Investment Strategy Brief

Spotlight on Stablecoins

August 10, 2025

Executive Summary

- Stablecoins are becoming more widely-used as a digital cash equivalent, merging dollar stability with crypto speed.

- The GENIUS Act (officially the Guiding and Establishing National Innovation for U.S. Stablecoins Act) has established a framework for stablecoins backed by traditional assets and clear regulatory oversight.

- Stablecoins are the 17th largest holder of Treasuries and represent a growing source of market demand.

- Clear reserve requirements and regulatory oversight are essential to ensure stable, transparent demand.

- Stablecoins should strengthen the link between the U.S. and digital assets, reinforcing dollar dominance and treasury ownership.

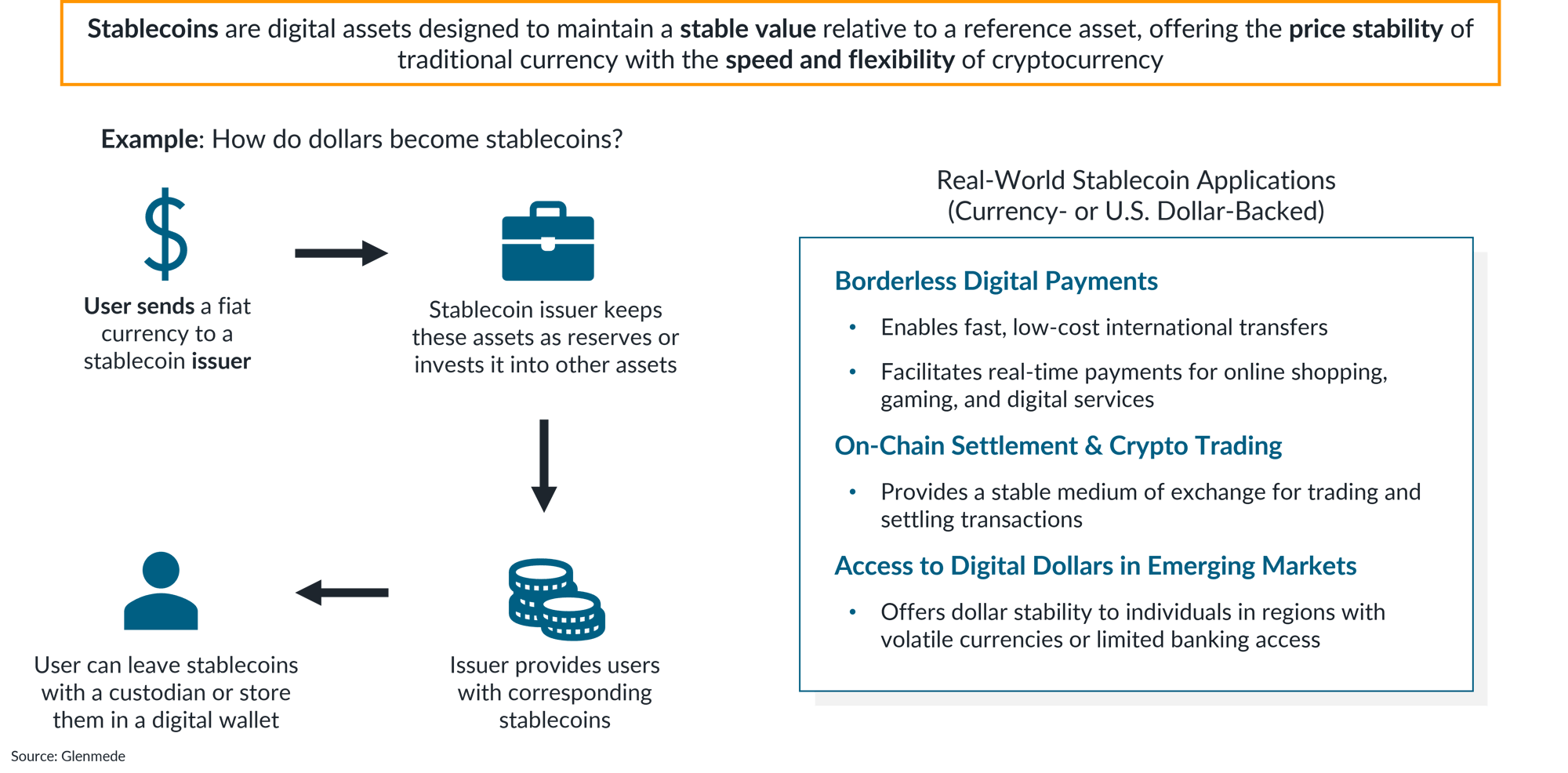

Stablecoins act as digital cash, designed to combine the stability of currency with the flexibility of digital assets

The illustration in the left panel depicts a general overview of how stablecoins are structured and function. Shown in the right panel are examples of stablecoin applications. This is not intended to be an exhaustive list. The information shown is solely for illustrative and educational purposes and should not be interpreted as an endorsement or recommendation to use stablecoins.

- Stablecoins are digital tokens designed to maintain a stable value relative to a reference asset (e.g., the U.S. dollar) supporting reliability across both traditional and digital financial systems.

- When users convert dollars into stablecoins, issuers hold those funds in reserve — often in assets like U.S. Treasuries or money market instruments — though the type and quality of backing assets can vary by issuer.

- Adoption of stablecoins has grown due to benefits like faster cross-border payments, efficient crypto trading and settlement, and greater currency stability in volatile markets.

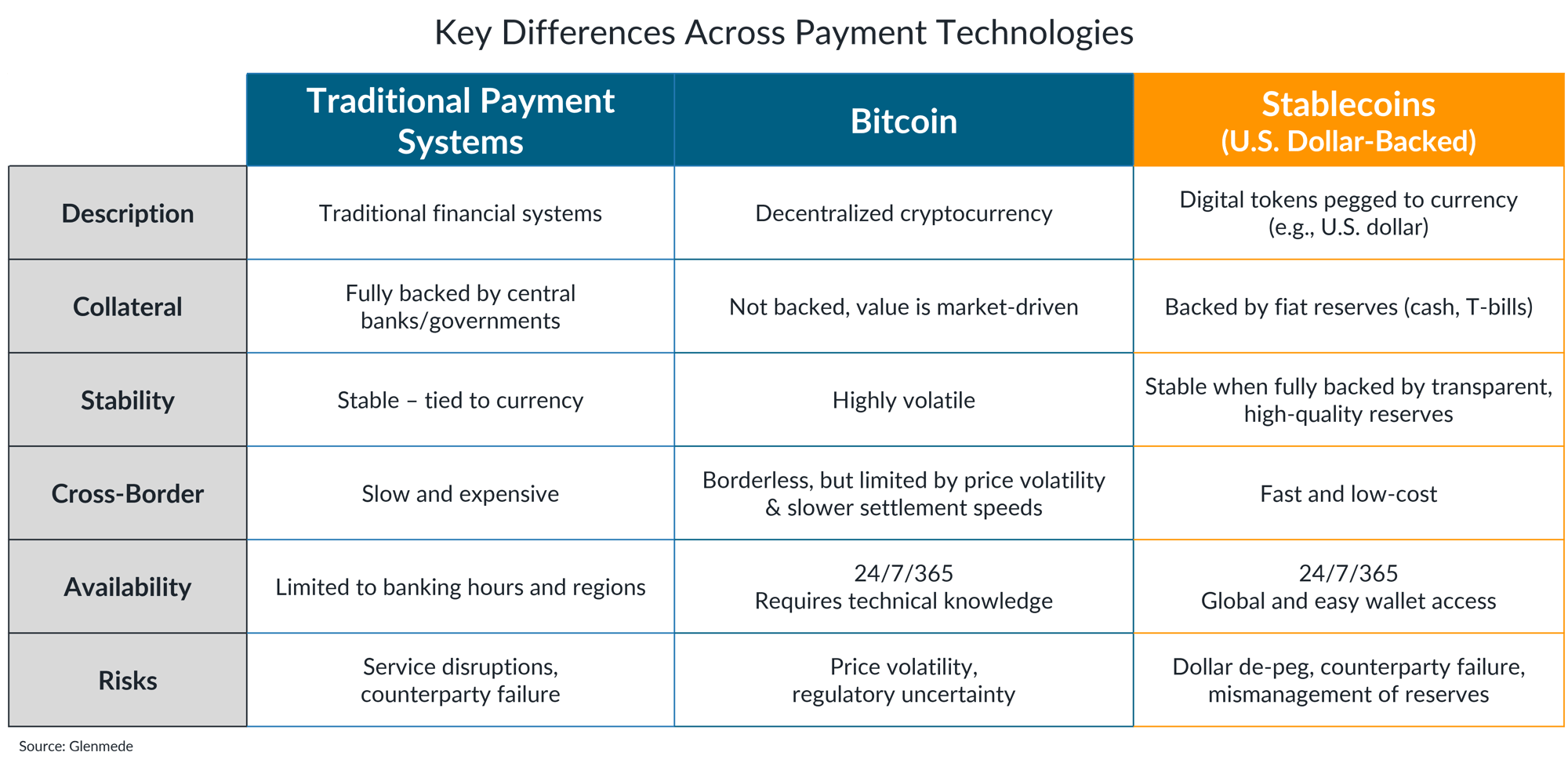

Stablecoins are the most practical form of cryptocurrency for daily transactions

The information depicted is a general overview of traditional payment systems, Bitcoin and U.S. Dollar backed stablecoins and should not be interpreted as an endorsement of any specific technology. The risks included in the visual are not an exhaustive list.

- Stablecoins offer faster settlement, lower costs, and 24/7 availability when compared to traditional payment systems, leading to their rapid adoption.

- When compared with other cryptocurrencies like Bitcoin, stablecoins are backed by reserve assets and maintain a stable value, making them more practical for everyday transactions.

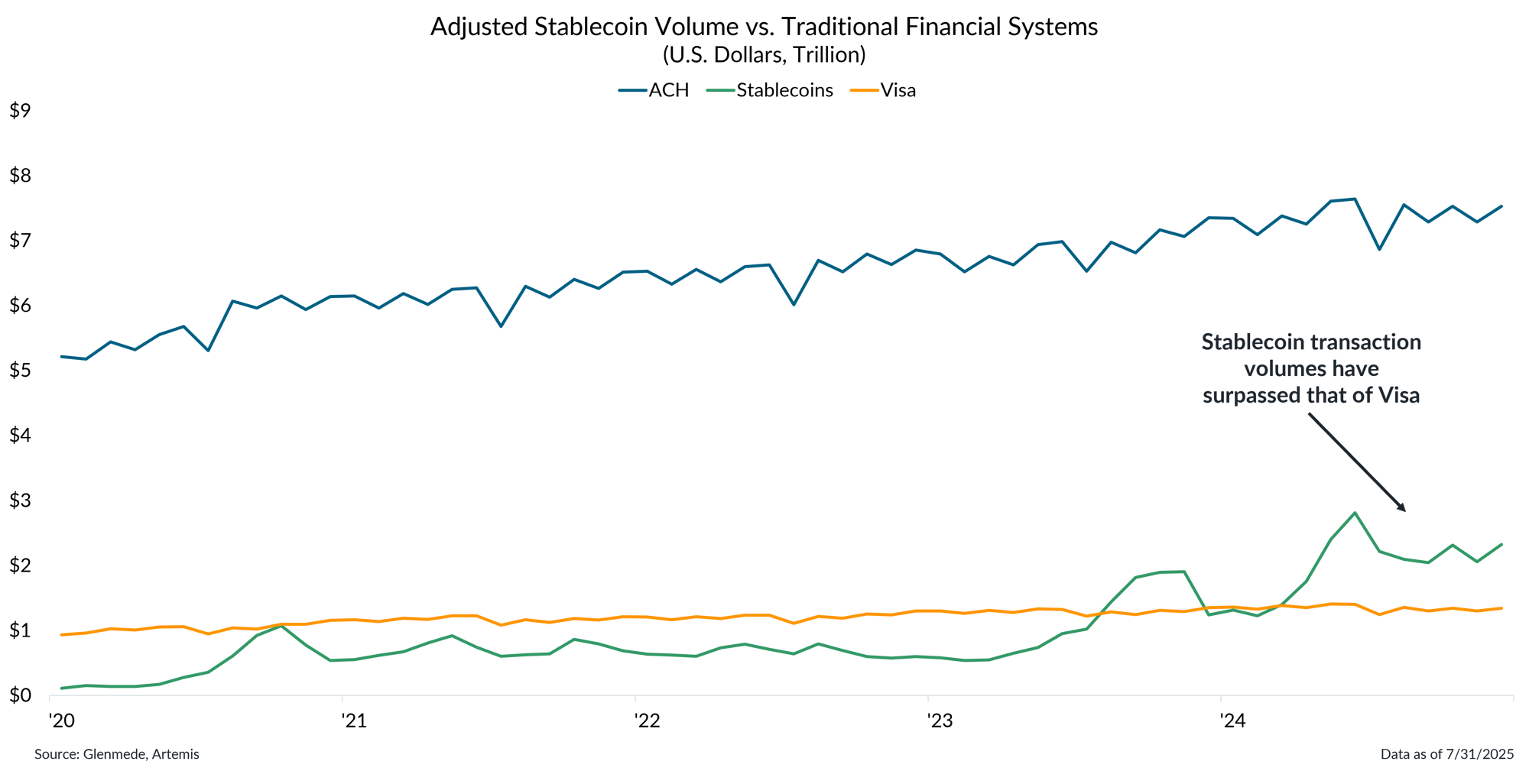

Rising stablecoin transaction volumes highlights their swift adoption as a medium of exhange

Data shown compare adjusted stablecoin transaction volumes against Visa and ACH payment networks. Stablecoin volumes reflect a 30-day rolling average of on-chain transactions, excluding maximum extractable value (MEV) and intra-centralized exchange transfers, to provide a more accurate representation of economically meaningful blockchain activity. Visa and ACH figures represent monthly average transaction volumes.

- Stablecoin transaction volumes have recently exceeded those of Visa, reflecting growing adoption within digital finance, particularly for use cases like trading and blockchain-based settlement.

- Broader adoption for traditional payments may evolve more gradually, as payment infrastructure and regulatory clarity continue to evolve.

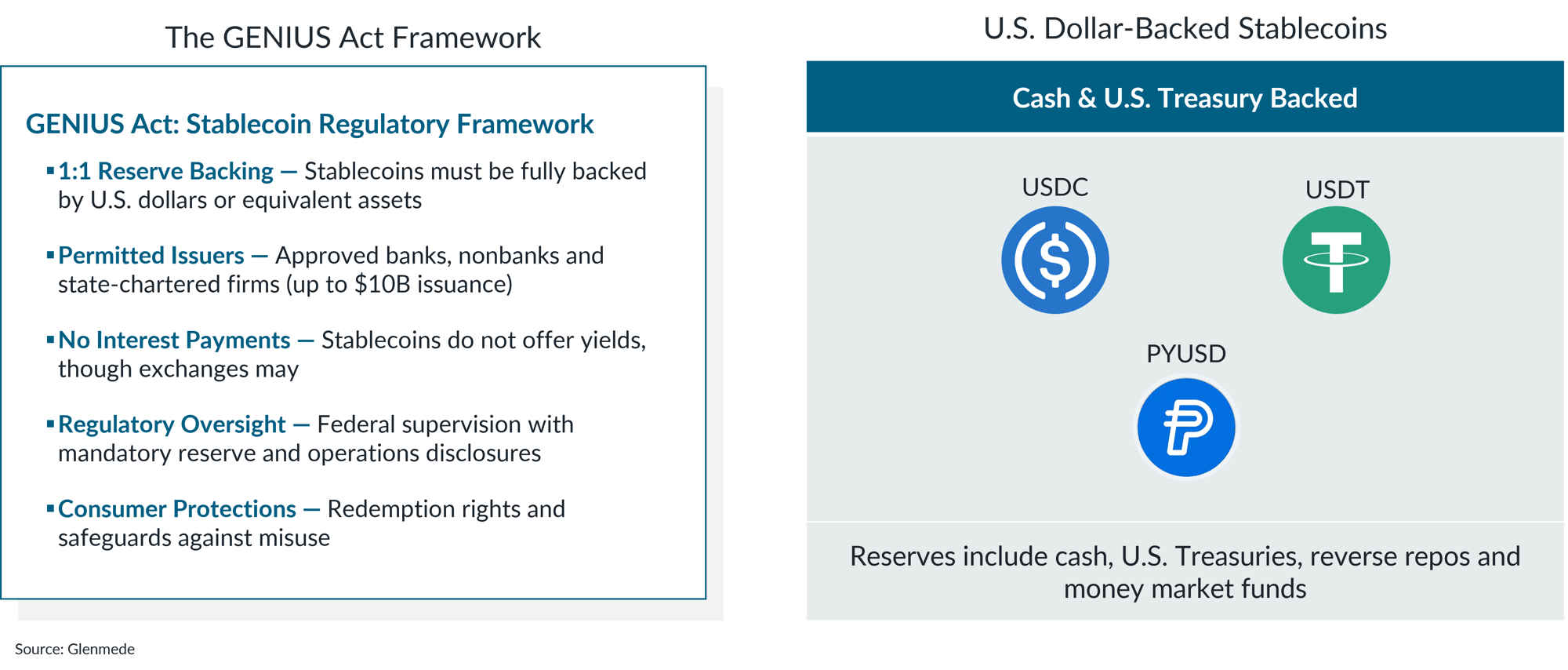

The GENIUS Act has established a regulatory framework for stablecoins backed by traditional assets

Shown in the left panel are provisions in the Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS) signed into law on July 18th, 2025. Shown in the right panel are select stablecoin issuers backed by cash and U.S. Treasury assets: Circle (USDC), Tether (USDT) and PayPal (PYUSD). This visual should not be interpreted as an endorsement of any issuer or recommendation to buy, hold or sell any specific instruments. The information presented is for illustrative purposes only and should not be interpreted as legal or regulatory guidance.

- Clear reserve standards and regulatory oversight are essential for stablecoins to maintain credibility and support transparent, dependable demand.

- The GENIUS Act lays the groundwork for a regulatory framework governing stablecoins, outlining reserve requirements and eligibility criteria for issuers, but full implementation awaits regulatory guidance and rulemaking from federal agencies.

- Major issuers like Circle, PayPal, and Tether disclose reserve holdings, but practices vary, highlighting the need for standardized transparency that future legislation is likely to provide.

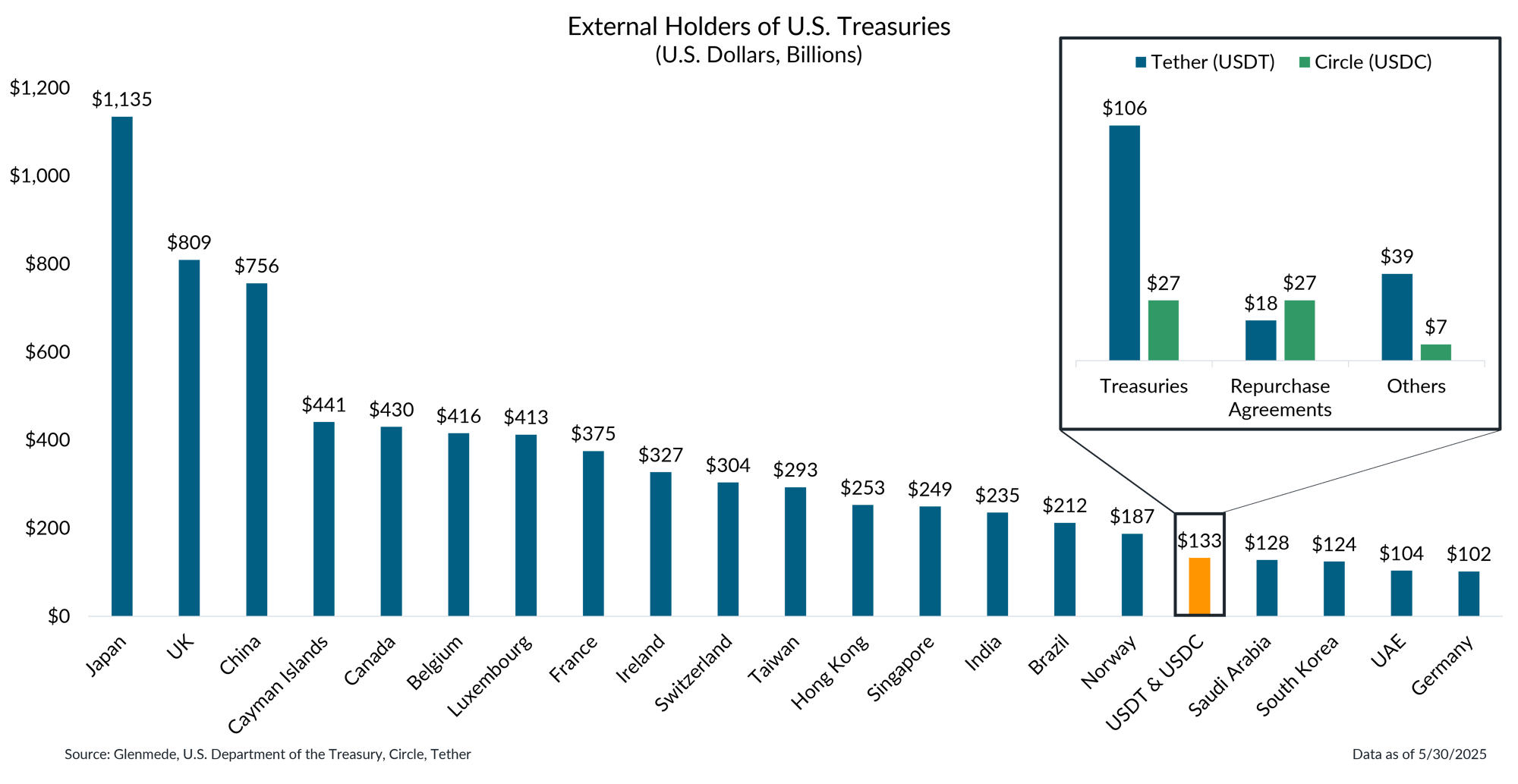

Stablecoins are the 17th largest holder of Treasuries and represent a growing source of market demand

Data shown represent the largest foreign holders of U.S. Treasury securities. The insert in the top right displays the composition of reserve assets held by Tether (USDT) and Circle (USDC). The “Others” category reflects reserves held in money market funds and cash equivalents. This visual is for illustrative purposes only and should not be interpreted as an endorsement of any issuer or recommendation to buy, hold or sell any specific instruments.

- Tether and Circle’s USD stablecoins alone hold enough U.S. Treasuries to rank as the 17th largest external holder globally.

- As the U.S. stablecoin market expands, demand for short-duration Treasuries, commonly used as reserve assets, is likely to increase accordingly.

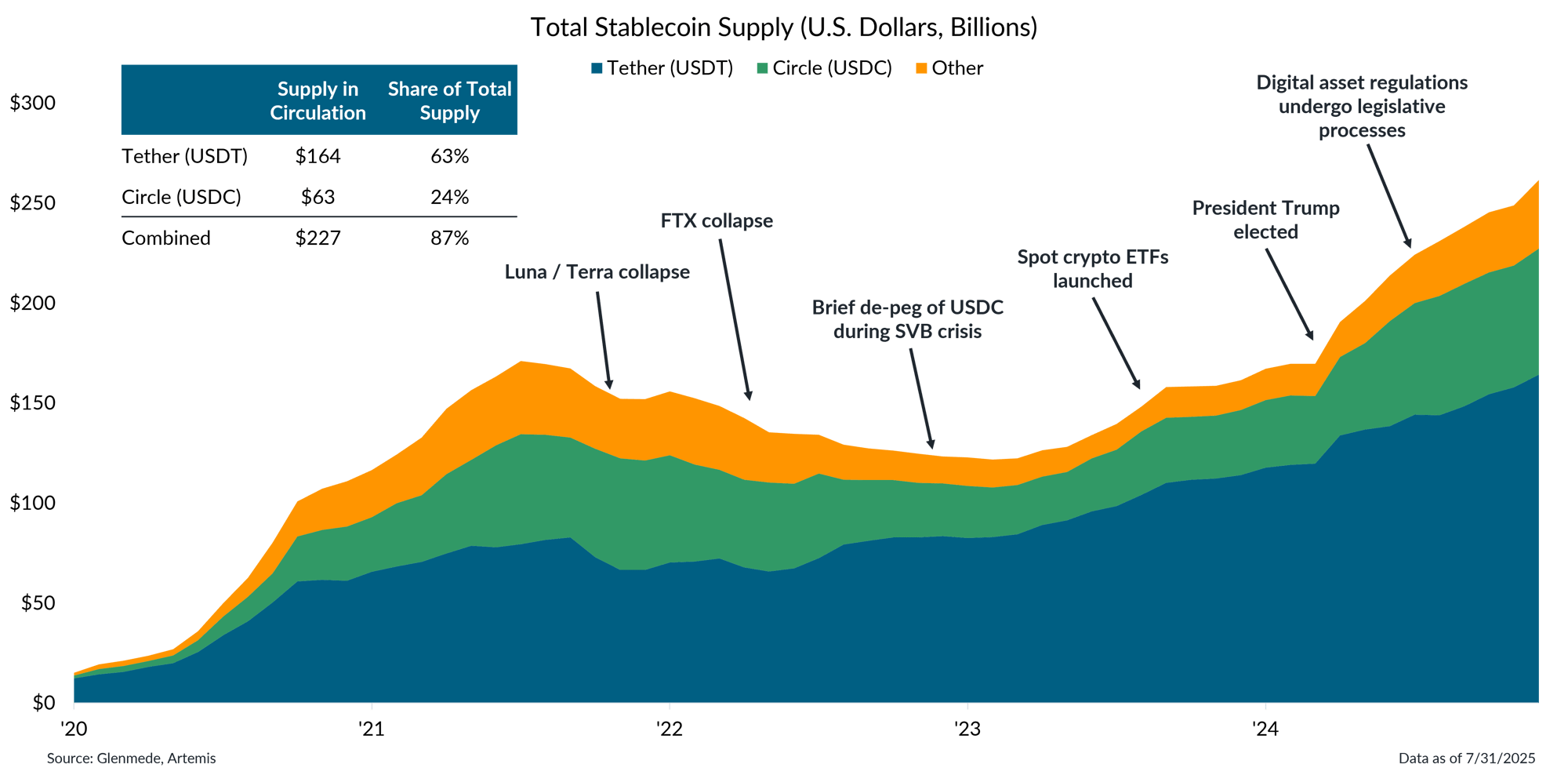

New stablecoin users are gaining share as policy shifts have broadened market adoption

Data shown represent the U.S. dollar value of stablecoin tokens issued and in circulation. The “Other” category includes approximately 70 active stablecoins across 20 major blockchains. The Luna/Terra collapse highlights the failure of algorithmic stablecoins, while FTX represents the collapse of a cryptocurrency exchange. The SVB crisis marks the failure of Silicon Valley Bank. ETFs refer to exchange-traded funds. This visual should not be interpreted as an endorsement of any issuer or recommendation to buy, hold or sell any specific instruments.

- While Tether and Circle continue to dominate the market, accounting for 87% of total U.S. stablecoin supply, their combined share has edged slightly lower amid growing interest in alternative issuers.

- Recent growth in the U.S. stablecoin landscape reflects evolving policy dynamics that have shaped broader perceptions of cryptocurrency and digital assets.

- Stablecoins should reinforce the role of the U.S. dollar in the digital economy, strengthening both dollar dominance and demand for U.S. Treasury assets.

This material is provided solely for informational and/or educational purposes and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Any company, fund or security referenced herein is provided solely for illustrative purposes and should not be construed as a recommendation to buy, hold or sell it. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.