Investment Strategy Brief

Markets React to a New Administration

November 10, 2024

Executive Summary

- U.S. equities responded favorably after the election was called, with the S&P 500 enjoying its best post-election session on record.

- Small caps were big beneficiaries of the post-election rally, as they stand to benefit most from a possible decline in effective tax rates.

- Inflation expectations have ticked higher, as investors may be starting to consider the impact of a return to a higher tariff regime.

- Expect the specifics of Trump’s agenda to come into view, the most consequential of which are likely tax cut extensions and tariffs.

Domestic equities responded favorably, as the S&P 500 had its best post-election session on record

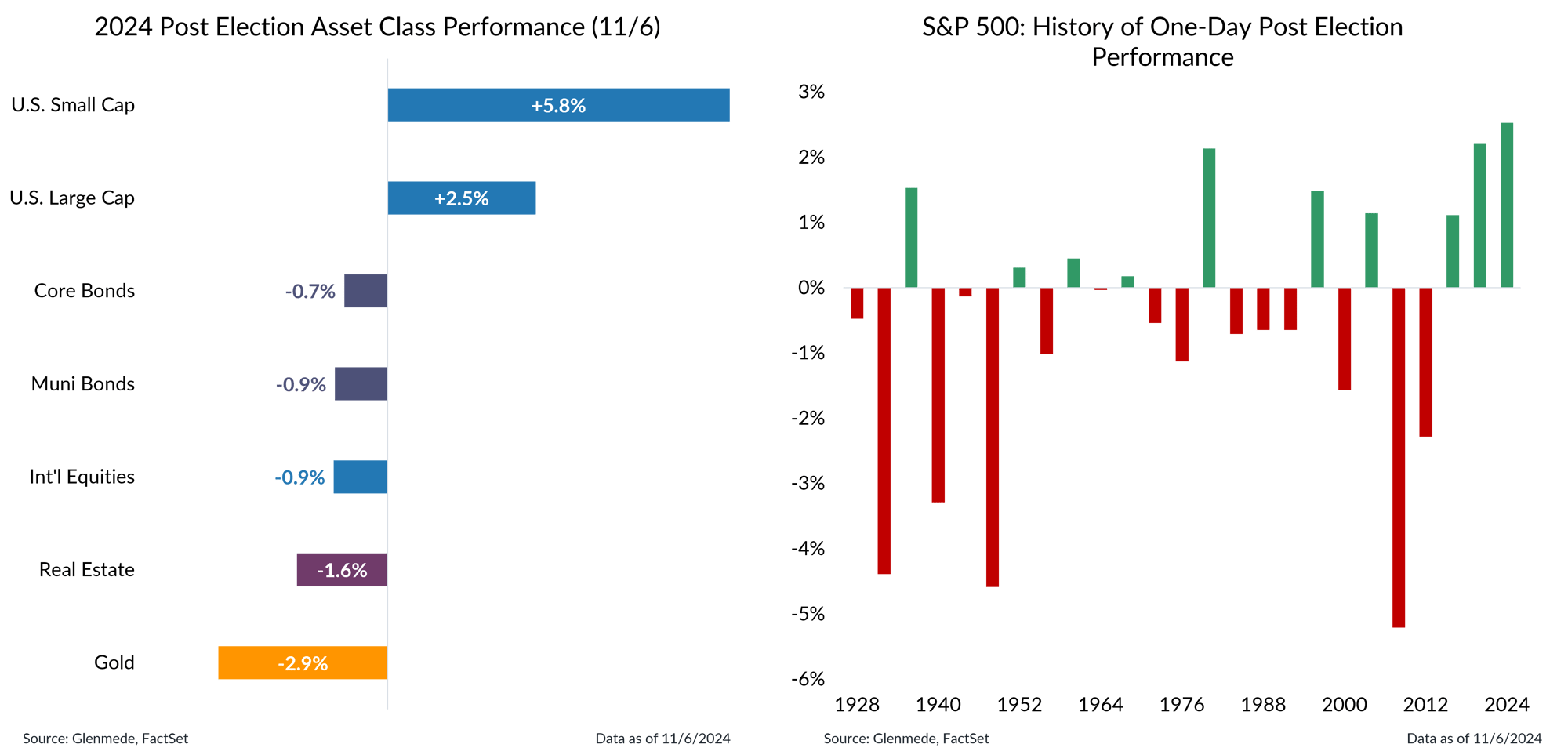

Data shown in the left panel are total returns for various asset classes during the one-day session after the 2024 Presidential Election (11/6), represented by the following indices: U.S. Large Cap (S&P 500), U.S. Small Cap (Russell 2000), Int’l Equities (MSCI All Country World ex-U.S.), Core Bonds (Bloomberg U.S. Aggregate), Muni Bonds (Bloomberg Municipal), Real Estate (FTSE EPRA/NAREIT Developed), Gold (Gold Composite Spot). Data shown in the right panel are total returns for the S&P 500 in the one-day session after each presidential election day since 1928. Past performance may not be indicative of futures results. One cannot invest directly in an index.

-

U.S. large cap and small cap equities had a strong session immediately following the election result, while rising interest rates were a headwind for bonds.

-

The S&P 500's 2.5% gain was the strongest one-day post election performance for the index on record, going back to the early 20th century.

Small caps benefitted from corporate tax hikes being taken off the table

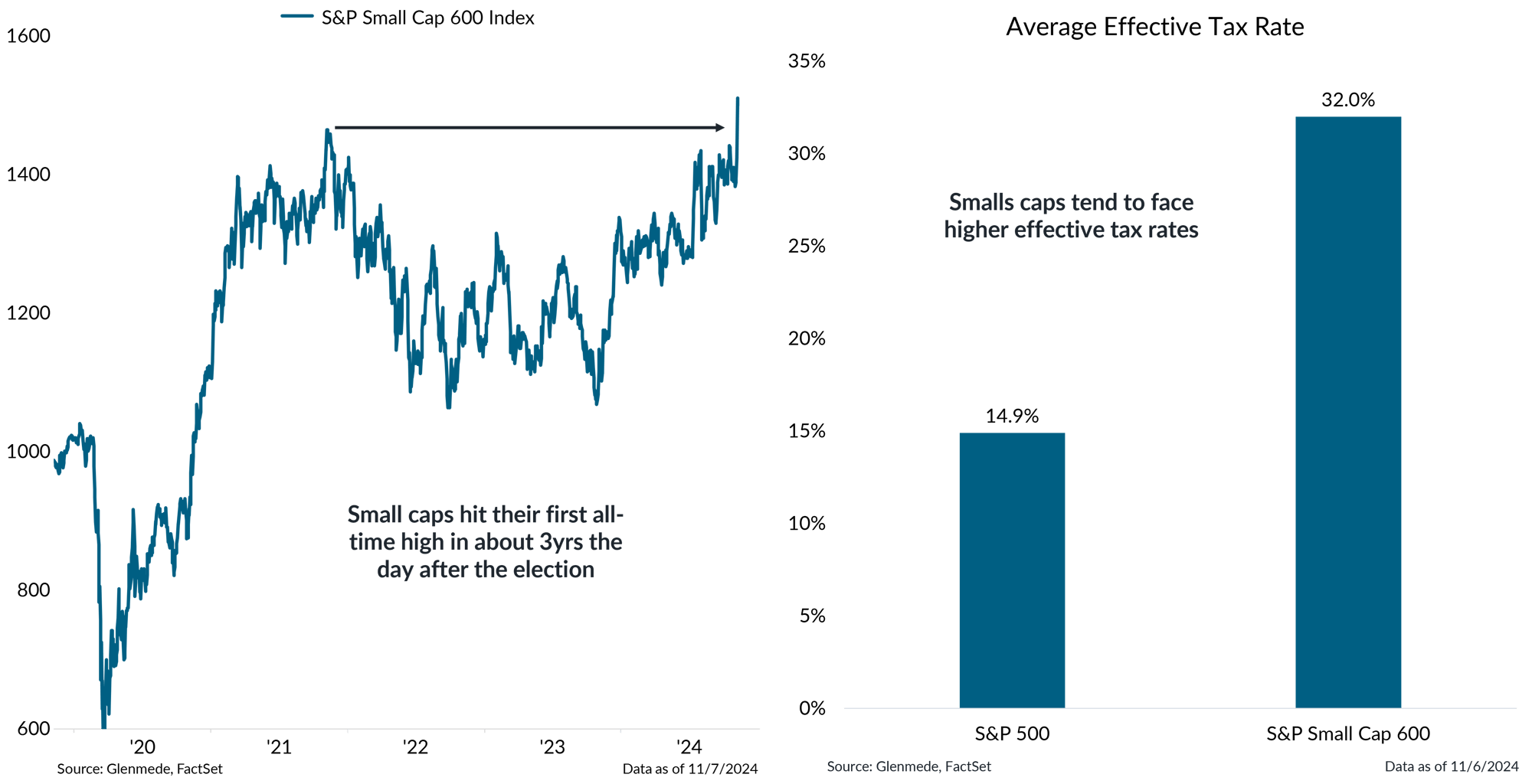

Shown in the left panel is the price performance (excluding dividends) for the S&P Small Cap 600 Index, which is a market capitalization weighted index of small cap stocks in the U.S. Shown in the right panel are the average effective tax rates for constituents in the S&P 500 and S&P 600 indexes. Past performance may not be indicative of future results. One cannot invest directly in an index.

- Domestic small cap equities were among the largest beneficiaries of the post-election rally, with the S&P Small Cap 600 index finally reaching new all-time highs for the first time in about three years.

- The strong reaction from small caps may be due to the fading threat of corporate tax hikes, as they tend to face higher effective tax rates relative to their large cap counterparts.

Interest rates have been rising, driven by inflation expectations that may be sensitive to fiscal policy

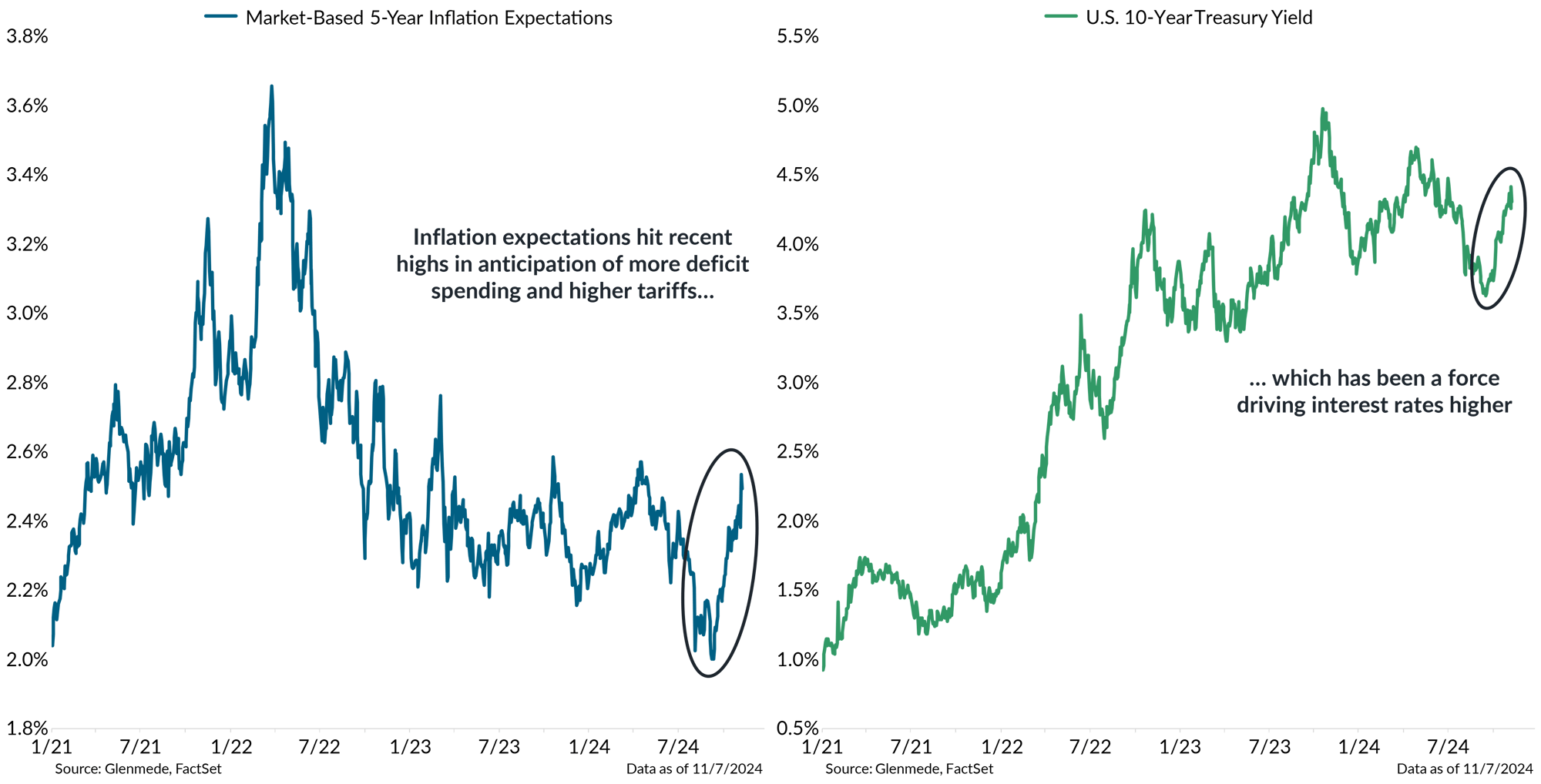

Data shown in the left panel are market-based inflation expectations for the next 5-years, represented by the average of 5-year U.S. inflation swap rates and 5-year Treasury Inflation Protected Securities (TIPS) breakeven rates. Data shown in the right panel are 10-year U.S. Treasury yields. Actual results may differ materially from projections.

- Inflation expectations ticked higher immediately following the election result, perhaps in expectation of more deficit spending and higher tariffs.

- As a result, bond yields rose, as investors often demand extra yield to overcome expected purchasing power erosion.

The most consequential result of the Republican sweep is likely a full extension of tax cuts and new tariffs

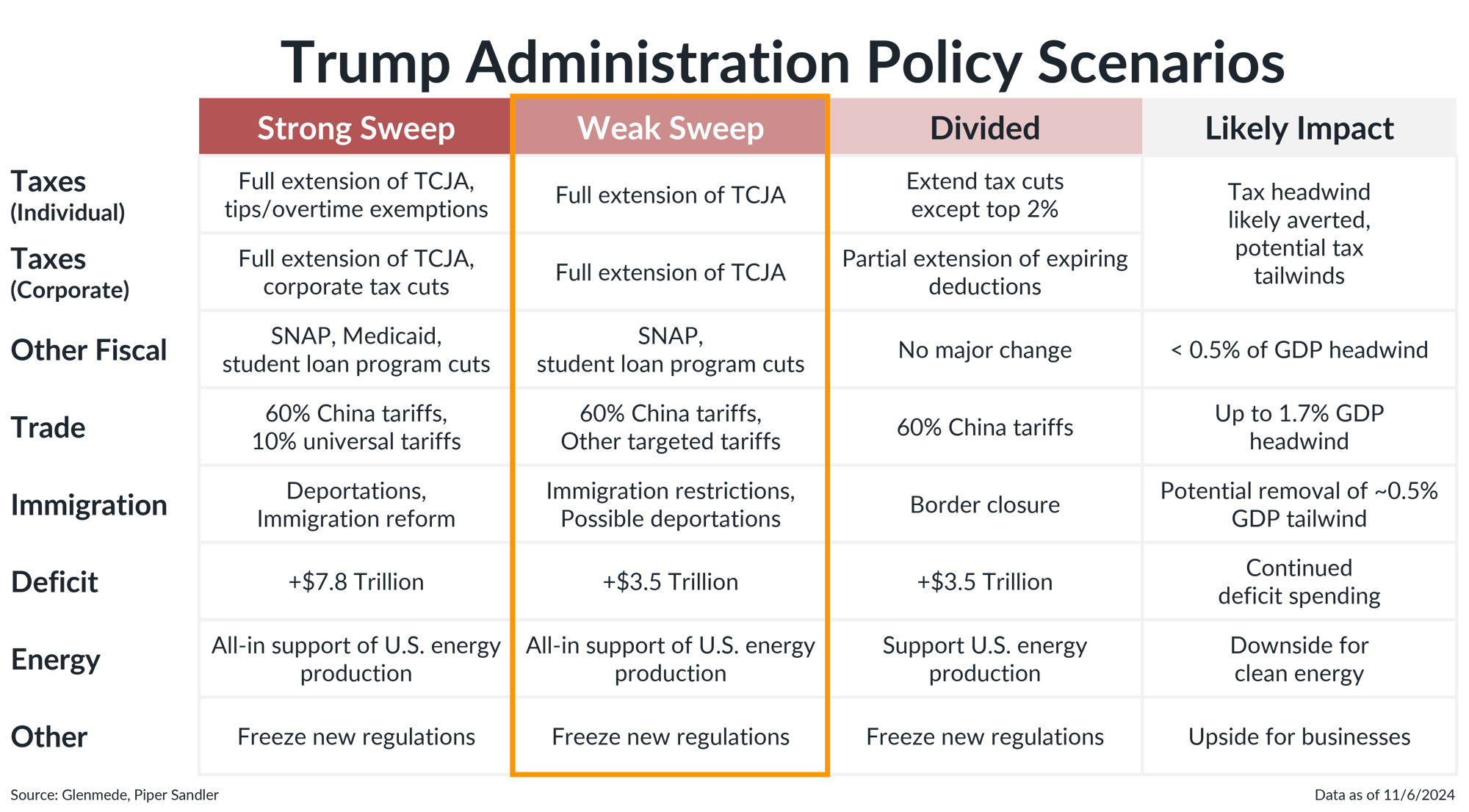

The information shown provides a general representation of the potential policy platforms for the Trump Administration in 2024 and is not meant to be exhaustive. TCJA refers to the Tax Cuts and Jobs Act of 2017. Impact Range reflects the potential Glenmede’s potential outcomes expected by Glenmede from Strong Republican Sweep to Divided government under a Trump presidency. Strong Republican Sweep refers to a scenario in which Republicans hold the White House, House of Representatives and a 60+ seat majority in the Senate. Actual policies may differ materially from those listed.

- A strong, 60-seat majority in the Senate that could overcome a filibuster now appears out of reach for the GOP, which may temper some of the new administration’s more ambitious proposals.

- The most immediate and consequential result of a weak Republican sweep is likely a full extension of tax cuts next year and the potential imposition of new tariffs.

- Other policies of note may limit immigration, support domestic energy production and freeze new regulations.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.