Investment Strategy Brief

Liberation Day: The Sequel

July 13, 2025

Executive Summary

- Headline volatility picked up last week after a flurry of new announcements regarding trade.

- Recently released letters contain updated reciprocal tariff rates, which appear to address both economic and non-economic issues.

- Despite the near-term noise, the spectrum for trade deal terms is beginning to come into view.

- The increased headwind from tariff policy may be largely offset near-term by stimulative fiscal policy.

- Increasing tariff headwinds are manageable given fiscal stimulus and may create a perception of accelerating growth between ’25 and ’26.

Last week brought a flurry of new trade announcements

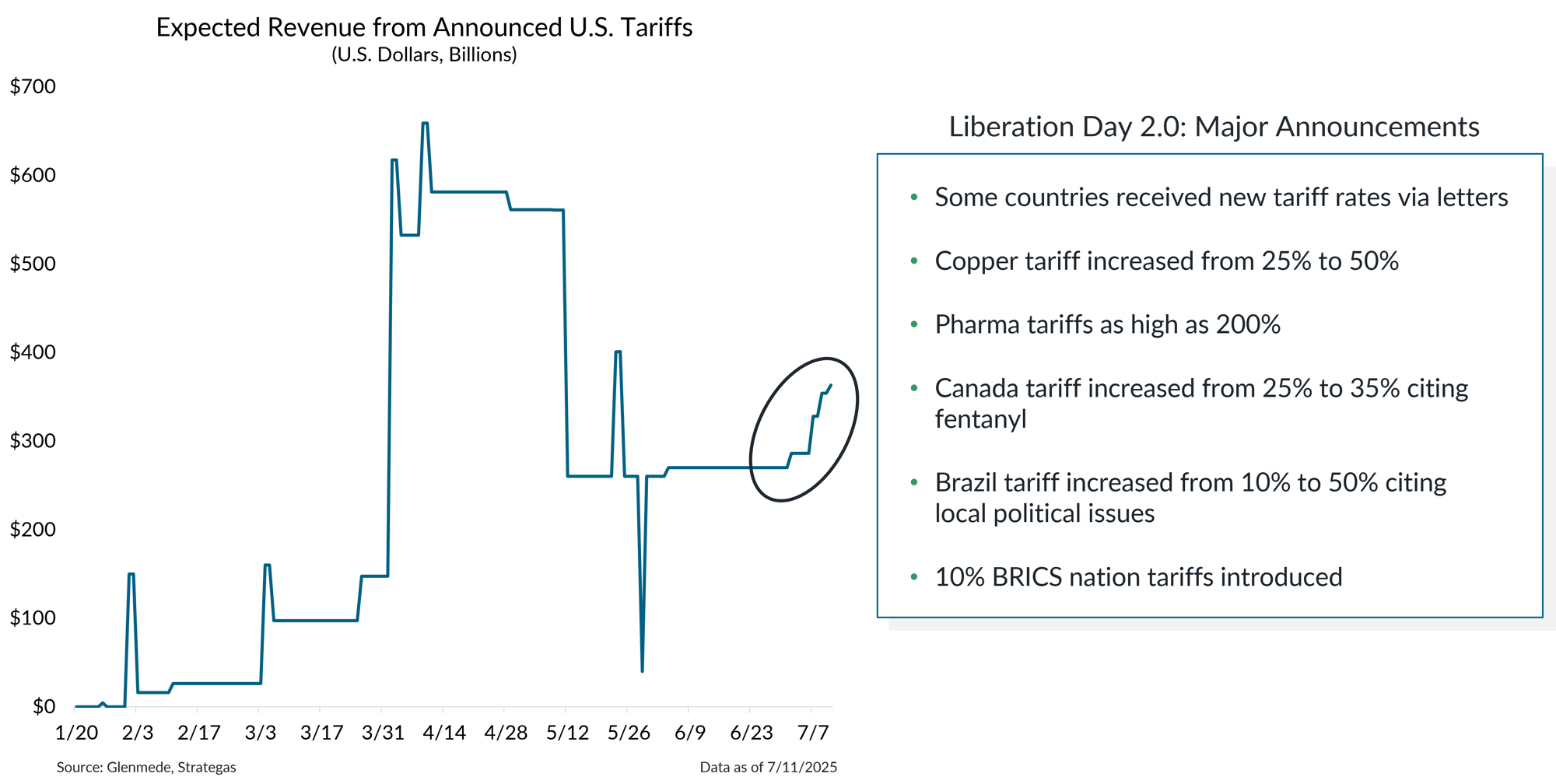

Shown in the left panel is a timeline of the cumulative amount of expected revenue generated from tariffs announced as of each day since President Trump’s second inauguration, measured in billions of U.S. dollars. Historical and projected tariff figures are derived from internal and third-party sources believed to be reliable. BRICS refers to the intergovernmental organization originally formed by Brazil, Russia, India, China and South Africa. Actual results may differ materially from expectations.

- Last week marked the expiration of the 90-day reciprocal tariff pause, highlighted by the issuance of letters to trade partners outlining updated terms.

- Additional announcements included an increased copper tariff, pharmaceutical tariffs as high as 200% and measures targeted at BRICS nations.

Recently released letters contain updated reciprocal tariff rates, scheduled for August 1st implementation

.png?width=2000&height=1016&name=IS%20Brief%202025-07-14%20Chart%202%20(REVISED).png)

Data shown represent the U.S. reciprocal tariffs as proposed on April 9th and updated rates reflected in published letters with updated terms, as of the latest date shown.

- Overall, the changes to reciprocal tariff rates outlined in the letters were modest, in most cases reducing or modestly increasing duties.

- On the other hand, Canada, Mexico, Brazil and the European Union received rates that were much higher than their “Liberation Day” rate, with the administration mainly citing non-economic issues.

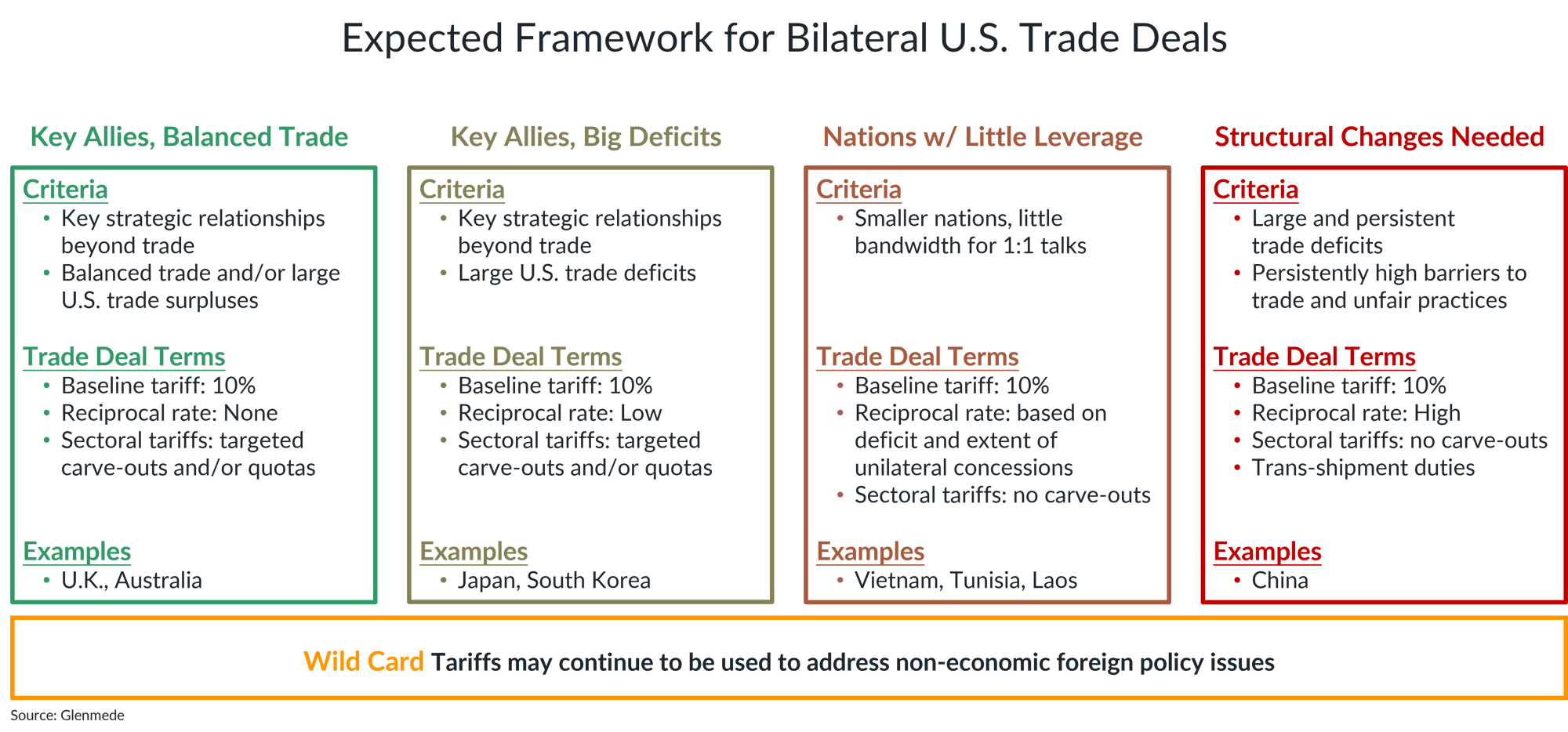

Despite the near-term noise, the spectrum for trade deal terms is beginning to come into view

The information shown is purely for illustrative purposes and highlights Glenmede’s expectations for the emerging framework on trade deals with the U.S. Actual results may differ materially from expectations and are subject to change alongside adjustments to trade policies.

- Negotiations with trading partners are ongoing, with some, such as the U.K., Vietnam and China securing some relief; others such as Japan, the EU and India have yet to reach an agreement.

- A spectrum of potential outcomes for trade deals is starting to take shape, though the negotiation path to these landing points is unlikely to be a smooth one.

The latest set of announcements has negatively shifted the range of possible outcomes at the margin

.png?width=2000&height=1015&name=IS%20Brief%202025-07-14%20Chart%204%20(REVISED).png)

Implemented Tariffs includes the impact of all tariffs implemented year-to-date. Each of the Upside Case, Base Case, Downside Case are based on Glenmede’s analysis of the likely landing point of U.S. trade policy over the next year. All figures shown are projections as a share of nominal U.S. gross domestic product (GDP) and are subject to change. Actual results may differ materially from projections.

- The range of potential outcomes for where trade policy ultimately lands has shifted to marginally larger economic headwinds in aggregate based on last week’s announcements.

- The economic impact, which could range from 1.0% to 2.7%, will likely depend on the final terms of implementation, which remain unclear at this time.

- The timing of implementation on tariffs will also be important to monitor – if they are spread out over time, the resulting impact may be more easily digestible for the economy.

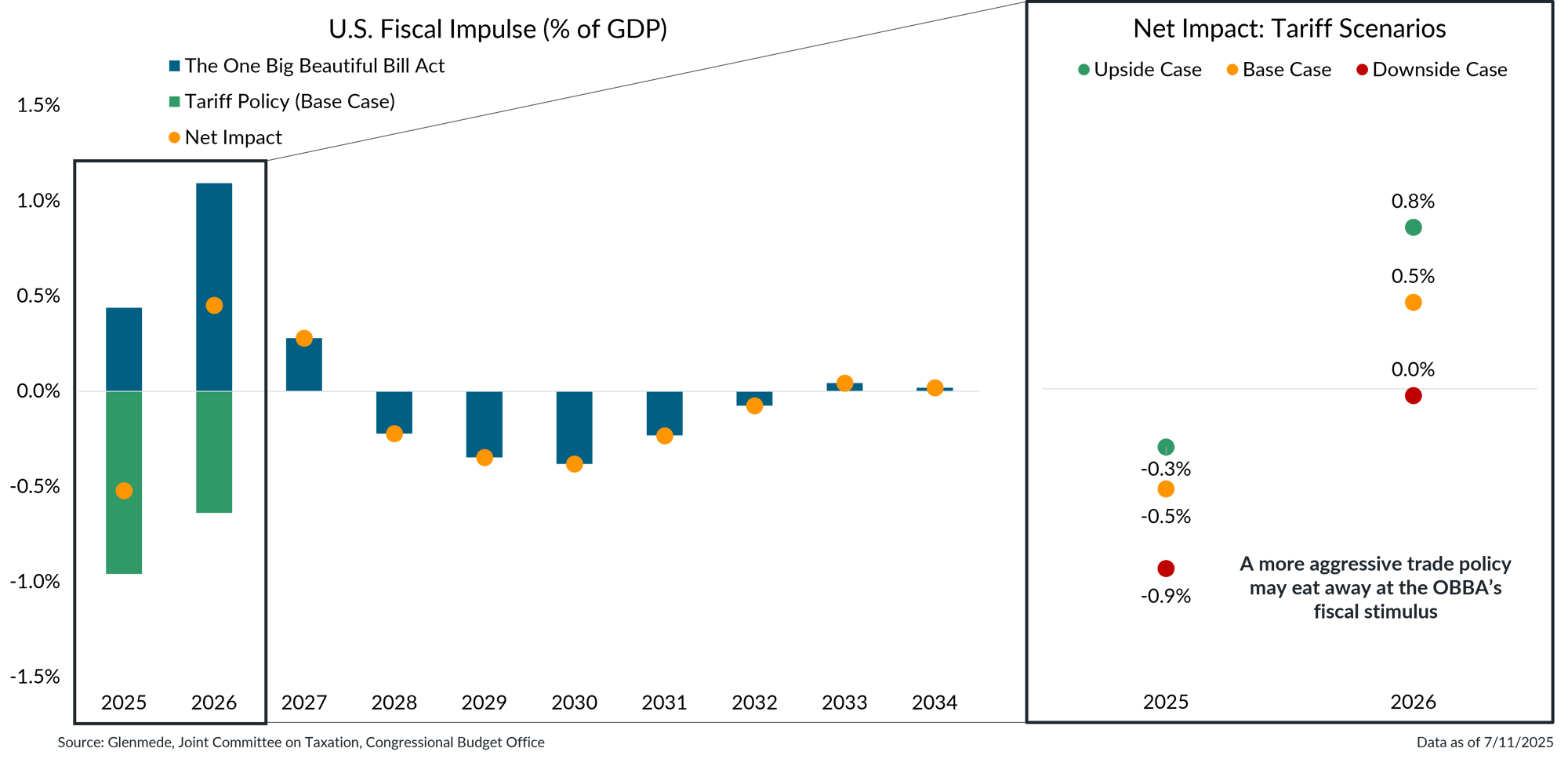

The increased headwind from tariff policy may be largely offset near-term by stimulative fiscal policy

Data shown in the left panel are the expected fiscal stimulus effects by year due to key policy changes associated with The One Big Beautiful Bill Act and Glenmede’s Base Case projection for revenues generated by new tariffs. Orange dots represent the net impact between both dimensions of policy change. Data shown in the right panel extrapolate the net impact based on Glenmede’s Upside Case, Base Case and Downside Case on the likely landing point of U.S. trade policy. Actual results may differ materially from projections and are subject to change.

- “The One Big Beautiful Bill Act” recently signed into law is projected to deliver significant fiscal stimulus in 2025 and 2026, potentially mitigating economic headwinds from tariffs.

- However, the potential implementation of a more aggressive trade policy could diminish the impact of that stimulus by increasing costs for businesses and consumers.

This material is provided solely for informational and/or educational purposes and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Any company, fund or security referenced herein is provided solely for illustrative purposes and should not be construed as a recommendation to buy, hold or sell it. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.