Investment Strategy Brief

Tariffs on Trial

June 1, 2025

Executive Summary

- Two federal courts ruled against some of the administration’s tariff orders, though enforcement has been delayed.

- Despite the recent court rulings, the administration still has many other tools at its disposal to reimpose tariffs if needed.

- In the near team, tariff uncertainty reduces U.S. negotiating leverage and may make trade deals harder to finalize.

- Rolling back tariffs would weaken a potential offset to the deficits embedded in the reconciliation bill advancing through Congress.

- Tariffs are likely to remain a feature of trade policy, but their scope and structure are still being shaped by both courts and policymakers.

The first federal court has ruled against recent tariff orders, though enforcement has been delayed

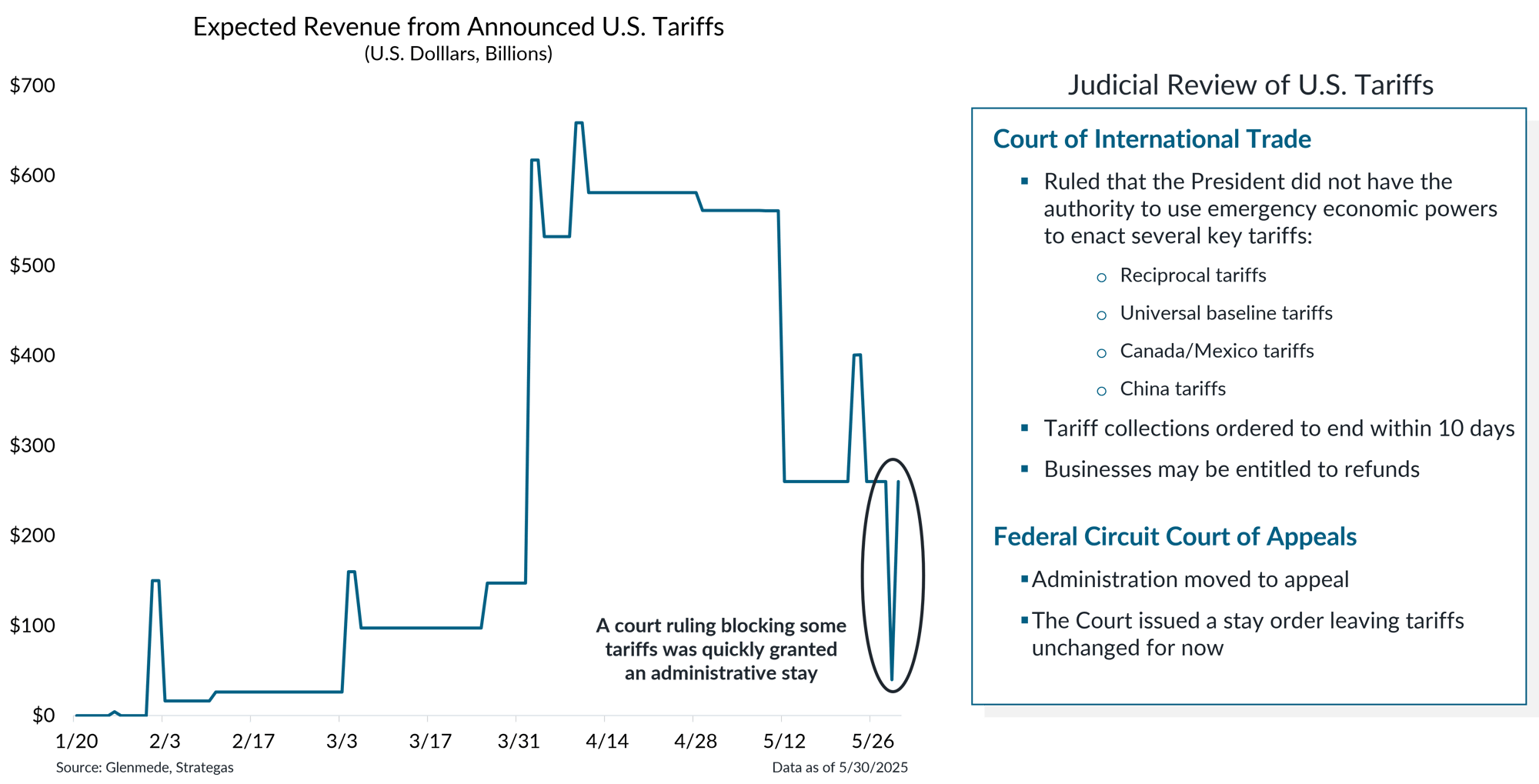

Shown in the left panel is a timeline of the cumulative amount of expected revenue generated from tariffs announced as of each day since President Trump’s second inauguration, measured in billions of U.S. dollars. Historical and projected tariff figures are derived from internal and third-party sources believed to be reliable. Actual results may differ materially from expectations.

- Last week, the U.S. Court of International Trade ruled that the President lacked the authority to use emergency economic powers to enact reciprocal, universal baseline, Canada/Mexico, and China tariffs.

- Product-specific tariffs were not impacted by the current court ruling, as they were imposed under a separate legal framework.

- The administration promptly appealed, and the Federal Circuit Court of Appeals issued a stay order, stating more time is needed to review the case, leaving tariffs unchanged for now.

Despite the recent court rulings, the administration still has many other tools at its disposal to reimpose tariffs

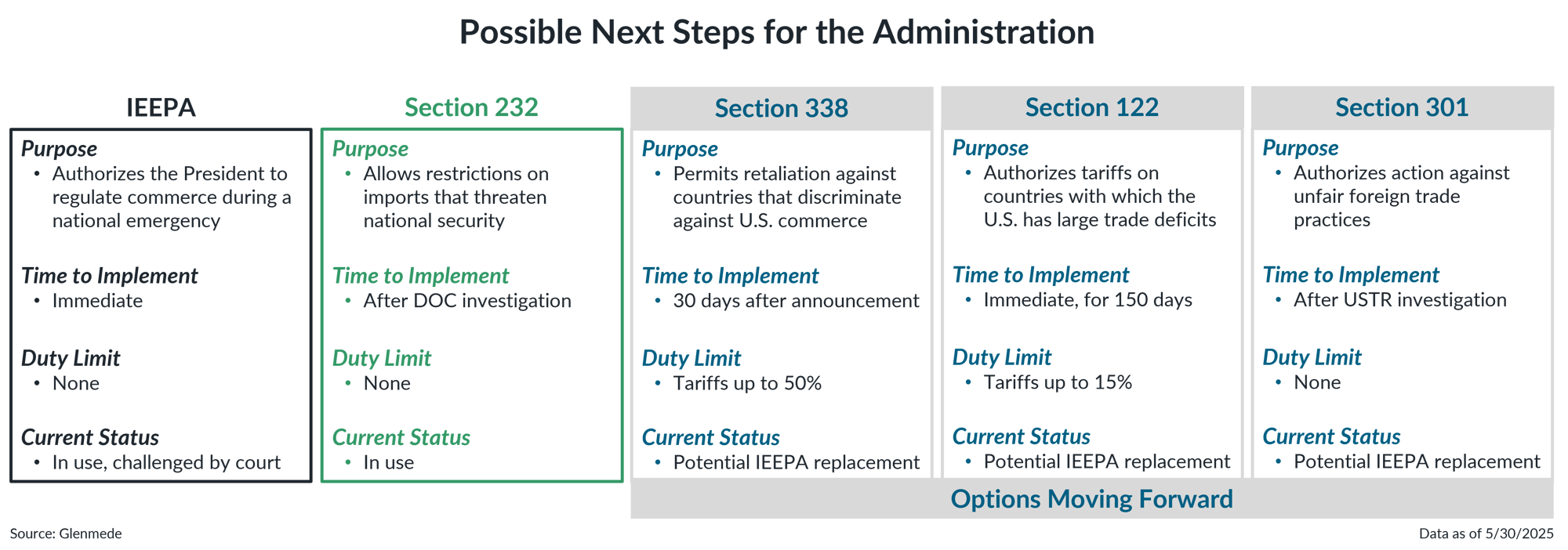

The information shown outlines legal provisions that grant the President and Congress authority to manage trade policy. The International Emergency Economic Powers Act of 1977 (IEEPA) authorizes the president to regulate international commerce after declaration of a national emergency or in response to threats to the U.S. The Trade Expansion Act of 1962: Section 232 delegates congressional authority to the President to impose import restrictions that threaten national security. The Trade Act of 1930: Section 338 grants the President the authority to impose tariffs of up to 50% on imports from countries that discriminate against the U.S. The Trade Act of 1974: Section 122 authorizes the President to address a balance of payments deficit or to prevent an imminent and significant depreciation in the dollar. The Trade Act of 1974: Section 301 authorizes the President to take appropriate action in response to unreasonable or discriminatory burdens to U.S. commerce. DOC refers to the Department of Commerce. USTR refers to the Office of the United States Trade Representative. The options shown are not exhaustive and actual trade actions taken may differ materially from those described.

- If the administration continues to face legal challenges related to its use of IEEPA, alternative measures are available to advance the tariff agenda.

- This includes implementing tariffs under Section 338 or Section 122, which provide different legal justifications for imposing trade restrictions as well as different tariff rate limits.

- Additionally, the administration may consider using Section 301, which requires investigations into trade practices before implementation and may be pursued in parallel as a contingency if other options prove unsuccessful.

The economic impact of tariffs may still be notable

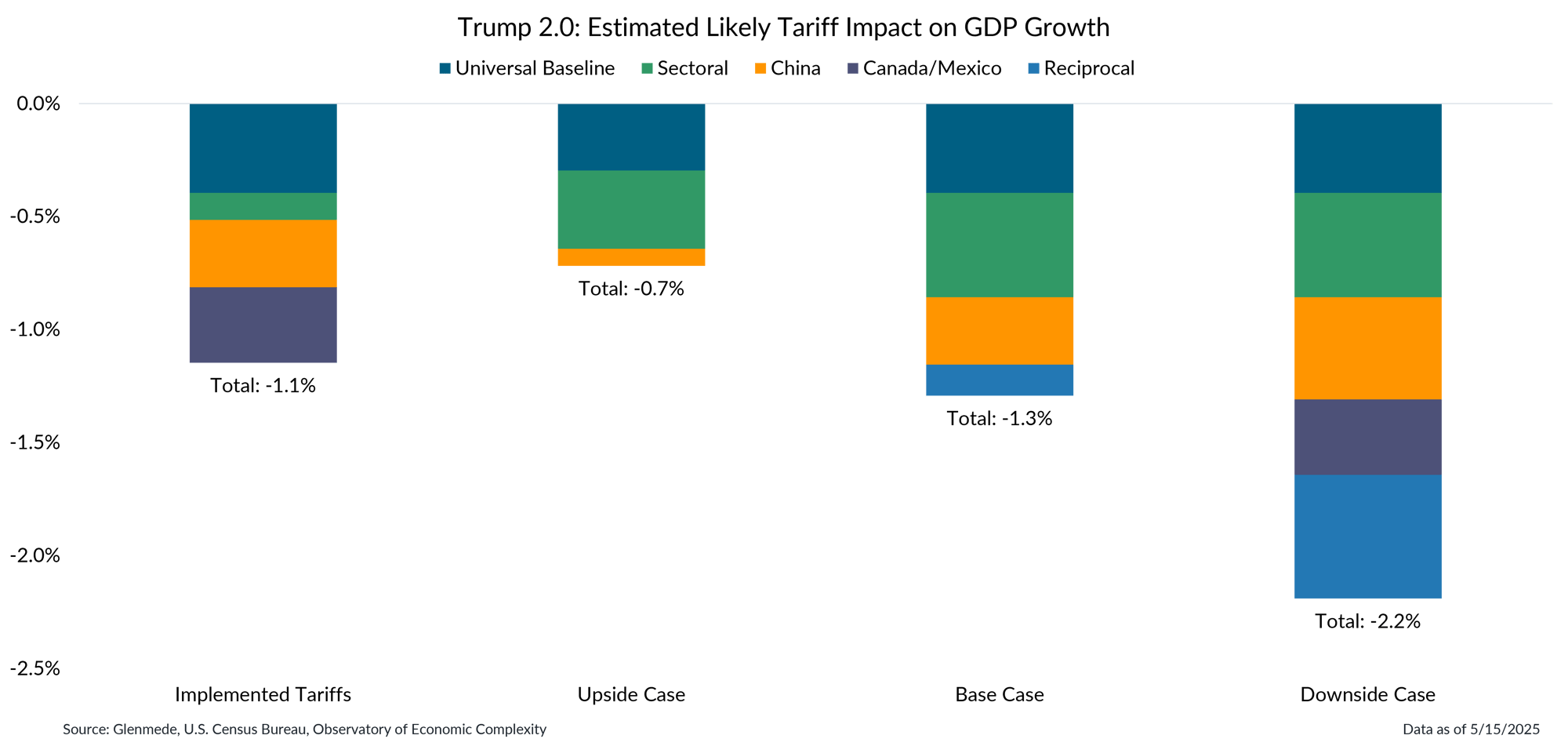

Implemented Tariffs includes 30% China tariffs, 25% Canada/Mexico tariffs, 25% steel/aluminum/auto tariffs and 10% universal baseline tariffs with all applicable exemptions. Upside Case includes 10% China tariffs and 25%+ sectoral tariffs (steel, aluminum, autos, copper, lumber, pharmaceuticals, semiconductors, solar panels). Base Case includes 30% China tariffs, 25+% sectoral tariffs, 10% universal baseline tariffs and a quarter of the full announced program of reciprocal tariffs. Downside Case includes 60% China tariffs, 25% Canada/Mexico tariffs, 25%+ sectoral tariffs, 200% alcohol tariffs from the European Union, 10% universal baseline tariffs and the full announced program of reciprocal tariffs. All figures shown are projections as a share of nominal U.S. gross domestic product (GDP) and are subject to change. Actual results may differ materially from projections.

- While the legal challenges continue, tariffs are likely to remain in place, with the economic impact amounting to an estimated 1.1% headwind to GDP.

- Despite the court challenges, there are a range of potential outcomes from here, including an upside case that focuses solely on China and product-specific duties, a downside case that goes full throttle on a range of tariffs and a base case in between.

The ongoing court challenges may throw a wrench in trade negotiations

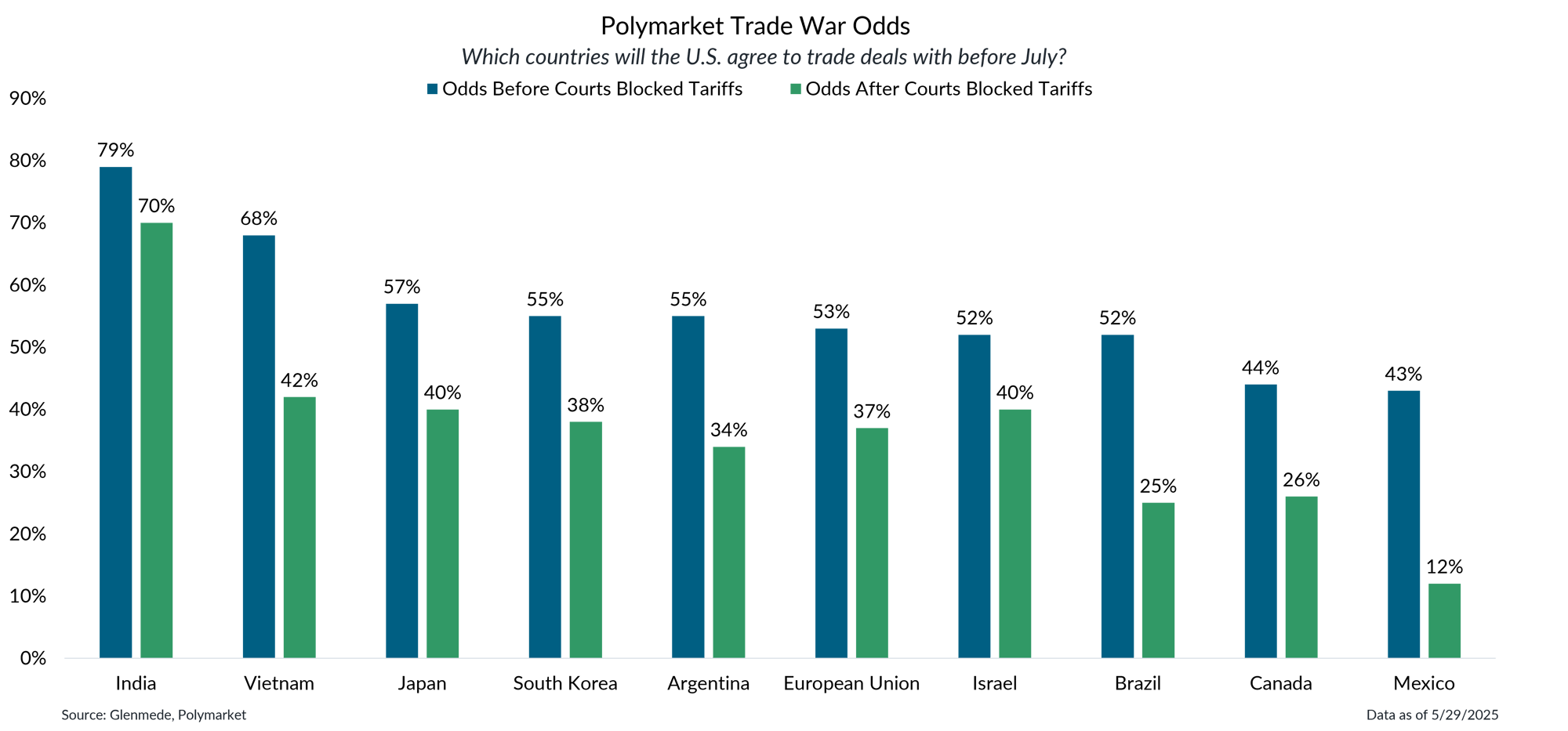

Data shown are probabilities of various trade negotiation outcomes via Polymarket. Shown are the probabilities of countries agreeing to trade deals with the U.S. before July. The blue bars are as of 5/19/2025. The green bars are probabilities as of the latest date shown. Polymarket is a prediction market where investors can place bets on various future events. References to Polymarket and use of its data herein should in no way be interpreted as an endorsement or recommendation of Polymarket by Glenmede. Probabilities or likelihoods shown are not the opinions of Glenmede and are shown for illustrative purposes only. Actual results may differ materially from probabilities shown, particularly for prediction markets with low trading volume.

- Court challenges reduce the incentive for other countries to negotiate with the U.S. since a successful court challenge could potentially remove the tariffs.

- The administration will likely look to assert the validity of its alternative strategies for imposing tariffs in order to re-establish credibility for the purpose of negotiations.

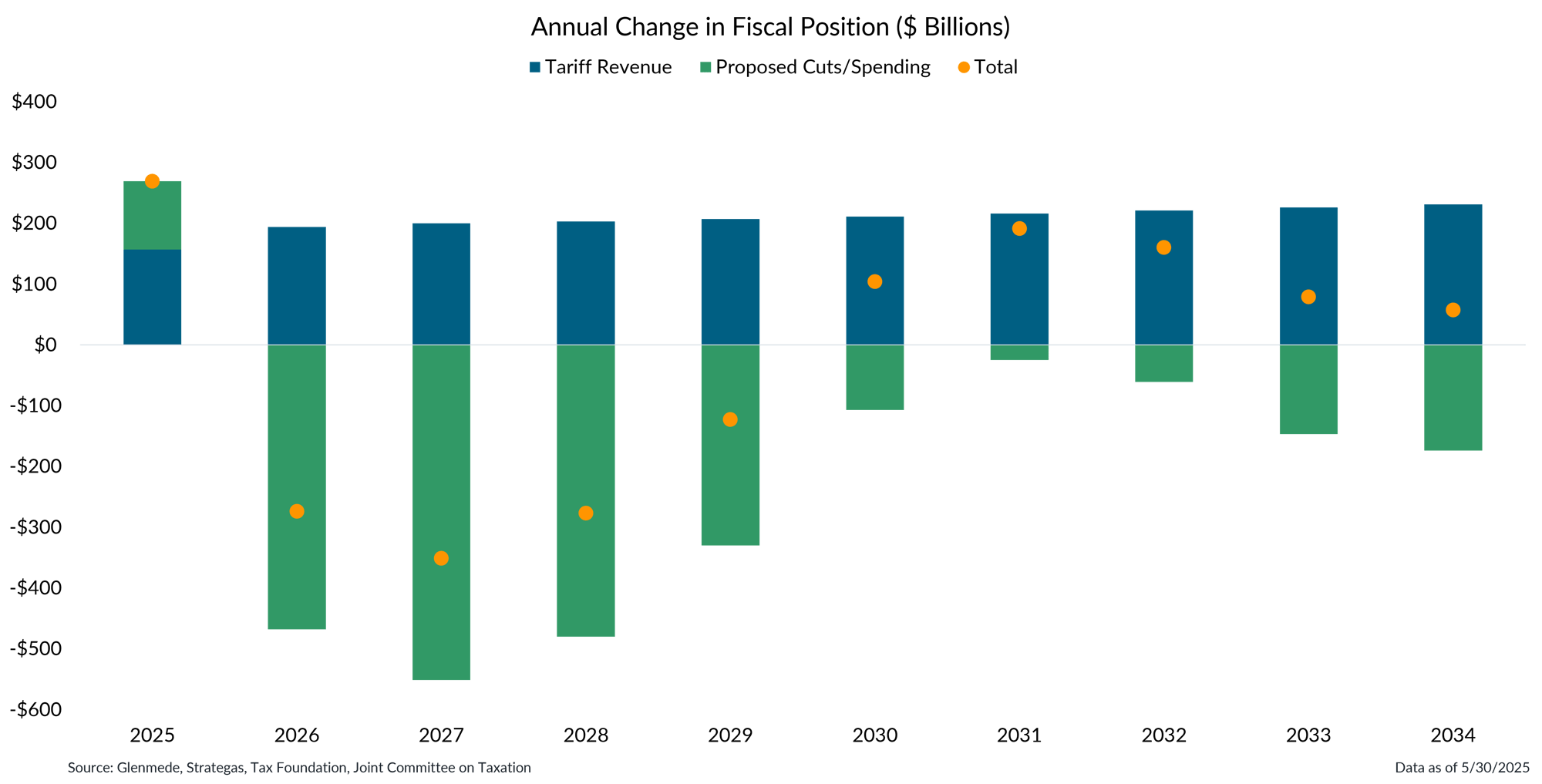

Tariff revenue was a potential offset to the deficits resulting from upcoming reconciliation bill

Data in blue represent annual tariff revenue estimates and data in blue represent the net change in annual government spending as proposed in the One, Big, Beautiful Bill legislation by the House of Representatives. Actual results may differ materially from projections.

- Tariff revenue is expected to help offset potential increases in the deficit resulting from new spending and proposed cuts in the budget bill under discussion in Congress.

- Tariffs are likely to remain a feature of trade policy, but their scope and structure are still being shaped by both courts and policymakers.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.