Investment Strategy Brief

The Policy Playlist at the 2024 Presidential Debate

June 23, 2024

Executive Summary

- President Biden and former president Trump will face off for their first debate of the 2024 election cycle on June 27th.

- Taxes and trade tariffs are among the most economically significant policies that will likely be up for discussion.

- Contrasting policy priorities on taxes and trade tariffs are likely to create different outcomes for individuals and corporations.

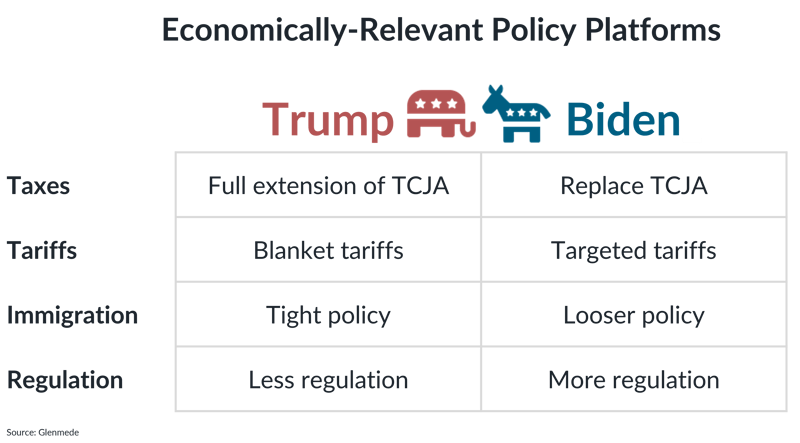

The major candidates have different visions for economically relevant policy

The lists shown are a general representation of the policy platforms for the major candidates for president in 2024 and are not meant to be exhaustive. TCJA refers to the Tax Cuts and Jobs Act of 2017. Actual policies may differ materially from those listed.

- President Biden and former President Trump’s first debate on June 27th will likely highlight key differences in the candidates’ policy priorities.

- Economically significant policies that may be discussed include taxes, trade, immigration and regulation, with taxes and trade tariffs among the most economically significant.

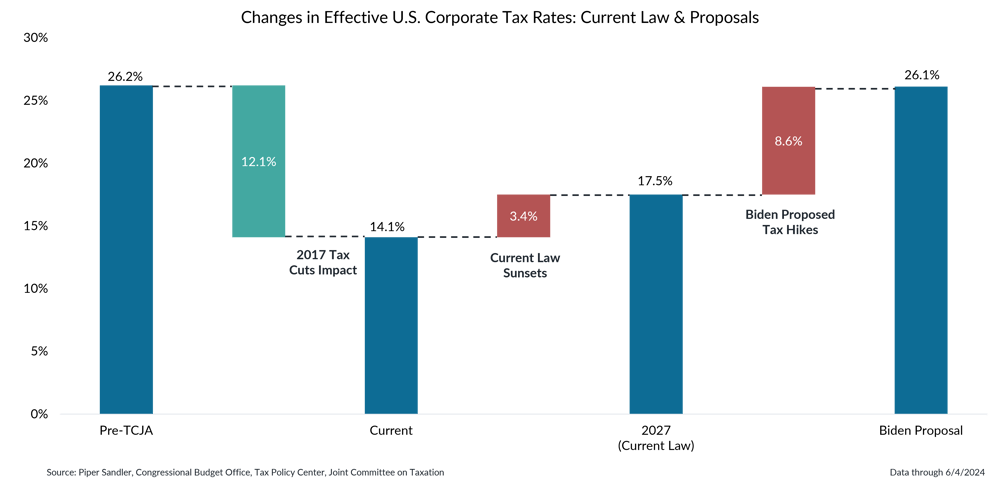

The next President will have a big say over expiring tax provisions

TCJA refers to the Tax Cuts and Jobs Act of 2017, which is current law. Data shown are estimates of the effective tax rates paid by corporations subject to the corporate income tax under various scenarios. Pre-TCJA refers to the effective tax rate before the Tax Cuts and Jobs Act took effect. Current refers to the effective tax rate currently in effect. 2027 (Current Law) refers to the estimated effective tax rate in 2027 based on current law due to sunsetting provisions. Biden Proposal refers to the estimated effective tax rate that is likely to prevail if all of his tax proposals are ratified into law. Actual results may differ materially from projections.

- A Biden administration is likely to extend only a portion of previous tax cuts that expire in 2025, creating effective tax hikes for those in the top tax brackets.

- A Trump administration is like to fully extend previous tax cuts but offset the cost with an aggressive set of trade tariffs, which will mostly impact businesses.

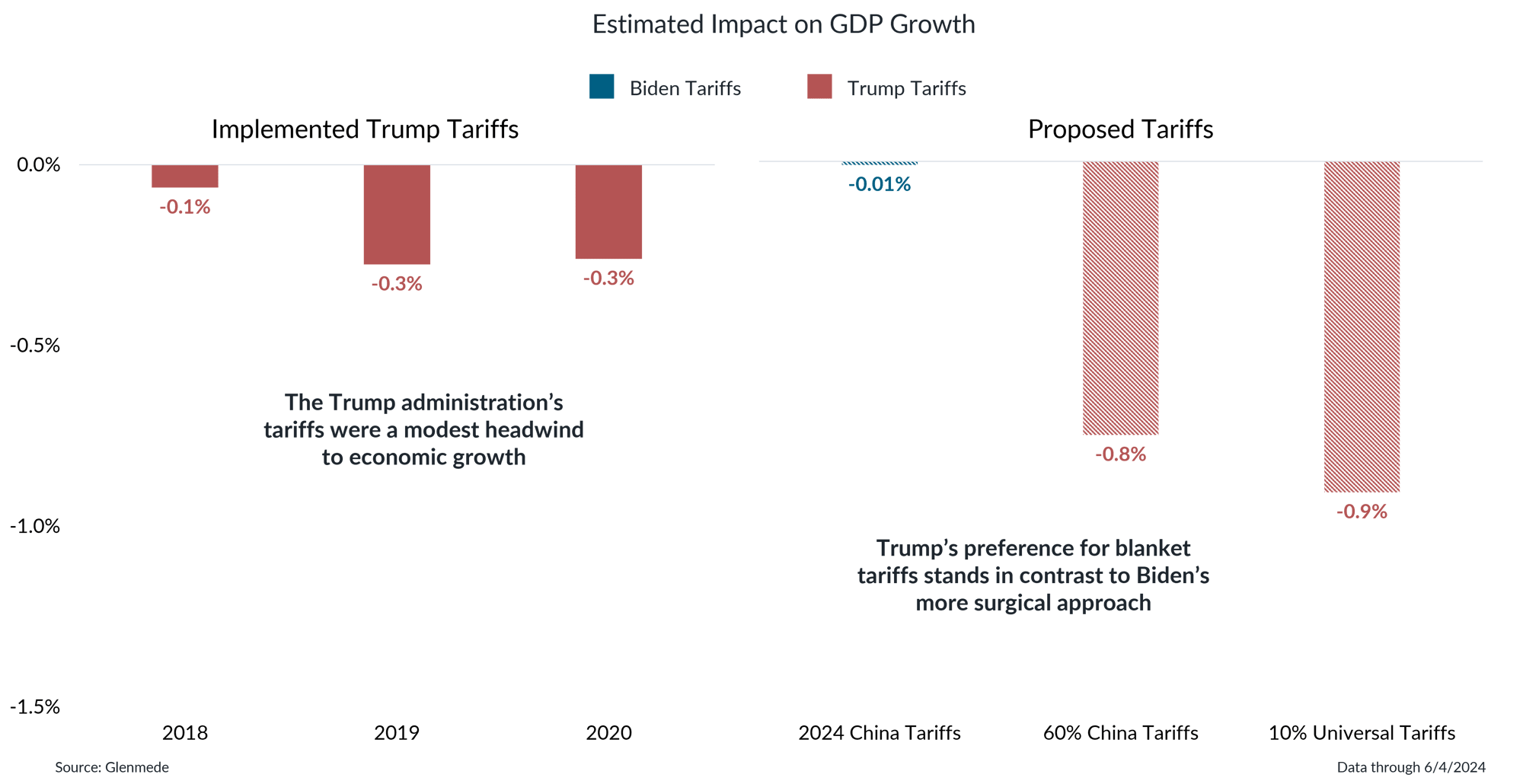

While the two major presidential candidates agree on trade directionally, they disagree on magnitude

Estimates of the impact of tariffs on gross domestic product (GDP) growth assume full demand destruction via a tariff-induced price shock. The impact of proposed tariffs assumes the following: “2024 China Tariffs” Biden administration’s tariffs are implemented as announced on 5/14/2024; “60% China Tariffs” increase all tariff levels on Chinese goods imports; “10% Universal Tariffs” increase tariffs on all goods imports to 10%. All tariff proposals assume they are implemented in isolation, with no cross effects. Actual results may differ materially from expectations or projections.

- The Trump administration’s tariffs implemented from 2018 to 2020 were a modest headwind to economic growth.

- Trump’s proposal for blanket tariffs on imports could have a more significant economic impact, as his proposed tariffs are likely to be much larger in scope than those announced by Biden.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.