Investment Strategy Brief

Reconciliation Bill Becomes Law

July 6, 2025

Executive Summary

- The long-awaited One Big Beautiful Bill Act has passed Congress and been signed into law by the President.

- At a cost of $3.3 trillion, the Bill includes a large amount of the President’s wish list but has some notable exclusions.

- The new tax legislation may provide near-term fiscal stimulus, partly offsetting tariff headwinds.

- The One Big Beautiful Bill Act is expected to rank among some of the most stimulative major tax measures to date.

- The stimulus associated with the new tax law should help offset tariff headwinds and broaden the path for continued economic expansion.

The long-awaited reconciliation bill has passed Congress and been signed into law by the President

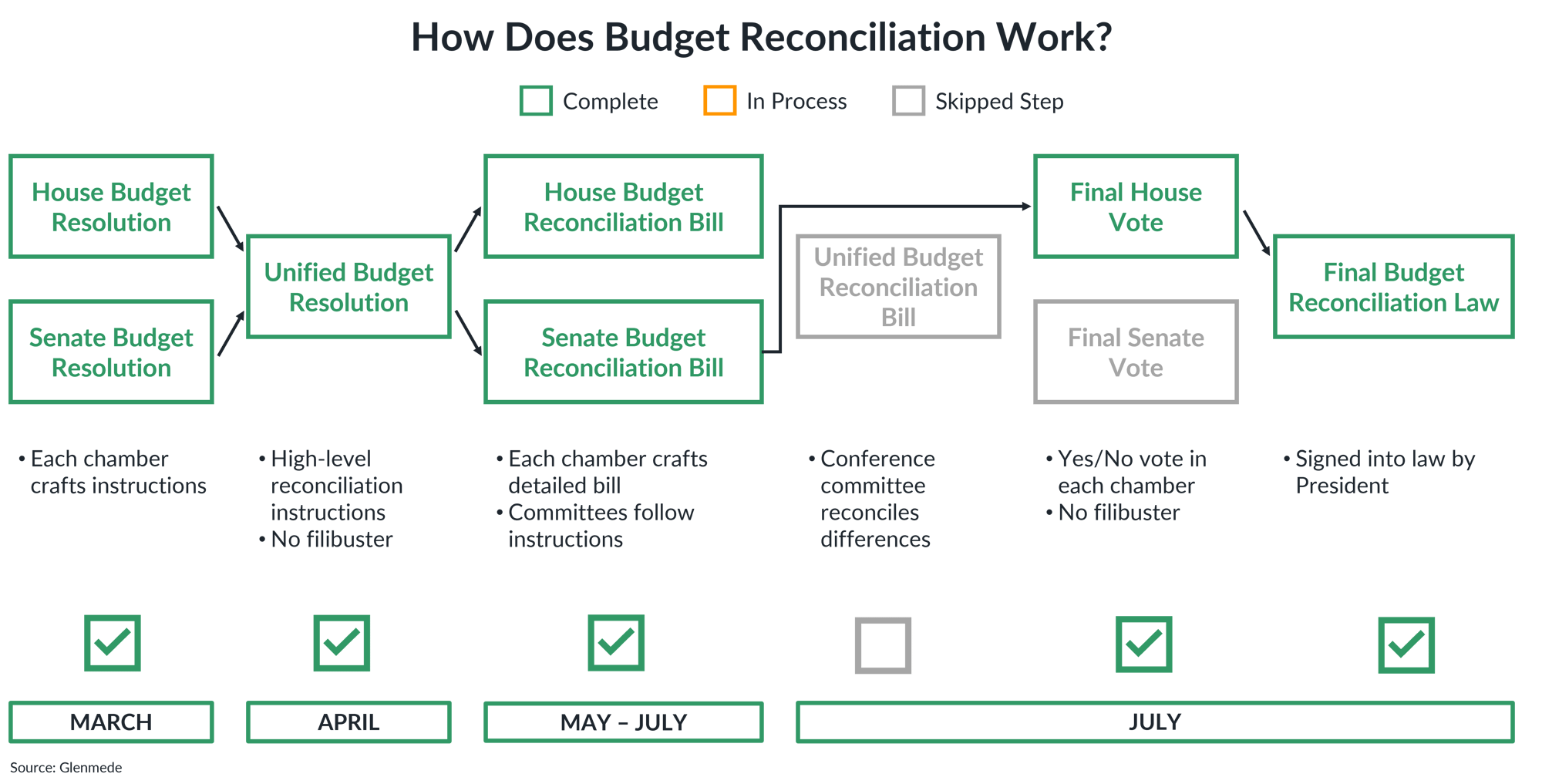

The illustration shown is a general overview of the US federal government’s congressional budget reconciliation process. The visuals shown are for illustrative purposes only and should not be interpreted as an exhaustive guide for the budget reconciliation process.

- Congress ushered along the One Big Beautiful Bill Act last week, with the House of Representatives taking up the Senate’s version of the legislation and bypassing the conference committee process.

- Facing a tight timeline to meet their self-imposed July 4th deadline, the GOP was able to secure enough votes to pass the One Big Beautiful Bill Act, which became law after the President’s signature.

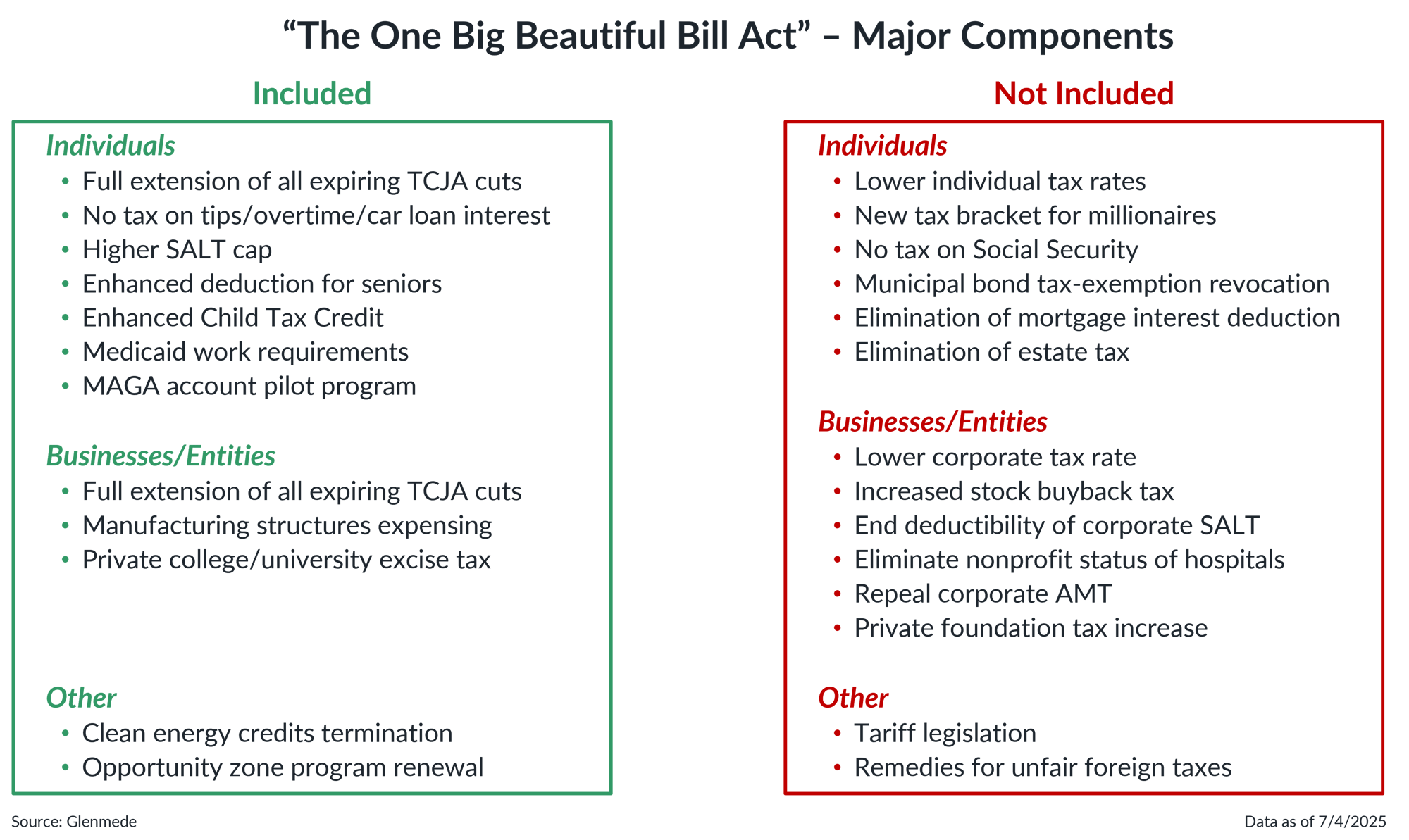

At a cost of $3.3T, the Bill includes a large amount of the President’s wish list but has some notable exclusions

The information shown in the left panel are the highlights of what has been included in The One Big Beautiful Bill Act. Shown in the right panel are additional provisions that have not been included in the final version. TCJA refers to the Tax Cuts and Jobs Act of 2017. SALT cap is the legislated cap on the deduction of state and local income taxes from federal income taxes. MAGA refers to the Money Account for Growth and Advancement program, which aims to set up savings accounts for children with contributions from the government to advance financial futures. AMT is the Alternative Minimum Tax. Actual results may differ materially from expectations.

- The final legislation includes the full extension of the 2017 Tax Cuts and Jobs Act, provisions from which were scheduled to expire at the end of this year.

- Also included are deductions for taxes on tips/overtime, car loan interest, a raised SALT cap for individuals, and expensing of fixed structures for businesses.

- Spending cuts include increased work requirements for Medicaid and SNAP and a rollback of clean energy subsidies from the Inflation Reduction Act of 2022.

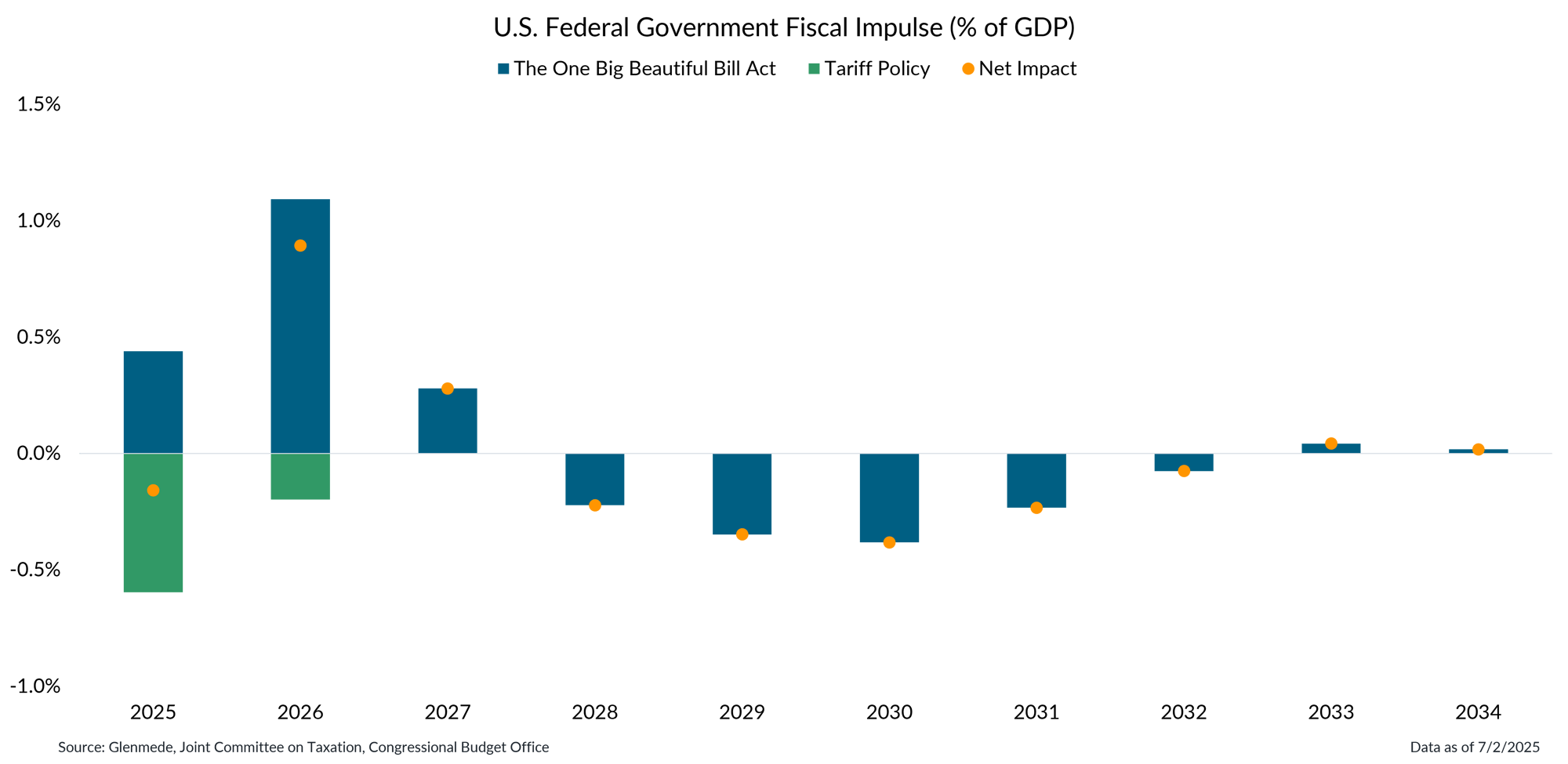

The new tax legislation may provide near-term stimulus, partly offsetting tariff headwinds

Data shown are the expected fiscal stimulus effects by year due to key policy changes associated with The One Big Beautiful Bill Act in the form passed by the US Senate on June 27, 2025 (blue bars) and tariffs implemented through executive action between January 6 and May 13, 2025 (green bars). Orange dots represent the net impact between both dimensions of policy change. The analysis does not include the impact of tariffs announced but not yet implemented, nor the effects of trade agreements that have not yet reached a legally binding stage. Actual results may differ materially from expectations and are subject to change alongside adjustments to fiscal policies.

- The budget reconciliation legislation is projected to deliver significant fiscal stimulus in 2025 and 2026, potentially mitigating economic headwinds from tariffs.

- Although the new spending measures may not fully offset the effects of tariffs in the short term, they could provide a meaningful boost to economic activity in 2026.

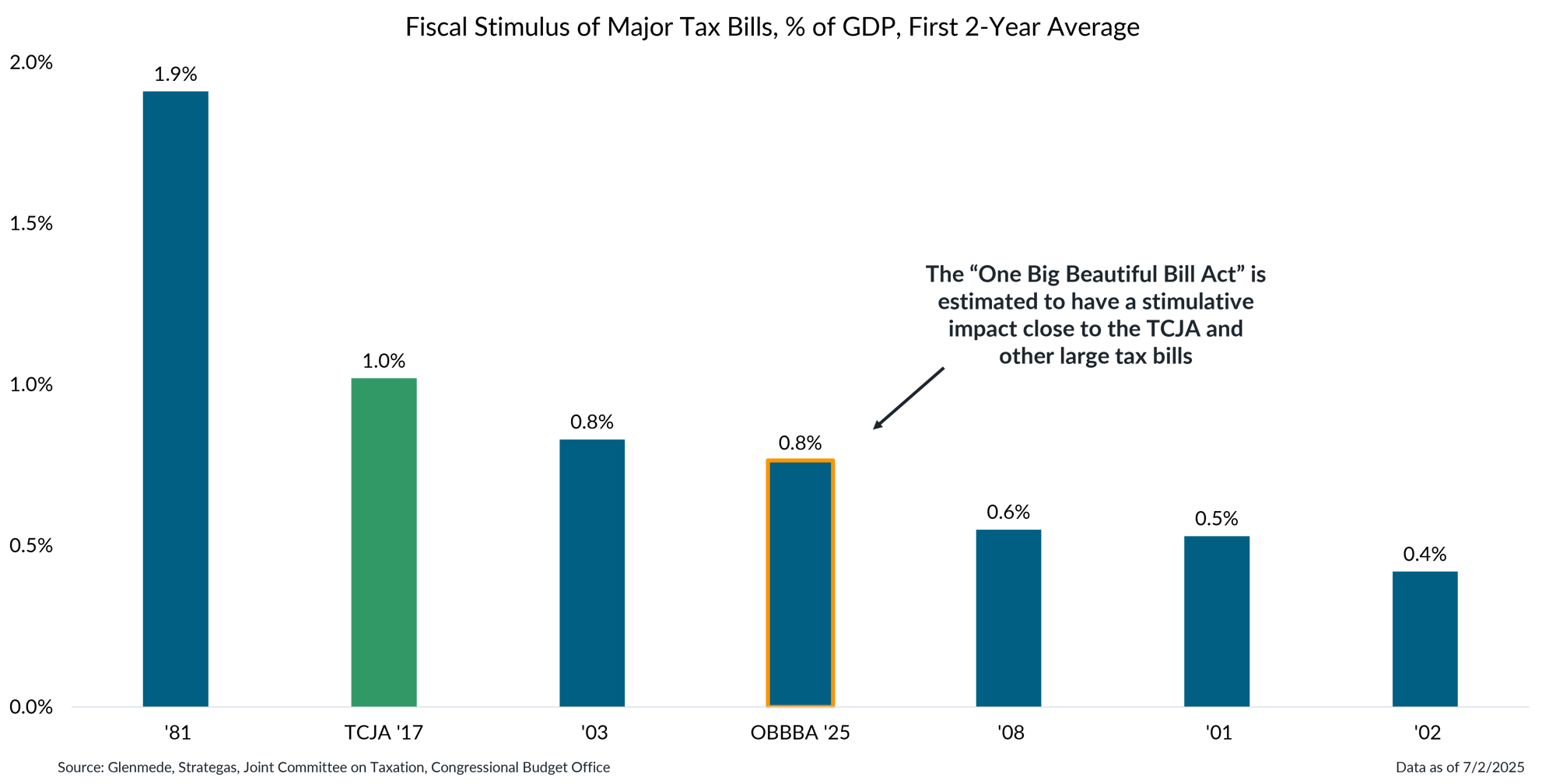

The One Big Beautiful Bill Act is expected to rank among the most stimulative major tax measures to date

Data shown represent various major tax legislation and the fiscal impulse over the first two years as a percentage of nominal gross domestic product (GDP), which quantifies the impact of government fiscal policies relative to total economic output. TCJA refers to the Tax Cuts and Jobs Act of 2017. OBBBA refers to The One Big Beautiful Bill Act in the form drafted by the US Senate on June 27, 2025.

- The economic impact of this legislation is estimated to have a stimulative impact close to the TCJA and other large tax bills.

- The stimulus associated with the new tax law should help broaden the path for continued economic expansion.

This material is provided solely for informational and/or educational purposes and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Any company, fund or security referenced herein is provided solely for illustrative purposes and should not be construed as a recommendation to buy, hold or sell it. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.