Investment Strategy Brief

The Government Is Open for Business (Again)

November 16, 2025

Executive Summary

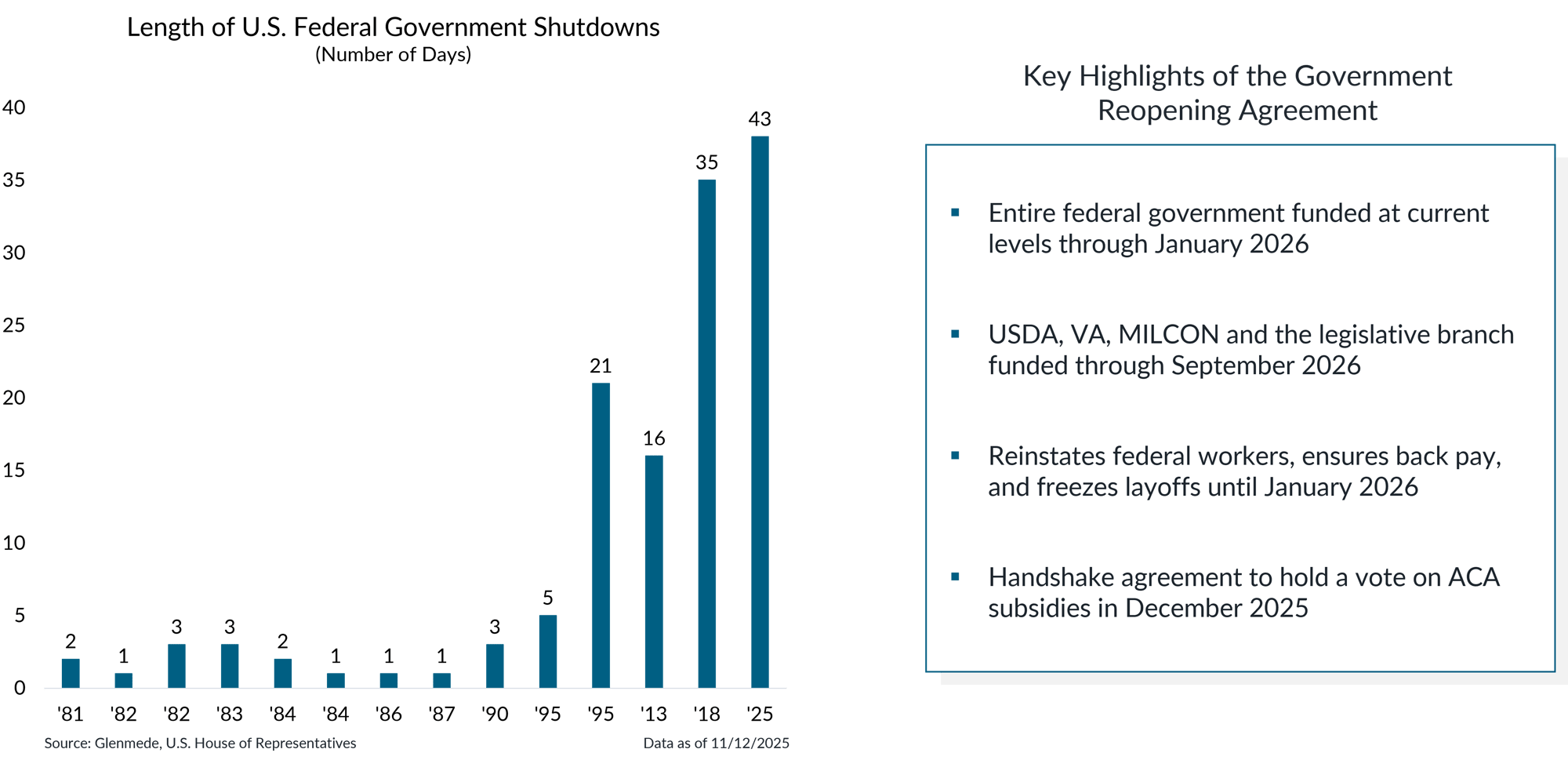

- The recent shutdown became the longest in U.S. history, lasting 43 days before a funding deal was reached.

- The continuing resolution restores broad funding through January 2026 and some key items through September 2026.

- The shutdown is expected to weigh on growth in Q4 but should be mostly recoverable in subsequent quarters.

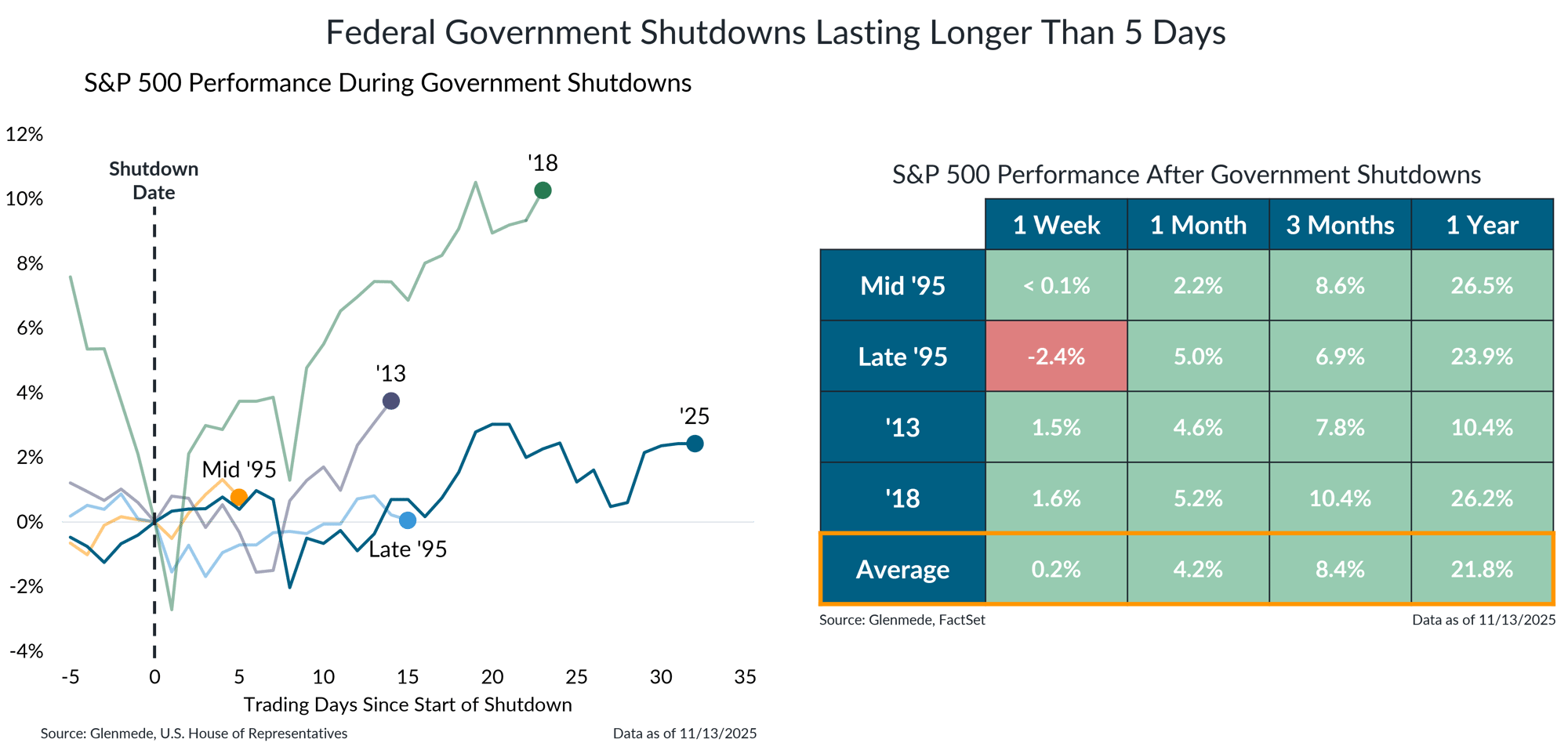

- Post-shutdown equity market returns have historically been positive, though the sample size is relatively small.

- The economy and markets have shown resilience amid the government shutdown and should benefit from its reopening.

The federal government has reopened after the longest shutdown on record

Shown in the left panel are the cumulative durations of each U.S. federal government shutdown since 1981, measured in number of days. Each shutdown is labeled by the year in which the shutdown began, though some shutdowns spanned multiple years. For example, the shutdown that started in 2018 but extended into 2019 is denoted as ’18. Shown in the right panel is a nonexhaustive general overview of key provisions included in the agreement to reopen the government and extend federal funding. USDA refers to the United States Department of Agriculture. VA refers to the United States Department of Veteran Affairs. MILCON refers to Military Construction. ACA refers to the Affordable Care Act.

- The President signed a temporary funding deal last week, officially ending the longest government shutdown in U.S. history at 43 days.

- Much of the agreement to reopen the government is temporary, potentially setting up another shutdown in January 2026.

- However, the nature of that shutdown could be notably less severe, as several programs, including the Supplemental Nutrition Assistance Program (SNAP), have been fully funded through next September.

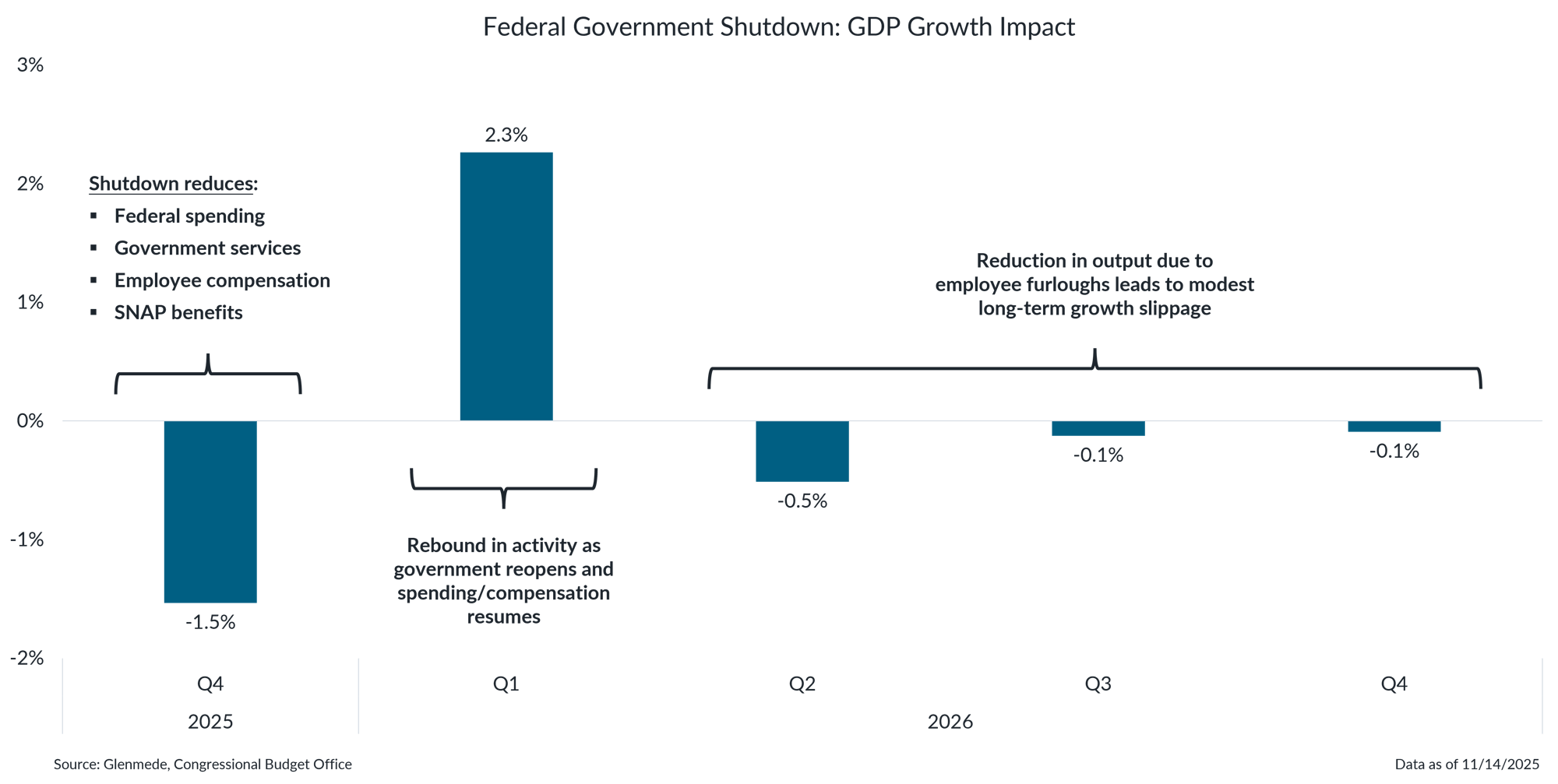

The shutdown is expected to weigh on growth in Q4 but should be mostly recoverable in subsequent quarters

Data shown are estimates for the effect on the annualized quarterly growth rate of U.S. real gross domestic product (GDP) from the federal government shutdown. Actual results may differ materially from estimates.

- The 43-day shutdown is estimated to have reduced Q4 2025 GDP growth by 1.5%, with most of the decline expected to reverse over the course of the next few quarters as delayed spending and production resume.

- Minor residual slowdowns in later quarters reflect temporary inefficiencies resulting from lost output from government workers and reduced business confidence, though output is projected to normalize by year-end.

Post-shutdown equity market returns have historically been positive, though the sample size is relatively small

Shown in the left panel is the price performance of the S&P 500 during the trading days before and after federal government shutdowns that lasted longer than five days, with each line ending when the government reopened. Federal government funding lapses that did not result in shutdown procedures are excluded from the dataset. Shown in the right panel is the price performance of the S&P 500 in the weeks and months following the end of federal government shutdowns that lasted longer than five days, measured from the day federal operations resumed. The S&P 500 is a market capitalization weighted index of large cap stocks in the U.S. Past performance may not be indicative of future results. One cannot invest directly in an index.

- Market performance during government shutdowns has varied significantly, reflecting other influencing factors as much as, if not more than, concerns about the shutdown.

- In contrast, history shows that the market outcome following shutdowns has been more consistently positive, largely reflecting the long-term tendency for markets to rise with time.

This material is provided solely for informational and/or educational purposes and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Any company, fund or security referenced herein is provided solely for illustrative purposes and should not be construed as a recommendation to buy, hold or sell it. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.