Investment Strategy Brief

Municipal Bond Yields:

Risk or Opportunity?

May 11, 2025

Executive Summary

- Municipal bond yields are notably higher relative to Treasuries, leading some to wonder if their tax-exempt status is at risk.

- Changes to municipal taxation face bipartisan pushback making a full revocation of their tax-exempt status unlikely.

- The primary culprit for the recent rise in the relative yield of municipal bonds appears more closely tied to a notable change in supply.

- Core municipal bonds now appear undervalued, offering potential opportunities as other fixed income yields remain near fair value.

- Higher yields driven by supply offer a compelling case for municipal bonds, as wholesale removal of their tax-exemption appears unlikely.

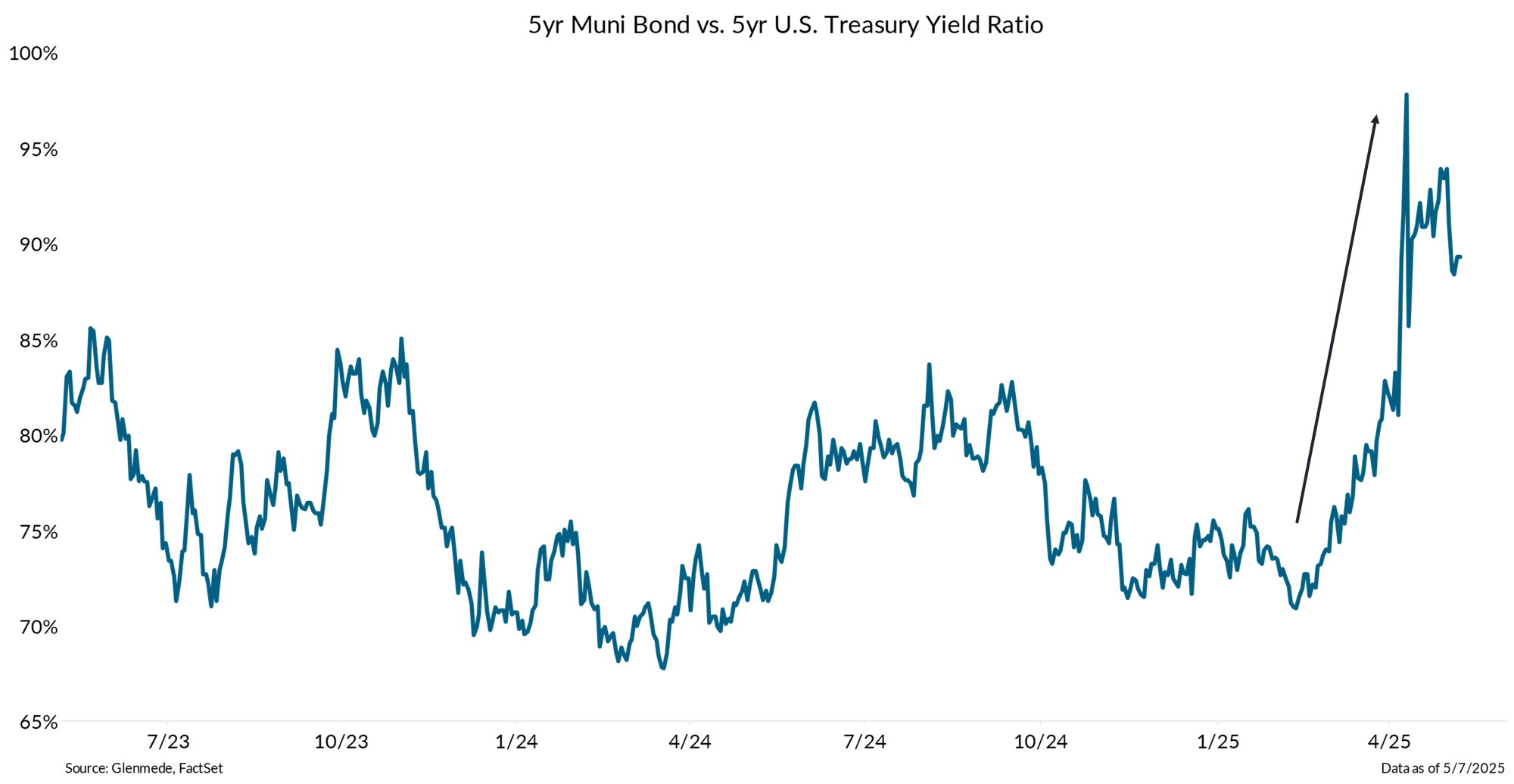

Municipal bond yields exhibit improved relative value compared to Treasuries

Data shown are the ratios over time between the yield to worst on the Bloomberg Municipal Bond 5yr Index and 5yr U.S. Treasuries. Past performance may not be indicative of future results. One cannot invest directly in an index.

- Municipal bond yields are higher than normal relative to Treasury equivalents, which should make their after-tax yields quite attractive to many investors.

- This shift in relative yields has led some investors to wonder if the tax-exempt status of the yield on municipal bonds may be at risk.

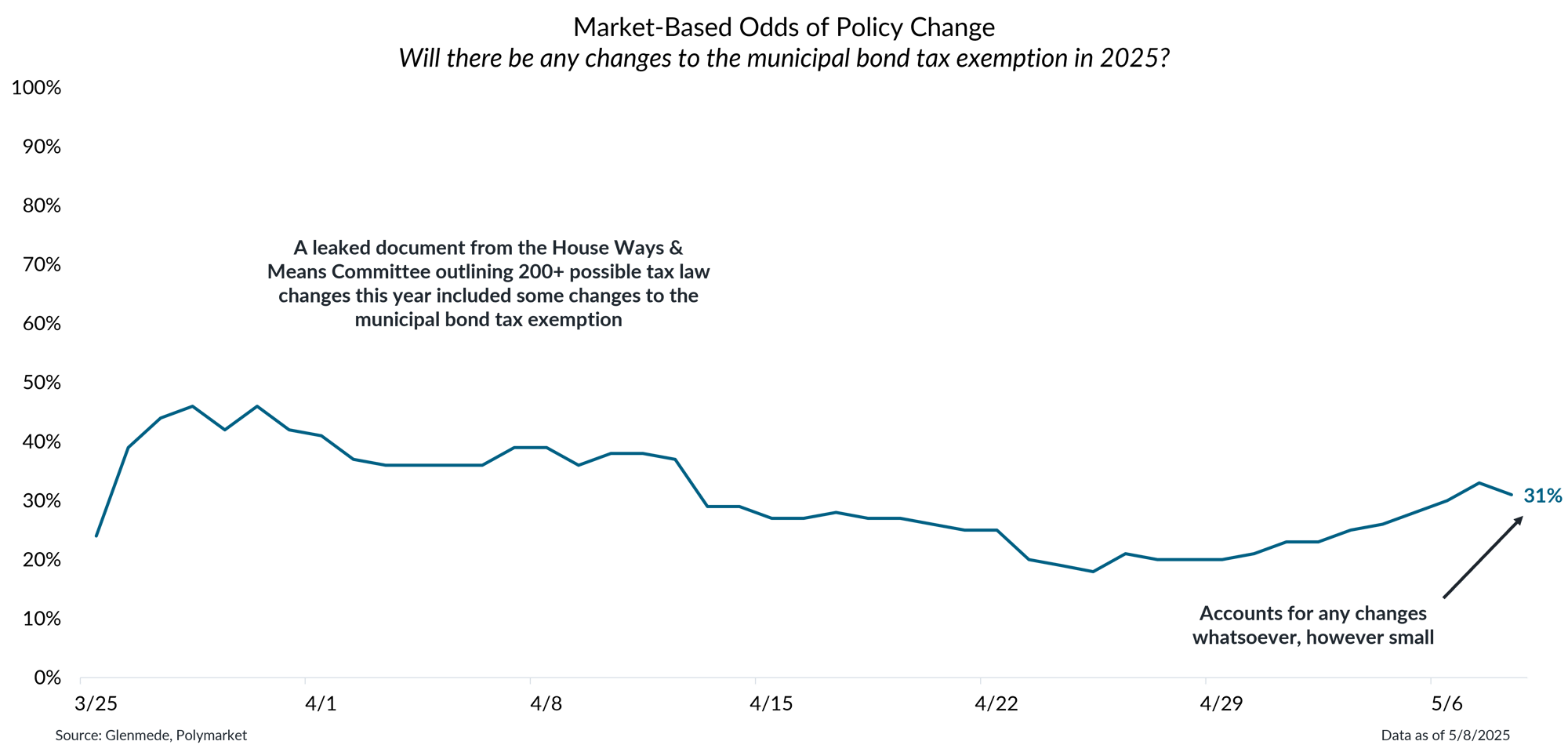

Prediction markets point to a low but non-zero likelihood of change to municipal bond tax treatment

Data shown are market-based odds of change to the municipal bond tax exemption by the end of 2025 via Polymarket. Change refers to any bill signed into law or executive action changing U.S. tax law to eliminate or modify the federal tax exemption on interest from municipal bonds. Changes may include complete revocation of municipal bond tax exemption or elimination for only specific types of municipal bonds. Polymarket is a prediction market where investors can place bets on various future events. References to Polymarket and use of its data herein should in no way be interpreted as an endorsement or recommendation of Polymarket by Glenmede. Probabilities or likelihoods shown are not the opinions of Glenmede and are shown for illustrative purposes only. Actual results may differ materially from probabilities shown, particularly for prediction markets with low trading volume.

- Prediction markets are beginning to price in some probability of changes to the exemption from federal income tax of municipal bond interest.

- “Change” in these prediction markets has a relatively broad definition, including even small changes in taxability or only for certain sectors, not just wholesale revocation of tax-exemption.

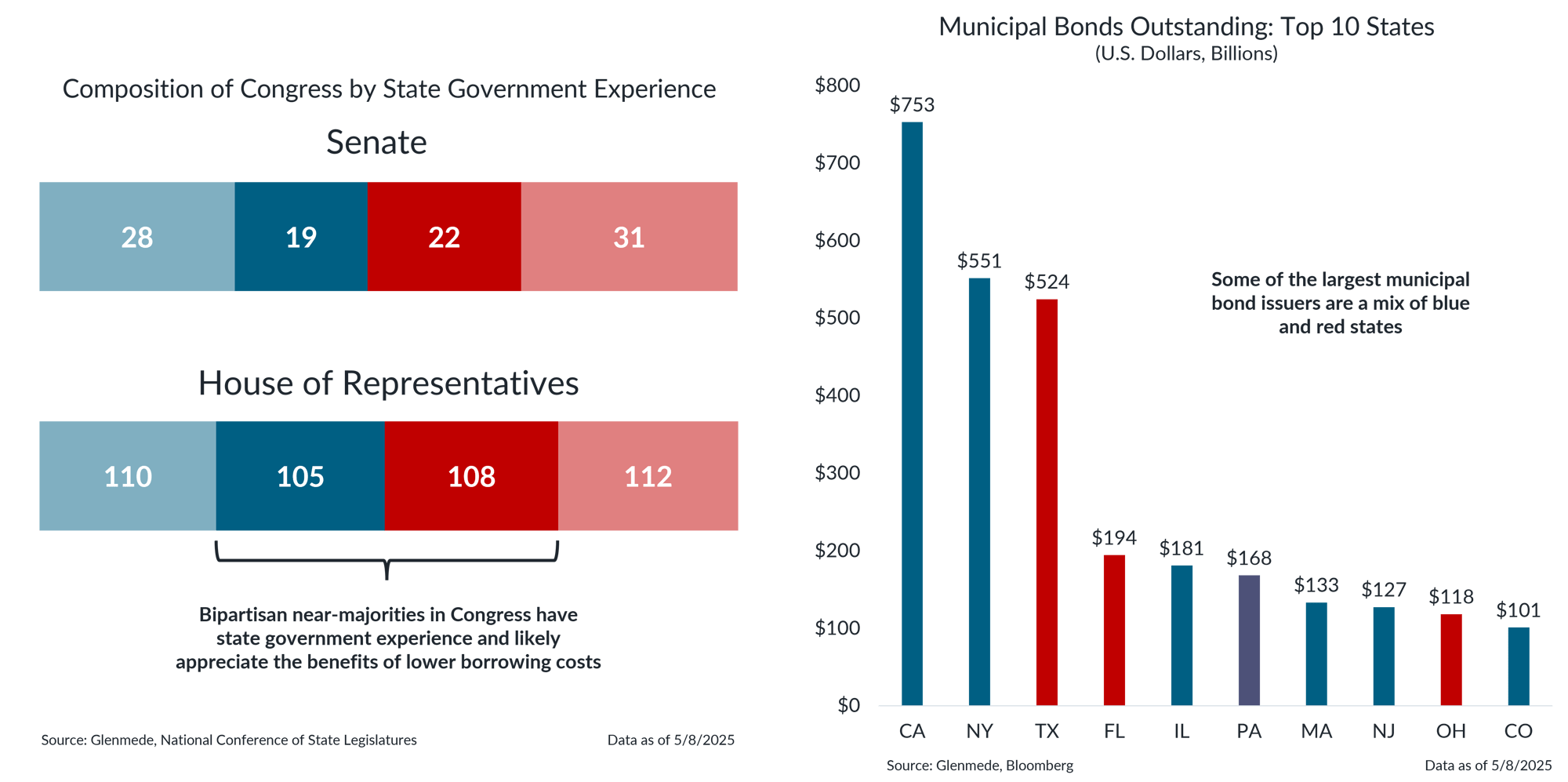

Revoking the tax exemption for municipal bonds would be politically challenging on a bipartisan basis

Shown in the left panel are the composition of both chambers of Congress by the party with which each Senator/Representative caucuses. Red areas represent Republicans and blue areas represent Democrats. Dark shaded areas represent members of those parties that have state government experience and light shaded areas represent those that do not. Shown in the right panel are the top 10 states by the amount of outstanding state and local municipal bonds by par value in billions of U.S. dollars, with each bar colored according to the statewide winner of the last two presidential elections.

- Revoking the tax-exempt status of municipal bonds is likely to face significant resistance, particularly from lawmakers whose states make the most use of municipal bonds’ lower borrowing costs.

- Further, the revenue raised from wholesale changes to municipal bonds’ tax treatment would be quite small relative to other tax/spending priorities, likely making the juice not worth the squeeze.

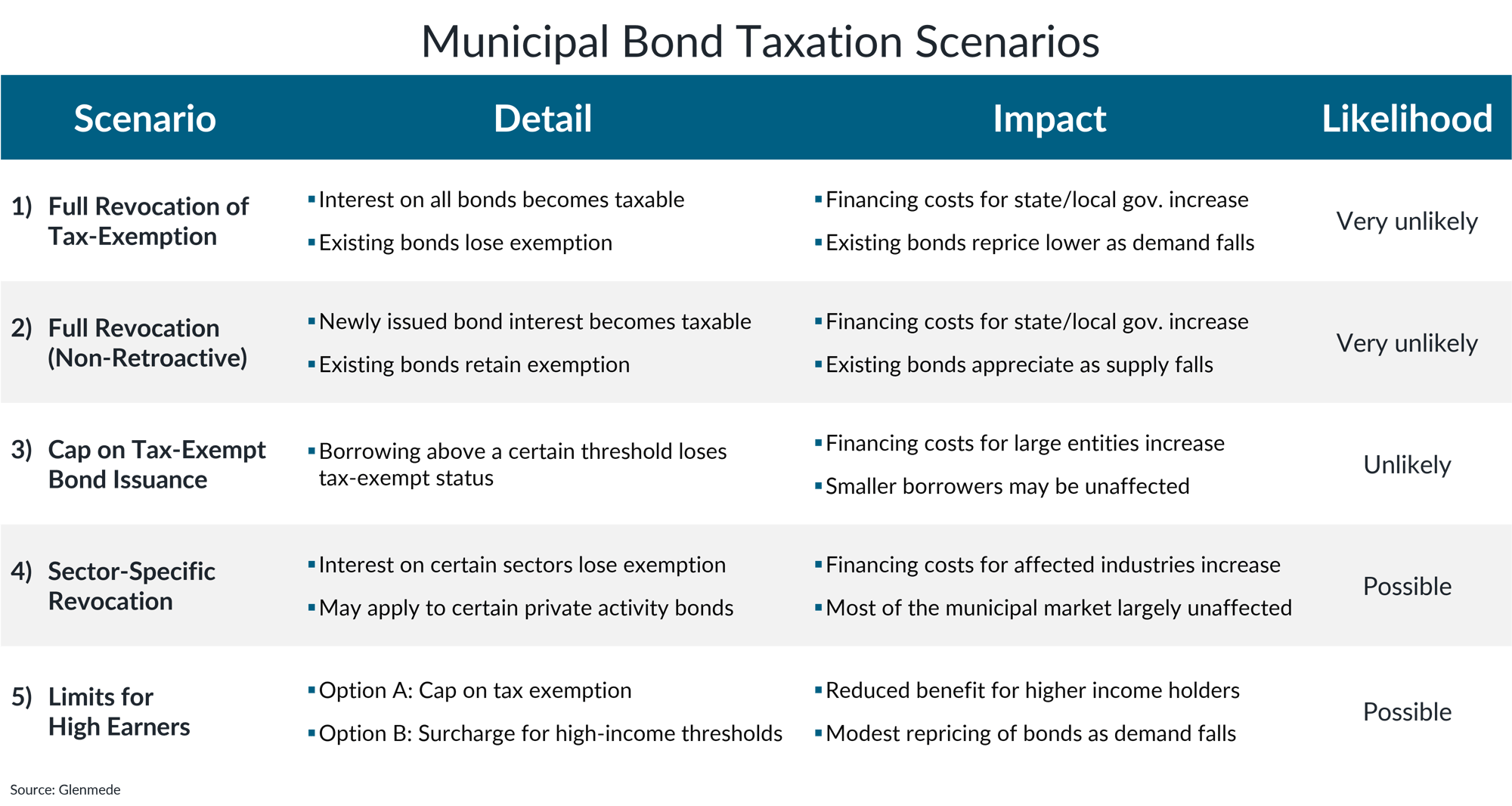

Smaller changes to municipal bond taxation seem more likely than a wholesale shift

Information shown is for illustrative purposes only. Actual policy changes and their details/impact may not be limited to the scenarios described in the table. The likelihoods of each scenario may differ materially from the opinions expressed.

- While several scenarios may be on the table, it remains highly unlikely that Congress will fully revoke the tax-exempt status for all municipal bonds.

- Congress may explore more targeted measures, such as placing restrictions on the types of institutions and investors eligible to benefit from the exemption.

Higher municipal bond yields are likely the result of an accumulation of months of larger-than normal issuance

Data shown represent the top 20 major countries by the expected maximum direct impact from all U.S. tariffs announced in 2025 as a percentage of their Gross Domestic Product (GDP). Major countries are defined by those with GDP greater than $100 billion U.S. dollars. The maximum direct economic impact of proposed tariffs assumes full demand destruction via a tariff-induced price shock and that tariffs are implemented fully and in isolation, with no changes to the sourcing of the imports, no other offsetting policies and no retaliatory tariffs. Actual results may differ materially from expectations.

- So far this year, new municipal bond issuance has been unseasonably strong, which is likely the biggest factor behind the swing in relative value.

- Large issuance, coincident with other factors such as cash needs during tax season, appears to have created the perfect storm for an unusual rise in municipal yields.

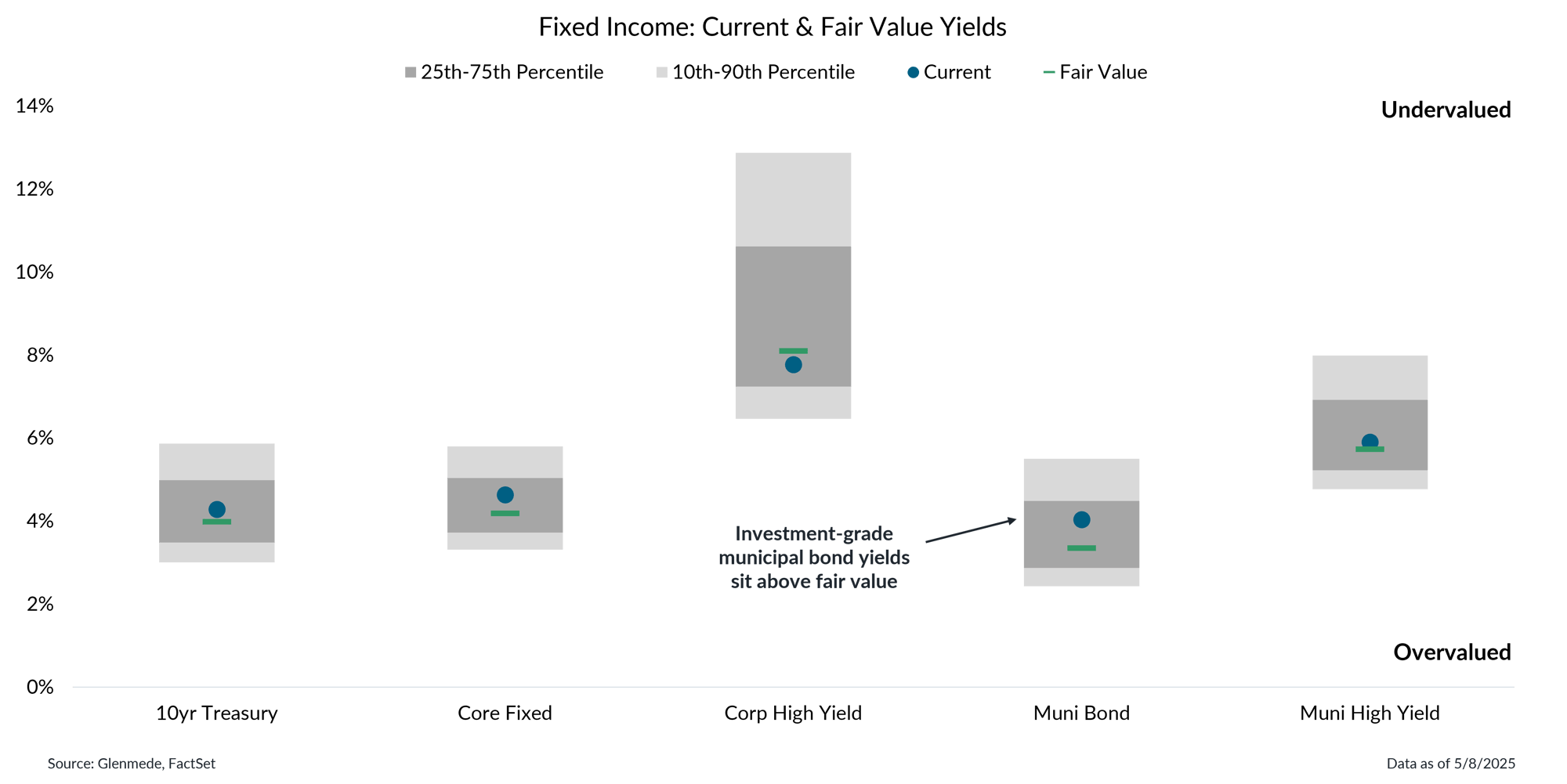

Most fixed income yields are in the vicinity of fair value levels, though core municipals appear undervalued

Shown are Glenmede’s estimates of long-term fair value for taxable and tax-exempt debt securities. Proxy indices for each asset class are as follows: Core Fixed (Bloomberg U.S. Aggregate), Corp High Yield (Bloomberg U.S. Aggregate Credit Corporate High Yield BB), Muni Bond (Bloomberg Municipal Bond), Muni High Yield (Bloomberg Municipal High Yield). Glenmede’s estimates of fair value are arrived at in good faith, but longer-term targets for valuation may be uncertain. One cannot invest directly in an index.

- Valuations appear relatively fair across the fixed income landscape though there may be opportunities within investment-grade municipal bonds, as yields have risen above fair value estimates.

- Higher yields driven by supply offer a compelling case for municipal bonds, as wholesale removal of their tax-exemption appears unlikely.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.