Investment Strategy Brief

The Labor Market’s “Curious Kind of Balance"

August 31, 2025

Executive Summary

- Although job gains saw deep revisions in July, the unemployment rate is expected to remain at 4.2%.

- The labor market remains in balance, but growth has stalled as the growth in supply of foreign-born labor has declined.

- U.S. economic growth will be more reliant on productivity if labor force growth continues to slow.

- Slowing employment growth provides the primary justification for rate cuts to resume in September.

- Headwinds to supply and demand have kept the labor market in balance but may still justify rate cuts to sustain economic growth.

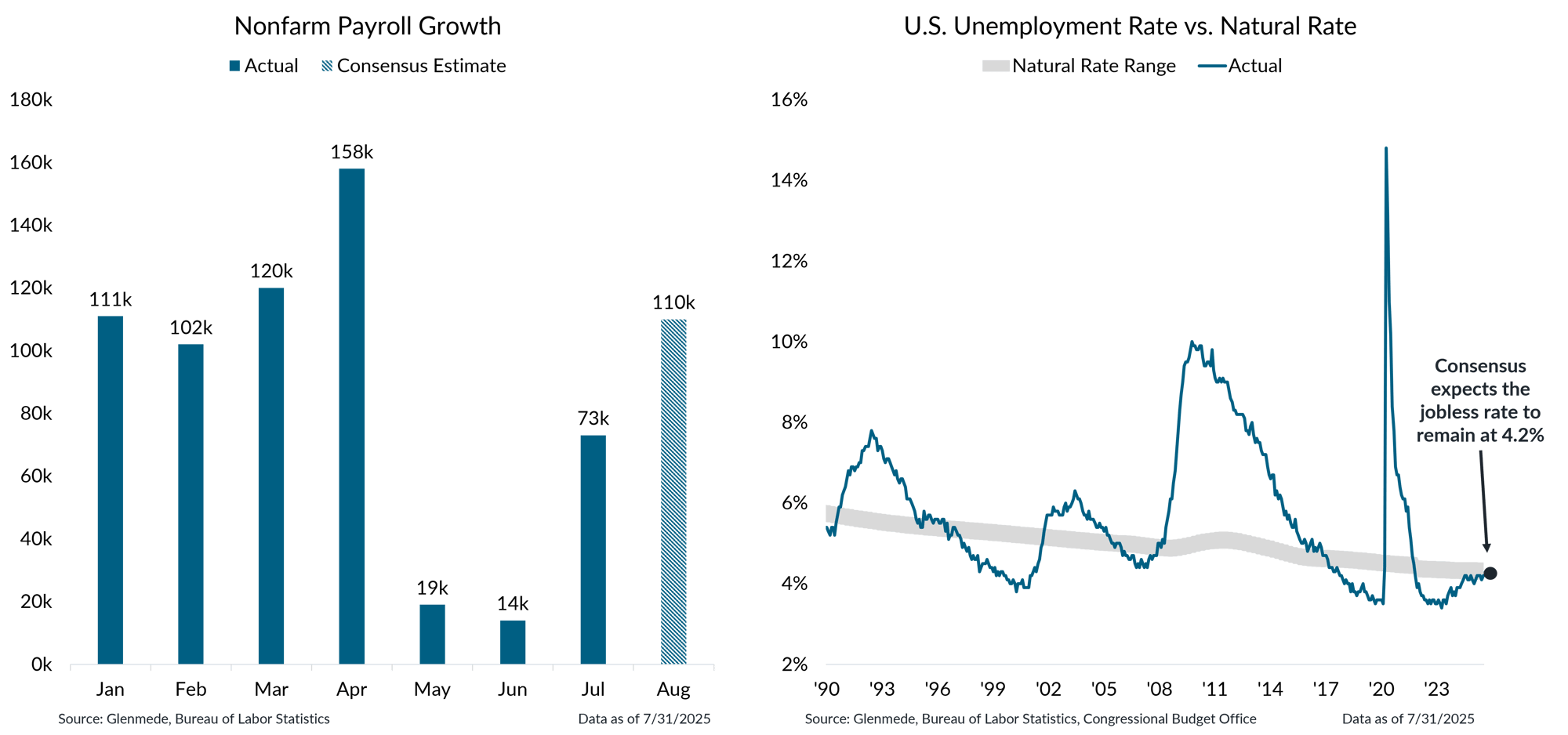

Although job gains saw deep revisions in July, the unemployment rate is expected to remain at 4.2%

Shown in the left panel are seasonally adjusted U.S. nonfarm payroll figures in solid bars. Consensus estimates for August nonfarm payrolls are shown in the hashed bar. Lower initial survey response rates may increase the likelihood of revisions in subsequent releases. Shown in the right panel is the U.S. unemployment rate for persons aged 16 years and over in blue and a range estimate of the natural rate of unemployment with a Glenmede-defined buffer in gray, which is the baseline level of joblessness estimated by Glenmede to persist in a well-functioning economy due to frictional and structural factors. Actual results may differ materially from projections or estimates.

- July’s employment report fell short of expectations and included abnormally large downward revisions to the previous months. However, the August report is expected to see a rebound.

- Still, the unemployment rate has remained relatively steady and is expected to hold at 4.2% in August, earning Federal Reserve Chair Jay Powell’s description of a “curious kind of balance.”

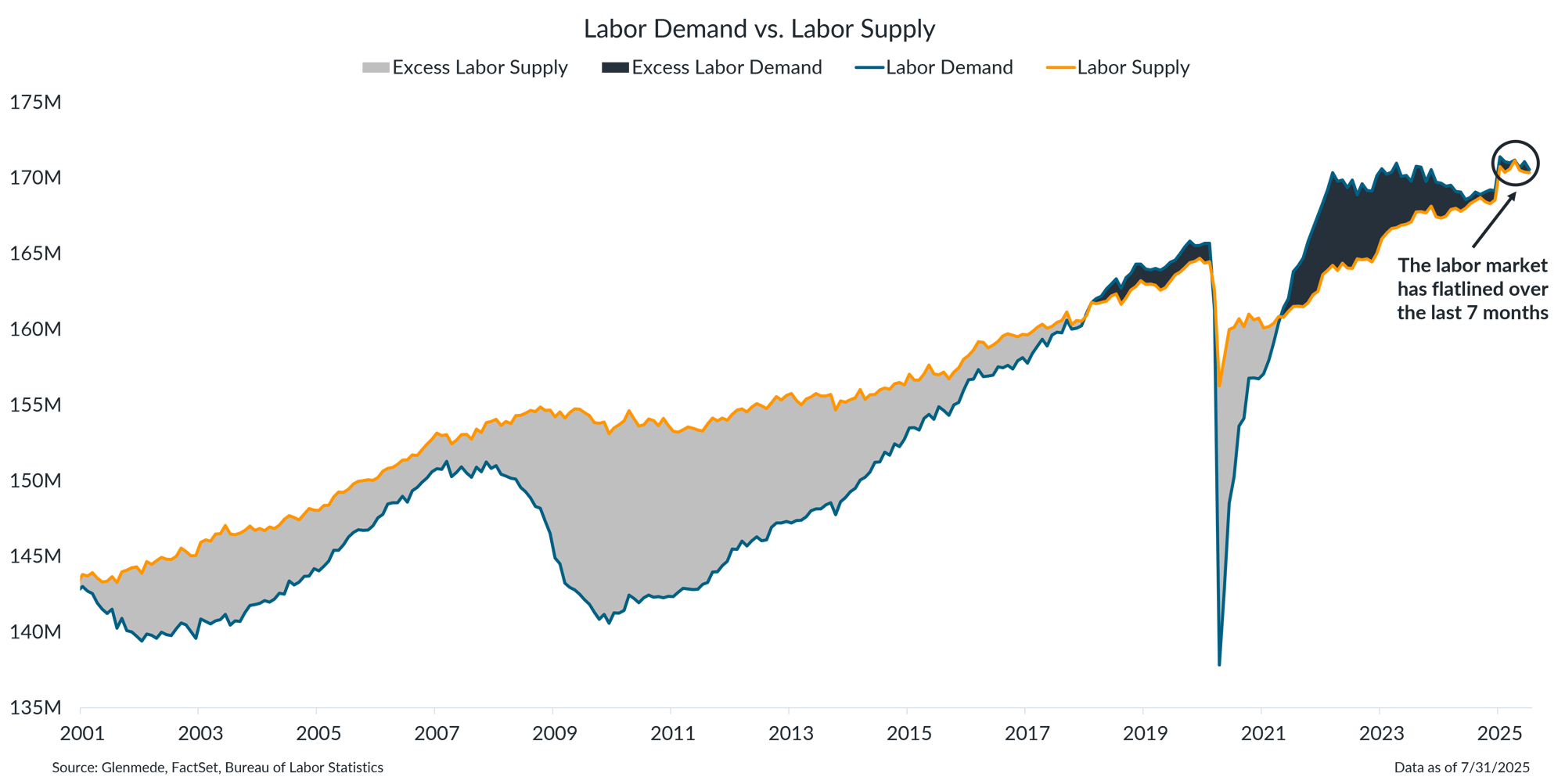

The labor market remains in balance, but growth has stalled, deviating from its typical upward trend

Shown in blue is labor demand defined as the number of employed individuals plus job openings. Shown in yellow is labor supply defined as the number of employed plus unemployed individuals. The light gray illustrates periods when supply outstripped demand and the dark gray illustrates those in which demand outstripped supply.

- The relatively normal unemployment rate reflects a labor market that is quite balanced between the supply of jobs and workers.

- This balanced labor market, however, is experiencing simultaneous slowdowns in labor demand and supply, warranting ongoing monitoring.

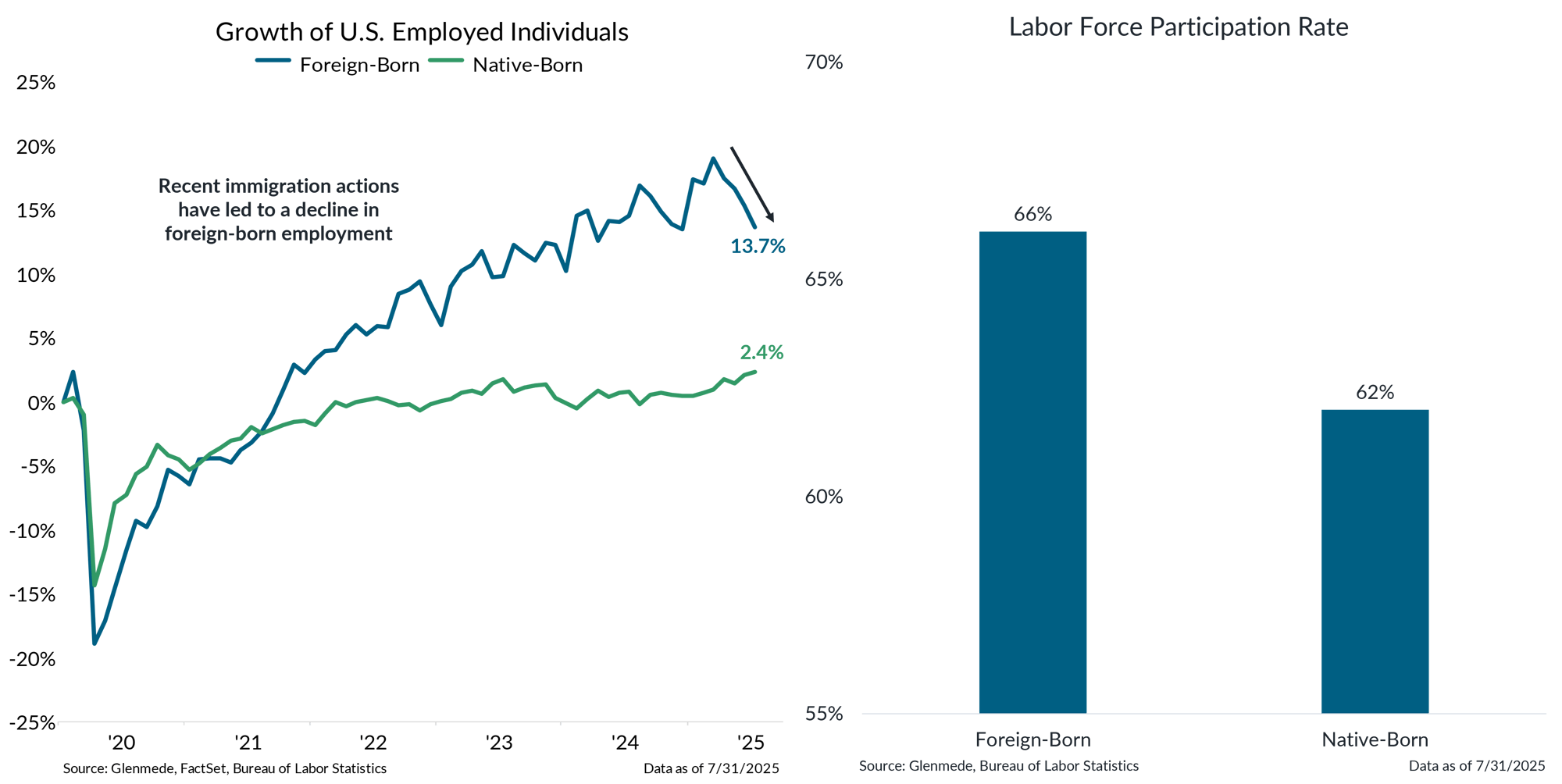

Labor market sluggishness appears to be driven by a declining supply of foreign-born workers

Shown in the left panel is the growth of employed foreign-born and native-born individuals ages 16 years or older, residing in the 50 states and the District of Columbia, and who are not institutionalized or on active duty in the armed forces, indexed to 0% on 1/1/2020. Shown in the right panel is the percentage of the foreign-born and native-born population aged 16 years and older who are either employed or actively looking for employment.

- The growth of foreign-born workers in the U.S. had been outpacing that of native-born workers, but shifting immigration policies have led to a sharp decline so far in 2025.

- Continued declines may serve as a headwind to the labor market, as the participation rate of the foreign-born labor force is notably higher than that of the native-born labor force.

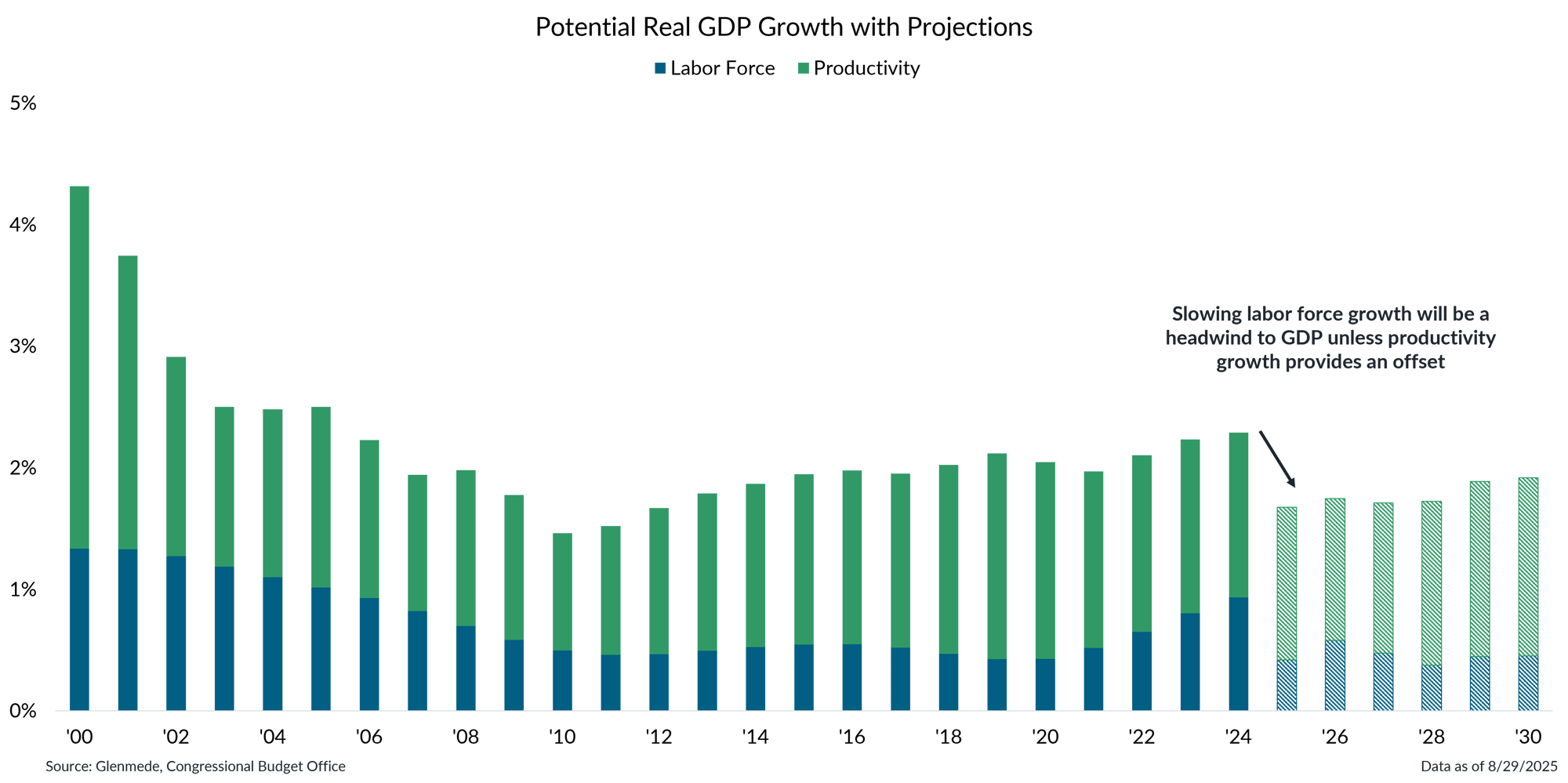

U.S. economic growth will be more reliant on productivity if labor force growth continues to slow

Data shown represent annual real potential gross domestic product (GDP) growth broken down by the growth in the labor force in blue and the growth in labor force productivity in green. Actual results are shown in the solid bars and estimates are shown in the hashed bars. Actual results may differ materially from projections or estimates.

- The labor force’s contribution to potential GDP is likely to decelerate, which could be a headwind to the U.S. economy’s sustainable growth rate.

- Productivity growth, which has been higher than normal in the post-pandemic period, will likely be needed to provide an offset and support economic growth.

Slowing employment growth provides the primary justification for rate cuts to resume in September

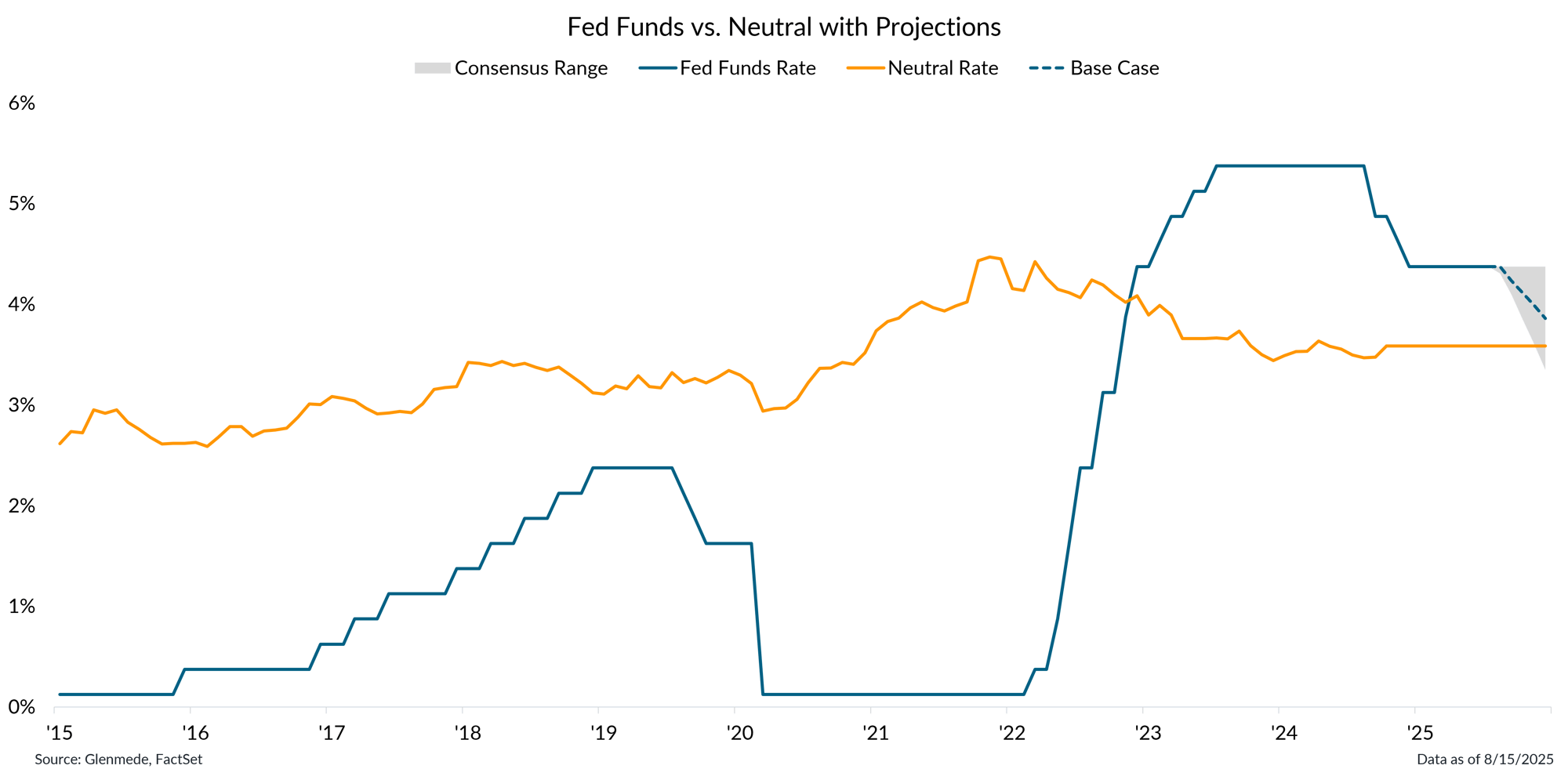

Data shown in orange are Glenmede’s estimates of the neutral federal funds rate over time (i.e., the level of rates that is neither economically stimulative nor restrictive) based on expectations for real interest rates via the Holston-Laubach-Williams model and Glenmede’s 10yr inflation expectations. Fed Funds Rate in blue is the target rate midpoint. The dashed blue line represents a base case projection based on current pricing in fed funds futures and the gray region around that represents a range of plausible outcomes. Actual results may differ materially from projections.

- With downside risks to the labor market now outweighing upside risks to inflation, a rate cut in September is justified, absent a tariff-driven inflation surprise.

- If the labor market continues to exhibit signs of weakness, it may warrant more rate cuts through year end, with approximately two to three rate cuts by year end the current base case.

This material is provided solely for informational and/or educational purposes and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Any company, fund or security referenced herein is provided solely for illustrative purposes and should not be construed as a recommendation to buy, hold or sell it. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.