Investment Strategy Brief

Q2 2025 Market Review

July 1, 2025

Executive Summary

-

Despite tariff uncertainty and Middle East tensions, equity markets proved remarkably resilient in the second quarter of 2025.

-

Diversification has proven its worth this year and provided stark reminders of the costs of wholesale market timing.

-

Trade policy has found a tentative footing, but the outcome of trade negotiations, the reconciliation bill, and Fed policy will be key.

-

The risk of recession has fallen as trade policy has softened, though the path taken from here remains uncertain.

-

Investors should maintain neutral positioning while actively looking to rebalance and diversify portfolios.

Equity markets whipsawed in Q2, while diversified investment approaches continued to prove their worth

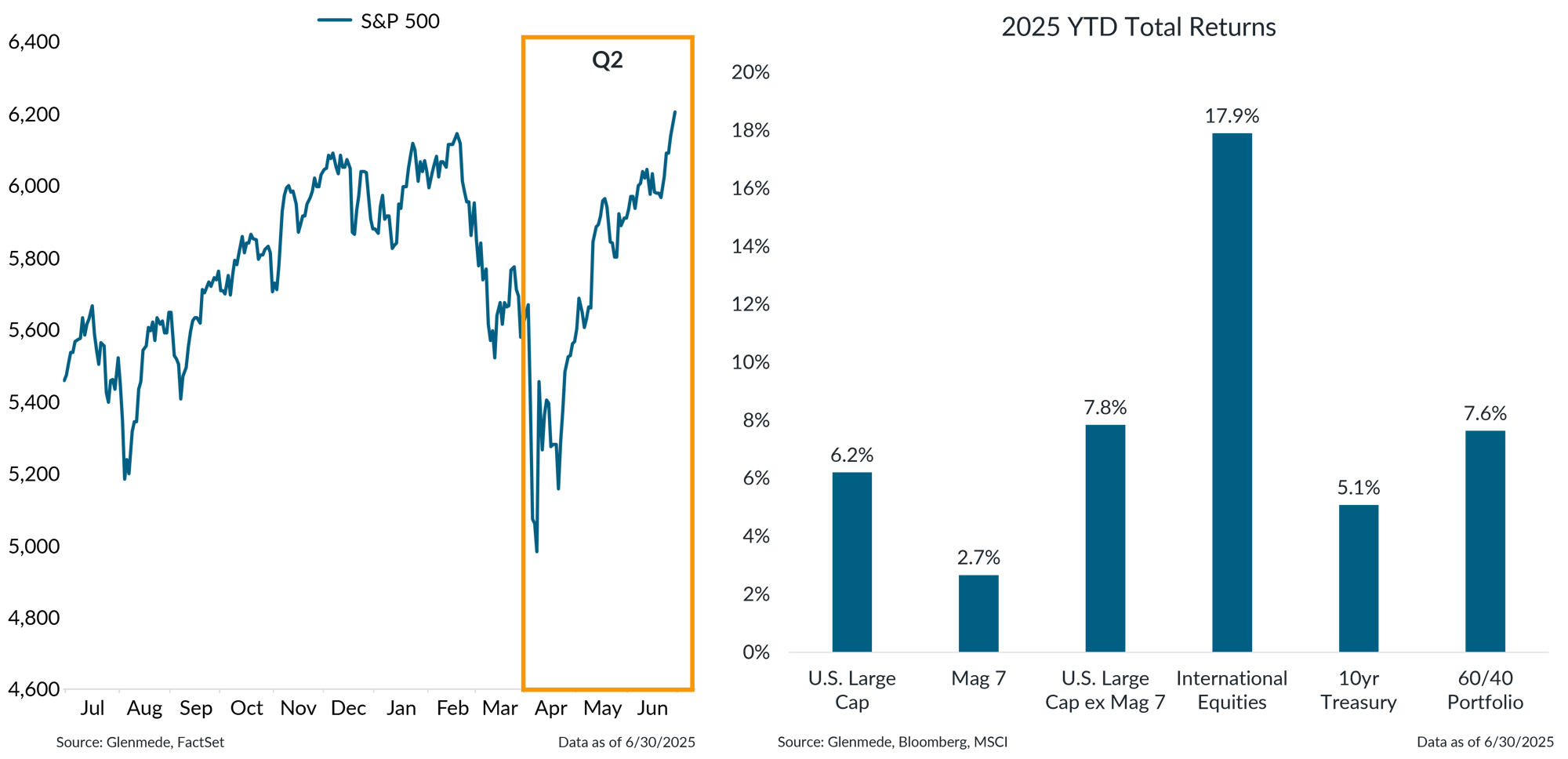

Shown in the left panel is the prior one-year history of the S&P 500, which is a market capitalization weighted index of U.S. large cap stocks. Shown in the right panel are 2025 year-to-date total returns for U.S. Large Cap (S&P 500), Magnificent 7 (Apple, Alphabet, Amazon, Meta, Microsoft, Nvidia, Tesla), U.S. Large Cap ex Magnificent 7 (S&P 500 ex-Mag 7), International Equities (MSCI All Country World ex-U.S. Index), 10yr U.S. Treasuries (Bloomberg U.S. Treasury Bellwethers 10Y Index) and 60/40 Portfolio (60% MSCI ACWI Index, 40% Bloomberg U.S. Aggregate Index). References to individual securities should not be construed as a recommendation to buy, hold or sell. Past performance may not be indicative of future results. One cannot invest directly in an index.

- In the wake of the “Liberation Day” tariff announcement, the S&P 500 briefly flirted with a bear market, falling nearly 20% from its all-time high.

- Following one of the worst weeks for the index since 2020, the S&P 500 posted a ~10% single session gain, highlighting the opportunity costs for investors engaging in wholesale market timing efforts amid peak uncertainty and market fears.

- International equity markets continued to prove their place in diversified equity portfolios, with both developed and emerging markets outperforming, assisted by a weaker U.S. dollar.

Trade policy has found a tentative footing, but the outcome of trade negotiations will be key

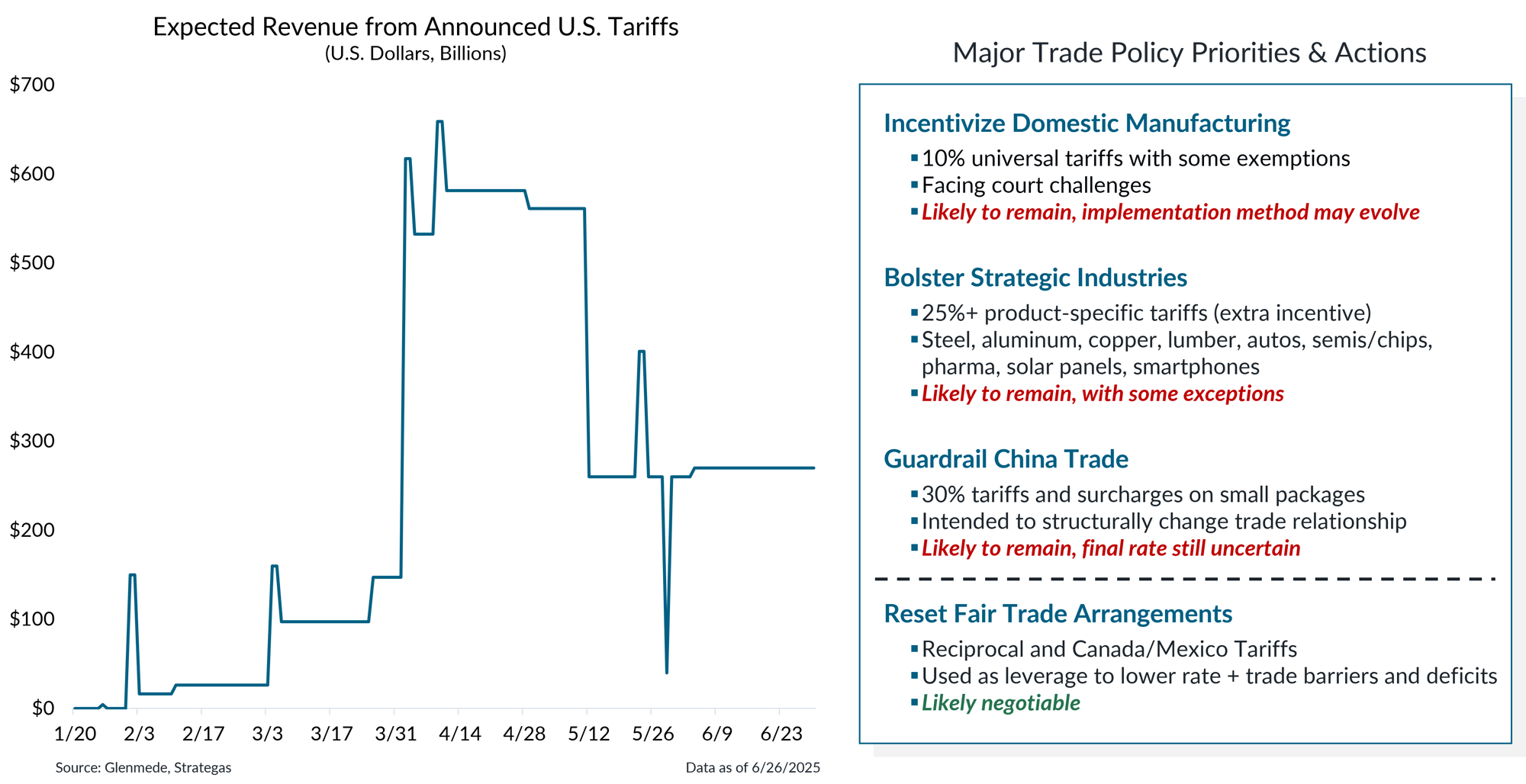

Shown in the left panel is a timeline of the cumulative amount of expected revenue generated from tariffs announced as of each day since President Trump’s second inauguration, measured in billions of U.S. dollars. Historical and projected tariff figures are derived from internal and third-party sources believed to be reliable. Actual results may differ materially from expectations.

.

- Changes in trade policy consumed the headlines in Q2, with April seeing the most volatility with the implementation of tariffs and then the subsequent 90-day pause.

- Trade negotiations with key trading partners are ongoing, with some, such as the U.K. and China securing some relief, while others, such as Japan, the EU, and India have yet to reach an agreement.

- Overseas, tensions flared in the Middle East, but fears that a broader conflict in the region would disrupt global energy markets proved short-lived.

The “One, Big, Beautiful Bill” may provide near-term stimulus, partly offsetting tariff headwinds

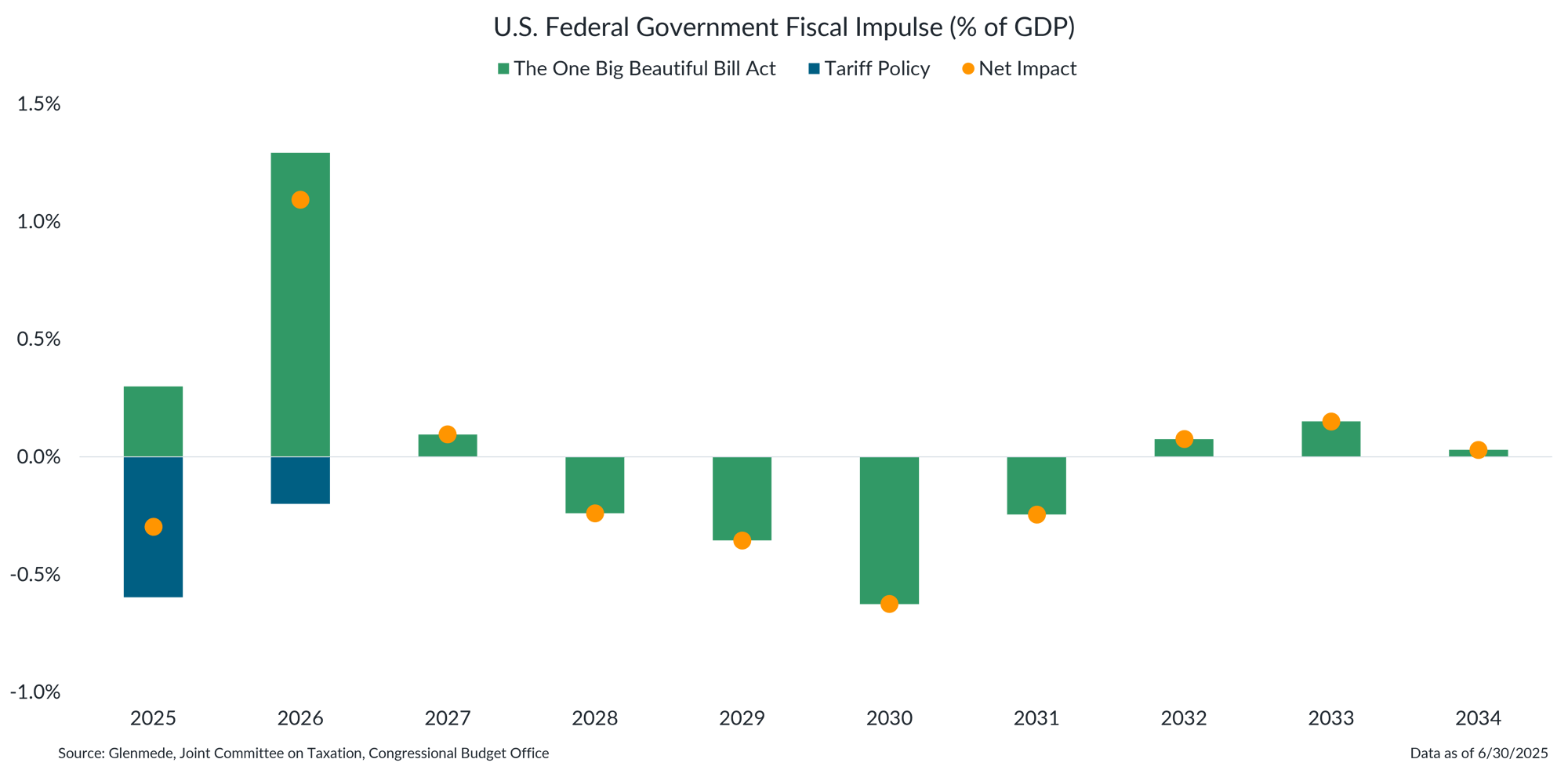

Data shown are the expected fiscal stimulus effects by year due to key policy changes associated with The One Big Beautiful Bill Act in the form passed by the U.S. House of Representatives on May 22, 2025 (green bars) and tariffs implemented through executive action between January 6 and May 13, 2025 (blue bars). Orange dots represent the net impact between both dimensions of policy change. The analysis does not include the impact of tariffs announced but not yet implemented, nor the effects of trade agreements that have not yet reached a legally binding stage. Actual results may differ materially from expectations and are subject to change alongside adjustments to fiscal policies.

-

New spending and proposed cuts in the reconciliation bill under discussion in Congress are expected to help offset the potential economic headwinds from tariffs.

-

Investors should expect the outcome of negotiations regarding the One Big Beautiful Bill Act to be a key market catalyst in Q3 ahead of a late-August debt ceiling deadline.

Softened tariff proposals have tempered recession risks, though the path taken from here remains uncertain

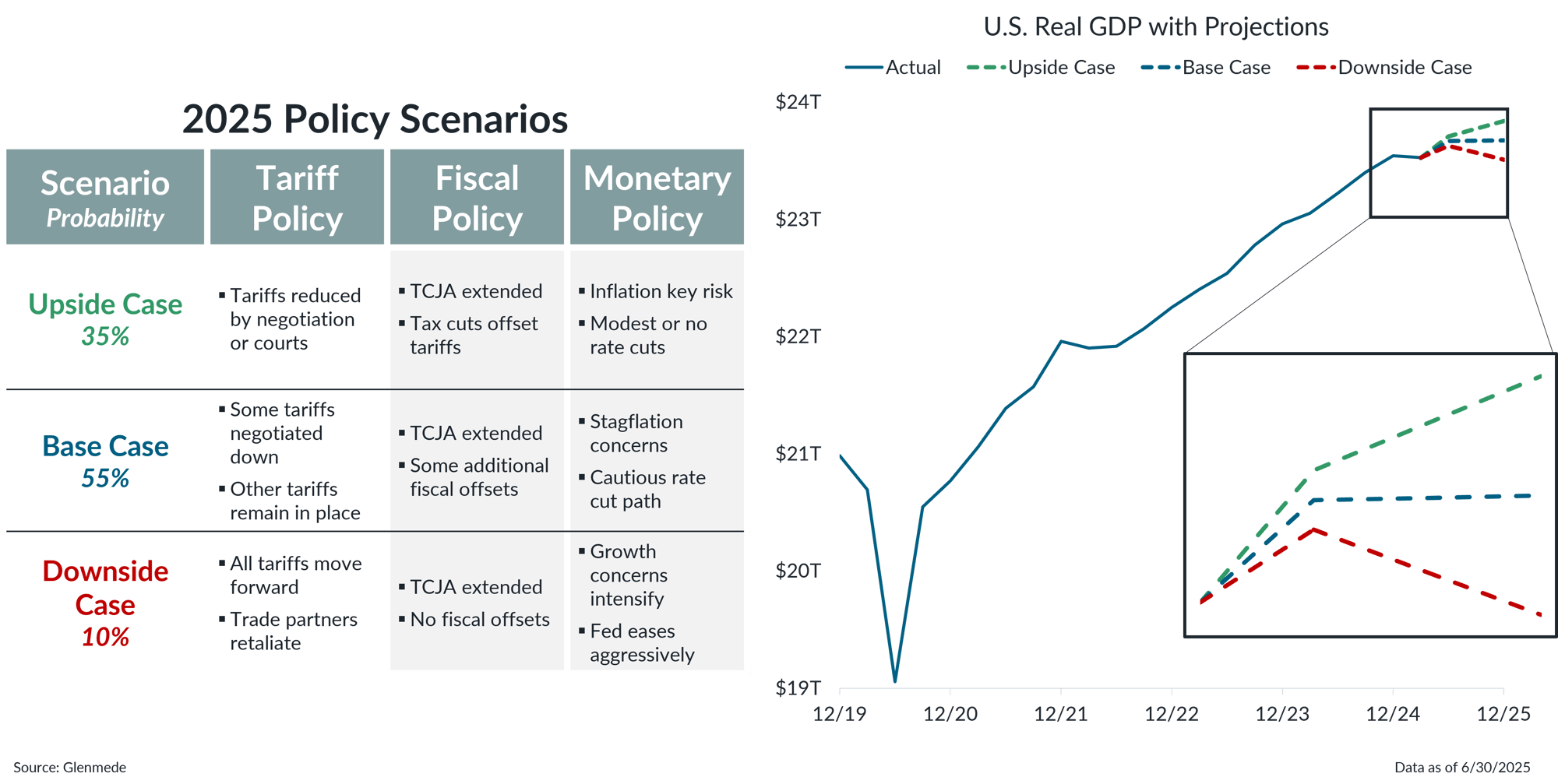

Shown in the left panel are hypothetical scenarios. TCJA refers to the Tax Cuts & Jobs Act of 2017. Shown in the right panel in solid blue is actual U.S. real gross domestic product (GDP) on a seasonally adjusted annualized basis by quarter. The dashed lines represent Glenmede projections. Actual results may differ materially from expectations or projections.

-

The base case assumes an estimated tariff headwind of 1.3% and a reconciliation bill that includes a full extension of the TCJA, along with additional provisions, which may result in slower growth in the second half of the year.

-

The upside case assumes marginally more successful trade negotiations leading to a smaller tariff headwind and a reconciliation bill that delivers a notable amount of stimulus.

-

While unlikely, the downside case assumes a breakdown in trade negotiations as well as a less stimulative reconciliation bill, which could lead to a more challenging economic environment.

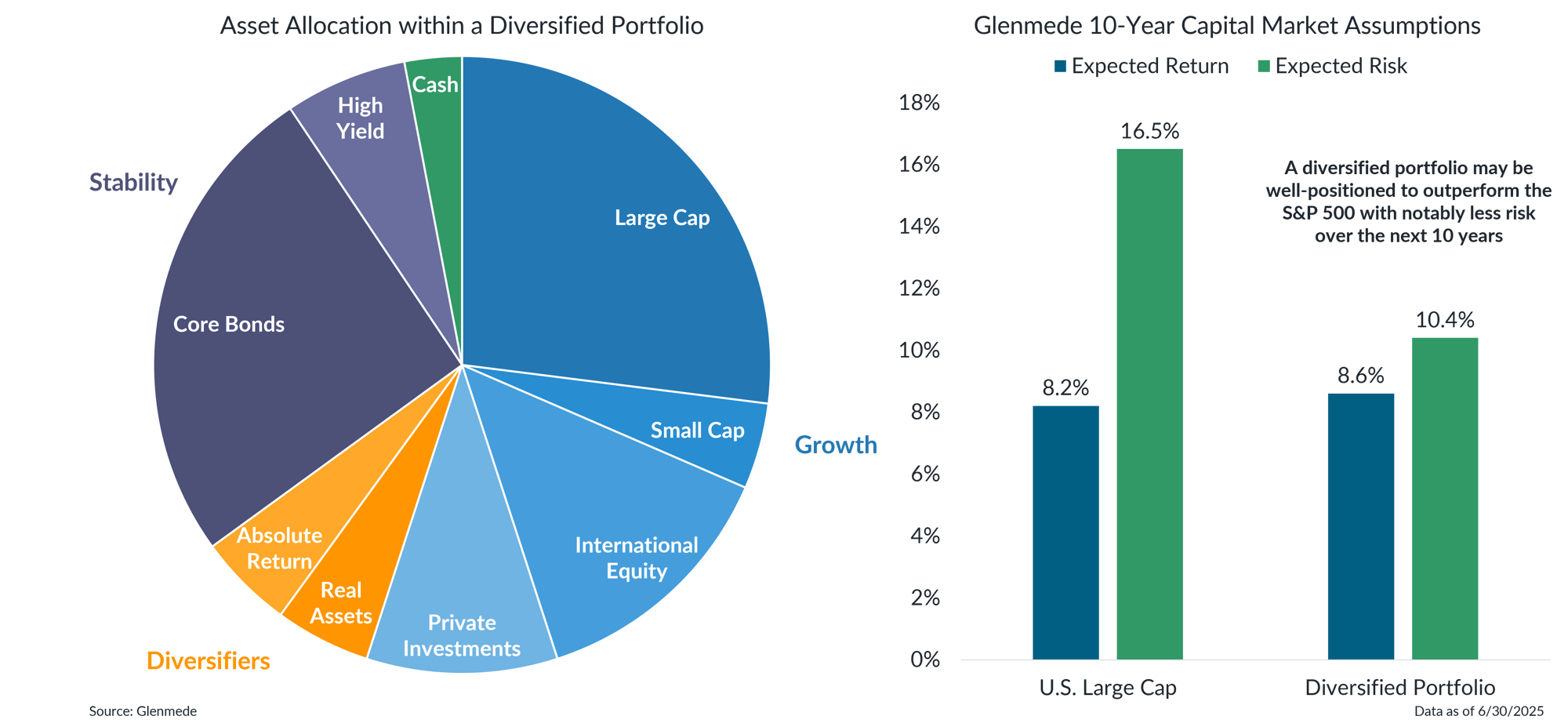

A diversified portfolio should continue to reduce risks and enhance potential returns

The chart in the left panel is provided solely for illustrative purposes to depict a hypothetical portfolio diversified across various asset classes and should not be construed as a recommendation to invest in any particular asset class or combination of asset classes. Investors should consult with their advisor to determine an appropriate asset allocation for their particular circumstances. Data shown in the right panel reflects Glenmede’s proprietary capital market assumptions for the next 10 years for U.S. Large Cap (represented by the S&P 500) and a Diversified Portfolio (represented by Glenmede’s All Asset+ Growth with Income model portfolio). Expected risk reflects the standard deviation of Glenmede’s expected asset class returns. Actual results may differ materially from expectations.

-

Glenmede’s capital market assumptions project that a well-diversified portfolio may be well-positioned to outperform the S&P 500 with less risk over the next 10 years.

-

Investors should maintain a neutral risk stance while staying alert for opportunities for thoughtful rebalancing and diversification.

This material is provided solely for informational and/or educational purposes and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Any company, fund or security referenced herein is provided solely for illustrative purposes and should not be construed as a recommendation to buy, hold or sell it. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.