced liquidity during the Fed's balance sheet runoff, leaving the segment more sensitive to policy shifts.

- As quantitative tightening winds down, improved liquidity and easing credit constraints could support a relative rebound in small-cap performance.

This material is provided solely for informational and/or educational purposes and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Any company, fund or security referenced herein is provided solely for illustrative purposes and should not be construed as a recommendation to buy, hold or sell it. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.