Investment Strategy Brief

October Surprise Watch

October 6, 2024

Executive Summary

- The economy and markets are contending with yet another list of “October surprises,” but these disruptions do not yet appear enough to knock the U.S. out of its late-stage expansion.

- Hurricane Helene is among the costliest in history, but its impact on the labor market may be temporary.

- Negotiations have suspended port strikes, mitigating but not eliminating the impact of container ship backlogs.

- The escalating conflict in the Middle East poses inflation risks, but spare OPEC capacity may limit the upside for energy prices.

The estimated economic damage from Hurricane Helene is climbing, but the labor market impact may be temporary

%202024-10-07.png?width=2000&height=1993&name=IS%20Brief%20Chart%201%20(Left%20Panel)%202024-10-07.png)

%202024-10-07.png?width=1929&height=2000&name=IS%20Brief%20Chart%201%20(Right%20Panel)%202024-10-07.png)

Data shown in the left panel are the top 10 costliest hurricanes in U.S. history based on nominal damage in billions of U.S. dollars. Estimate for Helene is based on an average of a $34B estimate from Moody’s and a $160B estimate from Accuweather.com. Data shown in the right panel are the average amounts of initial jobless claims in the U.S. in the ten weeks preceding and proceeding landfall of those hurricanes. Past performance may not be indicative of future results.

-

The damage assessments from Hurricane Helene are ongoing, but some estimates suggest it may be among the costliest in U.S. history.

-

The impact of hurricanes is often felt in the proceeding weekly jobless claims figures, though those effects tend to be temporary in nature.

East/Gulf Coast port strikes have been suspended, but there’s a backlog of shipments to work through

%202024-10-07-1.png?width=2000&height=1917&name=IS%20Brief%20Chart%202%20(Left%20Panel)%202024-10-07-1.png)

%202024-10-07.png?width=2000&height=1894&name=IS%20Brief%20Chart%202%20(Right%20Panel)%202024-10-07.png)

Data shown in the left panel are the share of total container volume by region across the top twelve U.S. ports. West Coast includes Los Angeles, Long Beach, Oakland, Seattle and Tacoma. East Coast includes the top ports in New York, New Jersey, Georgia, South Carolina, Virginia and Florida. Gulf Coast includes Houston. Shown in the right panel is the Federal Reserve Bank of New York’s Global Supply Chain Pressure Index, which integrates several commonly used supply chain metrics with the aim of providing a comprehensive summary of supply chain disruptions, measured in standard deviations from average.

- Striking East/Gulf coast port workers returned to work last Friday, bringing back online roughly half of U.S. container volume capacity.

- It may take some time to clear the backlogs of ships waiting outside the ports, but supply chain metrics so far appear relatively normal.

The threat of an escalated Middle East conflict could threaten regional energy production

%202024-10-07.png?width=1890&height=2000&name=IS%20Brief%20Chart%203%20(Left%20Panel)%202024-10-07.png)

%202024-10-07.png?width=1959&height=2000&name=IS%20Brief%20Chart%203%20(Right%20Panel)%202024-10-07.png)

-

Rising geopolitical risks in the Middle East threaten regional trade, which is overwhelmingly dominated by oil and petroleum products.

-

So far crude oil has risen 10% from its recent low, and prices may be volatile amid evolving perceptions of risk in the region.

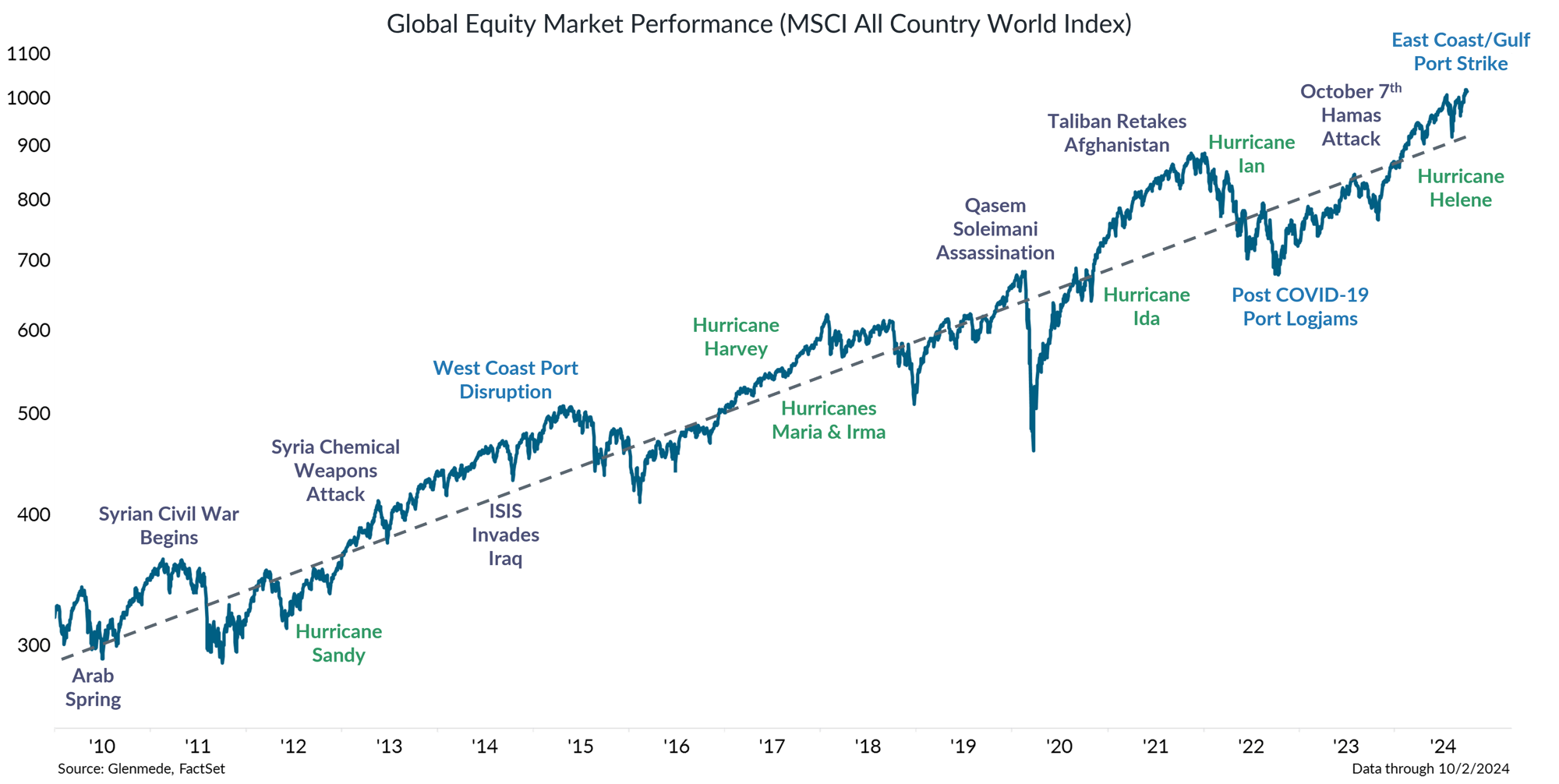

Markets have a long history of seeing through disruptions with only tangential economic impacts

- The economy and markets are contending with a list of “October surprises” that have emerged in just the first week.

- These October disruptions do not appear enough to knock the U.S. out of its late-stage expansion but warrant ongoing monitoring.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.