Investment Strategy Brief

Trade Policy Coming into Focus

February 16, 2025

Executive Summary

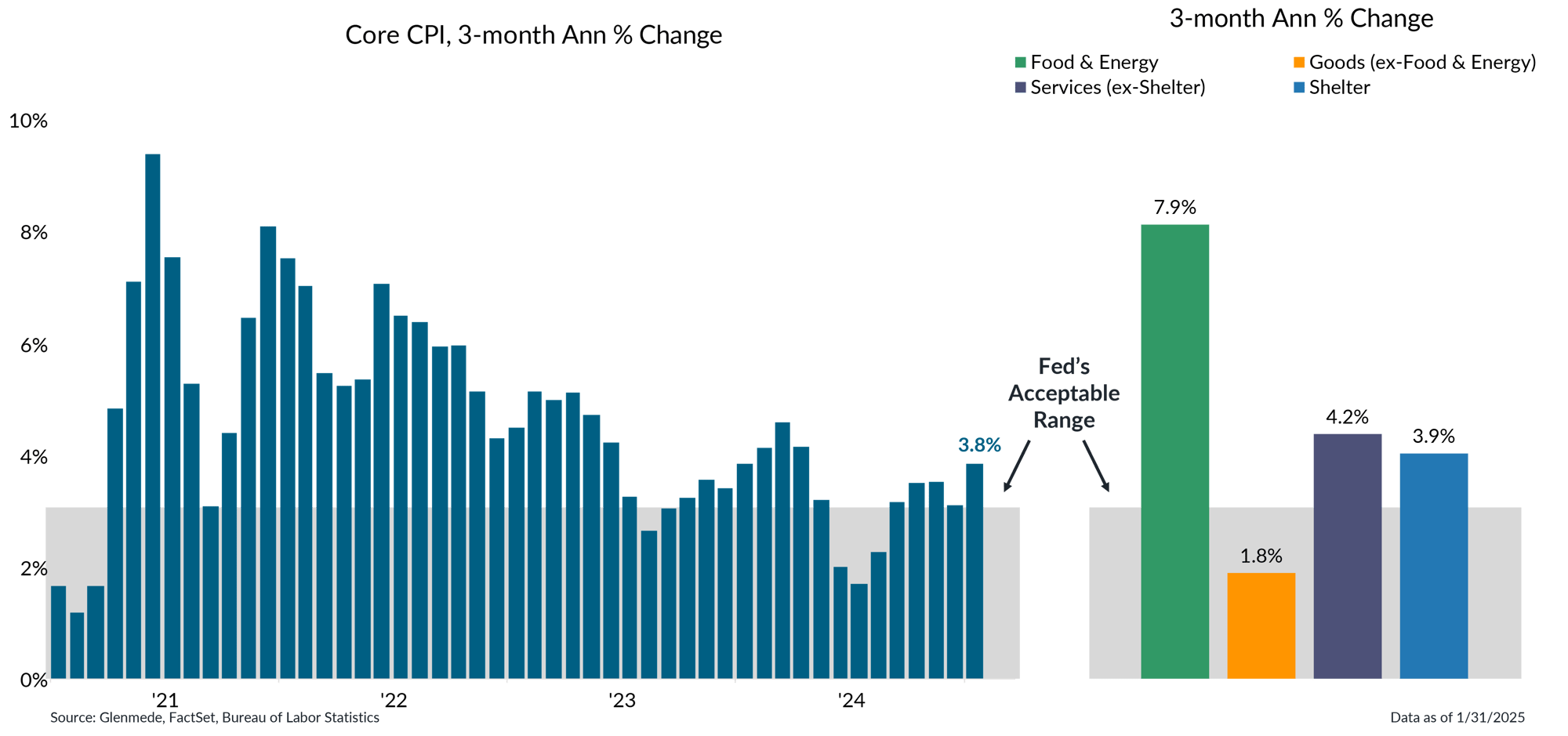

- The January Consumer Price Index (CPI) report raised concerns that prices may be reaccelerating, as inflation pressure is looking increasingly broad-based.

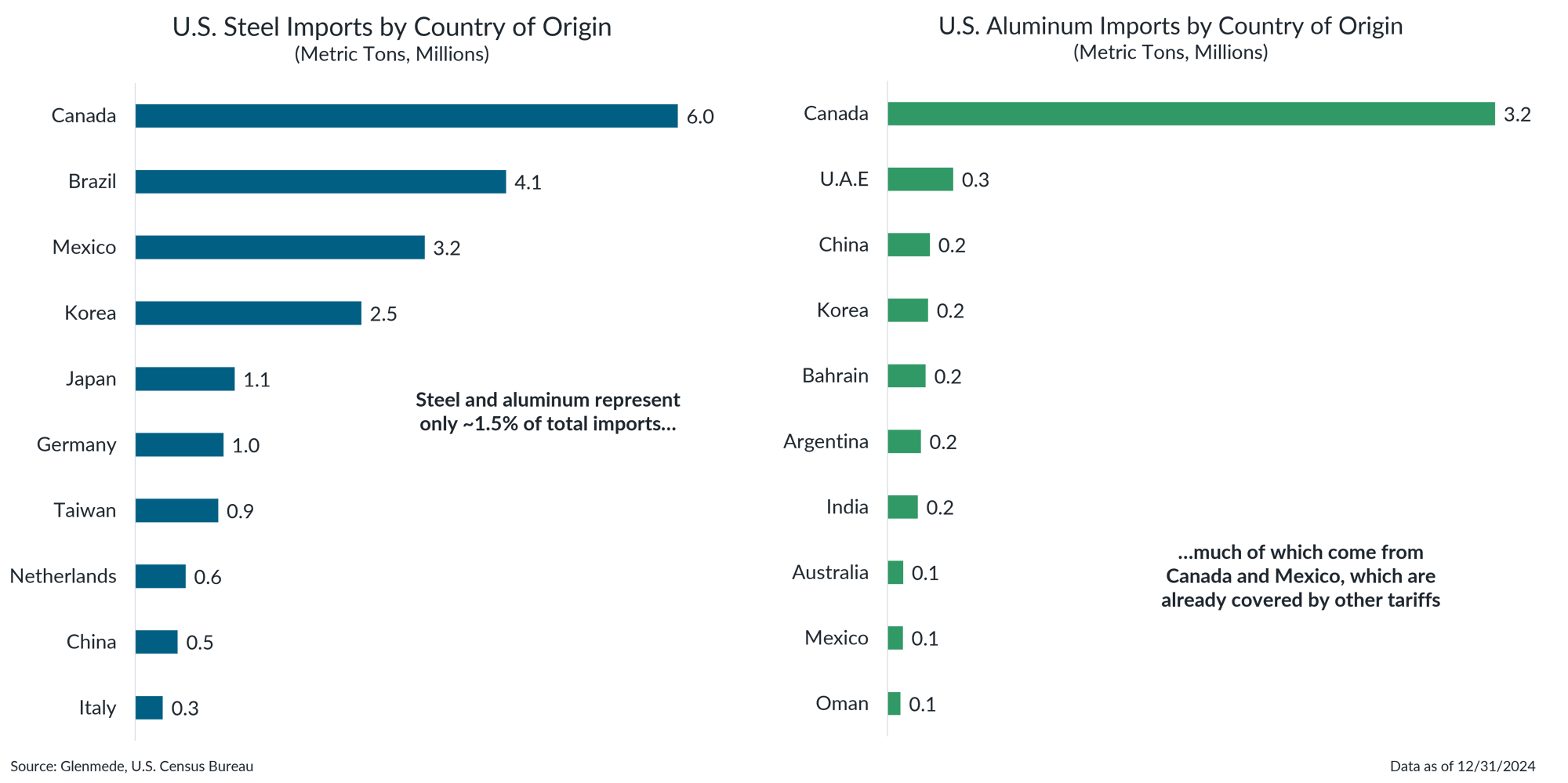

- Steel and aluminum are roughly 1.5% of imports, much of which comes from neighbors already covered by other tariffs.

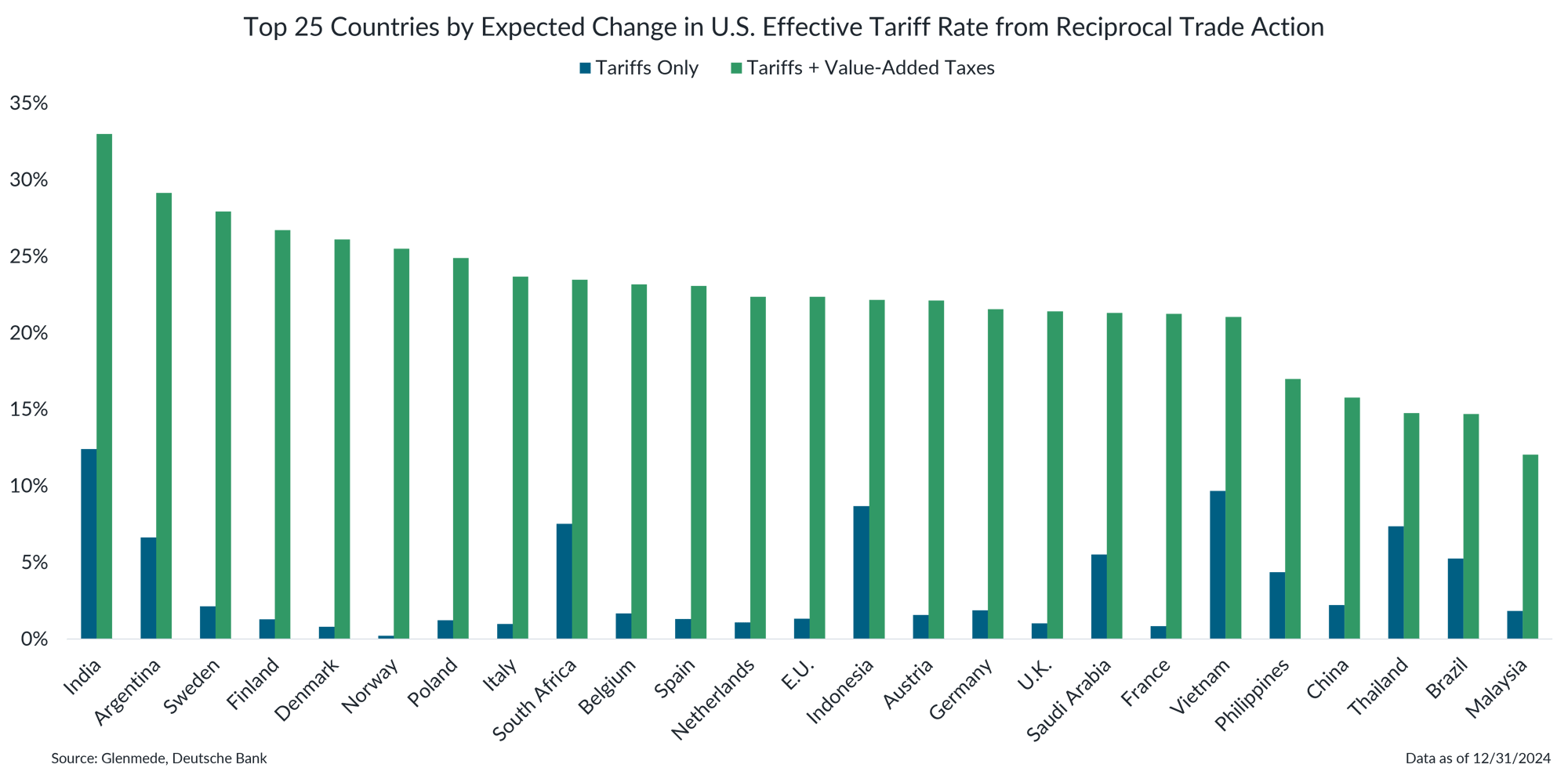

- Simple reciprocity may mean higher tariffs for emerging nations, but including value-added taxes (VATs) in the thought process could raise duties considerably for Europe.

- As the details of trade policy emerge, the economic growth impact appears notable but unlikely to knock the U.S. off its expansion path.

The January CPI report raised concerns that inflation may be accelerating

Shown in the left panel is the 3-month annualized percent change in the U.S. CPI excluding food and energy. Shown in the right panel are the 3-month annualized percent changes in the U.S. CPI components. Food & Energy is represented by the Food & Energy subcomponents. Services (ex. Shelter) is represented by Services Less Rent of Shelter. Shelter is represented by Rent of Shelter. Goods (ex-Food & Energy) is represented by the Commodities component (excluding food & energy). CPI measures the price of a basket of goods & services consumed by U.S. households. The gray region represents the Fed’s target range consistent with its longer-term price stability objective.

- The January CPI report came in hot, showing a reacceleration in prices and signaling that inflationary pressures may be resurfacing just as tariffs loom on the horizon.

- Inflation pressure is looking increasingly broad-based; 55% of components in the CPI basket are growing at levels higher than the Fed’s 2% target.

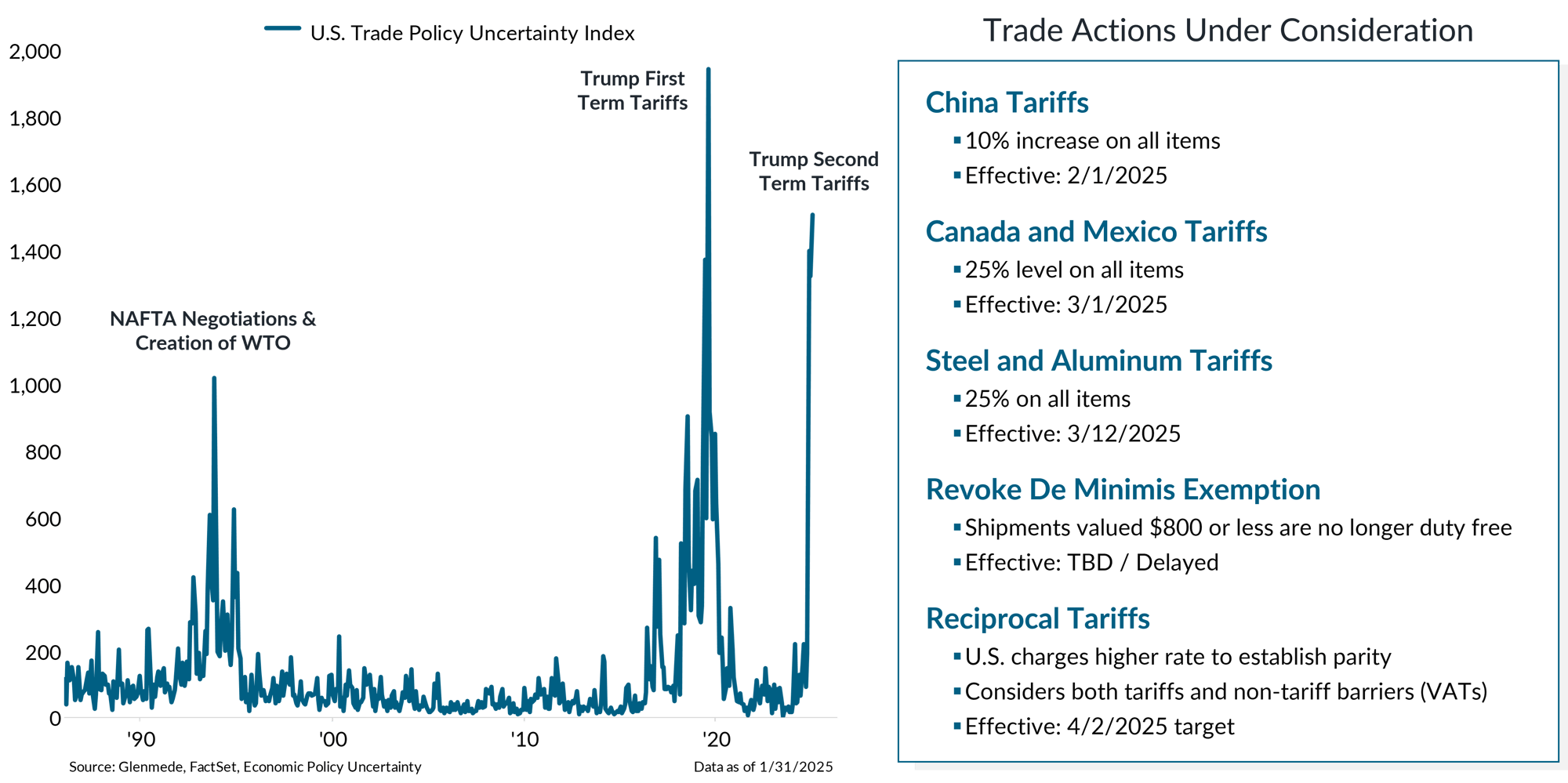

Uncertainty is on the rise after a flurry of tariff announcements to start the second Trump term

Shown in the left panel is the U.S. Trade Policy Uncertainty Index, which reflects the frequency of articles in American newspapers that discuss policy-related economic uncertainty and contain one or more references to trade policy. NAFTA stands for the North American Free Trade Agreement. WTO stands for the World Trade Organization. Shown in the right panel is a summary of trade actions announced under the second Trump administration. Non-tariff barriers primarily refers to VATs. Actual results may differ materially from expectations.

- Tariff uncertainty has been a key highlight of the first few weeks of the new administration, rivaling past environments of material change to terms of trade.

- The announcements include tariffs on China (already enacted), postponed tariffs on Canada and Mexico, steel and aluminum tariffs, revoking de minimis exemptions and reciprocal tariffs.

Steel and aluminum are ~1.5% of imports, much of which come from neighbors already covered by other tariffs

Shown in the left panel are the top 10 countries of origin for U.S. steel imports, measured in millions of metric tons. Shown in the right panel are the top 10 countries of origin for U.S. aluminum imports, measured in millions of metric tons.

- The U.S. imports a substantial portion of its steel and aluminum from Canada and Mexico, which have been key trading partners in this sector due to their proximity.

- Since these imports are already subject to previously announced tariffs, the incremental impact on economic growth is likely to be relatively low.

Simple reciprocity may mean higher tariffs for emerging nations, while VAT consideration raises duties for Europe

Data shown are expected change in tariff rates applied by the U.S. on imports under two scenarios. The bars in blue assume that tariff rates are matched one-for-one with each trade partner. The green bars assume that tariff rates are matched one-for-one with each trade partner and are also adjusted higher to offset the impact of non-tariff trade barriers, primarily VATs. Countries/regions included in the analysis are the top 25 by the tariffs + value-added taxes definition. Actual results may differ materially from expectations.

- The administration announced last week its plan to explore and implement reciprocal tariffs (i.e., the U.S. charges the same rates on imports that its trade partners charge on U.S. exports).

- A simple interpretation of this action that equalizes tariffs between trade partners is likely to have the largest impact on developing nations (e.g., India, Vietnam, Indonesia, etc.).

- A broader interpretation that accounts for VATs, which can functionally have the same effect as tariffs, could raise duties notably for Europe.

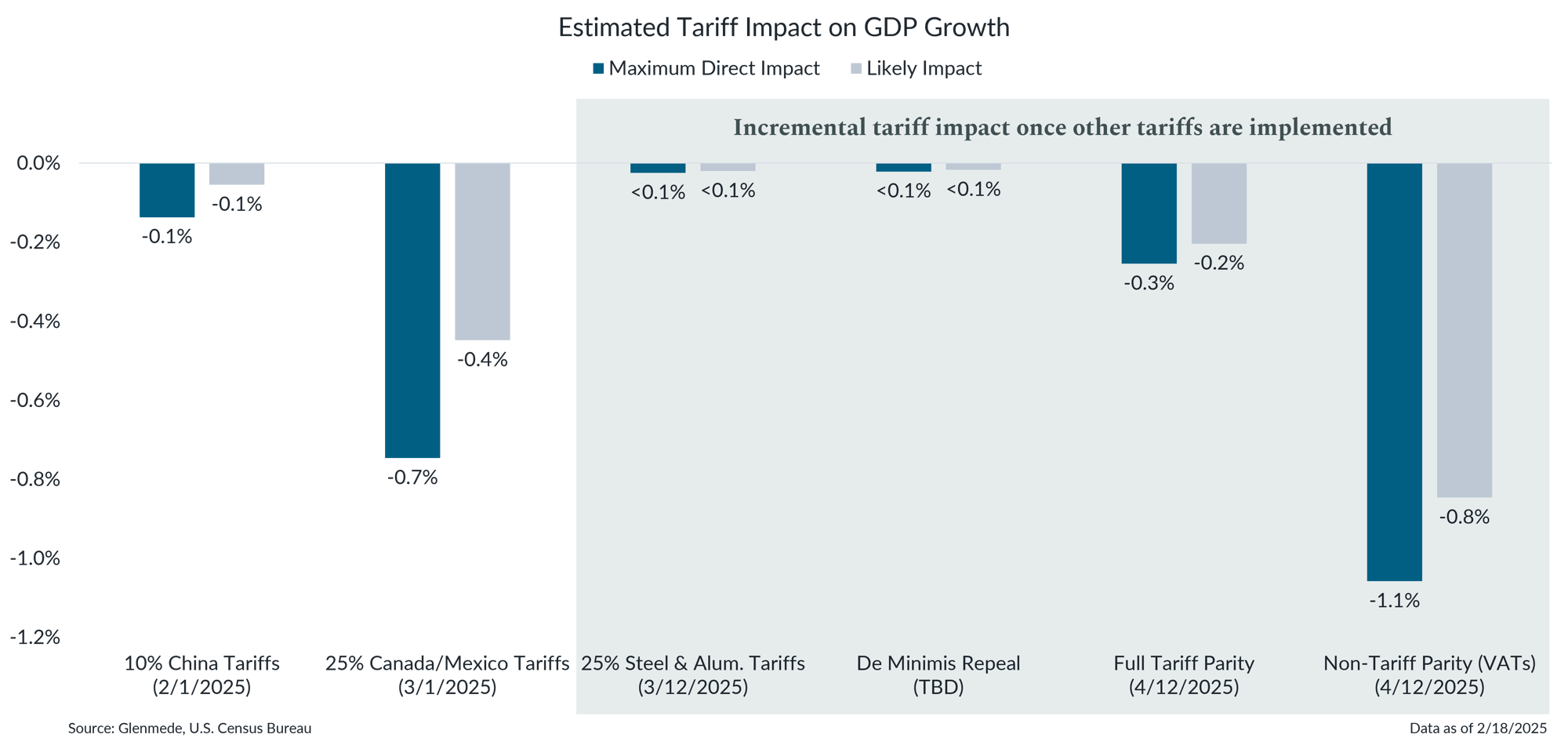

The range of possibilities on trade policy is coming into focus, with associated economic growth headwinds

Estimated tariffs reflect the tariff rate applied fully to all associated imports and are shown as a percent of gross domestic product (GDP). 25% Canada tariffs includes a carveout for energy products, for which 10% tariffs apply. The maximum direct economic impact of proposed tariffs assumes full demand destruction via a tariff-induced price shock and that tariffs are implemented fully and in isolation, with no changes to the sourcing of the imports, no other offsetting policies and no retaliatory tariffs. Likely impact accounts for offsetting factors such as reconfigured supply chains and substitution effects. Incremental tariff impact accounts for the effects of prior implemented tariffs to avoid double counting. VAT refers to value-added taxes. The dates below each tariff represent announced implementation dates, if available. Actual results may differ materially from expectations or projections.

- Tariffs on China are unlikely to have a significant impact on GDP, but Canada and Mexico tariffs may have a larger effect due to closer trade ties and difficulties in avoidance.

- Tariffs on steel, aluminum and de minimis imports are unlikely to have a material incremental impact on economic growth – in some cases, these are already covered by prior tariffs.

- Reciprocal tariffs are a more notable headwind for economic growth, but the degree of impact depends on how the administration defines reciprocity; including VATs in that definition could raise the stakes.

- As the details of trade policy emerge, the economic growth impact appears notable but unlikely to knock the U.S. off its expansion path.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.