Investment Strategy Brief

The Fed News Trifecta

June 9, 2024

Executive Summary

- This month sees an unusual convergence of events with an employment report followed by a CPI report and an FOMC meeting release on the same day.

- Inflation has moderated and the number of job openings has declined, but neither inflation nor the labor market have fully normalized.

- The Fed is still likely to cut rates in 2024 if inflation continues to moderate, initiating a return to neutral that is slower than originally expected.

- Fixed income will likely continue to provide higher yields for as long as inflationary pressures remain.

The Fed will look for an accumulation of evidence of moderating inflation before initiating rate cuts

.png?width=2000&height=950&name=IS%20Brief%20Chart%201%202024-06-07%20(1).png)

Shown on the left is the 3-month annualized percent change in the U.S. Consumer Price Index (CPI) excluding food and energy. Shown on the right are the 3-month annualized percent changes in the U.S. CPI components. Food & Energy is represented by the food & energy subcomponents. Services (ex. Shelter) is represented by Services Less Rent of Shelter. Shelter is represented by Rent of Shelter. Goods (ex-Food & Energy) is represented by the commodities component (excluding food & energy). CPI measures the price of a basket of goods & services consumed by U.S. households. The gray region represents the Fed’s target range consistent with its longer-term price stability objective.

- Inflation trends have moved in the wrong direction to start 2024 but may now be establishing a better trend.

- Since food and energy can be volatile, key drivers to watch will be shelter and services components, the latter of which is largely tied to wages.

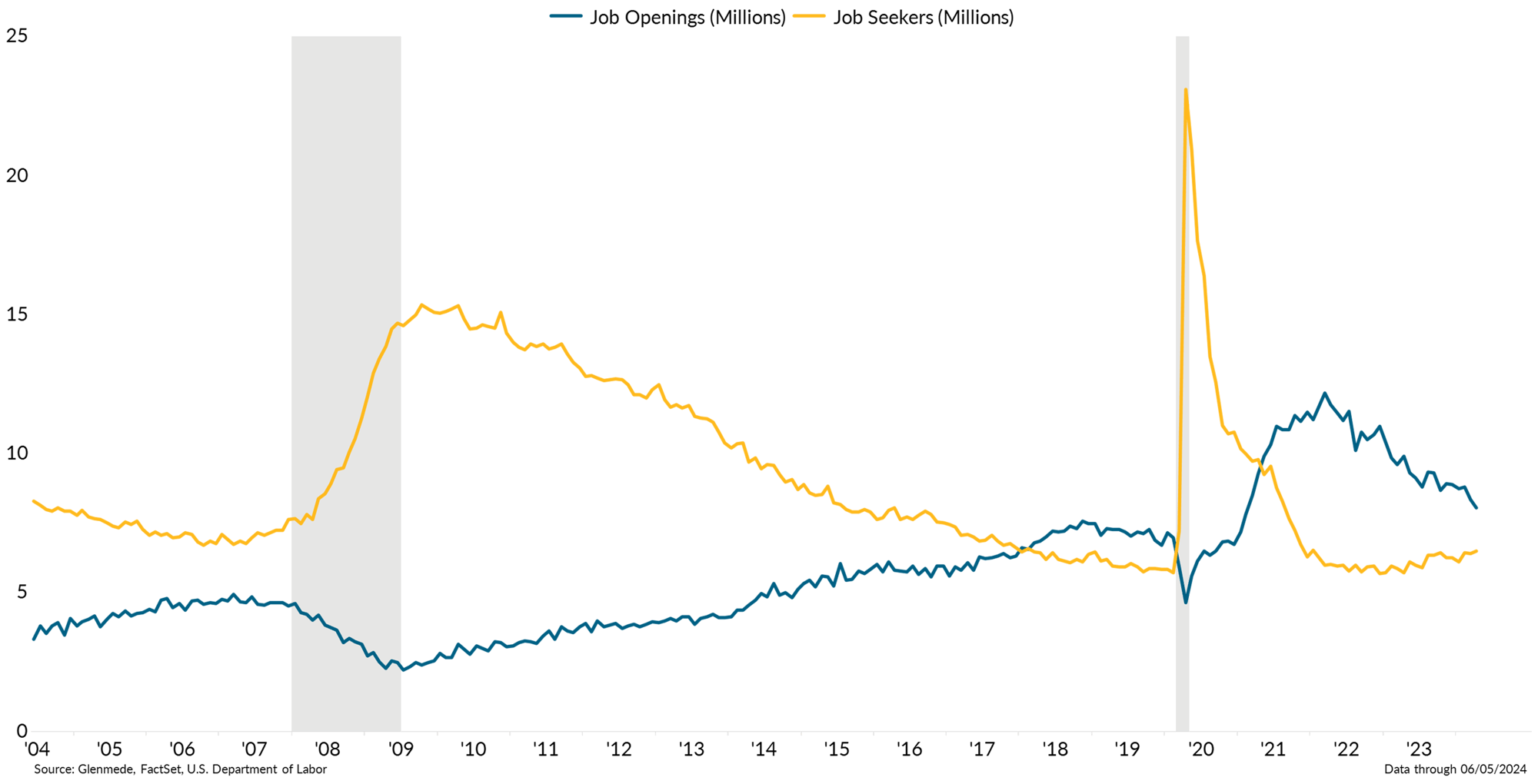

Fed tightening has reduced the number of job openings, but excess job supply may still be inflationary

Data shown are the number of non-farm job openings in the U.S. in blue and the number of unemployed persons in yellow, both measured in millions.

- The post-pandemic period was highly unusual for the labor market, in which the number of job openings far outnumbered the count of people seeking those jobs.

- The process of labor market normalization has been slow and likely has further to reach “normal” but has continued apace given the tight stance of monetary policy.

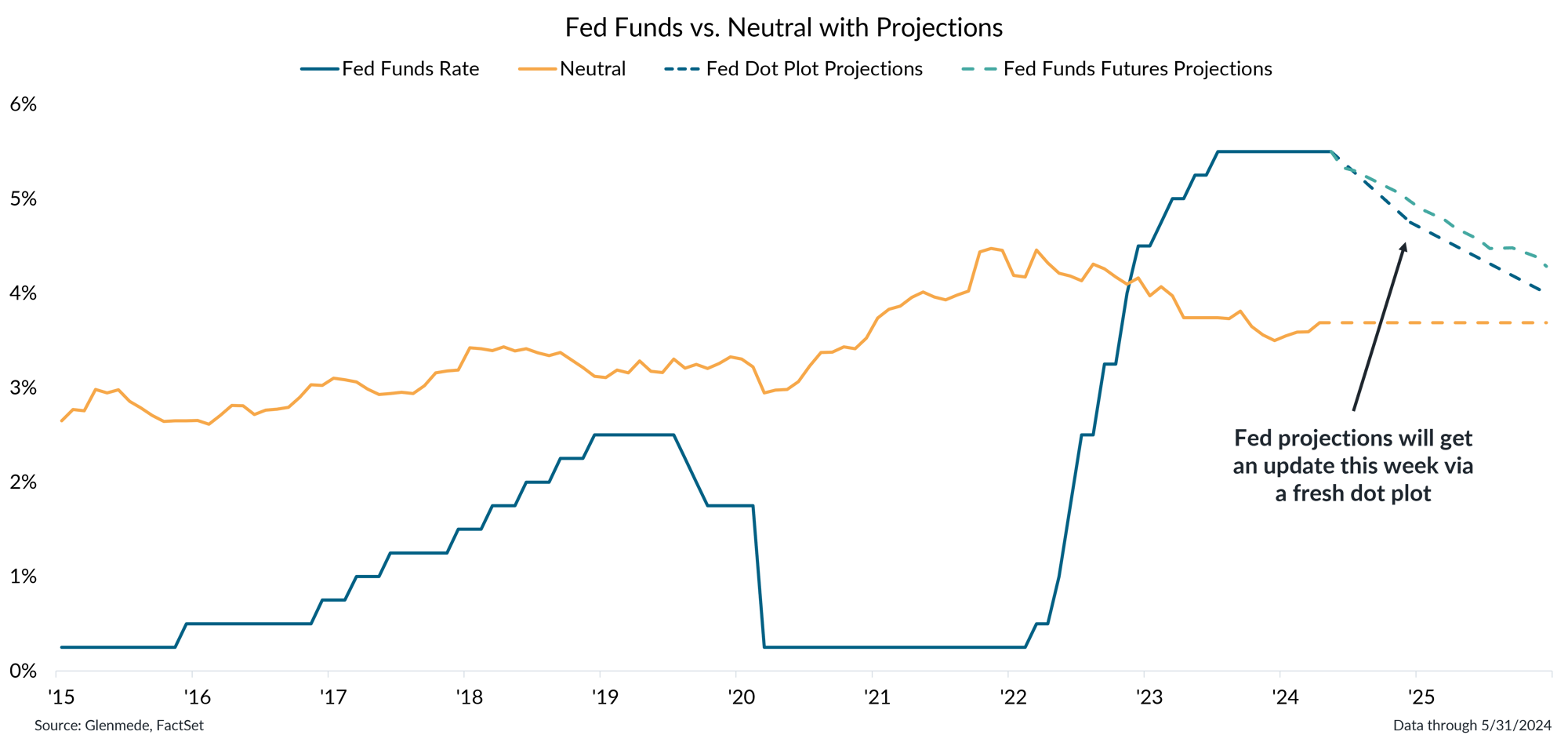

The Fed is still likely to cut rates in 2024, initiating a return to neutral slower than originally expected

Data shown in yellow are Glenmede’s estimates of the neutral federal funds rate over time (i.e., the level of rates that is neither economically stimulative nor restrictive) based on expectations for real interest rates via the Holston-Laubach-Williams model and Glenmede’s 10yr inflation expectations. Fed Funds Rate in blue is the target rate upper bound. The dashed blue line represents projections based on the median response in the Federal Open Market Committee’s latest dot plot survey. The dashed green line represents projections based on fed funds futures. Actual results may differ materially from projections.

- The focal point of this week’s FOMC meeting will be the release of its updated dot plot projections regarding where rates may go from here.

- The dot plot is likely to still signal a rate cut or two in 2024, higher for longer relative to prior expectations. Fixed income yields should remain higher for as long as inflationary pressures remain.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.