Investment Strategy Brief

Productivity: A Stealth Growth Tailwind

November 24, 2024

Executive Summary

-

Recent economic data revisions have shed light on larger productivity gains since COVID than previously measured.

-

Further improvement in productivity has the potential to be reminiscent of previous innovation-fueled cycles.

-

The last few years’ significant investments in AI are the potential catalyst, but realization may still take some time.

-

Productivity has the potential to provide a tailwind that could help extend this late-stage economic expansion.

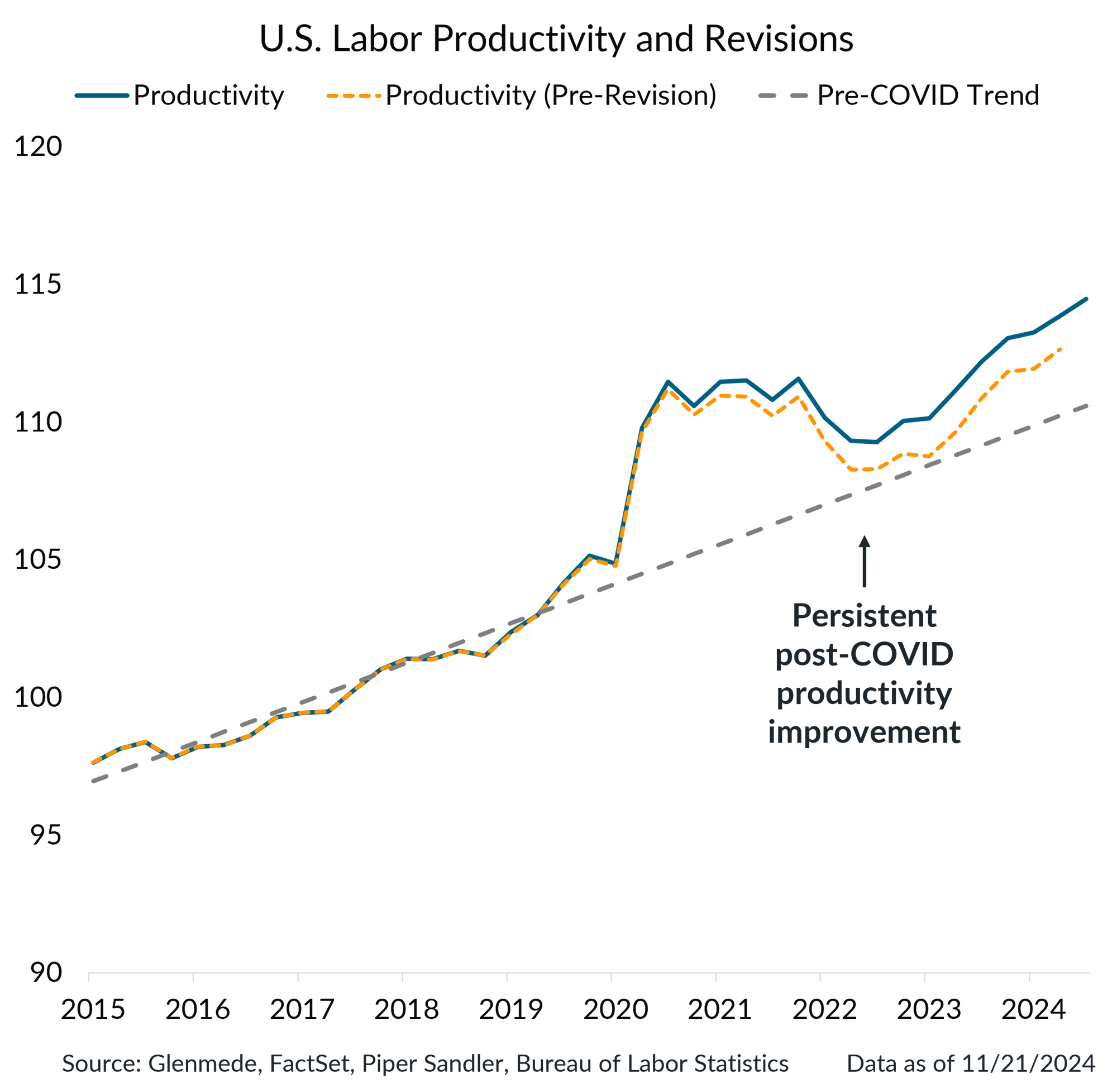

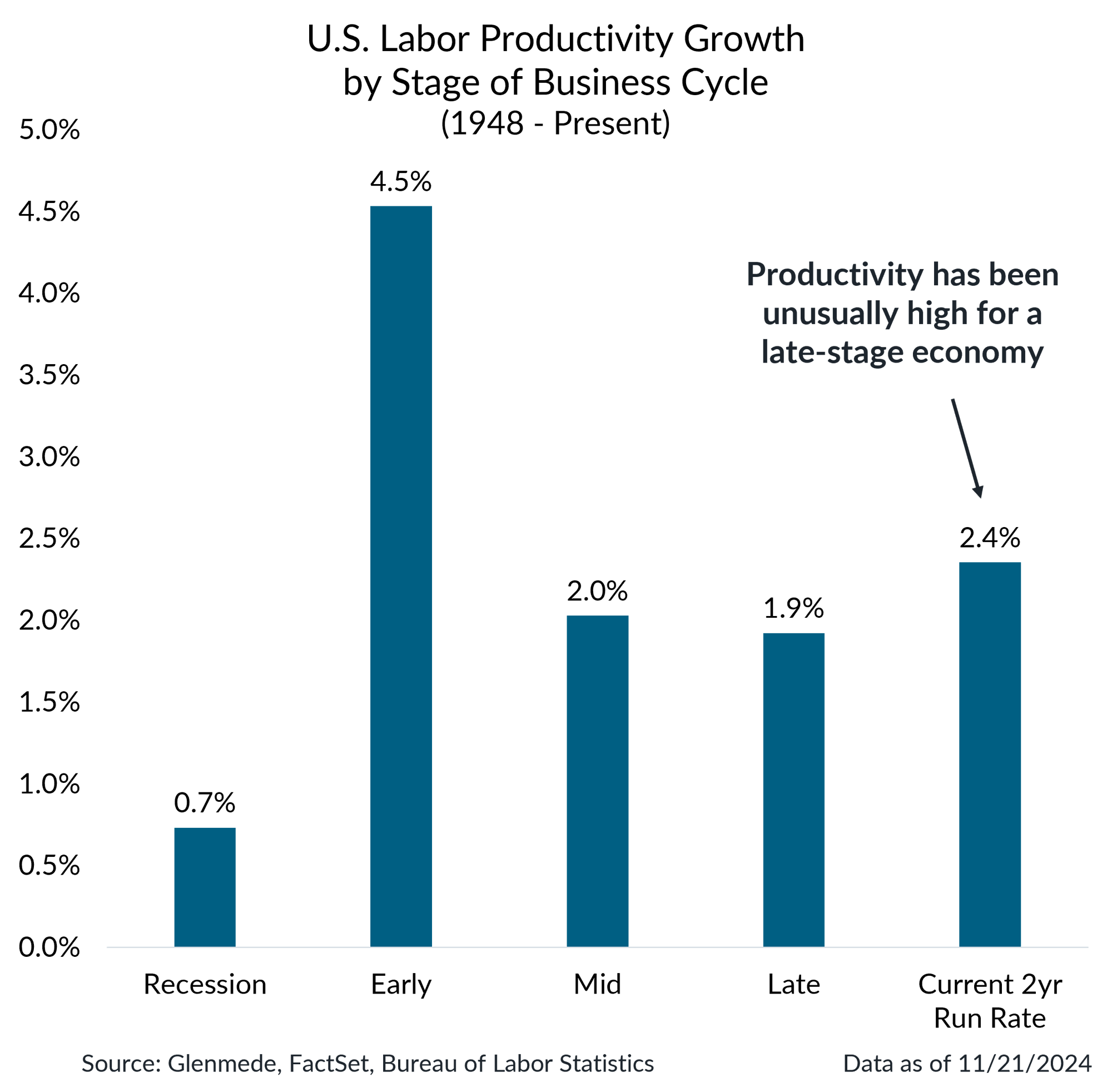

Recent revisions to economic data have made increased labor productivity more apparent

Shown in the left panel is U.S. non-farm labor productivity, measured as output per hour for all U.S. persons employed by non-farm businesses. Both final and pre-revision labor productivity figures are shown compared to the pre-COVID trendline based on 2015-2019 data. Shown in the right panel are average annualized growth rates in U.S. nonfarm productivity by stages of the business cycle. Business cycle is based on several factors including GDP gap which is the difference between a country's actual gross domestic product (GDP) and its potential GDP. Past performance may not be indicative of future results.

- The Bureau of Labor Statistics recently released a set of economic revisions, making more apparent the post-COVID gains in productivity due to new technologies and streamlined operations.

- The recent boost to productivity looks unusually high for a late-stage economic expansion and may be a contributing factor that helps extend the cycle.

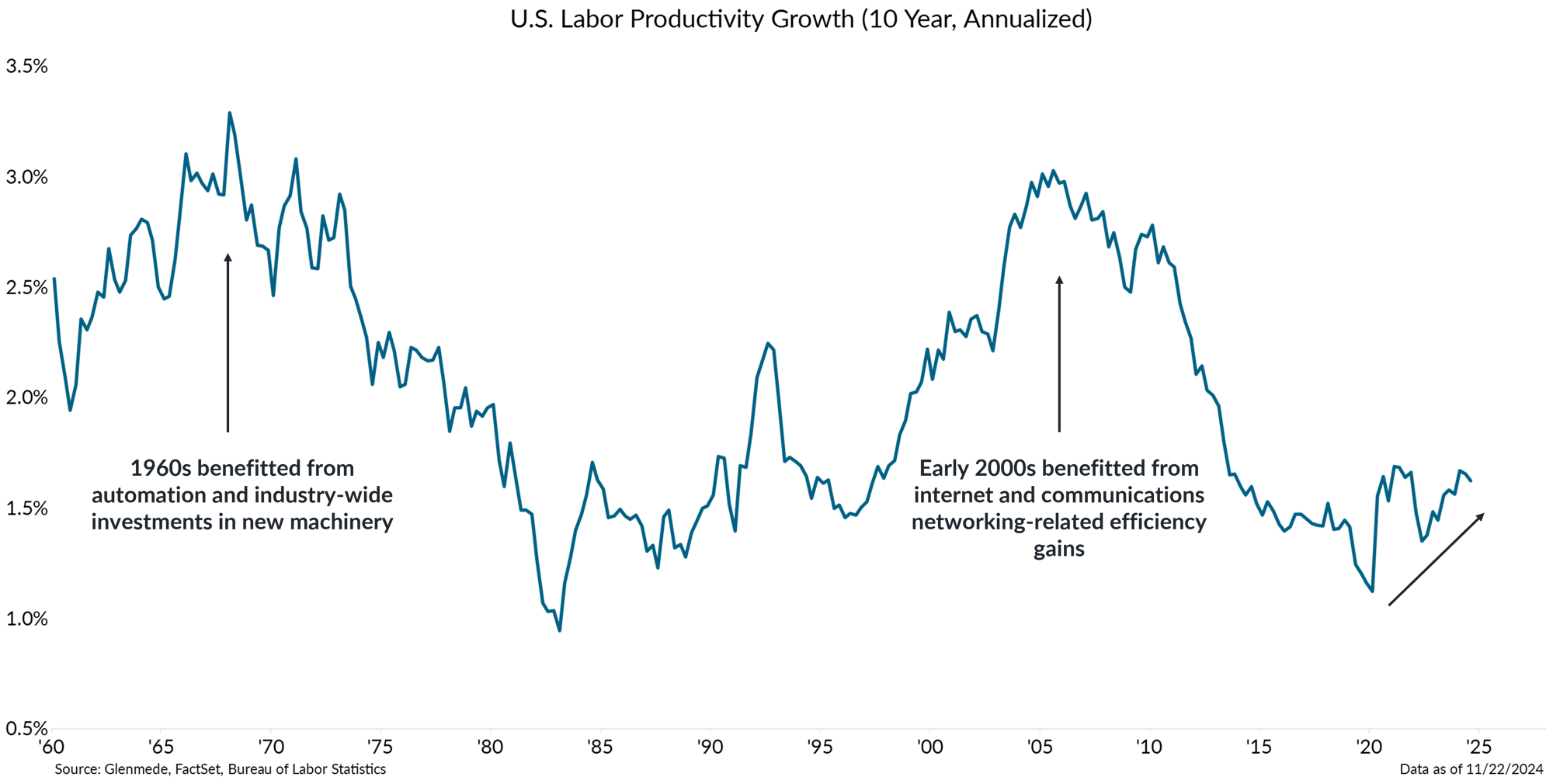

Labor productivity improvement has the potential to be reminiscent of past cycles in the 1960s and early 2000s

Shown is 10-year annualized U.S. non-farm labor productivity growth, measured as output per hour for all U.S. persons employed by non-farm businesses. Past performance may not be indicative of future results.

- Recent improvements in labor productivity echo patterns seen in innovation-driven cycles of the 1960s and early 2000s, hinting at a potential revival of long-term efficiency growth.

- A slight uptick in U.S. labor productivity suggests a rebound that could support sustained economic expansion if the trend continues.

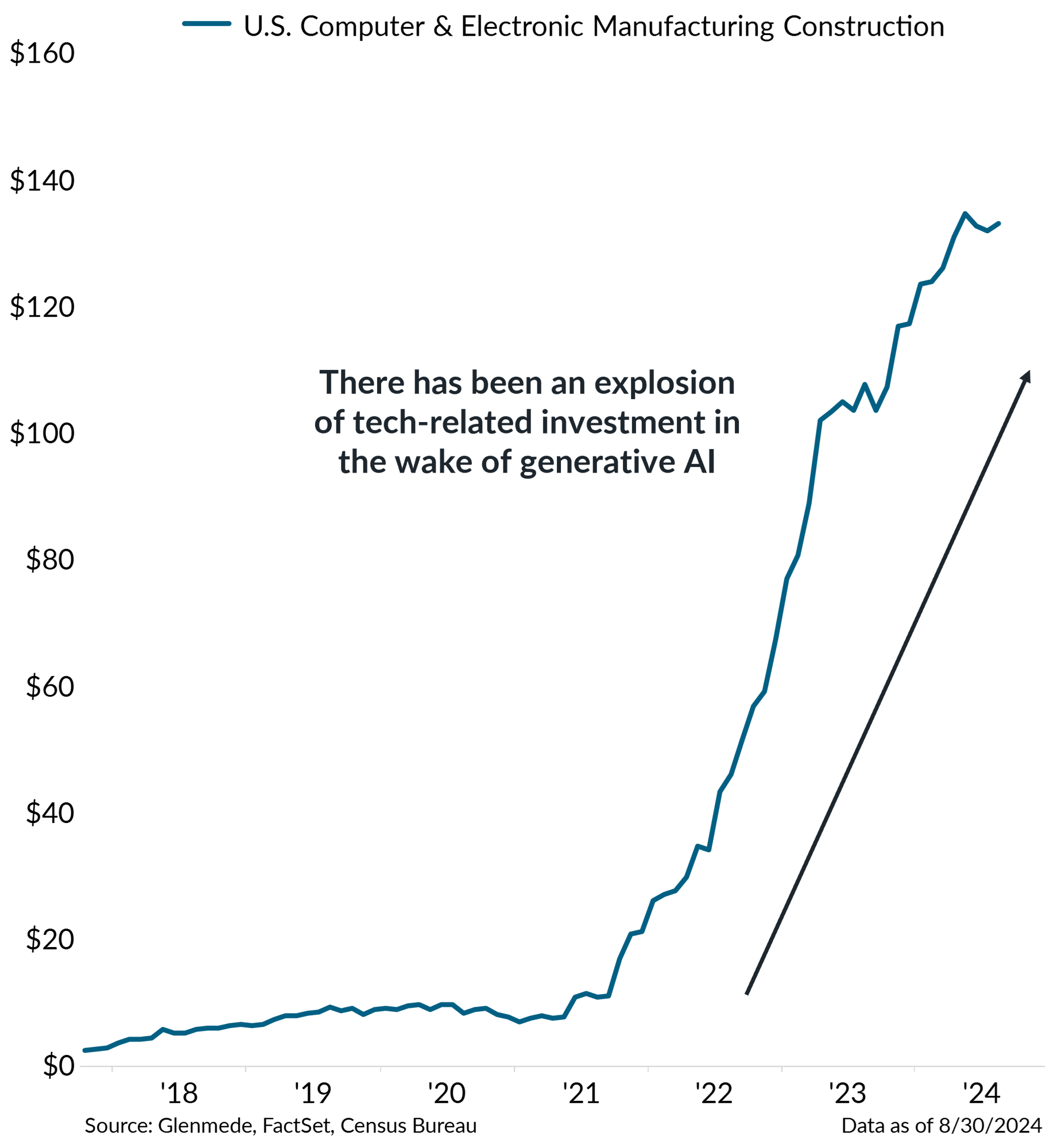

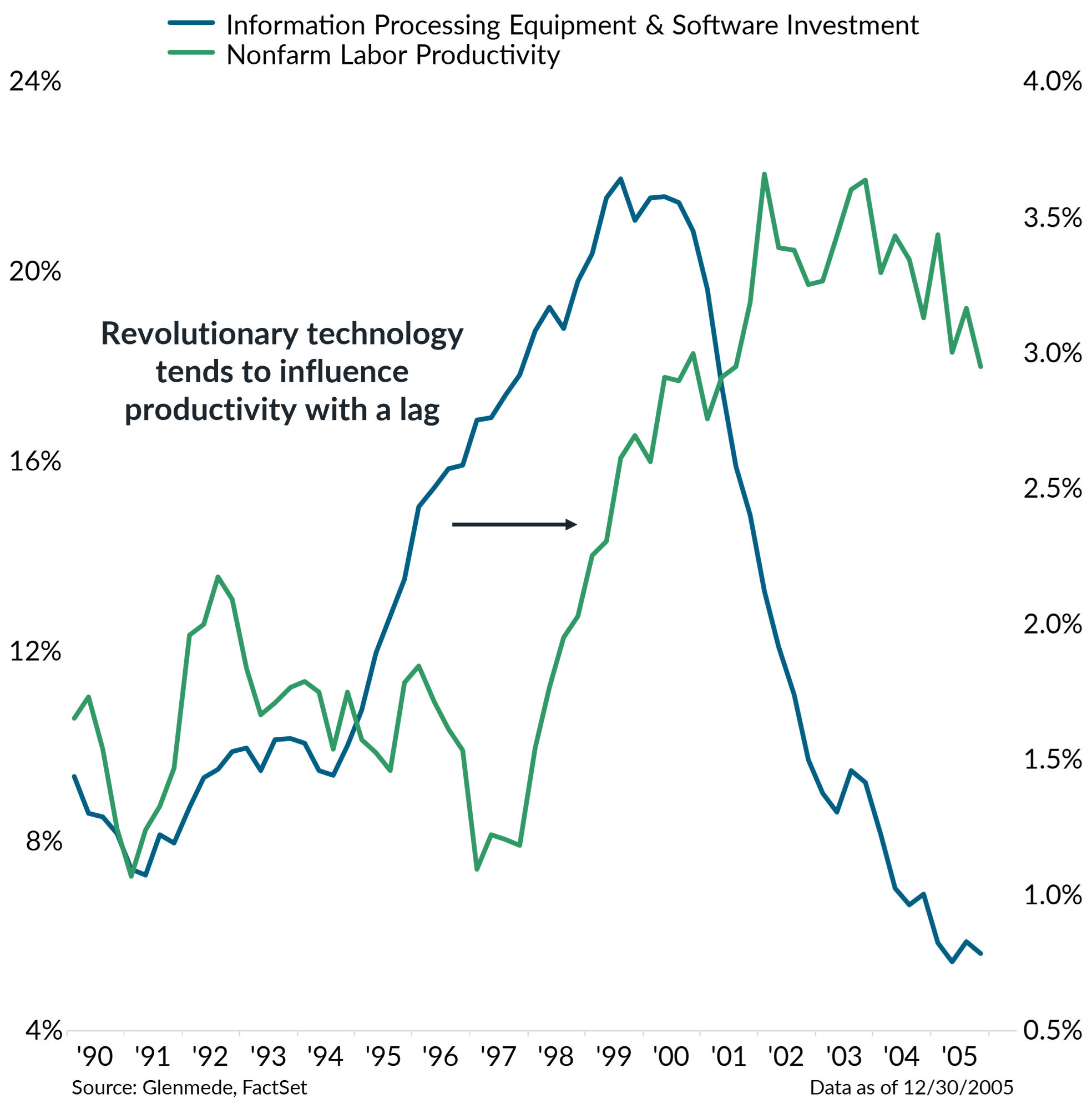

The last few years’ investments targeting AI are potential catalysts for tomorrow’s productivity growth

Shown in the left panel is U.S. manufacturing construction put in place for computer, electronic or electrical manufacturing in billions of U.S. dollars on a seasonally-adjusted basis. Shown on the right panel are 5-year annualized growth rates of private fixed investment in information processing equipment/software in blue (left y-axis) and nonfarm labor productivity in green (right y-axis).

- Since 2021, investment in U.S. computer and electronic manufacturing construction has surged, driven by growing interest in artificial intelligence.

- Revolutionary technologies often impact productivity with a lag, as investments gradually translate into efficiency gains.

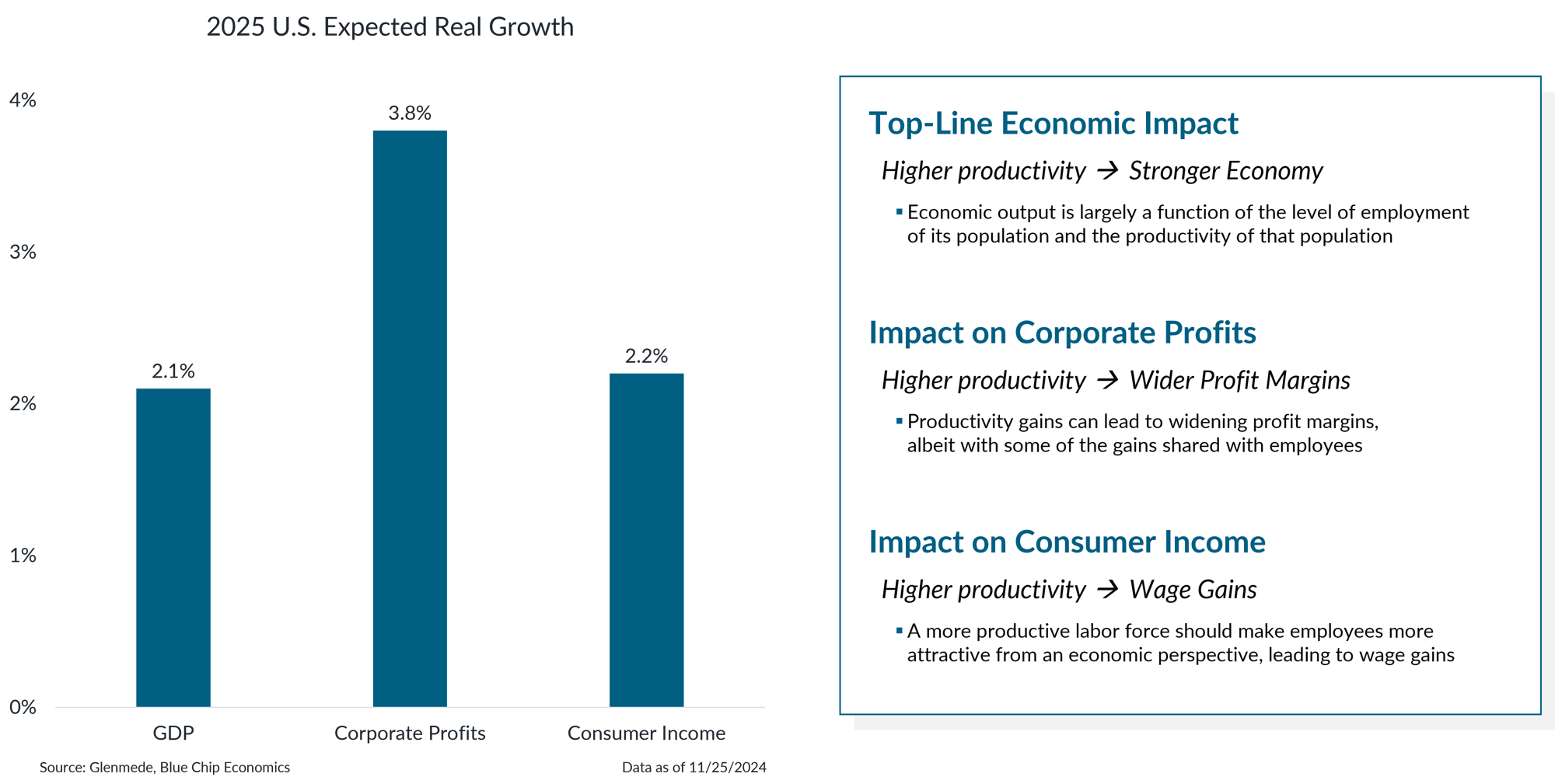

Productivity improvements can provide a tailwind to the economy, corporate profits and consumer income

The 2025 expected real growth projections reflect the consensus average of estimates from economists, sourced from the November 2024 release of Blue Chip Economic Indicators. These figures represent top-down estimates based on a broad survey of economic forecasts. Actual results may differ materially from projections.

- Productivity improvements can be a significant driver behind a strong economy, which is dependent upon a fully employed and productive population.

- Productivity often leads to some combination of higher profits for corporations and growth in household incomes.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.