Investment Strategy Brief

The Rate Cut Debate

August 24, 2025

Executive Summary

- The Fed is expected to restart rate cuts in September, but the exact path is data dependent and subject to debate.

- Recent economic data support the argument for at least two rate cuts by the end of 2025.

- With yields near fair value, rate cuts could provide upside for most fixed income assets.

- Small caps have historically responded favorably to rate cuts given their high floating rate debt exposure.

- Renewed Fed rate cuts are likely to be supportive for both stocks and bonds, but U.S. small caps may receive the most benefit.

The Fed is expected to cut rates in September, but the exact path is data dependent and subject to debate

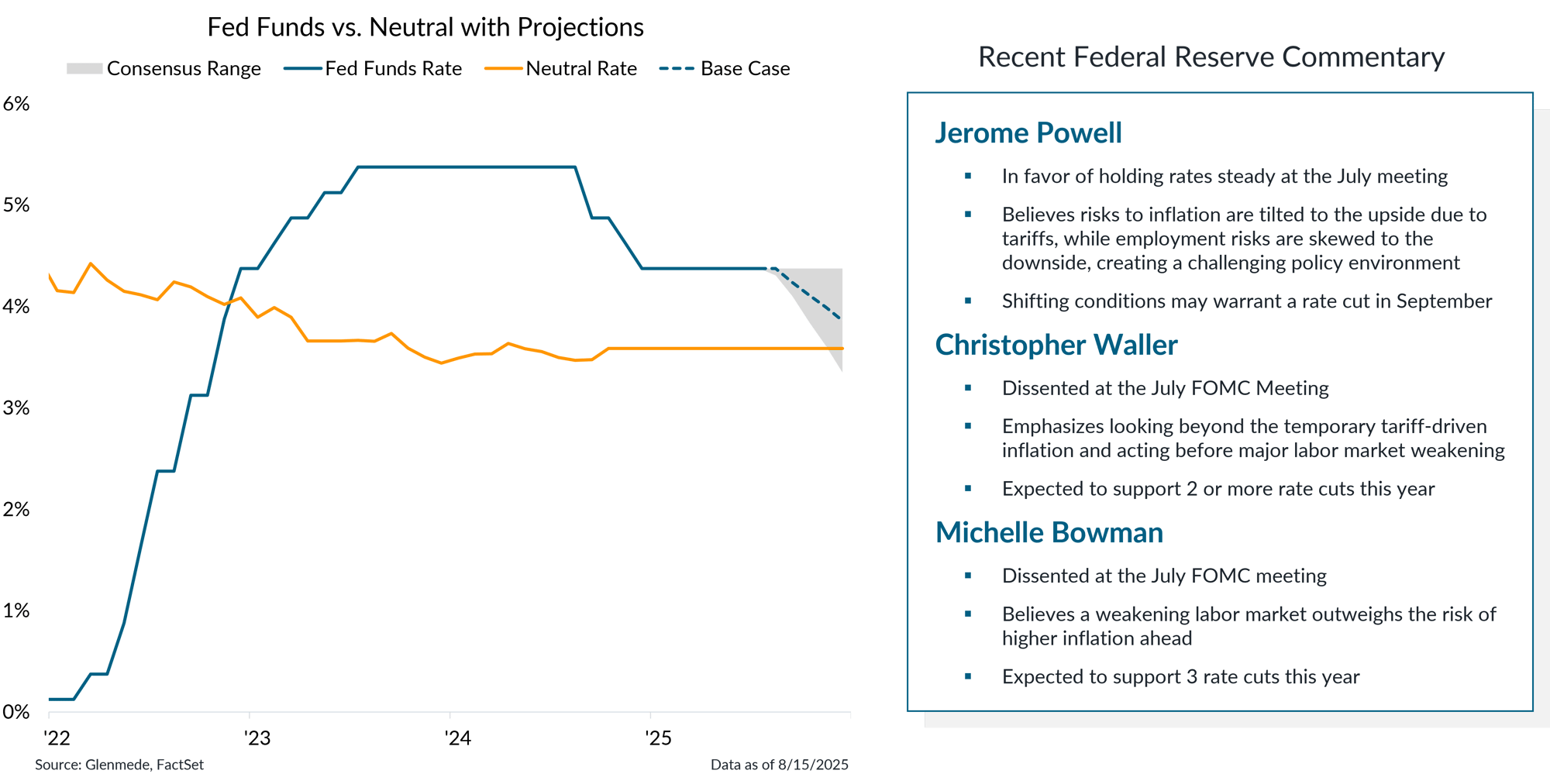

Data shown in orange are Glenmede’s estimates of the neutral federal funds rate over time (i.e., the level of rates that is neither economically stimulative nor restrictive) based on expectations for real interest rates via the Holston-Laubach-Williams model and Glenmede’s 10-year inflation expectations. Fed Funds Rate in blue is the target rate midpoint. The dashed blue line represents a base case projection based on current pricing in fed funds futures, and the gray region around that represents a range of plausible outcomes. Actual results may differ materially from projections. Shown in the right panel are key highlights from recent speeches by Jerome Powell, Chair of the Federal Reserve, and Federal Reserve Board of Governors members Christopher Waller and Michelle Bowman.

- The Fed is expected to cut rates at the September Federal Open Market Committee meeting, as more officials have shifted their focus from tariff-driven inflation concerns to emerging signs of weakness in the labor market following July’s jobs report.

- However, the exact path forward is still up for debate as Fed officials hold diverging views on the potential impact of tariffs and the overall state of the economy.

Candidates under consideration for the next Fed Chair are generally more dovish than Jerome Powell

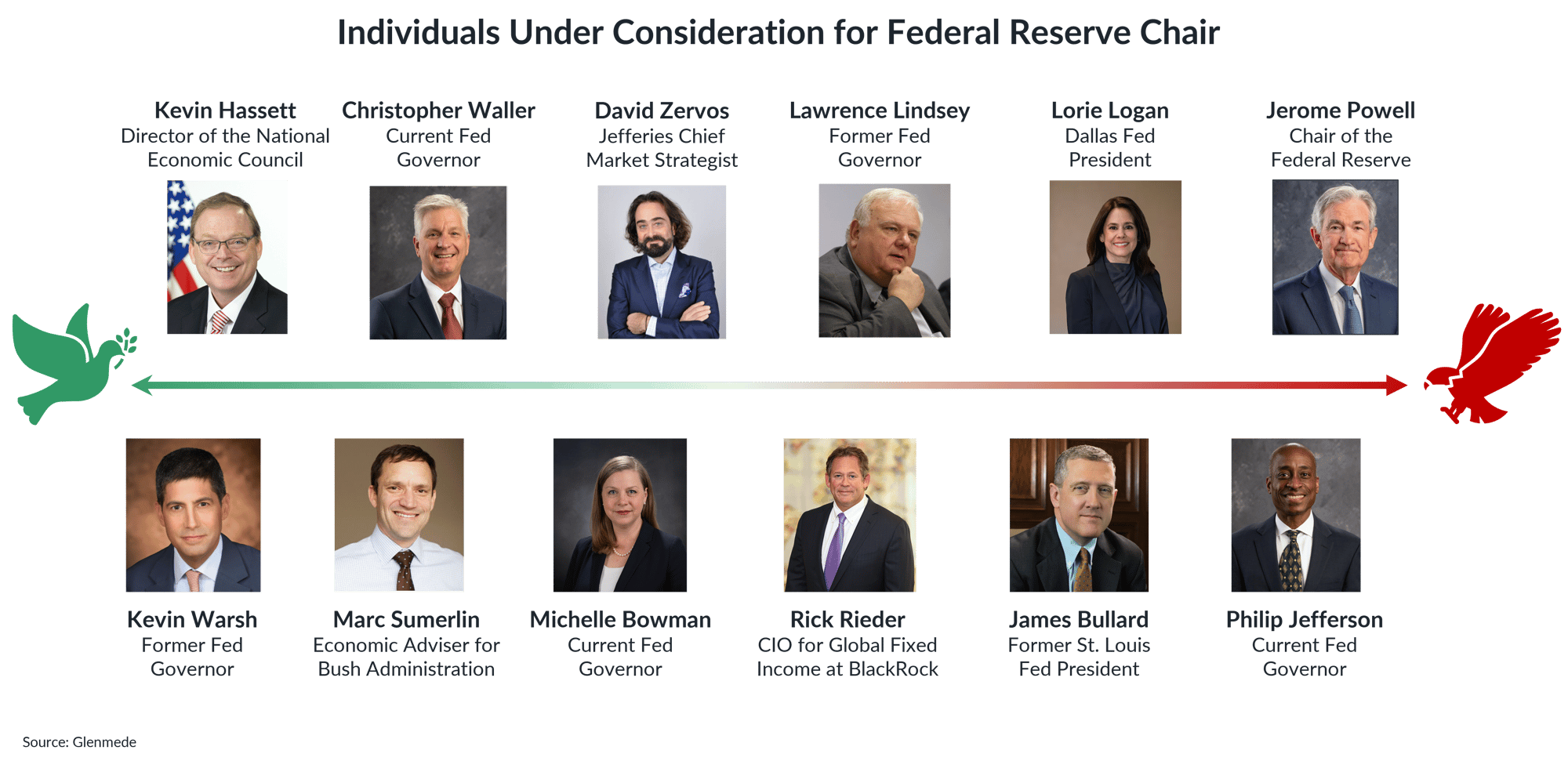

Shown is a general overview of the individuals being considered for the role of Federal Reserve Chair positioned on a spectrum of dovish to hawkish viewpoints in comparison to the current Federal Reserve Chair Jerome Powell. CIO stands for Chief Investment Officer. This is not an exhaustive list, nor should it be interpreted as an endorsement of any particular candidate.

- The administration is considering several candidates for the next Fed Chair, with most leaning more dovish than Jerome Powell.

- Leading contenders include Kevin Warsh, Kevin Hassett, and the two dissenting governors from the July FOMC meeting, Christopher Waller and Michelle Bowman.

Recent economic data support the argument for at least two rate cuts by the end of 2025

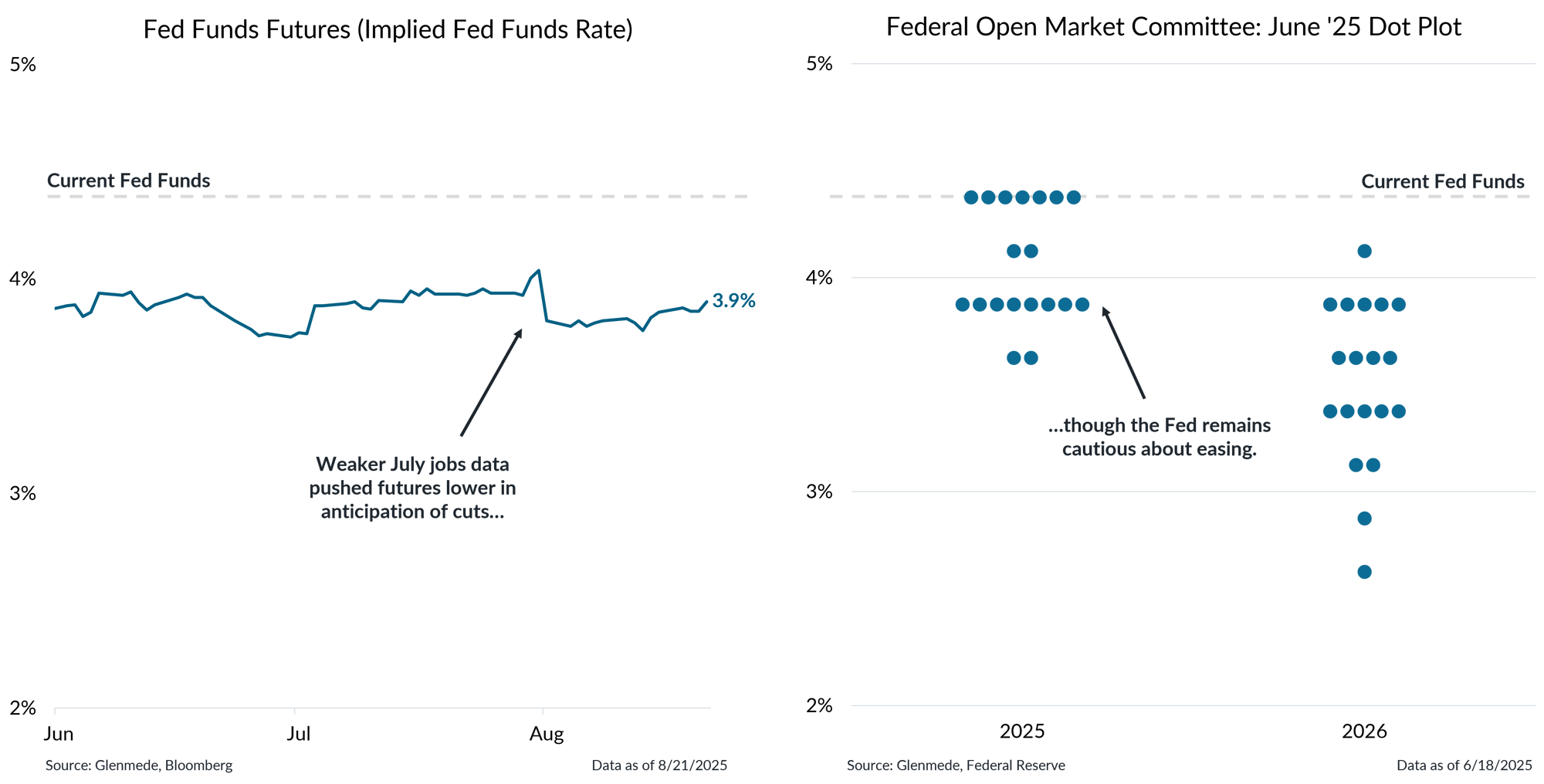

Data shown in the left panel are market-implied expectations for the federal funds rate based on federal funds rate futures expiring on 12/30/2025. Data shown in the right panel are the Federal Open Market Committee’s latest dot plot projections from June 2025. Each dot represents the response of one Fed official’s projections regarding where they expect the federal funds rate to sit at the end of each of the next two calendar years. Actual results may differ materially from projections.

- Fed funds futures are now pricing in at least two rate cuts by the end of the year, reflecting a shift in market focus from inflation risks to concerns about the labor market.

- These expectations align with the FOMC's June dot plot, as the Fed continues to signal a cautious, data-dependent approach to easing.

With yields near fair value, rate cuts could provide upside for most fixed income assets

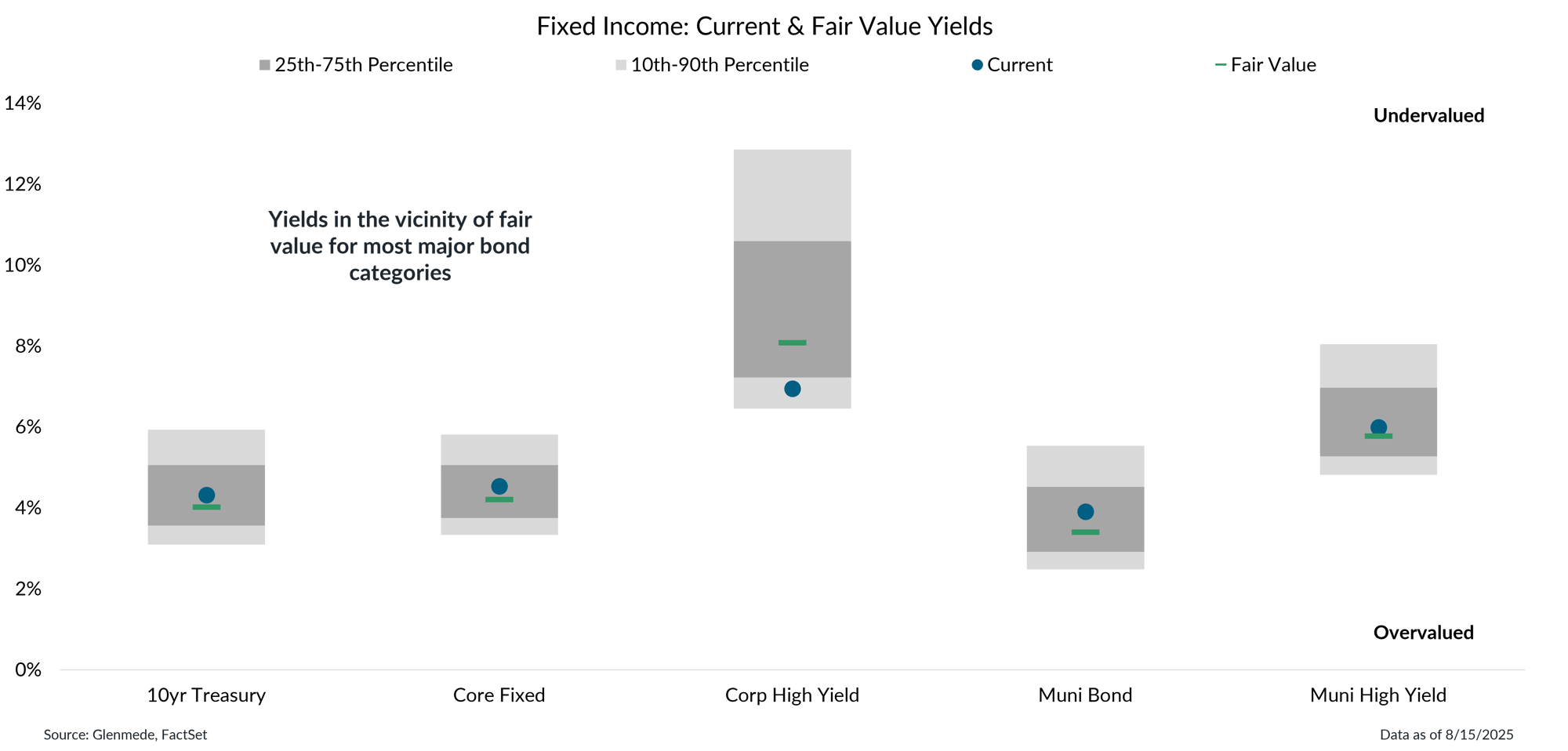

Shown are Glenmede’s estimates of long-term fair value for taxable and tax-exempt debt securities. Proxy indices for each asset class are as follows: Core Fixed (Bloomberg U.S. Aggregate), Corp High Yield (Bloomberg U.S. Aggregate Credit Corporate High Yield BB), Muni Bond (Bloomberg Municipal Bond), Muni High Yield (Bloomberg Municipal High Yield). Glenmede’s estimates of fair value are arrived at in good faith, but longer-term targets for valuation may be uncertain. One cannot invest directly in an index.

- Yields across major fixed income categories remain near fair value, presenting a compelling argument for incorporating bonds into a portfolio.

- As the rate cut cycle resumes, fixed income may offer meaningful upside potential for investors, with declining rates likely to act as a tailwind for bonds.

Small caps may also be a large beneficiary of the easing cycle, given their high floating rate debt exposure

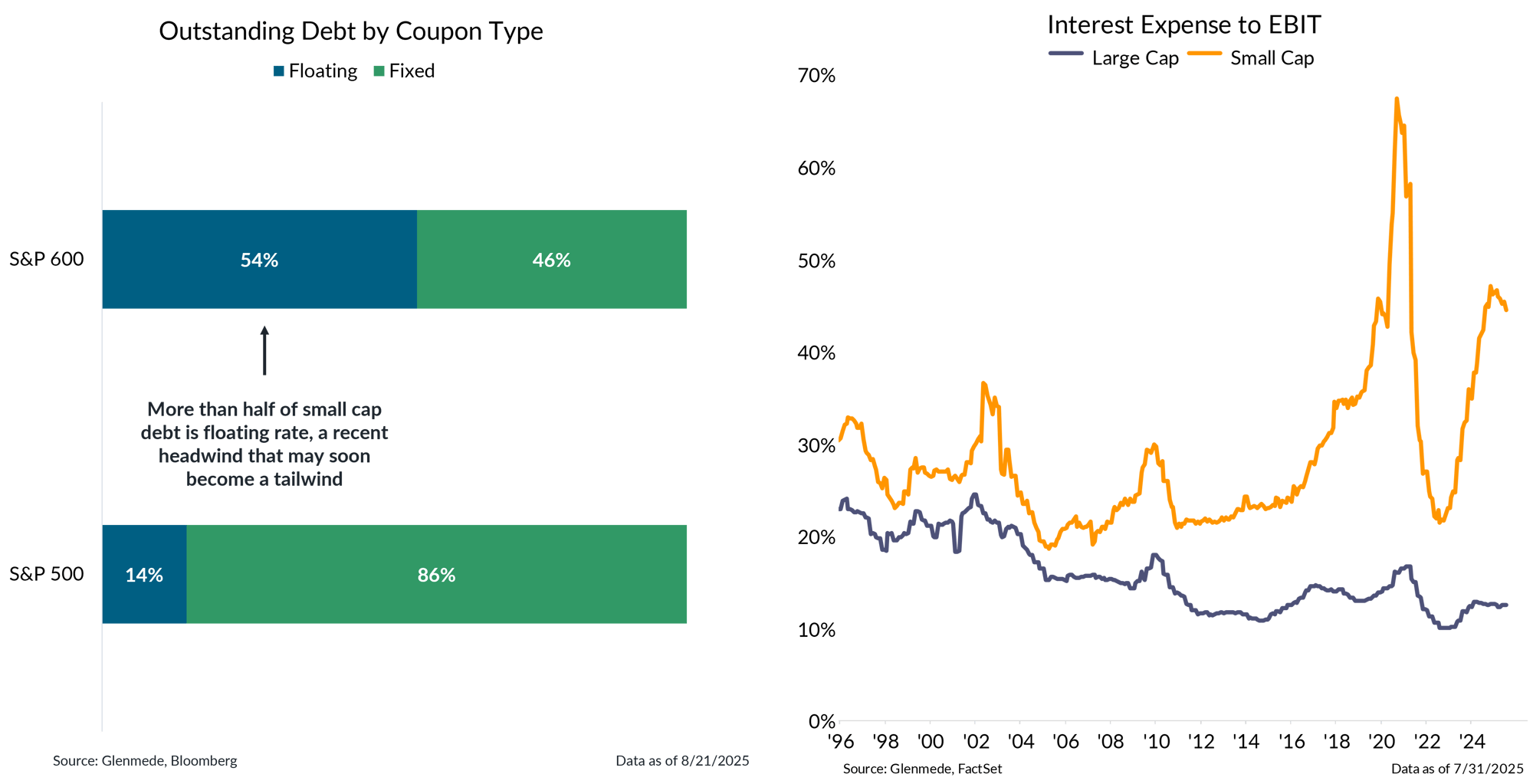

Shown in the left panel are the shares of outstanding debt that pay floating fixed coupons for the S&P 500 and S&P 600 indices. Shown in the right panel is the interest expense to earnings before interest and taxes for the S&P 500 and S&P 600 indices. One cannot invest directly in an index.

- With more than half of small cap debt issued at floating rates, small cap earnings are highly sensitive to interest rate movements, making them well-positioned to benefit from an easing cycle.

- In an easing rate environment, falling interest expenses could serve as a meaningful tailwind to earnings, supporting a more constructive outlook for small caps.

This material is provided solely for informational and/or educational purposes and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Any company, fund or security referenced herein is provided solely for illustrative purposes and should not be construed as a recommendation to buy, hold or sell it. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.