Investment Strategy Brief

The Fed Wrapped

December 14, 2025

Executive Summary

- The Federal Reserve closed out 2025 with another rate cut, firmly placing fed funds within the realm of neutral.

- The median dot calls for one cut in each of the next two years, though individual expectations vary widely.

- After some recalibration, balance sheet growth should help ease financial conditions.

- A new Fed chair taking office next year may ultimately preside over any additional rate cuts.

- Easier monetary policy should be a support for the economy and risk assets, with small caps in particular benefiting.

The Fed closed out 2025 with another rate cut, firmly placing fed funds within the realm of neutral

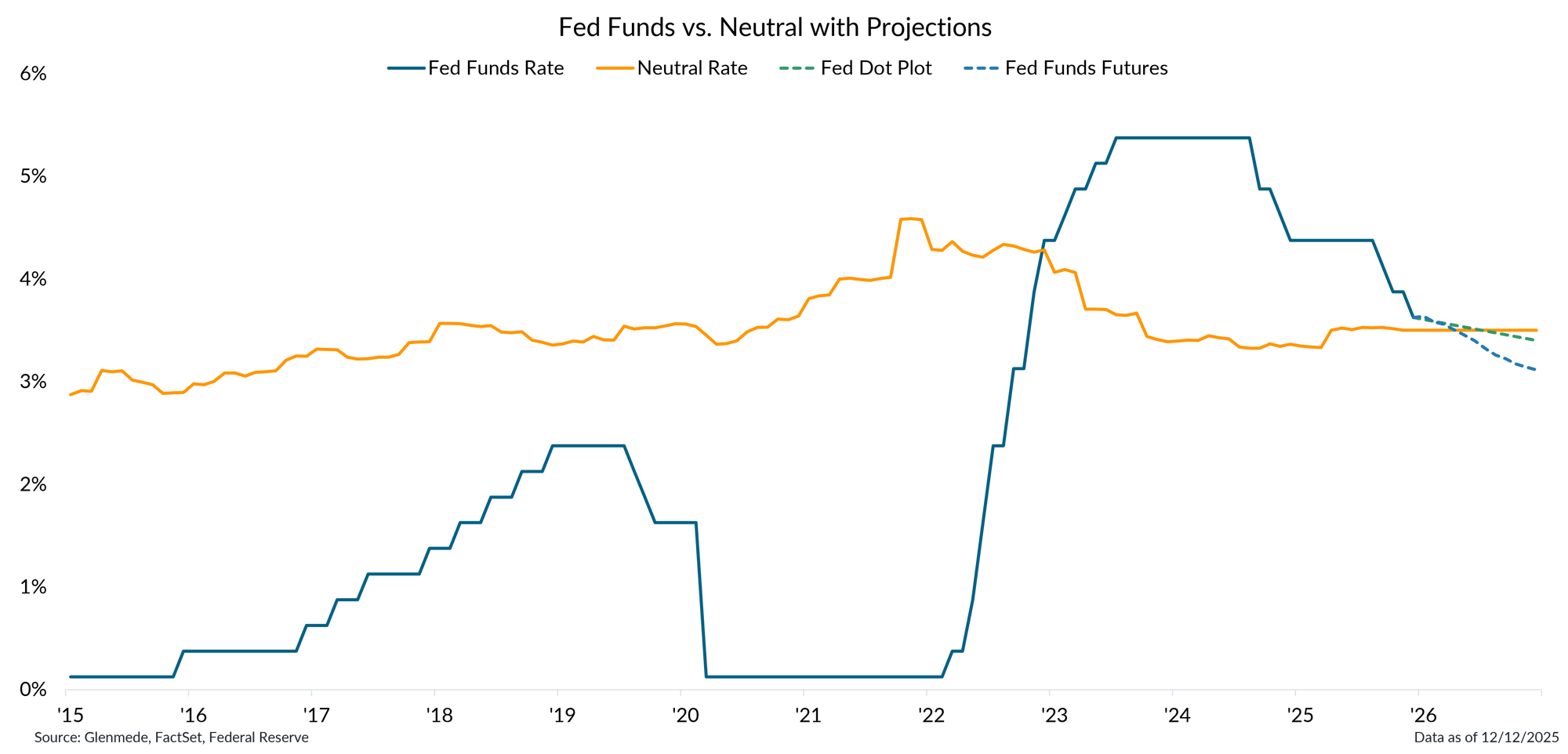

Data shown in orange are Glenmede’s estimates of the neutral federal funds rate over time (i.e., the level of rates that is neither economically stimulative nor restrictive) based on expectations for real interest rates via the Holston-Laubach-Williams model and Glenmede’s 10yr inflation expectations. Fed Funds Rate in blue is the target rate midpoint. The dashed blue line represents expectations for the forward path of rates based on fed funds futures pricing. The dashed green line represents expectations for the forward path of rates based on the median respondent in the Federal Open Market Committee’s dot plot projections. Actual results may differ materially from projections.

- The Fed cut its policy rate by a quarter point last week in a continuation of its ongoing easing campaign. The decision was not a unanimous one, with a higher-than-normal three dissents, and at least one dissent in both directions.

- Both the Fed’s projections and market pricing anticipate additional rate cuts ahead, but the expected path keeps policy close to the estimated neutral level rather than shifting into outright easy conditions.

The median dot calls for one cut in each of the next two years, though individual expectations vary widely

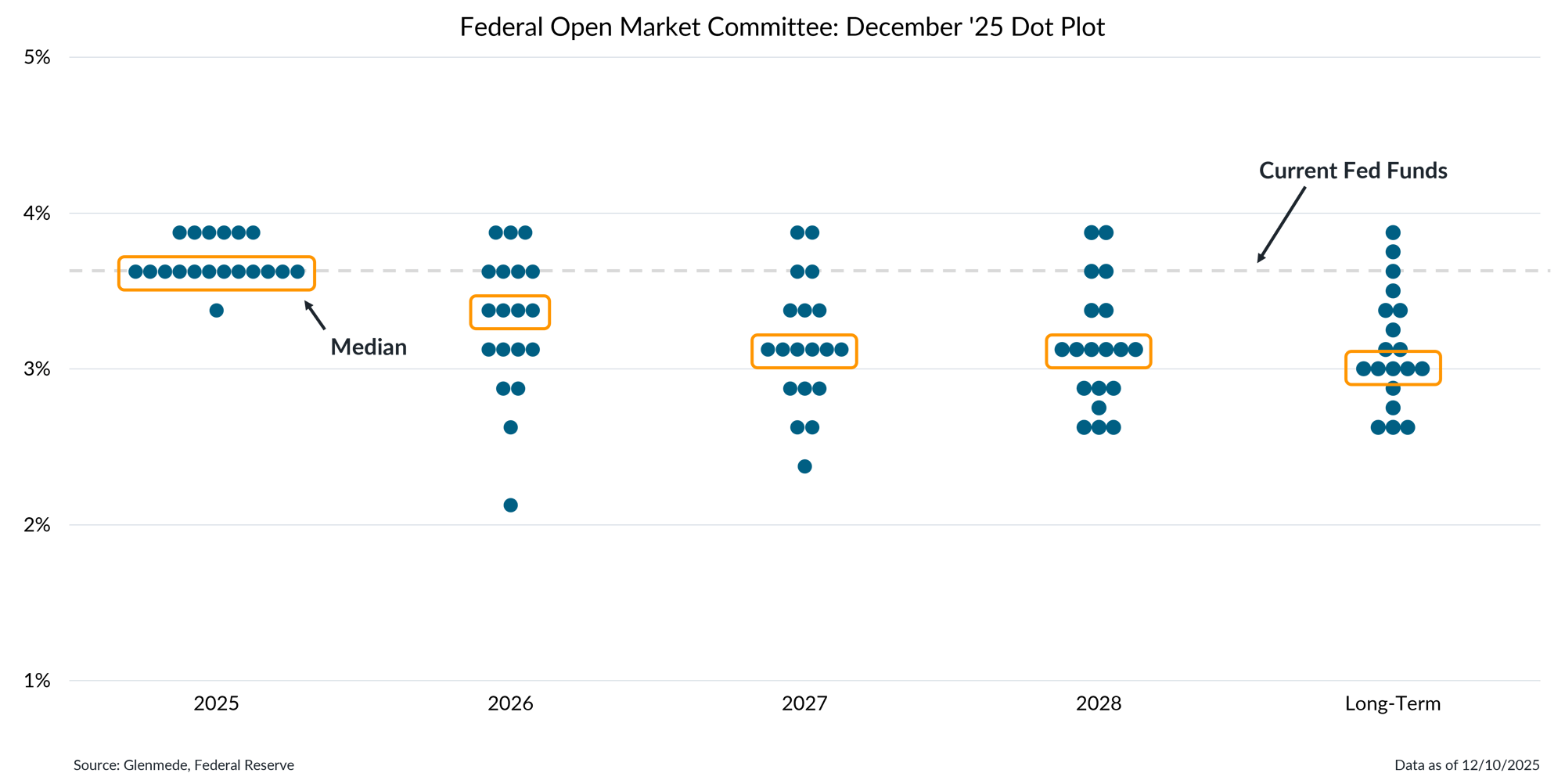

Data shown are the Federal Open Market Committee’s dot plot projections from December 2025. Each dot represents the response of one Fed official regarding where they expect the federal funds rate to sit at the end of each of the next four calendar years, as well as their estimate of the longer run level of federal funds. Actual results may differ materially from projections.

- The December update to the Federal Open Market Committee’s (FOMC) dot plot projections changed little from the last update in September, with the median respondent continuing to see one rate cut in both 2026 and 2027.

- The dispersion of opinions for next year is unusually wide, reflecting ongoing uncertainty around the appropriate path of monetary policy amid competing concerns around the labor market and inflation.

After some recalibration, balance sheet growth should help ease financial conditions

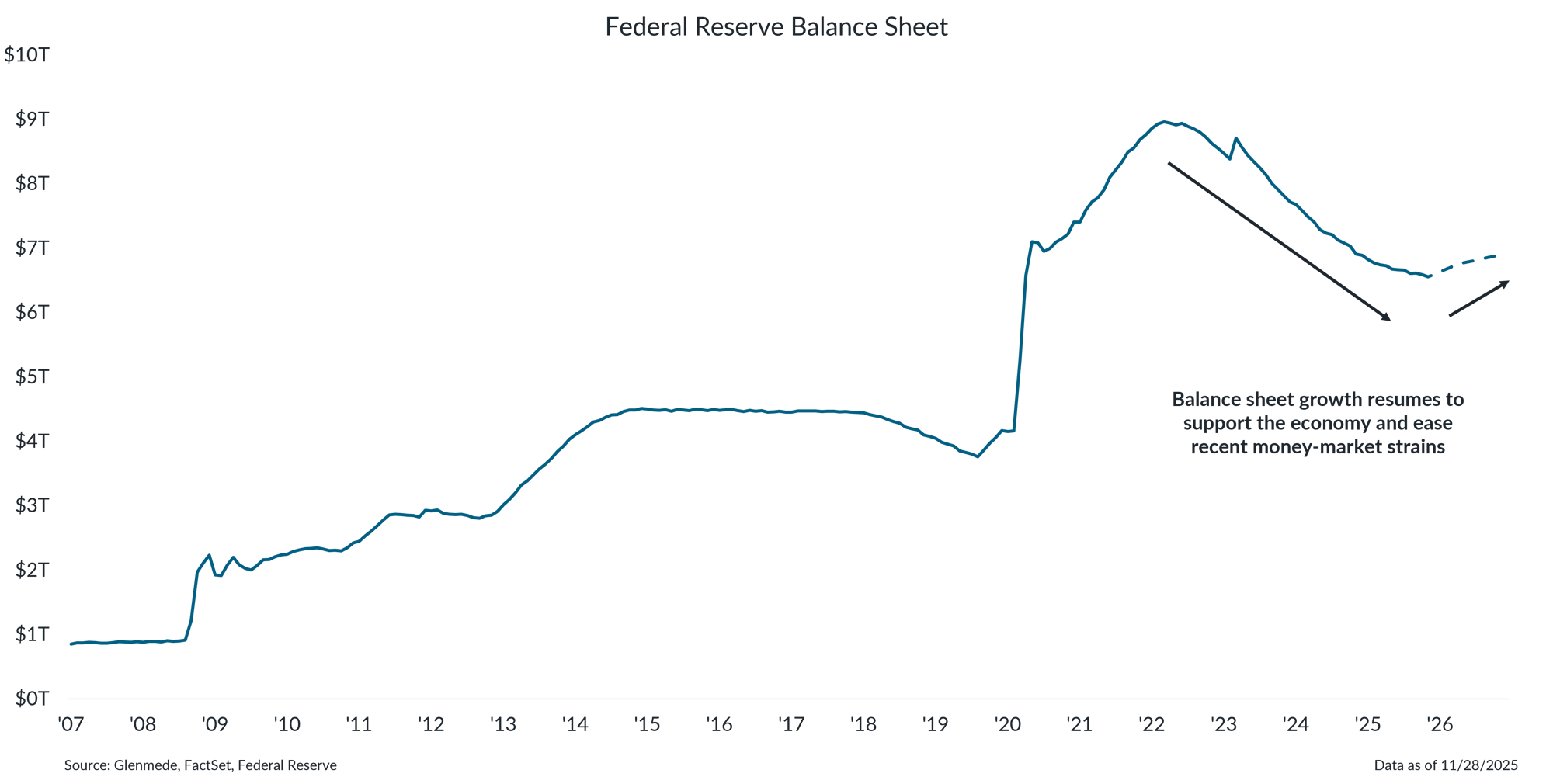

Shown is the Federal Reserve’s total assets in trillions of U.S. dollars. Actual figures are shown in solid lines, while projections are shown in dashed lines. Actual results may differ materially from projections.

- The Fed is once again increasing the size of its balance sheet with $40 billion in purchases of Treasury Bills over the next month, a move aimed at improving liquidity conditions without signaling a return to large-scale quantitative easing.

- Moderate balance sheet expansion will be necessary to accommodate the increased demand for reserves that accompanies ongoing economic growth.

A new Fed chair next year may ultimately preside over any additional rate cuts

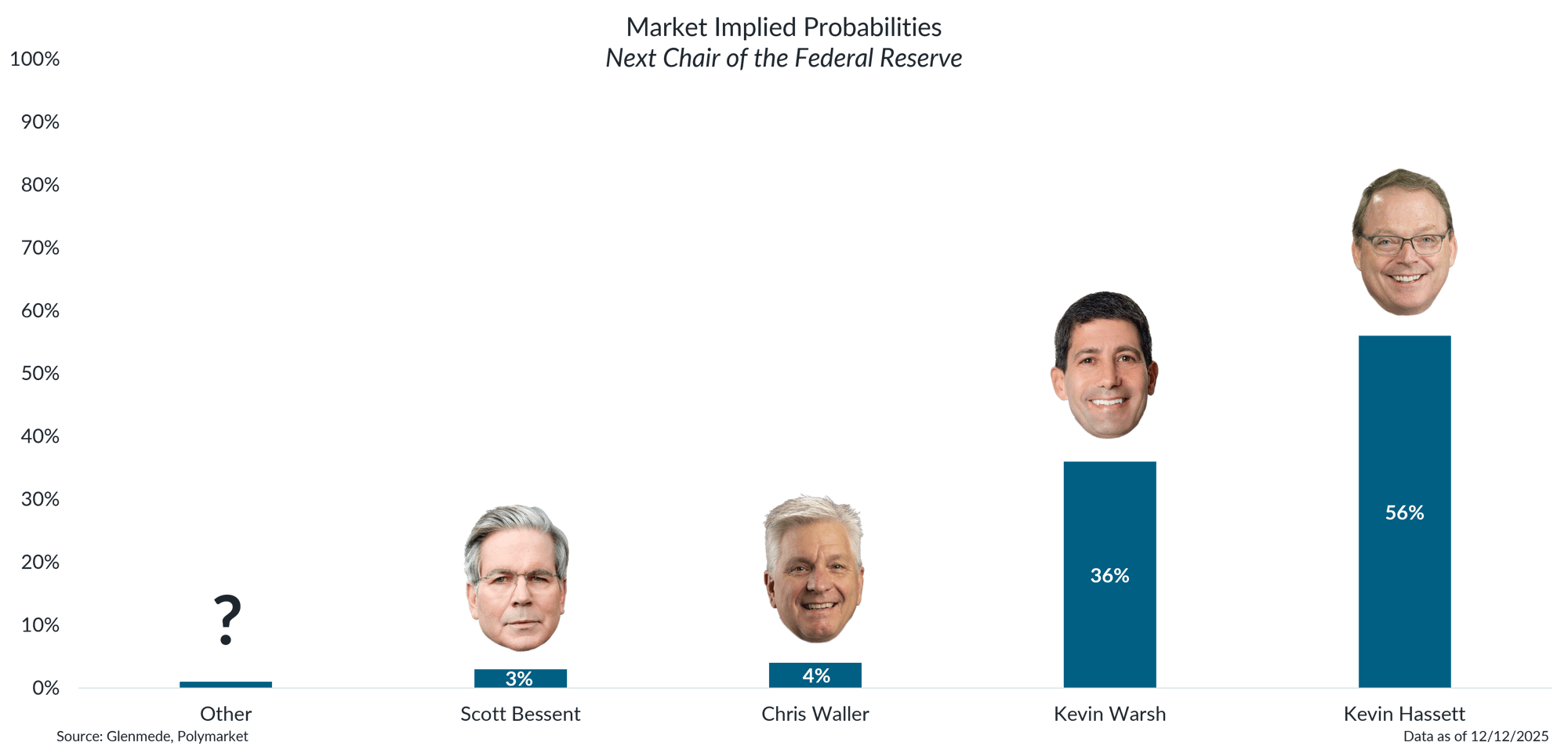

Data shown are market-based odds regarding the administration’s nominee for Chair of the Federal Reserve via Polymarket. Polymarket is a prediction market where investors can place bets on various future events. References to Polymarket and use of its data herein in no way should be interpreted as an endorsement or recommendation of Polymarket by Glenmede. Probabilities or likelihoods shown are not the opinions of Glenmede and are shown for illustrative purposes only. Actual results may differ materially from probabilities shown or projections, particularly for prediction markets with low trading volume.

- The Fed is likely to keep rates on hold for the next few meetings as it takes time to see how things evolve before making its next move. As a result, this may be Jerome Powell’s last rate cut as chair, given his term expires in early 2026.

- Further rate cuts are likely to come under a new Fed chair, for which betting markets suggest Kevin Hassett, Director of the National Economic Council, is a leading candidate among a narrowing shortlist.

- Monetary policy notoriously affects the economy with long and variable lags, but an easier Fed should be a tailwind for small cap equities, particularly due to their high floating rate debt balances.

Upcoming Webinar:

Strategy for a Year of Opportunity, Risks, and Altered Tax Policy

Thoughtful preparation can help you navigate a year defined by opportunity, growing risks, and meaningful shifts in tax law. Join Jason D. Pride, CFA, Chief of Investment Strategy & Research, and Mark R. Parthemer, JD, AEP, ACTEC Fellow, Chief Wealth Strategist, as they explore the following:

- Economic growth and evolving risks

- The impact of tax law changes

- How to position portfolios and support effective tax planning

Wednesday, January 7, 2026

11:00 AM ET

This material is provided solely for informational and/or educational purposes and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Any company, fund or security referenced herein is provided solely for illustrative purposes and should not be construed as a recommendation to buy, hold or sell it. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.