Investment Strategy Brief

Sticky Inflation

Getting Unstuck

June 16, 2024

Executive Summary

- Inflation is showing encouraging signs of moderating, with several major components within the Fed’s preferred range and others moving closer.

- Services ex-shelter inflation has been softening again, but may now be sustainable given declining wage pressure.

- The latest dot plot projections now call for only one rate hike in 2024, downgraded from expectations for three in March.

- A more constructive monetary policy outlook should be a tailwind for equities and fixed income.

Last week’s CPI report showed encouraging signs of softening inflation

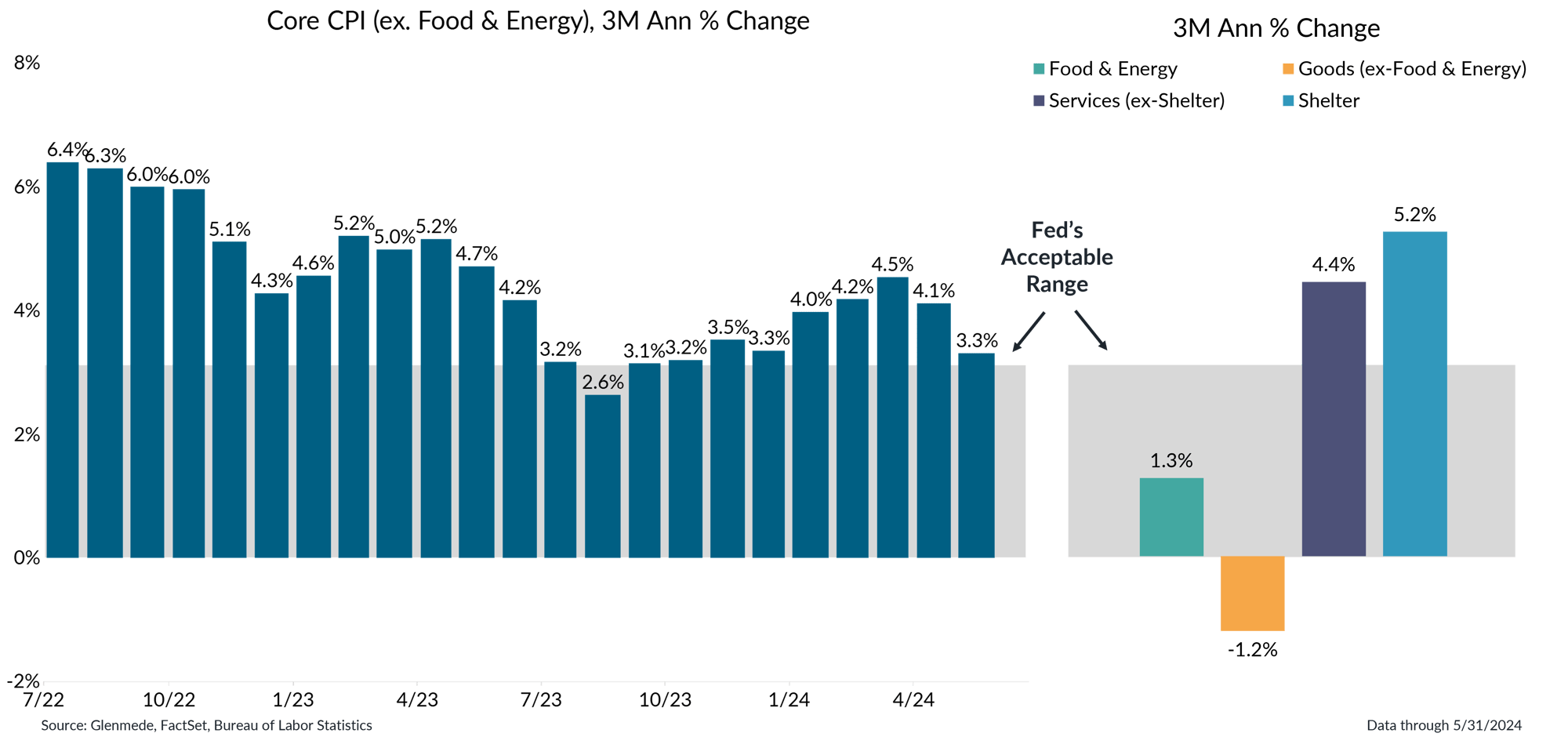

Shown on the left is the 3-month annualized percent change in the U.S. Consumer Price Index (CPI) excluding food and energy. Shown on the right are the 3-month annualized percent changes in the U.S. CPI components. Food & Energy is represented by the food & energy subcomponents. Services (ex. Shelter) is represented by Services Less Rent of Shelter. Shelter is represented by Rent of Shelter. Goods (ex-Food & Energy) is represented by the commodities component (excluding food & energy). CPI measures the price of a basket of goods & services consumed by U.S. households. The gray region represents the Fed’s target range consistent with its longer-term price stability objective.

- After reaccelerating to start the year, inflation rates have taken a turn closer to the 2 – 3% range in which the Fed would likely claim victory on its price stability mandate.

- Food, energy and core goods inflation are now well within the Fed’s preferred range; while services prices have been slowly moving in the right direction, they still have further to go.

Services inflation ex-shelter may now be sustainably softening given declining wage pressure

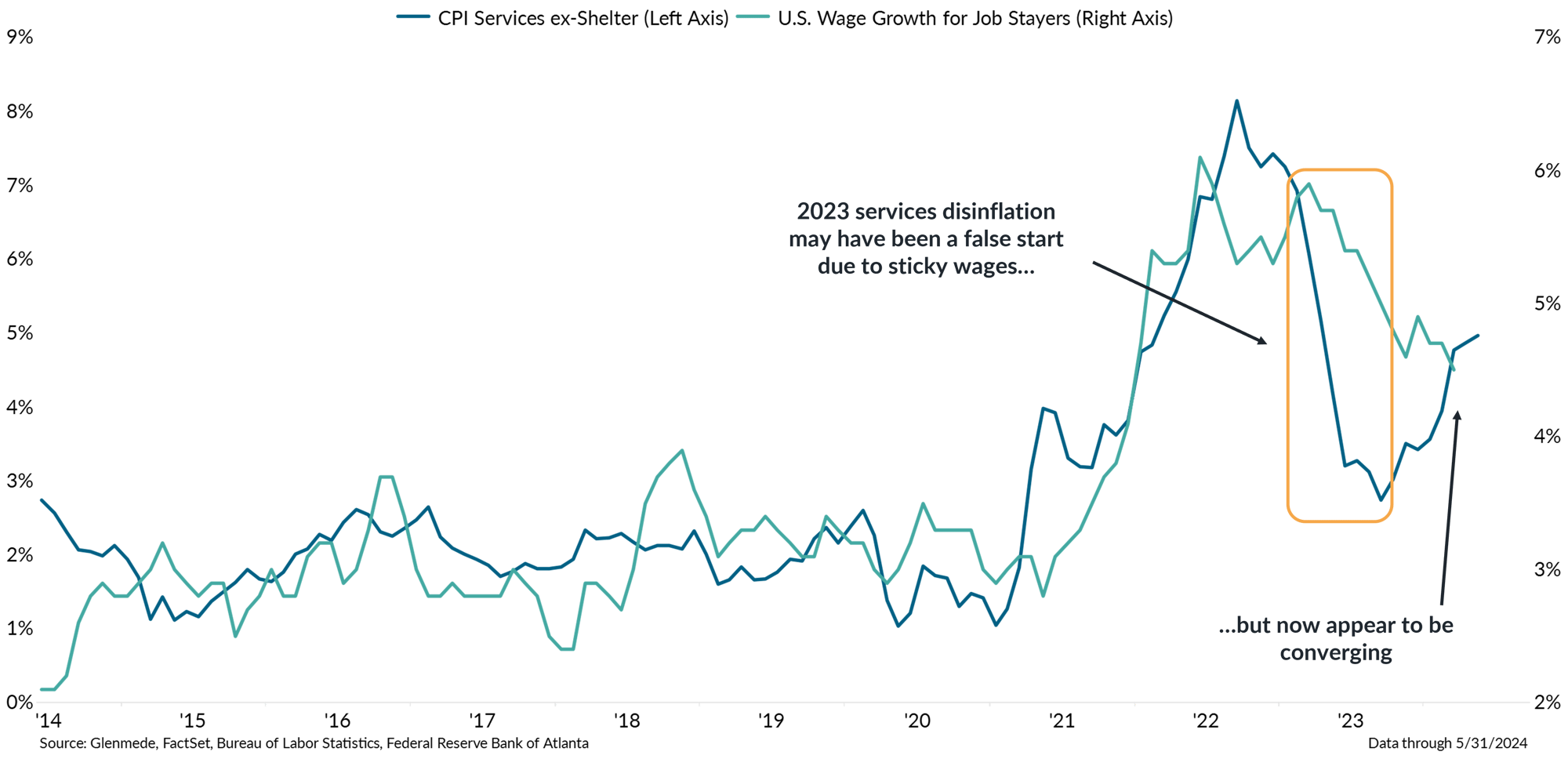

Data shown in blue represents the annual growth in the Consumer Price Index’s services excluding the rent of shelter component and graphed along the left y-axis. Data shown in green represents the Federal Reserve Bank of Atlanta’s median wage growth for those in the U.S. that have stayed in their existing job, expressed as a three-month moving average of annual growth and graphed along the right y-axis.

- Wages are a key input in the cost structure for many services, especially when excluding the impact from shelter.

- The softening in services ex-shelter inflation may now be sustainable since wage pressure is showing signs of abating.

The dot plot calls for only one rate cut in '24, but more may be on the table if inflation moderates further

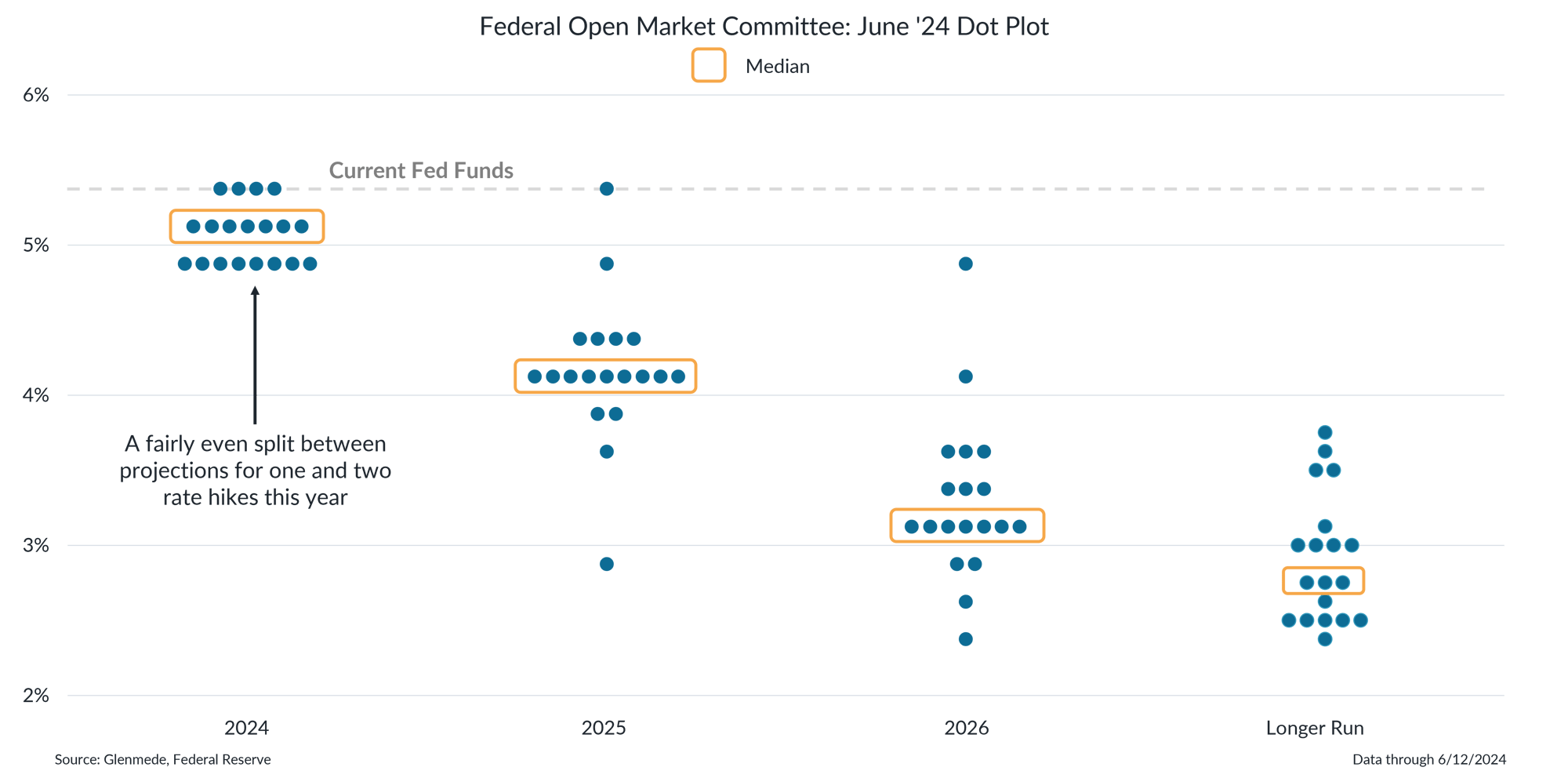

Data shown are the Federal Open Market Committee’s dot plot projections from June 2024. Each dot represents the response of one Fed official’s projections for where they expect the federal funds rate to sit at the end of each of the next three calendar years, as well as their estimate of the longer run level of federal funds. Actual results may differ materially from projections.

- The Fed may be able to squeeze in an extra rate cut if inflation cooperates, but that likely requires a few more soft reports to get members on board with that trajectory.

- Loosening monetary policy in the back part of 2024 should be the base case, and a more constructive Fed outlook should be a tailwind for both equities and fixed income.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.