Investment Strategy Brief

Tariff Market Volatility

March 10, 2025

Executive Summary

- Uncertainty is on the rise after a flurry of tariff announcements, the implementation of which has led to a decline in equity markets.

- Equity market declines of 5%+ are common, often occurring at least once per year amid shifting expectations and risks.

- Tariffs could materially slow economic growth but are less likely by themselves to cause a decline.

- Globalization had been a profit margin tailwind, the reversal of which, alongside tariffs, is likely a headwind.

- While tariff uncertainty is contributing to market jitters, the aggregate impact is more likely a moderation in growth than an outright decline.

Uncertainty is on the rise after a flurry of tariff announcements

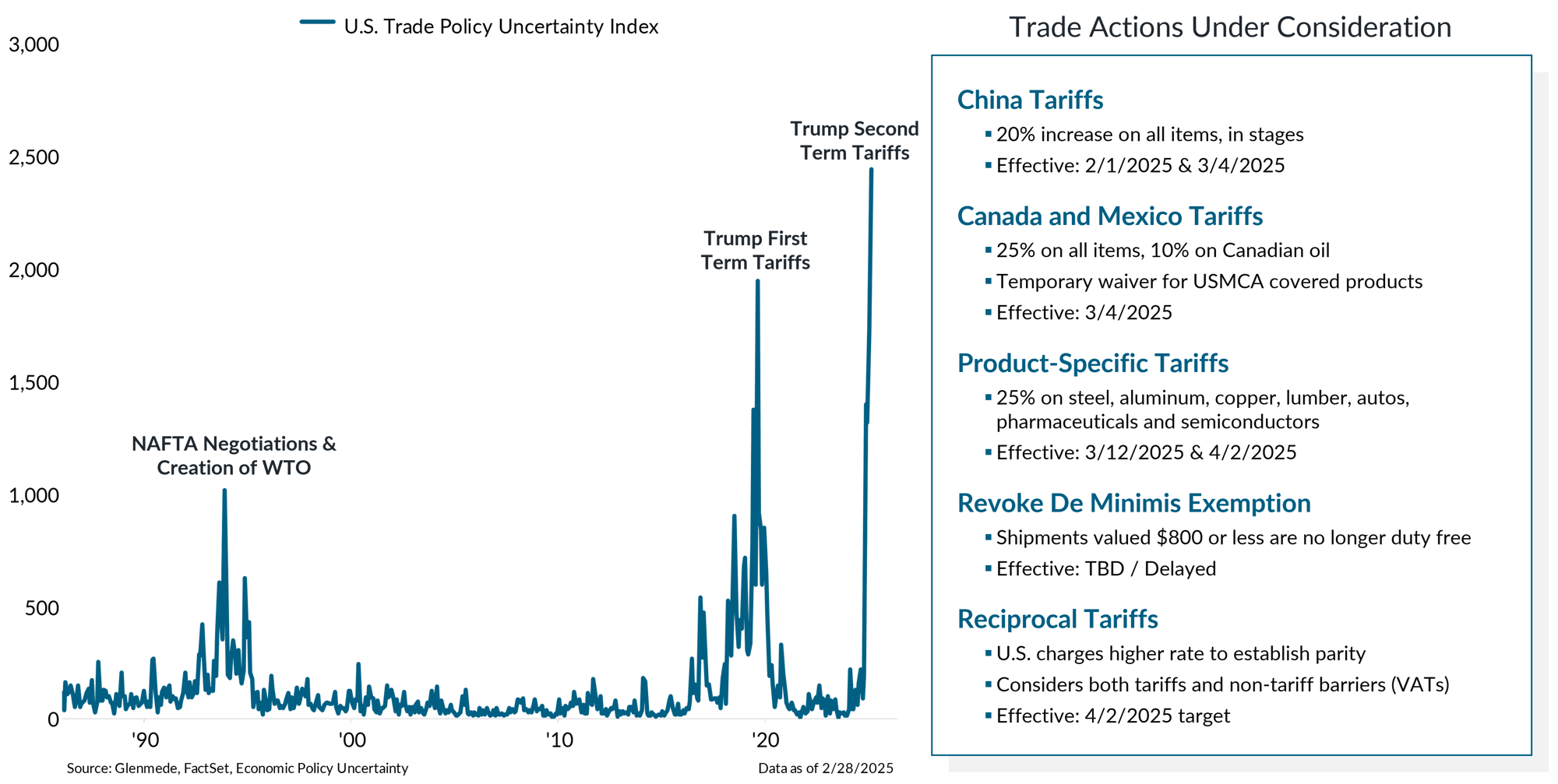

Shown in the left panel is the U.S. Trade Policy Uncertainty Index, which reflects the frequency of articles in American newspapers that discuss policy-related economic uncertainty and contain one or more references to trade policy. NAFTA stands for the North American Free Trade Agreement. WTO stands for the World Trade Organization. Shown in the right panel is a summary of trade actions announced under the second Trump administration. Non-tariff barriers primarily refers to value-added taxes (VATs). Actual results may differ materially from expectations.

- Trade policy has been a major focus in the early weeks of the administration, surpassing the tariff uncertainty seen in past periods of significant changes to trade terms.

- The implementation of an additional 10% tariff on China and a 25% tariff on Canada and Mexico has heightened uncertainty, contributing to market volatility.

Market weakness appears localized to regions directly affected by tariffs and the Magnificent 7

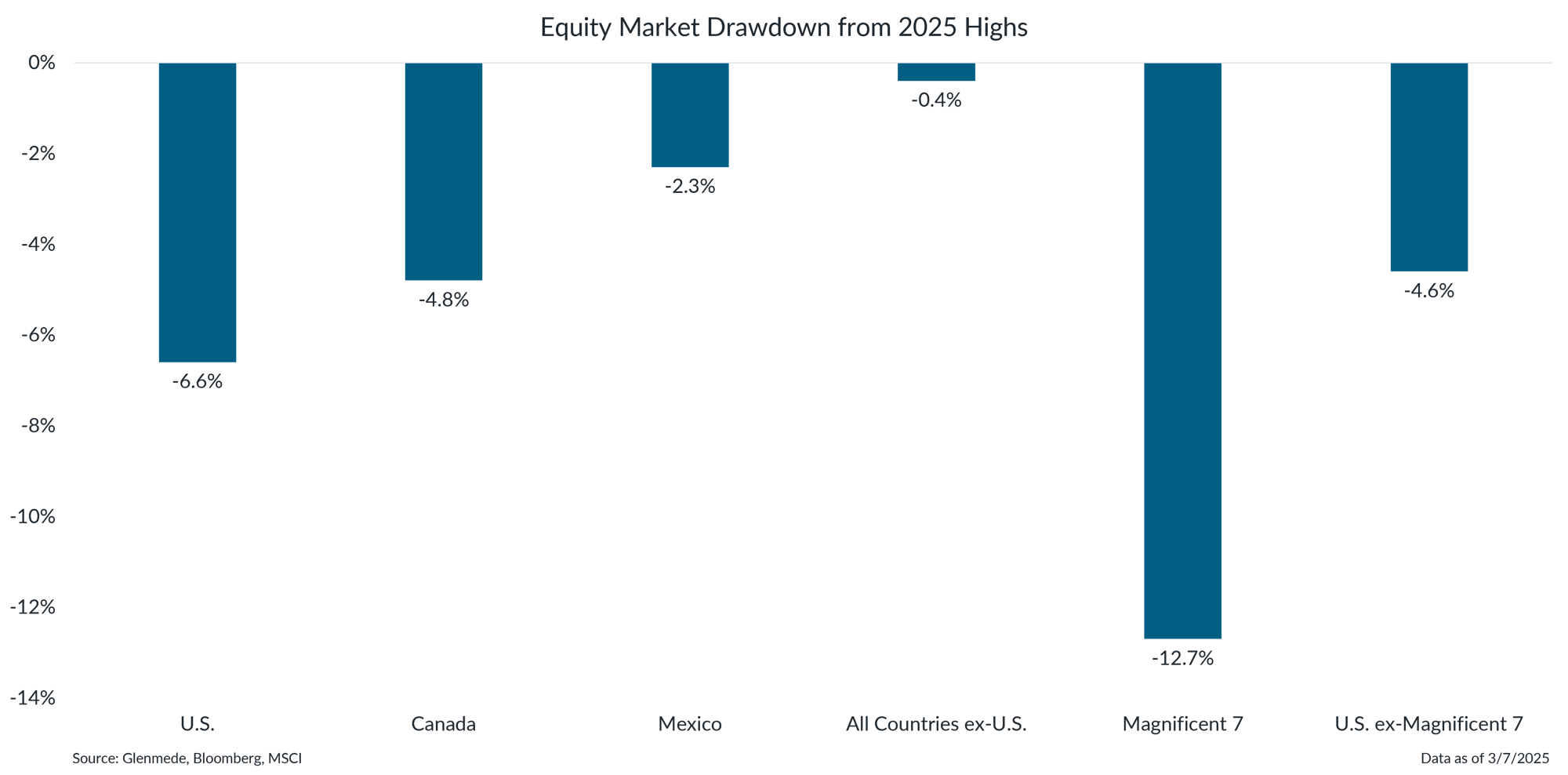

Data shown are the percentage drawdowns from 2025 highs for the S&P 500, MSCI Canada Index, MSCI Mexico Index, MSCI All Country World ex-U.S. Index, Magnificent 7 (Apple, Alphabet, Amazon, Meta, Microsoft, Nvidia, and Tesla) and the S&P 500 Index excluding the Magnificent 7. References to individual stocks should not be construed as a recommendation to buy, hold or sell. Past performance may not be indicative of future results. One cannot invest directly in an index.

- Last week, the S&P 500 dropped 7% from its all-time high. Drawdowns of this magnitude are common and normal; U.S. equities have experienced drawdowns of 5% or more in 93% of calendar years since 1927.

- Market weakness in the U.S., Canada and Mexico was pronounced after tariffs officially went into effect on March 4th, while other regions largely shrugged off the ongoing tariff uncertainty.

- Amid recent volatility, the market has also seen a rotation. The Magnificent 7 fell 12% from recent highs compared to just 5% for the rest of the S&P 500.

The range of possibilities on trade policy is coming into focus, with associated economic growth headwinds

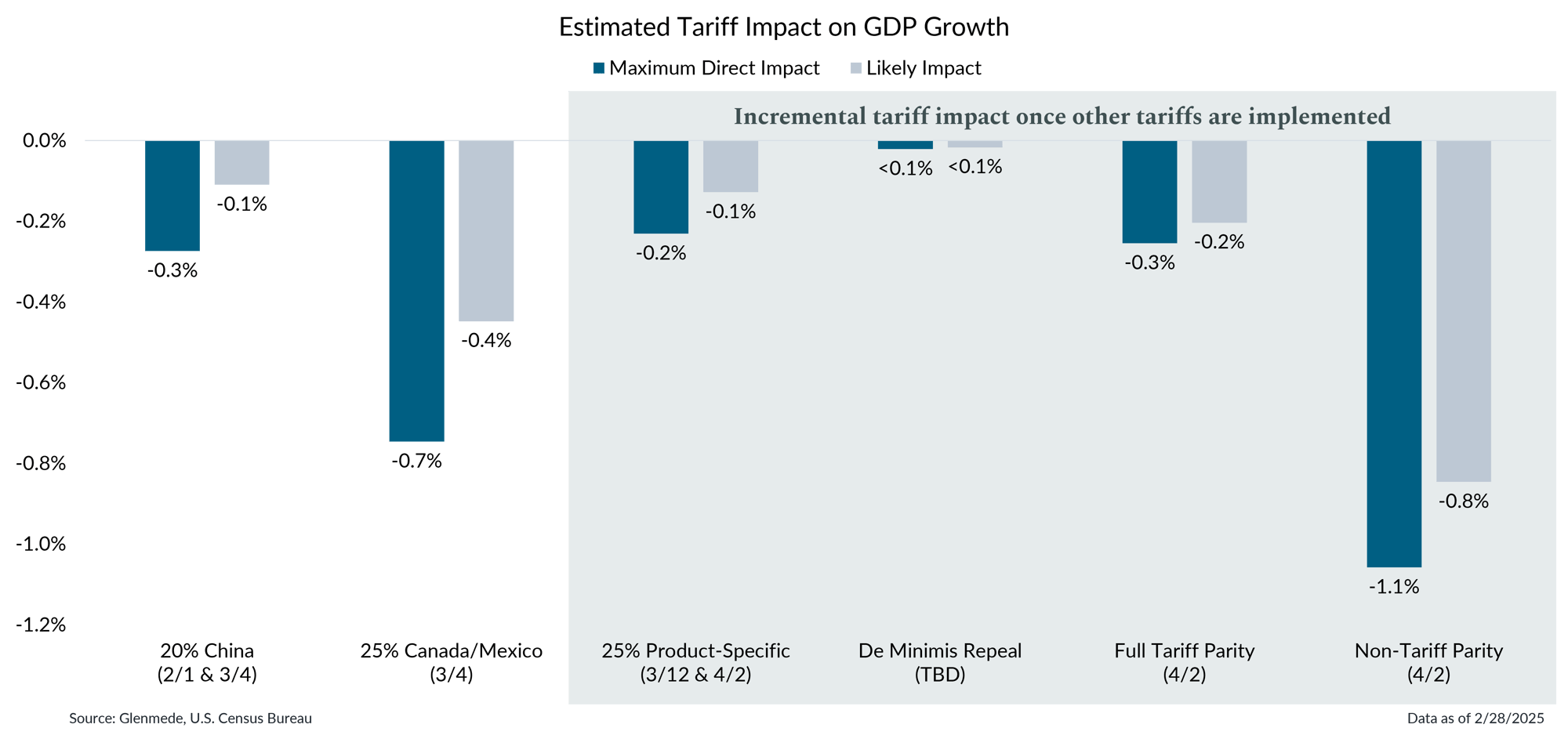

Estimated tariffs reflect the tariff rate applied fully to all associated imports and are shown as a percent of gross domestic product (GDP). 25% Canada tariffs includes a carveout for energy products, for which 10% tariffs apply. 25% Product-Specific refers to tariffs on steel, aluminum, copper, lumber, automobiles, pharmaceuticals and semiconductors. The maximum direct economic impact of proposed tariffs assumes full demand destruction via a tariff-induced price shock and that tariffs are implemented fully and in isolation, with no changes to the sourcing of the imports, no other offsetting policies and no retaliatory tariffs. Likely impact accounts for offsetting factors such as reconfigured supply chains and substitution effects. Incremental tariff impact accounts for the effects of prior implemented tariffs to avoid double counting. The dates below each tariff represent announced implementation dates, if available. Actual results may differ materially from expectations or projections.

- While the tariffs on China are unlikely to have a significant impact on GDP, Canada and Mexico tariffs may have a larger effect due to closer trade ties and difficulties in avoidance.

- The administration plans to impose additional tariffs in the near term that could also have a notable economic impact, including duties on specific products and reciprocal tariffs.

Tariffs could materially slow economic growth but are less likely by themselves to cause a decline

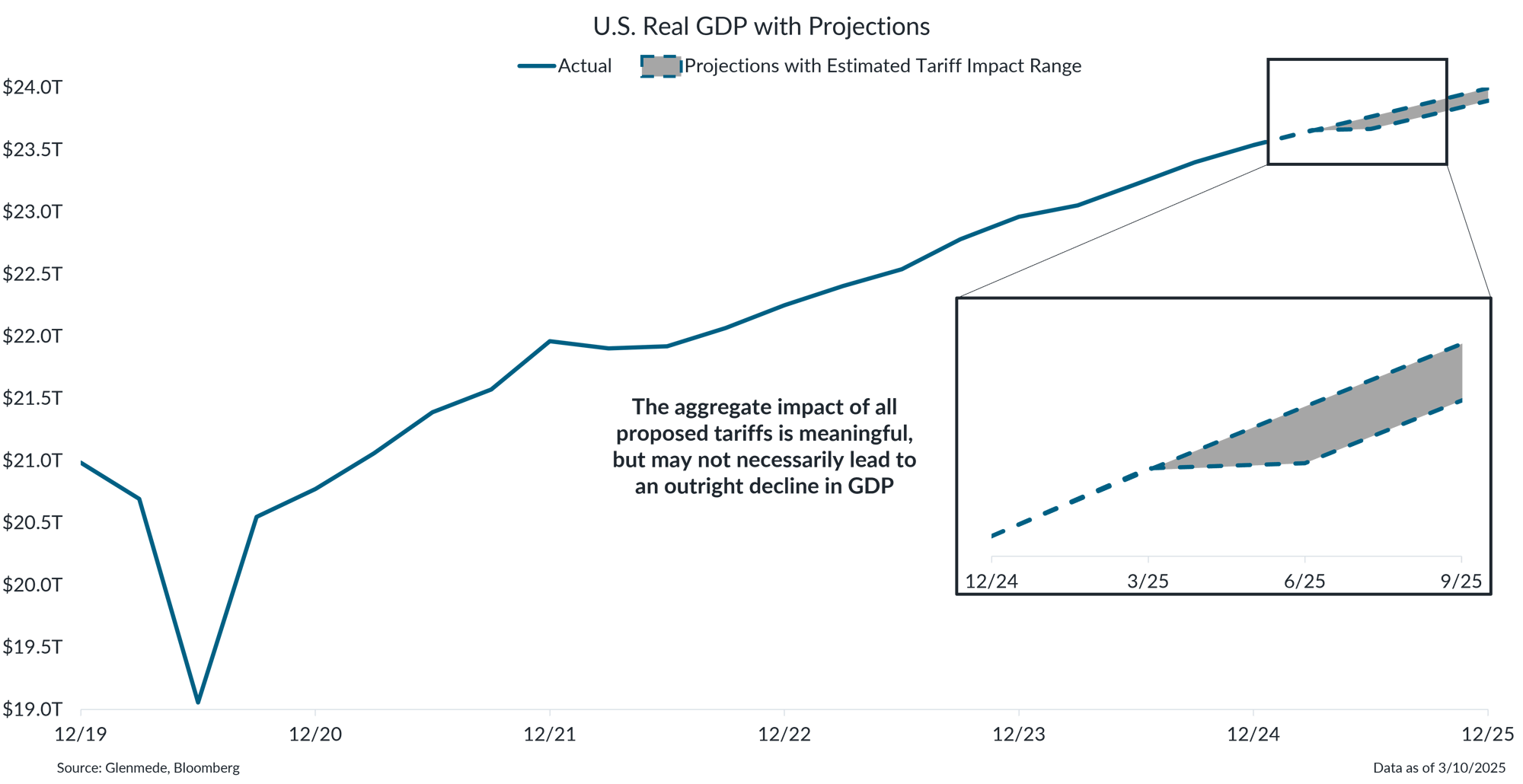

Data shown in solid blue are actual U.S. real gross domestic product (GDP) on a seasonally adjusted annualized basis by quarter. Projections with Estimated Tariff Impact Range apply Glenmede’s estimates of the economic growth impact of all tariffs imposed so far to consensus estimates to provide a range of possibilities for economic growth for 2025. Actual results may differ materially from projections.

- Assuming all proposed tariffs are implemented, economic growth may face a trade-related headwind in 2025, but by themselves are unlikely to lead to outright and persistent declines in GDP.

- It remains to be seen whether tariffs are the means to a negotiated end or the end in and of themselves, leading to a range of possibilities for economic impact in 2025.

Globalization had been a profit margin tailwind, the reversal of which, alongside tariffs, is likely a headwind

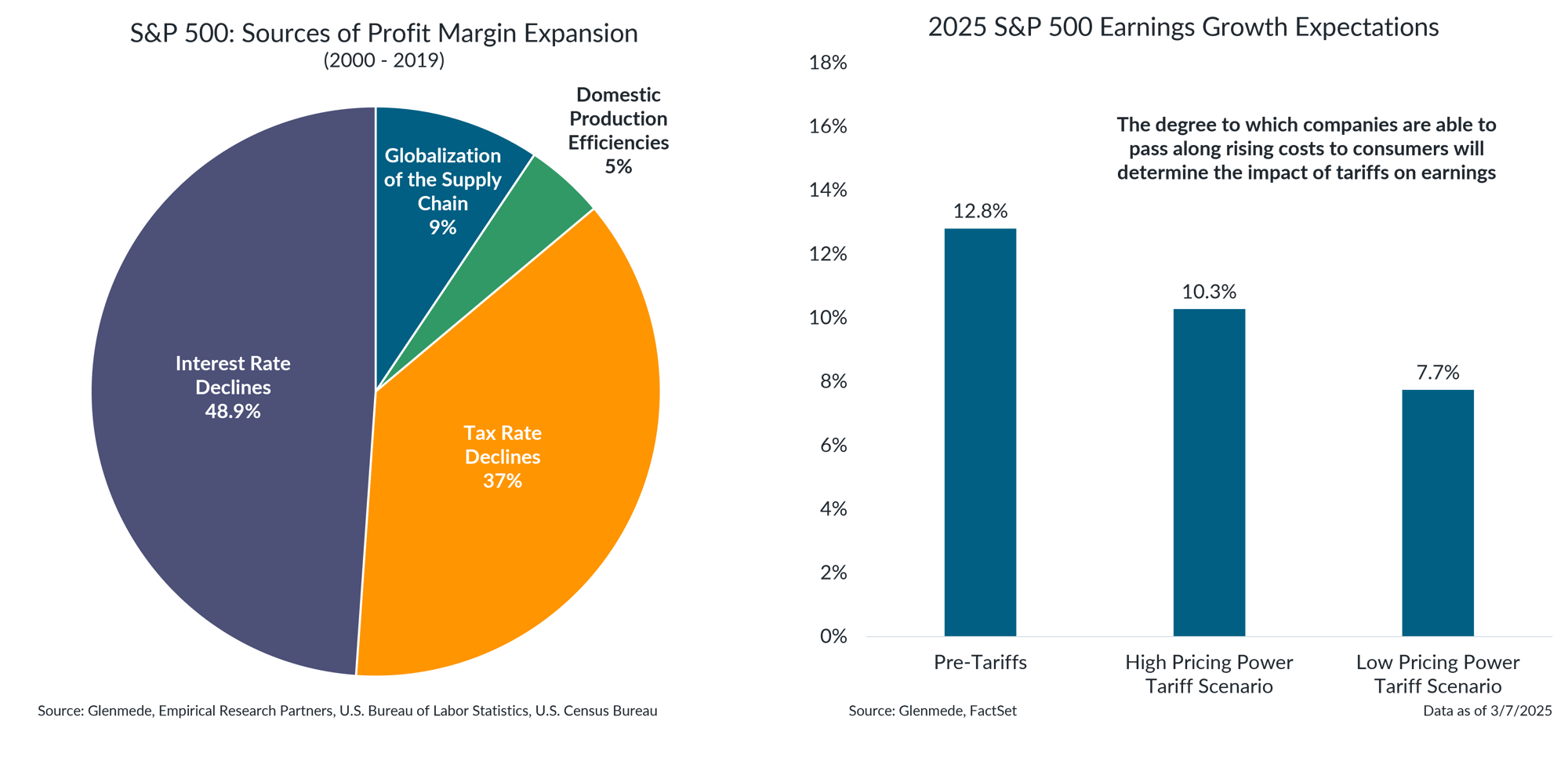

Data shown in the left panel are an attribution of sources for the S&P 500’s net profit margin expansion from 2000 to 2019. Data shown in the right panel are earnings growth expectations for the S&P 500 under three scenarios: Pre-Tariffs refers to the expected growth rate in earnings as of the end of 2024, High Pricing Power Tariff Scenario are projections based on the full implementation of all proposed tariffs if companies are able to pass along some higher costs to consumers via higher prices, Low Pricing Power Tariff Scenario are projections based on the same tariffs if companies are less able to pass along higher costs to consumers. All scenarios account for first-order impacts of tariffs only (i.e., increases in costs) and no second-order demand shocks or impacts from retaliatory tariffs. The S&P 500 is a market capitalization weighted index of large cap stocks in the U.S. Actual results may differ materially from expectations. Past performance may not be indicative of future results. One cannot invest directly in an index.

- Globalization has been a boon for corporate profit margins since the turn of the millennium due to wage savings and lower capital intensity, but that tailwind may turn to a headwind amid changing terms of trade.

- There is still some uncertainty regarding the extent of rising cost impacts on earnings growth expectations for 2025, but tariffs are unlikely to completely erase expected profit gains in 2025.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.