Investment Strategy Brief

Policy Crosscurrents and the Labor Market

February 9, 2025

Executive Summary

- The labor market had been finding balance after a period in which labor demand had outpaced supply.

- The administration is aiming to reduce government headcount, driving employees back out into the job seeker pool.

- Immigration is likely to swing from a strong net contribution to labor force growth to a possible headwind.

- While the implementation of both policies is still fluid, the net effect is likely a tightening labor market and a return to higher wage growth.

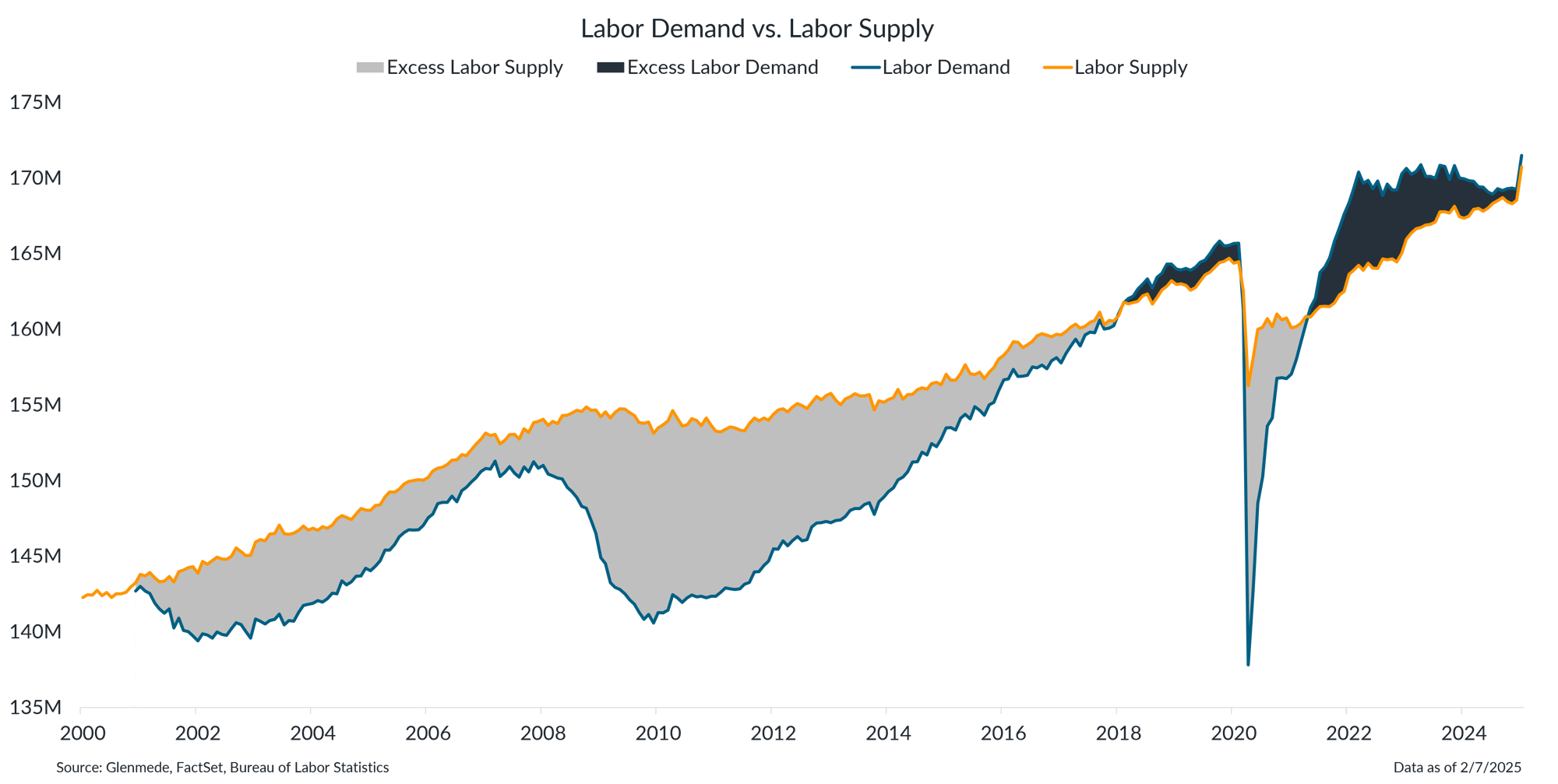

The labor market had been finding balance after a period where labor demand had outpaced supply

Shown in blue is labor demand defined as the number of employed individuals plus job openings. Shown in yellow is labor supply defined as the number of employed plus unemployed individuals. The light gray illustrates periods when supply outstripped demand and the dark gray illustrates those in which demand outstrips supply.

- While the labor market is gradually finding better balance, it continues to remain tight, with the demand for laborers exceeding the supply.

- The new administration has introduced new measures that are likely to reduce government employment and alter immigration policies, creating crosscurrents that will reshape the labor market.

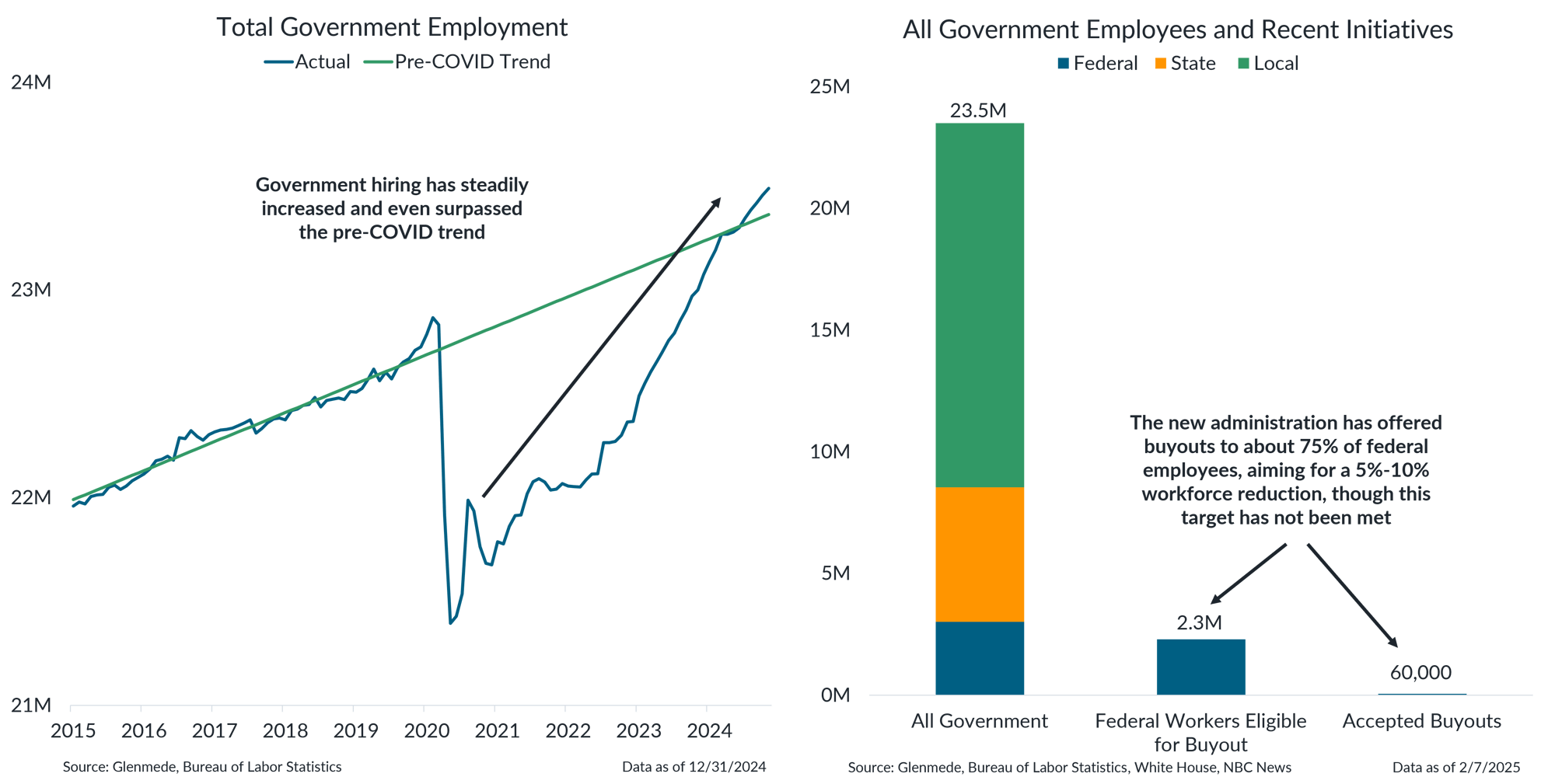

The administration is aiming to reduce government headcount, driving employees into the job seeker pool

Data shown in the left panel are the total number of government employees in blue, and the pre-COVID trend in green. Data shown in the right panel include total government headcount consisting of federal, state and local employees, the number of federal employees eligible for the administration’s buyout deal, and the estimated number of employees that have accepted the buyout.

- After a significant decline during the pandemic, the government rapidly increased hiring in the following years, not only catching up to, but surpassing the pre-COVID trend.

- In a cost-saving measure, the administration aims to reduce government headcount with policies like buyout deals that continue compensating employees for a set period after resignation.

- The reduction in government workers will drive many back to the private job seeker pool, potentially easing some of the current labor shortages in other industries.

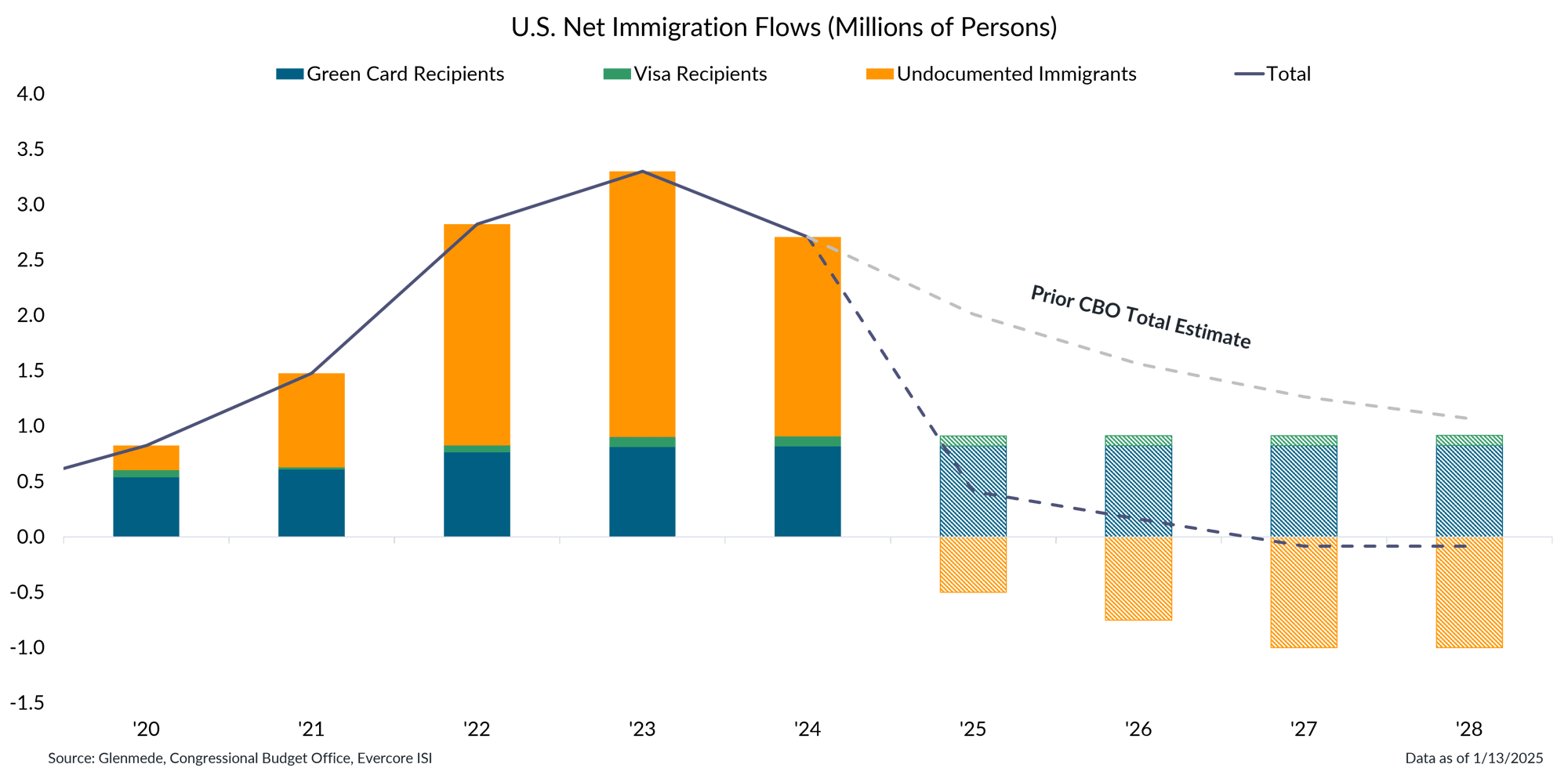

Immigration is likely to swing from a strong contribution to labor force growth to a possible headwind

Data are U.S. net immigration flows in millions of persons, broken down into three categories: green card recipients refers to permanent residents, visa recipients refers to Immigration and Nationality Act (INA) nonimmigrants (which includes temporary workers, students, business travelers and tourists) and undocumented immigrants. Solid bars and lines represent actual numbers. Hashed bars and dashed lines represent projections based on analyses from the Congressional Budget Office and Evercore ISI. Actual numbers may differ materially from projections.

- The administration’s immigration policies are expected to significantly reduce the net flow of persons entering the U.S. after a significant acceleration over the past few years.

- This could shrink the workforce, potentially leading to labor shortages and rising wages as businesses readjust to a tightening labor market.

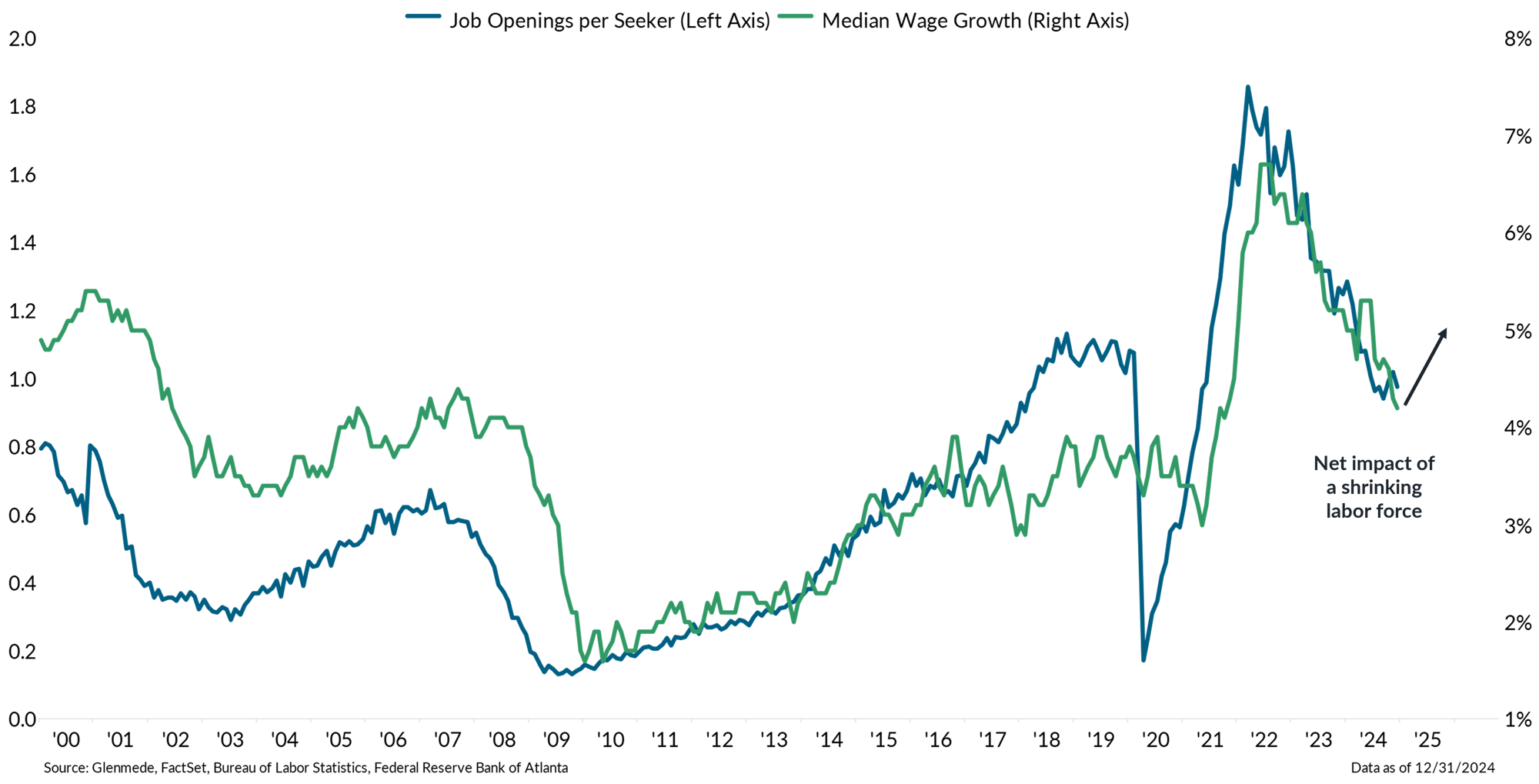

Recent policy shifts are likely to have offsetting effects on the labor market, leading to a modest tightening

Shown in blue and graphed along the left y-axis is the ratio of job openings to job seekers. Shown in green and graphed along the right y-axis are the Atlanta Fed’s median wage growth data, which are three-month annualized figures.

- The reduction in government workers could increase the job seeker pool, but the removal of an immigration tailwind may limit labor supply, resulting in a net tightening of the labor market.

- While the implementation of both policies is still fluid, the net effect is likely a tightening labor market and a resumption of higher wage growth.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.