Investment Strategy Brief

Robust Q3 Earnings Growth

November 9, 2025

Executive Summary

- Entering the final stretch of Q3 earnings season, corporate profits have exhibited marked resilience.

- Companies are surpassing analysts’ earnings expectations at the highest frequency since 2021.

- Eight of eleven sectors are on pace for positive earnings growth on a year-over-year basis.

- While large caps have held steady, small caps have rebounded and are poised for a continued comeback.

- Corporate earnings continue to show resilience, and growth appears to be broadening, particularly in small caps.

Entering the final stretch of Q3 earnings season, corporate profits have exhibited marked resilience

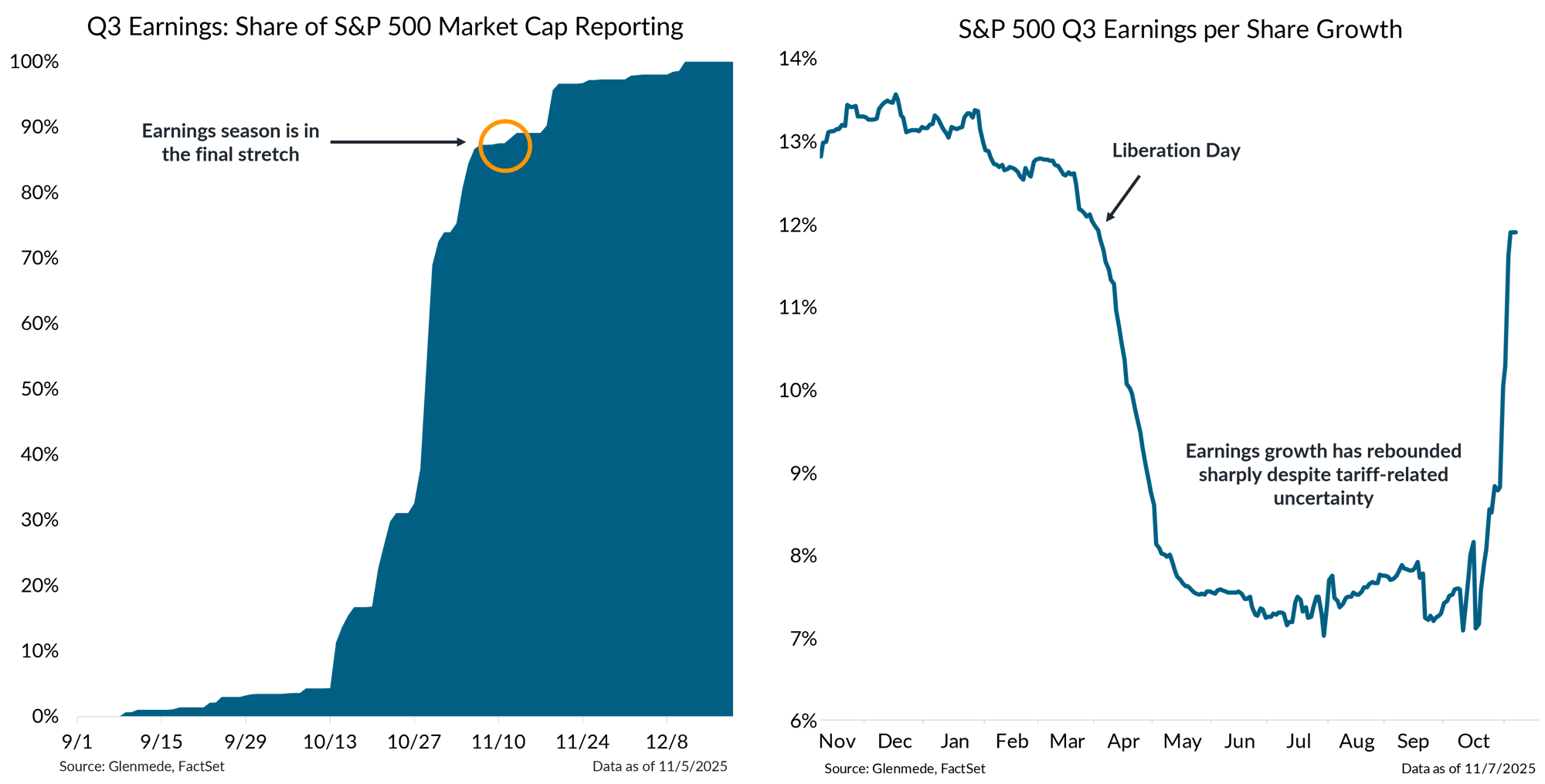

Shown in the left panel is a timeline of the cumulative share of the S&P 500’s market capitalization that has or will report Q3 2025 earnings results. Shown in the right panel is the progression of S&P 500 earnings per share estimates for Q3 2025 on a year-over-year change basis. Actual results may differ materially from expectations. One cannot invest directly in an index.

- Q3 earnings season is winding down, with only about 12% of the S&P 500 by market capitalization yet to report.

-

Expectations for this quarter took a hit earlier this year given the many changes to U.S. trade policy (and related uncertainty) but has ultimately held up just as well as pre-Liberation Day projections.

Companies are surpassing analysts’ earnings expectations at the highest frequency since 2021

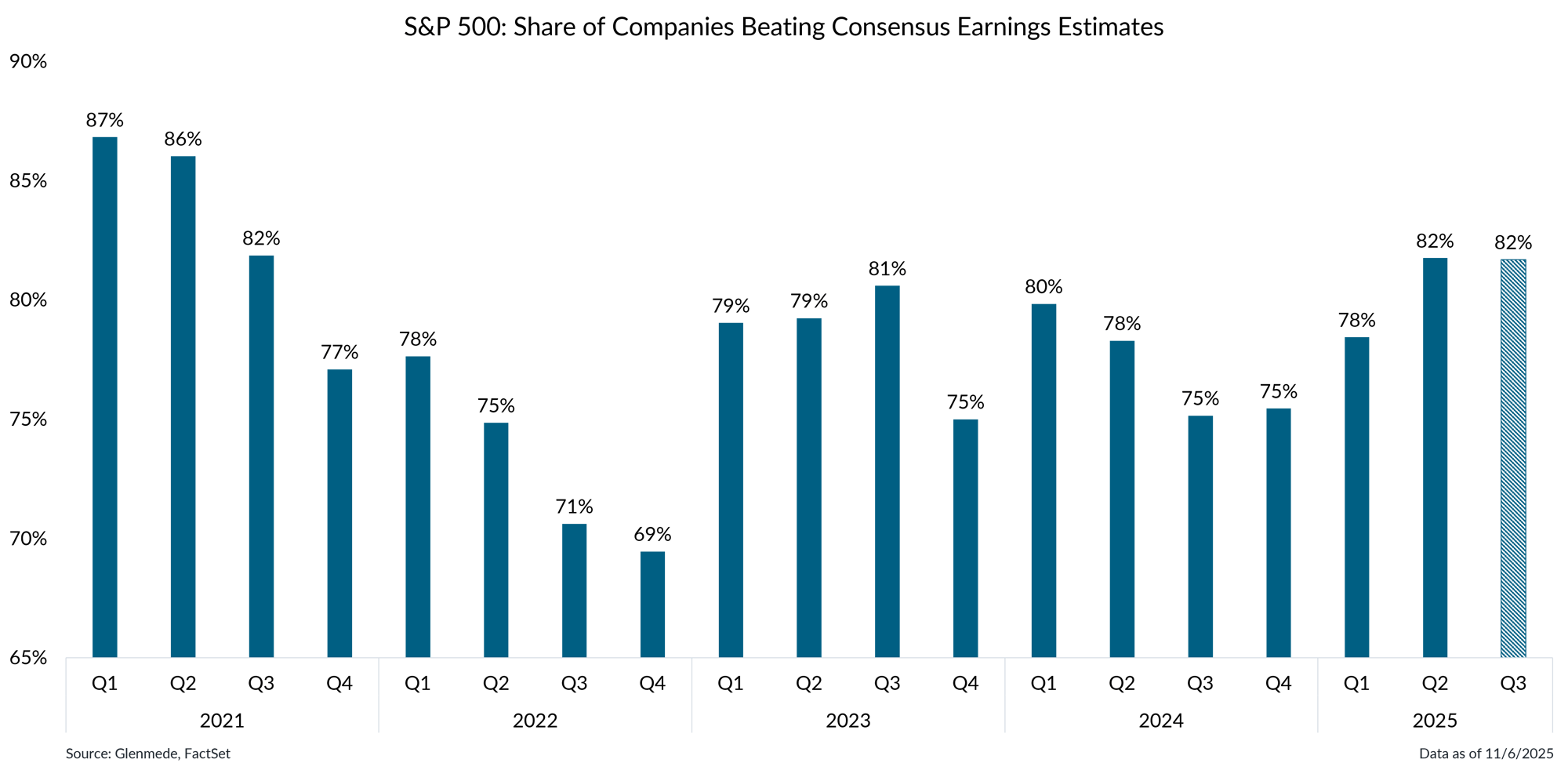

Data shown is the percentage of companies in the S&P 500 that have reported quarterly earnings results above consensus expectations. Solid bars represent full results, and hashed bars represent partial results. The S&P 500 is a market capitalization weighted index of large-cap stocks in the U.S. Past performance may not be indicative of future results. One cannot invest directly in an index.

- The share of S&P 500 companies beating earnings expectations has climbed to its highest level since Q3 2021.

- This could reflect the lower earnings bar associated with tariff-related concerns but also highlights a broadening in earnings strength that can be seen from other perspectives.

Eight of eleven sectors are on pace for positive earnings growth on a year-over-year basis

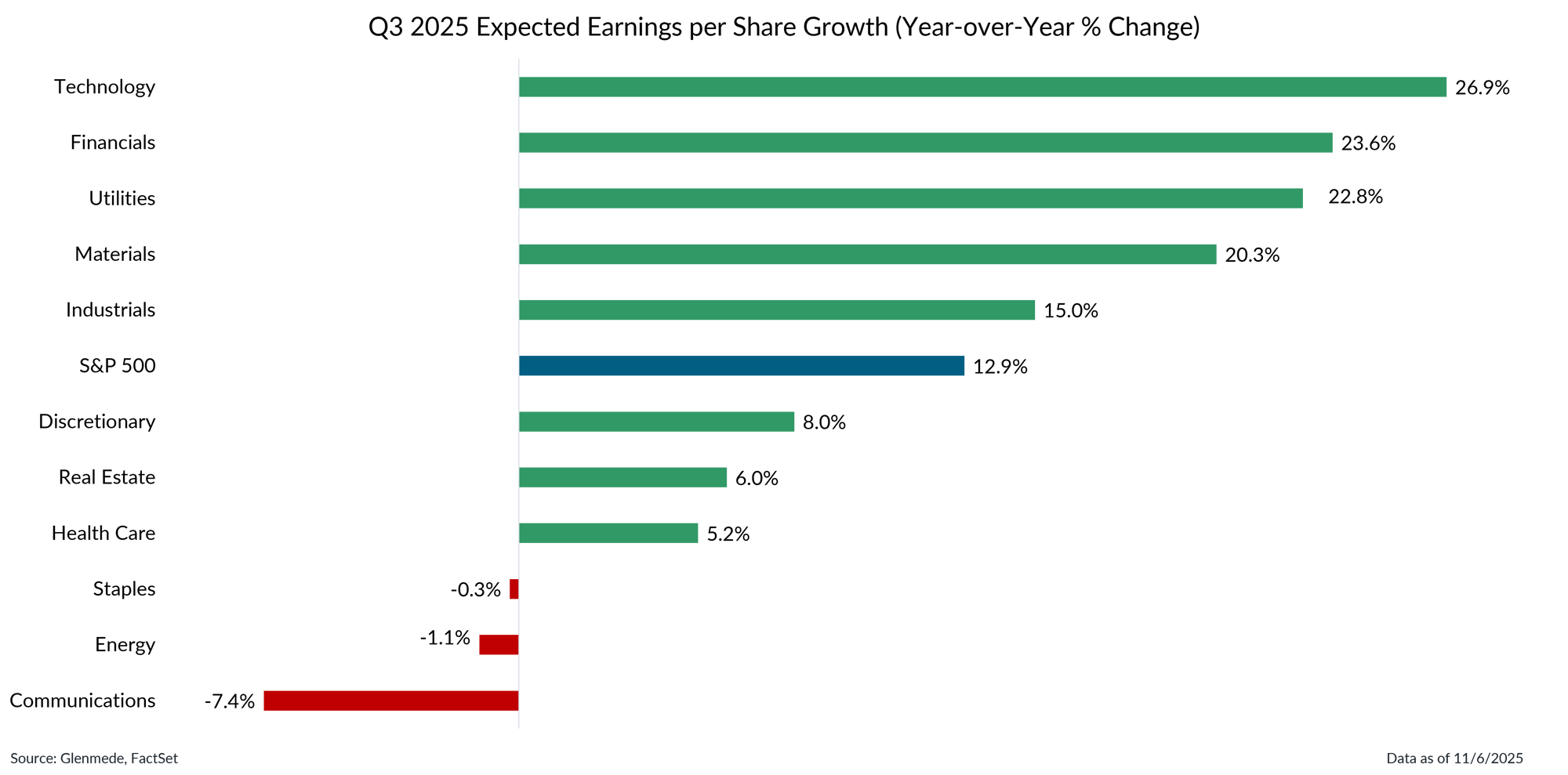

Data shown is the blended growth in earnings per share for the S&P 500 and its 11 constituent sectors for Q3 2025 on a year-over-year, percent change basis. Blended growth figures combine actual results with consensus expectations for companies that have yet to report. The S&P 500 is a market capitalization weighted index of large cap stocks in the U.S. Actual results may differ materially from expectations. One cannot invest directly in an index.

- Strong contributions from a handful of sectors are expected to help lift S&P 500 earnings into the low-double-digit range, led by technology, financials, and utilities.

- Communications is the only sector that has so far fallen short of pre-earnings season expectations, though this follows strong results in Q2.

While large caps have held steady, small caps have rebounded and are poised for a continued comeback

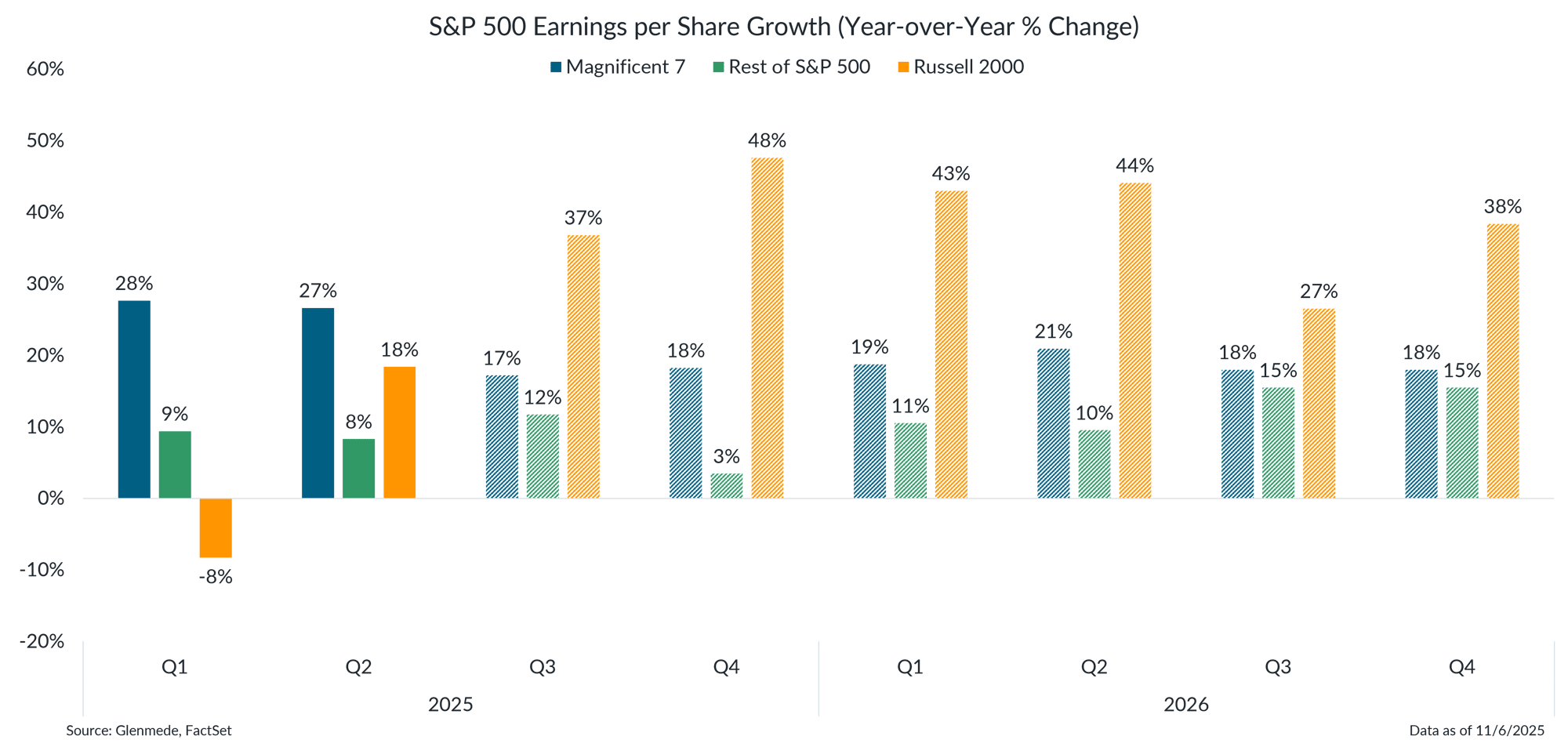

Data shown are quarterly earnings per share growth rates on a year-over-year percent change basis. Figures in blue represent the results for the Magnificent 7 (Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, Tesla), figures in green represent the rest of the stocks in the S&P 500 index, and figures in orange represent the Russell 2000 index. Solid bars represent actual results (based on at least 95% of companies having reported), and hashed bars represent projections based on bottom-up equity analysts’ estimates. Past performance may not be indicative of future results. Actual results may differ materially from expectations. One cannot invest directly in an index. References to specific stocks should not be construed as advice to buy, hold, or sell individual securities.

- The difference in earnings growth between the Magnificent 7 and the rest of the S&P 500 is on pace to narrow in Q3, potentially changing the relative attractiveness of these cohorts for investors.

- Small caps continue to see a resurgence in earnings growth, which is expected to persist into 2026.

This material is provided solely for informational and/or educational purposes and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Any company, fund or security referenced herein is provided solely for illustrative purposes and should not be construed as a recommendation to buy, hold or sell it. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.