Investment Strategy Brief

The Rate Cut Playbook

September 21, 2025

Executive Summary

- Amid debate within the Fed, the dovish camp is in the majority and accelerating the rate cut pace.

- Interest rates further out the yield curve are likely to see a more muted decline than the fed funds rate.

- The market has historically responded favorably to rate cuts, with small caps generally outperforming their large cap counterparts.

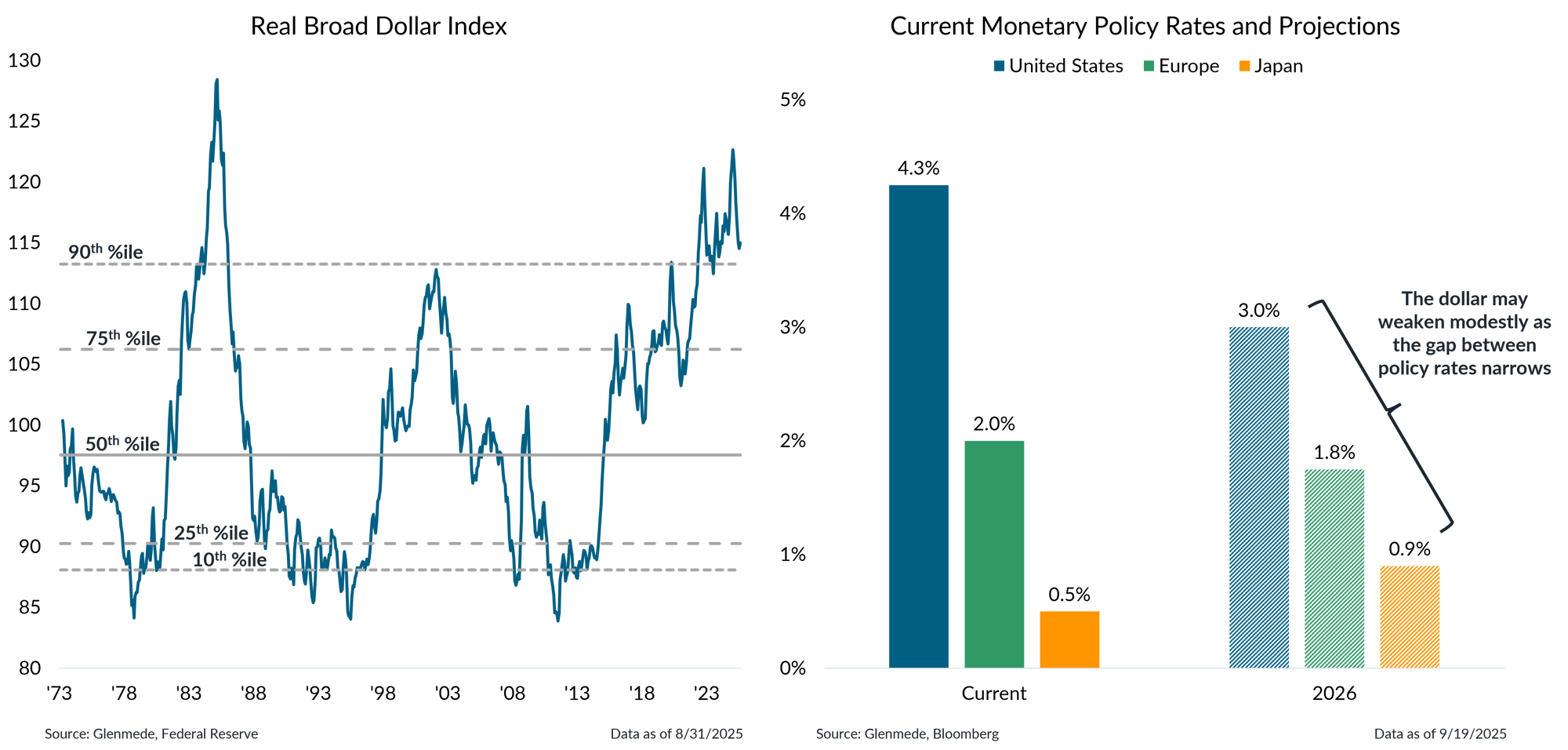

- The dollar’s valuation may continue to slowly fade as its interest rate advantage declines.

Amid debate within the Fed, the dovish camp is in the majority and accelerating the rate cut pace

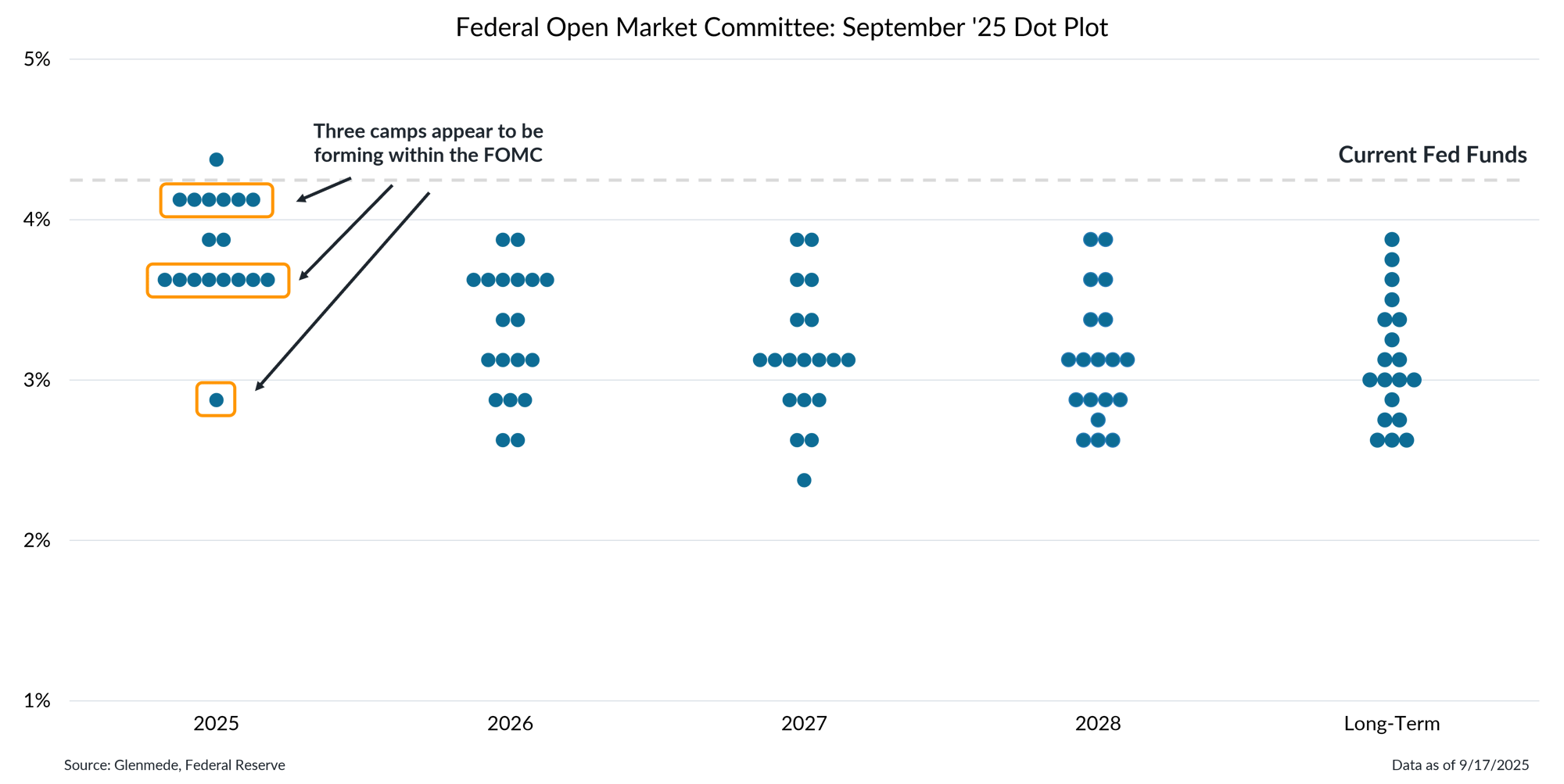

Data shown are the Federal Open Market Committee’s dot plot projections from September 2025. Each dot represents the response of one Fed official regarding where they expect the federal funds rate to sit at the end of each of the next four calendar years, as well as their estimate of the longer run level of federal funds. Actual results may differ materially from projections.

- The median respondent in the latest dot plot calls for two more cuts this year, although three camps appear to be forming.

- It is somewhat unusual to see this level of divergence within the Fed regarding the path of rates for the rest of year, with some respondents anticipating no more cuts, several expecting two more rate cuts and one calling for as many as five.

Federal Reserve rate cuts may have a more muted effect further out the yield curve

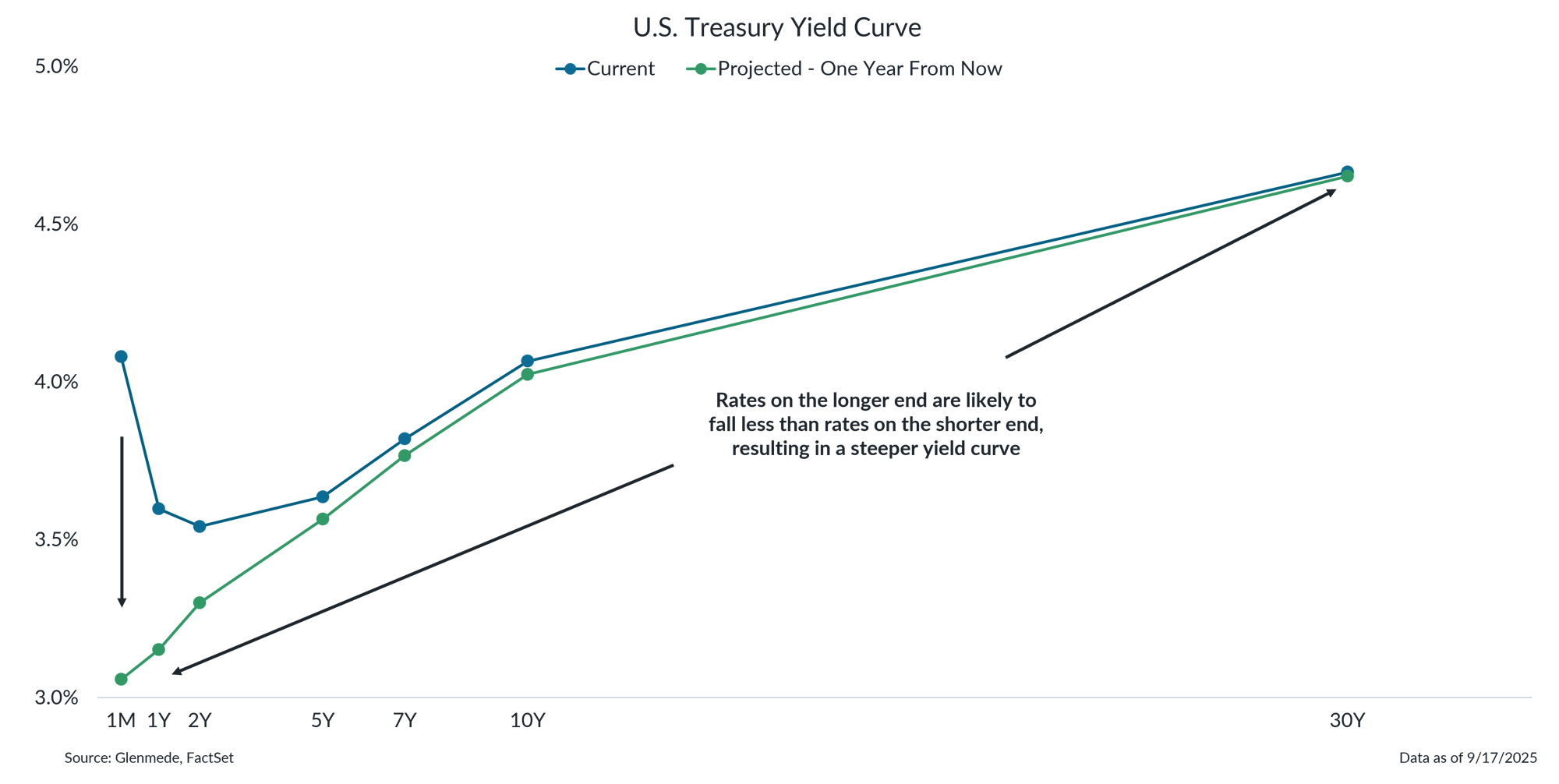

Shown in blue are the current yields for various U.S. Treasury Bills, Bonds and Notes. Shown in green are Glenmede’s proprietary yield estimates for the same U.S. Treasuries one year from now. These figures are projections which, though arrived at in good faith, are not guaranteed.

- As the Fed continues its rate cut campaign, real short-term rates are expected to fall and revert the U.S. Treasury yield curve to a more normal, upward sloping shape.

- However, the impact of rate cuts on longer-term rates is expected to be more muted, meaning they may remain elevated for some time.

The market has historically responded favorably to rate cuts, with weaker outcomes occurring during recessions

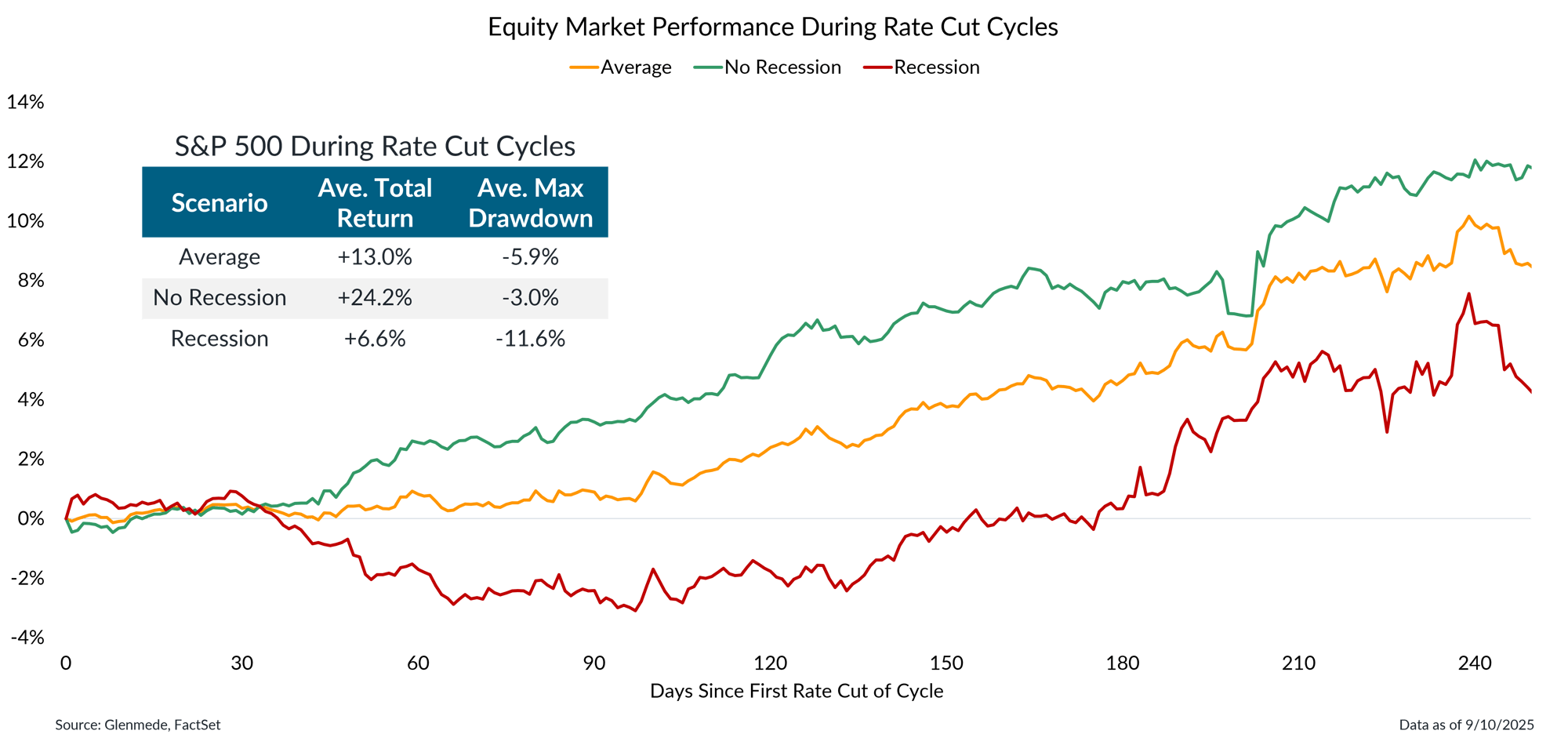

Data shown are the average paths of total returns for the S&P 500 based on the previous 45 Federal Reserve rate cut campaigns since 1954. Shown in yellow is the average path of returns during those rate cut campaigns. Shown in red is the average path of returns during rate cut campaigns in which the economy was in recession at any time during the rate cut cycle. Shown in green is the average path of returns during rate cut cycles that were not associated with recessions. Data shown in the table are summary statistics for each path based on average total returns and the maximum drawdown experienced within each rate cut cycle. Past performance may not be indicative of future results. One cannot invest directly in an index.

- Fed rate cut campaigns have been associated with positive market performance based on the average outcomes during the past 45 rate cut campaigns.

- The outcome, however, has historically been much better during rate cut campaigns that were not associated with recessions than those that were.

Small caps have historically responded more favorably to rate cuts than their large cap counterparts

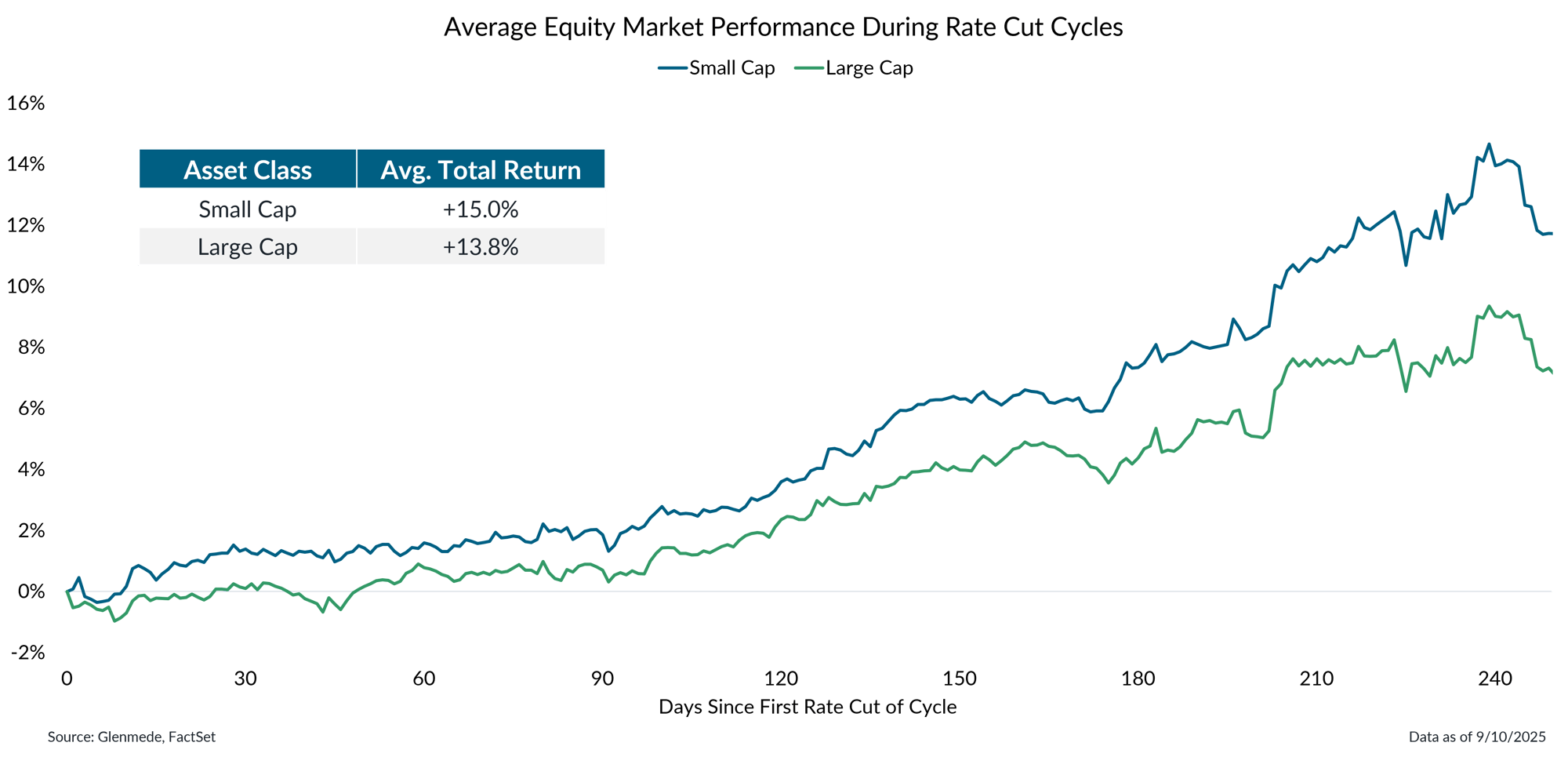

Data shown represent the average total return paths of the S&P 500 and Russell 2000 during the last 18 Federal Reserve rate cut campaigns since 1980. Shown in blue is the average return path for the Russell 2000 and shown in green is the average return path for the S&P 500. Data shown in the table are summary statistics for average total returns over the periods shown in the chart. Past performance may not be indicative of future results. One cannot invest directly in an index.

- Based on the average outcome during the past 18 rate cut campaigns small caps have responded more favorably than their large cap counterparts.

- With more than half of small cap debt issued at floating rates, the falling interest expenses during easing cycles could provide a meaningful tailwind to earnings, supporting a more constructive outlook.

The dollar's valuation may continue to slowly fade as its interest rate advantage declines

Data shown in the left panel are weighted averages of the foreign exchange value of the U.S. dollar against the currencies of a broad group of major U.S. trading partners, adjusted for inflation to account for purchasing power differentials. Shown in the right panel are upper-bound policy rates for the United States, Europe and Japan. Current rates are shown in solid bars while implied rates from futures prices for upper-bound rates as of 12/31/2026 are shown in hashed bars. Actual results may differ materially from projections.

- The dollar’s strength may gradually weaken as the gap between U.S. monetary policy rates and those of Europe and Japan begins to narrow.

- As this shift unfolds, the dollar’s interest rate advantage will likely diminish, which may make it somewhat less attractive to global investors.

This material is provided solely for informational and/or educational purposes and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Any company, fund or security referenced herein is provided solely for illustrative purposes and should not be construed as a recommendation to buy, hold or sell it. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.