Investment Strategy Brief

Tracking the Fed's Next Move

September 14, 2025

Executive Summary

- Although inflation has shifted higher, sluggish payrolls will likely drive the Fed’s rate decision.

- The Federal Open Market Committee (FOMC) includes members with differing views, but the consensus is tilting dovish.

- The Fed is expected to resume its rate cuts this month, with markets anticipating three cuts by year end.

- Quantitative tightening may soon come to an end as the Fed rolls maturing mortgage-backed securities into Treasury bills.

- Easing monetary policy in the face of labor market risks should be an economic support and market tailwind through year end.

Although inflation has shifted higher, sluggish payrolls will likely drive the Fed’s rate decision

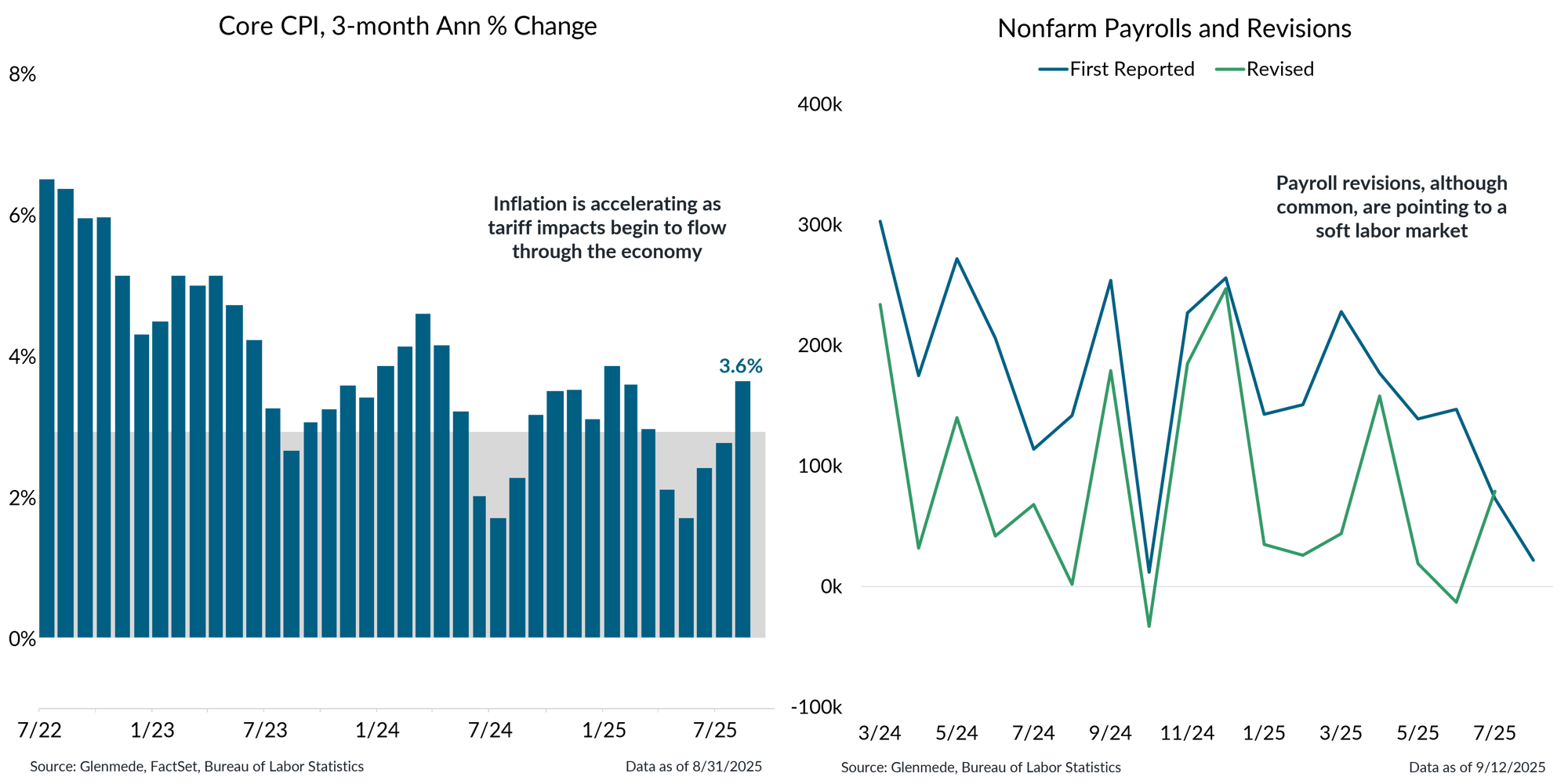

Shown in the left panel is the 3-month annualized percent change in the U.S. Consumer Price Index (CPI) excluding food and energy. The gray region represents the Fed’s target range consistent with its price stability objective. Shown in the right panel are seasonally adjusted U.S. nonfarm payroll figures as first reported in blue. Final monthly payroll revisions from March 2024 to March 2025 are based on the Quarterly Census of Employment and Wages (QCEW), and preliminary revisions for April 2025 to July 2025 are shown in green.

- Inflation accelerated in August as tariff pressures continued to creep through the economy, though signs of emerging consumer hesitancy toward higher-priced goods may have slowed the pace.

- Last week, nonfarm payrolls experienced the largest revision on record, further contributing to concerns that cracks may be forming in the labor market.

The FOMC includes members with differing views, but the consensus is tilting dovish

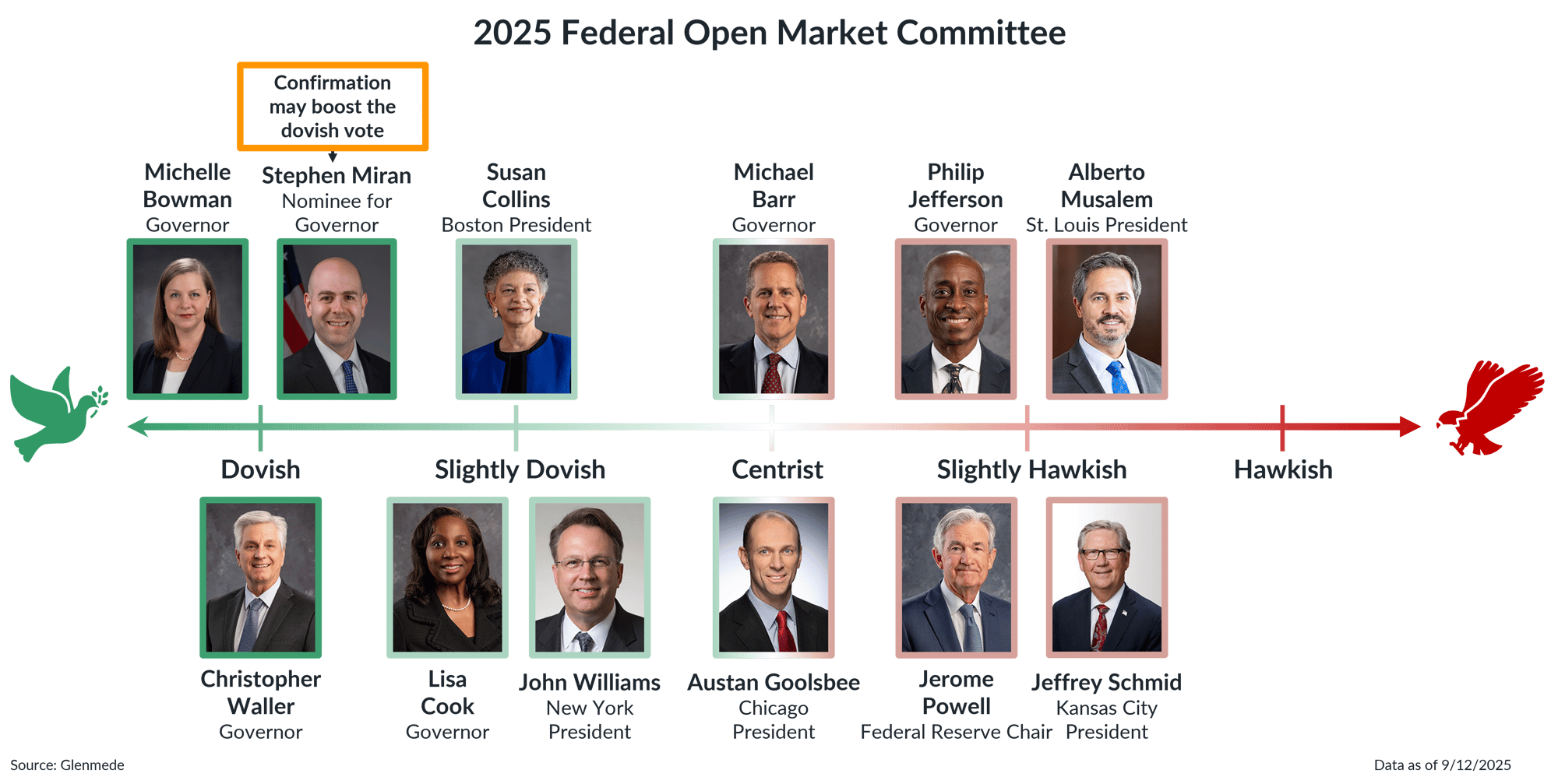

Shown is a general overview of the individuals on the FOMC, which includes seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four regional Federal Reserve Bank presidents on a spectrum of Glenmede’s assessment of their current viewpoints of monetary policy. This visual should not be interpreted as an endorsement of any viewpoint.

- In July, Bowman and Waller dissented the FOMC’s decision to hold rates steady, but with labor market risks now appearing to outweigh inflation concerns, others may be inclined to join them in favor of rate cuts.

- Stephen Miran, nominated to fill the open governor seat, is likely to be confirmed by Congress before this week’s FOMC meeting, tilting the committee more dovish on the margin.

The Fed is expected to resume its rate cuts this month, with markets anticipating three cuts by year end

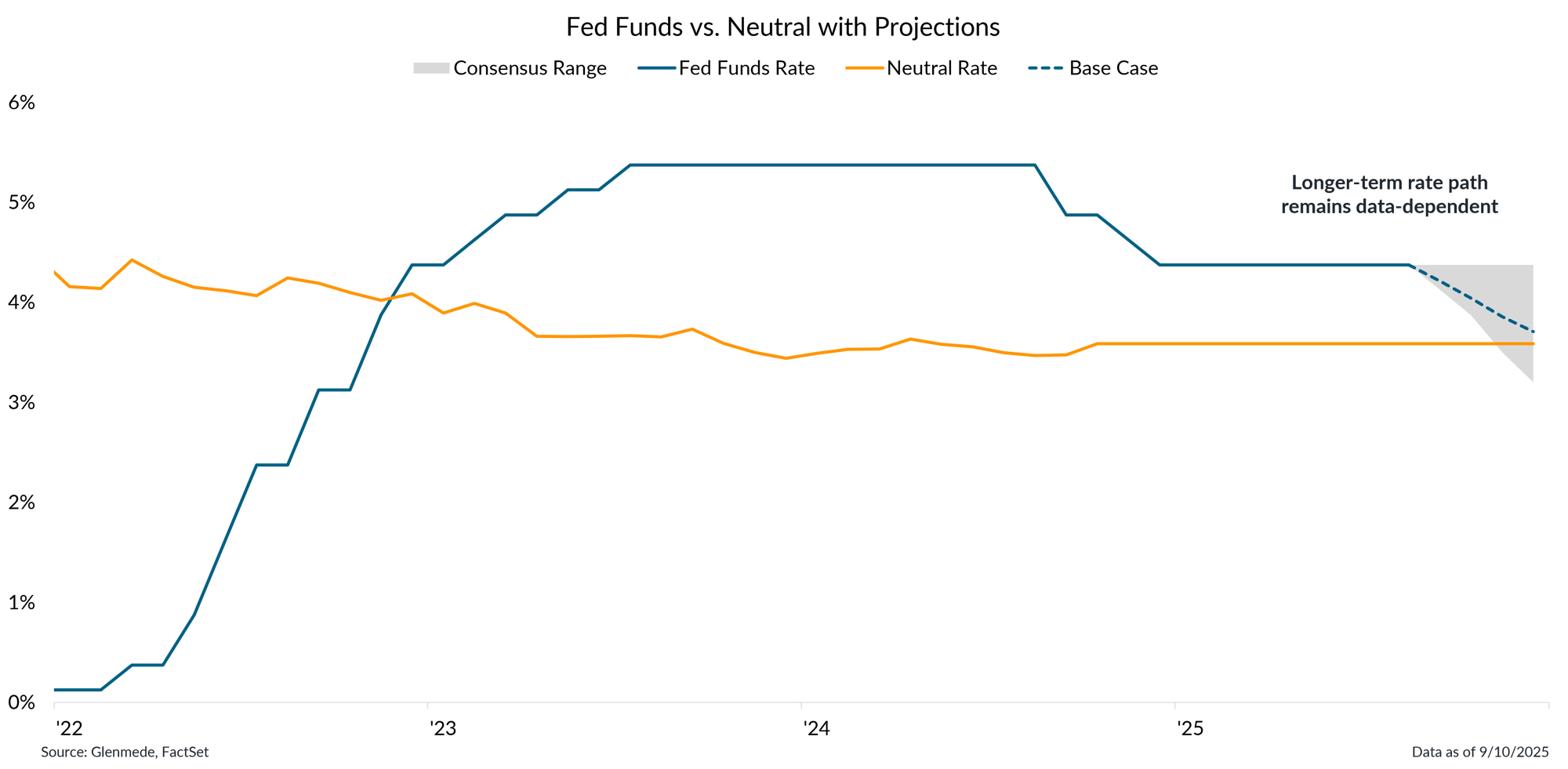

Data shown in orange are Glenmede’s estimates of the neutral federal funds rate over time (i.e., the level of rates that is neither economically stimulative nor restrictive) based on expectations for real interest rates via the Holston-Laubach-Williams model and Glenmede’s 10-yr inflation expectations. Fed funds rate in blue is the target rate midpoint. The dashed blue line represents a base case projection based on current pricing in Fed funds futures, and the gray region around that represents a range of plausible outcomes. Actual results may differ materially from projections.

- The Fed is widely expected to resume its rate cut campaign at this month’s FOMC meeting, responding to mounting concerns about emerging labor market risks.

- While markets are currently pricing in three rate cuts by year end, the base case remains between two and three, as persistent inflation may cause the Fed to slow the pace of cuts.

Quantitative tightening may soon come to an end as the Fed rolls maturing mortgage-backed securities into Treasury bills

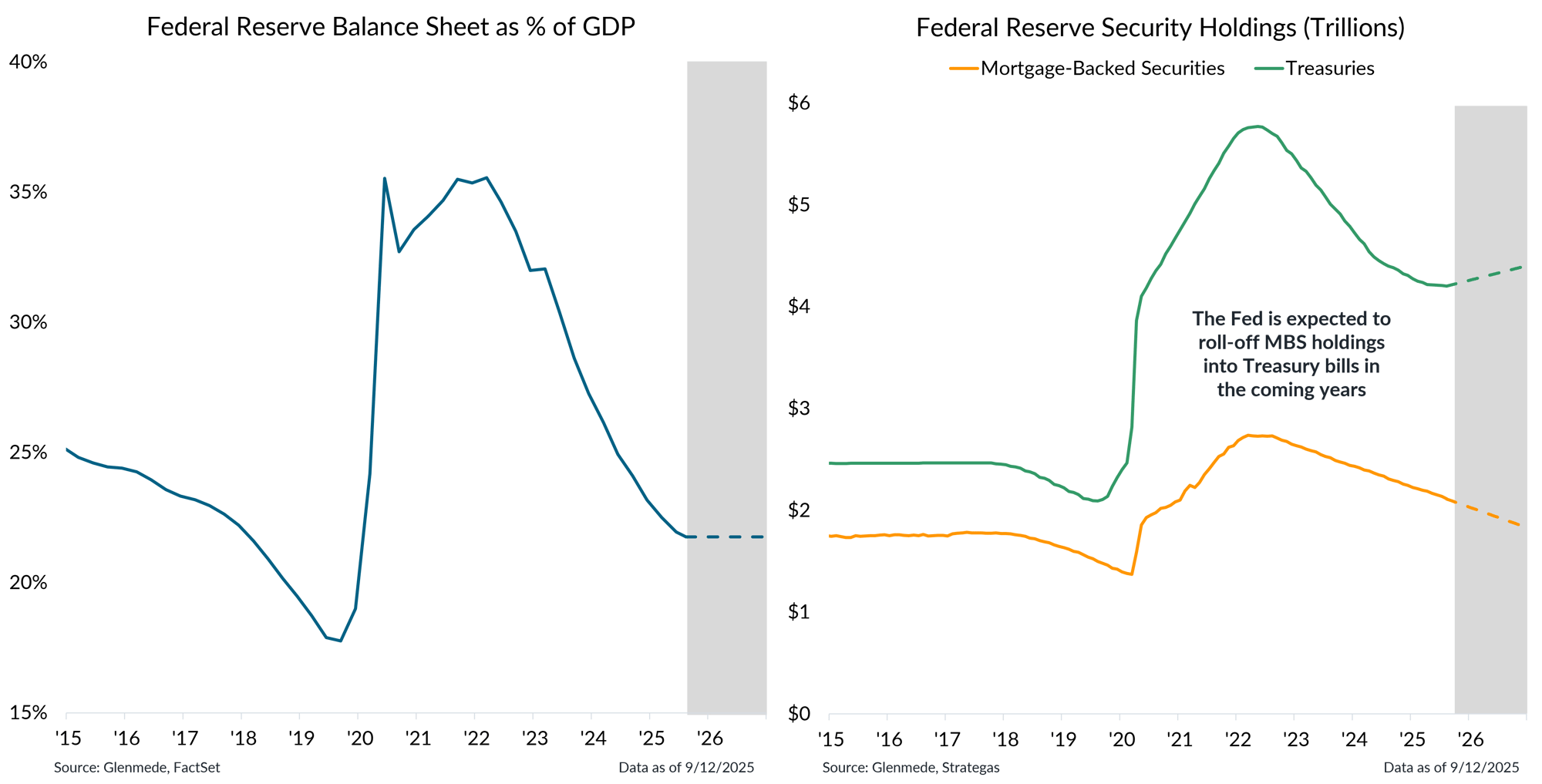

Shown in the left panel is the Fed’s balance sheet as a percentage of U.S. gross domestic product (GDP). Shown in the right panel are the Fed’s holdings of U.S. Treasuries and mortgage-backed securities (MBS). Actual figures are shown in solid lines, while projections are shown in dashed lines within the gray areas. Actual results may differ materially from projections.

- The Fed is expected to resume its rate cut campaign at the September FOMC meeting, with approximately two to three rate cuts by year end the current base case.

- The central bank is also likely to bring quantitative tightening to an end, stabilizing the size of its balance sheet relative to GDP and helping preserve liquidity in the financial system.

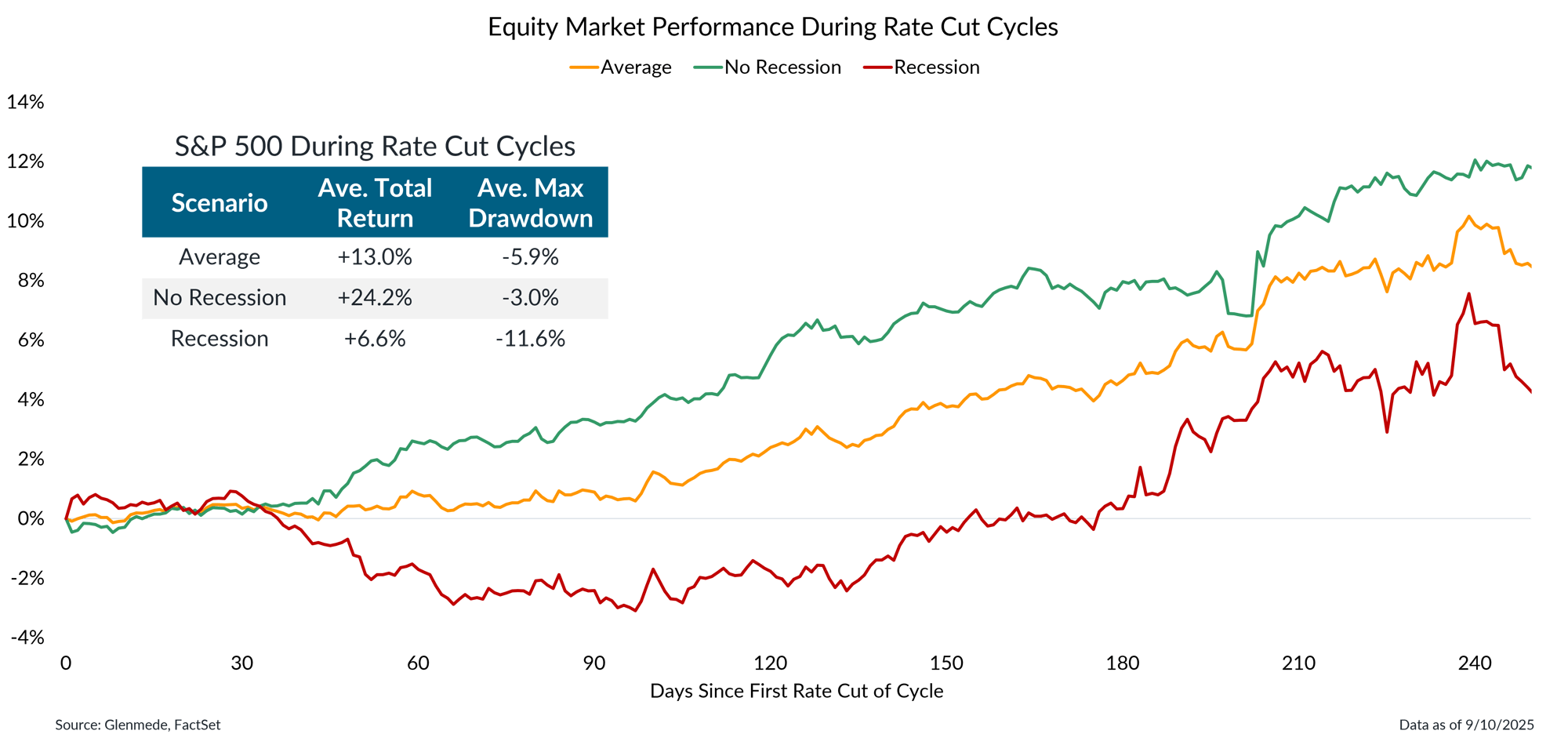

The market has historically responded favorably to rate cuts, with weaker outcomes occurring during recessions

Data shown are the average paths of total returns for the S&P 500 based on the previous 45 Federal Reserve rate cut campaigns since 1954. Shown in yellow is the average path of returns during those rate cut campaigns. Shown in red is the average path of returns during rate cut campaigns in which the economy was in recession at any time during the rate cut cycle. Shown in green is the average path of returns during rate cut cycles that were not associated with recessions. Data shown in the table are summary statistics for each path based on average total returns and the maximum drawdown experienced within each rate cut cycle. Past performance may not be indicative of future results. One cannot invest directly in an index.

- Fed rate cut campaigns have been associated with positive market performance based on the average outcome during the past 45 rate cut campaigns.

- The outcome, however, has historically been much better during rate cut campaigns that were not associated with recessions than those that were.

This material is provided solely for informational and/or educational purposes and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Any company, fund or security referenced herein is provided solely for illustrative purposes and should not be construed as a recommendation to buy, hold or sell it. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.