Investment Strategy Brief

Tariff Ripple Effects

May 4, 2025

Executive Summary

- Market uncertainty remains elevated but materially lower than at the peak of tariff concerns.

- Tariff front-running efforts contributed to one of the noisiest GDP reports in history.

- The latest labor market data points to a status quo approach by businesses amid uncertainty.

- Q1 earnings are beating expectations, but estimates for the rest of the year are being revised lower.

- Market volatility is likely to remain elevated alongside tariff uncertainty as business and consumer behavior adapts.

Market uncertainty remains elevated but materially lower than at the peak of tariff concerns

Data shown are the daily values of the Chicago Board Options Exchange Volatility Index (VIX). The VIX measures the implied volatility of the S&P 500 Index based on options-pricing. Past performance may not be indicative of future results. One cannot invest directly in an index.

- Markets have been acutely sensitive to major trade policy announcements so far this year. Although down from its recent peak, volatility remains elevated amid considerable uncertainty.

- There are several catalysts for continued market volatility over the next few weeks, including the outcome of trade negotiations, this week’s meeting of the Federal Open Market Committee and the April inflation report, which may reflect some initial effects from tariffs.

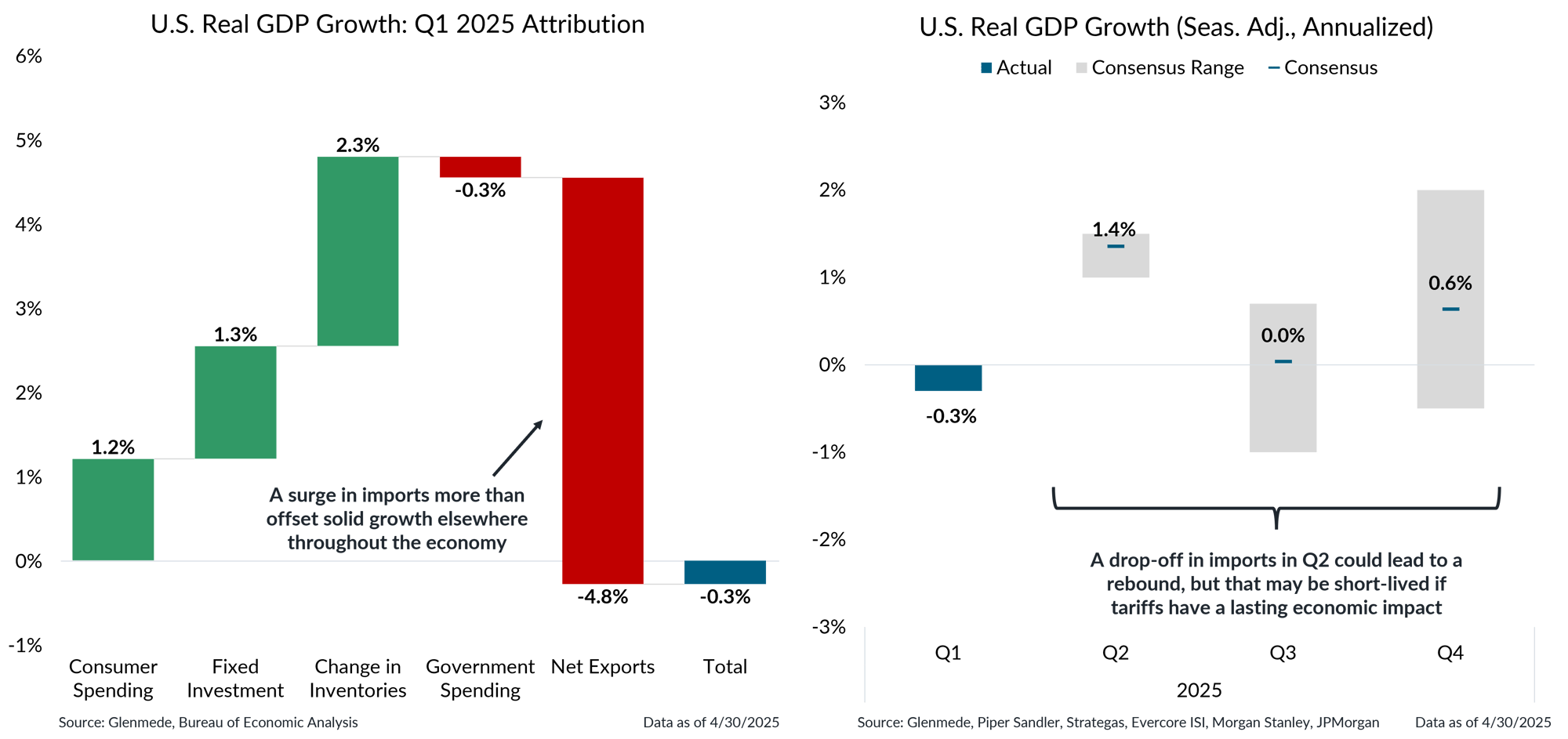

Tariff front-running efforts contributed to one of the noisiest GDP reports in history

Shown in the left panel is an attribution of Q1 2025 real gross domestic product (GDP) growth in the U.S. Consumer Spending is represented by personal consumption expenditures. Fixed Investment is represented by both residential and nonresidential investment. Net Exports refers to exports less imports. Shown in the right panel in gray are ranges of estimates from economists for quarterly U.S. real GDP growth on a seasonally adjusted annualized basis. Solid blue shading are actual results. The blue dashes represent the average of estimates. Actual results may differ materially from expectations.

- A surge in imports during Q1 weighed on GDP growth, but other components of GDP remained strong, indicating solid core economic fundamentals.

- If the weakness in Q1 reflects front-loaded activity that would have otherwise occurred in Q2, economic growth may rebound in the coming quarter.

- The outlook for the back half of the year is much more uncertain, as it remains to be seen how businesses will react to evolving tariff policy.

The latest labor market data points to a status quo approach by businesses amid uncertainty

Shown in the left panel is the U.S. unemployment rate for persons ages 16 years and over in blue and a range estimate of the natural rate of unemployment with a Glenmede-defined buffer in gray, which is the baseline level of joblessness that persists in a well-functioning economy due to frictional and structural factors. Shown in the right panel is the monthly change in nonfarm payrolls, which represent the total number of paid employees in the U.S. economy, excluding farm workers, government employees and certain other categories.

- The U.S. labor market remains resilient and relatively healthy despite the challenges posed by broader economic uncertainties.

- For now, businesses appear to be staying the course, but persistent trade policy uncertainty and rising costs could lead firms to slow hiring and reconsider investment plans.

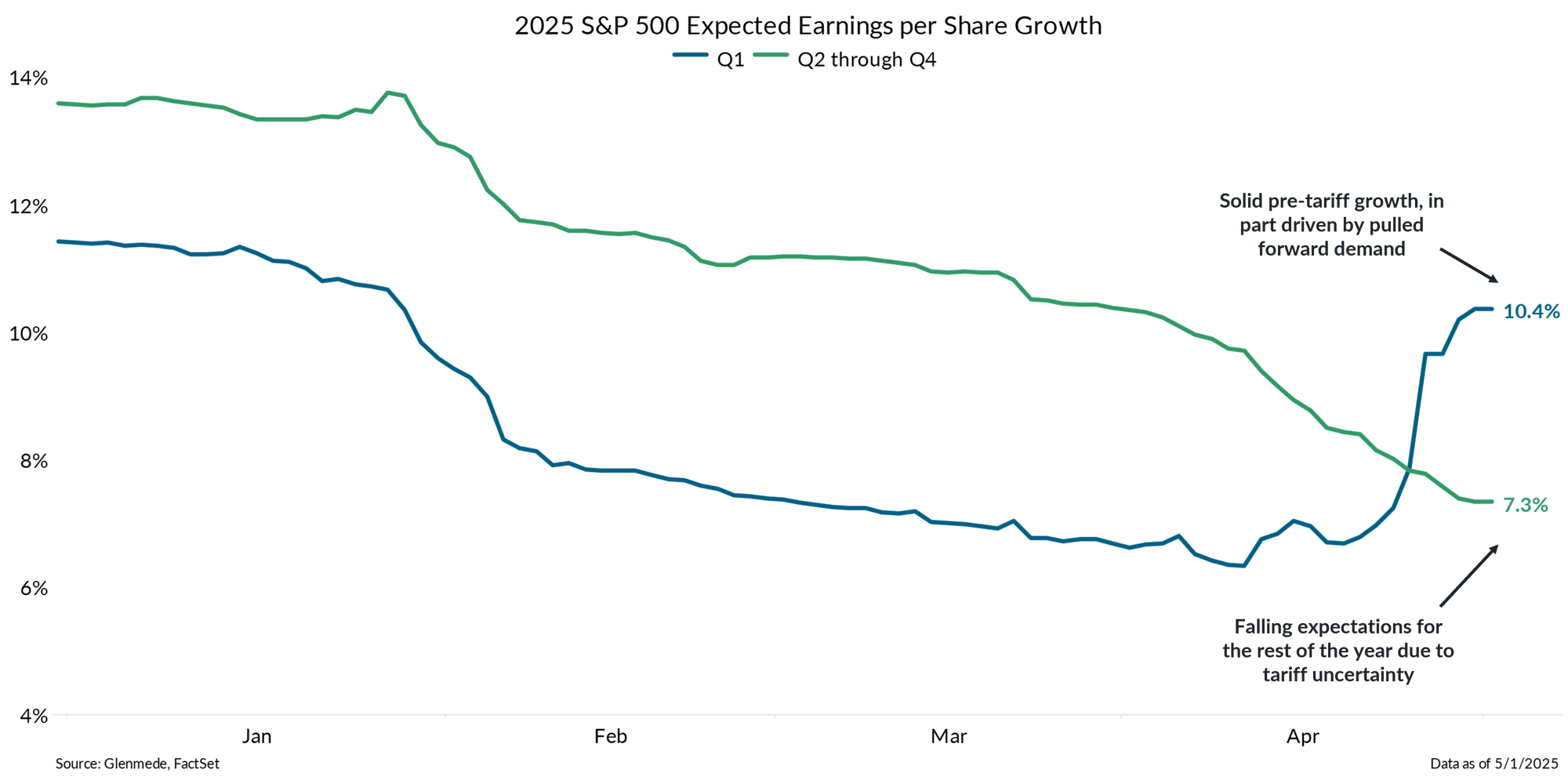

Q1 earnings are beating expectations, but estimates for the rest of the year are being revised lower

Shown are year-over-year earnings-per-share growth expectations for the S&P 500 for Q1 2025 and Q2 through Q4 combined on a year-over-year basis. Expectations are derived via a consensus of company-level analysts. The S&P 500 is a market capitalization weighted index of large cap stocks in the U.S. Past performance may not be indicative of future results. One cannot invest directly in an index. Actual results may differ materially from expectations

- Q1 earnings season is shaping up to be better than expected, with the S&P 500 on track to deliver ~10% earnings growth on a year-over-year basis.

- Some of that growth has perhaps been pulled forward from subsequent quarters, as earnings expectations for the remainder of the year have fallen due to concerns that higher costs may adversely affect profit margins.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.