Investment Strategy Brief

“One, Big, Beautiful Bill” on the Horizon

May 18, 2025

Executive Summary

- Congress is proceeding rapidly in crafting the budget reconciliation bill, exceeding policy experts’ expectations.

- The bill is likely to include both a full extension of the Tax Cuts and Jobs Act and a handful of wish-list items that may provide notable stimulus.

- Some cost-cutting provisions are likely to be included to build consensus, but net spending is still expected to increase.

- Many of the new stimulative spending provisions are front-end loaded and set to expire after 2028.

- Notable stimulus from fiscal policy could prove significant and help offset tariff headwinds.

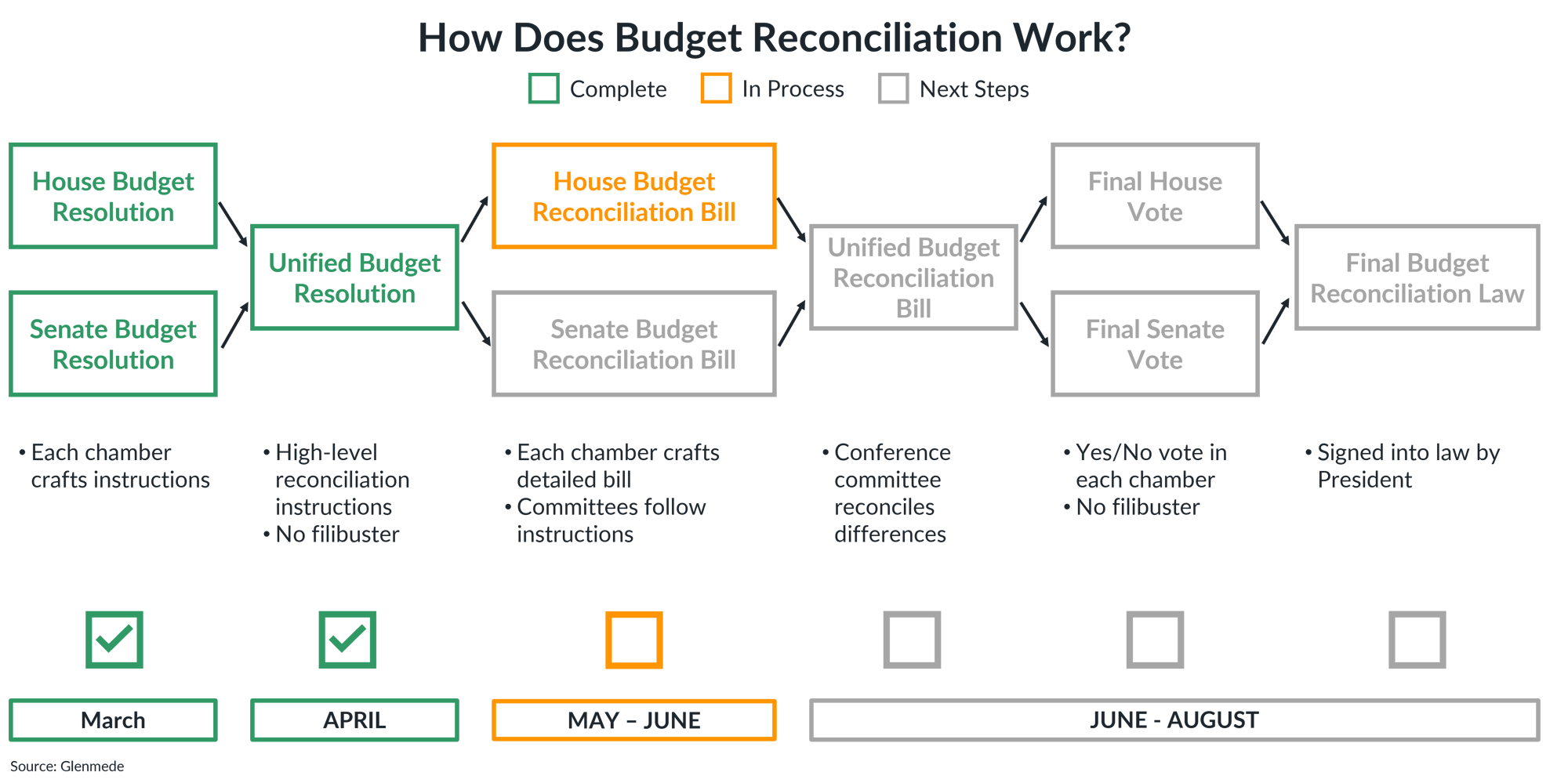

Budget reconciliation can be a complicated and often iterative process

The illustration shows a general overview of the U.S. federal government’s congressional budget reconciliation process. The visuals shown are for illustrative purposes only and should not be interpreted as an exhaustive guide for the budget reconciliation process.

- Navigating the federal budget process begins with the passage of a budget resolution, or broad fiscal guidelines, which was approved by both the House and Senate in April.

- The process has now advanced to key committees, such as the House Ways and Means Committee, in which detailed legislative language regarding the budget provisions is being drafted.

- Once both chambers finalize and reconcile their versions, the bill faces a final vote before being signed into law by the President, with an anticipated target of August due to the looming debt ceiling deadline.

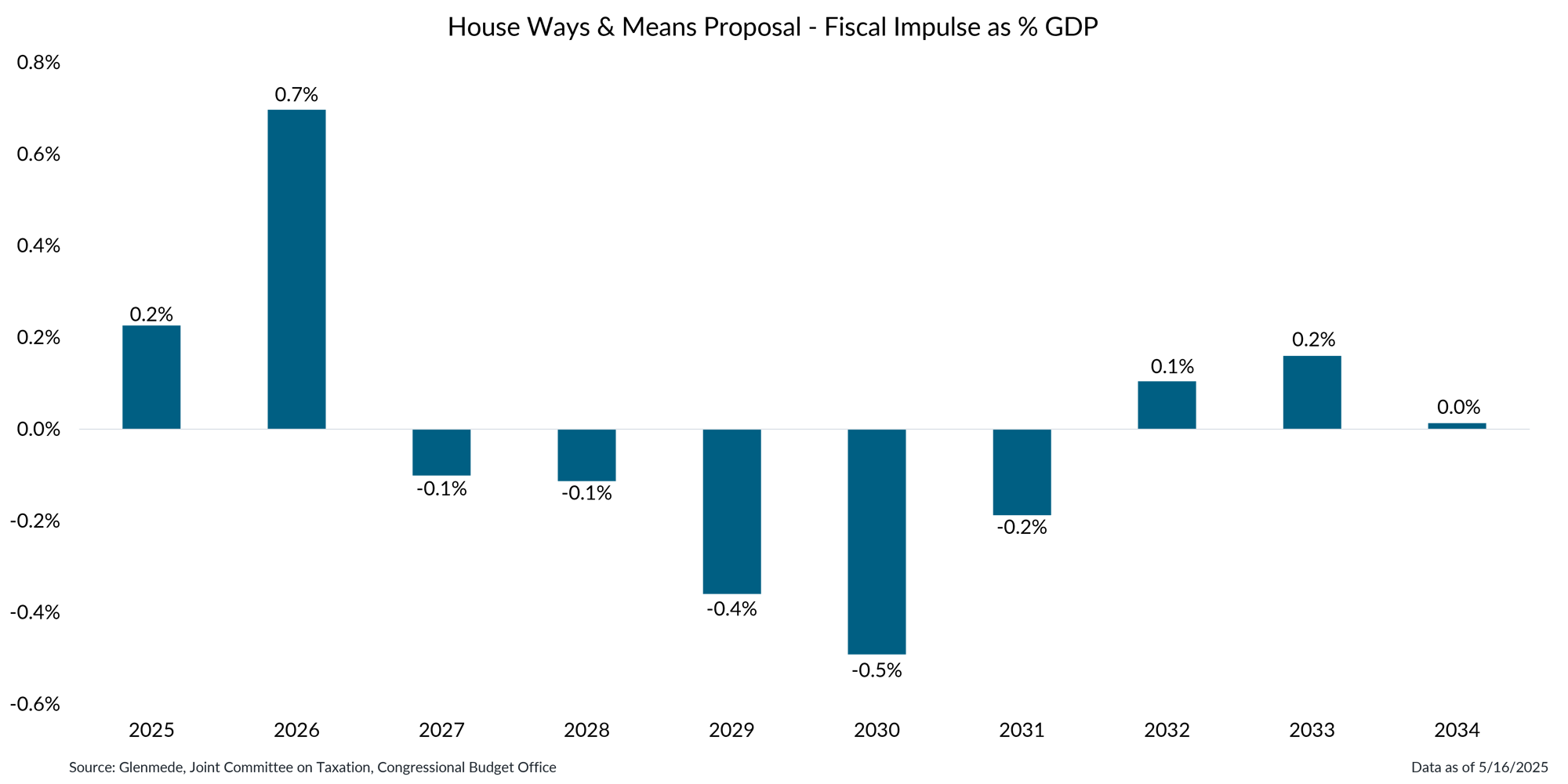

Front-end loading of new spending should provide notable stimulus in 2025 and 2026

Data shown represent the projected fiscal impulse as a percentage of nominal gross domestic product (GDP), which quantifies the impact of government fiscal policies relative to total economic output. Actual results may differ materially from projections.

- The House Ways and Means Committee’s latest markup of the bill features more new spending than expected, closely aligning with Senate priorities and likely requiring few, if any, changes to gain Senate approval.

- As currently structured, the budget proposal is expected to provide a notable economic stimulus in 2025 and 2026, helping to offset any potential impacts from tariffs.

- The Senate still may have some latitude to make changes on the margin, but based on their budget instructions, those adjustments are likely to tilt more stimulative.

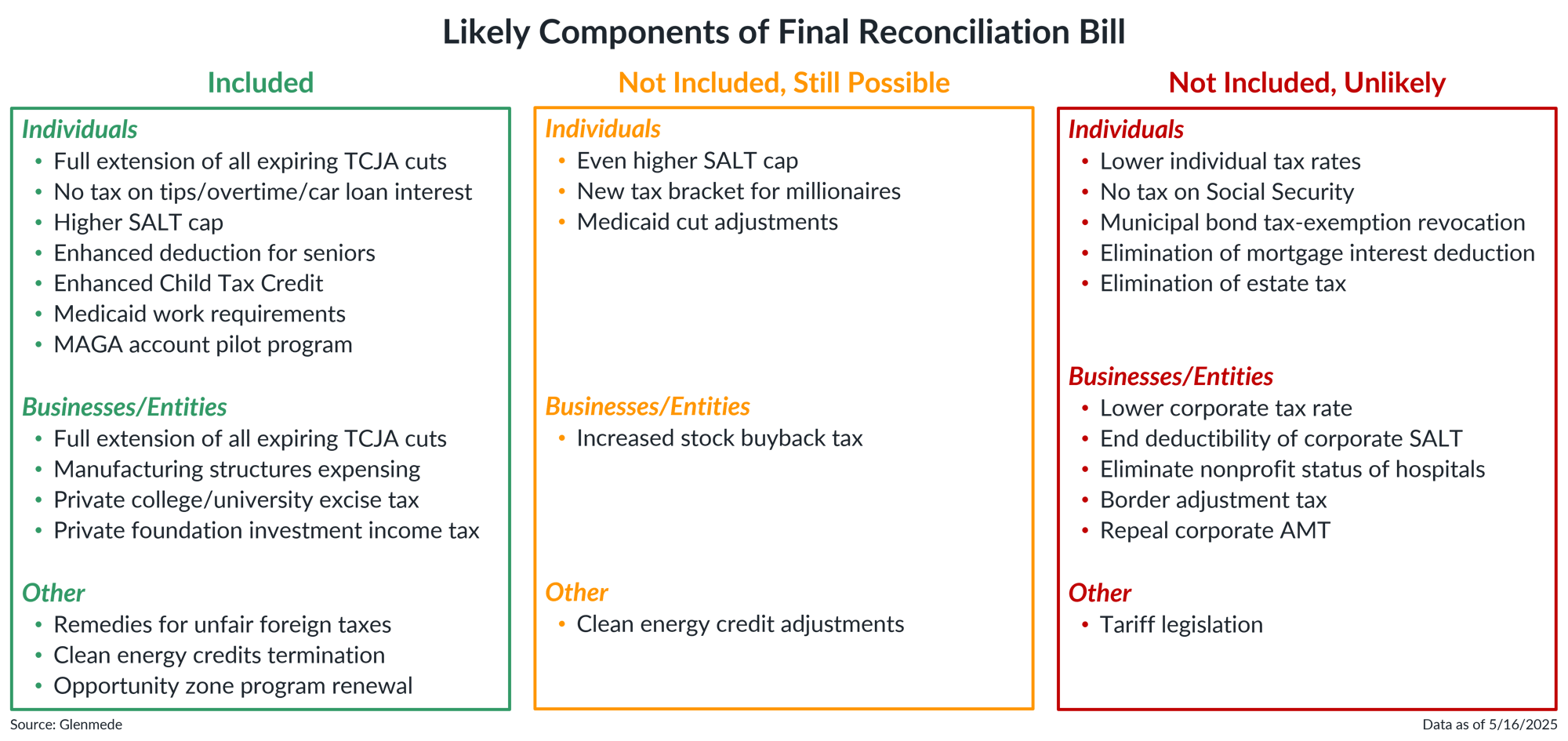

There still may be a few adjustments before the bill reaches the President’s desk

The information shown in the left panel are the highlights of what has been included in the draft form of the House of Representatives’ reconciliation bill. Shown in the middle panel are additional provisions that may be included in the final version of the House or Senate versions of the bill. Shown in the right panel are additional provisions that have not been and are unlikely to be included in the final version of the House or Senate versions of the bill. TCJA refers to the Tax Cuts and Jobs Act of 2017. SALT cap is the legislated cap on the deduction of state and local income taxes from federal income taxes. MAGA refers to the Money Account for Growth and Advancement program, which aims to set up savings accounts for children with contributions from the government to advance financial futures. AMT is the Alternative Minimum Tax. Actual results may differ materially from expectations.

- The scope of the House Ways and Means Committee’s version of the bill is larger than expected, delivering on several key administration priorities, including the full extension of the TCJA, tax breaks on tips/overtime and other targeted relief measures.

- While the contours of the bill have largely taken shape, a few provisions may be tweaked such as changes to the SALT cap and proposed Medicaid cuts before the final version is sent for the President’s signature.

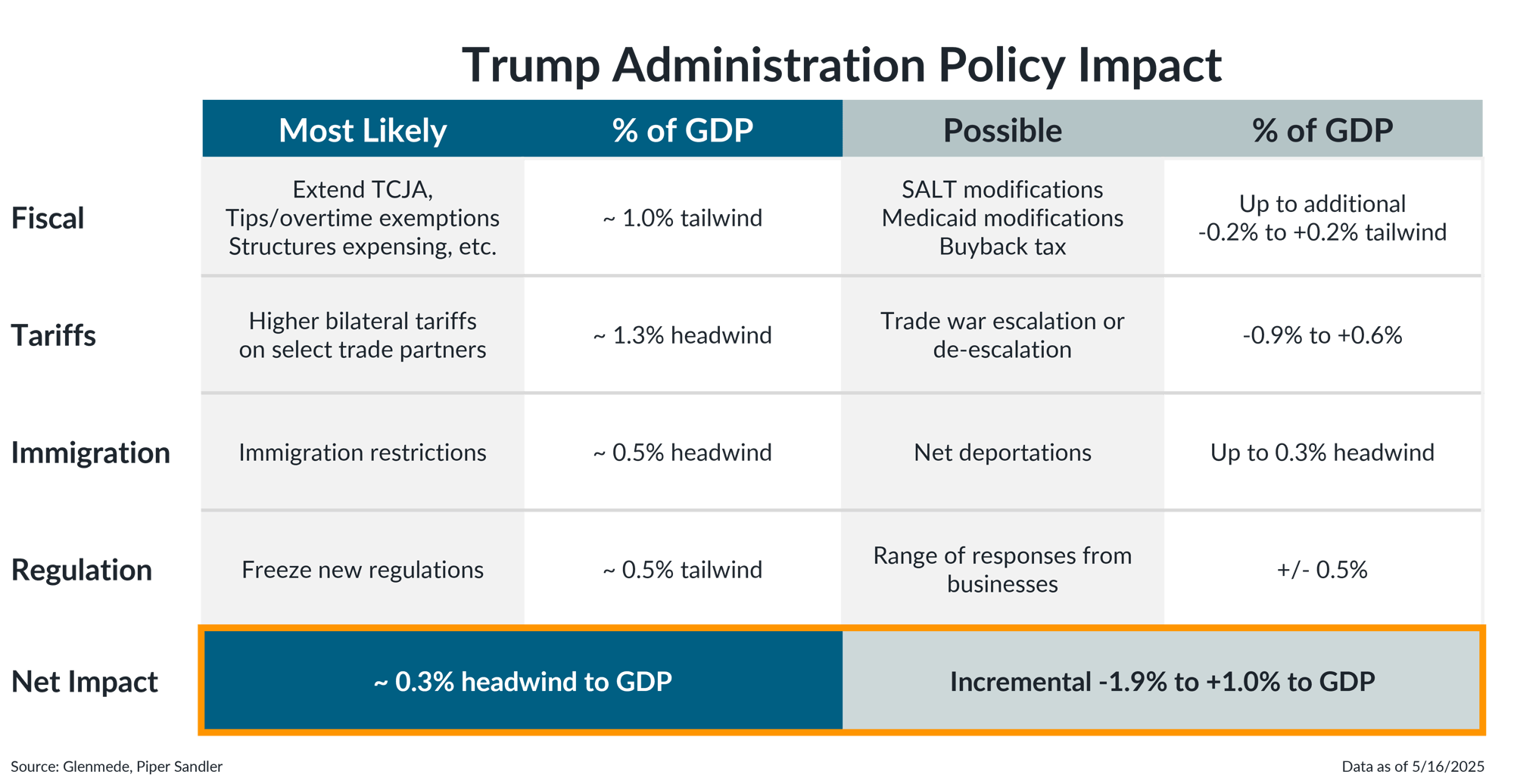

The aggregate likely policy impact still skews negative, with a range of possible outcomes on tax and trade

This information provides a general overview of the most likely Trump administration policy platforms and is not exhaustive. TCJA refers to the Tax Cuts and Jobs Act of 2017. SALT cap is the legislated cap on the deduction of state and local income taxes from federal income taxes. The “Impact” reflects Glenmede’s expectations for potential outcomes measured in impact to GDP growth, ranging from the most likely scenario to possible outcomes that include additional policy changes. Actual policies implemented and their resulting impacts may differ materially from expectations.

- At the same time as negotiations are incrementally de-escalating the economic headwinds from tariffs, fiscal policy is shaping to be more near-term stimulative than previously expected.

- The near-term net effect of the administration’s policies is most likely to be a modest headwind to economic growth, though there remains a range of possible outcomes depending on their ultimate execution.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.